Black Friday: Equities, Oil, Other Markets Plunge on New, Heavily Mutated Variant of Covid-19

More questions than answers on new Covid variant but fear, uncertainty rule markets today

In Today’s Special Edition

Black Friday crash in markets as fear grips investors following news of new Covid variant

MARKET FOCUS

— Equities today: Concerns around a new, heavily mutated variant of Covid-19 identified in South Africa have rocked investor confidence. Stocks are plunging, oil prices are dropping, bond yields are sliding. Low trading volumes globally due to the Thanksgiving holiday is likely exacerbating volatility. Meanwhile, South Korea’s central bank raised a key policy rate Thursday for the second time in three months. Dow futures plunged more than 800 points overnight, while contracts linked to the S&P 500 and Nasdaq fell 1.8% and 1.2%, respectively, after stocks sold off in Europe and Asia. In Asia-Pacific, Hong Kong’s benchmark Hang Seng Index lost 2.7% and Japan’s Nikkei 225 fell 2.5%. China’s Shanghai Composite Index fell 0.6%. Japan’s yen, which typically strengthens in times of market stress, gained against the dollar.

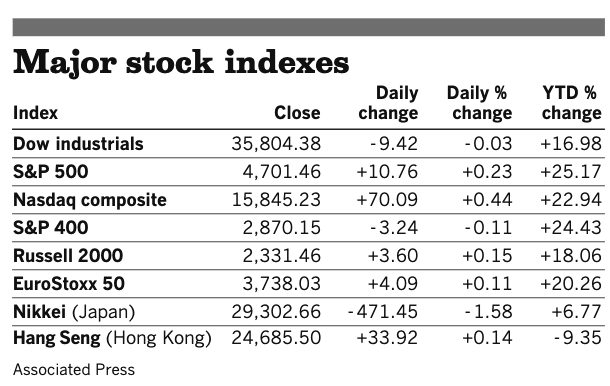

U.S. equities Wednesday: The Dow was only able to get into positive territory late in the trading session but could not finish higher ahead of the holiday Thursday. The Dow ended down 9.42 points, 0.03%, at 35,804.38. The Nasdaq rose 70.09 points, 0.44%, at 15,845.23. The S&P 500 finished up 10.76 points, 0.23%, at 4,701.46. U.S. markets were closed Thursday in observance of Thanksgiving and will trade an abbreviated session today in what is expected to be very light trade volume.

— New Covid-19 variant: more questions than answers. Scientific experts have net yet conclusions about the mutation, known for now as B.1.1.529, and there are less than 100 confirmed cases. Believed to have first emerged in Botswana, B.1.1.529 will be called as such until a Greek letter is assigned to it by the World Health Organization. The variant carries an unusually large number of mutations associated with increased antibody resistance and is "clearly very different" from previous incarnations. South African scientists have already detected 30 mutations to the spike protein, which play a big role in how the virus enters the body. Concern is mounting because of its high number of mutations and rapid spread among young people in Gauteng, South Africa’s most populous province, Health Minister Joe Phaahla said. “Over the last four or five days, there has been more of an exponential rise,” he said, adding that the new variant appears to be driving the surge in cases. Scientists in South Africa are working to determine what percentage of the new cases have been caused by the new variant. The worst case scenario is that it’s more deadly, contagious, and vaccine-resistant than what we’ve already faced. But for now, that is fear, not reality. But fear and uncertainty drive markets and traders.

— Focus on South Africa: About 41% of South Africa’s adults have been vaccinated and the number of shots being given per day is relatively low, at less than 130,000, significantly below the government’s target of 300,000 per day. South Africa has about 16.5 million doses of vaccines, by Pfizer-BioNTech and Johnson & Johnson, and is expecting delivery of about 2.5 million more in the next week, according to Nicholas Crisp, acting director-general of the national health department. South Africa, with a population of 60 million, has recorded more than 2.9 million Covid-19 cases including more than 89,000 deaths.

— Watch is on for new variant. Biggest concern is whether the virus could lead to more serious illness or decrease the effectiveness of vaccines and treatments. It's spreading across the globe. B.1.1.529 has been found in travelers arriving in Hong Kong, just as Covid cases surge around the world heading into the holiday season.

— Immediate impact of new variant: more travel bans. European and Asian governments were scrambling to impose new travel restrictions. The U.K., Germany, Italy and Singapore today imposed bans on entry from South Africa and neighboring African countries, and the European Commission is proposing member states to activate the “emergency brake” allowing a ban of air travel from the region.

— What some experts are saying: The strain, B.1.1.529, is “the most worrying that we’ve seen,” according to Dr. Susan Hopkins, the chief medical advisor to the U.K. Health and Security Agency. According to a South African scientist, 90% of the cases in the Gauteng region around Johannesburg are due to the new strain. Hong Kong and Israel officials said they had already identified cases of the new variant in travelers that had been to South Africa. Scientists say the strain has a high number of mutations that may make it more transmissible and allow it to evade some of the immune responses triggered by previous infection or vaccination. Bottom line: Covid-19 is back on the table.

— Next step: The World Health Organization is due to meet today to discuss whether the strain is a variant of concern.

— Market reactions:

- U.S. crude prices are down more than 6%, and energy producers are suffering steep declines. Brent crude slid 5.9% to under $77 a barrel, putting the global energy benchmark on track for its biggest one-day loss since July. Traders said the price plunge made it likely that the Organization of the Petroleum Exporting Countries and a group of Russia-led allies would pause steps to pump more oil when they meet next week.

- Bitcoin’s dollar price was down 7% from Thursday, and crypto stocks were falling along with it.

- Yields on 10-year Treasury notes fell to 1.517%, from 1.644% before the Thanksgiving break. Yields, which move in the opposite direction to prices, earlier fell to 1.505%, at which point they were on course for their biggest daily decline since the market panic of March 2020.

- Gold rose more than 1% to $1,812 a troy ounce.

- Are markets overreacting? Some are asking that. If so, it’s a buying opportunity for many, but as noted, fear and uncertainty are winning out for now. "For the moment it is understood that the number of cases is small, but due to the thin liquidity levels in Asia trading as a consequence of the U.S. holiday the reaction does appear to be outsized," said Michael Hewson, chief market analyst at CMC Markets. Other variants of concern include Delta, which is now dominant worldwide, as well as Alpha, which triggered a deadly wave of infections across Europe and the U.S. last winter and spring.

— A quick-on-the draw Fed? Federal Reserve officials at their last meeting were open to removing policy support at a faster pace to keep inflation in check, even before data showed price pressures accelerating. “Various participants noted that the Committee should be prepared to adjust the pace of asset purchases and raise the target range for the federal funds rate sooner than participants currently anticipated if inflation continued to run higher,” according to FOMC minutes released Wednesday of the November meeting. Since the meeting, data on inflation have worsened.

— Vilsack: BBB act will “help control inflation.” In an appearance on CNN Wednesday morning, USDA Secretary Tom Vilsack said, “The reality is we have got an economy that is growing. And obviously as a result of that we’re going to see some increase in prices. ... We’re going to do everything we can to continue to try to help folks with these costs. That’s why the President did what he did earlier this week with reference to gas prices. We’re going to see an impact on that to help family budgets.” Vilsack added, “The long-term strategy is getting the Build Back Better bill passed, which we know will help to control inflation...and help families with a lot of difficult costs they’re incurring.” However, some private economists have predicted more inflation impact should the BBB be approved.

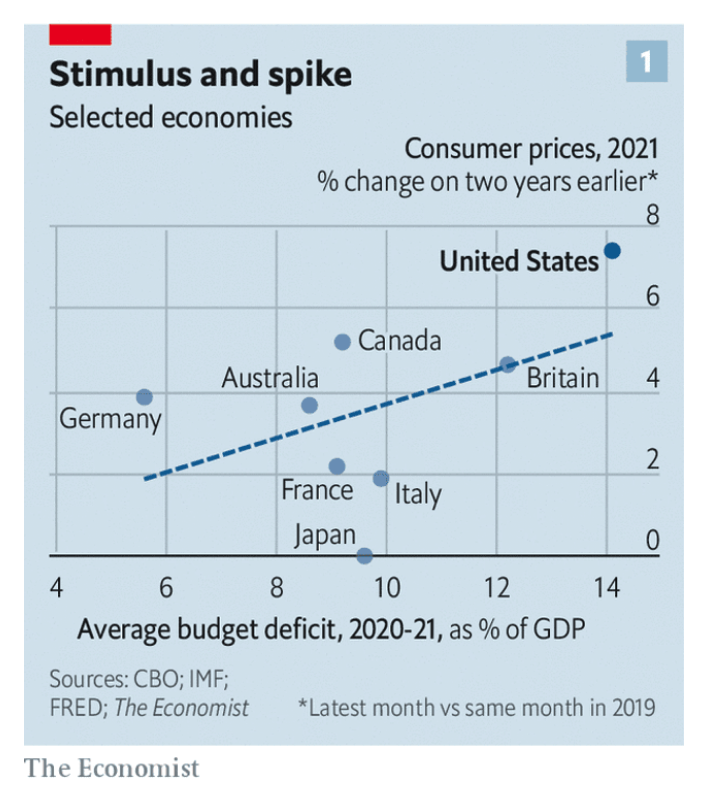

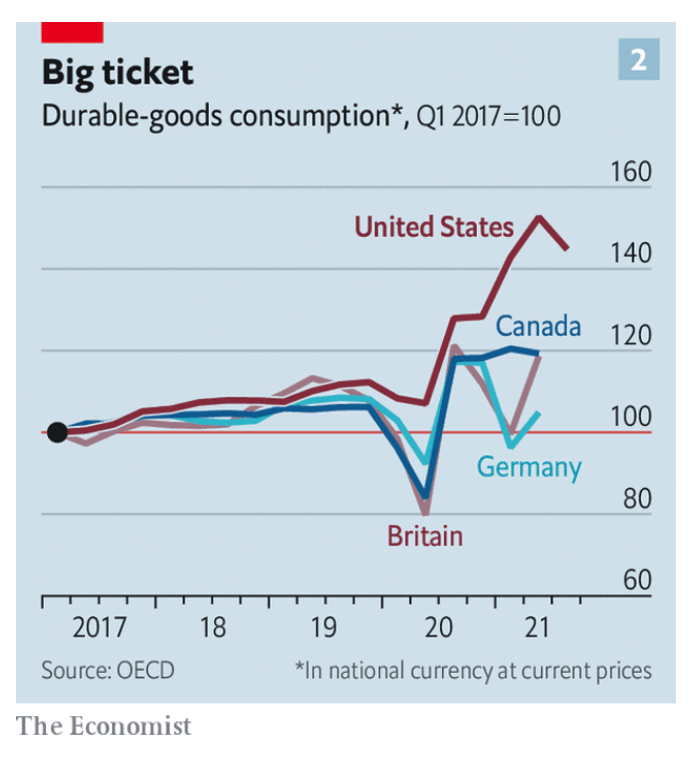

— Inflation is now higher in U.S. than in any other advanced economy. Democrat-friendly media and economists are quick to note rising inflation in Germany and other countries. That in large part is due to the supply chain woes which have also help boost prices in the United States. But looking at prices today and those 24 months ago shows consumer prices are up by about 7.5% in the U.S., more than two percentage points higher than anywhere else in the G7 group of rich countries. The Economist magazine did this and see the chart below for details. As for some of the reasons for U.S. inflation: Over the course of 2020 and 2021, the U.S. fiscal deficit is on track to average about 14% of GDP, according to projections from the Congressional Budget Office. As with inflation, that is higher than in any other G7 country. Another reason: the U.S. Fed, whose saw assets on its balance-sheet doubled over the past two years as a share of GDP. Another reason: U.S. consumer spending. The Economist notes that in the second quarter of 2021, spending on durable goods was roughly a third higher than in the final quarter of 2019, far above its previous trend and easily outpacing the increases in other big economies (see chart). Also, port throughput in the U.S. was 14% higher in the second quarter of 2021 than in 2019. Other parts of the world have been more subdued: throughput in Europe was 1% lower. This is why countries outside the U.S. could legitimately say America has helped boost inflation elsewhere.

— OPEC+ considering pause on planned increases. The global oil cartel is weighing whether to pause the 400,000 barrel per day production increase it resolved to undertake each month through next year following the announcement earlier this week of a coordinated release of crude by the U.S., China, South Korea, India, Japan, and the United Kingdom, the Wall Street Journal reported. Saudi Arabia worries that additional output from the reserves threatens to reduce prices, as does Russia, although the United Arab Emirates and Kuwait are reportedly not supportive of the pause.

Facts and figures. Several bodies, including the Energy Information Administration, International Energy Agency, and OPEC+ itself have projected the global market will loosen up next year, and a decision by the cartel to pause its planned increases would simply hasten a pull-back that was already likely considering those projections, said Ben Cahill, senior fellow for the Energy Security and Climate Change Program at the Center for Strategic and International Studies. “The idea that they were going to keep adding 400,000 barrels a day every month — it just doesn't hold up to scrutiny. It just never seemed possible that they will do that,” he said.

— China, the world's largest crude importer, was non-committal about whether it will release oil from its reserves as requested by Washington, while OPEC sources said the U.S. action has not made the producer group change course.