Biden Reveals Details of Expected BBB Package Totaling $1.75-$1.9 Trillion

Vilsack expected to join workers on picket line

In Today’s Digital Newspaper

Market Focus:

• Inflation stories escalate but equities run higher

• Bundesbank’s Weidmann to exit

• Bitcoin makes a new high

• Uranium prices getting boost from individual traders

• Calif. Governor Newsom expands drought emergency decree

• Ag demand update

• Soybeans extend corrective recovery overnight

• Ukraine sets wheat export quota at 25.3 MMT

• Rains delay China’s harvest, winter wheat seeding

• China taking steps to ensure fertilizer supplies

• China approves Russian beef imports

• Slow developing cash cattle market

• Pork cutout falls below $100

Policy Focus:

• Biden, Dems push for BBB framework agreement by end of week

• Biden identifies cuts to the Democrats’ ambitious spending bill

• Dems modify proposal to require banks to send IRS more info about customers’ accounts

Afghanistan:

• Russia hosting delegation from the Taliban

• Almost half 53,000 Afghan evacuees brought to U.S. are children

Biden Administration Personnel:

• OMB acting director to take maternity leave

• Vilsack to join picketers

China Update:

• Xi Jinping pledged to support development of crucial technologies

• Evergrande put off plans to sell majority stake in its property services unit

• New home prices in China fell on a monthly basis for first time in more than six years

• Xi Jinping facing resistance over property-tax plan aimed at curbing housing speculation

• China continues focus on fertilizer situation

• China approves Russian beef imports

• Report indicates Brazil telling meatpackers to halt beef production destined for China

Trade Policy:

• USDA’s Vilsack meeting today with Mexican counterpart in Iowa

• Texas lawmakers urge U.S. ambassador to Mexico to address ag, energy trade concerns

Energy & Climate Change:

• Manchin, Tester oppose a carbon tax

• Major companies commit to use of zero-carbon fuels in freight vessels by 2040

• FERC pick Phillips signals need for balance relative to clean energy push

• U.N.: Countries’ plans to extract fossil fuels are ‘dangerously’ out of line

• U.K.: Nuclear power to play big role in plan to cut greenhouse-gas emissions

Livestock, Food & Beverage Industry Update:

• USDA details new dairy export certificates process for shipments to U.K.

• How consumers buy food has been permanently changed by the pandemic

Coronavirus Update:

• White House details plan to roll out vaccines for children

• General Electric, Union Pacific, other large employers imposing vaccine mandates

• Labor Dept. moving to strip three Republican-led states of workplace safety oversight

• Mayorkas tests positive for Covid

• Supreme Court declines to block vaccine mandate for health workers

Politics & Elections:

• Wasserman offers election predictions

• Walz announces bid for second term as Minnesota governor

Congress:

• House panel votes to recommend full chamber hold Steve Bannon in criminal contempt

• Rep. Fortenberry indicted on charges of lying and misleading federal investigators

• House Ag markup today on six bills

Other Items of Note:

• Head of the International Atomic Energy Agency plans to visit Iran

• Senators call on DHS to explain efforts to protect ag sector from cyberattacks

• North Korea confirms new ballistic missile tested earlier this

• Update on crisis in Haiti

• Russia’s decision to halt its mission to NATO escalates a growing dispute

• U.S. affirms Ukraine's sovereignty despite Russia's aggression

• Queen Elizabeth II cancels trip, advised to rest for a few days

MARKET FOCUS

Equities today: Global stock markets were mostly higher in overnight trading. The U.S. Dow opened 25 points higher. In U.S. corporate results today, Tesla Inc.’s report will be closely watched for any of the chip problems plaguing other automakers, as well as updates on the company’s new factories in Texas and Germany. International Business Machines Corp., Verizon Communications Inc. and Abbott Laboratories are among the many other companies reporting. Asian equities finished mostly higher on support from rise in US markets Tuesday. Japan’s Nikkei rose 40.03 points, 0.14%, at 29,255.55. Hong Kong’s Hang Seng was up 348.81 points, 1.35%, at 26,136.02. Shares in India and mainland China were lower. European equities are mostly lower in early trade action as earnings updates are partly in focus. The Stoxx 600 is up 0.1% with most regional markets flat to seeing gains of 0.5%. French shares, however, were slightly lower.

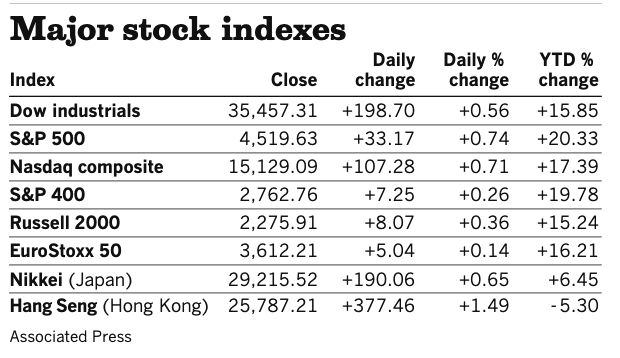

U.S. equities yesterday: The Dow closed up 198.70 points, 0.56%, at 35,457.31. The Nasdaq rose 107.28 points, 0.71%, at 15,129.09. The S&P 500 gained 33.17 points, 0.74%, at 4,519.63 and closed within half a percent of an all-time high.

On tap today (see detailed list of events and reports below):

• Federal Reserve releases its Beige book report on U.S. economic conditions at 2 p.m. ET.

• Fed speakers: Atlanta's Raphael Bostic, St. Louis's James Bullard, Chicago's Charles Evans, and Minneapolis's Neel Kashkari at an event on racism and the economy from 12 p.m. to 2:30 p.m. ET; Vice Chairman Randal Quarles on the economy at 1 p.m. ET; and San Francisco’s Mary Daly at a symposium on Asian banking and finance at 8:35 p.m. ET.

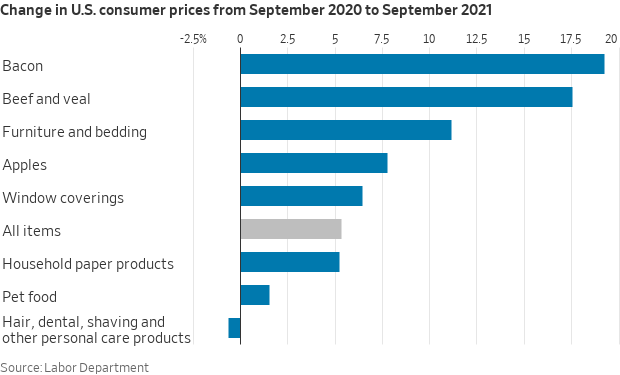

Companies continue to raise prices, taking advantage of consumers’ willingness to pay up for some products, the WSJ reports (link). Procter & Gamble, maker of Tide detergent and Crest toothpaste, said Tuesday it will start charging more for razors and certain beauty and oral care products, price increases that come besides earlier moves to start charging more for staples from diapers to toilet paper. IKEA, the world’s largest furniture seller, said even though many of its products are absent from shelves as they sit idle at warehouses waiting for trucks, shortages weren’t significantly affecting sales because the company has a big enough range of products to provide alternatives. Albertsons said this week that sales rose nearly 5% for the three-month period ended Sept. 11, despite major gaps in supply. The second-largest U.S. grocer said it is offering alternatives to out-of-stock items and passing on price increases to consumers.

Bundesbank’s Weidmann to exit. The 10-year leader of the German Bundesbank, President Jens Weidmann, announced he will leave the role for personal reasons at the end of this year. He has served as a member of the ECB rate-setting panel and has been a vocal critic of easy monetary policies. “I have come to the conclusion that more than 10 years is a good measure of time to turn over a new leaf — for the Bundesbank, but also for me personally,” he said in a note to staff. He also cautioned fellow ECB members not to lose sight of “prospective inflationary dangers.” His exit marks another shift for Germany as he will leave about the same time as German Chancellor Angela Merkel leaves office.

Market perspectives:

• Outside markets: The U.S. dollar index is firmer ahead of U.S. trading, with the euro, British pound and yen all weaker against the U.S. currency. The yield on the 10-year U.S. Treasury note has weakened to trade around 1.62% with a mixed tone in global government bond yields. Gold and silver futures have rallied in electronic trading, with gold around $1, with gold around $1,784 per troy ounce and silver around $24.10 per troy ounce.

• Crude oil prices remain under pressure ahead of U.S. trading, with U.S. crude around $81/60 per barrel and Brent around $84.35 per barrel. Futures were lower in Asian action, with U.S. crude down 52 cents at $81.92 per barrel and Brent down 57 cents at $84.51 per barrel.

• Bitcoin made a new higher this morning after yesterday’s launch in New York of a Bitcoin futures ETF, which drew nearly $1 billion in trading volume, one of the biggest fund debuts in history. Grayscale applied to convert its $40 billion Bitcoin trust into an ETF, and other fund managers have pending applications. Bitcoin is trading around $64,885 this morning, just over its previous all-time high.

• Uranium prices are getting a boost from individual traders, who have flocked to a new trust that gives a cheap and easy way of betting on the nuclear-fuel market. Link to details via the WSJ.

• Ag demand: Results of Jordan’s international tender to buy 120,000 MT of wheat are expected later today.

• Calif. Governor Newsom expands drought emergency decree, calls on residents to do more to conserve. California Gov. Gavin Newsom declared a statewide drought emergency on Tuesday, appealing to all Californians to do more to conserve water in the face of one of the state’s most severe droughts on record. Although most of California’s 58 counties have been in a state of drought emergency since July, Newsom’s proclamation added the last eight remaining counties, and further bolstered his call for everyone to voluntarily reduce water use by 15%. The proclamation notes that the State Water Resources Control Board may adopt emergency regulations to prohibit wasting water, such as hosing down sidewalks or driveways, allowing drinking water to flood gutters or streets, or washing a car without a shut-off nozzle. The declaration came as state water officials announced that Californians had cut their water usage by 5% in August, a modest improvement over July, when water use decreased by 1.8%. The eight counties added to the emergency declaration are Imperial, Los Angeles, Orange, Riverside, San Bernardino, San Diego, San Francisco and Ventura. A series of storms is forecast to bring rain and high-elevation snow to northern and central parts of California in late October. But those storms alone won’t be nearly enough to pull the state out of drought. Based on statewide precipitation totals, the water year that ended Sept. 30 was the second driest on record, surpassed only by 1924. State officials say the last two water years have been the driest on record for a two-year period, surpassing the drought of 1976-77.

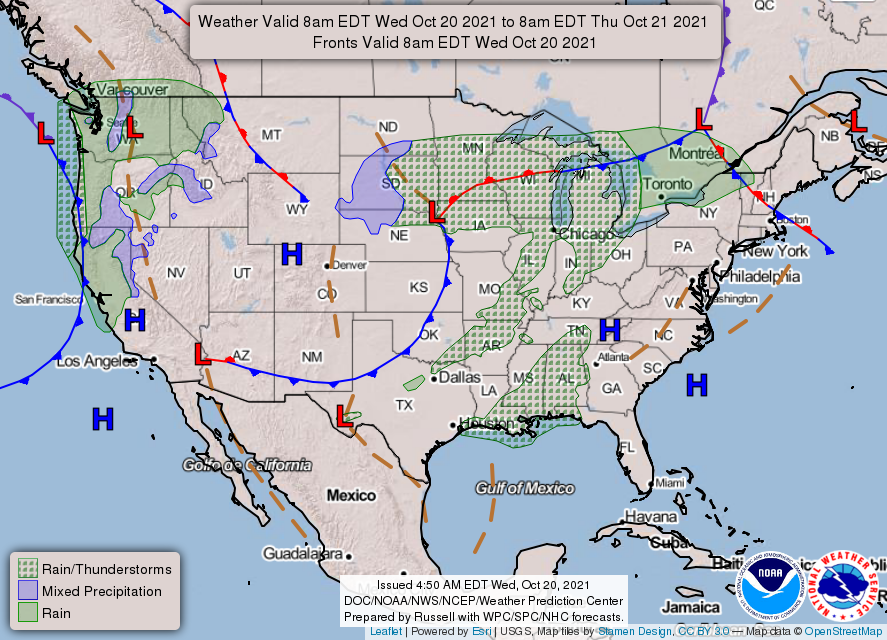

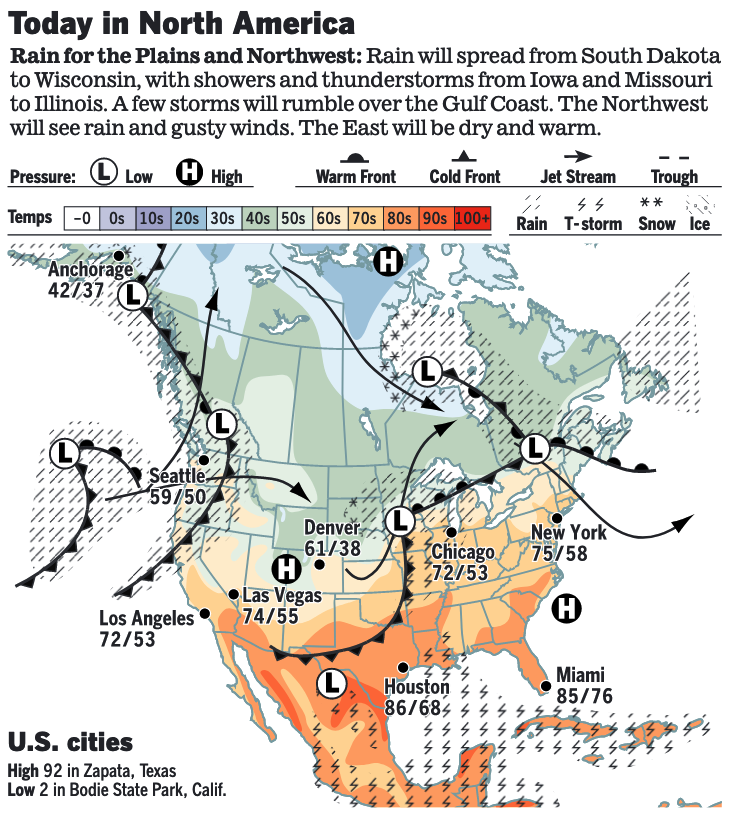

• NWS weather: Pair of Pacific storms to bring heavy rain and mountain snow to Northern California and the Pacific Northwest... ...Periods of rain and severe storms possible from the Midwest to the northern Mid-Atlantic; severe storms also possible in the Southern Plains on Thursday... ...Abnormally warm temperatures return in the East, cooler in the Midwest and along the West Coast.

Items in Pro Farmer's First Thing Today include:

• Soybeans extend corrective recovery overnight

• Ukraine sets wheat export quota at 25.3 MMT

• Rains delay China’s harvest, winter wheat seeding

• China taking steps to ensure fertilizer supplies

• China approves Russian beef imports

• Slow developing cash cattle market

• Pork cutout falls below $100

POLICY FOCUS

— Big push to get BBB/reconciliation framework agreement before President Biden heads to Italy and Scotland in 11 days. Biden wants to secure a vote on the $1 trillion bipartisan infrastructure bill (BIF) and a “public agreement” from Democrats on the parameters of the Build Back Better (BBB) package before he travels abroad to Italy and Scotland on Oct. 30. A BIF vote is contingent upon them getting a solid reconciliation framework in place.

Biden on Tuesday described a more limited vision to Democratic lawmakers of a scaled back $1.75-$1.9 trillion gov’t-overhaul package, including:

- Summary: At least $500 billion to tackle climate change and money for middle-class priorities — child tax credits, paid family leave, health care and free pre-kindergarten.

- Child tax credit will likely be means tested and it appears the party will extend the payments for just one or two more years.

- Community college: Biden informed House progressives that the final bill is expected to drop tuition-free community college — Democrats are reportedly considering including expanded community college scholarships in the bill as a half-measure.

- Paid family leave: Biden said negotiators are weighing reducing the duration of the paid leave benefit outlined in the package to four weeks and that it would be mean tested.

- Medicare: The president reportedly said they plan to keep an expansion of Medicare, which includes hearing, dental and vision, in line with what the progressives want, but some reports signal Democrats are discussing some sort of “pilot program” to offer some seniors dental coverage under Medicare.

- ObamaCare: Biden’s original proposal also would have expanded Medicaid in states that have yet to do so and extended the expanded ObamaCare subsidies. Those ideas are now expected to be implemented for shorter amounts of time; Biden reportedly suggested a three-year extension of the increased Obamacare subsidies.

- Elder care: Under Biden’s original plan, the package would have included $400 billion to support home-based care for elderly and disabled Americans. That initiative will remain in the bill, but is now likely to receive something more in the neighborhood of $250 billion.

- Public housing: The package is still expected to include around $200 billion to fund the development of new affordable housing units and retrofitting of existing units.

Bottom line: Biden told lawmakers that he is now eyeing a price tag between $1.75 trillion and $1.9 trillion, a significant reduction from his original $3.5 trillion proposal. Dropping or trimming parts of the tax and spending package brought signs of progress after the president met with party moderates and progressives at the White House and Senate Majority Leader Chuck Schumer (D-N.Y.) stepped up pressure to complete a framework deal this week.

— Big tax issue keeps changing in BBB debate. Aggressive lobbying by the banking industry, and resistance from Republicans, has forced Democrats to scale back plans to crack down on tax cheating. Yesterday, Democratic senators announced a revised proposal that narrows the scope of information banks would have to give to the IRS about their customers, limiting it to accounts with total annual deposits or withdrawals worth more than $10,000, rather than the $600 threshold initially proposed

The program is focused on collecting unpaid taxes from the rich, the Biden administration said, bolstering the IRS to shrink the $7 trillion so-called tax gap. White House officials say that opponents have incorrectly suggested that the IRS would be tracking information about individual transactions. But the administration has said that the IRS would use account information to spot discrepancies between what individuals report on their tax returns and what their bank accounts show.

“How is the honor system working right now?” Sen. Elizabeth Warren (D-Mass.) asked the deputy Treasury secretary, Wally Adeyemo, at a Senate hearing yesterday. “It’s not working well, senator,” Adeyemo replied, adding, “The top 1% of earners in America underpay their taxes by more than $150 billion dollars each year.”

AFGHANISTAN

— Russia is hosting a delegation from the Taliban along with regional powers in the first such meeting since the chaotic U.S. withdrawal from Afghanistan in August brought the radical Islamic movement to power.

— Almost half of the 53,000 Afghan evacuees brought to the U.S. and living at military installations are children, the Pentagon told lawmakers in a recent letter, underscoring the variety of challenges facing officials trying to resettle Afghans. The disclosure was the first time the military provided a breakdown of the evacuees. Defense Secretary Lloyd Austin said about 22% of the evacuees at U.S. military bases are female adults and 34% are male adults, but the letter didn’t address how many of the children were unaccompanied by adult guardians.

BIDEN ADMINISTRATION PERSONNEL

— OMB acting director to take maternity leave. Shalanda Young, the acting director of the Office of Management and Budget, is expecting a baby in the coming weeks, and she will pass off responsibilities to her deputy while on maternity leave. “Acting Director Young will be taking time away from the office to be with her daughter after she’s born in the next few weeks,” an OMB spokesperson said. “During that period, she will delegate day-to-day responsibilities to Deputy Director for Management Jason Miller while she continues to hold the position of Acting Director.” Young was named acting director when the Biden administration had to pull the nomination of Neera Tanden, who ran into heavy opposition from Democrats on Capitol Hill.

— Vilsack to join picketers: USDA Secretary Tom Vilsack was scheduled to join striking Deere employees in Des Moines, Iowa, on Wednesday, one of several political leaders who have showed support for the union workers. Link for details.

CHINA UPDATE

— Chinese President Xi Jinping yesterday pledged to support development of crucial technologies while strengthening regulation of the country’s tech giants. Beijing has identified the digital economy as a key driver for growth over the next few decades and has made achieving tech self-sufficiency a top national priority.

— The troubled Chinese property developer Evergrande put off plans to sell a majority stake in its property services unit, which was expected to raise $2.6 billion. Link to more via Reuters.

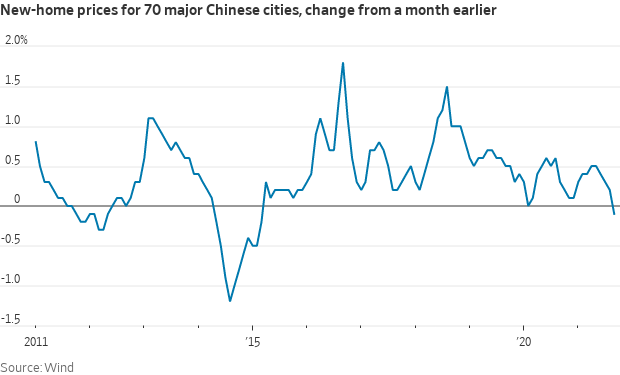

— New home prices in China fell on a monthly basis for the first time in more than six years in September, new official data showed, as Beijing’s measures to curb housing speculation and cool the property sector begin to bite. Average new home prices in 70 major cities edged down 0.08% in September from the previous month, China’s National Bureau of Statistics said. Though small, it is the first such month-on-month decline since March 2015.

— Chinese President Xi Jinping is facing resistance over a nationwide property-tax plan aimed at curbing housing speculation. Many economists and analysts have long argued that such a tax could make it more expensive to speculate on property and help bring down prices. That would help reduce the financial burden on middle-class families, in line with Mr. Xi’s goal of a more even distribution of wealth. But many party officials contend that such a levy could crush housing prices, cause consumer spending to plunge and severely harm the overall economy. An initial proposal to test a property tax in some 30 cities has been scaled back to about 10, while a proposal involving state-provided affordable housing is emerging as an alternative.

— China continues focus on fertilizer situation. Rising fertilizer prices in China this year have prompted a continued focus on those supplies by the National Development and Reform Commission (NDRC). The central planner has outlined efforts in recent weeks on the fertilizer supply situation, with NDRC spokeswoman Meng Wei saying they will make sure there are adequate supplies of coal, electricity, natural gas and sulphur to produce chemical fertilizers. Coal prices have shot higher which as contributed to a rise in prices. Meng said NDRC would also take action and release “relevant chemical fertilizer reserves,” and will closely monitor domestic and foreign fertilizer markets and import and export trends. Reuters reported that Urea futures on the Zhengzhou Futures Exchange have risen 70% this year, in part fueled by the rise in coal prices as coal is a feedstock ingredient. In a move viewed as a de facto ban on fertilizer exports, China's customs said from Oct. 15 inspection certificates would be required to ship fertilizer and related materials. More than two-thirds of China’s phosphate exports go to South America, with around 50% shipped to Brazil and 15% to 20% to Argentina.

— China approves Russian beef imports. China’s customs office has approved beef imports from Russia, effective Oct. 18. The beef must come from cattle under 30 months of age. China’s appetite for beef has exploded after domestic pork prices surged in the aftermath of the country’s African swine fever outbreak. Russia is not a major exporter of beef, but China is looking to find new sources for beef after Beijing last week renewed a ban on the import of British beef due to a case of bovine spongiform encephalopathy (BSE), while top beef exporter Brazil suspended shipments to China following two atypical cases of BSE. U.S. shipments of beef to China surged 841% versus year-ago through the first eight months of this year.

— Report indicates Brazil telling meatpackers to halt beef production destined for China. China’s failure to lift its ban on imports of Brazilian beef has prompted the Brazilian agriculture ministry to advise local meatpackers to halt production that was to be exported to China, according to a report in the O Globo newspaper cited by Reuters. China halted its imports of Brazilian beef after two atypical cases of BSE were discovered, and an internal memo indicated the partial production halt was ordered. The order also allowed beef processors to store meat produced before the suspension by China for up to 60 days. Link to Reuters item.

TRADE POLICY

— USDA’s Vilsack meeting today with Mexican counterpart in Iowa. USDA Secretary Tom Vilsack will be in Iowa today and Thursday for the World Food Prize and will meet with Mexican Secretary of Agriculture and Rural Development Víctor Manuel Villalobos Arámbula. The two are scheduled to tour Iowa State University’s Seed Science Center and Plant Sciences Institute and a farm near Ankeny, Iowa, to talk with producers. The two are scheduled to hold bilateral discussions later today and participate on World Food Prize events Thursday.

The issues of GMO corn, dairy and potatoes are likely to be on the agenda for the discussions. Vilsack has publicly insisted that the pending ban on imports of GMO corn will not affect U.S. corn exported to Mexico for feed use, a sizable market for the U.S. The presidential decree is not totally clear and it also could be changed by a future Mexican administration.

— Texas lawmakers urge new U.S. ambassador to Mexico to address agricultural, energy trade concerns. Newly confirmed U.S. Ambassador to Mexico Ken Salazar is being urged by Texas lawmakers to push Mexico to fully implement provisions in the U.S.-Mexico-Canada Agreement (USMCA) and address actions by Mexico on agricultural and energy trade issues. “Mexico has taken several actions that discriminate against American energy producers,” the lawmakers said, noting those actions favor state-owned enterprises (SOEs) in Mexico. “This includes the recent modifications to the Hydrocarbons Law, which allows Mexican officials the power to suspend and revoke key permits for private operations. Most recently, the government’s proposed constitutional reforms would increase state control of the electricity industry and severely limit private investment.”

On agriculture, the lawmakers pointed to biotechnology provisions as a major concern for the state’s agricultural producers. “USMCA locked in key provisions for agriculture and includes state of the art rules on agricultural biotechnology,” the letter noted. “Rigorous enforcement of these important priorities is vital for Texas producers. Mexico remains the top destination for U.S. agricultural trade — ensuring that Mexico abides by these commitments remains a top concern for the producers we represent.” Mexico’s actions on biotechnology in particular have created considerable uncertainty in the U.S. agricultural sector via a presidential decree that would bar imports of GMO corn and the country also recently rejected a request for approval of a GMO crop.

The letter (link) was signed by Sens. John Cornyn (R-Texas) and Ted Cruz (R-Texas) with Reps. August Pfluger (R-Texas) and Henry Cuellar (D-Texas).

ENERGY & CLIMATE CHANGE

— Manchin, Tester oppose a carbon tax. Sen. Joe Manchin (D-W.Va.) and Sen. Jon Tester (D-Mont.) expressed opposition to including a carbon tax in the massive social spending plan as Democrats scramble to make good on their pledge to combat climate change. Asked about a carbon tax, which would effectively place a fee on carbon dioxide and methane emissions, Manchin said the idea was not under discussion. He said, “We’re not — the carbon tax is not on the board at all right now.” Tester said he also wasn’t supportive of a carbon tax. Tester said, “I’m not a big fan of the carbon tax. I just don’t think it works the way it was explained to me.”

— Major companies commit to use of zero-carbon fuels in freight vessels by 2040. Nine major companies Thursday announced they will switch all their ocean freight vessels to be powered by zero-carbon fuels by 2040, the Clean Air Task Force said in an announcement Tuesday. Amazon, Brooks Running, Frog Bikes, IKEA, Inditex, Michelin, Patagonia, Tchibo, and Unilever all signed onto the pledge that was facilitated by Cargo Owners for Zero Emission Vessels (coZEV). Marine shipping generates some 1 billion tonnes of carbon emissions annually, Clean Air Task Force Director of Transportation Decarbonization Jonathan Lewis said, noting that “transitioning the sector from high-emitting fuels to zero-carbon fuels like hydrogen and ammonia is the pathway with the highest likelihood of success.”

— FERC pick Phillips signals need for balance relative to clean energy push. The Biden administration push for clean energy will involve decisions ahead for the Federal Energy Regulatory Commission (FERC) and Willie Phillips, nominated as a FERC commissioner, told the Senate Energy and Natural Resources he would seek to balance sustainability and affordability when it comes to decisions made by the regulator. “My approach would be to seek balance in everything that we do,” he told lawmakers at his confirmation hearing. “I believe in an all-of-the-above strategy. I know FERC is an economic regulator — they do not pick winners and losers.” He also said as FERC considers actions relative to clean energy, the U.S. energy infrastructure must be “resilient,” noting that “reliability depends on our vigilance” against climate change and extreme weather. Phillips has been a member of the District of Columbia Public Service Commission for seven years, serving as chair since 2018. If approved for the role, the Democrat would give the party a three-to-two margin on the regulatory body. He would take the place of Republican Neil Chatterjee whose term expired this summer, leaving the regulatory with two members from each party.

— U.N. said that countries’ plans to extract fossil fuels are “dangerously” out of line with the reductions needed to prevent serious global warming over the next decade. Coal, gas and oil production rates are more than double what they need to be in order to keep the rise in global temperatures within 1.5C. The stark report comes in the lead-up to the U.N.’s climate-change conference, COP26, in Glasgow.

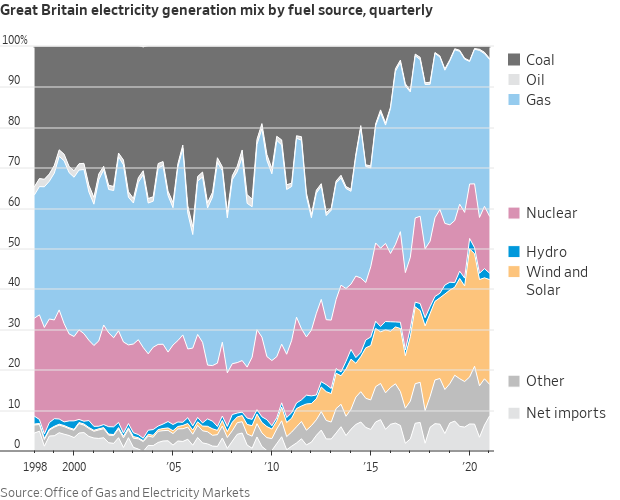

— U.K. said nuclear power would play an important role in underpinning its plan to cut greenhouse-gas emissions, joining a growing group of countries turning back to atomic energy as they consider how to wean themselves off fossil fuels. The announcement comes as the country faces a winter of high energy prices and worries over shortages of natural gas. The U.K. isn't alone. France recently announced plans to invest in nuclear technology. China is planning a 40% increase in nuclear capacity over the next five years. India is building seven new reactors.

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— USDA details new dairy export certificates process for shipments to U.K. New dairy export certificates for the export of U.S. dairy and dairy composite products to Great Britain were implemented Sept. 30, according to USDA’s Agricultural Marketing Service, applying to shipments to England, Wales, Scotland, the Isle of Man and the Channel Islands. However, U.S. dairy exports to Northern Ireland will still use European Union (EU) dairy certificates. If shipments to Great Britain are to end up in Northern Ireland or any other country, it will require a new export certificate issued by Great Britain. The action comes as part of the U.K. leaving the EU. Sept. 30 marked the end of a transition period where U.S. dairy exporters could still use EU export certificates.

— How consumers buy food has been permanently changed by the pandemic, Instacart CEO Fidji Simo said at WSJ’s Tech Live conference. Link for details.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 241,670,428 with 4,915,486 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 45,139,222 with 728,296 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 408,265,959 doses administered, 189,141,481 have been fully vaccinated, or 57.6% of the U.S. population.

— General Electric, Union Pacific and other large U.S. employers are imposing Covid-19 vaccine mandates for their workers to comply with a Dec. 8 deadline set by the Biden administration for companies that are federal contractors. Boeing, International Business Machines and Raytheon Technologies are other federal contractors that have already announced such mandates for their U.S. staff. Together, these companies collectively employ more than 300,000 U.S. workers. Employees of government contractors are required to get vaccinated against Covid-19 under an executive order signed in September by President Biden.

— Labor Department is moving to strip three Republican-led states of workplace safety oversight, saying they have failed to adopt more-rigorous Covid-19 safety standards. It is the latest development in a fight between the Biden administration and some states over federal coronavirus rules. Officials at the Labor Department said it is starting the process of revoking state-level oversight of workforce-safety programs in Utah, Arizona and South Carolina after the three states didn’t adopt, at minimum, the federal Covid-19 safety plans for healthcare workers.

— White House details plan to roll out vaccines for children. The White House today unveiled its plans to roll out Covid-19 vaccines for children ages 5 to 11, pending Food and Drug Administration authorization. The Biden administration has secured enough vaccine supply to vaccinate the 28 million children ages 5 to 11 who would become eligible for vaccination if the vaccine is authorized for that age group and will help equip more than 25,000 pediatric and primary care offices, hundreds of community health centers and rural health clinics as well as tens of thousands of pharmacies to administer the shots, according to the White House.

— Mayorkas tests positive for Covid. Homeland Security Secretary Mayorkas tested positive for Covid-19 on Tuesday, according to a statement from a DHS spokeswoman to NBC News. The statement also says, “Secretary Mayorkas is experiencing only mild congestion; he is fully vaccinated and will isolate and work at home per CDC protocols and medical advice. Contact tracing is underway.” The Washington Post says Mayorkas “had been scheduled to travel to Colombia on Tuesday with Secretary of State Antony Blinken.” Mayorkas is the latest public figure to have tested positive for the coronavirus despite having been fully vaccinated. The Associated Press reports he “was with President Joe Biden Saturday at the annual National Peace Officers’ Memorial Service at the Capitol, standing on the podium between first lady Jill Biden and FBI Director Christopher Wray. The White House said they were not determined to have been in close contact with the DHS secretary, given that the memorial service was outside.”

— Supreme Court declines to block vaccine mandate for health workers. The U.S. Supreme Court declined to block a vaccine mandate for health workers in the state of Maine on Tuesday, sending a potential green light to state mandates across the country. Justice Stephen Breyer, who handles emergency requests from Maine for the court, was responsible for the denial, which he said came “without prejudice.” The challenge came from a group of Maine health workers who argued Democratic Maine Gov. Janet Mills’ vaccine mandate was illegal. With the SCOTUS denial, the mandate for employees at hospitals and nursing homes will take effect next week.

POLITICS & ELECTIONS

— Wasserman offers election predictions. Dave Wasserman of the Cook Political Report with Amy Walter, during an address to CIPA in Seattle, Washington, predicted:

- Democrat Terry McAuliffe will narrowly win the Virginia governor’s race on Nov. 2 versus GOP challenger Glenn Youngkin. Biden won Virginia by 10 points.

- In 2022, Republicans will likely win a net 20-25 seats, taking control of the House in 2023. Republicans need a net gain of five seats to take back control of the House. Wasserman says redistricting could bring two to five of those needed seats to Republicans.

- 2022 Senate elections will likely find Republicans winning 53 seats versus 47 for the Democrats.

- Wasserman gave a 60% chance that former President Donald Trump would again run for president; he gave a 40% chance current President Biden would go for re-election.

— Walz announces bid for second term as Minnesota governor. Minnesota Gov. Tim Walz (D) launched his campaign for a second term Tuesday in an increasingly divided state, saying he made “the tough calls necessary to beat back the Covid-19 pandemic and revive the economy.” Walz won office in 2018on a theme of ‘One Minnesota,’ a slogan he’s using again for 2022. But the fissures in Minnesotan politics have grown deeper since then, mostly over disagreements over his management of the pandemic, as well as the unrest and spike in crime that followed the death of George Floyd. The Minneapolis Star Tribune said “more than a half-dozen candidates are already seeking the Republican nomination to challenge him next year, including former Senate Majority Leader Paul Gazelka, state Sen. Michelle Benson and former state Sen. Scott Jensen. They are “tapping into frustration with vaccines and mask mandates among conservatives and sounding the alarm about rising crime rates in Minneapolis.”

CONGRESS

— Legal showdown. A U.S. House committee voted to recommend that the full chamber hold Steve Bannon, a former adviser to Donald Trump, in criminal contempt for defying the panel’s subpoena for documents and testimony. It marks the first test of the committee’s power to thwart the ex-president’s attempts to hobble its inquiry into the Jan. 6 insurrection at the Capitol. Bannon ignored a subpoena to testify last week at an inquiry into the storming of the Capitol building in January.

— Campaign-finance probe. U.S. Rep. Jeff Fortenberry (R-Neb.) was indicted on charges of lying and misleading federal investigators about illegal campaign contributions tied to his 2016 campaign for Congress. He pledged to fight the charges.

— House Ag markup. Among the six bills the House Agriculture Committee will consider at a business meeting on Thursday will be legislation to provide additional funding for scholarships at historically Black land-grant colleges, said chairman David Scott. Link for more info.

OTHER ITEMS OF NOTE

— Head of the International Atomic Energy Agency plans to visit Iran in the coming days to help jump-start talks on re-entering the 2015 deal that put severe limits on the country's nuclear program.

— Senators call on DHS to explain its efforts to protect agricultural sector from cyberattacks. The U.S. agricultural sector remains vulnerable to cyberattacks, and Iowa’s Republican Sens. Chuck Grassley and Joni Ernst are asking the Department of Homeland Security (DHS) to answer questions about what the agency is doing to protect the nation’s agriculture and food supply chain. The lawmakers want DHS Secretary Alejandro Mayorkas to respond by Nov. 19 with information on how DHS is integrating the agricultural sector in its plans against future cyberattacks. The two referenced attacks on Iowa-based NEW Cooperative and Farmers Cooperative Elevator Company as damaging events. The two said the cyberattacks were “not isolated” to grain markets. “Feed from the cooperatives’ grain supply sustains millions of livestock,” the lawmakers noted. “These attacks will affect the supply chain that puts food on the shelves in grocery stores across the country.” Given that situation, the lawmakers asked DHS to provide information on the actions they are taking relative to the NEW Cooperative event and what resources are being deployed to restore the cooperative to a “fully functional and secure state.” DHS is also being asked to provide information on efforts to prepare the sector for future attacks. Link to letter.

— North Korea confirmed that a new ballistic missile it tested earlier this week had been launched from a submarine, as suspected by its neighbors. It comes with “advanced control guidance technologies”, according to a state media outlet. South Korea too is ramping up its weapons program. This week it is hosting its largest-ever defense exhibition, where it is expected to unveil a new fighter jet.

— Presidents of the Dominican Republic, Panama and Costa Rica will meet today to discuss the crisis in Haiti, where gangs effectively control most of the national territory, fueling a surge of migration through the region.

— Russia’s decision to halt its mission to NATO escalates a growing dispute with the alliance and complicates the Biden administration’s pivot to China, the WSJ notes (link). Russia’s decision to recall its diplomats from its mission to the North Atlantic Treaty Organization’s headquarters in Brussels at the end of October follows the alliance’s expulsion earlier this month of eight Russian officials, whom NATO called undeclared intelligence officers. The Russian Foreign Ministry called its move on Monday a reaction to “unfriendly actions.” The ministry also said it would close NATO’s military mission and information bureau in Moscow.

Meanwhile, the U.S. has affirmed Ukraine's sovereignty despite Russia's aggression within the nation. In a meeting with Ukraine's President Volodymyr Zelenskyy on Tuesday, U.S. Defense Secretary Lloyd Austin emphasized the U.S. and its allies support Ukraine's authority in the future of their foreign policy. Zelenskyy has said that the U.S. is Ukraine's "chief partner in security and defense" as Russia annexation of Crimea in Ukraine threatens the country's territorial integrity. Austin has criticized Russia for the Ukrainian takeover of the peninsula and for their support of the rebels in East Ukraine.

— Queen Elizabeth II cancels trip, advised to rest for a few days. Queen Elizabeth II has canceled a trip to Northern Ireland today and has "reluctantly accepted medical advice to rest for the next few days," Buckingham Palace said, Britain's PA Media news agency reported today.