Energy Prices Soaring as Brent Crude Trades Above $80/bbl; Natgas Surging in Europe

U.S. natural gas futures trading above $6/mmbtu and about to take out 2014 peak

In Today’s Digital Newspaper

Market Focus:

• USDA daily export sale: 150,000 MT corn to Mexico during 2021-2022 MY

• Powell: Inflation to stay high in coming months before moderating

• Two Fed officials retire early amid trading controversy

• Fed’s Williams: Tapering bond buying ‘may soon be warranted’

• Bank mergers on track to hit highest level since the financial crisis

• Bond yields rising globally, putting pressure on growth stocks

• Huobi Global to close all cryptocurrency user accounts in mainland China by end year

• Shortfall in global energy supplies spilled into crude markets on Tuesday

• OPEC’s World Oil Outlook released

• Gas shortages in U.K., power outages in China

• Cotton futures prices rose to their highest level since 2018

• Ag trade update

• Light pressure on corn and soybeans overnight

• Crop Progress & Condition Report highlights

• Little change in late-season corn, soybean CCI rating

• Cordonnier cuts U.S. corn yield estimate, citing pushed maturity and foliar disease

• CNGOIC official expects Chinese grain imports to hold strong in 2021-22

• Czech Republic records first bird flu outbreak since spring

• Cattle futures signal traders expect another week of near steady cash action

• Hog futures surge on bullish H&P data

Policy Focus:

• Pelosi shifts stance on linking CR and reconciliation measures

• Pelosi schedules Thursday vote on the $1 trillion BIF

• Funding and re-authorization for highway programs expire at end of month

• House progressives still say vote for BIF only after voting on reconciliation bill

• Are Dems counting on GOP votes for BIF? If so, GOP leadership has plan

• Biden cast doubt on whether his agenda would get through House this week

• Leaked language on debt relief provisions via reconciliation

• CR/stopgap spending bill update

• USDA provides breakdown on CFAP 2 payment

Afghanistan:

• How $145 billion can equal zero

• Pentagon: About 100 Americans still in Afghanistan, hampered by Taliban 'unpredictability'

Biden Administration Personnel:

• Jayme White sworn in as deputy USTR

China Update:

• China facing coal shortages and power outages on efforts to curb energy consumption

• China's central bank to protect consumers exposed to housing market

• China frees two Americans banned from leaving country since 2018

• CNGOIC official expects Chinese grain imports to hold strong in 2021-22

Energy & Climate Change:

• Democratic lawmakers add their voices to the RFS mix

• One meeting on proposed RFS levels from EPA remains on OMB schedule

• Carbon pricing

• Methane fee

• Laurene Powell Jobs' $3.5 billion climate campaign

• Ford Motor plans to build its first new U.S. assembly plant in decades

Coronavirus Update:

• Biden receives booster shot, encourages Americans to get vaccinated

Politics & Elections:

• Obama: U.S. 'desperately needs' Biden agenda

Congress:

• Milley faces Congress

Other Items of Note:

• Murders rose nearly 30% in the U.S. in 2020

• Sullivan in Saudi Arabia

• Vilsack to journey to western U.S. later this week

• Farm groups ask Supreme Court to block California's Prop 12

MARKET FOCUS

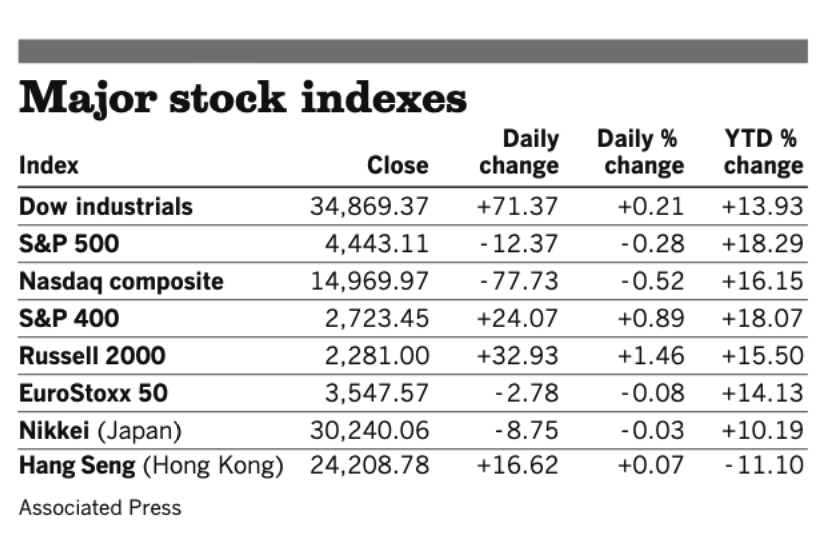

Equities today: Global stock markets were mostly lower in overnight trading. The U.S. stock indexes are also pointed to lower openings when the New York day session begins. Asian equities finished mostly lower as worries about China’s Evergrande continued to dampen investor spirits. Japan’s Nikkei fell 56.10 points, 0.19%, at 30,183.96. Hong Kong’s Hang Seng rose 291.61 points, 1.20%, at 24,500.39. European equities are under pressure in early action with energy prices weighing. The Stoxx 600 is down 1.4% with regional markets seeing losses of 0.2% to 1.4%.

U.S. equities yesterday: The Dow finished up 71.37 points, 0.21%, at 34,869.37. The Nasdaq fell 77.73 points, 0.52%, at 14,969.97. The S&P 500 declined 12.37 points, 0.28%, at 4,443.11.

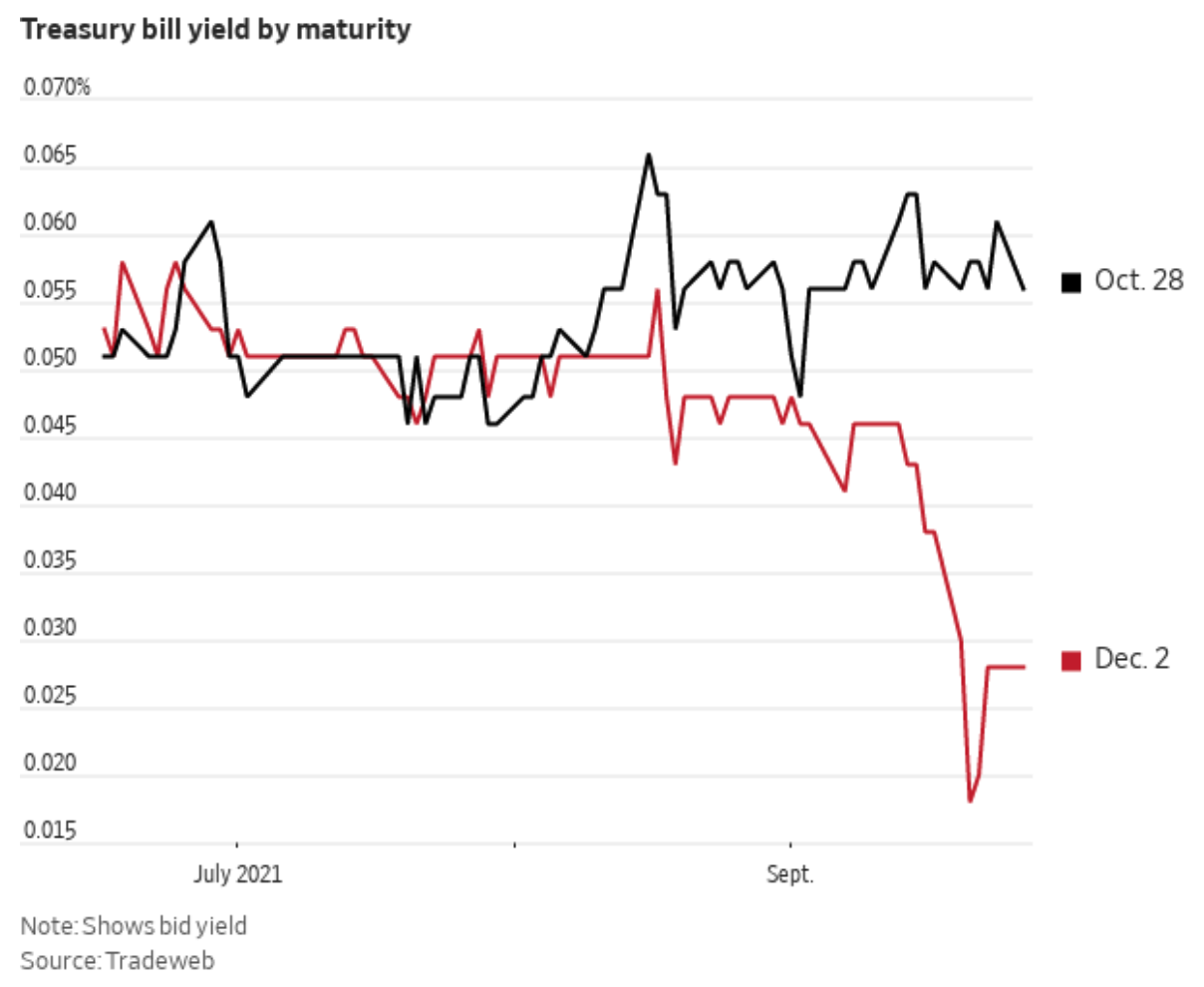

Bond yields are rising globally, which tends to put pressure on growth stocks. U.S. real yields are also up sharply over the past couple of weeks. The debt-ceiling standoff is distorting the short-term Treasury market. Investors are demanding more yield to hold some short-term Treasurys with the greatest risk of delayed payment. Meanwhile, they are driving down yields on a dwindling supply of others. The yield on the benchmark 10-year U.S. Treasury note on Monday topped 1.5% for the first time since June, lifted by optimism about the economic outlook and the prospects of tighter monetary policy.

On tap today (see detailed list of events and reports below):

• European Central Bank President Christine Lagarde speaks at a virtual ECB forum on central banking at 8 a.m. ET.

• U.S. advance economic indicators for August are out at 8:30 a.m. ET.

• S&P Case-Shiller 20-city home price index for July is expected to rise 20.1% from one year earlier. (9 a.m. ET)

• Conference Board's consumer confidence index is expected to tick up to 114.9 in September from 113.8 one month earlier. (10 a.m. ET)

• Richmond Fed's manufacturing survey is expected to rise to 10.5 in September from nine one month earlier. (10 a.m. ET)

• Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen appear at a Senate hearing to discuss the recovery at 10 a.m. ET.

• Fed speakers: Chicago’s Charles Evans at a Chicago Fed payments symposium at 9 a.m. ET, St. Louis’s James Bullard on community banking at 1:40 p.m. ET, governor Michelle Bowman on community banking at 1:40 p.m. ET, Atlanta's Raphael Bostic on the economic outlook at 3 p.m. ET, and Bullard on the economy and monetary policy at 7 p.m. ET.

Two Federal Reserve leaders announced their retirements amid controversy. Leaders of the Dallas and Boston Federal Reserve Banks said they were both stepping down after drawing controversy around their trading in the financial markets. Robert Kaplan of the Dallas Fed and Eric Rosengren of the Boston Fed cited different reasons for the timing of their exits, which followed comments by Fed Chairman Jerome Powell last week that expressed displeasure with the revelation that both men had been actively trading in financial markets while helping to set monetary policy. Rosengren’s trading, along with more significant trading by Kaplan, alarmed some central bank watchers. Kaplan, a 64-year-old who is resigning effective Oct. 8., acknowledged in a statement released by the bank that his stock trading distracted from the Federal Reserve’s work. The Boston Fed said Rosengren, also 64, would retire Thursday, about nine months early, citing health reasons.

Meanwhile, Vice Chairman Richard Clarida, a centrist, sees his term expire on Jan. 31, and Randal Quarles sees his position as vice chairman of supervision end on Oct. 13, although his term ends in 2032.

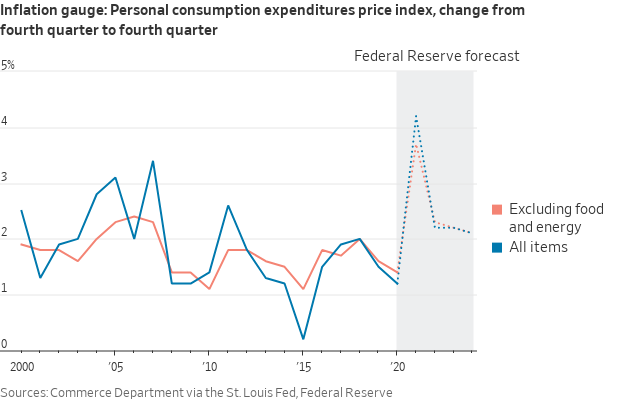

Fed Chair Powell: “Inflation is elevated and will likely remain so in coming months before moderating.” That is what Federal Reserve Chair Jerome Powell will say at a hearing today, according to prepared remarks. “If sustained higher inflation were to become a serious concern, we would certainly respond and use our tools to ensure that inflation runs at levels that are consistent with our goal,” Powell says in prepared remarks (link). Powell acknowledged that a surge in inflation because of supply-chain bottlenecks and other challenges related to the reopening of the economy has been larger and longer-lasting than anticipated. “But they will abate, and as they do, inflation is expected to drop back toward” the Fed’s 2% goal, Powell said. He acknowledged that there are risks that price pressures are higher than anticipated or more enduring.

Fed’s Williams: Tapering bond buying “may soon be warranted.” Federal Reserve Bank of New York President John Williams said the time for the central bank to pull back on asset buying was coming up, but rate rises are still well off.

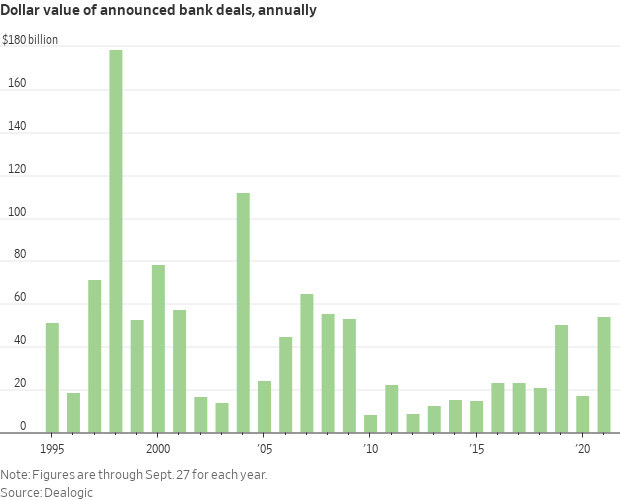

Bank mergers are on track to hit highest level since the financial crisis. Banks are on pace this year to merge at a level not seen since the 2008 financial crisis. It is a sharp turnaround from last year. Banks have announced more than $54 billion in deals through late September, according to Dealogic.

Market perspectives:

• Outside markets: The U.S. dollar index is firmer as both the euro and British pound have weakened against the U.S. currency. The yield on the 10-year U.S. Treasury note has firmed to trade around 1.53% with a higher tone in global government bond yields. Gold and silver futures are under considerable pressure ahead of U.S. trading, with gold under $1,735 per troy ounce and silver under $22.20 per troy ounce.

• Huobi Global, one of the world’s largest cryptocurrency exchanges, said it would close all user accounts in mainland China by the end of the year.

• Shortfall in global energy supplies spilled into crude markets on Tuesday, pushing oil prices to their highest levels in three years. Traders will focus on OPEC’s latest World Oil Outlook, which was published today. OPEC said it expects global oil demand to grow steadily over the next two decades. By 2045, it predicts its members’ oil will constitute 39% of global crude consumption, up from about 33% now. The group said it expects the Middle East — dominated by OPEC members like Saudi Arabia and the United Arab Emirates — to ship 57% of the world’s crude exports by 2045, up from 48% in 2019. The group’s market-share gains will come as production by other big producers, including the U.S., ebbs amid falling investment in new hydrocarbon development, according to the report. Non-OPEC supply is forecast to “plateau and peak” in the late 2020s, OPEC said. American oil production is expected to fall by 1.5 million barrels a day by 2045 compared with 2019, the report said.

• Crude oil remains firmer ahead of U.S. trading, with U.S. crude atop $76 per barrel and Brent hovering near $80 per barrel. Futures also were higher in Asian action, with U.S. crude up 21 cents at $79.74 per barrel and Brent up 21 cents at $79.74 per barrel.

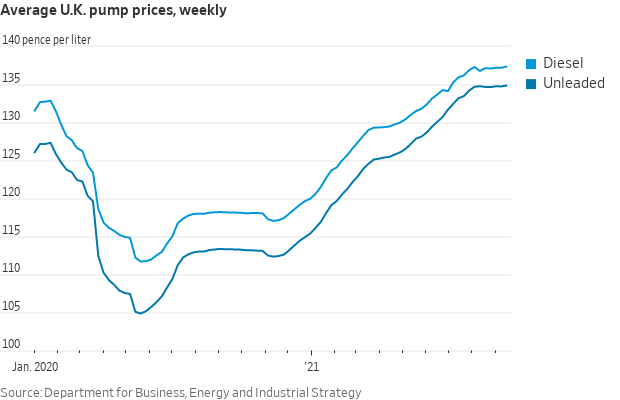

• Gas shortages in the U.K., power outages in China. The British government is searching for drivers to deliver fuel to gas stations across the country after panic buying over the weekend left long lines of customers waiting to fill their tanks. The Covid-19 pandemic and the U.K.’s departure from the European Union have resulted in a shortage of tanker drivers to ferry fuel across the country. Brexit also ended freedom of movement for EU citizens in the United Kingdom, making it harder for European truck drivers to add British stops to their itineraries. New immigration rules have compounded the problem, making it harder for foreign drivers to immigrate to the United Kingdom. Prime Minister Boris Johnson’s government has attempted to address the shortfall by offering 5,000 temporary visas for foreign truck drivers, among other measures to train workers domestically. The increase the visa program would bring represents a drop in the ocean, according to figures from the Road Haulage Association. The trade group warned in August that 100,000 additional drivers were necessary to address Britain’s needs. Panic buying started last week after media reports that a handful of gas stations had to close because of dwindling supplies (for more info, see China section below). For now, the U.K. is keeping soldiers on standby to deliver fuel supplies if the situation worsens. “We don’t have a fuel crisis, we have a fuel panic,” said Duncan Buchanan of the U.K.’s Road Haulage Association.

• Cotton futures are on a tear, nearly touching $1 a pound, a level not seen since 2011. Heavy rains are threatening crops in major U.S. growing regions including Texas and the Mississippi Delta, Maxar Technologies Inc.’ senior meteorologist Donald Keeney told Bloomberg (link). The U.S. is the world’s biggest cotton exporter. At the same time, overseas shipments are flowing with demand rising in China, the top user, and buyers like Turkey and Pakistan are looking for product as well.

• USDA daily export sale: 150,000 MT corn to Mexico during 2021-2022 marketing year.

• Ag trade: Taiwan’s MFIG purchasing group purchased around 65,000 MT of animal feed corn that’s expected to be sourced from Brazil in an international tender

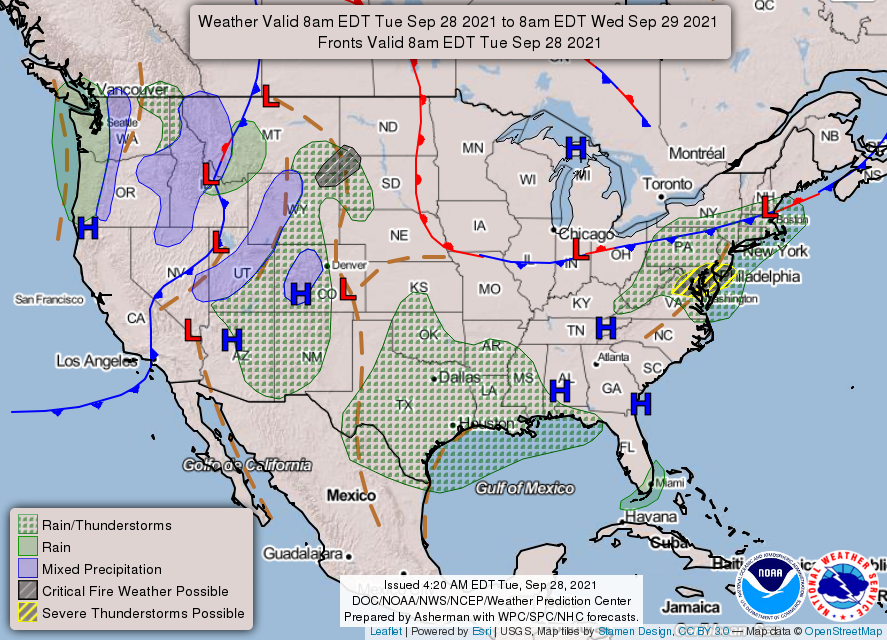

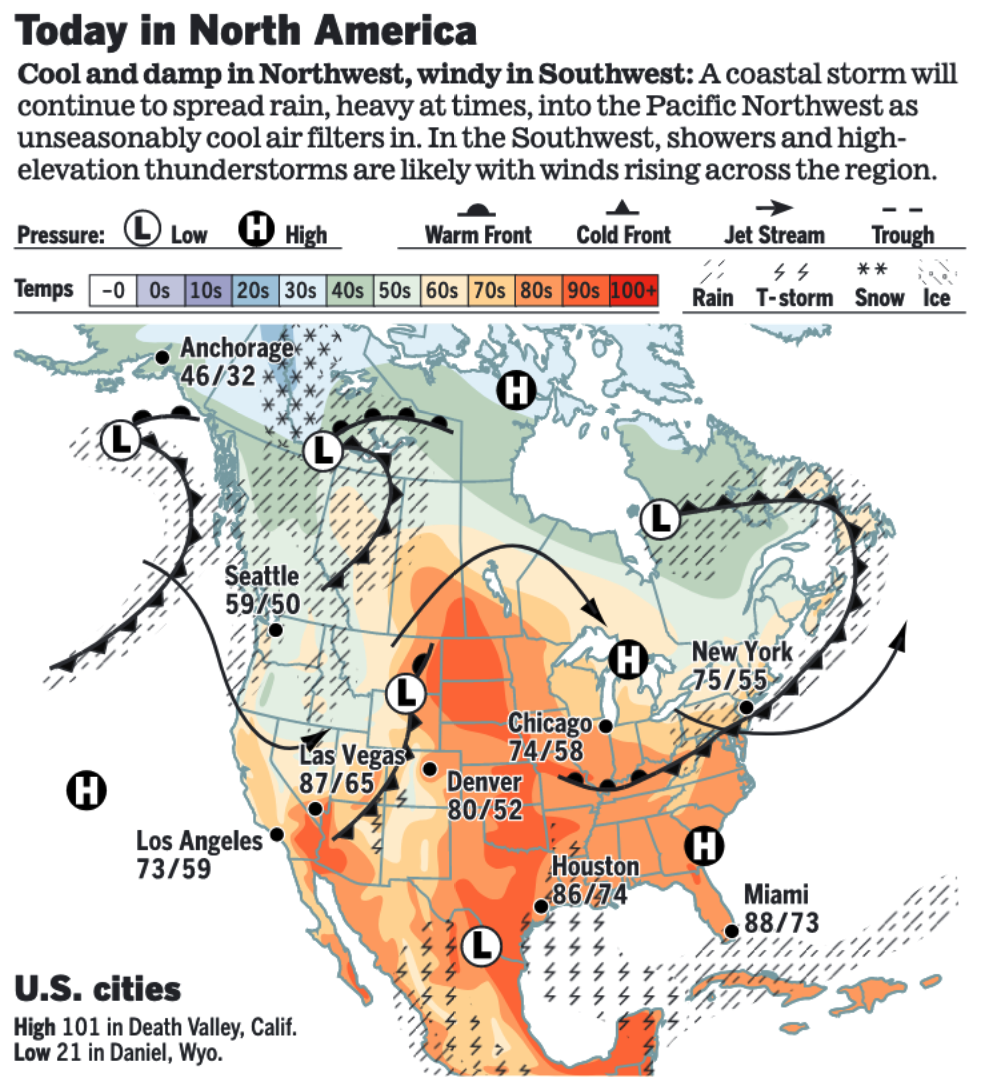

• NWS weather: Severe thunderstorms possible across portions of the Mid-Atlantic today... ...Increasing chances for thunderstorms and heavy rain found throughout the central and southern Plains through midweek... ...Record breaking warmth and critical fire weather forecast across the Northern Plains.

Items in Pro Farmer's First Thing Today include:

• Light pressure on corn and soybeans overnight

• Crop Progress & Condition Report highlights

• Little change in late-season corn, soybean CCI rating

• Cordonnier cuts U.S. corn yield estimate, citing pushed maturity and foliar disease

• CNGOIC official expects Chinese grain imports to hold strong in 2021-22

• Czech Republic records first bird flu outbreak since spring

• Cattle futures signal traders expect another week of near steady cash action

• Hog futures surge on bullish H&P data

POLICY FOCUS

— Legislative updates:

- Big shift by Pelosi. House Speaker Nancy Pelosi (D-Calif.) said House Democrats can no longer wait until a reconciliation package is approved — or even the outlines of the reconciliation legislation are settled —before voting in favor of the $1 trillion bipartisan infrastructure (BIF) bill. Pelosi said that the House-Senate-White House negotiations on the reconciliation package aren’t far enough along to justify linking the two measures. Top House Dems are urging progressives (liberals) to take an initial win by approving the BIF.

- Pelosi scheduled a Thursday vote on the $1 trillion BIF. To win support of wary progressives, Democratic leaders are working on finalizing a “framework” for the social policy and climate change reconciliation bill to demonstrate progress is being made, but as noted previously, work on reconciliation language is dragging.

- Part of the reason to vote on the BIF before this week is up: it includes funding and re-authorization for highway programs that expire at the end of the month. House moderates reportedly are okay with the new timing of the BIF vote.

- House progressives are still signaling they will vote for traditional infrastructure only after voting on the reconciliation bill. For example, in a CNN op-ed (link) by Reps. Pramila Jayapal (D-Wash.), Ilhan Omar (D-Minn.) and Katie Porter (D-Calif.), the three progressives reiterate that they will not vote for the BIF measure until after the reconciliation portion is passed. some Republicans will vote for the BIF bill, so it still could pass if the three Democrats vote no.

- Perhaps the Dems are counting on Republican votes for BIF to offset some Democratic naysayers. But reports have surface that Republican leaders will force Pelosi to get 218 Democratic votes for the infrastructure bill before cutting GOP lawmakers free to vote yes. At least four Republicans — Reps. Fred Upton (Mich.), Tom Reed (N.Y.), Brian Fitzpatrick (Pa.) and Don Young (Alaska) — have declared publicly that they will vote for the bill, which passed the Senate with strong bipartisan support.

- President Joe Biden cast doubt on whether his agenda would get through the House this week. Biden spoke during a photo event during which he got his Covid booster shot. “Well, it may not be by the end of the week. I hope it's by the end of the week but as long as we're still alive. We got three things to do. The debt ceiling. The continuing resolution, and the two pieces of legislation.”

- Leaked language on the debt relief provisions via reconciliation (it’s dated Sept. 23 and thus is not final). The added debt relief provisions include:

— $1 billion for payments and loan modifications to cover up to 100% of outstanding indebtedness of “economically distressed borrowers.” That includes USDA loan borrowers who are delinquent 90 days or more on loans as of April — not just those of color — that are “economically distressed.” Payments to individuals are also capped at $200,000. Determining at-risk borrowers would be up to the Agriculture Secretary using factors that may include whether the borrower is a limited resource farmer or rancher or the amount of payments received by the borrower during calendar years 2020 and 2021 under the Coronavirus Food Assistance Program. To be eligible, borrowers must meet several criteria including: living in a county with a poverty rate of at least 20%, living on tribal land, and facing foreclosure. Payments are capped at $200,000. Note: The plan Congress approved earlier this year to provide $4 billion in debt relief for designated disadvantaged farmers has been stalled with court challenges and lawmakers are seeking to alter the rules so as to avoid pursuing the matter through the court system as a negative ruling could impact other programs.

— $200 million to USDA for technical assistance and financial assistance for underserved farmers and ranchers.

— $255 million to address land loss and improve land access, which includes addressing heir’s property issues.

— $10 million to fund the equity commission recently announced by USDA.

— $200 million to fund agricultural research, education and scholarships.

— $350 million in financial assistance to farmers, ranchers and foresters who have suffered discrimination in USDA lending programs.

- Republicans on House Ag panel continue to blast committee Dems over the reconciliation process, calling it an attack on the upcoming farm bill.

Last week, Senate Agriculture Chair Debbie Stabenow (D-Mich.) told reporters that her Republican counterparts would be “thanking her later” for creating a bigger baseline for the farm bill, but ranking member G.T. Thompson (R-Pa.) slammed her strategy.

“It is no wonder why Democrats chose to keep this text from their own rank-and-file members, let alone Republicans,” he said in a statement last week. “Rural communities certainly won't be 'thanking anyone later' for leaving farmers high and dry.”

- CR/stopgap spending bill update: As expected, the Senate on Monday rejected two bills Monday: A Democratic effort to fund the government until early December that also extends the debt limit until Dec. 2022, and a GOP effort to fund the government until December without the debt limit. Senate Majority Leader Chuck Schumer (D-N.Y.) said “Keeping the government open and preventing a default is vital to our country's future. And we'll be taking further action to prevent this from happening this week.” Meanwhile, the House Rules Committee recessed without approving a rule for three education and labor bills (HR 2119, HR 3110, HR 3992). Chairman Jim McGovern (D-Mass.) said the panel would leave room to consider a rule for debate on a possible second CR today.

— USDA provides breakdown on CFAP 2 payments. USDA is finally reporting a breakdown on the Coronavirus Food Assistance Program 2 (CFAP 2) payments that many have been waiting for — the agency is now breaking out the “regular” CFAP 2 payments and the top-up payments.

As of Sept. 26, total CFAP 2 payments are shown at $18.64 billion, with $13.84 billion for CFAP 2 and $4.81 billion on top-up payments. Within that $18.64 billion total, USDA said the payments include $11.1 billion in acreage-based payments, $3.46 billion for livestock, $2.81 billion for sales commodities, $1.22 billion for dairy and $65.9 million for eggs/broilers.

CFAP 1 payments are at $10.6 billion, including $5.06 billion for livestock, $2.66 billion for non-specialty crops, $1.81 billion for dairy, $941.9 million for specialty crops and $120.4 million for aqua nursery flora.

AFGHANISTAN

— How $145 billion can equal zero. The U.S. gov’t spent $145 billion over two decades to turn one of the poorest nations on Earth into a self-sustaining economy — the boldest effort this century at Western nation-building and largely a failed one. While the Afghan economy did grow — giving millions access to education, healthcare, and jobs — it relied overwhelmingly on foreign aid, most of which evaporated after Kabul fell to the Taliban last month. Afghanistan’s economy and the welfare of its people are now in a dire state, international experts say.

— Pentagon says about 100 Americans still in Afghanistan, exit hampered by Taliban 'unpredictability'. An estimated 100 U.S. citizens are still waiting to leave Afghanistan, nearly a month after American troops officially left the country, with the "unpredictability" of the now-ruling Taliban purportedly the wildcard in the departures. "The biggest constraint to the departure of our citizens and others from Afghanistan, of course, remains the Taliban's unpredictability, regarding who is permitted to depart," a senior State Department official Monday told the reporters from Voice of America and other news outlets.

BIDEN ADMINISTRATION PERSONNEL

— Jayme White sworn in as deputy USTR. Jayme White was sworn in as Deputy United States Trade Representative (USTR) yesterday by USTR Katherine Tai. Deputy Ambassador White’s portfolio will include the Western Hemisphere, Europe, the Middle East, Labor, and Environment. He was confirmed by the U.S. Senate on Sept. 22, 2021.

CHINA UPDATE

— Like Europe, China is facing a power crunch. But in China, the biggest shortage involves coal, not natural gas as is happening in Europe. “China is in the grip of a power crunch as a shortage of coal supplies, toughening emissions standards and strong demand from manufacturers and industry have pushed coal prices to record highs and triggered widespread curbs on usage,” Reuters reported (link). The tight coal supplies are due mostly to a pickup in industrial activity as the economy recovered from the pandemic, analysts say.

The coal price surge prompted the China Electricity Council to publish a statement saying that "to ensure winter coal supply, power companies continue to increase market purchases regardless of cost under the situation of substantial losses."

Dilemma: Two-thirds of China’s electricity comes from burning coal, which Beijing is trying to curb to address climate change.

Bottom line: This has forced some factories to shut down, snarling global supply chains and leading economists to cut their forecasts for China’s growth.

— China's central bank said it will protect consumers exposed to the housing market, though it didn't specifically name debt-laden China, Reuters reports, giving investors some confidence that spillover effects from the developer's liquidity crisis may be manageable. Evergrande missed an $83.5 million interest payment on March 2022 bonds on Sept. 23 and is scheduled to pay a $47.5 million coupon on Sept. 29. Besides the People's Bank of China statement, the Shenzhen government started investigating Evergrande's wealth management unit, Reuters reports, citing a letter to investors, another sign that authorities may take some action to contain the fallout from the real estate developer's troubles.

— China has let two Americans, banned from leaving the country since 2018, return to the U.S. following a Justice Department deal with a Chinese-technology company executive. The exit from China of Victor Liu and Cynthia Liu over the weekend coincided with the U.S. deal last week that freed Huawei Technologies Co. Chief Financial Officer Meng Wanzhou and the almost simultaneous departure from China of Canadian prisoners. A State Department official confirmed that the Massachusetts siblings, both in their 20s, returned to the U.S. on Sunday after more than three years of being subject to a vague “exit ban” from China. The pair had faced no allegations of wrongdoing in the country and were free to move around China, just not leave it.

— CNGOIC official expects Chinese grain imports to hold strong in 2021-22. Chinese corn prices are likely to retreat in 2021-22 amid an increase in supplies thanks to a bumper new corn crop, Li Xigui, an analyst with the China National Grain and Oils Information Center (CNGOIC), said during a live streamed talk yesterday. Chinese corn prices have already pulled back 13% from record levels hit in May. And Li expects China’s wheat and rice use in feed to remain high, helping to curb corn prices. Li expects China to import 20 MMT of corn in 2021-22, which compares to imports of 29 MMT for 2020-21. Li also commented that feed wheat and rice stocks were plentiful and that grain imports should remain elevated in the new year. Li expects China’s sorghum imports to climb from 8.5 MMT in 2020-21 to 10 MMT in 2021-22. Barley imports are expected to climb from 11.4 MMT to 12 MMT in 2021-22. And China will likely import a near-steady 200,000 MT of distillers dried grains (DDGs) in 2021-22.

ENERGY & CLIMATE CHANGE

— Democratic lawmakers add their voices to the RFS mix. A group of Democratic Senate and House members have written to President Joe Biden urging no reduction in the biofuel mandate levels under the Renewable Fuel Standard (RFS). Lawmakers and others have been weighing in on both sides of the issue in recent weeks, with the latest letter coming in the wake of reports that EPA was set to propose lower RFS mandates for 2021 and 2022 and to retroactively reduce the 2020 levels that were approved in December 2019. “This action would directly undermine your commitment to address climate change and restore integrity to the Renewable Fuel Standard (RFS),” the letter stated.

— One meeting on the proposed RFS levels from EPA remains on the schedule at the Office of Management and Budget (OMB) — today (Sept. 28) with the Pennsylvania Chamber of Business and Industry. There will have been 17 meetings at OMB on the proposed RFS levels since September 2. Contacts are now indicating they expect the proposed marks to be released by EPA yet this week, with some specifying Thursday as the most likely day. But the track record of those who have tried to predict when the EPA plan will be released has not been a good one. But with no more meetings on the schedule after today as part of the regulatory process, it would seem the potential for the proposed levels to be released soon is on the rise.

— Carbon pricing: Moderate Sen. Joe Manchin (D-W.Va.) has been vocal against carbon pricing, but Democratic leaders are reportedly pitching another moderate, Sen. Kyrsten Sinema (D-Ariz.) on adding a modest carbon fee as an alternative revenue source to overcome her opposition to corporate and income tax increases. But Manchin’s opposition is key, sources advise. Also, Pelosi only has a three-vote margin among Democrats in the House, where several centrists from Texas have warned against including taxes and fees targeting the oil and gas industry.

— Methane fee: Despite lobbying against the fee from the oil and gas industry, Manchin has repeatedly said companies need to better crack down on methane to prove credibility as a competitive clean energy option.

— Laurene Powell Jobs' $3.5 billion climate campaign. Laurene Powell Jobs, president of Emerson Collective, is investing $3.5 billion in her new climate-action group, the Waverley Street Foundation — all to be spent in 10 years, to show urgency on the issue. Then the group will sunset.

— Ford plans to spend $7 billion to build two battery factories in Kentucky and a third in western Tennessee — part of a collaboration with South Korean battery maker SK Innovation — as well as a factory for producing electric trucks. The new truck factory is set to begin producing electric F-series pickups by 2025, creating 11,000 jobs. The company says the planned $5.8 billion Blue Oval City complex in Tennessee "will usher in a new era for American manufacturing," comparing it to the Rouge complex in Michigan a century ago.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 232,407,582 with 4,758,001 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 43,116,448 with 690,434 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 390,664,923 doses administered, 183,888,907 have been fully vaccinated, or 56.0% of the U.S. population.

— Biden receives booster shot, encourages Americans to get vaccinated. The FDA recently cleared a third Pfizer-BioNTech shot for people 65 and older and certain other at-risk adults.

POLITICS & ELECTIONS

— Obama: U.S. 'desperately needs' Biden agenda. Former President Barack Obama said President Joe Biden’s “Build Back Better” agenda, hinging now on a $3.5 trillion rebuilding proposal being fought over in Congress, is something the United States “desperately needs.” In an interview with ABC's Good Morning America, Obama made the case for his former vice president’s economic recovery plan. In particular, he voiced support for higher taxes on the wealthy to prop up government-funded childcare and infrastructure reinforcement against climate change. “I think anybody who pretends that it's a hardship for billionaires to pay a little bit more in taxes so that a single mom gets childcare support or so that we can make sure that our communities aren't inundated by wildfires and floods and that we're doing something about climate change for the next generation — you know, that's an argument that is unsustainable,” Obama said in the interview set to air today.

CONGRESS

— Milley faces Congress. Mark Milley, the chairman of the U.S. Joint Chiefs of Staff, testifies before the House Armed Services today with both parties asking the highest-ranking U.S. military officer on the U.S. withdrawal from Afghanistan and remarks in recent books about his influence on China and nuclear issues during the final days of the Trump administration. Milley, who will appear alongside U.S. Secretary of Defense Lloyd Austin, is also expected to face tough questions about a U.S. drone strike in Kabul following the Islamic State-Khorasan bombings at Kabul airport. It soon emerged that U.S. forces had not hit Islamic State fighters at all: Ten civilians were killed instead, including seven children.

OTHER ITEMS OF NOTE

— Murders rose nearly 30% in the U.S. in 2020. The FBI said there were 21,570 last year, the largest single-year increase it has ever recorded. The rate of 6.5 homicides per 100,000 residents is the highest since 1997 but still below historic highs of the early 1990s. However, the increase from 2019 was the largest since national record keeping began in 1960, according to figures released by the FBI. Some 21,500 people were killed last year, a toll that is still well below the record set during the violence of the early 1990s. Still, several cities, like Albuquerque, Memphis, Milwaukee and Des Moines, are recording their highest murder numbers ever. The high murder rate has continued into 2021, although the pace has slowed as the year has progressed. The significant rise in homicides has roughly coincided with the 18 months of the Covid-19 pandemic.

— Sullivan in Saudi Arabia. U.S. National Security Adviser Jake Sullivan begins talks in Saudi Arabia today as part of a Middle East trip which also includes a visit to the United Arab Emirates. Sullivan is the highest-ranking Biden administration official to travel to the kingdom and will meet with Crown Prince Mohammed bin Salman as part of the trip.

— Vilsack to journey to western U.S. later this week. The Ag secretary will participate in events focusing on addressing challenges in agriculture, according to a department announcement. On Wednesday, Vilsack will give a speech at Colorado State University’s Salazar Center’s Virtual International Symposium for Conservation Impact and announce a comprehensive set of investments to address challenges facing producers and agriculture, including market disruptions, climate change and animal disease prevention. On Thursday, Vilsack will give remarks at the University of Colorado’s 41st Annual Colorado Law Conference on Natural Resources.

— Farm groups ask Supreme Court to block California's Prop 12. With California's Proposition 12 animal welfare law set to go into effect on Jan. 1, two farm groups asked the Supreme Court (link) to invalidate the voter-approved standards as an unconstitutional burden on farmers and consumers everywhere. Prop 12 bans the sale of pork products that are produced outside the state but do not match California's rules. The National Pork Producers Council and the American Farm Bureau Federation, unsuccessful at the district and appellate court levels, turned to the Supreme Court with a Commerce Clause argument that Prop 12 puts an undue burden on producers and consumers outside of the state. “The massive costs of complying with Proposition 12 fall almost exclusively on out-of-state farmers,” they said in a petition for Supreme Court review. All hog producers will be forced to remodel their barns or build new ones to meet California’s rules, they argued, because “it is impracticable, in the complex, multi-stage pork production process to trace a single cut of pork back to a particular sow housed in a particular manner.” As a result, “costs will be passed on to consumers everywhere, in countless transactions having nothing to do with California.”

EVENTS AND REPORTS

Tuesday, September 28

· Federal Reserve. Chicago Fed President Charles Evans, Atlanta Fed President Raphael Bostic and St. Louis Fed President James Bullard to speak.

· NABE meeting. National Association for Business Economics (NABE) 63rd annual meeting, with the theme "Shocks, Shifts, and the Emerging Economic Landscape," including remarks from Treasury Secretary Janet Yellen.

· U.S./Japan relations. Center for Strategic and International Studies conference call briefing to preview "Japan's Leadership Election and Implications for U.S.-Japan Relations."

· LNG situation. Center for Strategic and International Studies virtual discussion on "U.S. Liquid Natural Gas (LNG) in the Energy transition," focusing on the role of gas in the global effort to reduce emissions.

· Prescription drug user fees. Food and Drug Administration teleconference on "Reauthorization of the Prescription Drug User Fee Act," to discuss proposed recommendations for the reauthorization of the Prescription Drug User Fee Act for FY 2023 through FY 2027.

· Afghanistan. Senate Armed Services Committee hearing on "The Conclusion of Military Operations in Afghanistan and Plans for Future Counterterrorism Operations."

· U.S. ties with South Asia. House Foreign Affairs Asia, the Pacific, Central Asia and Nonproliferation Subcommittee hearing on "Strengthening the U.S. Ties with Southeast Asia."

· U.S./Southeast Asia. House Foreign Affairs Asia, the Pacific, Central Asia and Nonproliferation Subcommittee hearing on "Strengthening the US Ties with Southeast Asia."

· FERC issues. Senate Energy and Natural Resources Committee hearing on "Review Administration of Laws Within FERC's (Federal Energy Regulatory Commission) Jurisdiction," with FERC Chairman Richard Glick, and FERC Commissioners Mark Christie, Allison Clements and James Danly.

· CARES Act oversight. Senate Banking, Housing and Urban Affairs hearing on "CARES Act Oversight of the Treasury and Federal Reserve: Supporting an Equitable Pandemic Recovery,” with Treasury Secretary Janet Yellen.

· U.S. economy. House Economic Disparity and Fairness in Growth Committee hearing on "The Interconnected Economy: The Effects of Globalization on U.S. Economic Disparity."

· U.S./Korea. Atlantic Council and the Korea Foundation virtual conference on "recommendations for the U.S./ROK alliance."

· U.S. competitiveness. Economic Club of Washington, D.C. virtual discussion on ways to increase American competitiveness.

· German elections. American Institute for Contemporary German Studies virtual discussion on "The Results Are In: Analyzing the 2021 Bundestag Election."

· U.S. Supreme Court. Heritage Foundation discussion on "Supreme Court Preview of the 2021-2022 Term."

· Clean energy issues. District of Columbia's Public Service Commission hosts the 2021 Clean Energy Summit: Path to Decarbonization," on "how utility regulators and industry experts can advance progress toward national and local clean energy goals."

· Economic reports. International Trade in Goods | Wholesale Inventories | S&P CoreLogic Case-Shiller HPI | FHFA House Price Index | Consumer Confidence | Richmond Fed Manufacturing

· Energy reports. API US inventory report

· USDA reports. ERS: Livestock and Meat Domestic Data NASS. Egg Products | Potatoes