Coming FOMC Decisions/Comments Rule the Market Day

CFTC releases more data | Xi/Putin | EPA chief to testify | Stepped-up basis tax rule protection

|

In Today’s Digital Newspaper |

USDA daily export sale: 178,000 tonnes of corn to China during MY 2022-23.

Volatility eases as fears diminish over banking tumult. Treasury, Fed and FDIC officials will brief lawmakers on the Senate Banking Committee today by Zoom. The Senate Banking Committee will hold the first of several hearings on the collapse of Silicon Valley Bank and Signature Bank on March 28, committee Chair Sherrod Brown (D-Ohio) said in statement.

Treasury Secretary Janet Yellen said the U.S. could repeat moves to shield bank depositors if smaller lenders are threatened. A WSJ editorial (link) leaves no doubt what they think about recent Yellen comments: “The End of Market Discipline for Banks; Janet Yellen essentially says all deposits are insured. From now on, moral hazard rules.”

Inflation in Britain surged unexpectedly to 10.4% in the year to February, breaking a three-month downwards streak. Core inflation rose by 6.2%. Driven by vegetable shortages, the price of food rose by 18%, the fastest pace in 45 years. The news comes ahead of the Bank of England’s meeting on Thursday, when it is expected to raise interest rates.

This week’s Moscow-based meetings between Chinese leader Xi Jinping and Russian President Vladimir Putin concluded today, leaving no question about Beijing's commitment to Russia amid its onslaught in Ukraine. The confab yielded no breakthrough in resolving the conflict. Both leaders emphasized that peace talks should be used to solve the Ukraine crisis, but Kyiv and the West say any peace agreement must include the withdrawal of Russian troops. We have more in the Russia/Ukraine section.

Ukraine won the backing of IMF staff for a $15.6 billion loan. The deal — which needs to be ratified by the IMF’s board — would last four years. At first Ukraine will put the money towards maintaining financial stability. After around 18 months, it will attempt more expansive reforms to help it recover and reconstruct.

Japanese Prime Minister Fumio Kishida held talks with Zelenskyy in Kyiv, showing how the war in Ukraine is affecting geopolitical alignments in Asia. Kishida said Japan would supply $30 million in nonlethal military assistance to Ukraine through a NATO fund, and that Zelenskyy would participate remotely in the Group of Seven’s May summit in Hiroshima, Japan, according to Kyodo News.

Norfolk Southern CEO Alan Shaw will testify before the Senate Commerce Committee during a hearing on rail safety. National Transportation Safety Board Chair Jennifer Homendy is also among the witnesses. Shaw plans to tell senators his company supports more regulation, including stricter standards for rail tank cars, following a train accident last month that spilled chemicals in Ohio.

EPA Administrator Michael Regan testifies today and the usual topics of the RFS and WOTUS rule will be among the likely topics addressed besides the huge budget increase the White House wants for the agency in part to hire nearly 2,000 additional regulators.

A bipartisan group of lawmakers is trying to protect a tax provision that reduces the capital gains tax on inherited property, saying elimination would hurt farmers and businesses. More in Policy section.

Supreme Court will hear arguments in Jack Daniel's case vs. dog toy company… more below. No one is pooh-poohing this case about, well, poop.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. U.S. Dow opened slightly higher and then turned slightly lower. European equities were flat to lower on Wednesday, as the focus shifts to the U.S. Fed interest rate decision later in the day. Also, traders are digesting a hotter-than-expected U.K. inflation reading, which raised bets the Bank of England will continue to raise interest rates to tame high inflation. In Asia, Japan +1.9%. Hong Kong +1.7%. China +0.3%. India +0.2%. In Europe, at midday, London -0.1%. Paris +0.3%. Frankfurt +0.5%.

U.S. equities yesterday: The Dow ended near its highs for the day while all three indices registered gains. The Dow closed up 316.02 points, 0.98%, at 32,560.60. The Nasdaq gained 184.57 points, 1.58%, at 11,860.11. The S&P 500 rose 51.30 points, 1.30%, at 4,002.87.

Agriculture markets yesterday:

- Corn: May corn futures fell 3 cents to $6.30 and near the session low.

- Soy complex: May soybeans fell 19 cents to $14.67, near the session low after trading as high as $14.97. May meal closed $2.10 lower to $460.60, while May soyoil dropped 175 points to 56.24 cents.

- Wheat: May SRW futures sold 17 1/2 cents to close at $6.83 1/4, near the session low. May HRW futures closed 9 1/2 cents lower at $8.20 1/4. Spring wheat settled 5 3/4 cents lower at $8.45 3/4.

- Cotton: May cotton rose 63 points to 77.85 cents, a low-range close after marking an intraday high 79.16 cents.

- Cattle: April live cattle futures rose 40 cents to $162.425 Tuesday, while most-active April feeder futures edged up 7.5 cents to $194.70.

- Hogs: April lean hogs fell 72 1/2 cents to $77.05, near the session low and hit another contract low.

Ag markets today: Bears controlled price action overnight, with corn, soybean and wheat futures trading solidly lower and near their session lows this morning. As of 7:30 a.m. ET, corn futures were trading 5 to 7 cents lower, soybeans were 7 to 12 cents lower, winter wheat futures were 13 to 16 cents lower and spring wheat was 10 to 11 cents lower. Front-month crude oil futures were modestly weaker, and the U.S. dollar index was around 200 points lower.

Technical viewpoints from Jim Wyckoff:

On tap today:

• Federal Reserve releases its interest-rate decision and economic projections at 2 p.m. ET. Chair Jerome Powell holds a press conference at 2:30 p.m. ET.

• U.S. Treasury Secretary Janet Yellen appears before a Senate panel at 2:30 p.m. ET.

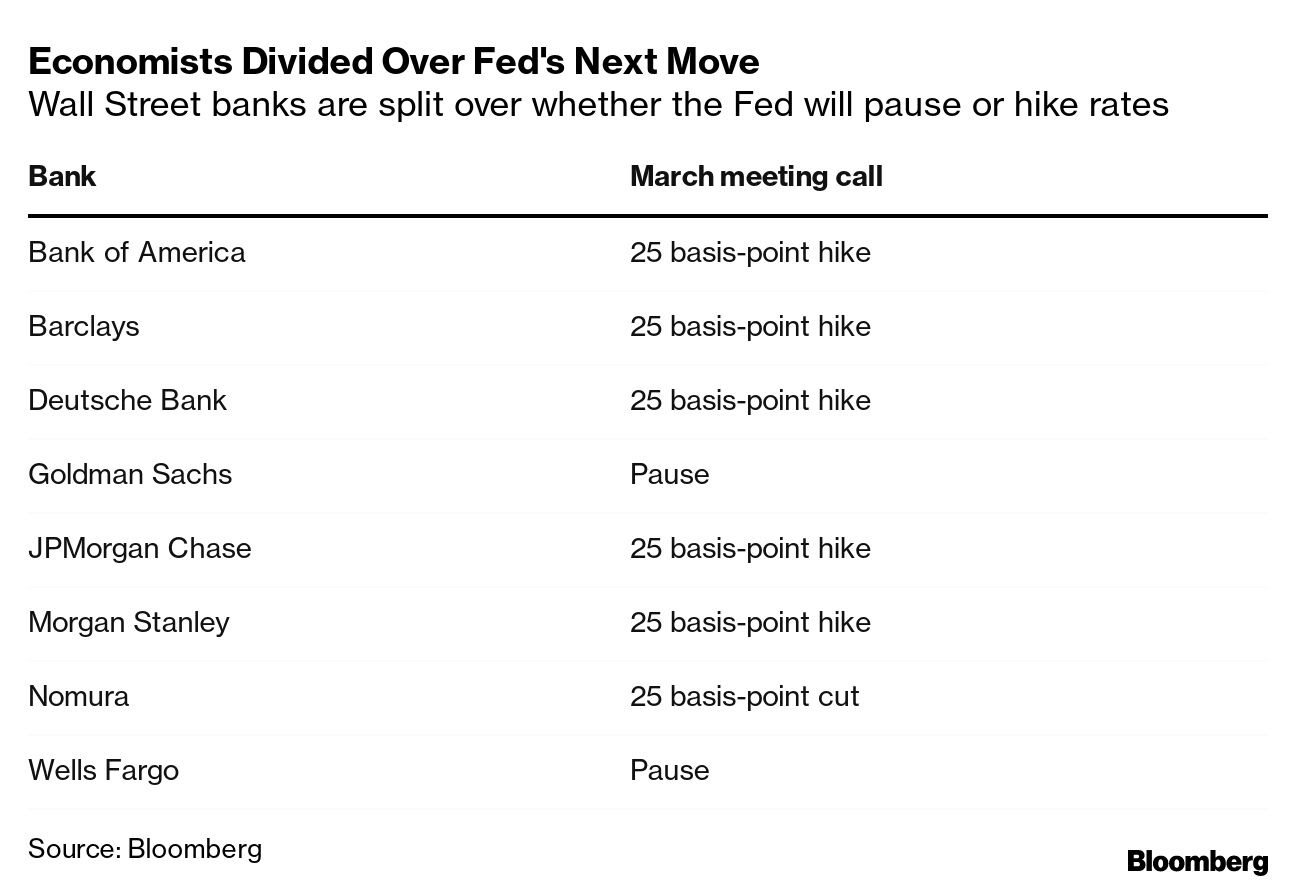

Decision day for Fed: Raise or pause? Or cut? The consensus is on a rate hike, especially since markets have shown signs of calming down after several extraordinary steps by bankers and regulators alike to shore up confidence in the financial system. Some analysts’ forecasts of what the Fed will do relative to rates:

U.S. officials are prepared to take more actions if needed to ensure liquidity in the banking sector, Treasury Secretary Janet Yellen said yesterday during an American Bankers Association meeting in Washington, D.C. She defended federal regulators' actions to protect the depositors of Silicon Valley Bank and Signature Bank, saying "our intervention was necessary to protect the broader U.S. banking system." While conditions have improved with aggregate outflows stabilizing, "similar actions could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion." Yellen also cited a need to re-examine current regulatory and supervisory regimes, and expressed worries over a last-minute deal to resolve the debt ceiling.

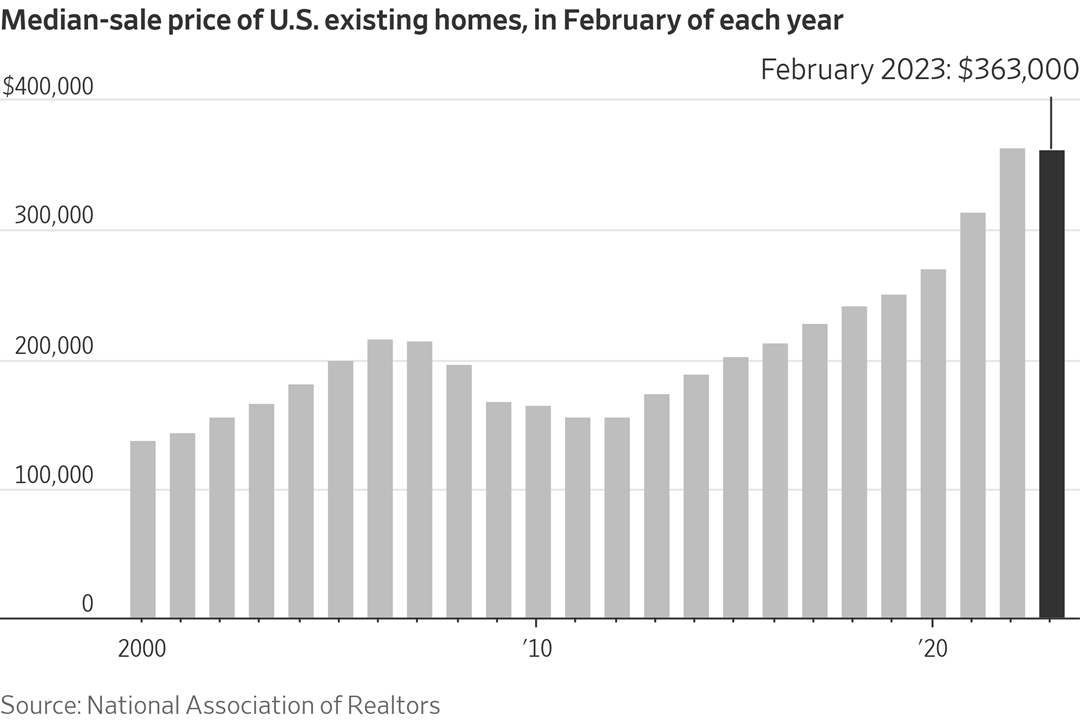

Sales of existing homes spike in February. The National Association of Realtors reports that sales of previously owned homes were up 14.5% in February to an annual rate of 4.58 million units. Economists had expected sales to come in at 4.17 million. However, sales were down 22.6% year-over-year.

The median sale price fell 0.2% from one year ago to $363,000, the first decline in 131 months.

Inventory fell to 980,000 units, and at the current sales pace, would be exhausted in 2.6 months.

Upshot: Slower mortgage applications this month point to weakness ahead for home sales.

U.K. inflation rate unexpectedly rises. Annual inflation rate in the U.K. rose to 10.4% in February from 10.1% in January, the first increase in four months and compared to forecasts of 9.9%. Food inflation hit its highest since 1977, due to shortages of salad produce and other vegetables. Upward pressure also came from the prices of drinks and clothes.

EIU’s (Economist Intelligence Unit) global economic outlook 2023: Modest global growth and challenges ahead. Highlights:

- EIU expects global economic growth to slow sharply in 2023, reflecting persistent headwinds stemming from the ripple effects of the war in Ukraine, as well as high inflation and rising interest rates.

- Our forecast for global growth stands at 2% (up from 1.9% last month). This upward revision reflects an improvement to our US growth outlook, which we now forecast at 0.7% for 2023 (up from 0.3% previously).

- We forecast that the Chinese economy will grow by 5.7% in 2023. The recovery will be consumer-led as the exit from the country’s zero-covid policy unleashes pent-up demand for goods and services (including outbound tourism).

- The euro zone has avoided recession in the winter of 2022/23, owing to lower-than-expected energy demand due to mild temperatures. However, high inflation continues to weigh on spending—we forecast GDP growth of just 0.7% in the bloc.

- We expect a moderate global recovery in 2024, with real GDP growth of 2.5%. However, growth in OECD economies will remain subdued, at a forecast 1.5%. By contrast, we forecast growth of 4.1% in non-OECD economies.

- Inflation was a major driver of our forecasts in 2022, and this will continue to be the case in 2023. We expect major central banks to end their tightening cycles by mid-year as inflation slows, but rates will remain high in 2023-24.

- Despite sky-high interest rates, global inflation will subside only gradually, from an estimated 9.3% in 2022 to 6.7% in 2023 and 4.3% in 2024. Prices will remain high in level terms, even after inflation subsides, fueling the risk of social unrest.

- Oil prices will remain high in 2023, owing to continued disruption from the war in Ukraine and rising Chinese demand. We expect oil (dated Brent Blend) to trade above US$80/barrel until 2025.

Market perspectives:

• Outside markets: The U.S. dollar index was lower. The yield on the 10-year US Treasury note was higher, trading around 3.64%, after having been weaker in earlier overnight action. Global government bond yields are generally higher. The benchmark 10-year U.S. Treasury note is yielding 3.604%. Crude oil is weaker, but off lows seen in earlier overnight action. U.S. crude was around $69.30 per barrel while Brent was around $75 per barrel. Gold and silver futures were firmer in electronic trade, with gold around $1,945 per troy ounce and silver around $22.50 per troy ounce.

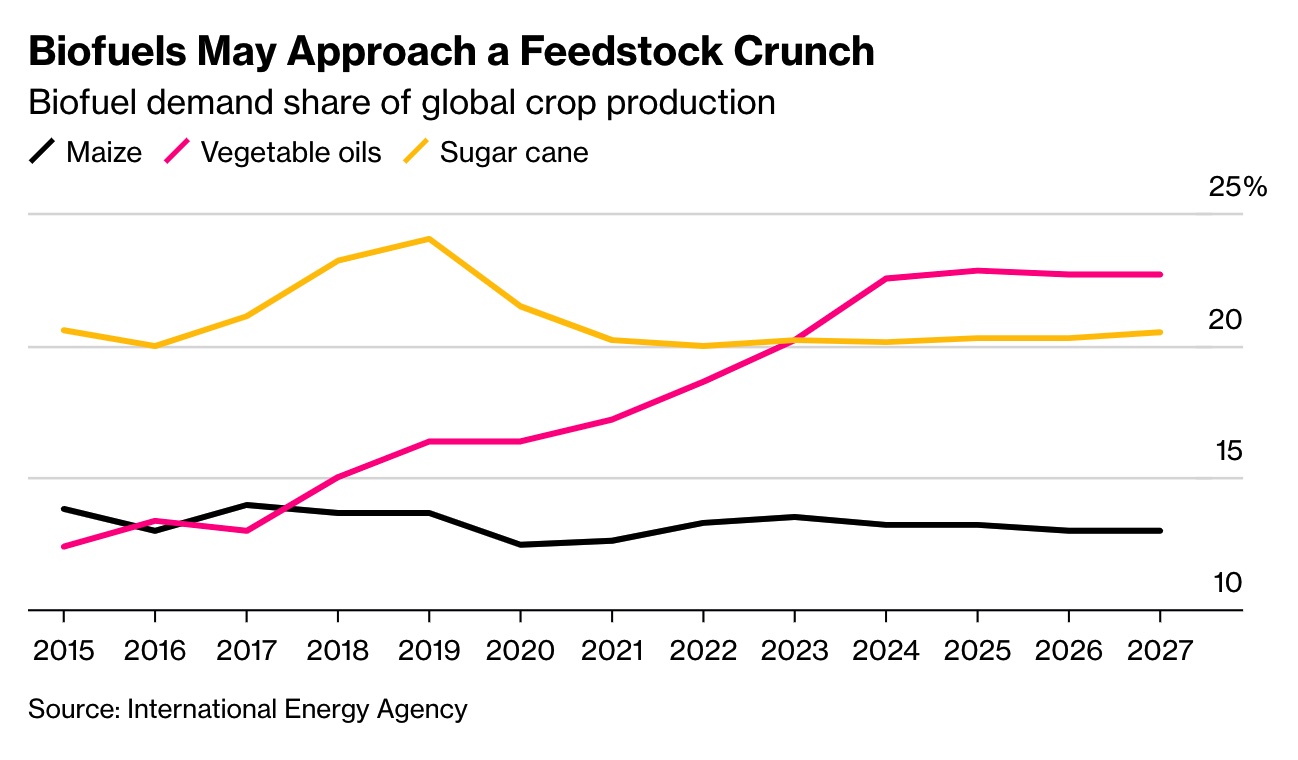

• A global biofuel boom is set to drive a shortage of vegetable oils — used for cooking and increasingly to power trucks and planes — intensifying a debate over food versus fuel. Demand is so hot that producers are hunting for sludge, a waste product from processing palm oil, as feedstock. More info via Bloomberg.

• Ag trade: Jordan tendered to buy up to 120,000 MT of optional origin milling wheat.

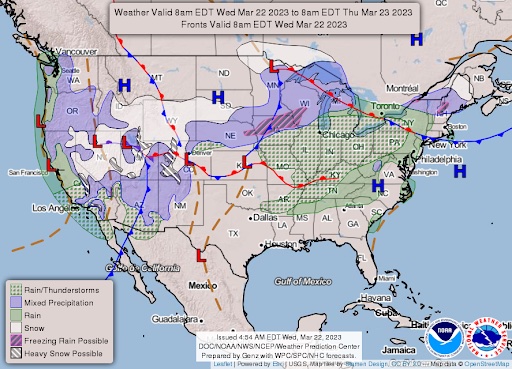

• NWS weather outlook: Damaging winds and heavy rain gradually subside today across west-central California... ...Powerful storm system will deliver widespread high winds, heavy rain/heavy mountain snow rapidly through the Southwest, the Four Corners, and central/southern Rockies today and tonight... ...Same storm system will bring a quick round of snow through the northern Plains tonight as well as setting up for a heavy rain event across the central U.S. and severe weather across the southern Plains on Thursday... ...Heavy mountain snows will then impact the Pacific Northwest to the northern Rockies over the next few days.

Items in Pro Farmer's First Thing Today include:

• Followthrough grain market selling overnight

• Argentina exports first shipment of beef to Mexico

• Wholesale beef prices continue to drop

• Attitudes toward hogs continue to erode

|

RUSSIA/UKRAINE |

— Ukraine won backing for some $15.6 billion in financing from the International Monetary Fund as part of a large-scale aid package, the first time the institution has agreed to lend to a nation at war in its 77-year history. Ukraine is also getting some U.S. main battle tanks sooner.

— The Pentagon announced another $350 million in more weapons to Ukraine, including patrol boats and mine-clearing equipment.

— Highlights of Moscow-based meeting of Chinese leader Xi Jinping and Russian President Vladimir Putin:

- Bottom line: The two leaders made a sweeping affirmation of their alignment across several issues – and shared mistrust of the United States – in a lengthy statement following talks between the two leaders in Moscow this week.

- Xi’s parting message reiterated his view that global power dynamics are shifting. “Together, we should push forward these changes that have not happened for 100 years. Take care,” he said during a goodbye handshake with Putin, alluding to what Xi sees as an era where the West is fading, and China is ascendent.

- Meetings resulted in more than a dozen agreements bolstering cooperation in areas from trade and technology to state propaganda, according to a Kremlin list. The leaders’ central statement focused on how the two countries would “deepen” their relationship.

- No breakthrough on resolving the conflict in Ukraine. Both leaders called for the cessation of actions that “increase tensions” and “prolong” the war in Ukraine, according to their joint statement released by China’s Foreign Ministry. The statement did not acknowledge that Russia’s invasion and military assault were the cause of ongoing violence and humanitarian crisis in Ukraine.

- Leaders urged NATO to “respect the sovereignty, security, interests,” of other countries — a reference that appeared to echo long-standing rhetoric from both countries blaming the Western security alliance for provoking Russia to invade.

- Putin said that “many of the provisions” could be “taken as the basis” for a peaceful settlement in Ukraine, “when the West and Kyiv are ready for it,” in comments to reporters following Tuesday talks. But the proposal is seen as a nonstarter in the West and Ukraine, because it includes no provision that Moscow withdraw its troops from Ukrainian land.

- One of the more pressing considerations from Kyiv's perspective, the prospects of China supplying Russia with military equipment remain unclear.

- Putin failed to clinch a deal to sell more natural gas to China as there was no explicit agreement or even a nod to progress on the Power of Siberia 2 pipeline as Moscow attempts to shift sales from Europe to Asia.

After Xi's visit on Wednesday, the Kremlin launched fresh drone and missile strikes on Ukrainian cities, killing at least four people in a residential area outside Kyiv.

— Ukraine’s 2023 corn crop may be smaller than officials said earlier this week, according to a report from Reuters. The Ukraine Agriculture Ministry this week said that 2023 corn production could be 21.7 million tonnes, down from 25.6 million tonnes in 2022, as area is expected to decline to 3.6 million hectares after being at more than 4 million in 2022. However, Reuters reported am unnamed “senior Ukrainian agriculture official” indicated the “decrease in the harvest could be even bigger.”

— Ukrainian grain exports top 36 MMT. Through March 22, Ukraine’s grain exports this month reached 3.99 MMT. Since July 1, Ukraine has exported 36.3 MMT of grain, according to the country’s ag ministry. That total included 21.3 MMT of corn, 12.4 MMT of wheat and 2.25 MMT of barley.

|

POLICY UPDATE |

— EPA Administrator Michael Regan will testify today about the White House’s fiscal 2024 budget request (link) before the Senate Environment and Public Works Committee. The budget plan would boost the agency’s funding to a record-high $12 billion, a 19% increase over the current enacted level. Included in the budget blueprint are:

- Funding to hire 1,960 new staffers, to bring its workforce to more than 17,000 nationwide.

- A 247% increase for the agency’s environmental justice efforts.

- A 60% boost to help states implement air quality programs, and

- A 37% rise in chemicals oversight spending.

Lawmakers will very likely ask Regan about the Waters of the U.S. (WOTUS) rule that went into effect on Monday for most states.

Ethanol and biodiesel mandated amounts relative to the Renewable Fuel Standard (RFS) are other areas of interests lawmakers may ask about.

Regan has promised that new regulations being written by his staff now will be made public by spring. Agency officials said that EPA has stepped up its recruitment efforts and has purchased software that has helped it identify more potential job candidates, particularly from universities.

— Army Corps confirms pre-2015 WOTUS definition being used in Texas, Idaho. The U.S. Army Corps of Engineers said the Biden administration’s definition of what constitutes waters of the U.S. (WOTUS) is in place in all states except Texas and Idaho after a preliminary injunction in federal court. “In light of the preliminary injunction, the agencies are interpreting ‘waters of the United States’ consistent with the pre-2015 regulatory regime in Idaho and Texas until further notice,” Army Corps spokesman Douglas Garman said.

Being watched: Another suit led by West Virginia, the largest of the suits brought so far as it includes 24 states.

Still awaited: The U.S. Supreme Court ruling in the Sackett v. EPA case. There is no date certain for when the Supreme Court will issue their ruling in that case.

— Bipartisan group pushes for stepped-up basis tax rule protection. A bipartisan group of lawmakers is trying to protect a tax provision that reduces the capital gains tax on inherited property, saying elimination would hurt farmers and businesses. The Joint Committee on Taxation says the failure to collect these taxes costs $40 billion per year, and Democrats have proposed ways to eliminate the provision, while leaving an exemption for farmers. The resolution, introduced Tuesday by Reps. Tracey Mann (R-Kan.), Adrian Smith (R-Neb.), Jim Costa (D-Calif.), Jimmy Panetta (D-Calif.), Angie Craig (D-Minn.), and Bob Latta (R-Ohio), would support the “preservation” of the rule and “oppose efforts to impose new taxes on family farms or small businesses.”

President Joe Biden’s budget request included changes that would tighten loopholes related to partnerships and the stepped-up basis rule and those who have over $100 million in wealth, according to the Treasury Department’s Greenbook (link). Democrats have said the provision allows the wealthy to avoid paying taxes.

Bottom line: The resolution cites a study from the USDA’s Economic Research Service that found 66% of midsize farms would see a tax liability increase if the stepped-up basis was cut.

|

CHINA UPDATE |

— The Biden administration unveiled tight restrictions on new operations in China by chipmakers that get federal funds to build in the U.S., in the latest efforts to curtail China’s expansion in the industry.

— China’s first hydrogen fuel cell-powered ship begins operations. China’s first ship powered by a 500 KW hydrogen fuel cell has been put into operation by China Three Gorges Corporation. The service ship, Three Gorges hydrogen ship No.1, uses homegrown hydrogen fuel cells and a lithium battery system and will be used for various emergency services in the Three Gorges reservoir area.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Lab-grown chicken. GOOD Meat, a division of Eat Just foods, is the second alternative-foods startup after Upside Foods to win an initial FDA approval (link) to sell chicken grown in bioreactors to the American public. But other hurdles remain: The company needs more USDA approvals and must continue to meet additional regulatory requirements before it can start mass commercial sales.

— New funding awards under the Healthy Meals Incentives Initiative and a pathway for healthy school meals to more students at no cost will be announced today by USDA Secretary Tom Vilsack.

|

HEALTH UPDATE |

— FDA might authorize more Covid booster shots. The decision about a second round of Omicron-targeted jabs for the elderly and the immunocompromised could come within a few weeks, the Wall Street Journal reports, citing people familiar with the agency’s deliberations. The CDC would then have to recommend the shots for them to become widely available. Some Americans more vulnerable to infection have asked their doctors already for another updated booster, and countries including Canada and the U.K. have offered a second round of the shots. Some vaccine experts say no evidence supports giving boosters more frequently than once a year, à la the flu shot, and many people have tired of frequent jabs.

|

POLITICS & ELECTIONS |

— Japan is set to allocate more than 2 trillion yen ($15.1 billion) in additional aid to ease the impact from high inflation ahead of local elections next month.

|

CONGRESS |

— Senate Minority Leader Mitch McConnell (R-Ky.) is taking calls from his colleagues and is eager to return to Capitol Hill as he recovers from a concussion suffered earlier this month, a GOP senator said. Sen. John Cornyn (R-Texas), one of McConnell’s closest friends in the Senate, said he sounds “sharp” but there is no timetable as far as when he would come back. “He’s chomping at the bit,” Cornyn added.

— Many of Biden’s Cabinet secretaries and other administration officials appear before committees today for hearings on the president’s budget request, including:

- Office of Management and Budget Director Shalanda Young at House Budget

- Treasury Secretary Janet Yellen before Senate Appropriations

- Secretary of State Antony Blinken at Senate Appropriations and Senate Foreign Relations

- Small Business Administration chief Isabella Casillas Guzman in Senate Small Business

|

OTHER ITEMS OF NOTE |

— A poop-themed dog toy shaped like a bottle of Jack Daniel’s whiskey is at the center of oral arguments at the U.S. Supreme Court this morning, in a case that could shape how the high court handles trademark, parodies and free speech disputes. Jack Daniel's Properties, represented by Lisa Blatt of Williams & Connolly, is appealing a lower court's decision that dog toy maker VIP Products’ "Bad Spaniels" chew toy is an "expressive work" covered by the First Amendment. President Joe Biden's administration supports Jack Daniel's appeal, and the DOJ’s Matthew Guarnieri will present arguments. VIP Products is represented by Dickinson Wright’s Bennett Cooper. Link for details.

— Japan beat America in the World Baseball Classic final in Miami, Florida. The clash came down to a tense individual battle between Ohtani Shohei, and America’s captain, Mike Trout. Pitching at 100 mph, Ohtani struck out Trout. In dethroning the U.S. — who won the previous tournament, in 2017 — Japan secured a third title.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |