Big Jobs Miss for December, but Unemployment Falls to 3.9%

Big miss on employment has traders focusing on Fed reaction with different opinions

|

In Today’s Digital Newspaper |

Market Focus:

• Another jobs report, another big miss

• President Biden will speak about December jobs report at 10:45 a.m. ET

• Strategist: Fed won’t risk a 20% drop in house prices and a 30% slide in stocks

• U.S. mortgage rates this week rose to highest levels since May 2020

• Number of small firms lifting compensation hits new high

• U.S. imports surge

• U.S. tariff revenue reached new heights

• U.S. agriculture registered fresh export, import records in November

• Eurozone inflation rose at fastest pace on record in December, defying expectations

• Has inflation peaked

• IMF criticism

• IRS tax tables getting a bigger-than-usual adjustment this year, thanks to inflation . •

• Bitcoin dropped again overnight, declining to as low as $41,008

• U.S. forecast to be top LNG exporter in 2022

• Kazakhstan instability continues to impact uranium market

• More than 60 million people under winter weather alerts across U.S.

• USDA daily export sales:

— 176,784 MT corn to Mexico during 2021-2022 marketing year

— 120,000 MT soybeans to unknown destinations during 2022-2023 marketing year

• Ag demand update

• Wheat leads overnight price declines

• China tries to avoid real estate meltdown (see details under China section

• Brazil posts record pork exports in 2021

• Slaughters slowed by absenteeism

• Some cattle left to move

• Pork cutout clawing back

Policy Focus:

• Field hearings about new farm bill likely early this year, but don’t expect much beyond that

Afghanistan:

• Senate Armed Services Committee on Jan. 11 receives closed briefing

Personnel:

• Central command nominee

• Environmental justice official exits

China Update:

• Major port in China threatened with Covid outbreaks that could disrupt supply routes

• China tries to avoid real estate meltdown

• Chinese police allege Walmart violated the country’s cybersecurity law

Trade Policy:

• EU retaliatory rice tariffs officially lifted; focus now on U.K. negotiations

• Mexico takes step to challenge U.S. implementation of vehicle rules under USMCA

Energy & Climate Change:

• DOE awards $35 million in funding for small business green technology projects

Livestock, Food & Beverage Industry Update:

• Coca-Cola makes deal with Constellation Brands to introduce canned cocktails this year

• Conagra Brands Inc. expects spread of Omicron to stress food supply chains

Coronavirus Update:

• CDC: More than 84,000 people in U.S. could die of Covid-19 over next month

• Supreme Court enters fray over workplace vaccine mandates

Politics & Elections:

• Will Thune exit or run for re-election?

• Ex-columnist Kristof ineligible to run for Oregon governor

• President Biden assailed former President Donald Trump

Congress:

• Senate out until Monday after a week delayed by snow and ended by funeral services

Other Items of Note:

• Cotton AWP rises back over $1 per pound

• AMS publishes inspection fees for 2022

• President of Kazakhstan ordered security forces to ‘kill without warning’

• What would happen if U.S. gov’t was really in the food industry

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. U.S. stock indexes all opened lowered following the U.S. jobs report. Asian equities were mixed as markets focused ahead on U.S. jobs data due this morning. The Nikkei eased 9.31 points, 0.03%, at 28,478.56. The Hang Seng Index rose 420.52 points, 1.82%, at 23,498.38. European equity markets are mostly lower in early action, though losses are relatively muted ahead of US jobs data. The Stoxx 600 was down 0.3% while other markets were down 0.1% to 0.7%.

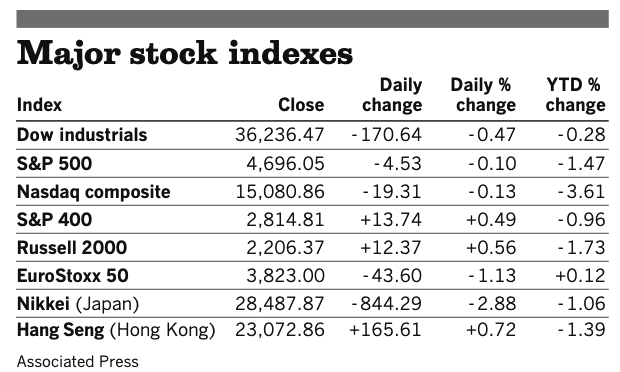

U.S. equities yesterday: The Dow was unable to sustain gains during the session and ended down 170.64 points, 0.47%, at 36,236.47. The Nasdaq fell into negative territory late in the session, finishing down 19.31 points, 0.13%, at 15,080.86. The S&P 500 also slid into negative territory at the close, down 4.53 points, 0.10%, at 4,696.05.

On tap today (despite a snow closing for the federal gov’t in Washington, most if not all reports should be issued):

• U.S. nonfarm payrolls are expected to increase by 422,000 in December and the unemployment rate is forecast to tick down to 4.1% from 4.2% one month earlier. (8:30 a.m. ET) UPDATE: A big miss as December payrolls rose only 199,000, while the unemployment rate fell to 3.9%, according to Bureau of Labor Statistics data. The report covered the week including Dec. 12, which came before the worst of an Omicron spike that began heading into Christmas. The figures — which represent the total number of paid workers in the U.S. minus farm, government, private household and non-profit employees -—come as many grow concerned over the direction of the U.S. recovery in 2022. Observers note the Bureau of Labor Statistics is struggling to get data during the pandemic. In fact, the agency already adjusted its initial estimates for payrolls growth by nearly 1 million jobs in 2021, which was the highest adjustment ever. Upshot: The Fed has turned more hawkish as the labor market struggles, fueling concerns it will move too far in the opposite direction after ignoring inflation through 2021. But ING Economics says: “With an unemployment rate below 4% and pay pressure building the Fed looks set to respond swiftly.” The economic group concludes: “The upward pressure on interest rate expectations is not going to let up soon. Next week we expect to see headline inflation break above 7% year-on-year with core inflation breaching 5% YoY while later in the month all eyes should be on the 4Q employment cost index. With the NFIB and the Fed’s own Beige Book reporting broadening wage pressures another 1% quarter-on-quarter rise in this index could really tip the balance in favor of a March rate hike and open the door to the possibility of four rate increases this year. For now we are more cautious and think May will mark the starting point for higher policy rates on the basis that the Omicron wave clouds the near-term economic outlook, but this is a fast moving situation and the Fed [has] signaled they want to get back in control.” Despite the disappointing showing to end the year, the U.S. added jobs during 2021 at a record pace. Nonfarm payrolls grew by an average of 537,000 per month.

• President Biden will speak about the December jobs report at 10:45 a.m. ET. He then is scheduled to travel to Colorado to survey wildfire damage.

• Federal Reserve speakers: San Francisco’s Mary Daly at an American Economic Association virtual conference at 10 a.m. ET., Atlanta’s Raphael Bostic at an American Economic Association virtual conference at 12:15 p.m. ET, and Richmond’s Thomas Barkin to the Maryland Bankers Association at 12:30 p.m. ET.

• Baker Hughes rig count is out at 1 p.m. ET.

• Fed releases its November consumer credit report at 3 p.m. ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

Strategist says Fed won’t risk a 20% drop in house prices and a 30% slide in stocks. David Rosenberg, chief economist and strategist at Rosenberg Research and the former chief North American economist at Merrill Lynch, isn’t buying the tough talk from the Fed. “One should be skeptical of the Fed’s forecasts, given the poor track record, even though investors treat them (and the dot plots and FOMC minutes) as gospel,” he says. Dating back to 2012, the Fed’s forecasts on rates have been correct 37% of the time, accurate on core inflation 29% of the time, accurate on unemployment 24% of the time and accurate on real gross domestic product growth 17% of the time. And the Fed tends to be too bullish on growth, he adds. “What I’m saying is that they say in the stock market never to bet against the Fed but in the bond market, I can definitely tell you that it is perfectly safe to say that you can bet against the Fed’s forecasting ability — especially when it comes to the one thing the Fed can actually control, which is the policy rate,” he says. Pointing to flattening real consumer spending, housing past its peak, too much inventory, a record high trade deficit and flat-to-down real business speaking, “there is absolutely no impetus to domestic demand growth going forward and yet the Fed continues to play the role of economic cheerleader.”

Perspective: Today’s Employment report (see related item) may give have some Fed second-guessers backing off, but there is disagreement about that in the private sector.

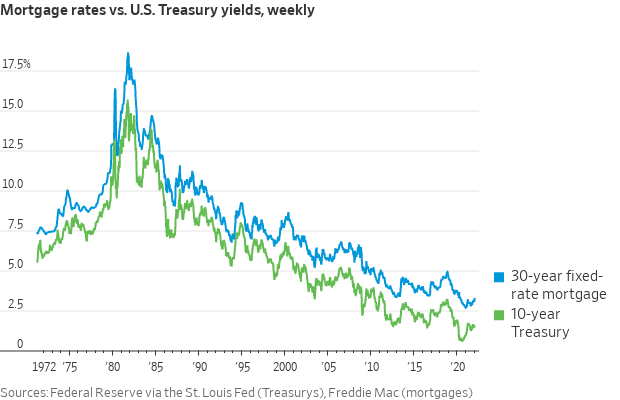

U.S. mortgage rates this week rose to their highest levels since May 2020, driving up the costs associated with home buying at a time when home-sales prices are already near record highs. The average rate for a 30-year fixed-rate loan was 3.22%, up from 3.11% last week and 2.65% one year ago, according to mortgage finance giant Freddie Mac. Ultralow interest rates have been a major force in the housing boom of the last two years. But with the Federal Reserve on course to raise short-term interest rates this year, mortgage rates are likely to accompany them higher, making home affordability an even greater challenge. Mortgage rates in recent days have followed the steep climb in U.S. Treasury yields, which set a floor on borrowing costs across the economy.

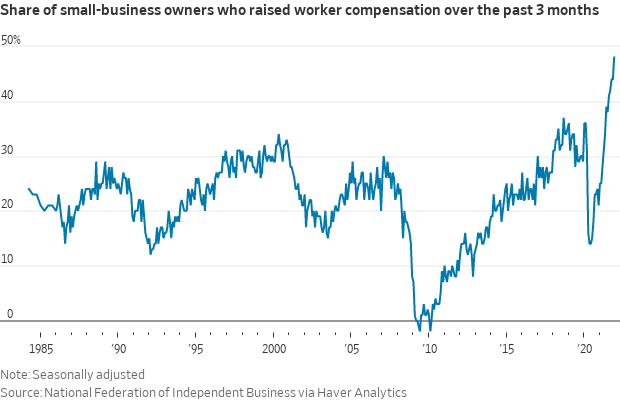

Number of small firms lifting compensation hits a new high. The fierce competition for workers among U.S. employers has inspired another record-setting month for wage hikes at small firms. That’s according to the latest monthly employment survey from the National Federation of Independent Business (NFIB). NFIB Chief Economist William Dunkelberg reports on the December numbers from member companies participating in the survey:

- Seasonally adjusted, a net 48% reported raising compensation, up 4 points from November and a 48-year record high reading. A net 32 percent plan to raise compensation in the next three months, unchanged from November’s record high reading.

- Yet so far, the rising wages still haven’t been nearly enough to attract workers to fill all of the open positions. According to NFIB:

- Overall, 60% reported hiring or trying to hire in December, unchanged from November...

- 57% (95 % of those hiring or trying to hire) of owners reported few or no qualified applicants for the positions they were trying to fill (up 1 point).

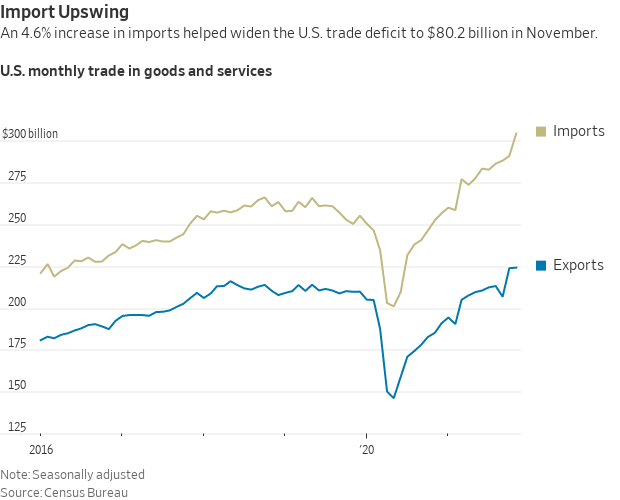

U.S. import surge. U.S. consumer demand for goods and an easing of supply-chain constraints drove a surge in imports in November, pushing the trade deficit close to a record. The goods deficit increased in November to a record $99 billion as Americans shopped for clothing, toys, and cell phones early in the holiday season, the Commerce Department said on Thursday. The overall U.S. trade deficit in goods and services in November widened to $80.2 billion. American manufacturers sent fewer goods overseas in November compared with the prior month but spending by tourists as U.S. borders loosened Covid-19 restrictions for international travelers boosted services exports. (Spending by foreign tourists in the U.S. is counted as an export, spending by U.S. tourists overseas is counted as an import.) That meant that the U.S. recorded a 0.2% increase in exports for the month overall.

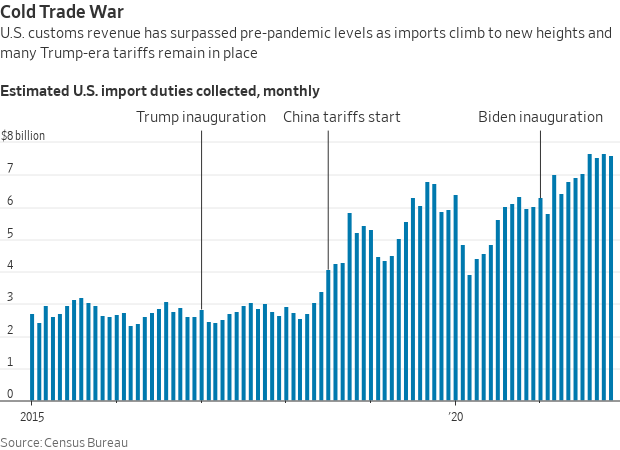

U.S. tariff revenue also has reached new heights as many Trump-era duties remain in place while demand for overseas goods soars.

U.S. agriculture registered fresh export, import records in November. Trade data shows U.S. agricultural exports hit a new record of $18.48 billion in November, above the October total of $17.60 billion that also was a new record.

Agricultural imports rose to $15.41 billion, also a new record, displacing the prior mark of $14.97 billion that was set in June 2021.

That left a trade surplus for the sector of $3.07 billion, up from $2.79 billion in October.

So far in fiscal year (FY) 2022, U.S. agricultural exports total $36.08 billion against imports of $30.22 billion for a surplus of $5.8 billion. For the same period in FY 2021, U.S. agricultural exports totaled $31.55 billion with imports at $25.09 billion for a surplus of $6.46 billion. After the strong start to FY 2021, the sector saw export values ebb while the value of imports picked up steam as the U.S. economic recovery from the pandemic continued. U.S. agriculture registered four monthly deficits to close out FY 2021, finishing with exports valued at $172.2 billion against imports of $163.3 billion for a surplus of $8.9 billion, a turnaround from a deficit of $3.7 billion in FY 2020.

USDA currently forecasts FY 2022 agricultural exports at $175.5 billion with imports at $165.5 billion which would leave a surplus of $10.5 billion. U.S. agricultural exports would need to average just over $13.9 billion per month and imports just over $13.4 billion per month to reach USDA’s forecast. The final 10 months of FY 2021 saw U.S. agricultural exports top $13.9 billion in five months, while U.S. agricultural imports only fell short of $13.4 billion three months. While early, a similar pace to year ago would suggest agricultural imports could well top USDA’s forecast.

Eurozone inflation rose at the fastest pace on record in December, defying expectations for a slowdown. Consumer prices rose 5% from a year earlier following a 4.9% increase in November, according to Eurostat, the European Union's statistics agency. The European Central Bank targets inflation around 2% but officials haven't appeared overly concerned that price pressures will endure. ECB plans outlined last month to wind down pandemic-era stimulus were less aggressive than those from the Federal Reserve, Bank of England and some other central banks.

Has inflation peaked? Some of the same observers who didn’t catch the recent inflation are now saying it could have reached its peak. They cite purchasing managers’ indexes which, while remaining high, note that international companies reported input prices fell for a second month in December and those for manufacturers reached their lowest level since last March. Delivery times may also be improving. Meanwhile, others note that food prices are slightly coming off recent price gains. And, a new gauge of global supply-chain disruptions developed by the Federal Reserve Bank of New York showed that while pressures are the highest level since at least 1997, there are signs of a peak and strains “might start to moderate somewhat going forward.”

JPMorgan Chase economists predict global inflation will slow to a still heady 3.5% this quarter from 5.9% in the prior three months, which was around the highest in a quarter century. “For the first time in a year, we assess risks at the start of the quarter as skewed towards a downside inflation surprise,” they said.

IMF criticism. The International Monetary Fund’s deployment of $818 billion in pandemic aid, often without conditions, drew fire from some former officials worried it’s no longer a hard-nosed lender. Link for details via Bloomberg.

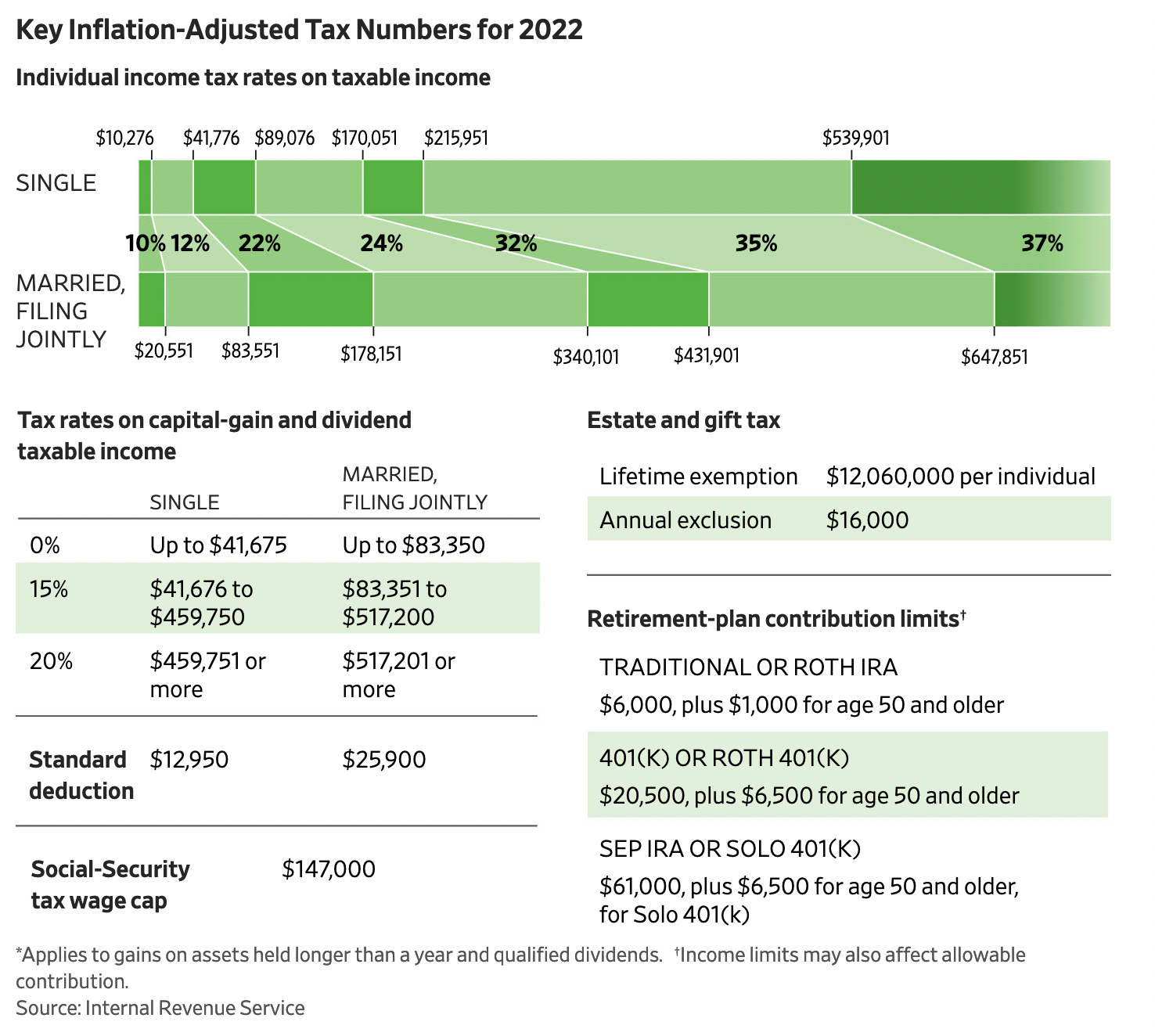

IRS tax tables are getting a bigger-than-usual adjustment this year, thanks to inflation. Here are some tax numbers you need to start planning for 2022 taxes, set retirement savings for the year, and more. (Source: Wall Street Journal)

Market perspectives:

• Outside markets: The U.S. dollar index was weaker ahead of the Employment report even as the euro was slightly weaker against the greenback. The yield on the 10-year U.S. Treasury note has firmed slightly to trade around 1.73%. Gold and silver futures turned mixed ahead of the jobs data, with gold firmer around $1,791 per troy ounce and silver weaker around $22.15 per troy ounce.

• Bitcoin dropped again overnight, declining to as low as $41,008 to hit the lowest level since September. Other cryptocurrencies were also lower. Technical indicators suggest a drop below $40,600 would signal further weakness for the Bitcoin. Among the factors being blamed for the slump is the outlook for Fed policy, the tech selloff and even the unrest in Kazakhstan where a substantial number of miners had gone after China’s crackdown.

• Crude oil futures were higher ahead of U.S. trading, with U.S. crude around $80 per barrel and Brent around $82.65 per barrel.

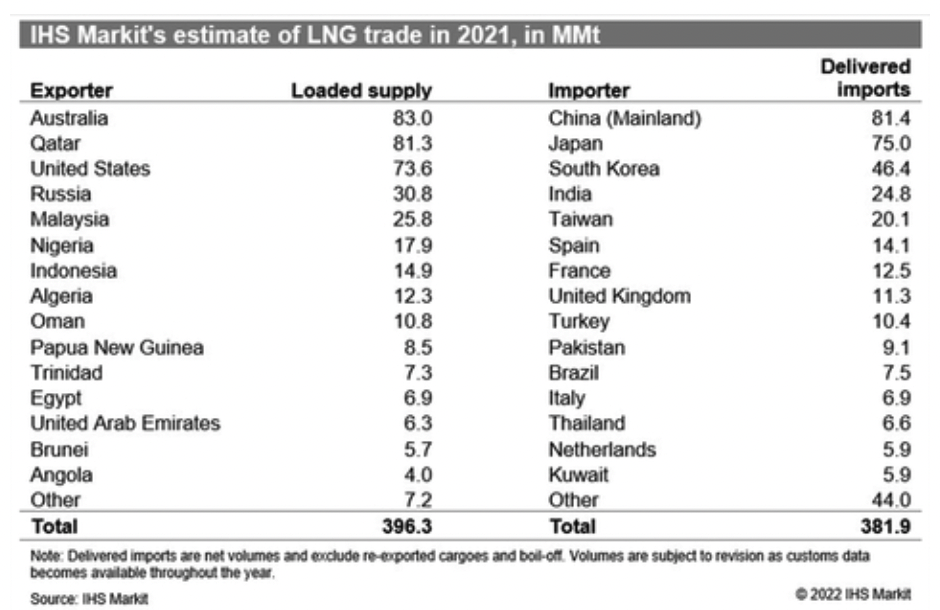

• U.S. forecast to be top LNG exporter in 2022. Global analytics firm IHS Markit says (link) the U.S. is positioned to ship more liquefied natural gas (LNG) overseas during 2022 than major competitors Australia and Qatar, which led the world in 2021. Australia exported 83 million metric tons of LNG last year, while Qatar exported 81.3 million metric tons, per IHS numbers. The United States was responsible for the single largest supply increase among exporting nations, with 25.3 million metric tons of additional LNG year over year, a 52% jump, and reached 73.6 million metric tons total. Soaring demand in Asia, home to No. 1 LNG importer China, and Europe fueled the high export volumes. Gas-hungry Europe, where benchmark gas futures rose 112% from Nov. 21 to Dec. 20, led some U.S. cargoes toward the continent and away from Asia.

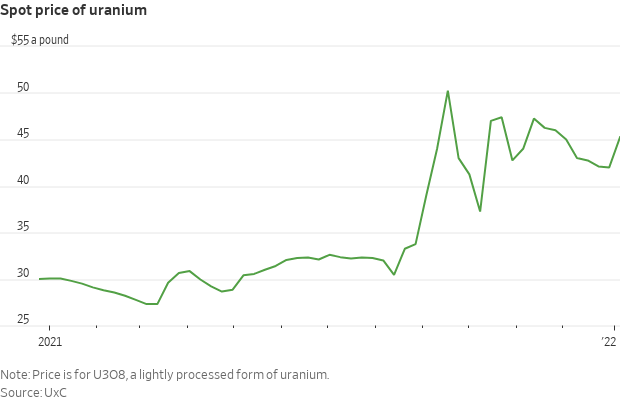

• Kazakhstan instability continues to impact uranium market. Instability in Kazakhstan, the world’s biggest uranium producer, threatens to curb output and boost prices at the same time supplies of the nuclear fuel are becoming tighter. Dozens of people died Thursday when authorities moved against protesters after several days of unrest and the arrival of a Russia-led military alliance to quell the disorder. Traders and Western mining companies say the protests might make it difficult to transport workers and equipment to mine sites when shifts rotate and could impact exports out of the country. Kazakhstan, a Russian ally, produces about 40% of the world’s uranium output. (See related item in Other Items of Note.)

• USDA daily export sales:

— 176,784 MT corn to Mexico during 2021-2022 marketing year

— 120,000 MT soybeans to unknown destinations during 2022-2023 marketing year

• Ag demand: Jordan tendered to buy 120,000 optional origin milling wheat.

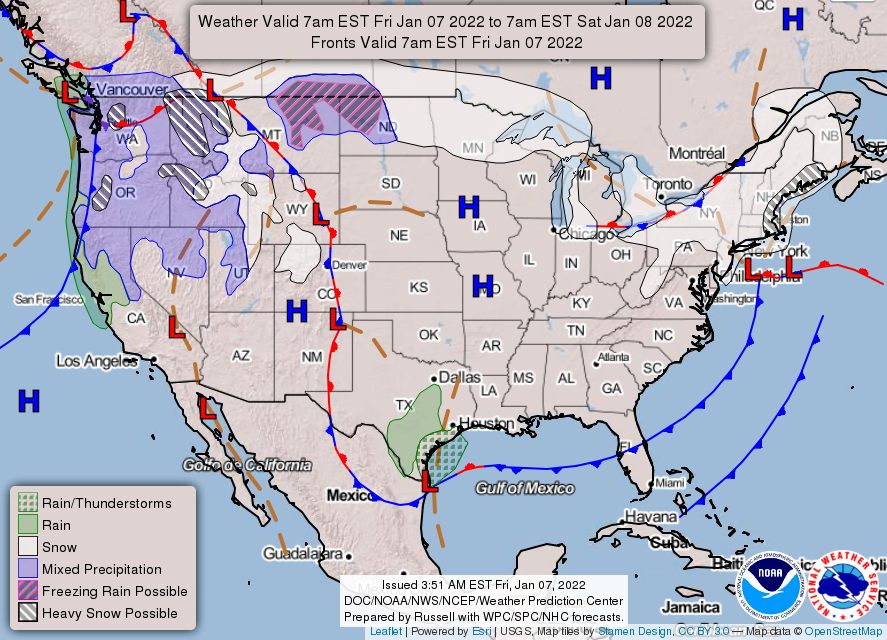

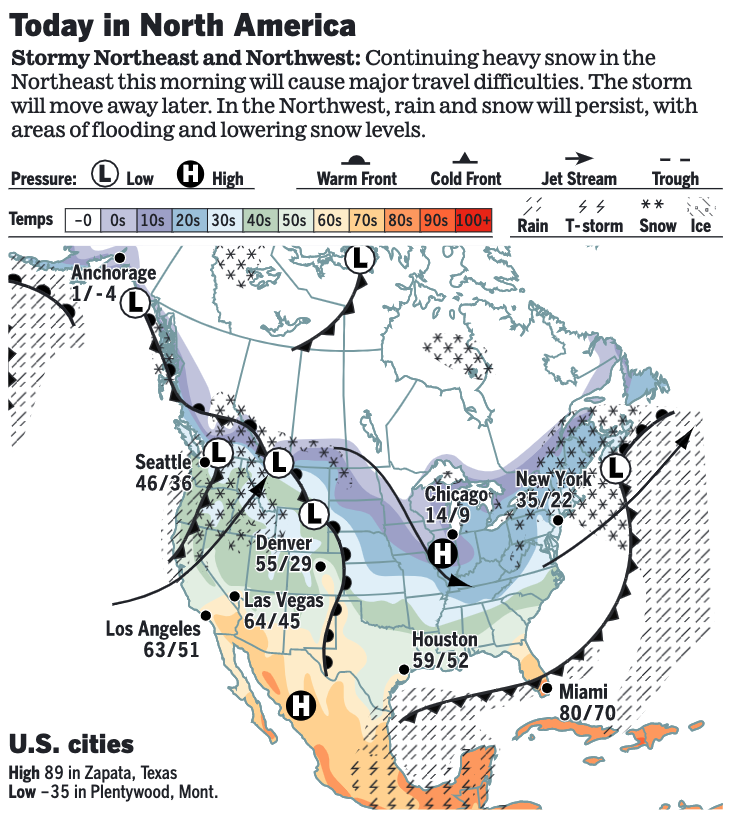

• More than 60 million people are under winter weather alerts across the U.S. as several storm systems grip the country. On the West Coast, record-breaking rain and snowmelt in Washington and California are causing river flooding and avalanches. Across much of the South, dropping temperatures are causing icy road conditions that have led to massive backups and accidents in states like Kentucky, where a more than 20 car pile-up yesterday brought traffic to a halt. On the East coast, a fast-moving winter storm is expected to drop several inches of snow on New York, Massachusetts and parts of the mid-Atlantic this weekend. One report notes the Northeast snowstorm could evolve into a “bomb cyclone” and wreak havoc on morning commutes.

• NWS weather: Quick hitting Nor'easter to bring disruptive snowfall to parts of the Northeast and New England today... ...Heavy mountain snow and gusty winds to impact the Pacific Northwest and Northern Rockies to end the workweek... ...Dangerously cold temperatures located throughout the Northern Plains and Midwest this morning to briefly retreat on Saturday, before the next surge of arctic air enters the region on Sunday.

Items in Pro Farmer's First Thing Today include:

• Wheat leads overnight price declines

• China tries to avoid real estate meltdown (see details under China section

• Brazil posts record pork exports in 2021

• Slaughters slowed by absenteeism

• Some cattle left to move

• Pork cutout clawing back

|

POLICY FOCUS |

— Field hearings about a new farm bill likely early this year, but don’t expect much beyond that. Reason: Republicans think they have high odds to take over control of the House and fair odds to regain control of the Senate. Here are some bullets points regarding a new farm bill:

- Farm bill expiry varies. Some programs amended by the farm bill do not expire. Others expire after the 2023 crop year. Still others at the end of the 2023 fiscal year. Still others at the end of the 2023 calendar year. And others at other times. It varies.

- Outcome of Nov. elections could flip control of either or both House & Senate.

- Farm bill hearings expected this year. House Ag Chairman David Scott (D-Ga.) wants to start hearings as soon as January.

- Uncertainty re: how much new funding could be available.

- BBB is quite literally an extension of some programs including various conservation programs into which the bill puts money. These programs are extended into 2026 under the bill. It puts nothing into the farm safety net.

- BBB includes around $80 bil. In climate-related ag provisions, with bulk of money earmarked for farm bill programs.

- BBB if approved would be scaled back from $1.75 trillion level that cleared the House.

- BBB includes several provisions intended to scale up adoption of cover crops and other climate-related conservation practices and to address climate change via forestry.

- Bill would authorize payments of $25 an acre to farmers who plant cover crops, but farmers say a much higher payment rate is needed.

- Bill would boost funding for farm bill conservation programs by more than $20 billion and provide for $2.35 bil. In conservation technical assistance over 10 years.

- Many see a farm bill extension… by default.

|

AFGHANISTAN |

— Senate Armed Services Committee on Jan. 11 receives a closed briefing on U.S. policy in Afghanistan, with Defense Secretary Lloyd Austin expected to speak.

|

PERSONNEL |

— Central command nominee. President Biden has nominated Army Lt. Gen. Michael Erik Kurilla to be the next commander of U.S. military operations that include the Middle East, the Wall Street Journal reports. Gen. Kurilla would assume the role as concerns grow that al Qaeda and the Afghanistan branch of Islamic State could re-emerge as a threat to American interests. Other issues include Tehran’s nuclear program and influence in the region and ongoing civil wars in Syria and Yemen.

— Environmental justice official exits. Cecilia Martinez, who helped develop President Biden's environmental agenda while he was running for office, will step down today as the top White House official on environmental justice.

|

CHINA UPDATE |

— Major port in China is threatened with Covid outbreaks that could disrupt supply routes yet again and push up still-high freight costs. A suspension of trucking services in several parts of East China’s Zhejiang province has slowed the transportation of manufactured goods and commodities through one of the world’s most important ports. There are strict controls on trucks moving goods to or from the Beilun district in Ningbo after the discovery of several cases of Covid-19 in the area, shipping line A.P. Moller-Maersk A/S said in a Thursday customer advisory. This suspension, along with restrictions on truckers in some areas in and around Zhejiang, has halted operations at some yards and warehouses at Ningbo port.

— China tries to avoid real estate meltdown. China will make it easier for state-backed property developers to buy up distressed assets of debt-laden private peers, a source with direct knowledge told Reuters. State-owned developers acquiring distressed assets will not have those loans counted as debt under rules that cap borrowing. The “three red lines” policy restricts the amount of new borrowing property developers can raise each year by placing caps on their debt ratios. Banks have told state-owned developers about the exclusion of M&A loans in calculating their debt ratios, the source said, but added that the appetite to acquire assets is not high. Chinese authorities have encouraged state-owned builders to look at the assets of private peers struggling with liquidity issues, as an increasing number have failed to meet their debt obligations.

— Chinese police allege Walmart violated the country’s cybersecurity law, according to a media outlet backed by the country’s market regulator. The retailer was slow to fix vulnerabilities police found in its network system, the media outlet reported, citing people familiar with the matter. Walmart had no immediate comment. Days earlier, it was criticized on social media and by China’s anticorruption watchdog for supposedly stopping sales of products from Xinjiang, site of a government campaign of forcible assimilation against religious minorities.

|

TRADE POLICY |

— EU retaliatory rice tariffs officially lifted; focus now on U.K. negotiations. The European Commission last November published a draft regulation formally repealing the 25% retaliatory tariffs on U.S. products, including milled and broken rice entering the European Union (EU). The tariffs were originally imposed in 2018 in response to U.S. Section 232 tariffs assessed on European steel and aluminum. The USA Rice Federation notes that on Jan. 1, the draft regulation was finalized and brought into force, and shipments of U.S. rice will no longer be subject to the additional 25% duty. All shipments must still be accompanied by either an official import license, purchased and issued through the tariff rate quota auction process, or pay the standard EU tariffs for milled (€175/MT) and broken (€65/MT) rice.

“The deal brokered last fall by U.S. and EU negotiators to lift the tariffs on both sides could be used as a model for resolution of a similar tariff situation that persists between the U.S. and the United Kingdom,” according to Peter Bachmann of USA Rice. “We are glad to see the quick implementation of the agreement made last fall and think this is positive news about the future of U.S. rice trade with the EU,” said Mark Holt, rice miller and chair of the USA Rice Subcommittees that oversee Europe, Africa, and Middle East trade policy and promotions. “We can now shift our focus to eliminating the rice tariffs on U.S. rice in the U.K., something that has long been a priority for both USA Rice and our counterparts at the U.K. Rice Association.”

— Mexico takes expected step to challenge U.S. implementation of vehicle rules under USMCA. Mexico Thursday requested a dispute settlement panel be established under the U.S.-Mexico-Canada Agreement (USMCA) on the U.S. implementation of rules relative origin requirements for vehicles, maintaining the U.S. interpretation of the rules is too narrow. Mexico believes USMCA gives automakers more flexibility in how they calculate how much of a vehicle is made within the three countries, making it eligible for duty-free trade. "The US imposes on auto makers requirements that are incompatible with the USMCA to calculate the regional value content of passenger vehicles, light trucks, and their parts," Mexico’s Economy Ministry said. "Mexico considers that a panel's decision would provide certainty to the automotive industry in benefit of competitiveness in the region."

The Office of the U.S. Trade Representative said it was studying the Mexican request but is “confident” the U.S. interpretation of the rules is in line with its USMCA commitments.

This marks Mexico’s first request to use the dispute settlement provisions of USMCA and comes after a ruling this week which found Canada did not live up to its USMCA commitments relative to operation of its dairy tariff-rate quotas (TRQs). A final decision in the Mexico auto request is expected yet this year, a far more accelerated pace compared to World Trade Organization disputes. Meanwhile, there are reports indicating Canada may join Mexico’s request on autos content, but that has not yet been confirmed.

|

ENERGY & CLIMATE CHANGE |

— DOE awards $35 million in funding for small business green technology projects. The Department of Energy (DOE) announced Thursday (Jan. 6) it has awarded $35 million to support 158 small business green technology projects. The projects in 29 states “aim to develop an array of clean energy technology, from climate research tools to improved batteries for electric vehicles,” DOE said. Funding is administered by DOE’s Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs. Examples of projects funded in the effort include a $200,000 award to Novoreach Technologies for the development of composite materials that capture carbon dioxide from the air, and a $256,000 award to Birch Biosciences for the development of next-generation plastic recycling technology.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Coca-Cola has made a deal with Constellation Brands to introduce canned cocktails this year under its Fresca brand — starting with some familiar to those who already use Fresca as a mixer. Link for details.

— Conagra Brands Inc. expects the spread of Omicron to stress food supply chains and stretch staffing at the maker of Birds Eye frozen vegetables and Slim Jim meat snacks.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 300,388,207 with 5,474,006 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 58,487,940 with 833,989 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 515,162,867 doses administered, 207,016,514 have been fully vaccinated, or 63.07% of the U.S. population.

— CDC predicts more than 84,000 people in the U.S. could die of Covid-19 over the next month. Health experts say this forecast may not even fully account for the emergence of the Omicron variant and the spike in cases linked to holiday travel. Meanwhile, in California, local health officials say next month's Super Bowl is expected to go ahead as planned in Los Angeles despite the latest surge of cases in the region.

— U.S. Supreme Court will hear arguments today on the Biden administration’s vaccine mandates. The Supreme Court will hold a special session today to consider whether the Biden administration can enforce vaccine-and-testing rules for large private employers and a vaccine mandate for most healthcare workers. The issues come to the court on an emergency basis during a record increase in U.S. Covid-19 infections. In a departure from its usual procedures, the court is hearing arguments on cases that haven’t been fully aired in lower courts. The Supreme Court has consistently blocked challenges to state-local vaccine mandates, but analysts note the Biden mandates for health care workers and large employers present different issues for the justices. The court's six conservatives may be sympathetic to claims that the federal agencies have overstepped their statutory authority. Chief Justice John Roberts, in particular, cares about agencies following the rules when issuing new regulations or requirements. One of the challengers’ arguments is agency failure to follow notice-and-comment requirements before issuing the mandates. And agency overreach was at the heart of the justices’ August, 6-3 ruling blocking the Biden administration’s extension of the federal eviction moratorium. Link to see how the Washington Post covers this topic.

Only about 18% of businesses require vaccinations, according to a November survey from Willis Towers Watson.

|

POLITICS & ELECTIONS |

— Will Thune exit or run for re-election? Congressional contacts inform Sen. John Thune (R-S.D.) will announce, most likely on Sunday, Jan. 9, whether he will seek another term or retire after this session of Congress.

— Ex-columnist Kristof ineligible to run for Oregon governor. Oregon election officials ruled Thursday that former New York Times columnist Nicholas Kristof is ineligible to run for governor because he does not meet the state’s three-year residency requirement. Secretary of State Shemia Fagan, a Democrat, said it was obvious Kristof had been a New Yorker until just over one year ago, citing his having voted in New York in the 2020 election. “Oregon statute provides directly that ... if a person casts a ballot in another state, they are no longer a resident of Oregon. It’s very, very simple,” Fagan told reporters. “For 20 years living, working, raising his kids, holding a driver’s license, filing taxes and voting as a New York resident until a year ago just doesn’t pass the smell test,” she added. Kristof vowed to appeal the decision and tweeting: “A failing political establishment in Oregon has chosen to protect itself, rather than give voters a choice.”

— President Biden assailed former President Donald Trump and a mob of his supporters for the Jan. 6 riot at the U.S. Capitol, using the first anniversary of the attack to rebuke his predecessor’s attempts to undermine the 2020 election results. The president accused Trump of spreading a “web of lies about the 2020 election,” pointing to his claims of election fraud and his attempt to block the certification of Biden’s victory by Congress that day. Biden characterized the events as a threat to the nation’s democracy and orderly transfer of power.

Meanwhile, a White House official said Vice President Kamala Harris was at the Democratic National Committee's headquarters last Jan. 6 when a pipe bomb was found outside the building. She was evacuated. A bomb was also placed outside the Republican National Committee headquarters. Both cases remain unsolved.

|

CONGRESS |

— Senate is out until Monday after a week delayed by snow and ended by funeral services. It confirmed just one lower-level nominee. There was little apparent progress on elections reform or the social and climate mitigation spending bill (BBB). Sen. Tim Kaine (D-Va.) spent the night in his car and endured a 27-hour commute to vote for one nomination. The House returns next week.

|

OTHER ITEMS OF NOTE |

— Cotton AWP rises back over $1 per pound. The Adjusted World Price for cotton rose to 103.85 cents per pound, effective Jan. 7, back atop $1 per pound for the first time since a string of four weeks above that mark ended with the week of Nov. 26. Meanwhile, USDA said that Special Import Quota #12 would be stablished Jan. 13 for 43,094 bales of Upland Cotton, applying to supplies purchased not later than April 12 and entered into the U.S. not later than July 11.

— AMS publishes inspection fees for 2022. USDA’s Agricultural Marketing Service (AMS) today published in the Federal Register (link) the 2022 rate it will charge for official inspection and weighing services, supervision of official inspection and weighing services, and miscellaneous fees for other services performed under the United States Grain Standards Act. The document includes its annual review of the charges and the resulting charges that will be in place for 2022.

— President of Kazakhstan ordered security forces to "kill without warning" in an effort to crush to violent protests raging in the country. What began as demonstrations against rising fuel prices has grown to include larger, long-simmering political grievances. President Kassym-Jomart Tokayev claims the increasingly violent conditions were caused by “terrorists” and "specialists trained in ideological sabotage.” Dozens of people have been killed in the violence. Tokayev has appealed to the Russian-led Collective Security Treaty Organization for assistance. The unrest is also posing a problem for Russia — which maintains close relations with Kazakhstan and relies on a spaceport there.

— Here is what would happen if the U.S. gov’t was really in the food industry: