Biden to Hold Call with Russian President Putin Today Re: Russia/Ukraine Tensions

Several hurdles for big use of sustainable aviation fuel

In Today’s Digital Newspaper

Market Focus:

• S&P 500 headed toward 28% advance for 2021 and has hit 70 highs

• Dow and Nasdaq have gained 19% and 22%, respectively, this year

• Jobless claims for week ended Dec. 25 fell to seasonally adjusted 198,000

• Chip supply impacted again

• Nearly half of states will ring in new year with higher minimum wages

• Holiday ahead with mostly normal market hours

• Turkish lira tumbled against the dollar Wednesday

• Putin: Nord Stream 2 loaded with gas & ready to stabilize Europe energy prices

• At least one part of Alaska reached 67 degrees this week

• Soybeans and corn weaker overnight

• Russia wheat export tax continues to rise

• Cash cattle trade starts at higher prices

• Loins weigh on pork cutout

Policy Focus:

• Commerce agency seeks input for Rural Business Center Program

Personnel:

• APHIS official exiting

• GOP senators urge White House to alter its selection for DOL wage-hour regulator

China Update:

• Soybeans, pork sales for 2022 main sales activity for China in most recent week

• USDA issues ‘public health alert’ for undetermined quantity of foods from China

• Food shortages hit Xi’an as they enter eight days of Covid lockdown

• China to auction wheat from reserves to millers

• China initial 2022 crude import quotas 11% below year-ago: report

• China issues first ‘green’ loans

• Shares of China Evergrande Group tumble

Energy & Climate Change:

• Sustainable aviation fuel (SAF) has several high hurdles

Livestock, Food & Beverage Industry Update:

• Massachusetts delays animal welfare standards

Coronavirus Update:

• New forecast from CDC: More than 44,000 people could die of Covid-19 next four weeks

• Flight Cancellations continue

• Fauci predicts U.S. Omicron surge will peak in late January

• CDC Director: Anyone with symptoms, even if fully vaccinated, should isolate at home

Politics & Elections:

• Spanberger, Griffith to seek re-election in redrawn Virginia districts

Other Items of Note:

• Putin will speak today with President Biden about crisis at Ukrainian border

• Rebekah Koffler: Russia will strike Ukraine soon; Putin playing with Biden and NATO

• South Korea "effectively" agreed with U.S. on draft declaring end of Korean War

• Supreme Court starts 2022 with a special session on Biden’s vaccine mandate

MARKET FOCUS

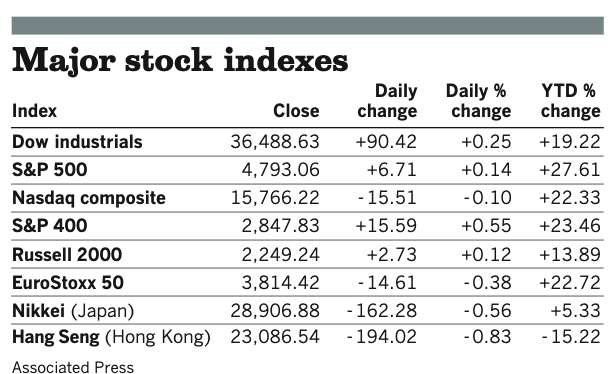

Equities today: Global stock markets were mostly firmer overnight. U.S. stock indexes are pointed toward slightly higher openings. Look for lower volume trading the last two days of 2021. Asian equities ended mixed as traders balanced U.S. market advances against a rise in Covid cases. The Nikkei fell 115.17 points, 0.40%, at 28,791.71. The Hang Seng Index was up 25.47 points, 0.11%, at 23,112.01. European equities are posting advances in early trading. The Stoxx 600 was up 0.3% while regional markets were seeing gains of 0.1% to 0.4%.

U.S. equities yesterday: The Dow gained 90.42 points, 0.25%, at 26,488.63. The Nasdaq eased 15.51 points, 0.10%, at 15,766.22. The S&P 500 rose 6.71 points, 0.14%, at 4,793.06.

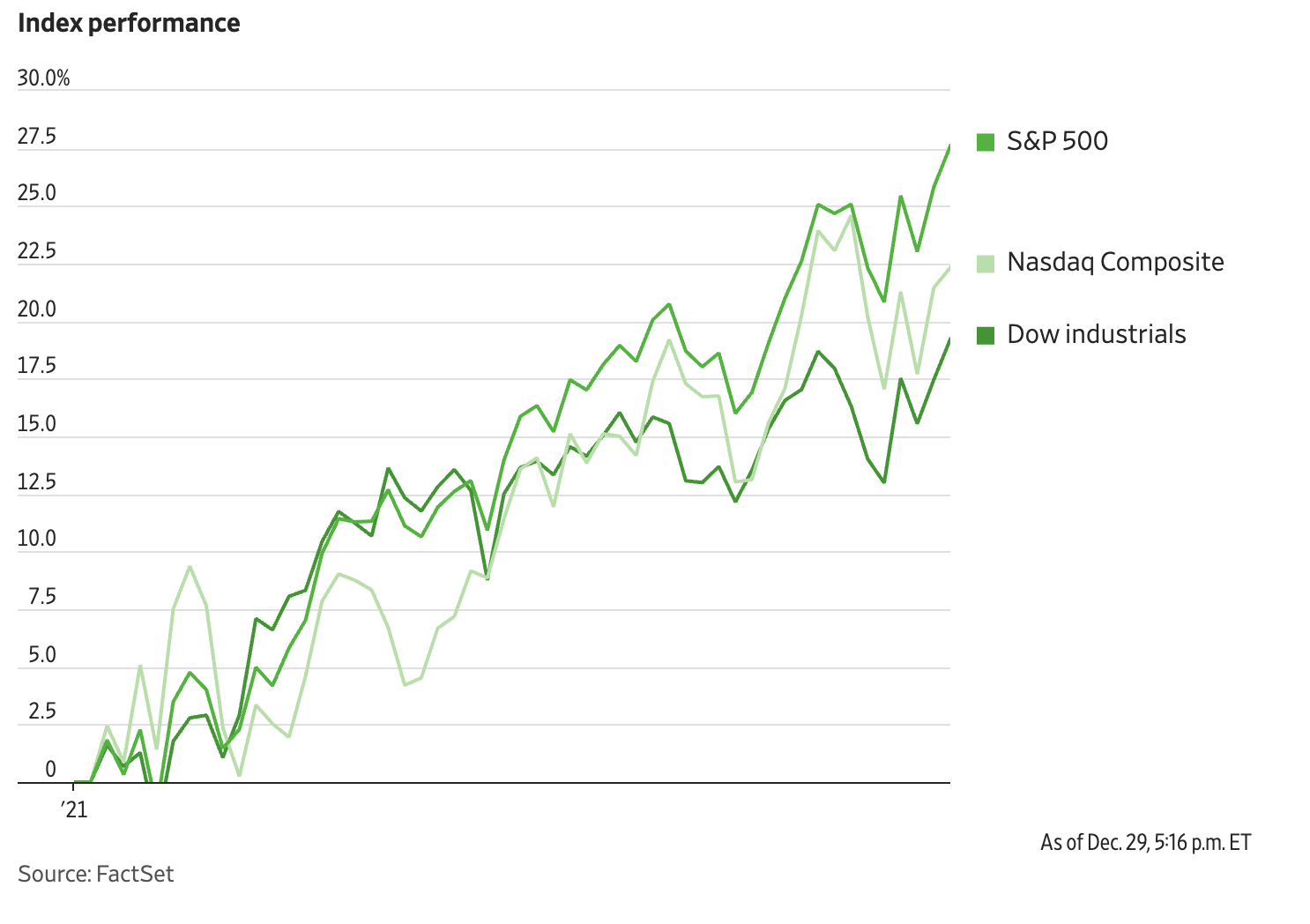

The S&P 500 is headed toward a 28% advance for 2021 and has hit 70 highs. It is the third straight year of double-digit gains for the broad index. (The S&P 500’s energy sector is on pace for the biggest percentage gain on record.) The Dow and Nasdaq have gained 19% and 22%, respectively, this year, helping send the major indexes to their best three-year performance since 1999.

On tap today:

• U.S. economic data due for release is light and includes the weekly jobless claims (see next item) report and the Chicago ISM business survey.

Jobless claims for the week ended Dec. 25 fell to a seasonally adjusted 198,000 applications from a revised 206,000 the prior week, the Labor Department said today. That leaves them hovering just above the 188,000-level recorded earlier in December, the lowest level since 1969. Last week’s four-week moving average, which smooths out volatility, fell to the lowest level since October 1969.

Chip supply impacted again. Samsung Electronics and Micron Technology issued separate warnings Wednesday about how lockdowns in the Chinese city of Xi’an, which has tightened Covid restrictions to the “strictest” level, will affect production of memory chips. Samsung said it would “temporarily adjust operations” but will leverage its global manufacturing network to ensure customers aren’t affected. Micron issued a similar statement, though it conceded “there may be some near-term delays” even as it taps subcontractor partners to help meet demand.

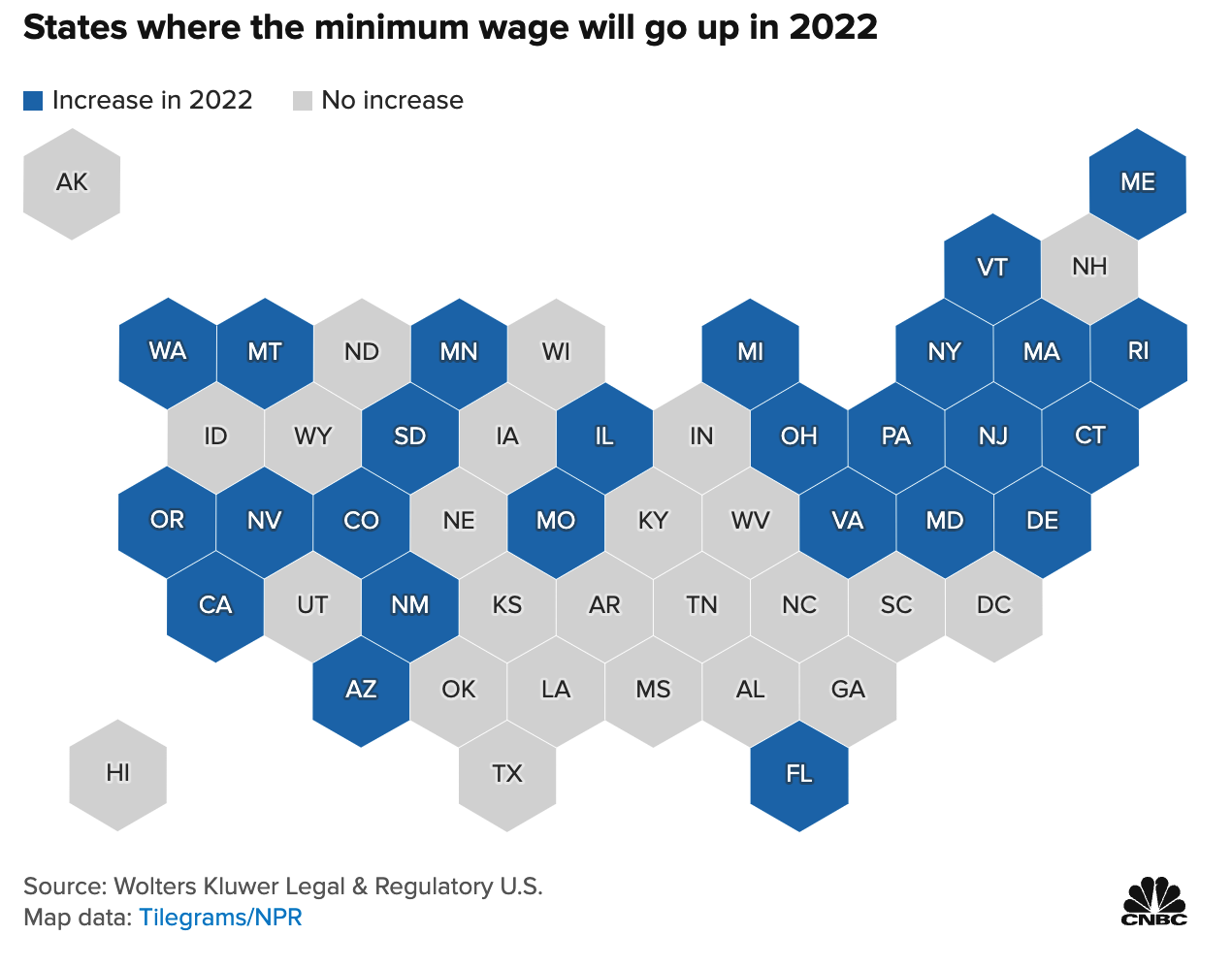

Nearly half of U.S. states will ring in the new year with higher minimum wages — with 30, plus D.C., now over the federal rate of $7.25, a rate that’s not changed for a decade. In total, 25 states will see boosts to their minimum hourly pay requirement in 2022, according to the Economic Policy Institute and National Conference of State Legislatures. Four states, Oregon, Florida, Nevada, and Connecticut, will phase in their increases later in the year.

Market perspectives:

• Holiday ahead with mostly normal market hours. Friday (Dec. 31) will see U.S. government offices closed in observance of the New Year’s holiday, while most markets will trade normal hours today and Friday. The exception is the bond market which will close at 2 pm ET.

• Outside markets: The U.S. dollar index is weaker ahead of U.S. economic updates even as the euro is slightly weaker versus the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 1.52%, with a mixed tone in global government bond yields. Gold and silver futures were mixed ahead of U.S. economic updates, with gold trading under $1,805 per troy ounce and silver above $22.89 per troy ounce.

• Turkish lira tumbled against the dollar Wednesday, a setback to the government’s plan to stabilize the currency.

• Crude oil futures are under mild pressure ahead of U.S. trading with U.S. crude around $76.25 per barrel and Brent around $79 per barrel. Futures had been higher in Asian action, with U.S. crude up 38 cents at $76.95 per barrel and Brent up 38 cents at $79.59 per barrel.

• Putin: Nord Stream 2 loaded with gas & ready to stabilize Europe energy prices. Russian President Vladimir Putin declared that the Nord Stream 2 pipeline to Germany is fully ready and prepared to start pumping gas exports, amid a continued hold-up in regulatory approval on the German side. Hailing the completion of the $11 billion natural gas pipeline which the U.S. had long worked to block until President Joe Biden gave approval, Putin told a government meeting which was attended by Gazprom head Alexei Miller, "I’d like to congratulate Gazprom and your partners in Nord Stream 2 on the completion of work and the creation of this additional large trunk-route and that it is ready for work," according to Reuters. Putin announced for the first time the second stretch of the pipeline has been filled with gas and said it's going online will inevitably reduce gas prices in — which have recently hit record highs — including in Ukraine. He said once gas starts flowing, an "immediate" positive impact will be felt on the market. The U.S. Senate will vote next month on whether to sanction the builder of Nord Stream 2. Dems are opposed to sanctions.

• At least one part of Alaska reached 67 degrees this week, the warmest December day in the state’s history.

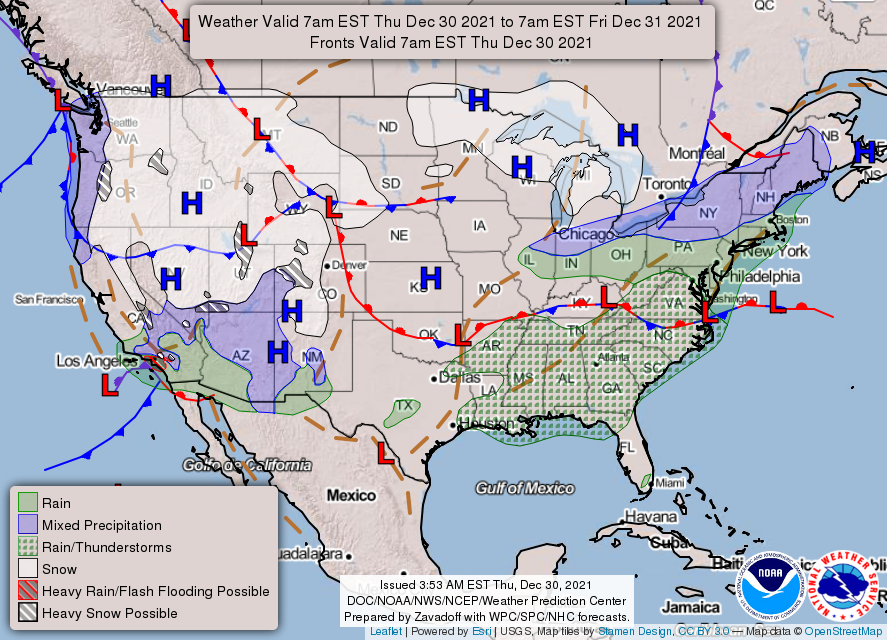

• NWS weather: More heavy mountain snow to overtake much of the Intermountain West to close out 2021; bitterly cold wind chills to stick around in the Northern Rockies and Northern Plains; Slight Risk for Excessive Rainfall in Southern California today.. ...Record breaking Spring-like temperatures in the South to reach the portions of the East Coast; Slight Risks for severe storms and Excessive Rainfall on Friday... ...Both winter weather and severe weather possible to kick off the new year this weekend.

Wx

Items in Pro Farmer's First Thing Today include:

• Soybeans and corn weaker overnight

• Russia wheat export tax continues to rise

• Cash cattle trade starts at higher prices

• Loins weigh on pork cutout

POLICY FOCUS

— Commerce agency seeks input for Rural Business Center Program. The Department of Commerce’s Minority Business Development Agency (MBDA) is seeking public comment on issues related to rural areas and rural minority businesses as the agency seeks to establish a Rural Business Center Program. The program was authorized by the bipartisan infrastructure bill signed into law Nov. 15. In a Federal Register notice (link), MBDA is seeking input on several areas which address the areas of focus, geographical location and distribution, and additional areas of service for the Rural Business Center Program. Comments are due Jan. 25 on topics including the types of business operations in rural areas; financial, operational, and logistical needs of rural business enterprises; unique challenges MBEs face in rural and remote areas of the US; and the best methods to provide training, education, legal, financial and technical help to MBEs in rural areas. MBDA focuses on efforts to promote growth and global competitive of minority business enterprises (MBEs).

PERSONNEL

— APHIS official exiting. Dr. Osama El-Lissy, deputy administrator of the Plant Protection and Quarantine program at USDA’s Animal and Plant Health Inspection Service (APHIS) is leaving the role December 321. El-Lissy has been in the PPQ area for 22 years. APHIS Associate Administrator Mark Davidson will now be in the role on an acting basis until a new deputy administrator has been named.

— GOP senators urge White House to alter its selection for the Labor Department’s head wage-hour regulator. Biden in June nominated David Weil to again lead the DOL’s Wage and Hour Division, a role he held during part of the Obama administration. But Weil’s nomination languished for months after a tie vote in the Senate Health, Education, Labor, and Pensions Committee. The Senate failed to confirm Weil before ending its business for the year. Biden must now decide whether Weil will remain his pick or if he’ll select a candidate who faces less opposition.

CHINA UPDATE

— Soybeans, pork sales for 2022 main sales activity for China in most recent week. U.S. export sales activity for China the week ended Dec. 23 included net sales of 73,000 tonnes of corn, 124,900 tonnes of sorghum (new sales of 333,400 tonnes but cancellations of 208,500 tonnes), 432,800 tonnes of soybeans and 69,300 running bales of upland cotton. There were cancellations of 700 running bales of upland cotton for 2022-23 reported.

Meat sales: For 2021, there were net reductions of 9,500 tonnes of pork and net sales of 1,000 tonnes of beef. For 2022, net sales of 300 tonnes of beef and 18,600 tonnes of pork were reported.

— USDA issues ‘public health alert’ for undetermined quantity of foods from China. USDA’s Food Safety and Inspection Service (FSIS) has issued a public health alert for an “undetermined amount of imported meat and poultry products from China,” but no recall has been issued as FSIS has not been able to identify and contact the importers. “The total amount of ineligible product is undetermined because the investigation is ongoing,” FSIS said. The products do not identify an eligible establishment number on the packaging and were not presented for import reinspection. “These products are ineligible to import into the US, making them unfit for human consumption,” FSIS said. There have been no confirmed reports of any adverse reaction to consuming the products. Follow this link for a listing of the products subject to the public health alert.

— Chinese officials admitted that they were struggling to get sufficient supplies to residents in the northern city of Xi’an, which has been under a strict lockdown since December 23. Inhabitants complained on social media that they do not have enough food. The measures, which mean no one can leave or enter the city without approval, are in response to around 1,000 Covid-19 infections this month.

— China to auction wheat from reserves to millers. China will sell 500,000 tonnes of wheat at auction Jan. 5 to wheat flour processing companies, according to a notice from the National Grain Trade Center. The wheat can only be processed and cannot be sold. The most recent auction of wheat from state-owned reserves took place in October.

— China initial 2022 crude import quotas 11% below year-ago: report. China’s first allotment of crude oil import quotas for 2022 is set at a volume that is 11% under the first allotment issued for 2021, Reuters reported based on industry sources and a document the news service reviewed. There were 42 companies granted quotas, with three private refiners — Zhejiang Petrochemical Corp (ZPC), Hengli Petrochemical 600346.SS and Shenghong Petrochemical — together getting 41.95 million tonnes, about 38% of the total and nearly 50% more than a year earlier, the news service said. Smaller refiners, mostly in Shandong province, received a total of 51.4 million tonnes, 26% under the year-ago levels. China has been shifting its policies to remove excessive and inefficient processing capacity and focus on larger, more-advanced operations, the report sale. China in November set total crude import quotas for non-state firms for 2022 at 243 million tonnes, unchanged from the initial total 2021 level, but the country eventually only issued 189 million tonnes of quotas for 2021 to those entities.

— China issues first ‘green’ loans. China has issued the first 85.5 billion yuan ($13.4 billion) batch of low-cost loans to financial institutions to promote green projects and corporate efforts to cut carbon emissions, the People’s Bank of China (PBOC) announced. The carbon emission reduction facility (CERF) is part of China's broader goal of bringing carbon emissions to a peak before 2030 and achieving carbon neutrality by 2060, as well as to shelter the economy from the economic fallout of the pandemic. Under the CERF, PBOC will provide financial institutions with funds equal to 60% of a loan’s principal at a one-year lending rate at 1.75%. That would be at a discount to the seven-day reverse repo rate of 2.2%. The bank has also officially rolled out low-cost loans to support companies’ efforts to use clean coal.

— Shares of China Evergrande Group tumbled after the embattled real estate developer did not pay offshore coupons due earlier this week. The decline wiped out gains from earlier this week, when the market cheered the initial progress made by the firm in resuming construction work.

ENERGY & CLIMATE CHANGE

— Sustainable aviation fuel (SAF) has several high hurdles. USDA Secretary Tom Vilsack frequently mentions the growth potential for SAF. He says the industry can expect a 35-billion-gallon demand. But a Los Angeles Times article today (link) notes several hurdles for the fledgling industry. While airlines say recycled grease could help end emissions by 2050, they ask, “Is there enough?” Earlier this month, the article notes, “a United Airlines flight from Chicago to Washington made a bit of aviation history, completing a 600-mile trip that the airline hopes will prove the first leg of a journey to a greener future.”

Hurdles ahead. Reaching the goal of eliminating aviation emissions — responsible for 3% to 4% of the world’s carbon emissions — won’t be easy. Some reasons, according to the article:

- It will take huge gov’t investments via tax breaks or grants and ground-breaking technological advances, such as hybrid or all-electric jet planes — some experts envision making the switch to such technology sometime in the 2030s.

- Airlines currently have to pay up to four times as much for low-emission SAF as they pay for conventional fuel, which could mean higher airfares for everyone.

- The world’s refineries now produce about 26.4 million gallons of low-emission, sustainable aviation fuel a year. That is only a fraction of the 18.3 billion gallons of fuel burned by U.S. carriers alone in 2019, according to the U.S. Bureau of Transportation Statistics.

- A proposal in President Biden’s Build Back Better plan calls for a fuel tax credit that could boost production of SAF to 3 billion gallons a year by 2030 — still a fraction of the fuel that airlines expect to need over the next decade.

- For now, biofuel producers are relying on used cooking oil, rendered animal fat, the jatropha plant, algae and other so-called feedstock, but experts say refineries do not have access to enough of those materials to produce the billions of gallons of aviation fuel needed to reach the net-zero goal. About 3 billion gallons of used cooking oil is collected annually from the nation’s hotels and restaurants, according to the U.S. Environmental Protection Agency, but a lot of oil ends up in landfills or in sewers. It takes about eight gallons of used cooking oil to make one gallon of sustainable aviation fuel, industry experts say. That means that even if every drop of cooking oil were collected and turned into jet fuel today, it still wouldn’t be enough to fuel all current flights.

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— Massachusetts delays animal welfare standards. Massachusetts has revised portions of a state animal welfare law because of concern about price spikes for eggs and pork. The underlying statute was approved by Massachusetts voters in 2016, requiring eggs sold in the state come from hens that have at least 1.5 feet of space. Similar to California’s Proposition 12, the Massachusetts law also imposes space requirements for pork and veal and bars producers who fail to comply from selling their products within the state. The regulations were set to enter into effect on Jan. 1, 2022. In response to concerns from producers and retailers, state legislators approved a bill to delay implementation of the pork regulations until Aug. 15, 2022 and decrease the space requirements for hens to 1 square foot. Massachusetts Governor Charlie Baker signed the legislation into law on Dec. 22. (Note: Pro Farmer covered this issue on Dec. 21, ahead of Baker signing the legislation.)

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 284,649,446 with 5,424,718 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 53,663,256 with 822,920 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 506,313,935 doses administered, 205,638,307 have been fully vaccinated, or 62.64% of the U.S. population.

— New forecast from the CDC predicts more than 44,000 people could die of Covid-19 over the next four weeks as the U.S. endures a much-feared winter surge. Cases are rising in other countries around the world, as well.

— Flight Cancellations: U.S. travelers faced a fifth consecutive day of more than 1,000 flight cancellations as airlines continued to struggle with weather and Covid-19-driven staffing issues.

— Fauci predicts U.S. Omicron surge will peak in late January. Dr. Anthony Fauci predicted on Wednesday that the highly contagious Covid-19 Omicron variant will peak in the U.S. by the end of January. “I would imagine, given the size of our country and the diversity of vaccination versus not vaccination, that it likely will be more than a couple of weeks, probably by the end of January, I would think,” Fauci said on CNBC’s Closing Bell when asked when the latest coronavirus surge will start to wane. But Fauci, the White House chief medical adviser, admitted “it’s tough to say” before offering the timeline. He also cited the trajectory of Omicron cases in South Africa, where the mutation was first detected, ahead of his response. “It certainly peaked pretty quickly in South Africa,” Fauci said of Omicron. “It went up almost vertically and turned around very quickly.”

— CDC Director Dr. Rochelle Walensky said anyone with symptoms, even if fully vaccinated, should isolate at home. Walensky said the CDC didn’t recommend testing to return to work because PCR tests can stay positive for up to 12 weeks, even after people are no longer contagious.

POLITICS & ELECTIONS

— Spanberger, Griffith to seek re-election in redrawn Virginia districts. Rep. Abigail Spanberger (D-Va.) said Wednesday that she will seek re-election in the newly-redrawn VA7 district “after the commonwealth’s Supreme Court approved a new political map that substantially changes her current one. Her current district is one of the most competitive districts in the country, and the new map shifts her district north, away from the Richmond suburbs where she has her strongest support. In addition, VA9 Rep. H. Morgan Griffith (R-Va.)) declared on Twitter that he will seek re-election to the 9th District in the state’s rural southwest, even though the maps approved Tuesday by the Supreme Court of Virginia put him in the adjacent 6th District with fellow Republican Ben Cline. The new lines, approved unanimously by the court on Tuesday, establish swing seats in the areas represented by the two-term Representatives, who were narrowly re-elected in 2020.

OTHER ITEMS OF NOTE

— Vladimir Putin, the president of Russia, will speak today with President Biden about the crisis at the Ukrainian border. Putin requested the call, which will be the second time in three weeks that the two leaders speak about tensions at the Ukrainian border. On Wednesday, to prepare for the call, Secretary of State Antony J. Blinken spoke with President Volodymyr Zelensky of Ukraine, and with his British, French and German counterparts. American officials said it was part of an effort to make clear that the United States would not negotiate about the future of Ukraine or borders in Europe behind the backs of the region’s leaders. Putin is likely to push Biden for answers about a proposed treaty in which Moscow demanded assurances that Ukraine would never join NATO — which would bring Western troops and missiles even closer to Moscow — and that the alliance would not place offensive arms in the former Soviet states. A senior administration official on Wednesday said that Biden and Putin would not be directly involved in Jan. 10 negotiations, which will most likely take place in Geneva. That is where the two men met for a brief and tense summit in June, before Russia massed roughly 100,000 troops along Ukraine’s border. The official said the U.S. delegation next month would be led by the State Department, most likely by Deputy Secretary of State Wendy Sherman, and would include Pentagon and National Security Council representatives. On Wednesday, Putin announced that a joint military exercise of Belarusian and Russian troops would take place early next year in Belarus, north of Ukraine.

— Russia will strike Ukraine soon… Putin is playing with Biden and NATO: Analysis by Rebekah Koffler, a former Defense Intelligence Agency officer and currently a strategic intelligence analyst with The Lindsey Group. “Do not be distracted by Russia’s announcement on Sunday of a troop withdrawal from the Ukrainian border. It may appear that Moscow is signaling, ahead of the just announced U.S./Russia talks early next year, that it favors a diplomatic approach to resolving the current standoff with the U.S. and NATO over Ukraine. But in all likelihood, it is just a ruse. There’s a more than 50% chance that Putin will attack Ukraine in the coming weeks, regardless of the outcome of another round talks between Moscow and Washington planned for Jan. 10 through 13.” Link for full report.

— South Korea has "effectively" agreed with the U.S. on a draft declaring the end of the Korean War, according to South Korean Foreign Minister Chung Eui-yong. Although the war ended in 1953 with an armistice, there was never actually a peace treaty to conclude the conflict between North Korea, South Korea and their respective allies.

— Supreme Court starts 2022 with a special session on Biden’s vaccine mandate, joining a docket that could also see affirmative action and Donald Trump’s Capitol riot dispute with Democrats go before the justices. The court with its conservative majority has a small window in January to tack on new cases to its argument calendar. Already, expected rulings on abortion, gun rights, and religious freedom highlight how closely the court’s work this term has become tied to disputes that are sharply dividing the nation.