Biden, Garland, Vilsack to Meet with Independent Producers on Concentration in Meat Sector

Snow day in Washington as first snowfall of winter will likely upset schedules

|

In Today’s Digital Newspaper |

Market Focus:

• Holiday flight cancellations hit a new peak with thousands of flights called off

• Rollout of new 5G services could cause further flight disruptions

• Tesla reports 87% growth in annual vehicle deliveries

• S&P 500 ended Dec about 4.5% higher, third-best month of year, best Dec since 2010

• Jobs update on Friday looms large

• Fed focus on Wednesday with FOMC minutes from Dec. 14-15

• Trio of Fed speakers on schedule for Friday, with all three being 2021 voters

• Ag sector stakeholders watching USDA data on demand news, conditions

• Florida’s population topped 21 million in 2020, 14.6% increase over 2010

• IRS still has big backlog of 2020 returns to process

• IHS Markit provides look at health of European manufacturing sector

• Families bracing for bank balances to suffer as monthly child-tax-credit payment lapses

• Americans borrowed more than ever to buy homes in 2021

• Gold hit its largest percentage decline since 2015

• First OPEC+ meeting of year takes place Tuesday

• U.S. natural gas prices for 2022: Volatility ahead

• Bad winter weather could send wheat prices higher: Barron’s article

• Some European officials accuse Russian gas giant Gazprom of withholding product

Policy Focus:

• Odds rising of potential scaled-back BBB

Personnel:

• Trump-appointed bank regulator resigns after partisan fight

• Biden administration still filling the roles of various

China Update:

• China’s upcoming big events

• China’s no-Covid policy continues, with some say could last into 2023

• Concerns are rising around the health of China’s property market

• Competition with China legislation

Trade Policy:

• U.S. on sidelines as China and other nations launch trade pact

Livestock, Food & Beverage Industry Update:

• Pricey chicken puts thighs on restaurant menus

• Mandatory bioengineered labeling begins this week

Coronavirus Update:

• Clue on Omicron's milder symptoms

• Pentagon chief Austin says he has tested positive for Covid

• Supreme Court to hear oral arguments Jan. 7 re: vaccine, mask mandates

• K-12 schools press to reopen as Omicron surges

• Fauci: CDC considering adding negative Covid test to five-day isolation guidelines

• Fauci notes rise in reported cases, averaging around 400,000 a day

• Deaths from Covid-19 in eastern Europe (including Russia) passed 1 million

Politics & Elections:

• Facts and figures of midterm elections

• One of Marjorie Taylor Greene's Twitter accounts permanently suspended from Twitter

• Washington prepares to mark one year since Capitol riot

Congress:

• Pelosi to give agenda update

• Harry Reid will lie in state in U.S. Capitol Rotunda on Jan. 12

Other Items of Note:

• Russia/Ukraine update

• North Korean leader Kim Jong Un acknowledges ‘food problem’

|

MARKET FOCUS |

Equities today: Global stock markets were mostly firmer overnight. Markets in China, Japan and Australia were closed. U.S. stock indexes are pointed toward higher openings. Asian equities ended mixed though trade action was light as markets in Japan, mainland China and Australia were closed for a holiday. The Hang Seng Index was down 122.92 points, 0.53%, at 23,274.92. South Korea’s KOSPI was up 11.12 points, 0.37%, at 2,988.77. European equities are posting advances in early trading, with the Stoxx 600 up 0.7% and regional markets up 0.7% to 1.2%; UK markets are closed for a holiday.

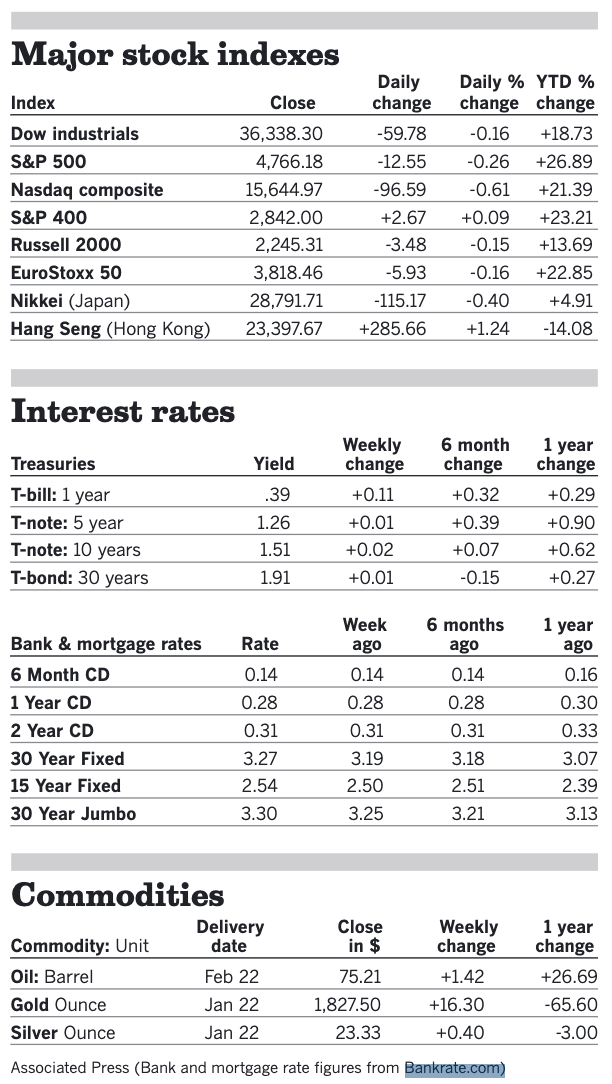

U.S. equities Friday: The Dow slid 59.78 points, 0.2%, to 36,338.30 and the Nasdaq Composite declined 96.59 points, 0.6%, to 15,644.97. The S&P 500 fell 12.55 points, 0.3%, to 4,766.18.

S&P 500 ended December about 4.5% higher, the third-best month of the year and best December since 2010. For the year, the S&P 500 Index was up about 27% to outpace the Dow and the Nasdaq — the Nasdaq increased by 21% and the Dow rallied 19%. The S&P 500 Index set 70 all-time highs during the year, which is the most in a single year since the 77 that was carved out in 1954.

On tap today:

• Gov’t offices in Washington shuttered; NASS reports still expected to be released. A winter storm has prompted the Office of Personnel Management to declare today a snow day for federal government offices in Washington, meaning federal offices are closed to all but essential personnel. In the past, USDA has still released weekly export inspections data when offices are closed. The monthly reports from USDA — Grain Crushings, Fats & Oils and Cotton System — are expected to be released as scheduled, according to the National Agricultural Statistics Service. The Federal Reserve has said that they plan to issue all daily postings as scheduled.

• IHS Markit's U.S. manufacturing index for December is out at 9:45 a.m. ET.

• U.S. construction spending for November is expected to rise 0.7% from the prior month. (10 a.m. ET)

• China's Caixin manufacturing index for December is out at 8:45 p.m. ET.

• USDA Grain Export Inspections report, 11 a.m. ET.

• Biden, Garland and Vilsack meet with independent producers on concentration in the meat industry, 1:30 p.m. ET. Link for details and see separate item below.

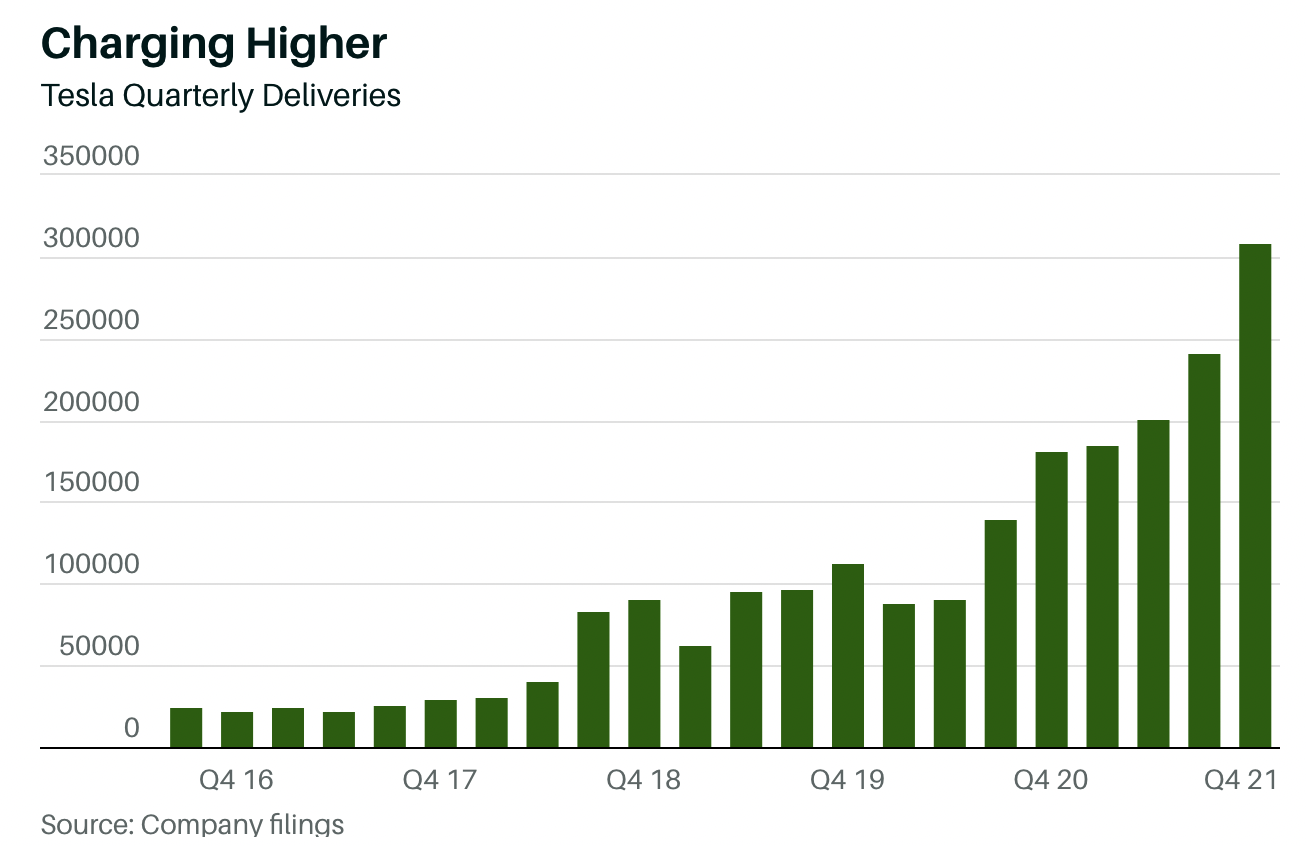

Tesla reports 87% growth in annual vehicle deliveries. The electric-vehicle maker’s expansion comes despite parts shortages and other logistical problems that have hamstrung the global auto industry. Tesla delivered 308,600 vehicles in the fourth quarter of 2021. That’s a record result. Fourth quarter deliveries grew 71% compared with the fourth quarter of 2020. For the full year, deliveries came in at around 936,000, up roughly 87% compared with the around 500,000 units delivered in 2020. The company’s shares have soared on the back of expectations for continued growth, with the stock up almost 50% in 2021 and a market valuation exceeding $1 trillion — one of only five publicly listed U.S.-based companies to achieve that status.

Jobs update looms large. The Friday Employment report is the main attention point for U.S. economic data to open 2022. The private sector update from ADP arrives Wednesday, but the broader Friday recap will cap off the week with a steady unemployment level expected for December. An increase in nonfarm payrolls for December versus November is also expected. The data reflects mid-December surveys before the Omicron variant caused Covid-19 cases to rise sharply.

Other data of note this week will include readings on the manufacturing and services sectors and International Trade data, which is due out Thursday, is expected to reveal a rise in the trade deficit in goods and services compared with October’s level. Factory activity will also be released with the week closing out with the update on consumers’ use of credit in November as they geared up for the Christmas holiday.

Fed focus is on Wednesday. Minutes from the Dec. 14-15 Federal Open Market Committee (FOMC) will be released Wednesday. The recap will be combed through for more clues on Fed policy ahead as this was the meeting where the Fed sped up the pace of their tapering of bond purchases and sent the signal that rate increases were likely in 2022. How the minutes characterize the timing of the rate increases in the FOMC discussion will be important with many expecting it will be as soon as the May FOMC meeting.

A trio of Fed speakers are on the schedule for Friday, with all three being 2021 voters — Atlanta Fed President Raphael Bostic, Richmond Fed President Thomas Barkin and San Francisco Fed President Mary Daly. They may offer some additional color on the discussions that took place at the Dec. 14-15 FOMC meeting.

Agriculture stakeholders will be watching USDA data on demand news, conditions. USDA opens the week and new year with reports outlining demand for corn to be made into ethanol and soybean crush data. Demand on both fronts has been strong and the expectations are that could continue in the monthly data covering November. Tuesday USDA releases “State Stories,” updates from some states that will provide a snapshot in winter wheat conditions during the month of December. Focus will be on how the ratings in individual states compare with those issued at the end of November. USDA’s weekly Export Sales update due on Thursday remains an attention point, but the report this week will cover the period ending December 30 which will include the Christmas holiday so the data could be down from prior weeks. And the week closes out with November trade data which is likely to show another strong month for U.S. agricultural exports but could also show continued strong demand for agricultural imports in the second month of fiscal year 2022. The U.S. trade deficit, reported by the Commerce Department, is estimated to widen in November to $72.6 billion, up about $5.5 billion from the month before. Global supply-chain constraints and elevated consumer demand for capital goods are some of the factors feeding the deficit.

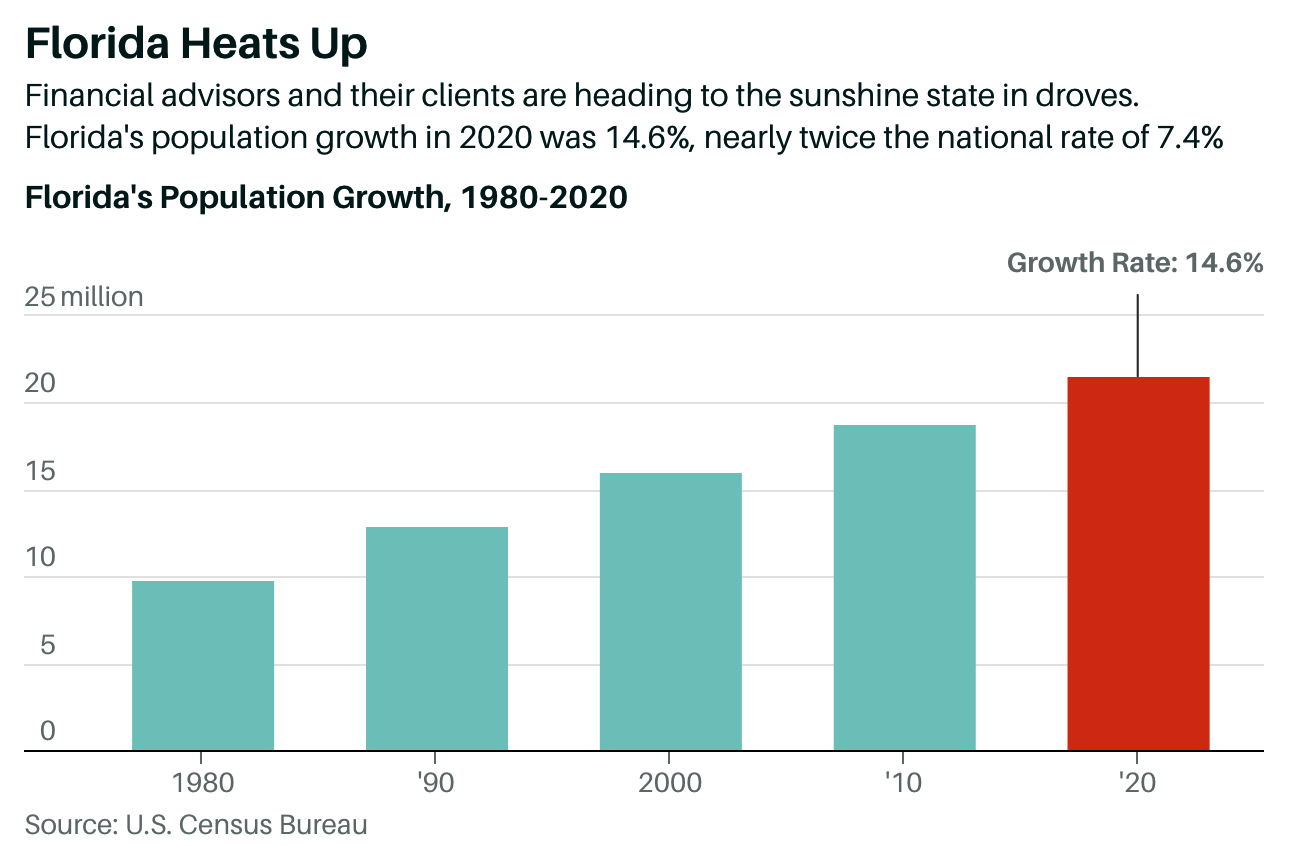

Florida’s population — particularly in the Miami, Orlando, and Tampa metro areas — has mushroomed, topping 21 million in 2020, a 14.6% increase over 2010 and nearly twice the nation’s growth rate of 7.4%, according to the U.S. Census Bureau. It’s not just senior citizens that are moving in; wealthy people and financial services firms are decamping for a state that boasts a lot of sunshine, beaches, and low taxes, notes Barron’s (link/paywall). (Florida also does not have income or capital gains taxes, and lower-than-average property taxes.) The latest stats from snntv.com indicate that nearly 1,000 people move to Florida every day and many are coming from northern states like New York, New Jersey, and Connecticut. According to the National Association of Realtors, a total of 8.9 million people changed address since the start of the pandemic. The Association reports that close to 28% of the people relocating to Florida came from Texas and another 15% relocated from New York, with a little over 6% coming from California. Florida’s popularity isn’t expected to end any time soon: it’s expected to gain an average 845 new residents a day until 2025, according to state projections.

IRS still has a big backlog of 2020 returns to process. The IRS still had 6.3 million unprocessed individual returns and 2.3 million amended tax returns to process as of Dec. 18.

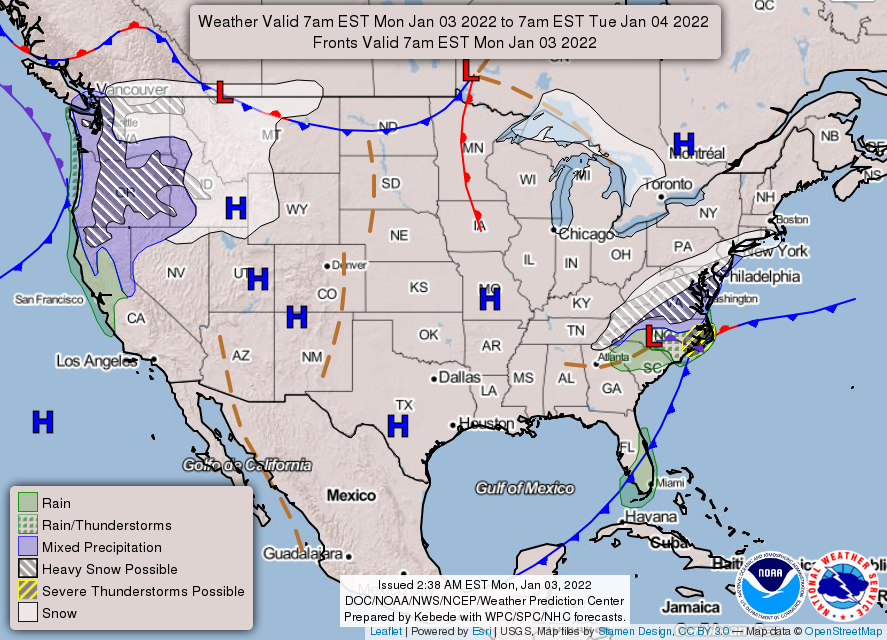

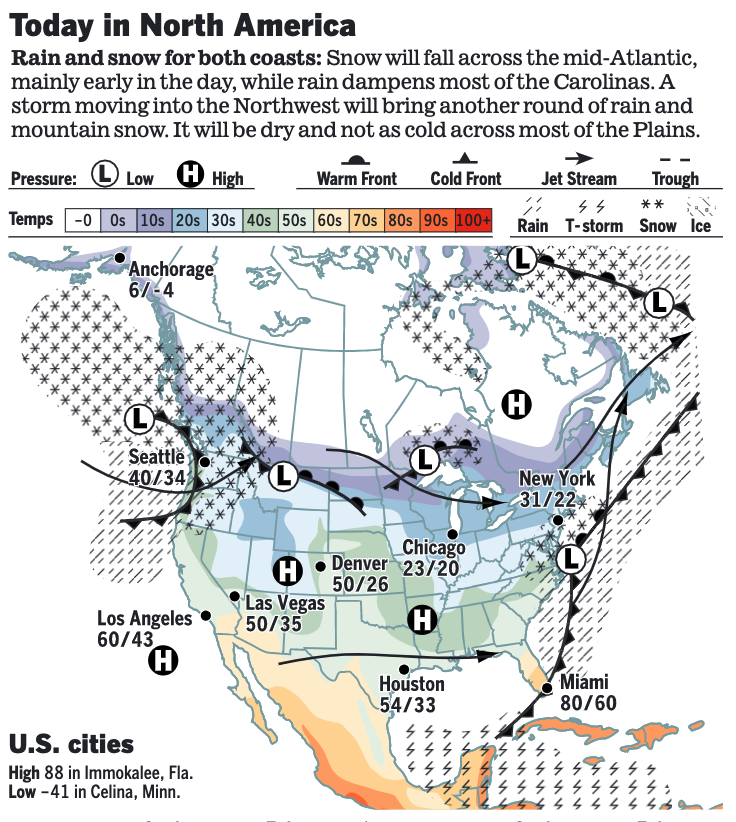

Air travelers encountered more than 2,400 canceled flights within, into or out of the U.S. on Sunday and more than 5,700 delays as winter weather and staff shortages continued to plague the nation’s air carriers. More than 2,600 flights into and out of the U.S. were canceled Saturday, and more than 4,000 were delayed, according to the tracking firm FlightAware.com, amid bad weather and staff shortages caused by the rapid spread of the Omicron variant. On Sunday, Southwest Airlines canceled 11% of its flights, according to FlightAware, while JetBlue had canceled 16%, Delta Air Lines 6%, and American Airlines 5%. SkyWest, which operates regional carriers for United Airlines, Delta, American and Alaska Airlines, canceled 21% of its flights. Some flights have already been scrubbed for Monday, FlightAware said. A heavy snowstorm across large parts of the country is expected to cause major travel disruptions, according to the National Weather Service. Some of the biggest trouble spots for travelers were in the Midwest, where 55% of flights scheduled to leave from Chicago Midway and 45% from Chicago O’Hare were scratched, according to FlightAware. Airports in Denver, Kansas City and Detroit also saw a high number of cancellations and delays.

Perspective: The number of canceled flights over the past two weeks has surpassed those of the entire winter season in each of the past four years, according to FlightAware, whose tally included domestic flights and those into and out of the United States. Winter 2013 was the worst in recent years for cancellations, with nearly 10,000 scrubbed flights during the season, according to the Bureau of Transportation Statistics.

Rollout of new 5G services could cause further flight disruptions. More than 6,000 flights were canceled in the U.S. this weekend due to winter storms and coronavirus-related staffing problems. Airlines could face another challenge this week if the Federal Aviation Administration imposes new flight restrictions to address safety concerns over 5G wireless services slated to go live on Wednesday. AT&T and Verizon rebuffed the request but offered a counterproposal that would allow limited deployments to move forward this week.

IHS Markit will provide a look at the health of the European manufacturing sector with December’s purchasing managers index. The index is expected to slip slightly to 58.0 from 58.4 in November, amid a continuing supply-chain crunch and rising Covid-19 infection rates in Europe.

Families are bracing for bank balances to suffer when the middle of January comes and the monthly child-tax-credit payment doesn’t. More than 30 million households started getting up to $300 per child in July after Congress temporarily transformed an annual tax break into a near-universal monthly benefit. Families spent the money on essentials like groceries and stashed it as emergency savings, researchers found, according to the WSJ (link). Democrats hailed the expansion as a simple yet groundbreaking policy that would prove so popular and beneficial that Congress wouldn’t let it lapse. It just lapsed.

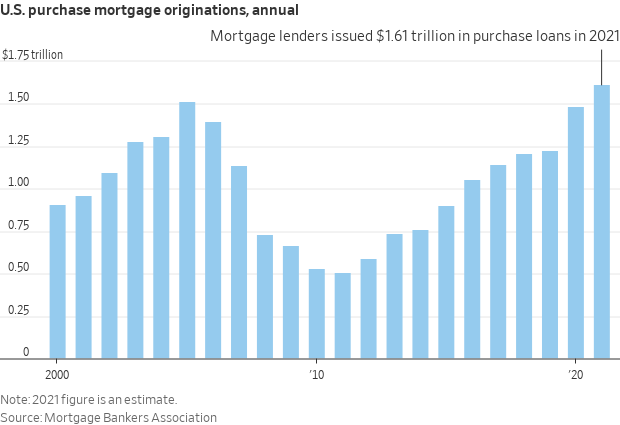

Americans borrowed more than ever to buy homes in 2021. The mortgage boom reflects a thriving housing market and the corresponding run-up in prices over the past year. Many of the forces that pushed Americans into the housing market in the early months of the pandemic — low interest rates and a desire for bigger homes — continue to drive up prices and mortgage balances.

Market perspectives:

• Outside markets: The U.S. dollar index is lower even as the euro, yen and British pound were all slightly weaker versus the greenback ahead of U.S. trading. The yield on the 10-year U.S. Treasury note is firmer, trading around 1.53%, with global government bond yields steady to firm. Gold and silver futures are under pressure ahead of US economic data, with gold trading around $1,822 per troy ounce and silver around $23.25 per troy ounce.

• Crude oil futures are higher ahead of U.S. market action, with U.S. crude around $75.75 per barrel and Brent around $78.40 per barrel. Futures were higher in Asian action, with U.S. crude up 40 cents at $75.61 per barrel and Brent up 35 cents at $78.13 per barrel.

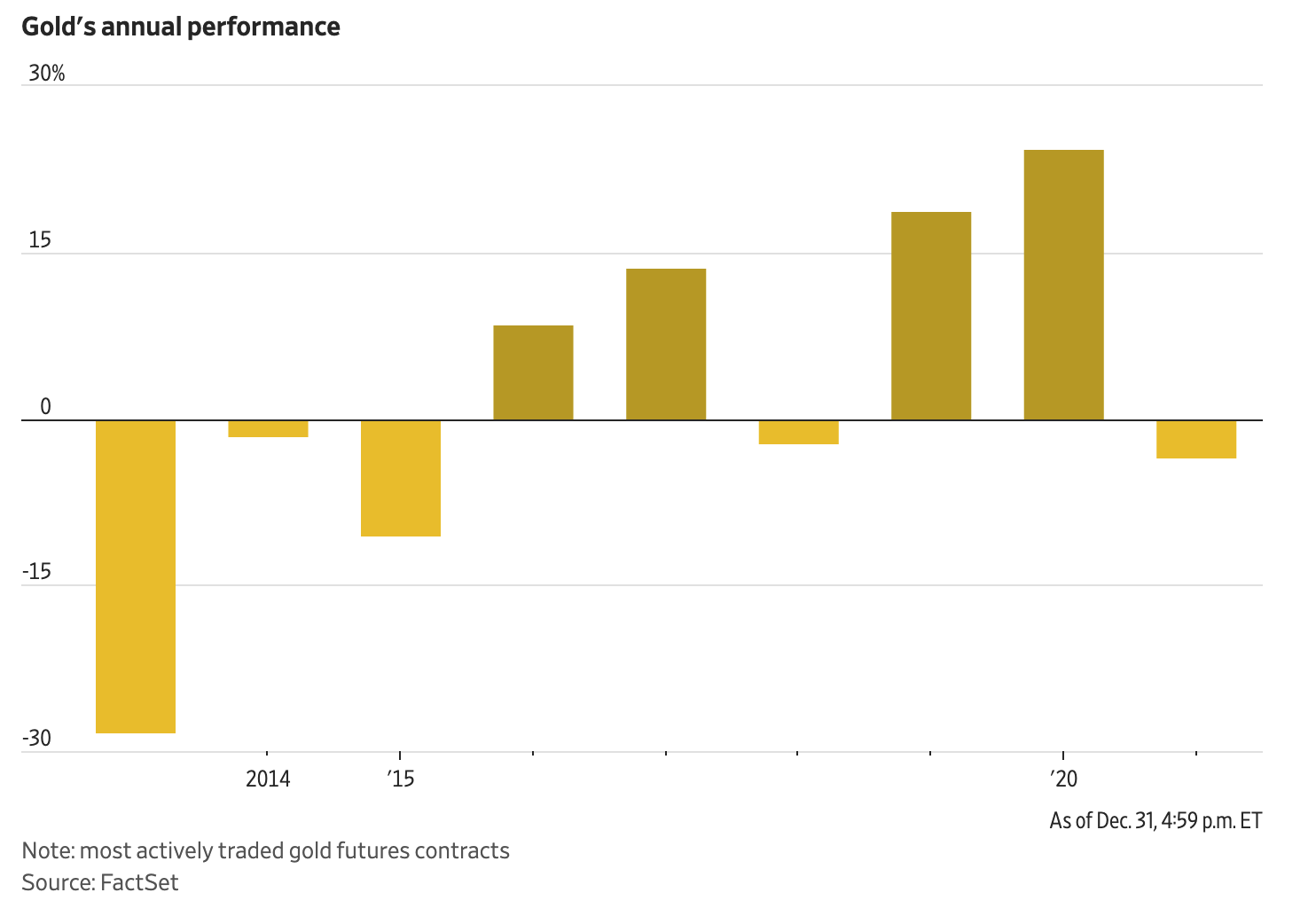

• Gold hit its largest percentage decline since 2015. Most-actively traded gold futures fell roughly 3.5% to around $1,828.60 a troy ounce in 2021, dragged lower by investors’ expectations for the Federal Reserve’s response to price increases.

• First OPEC+ meeting of the year takes place Tuesday with Saudi Arabia and other participants mostly positive on the outlook for oil demand recovery. The producer alliance is expected to push ahead with a planned 400,000 barrels per day production increase in February. Oil prices have been under some pressure after U.S. airlines cancelled thousands of flights during the holidays due in part to COVID issues.

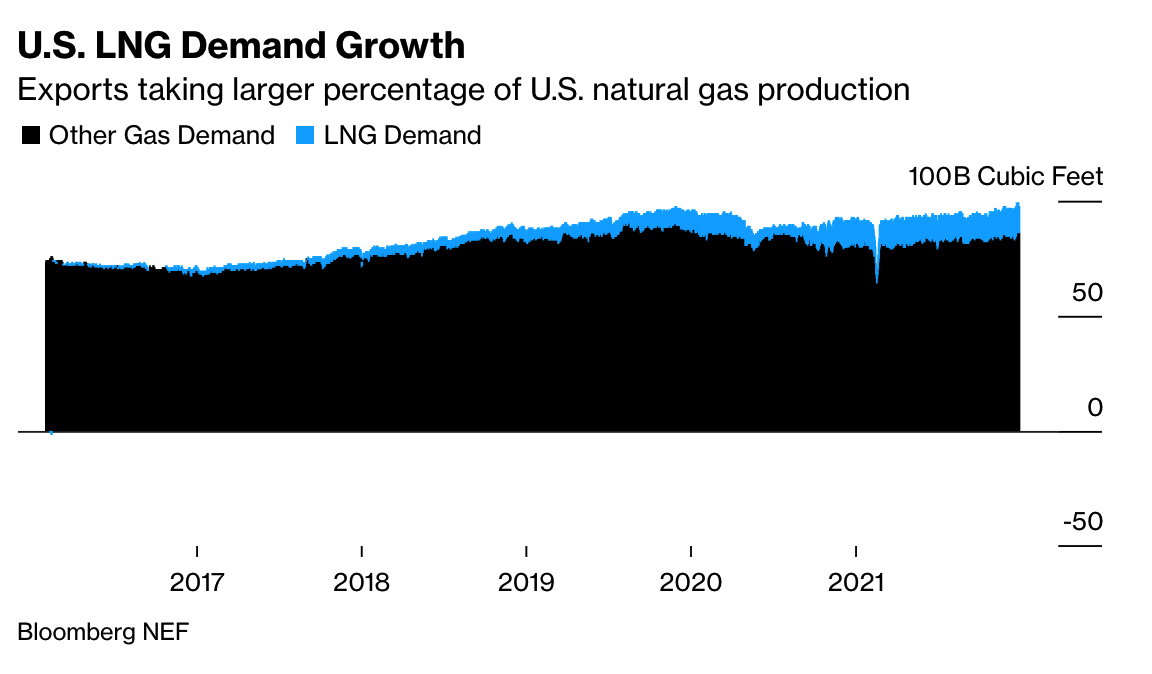

• U.S. natural gas prices for 2022: Volatility ahead. Benchmark American gas futures climbed almost 45% in 2021 for the strongest annual performance in half a decade. What’s ahead: more volatility and when increased production comes, a price downturn. Overseas buyers purchased 13% of U.S. gas production in December, a seven-fold increase from five years earlier when most of the infrastructure required to ship the fuel out of the country didn’t yet exist, a Bloomberg item noted. Prices already have been falling in Europe as the arrival of American cargoes eased fears of an immediate shortage, but buyers in continental Europe still are paying six times as much as U.S. rivals. Bank of America is predicting a 3.5 cubic-foot increase in daily production this year, driven by new wells in shale fields from West Texas to Pennsylvania. U.S. gas production, excluding Alaska, rose about 7% in 2021, more than erasing 2020’s pandemic-related decline, according to BloombergNEF.

• Bad winter weather could send wheat prices higher. So says an article in the latest Barron’s (link/paywall). Poor winter weather conditions combined with already low global inventories could send prices for wheat higher by up to 19%, experts say. War in Eastern Europe could catapult them further. “Europe, Ukraine, and the U.S. face some very unfavorable weather that will really set off a supply shortage concern,” says Shawn Hackett, president of Hackett Financial Advisors. Hackett sees prices rallying to between $9.50 and $10 a bushel, or as much as 19% above recent levels. That’s his outlook without a military conflict. Wheat prices could go far higher than $10 if Russia decides to invade Ukraine, a major producer. “If there are any problems in Ukraine it is a very big deal,” says Sal Gilbertie, CEO of Teucrium Trading. Russia is forecast to be the second-largest wheat exporter in the 2021-22 season and Ukraine the fourth, according to recent data from USDA. Together the two countries are expected to export 60 million metric tons, or 29% out of a forecast global export total of 205 million tons.

• Some European officials accuse Russian gas giant Gazprom of withholding additional volumes as it aims to launch the controversial Nord Stream 2 pipeline to Europe, whose approval by German regulators is on hold. Gazprom insisted it was meeting all its contractual obligations to supply gas to Europe and said the record prices had killed demand for spot sales.

• NWS weather: There is a Slight Risk of severe thunderstorms over much of coastal North Carolina today... ...Heavy Snow for parts of the Central/Southern Appalachians and Mid-Atlantic on today; Heavy Snow for the Cascades and northern Sierra... ...Freeze Warnings from south Texas to the Western/Central Gulf Coast through this morning; Critical Fire Weather risk for a portion of eastern New Mexico and the Texas Panhandle on Tuesday.

|

POLICY FOCUS |

— Odds are rising of a potential scaled-back BBB. Centrist Sen. Joe Manchin (D-W.Va.) has consistently said he is open to reengaging on the climate and childcare provisions in President Biden's Build Back Better (BBB) agenda if the White House removes the enhanced child tax credit from the $1.75 trillion package — or dramatically lowers the income caps for eligible families. He continues to tell colleagues he’s concerned about the inflationary effects of so much gov’t spending but has continued to confer with senior White House officials over the holidays.

A much talked about alternative: Remove the child tax credit from BBB, which the Senate plans to pass with only Democratic votes. The chamber could then have a separate, focused debate later about making the tax credits permanent, with retroactive payments.

More information should surface after Monday night’s Senate leadership meeting, which Manchin will attend, and Tuesday’s weekly caucus lunch. The lunch will be the first time all Senate Democrats are together in one room since Manchin made his opposition to the bill public last month. Schumer will use the occasion as the marker for whether to hold a vote to proceed on BBB or hold off to try to negotiate more, Senate leadership aides signal.

|

PERSONNEL |

— Jelena McWilliams, chairman of the Federal Deposit Insurance Corporation, an American bank regulator, said she would step down on February 4. McWilliams, who was appointed by President Donald Trump but stayed on under President Joe Biden, had disagreed with Democrats on the FDIC’s board, who are now in a majority, over a proposed review of bank-merger rules.

— Biden administration is still filling the roles of various posts after December saw a lot of nominees approved. However, there are still many slots that remain open. Senate Majority Leader Chuck Schumer (D-N.Y.) is expected to become more aggressive to get nominees moved through the chamber. The Senate Health, Education, Labor and Pensions Committee on Wednesday will vote on the nomination of Robert Califf to head the Food and Drug Administration. Califf, a cardiologist, served as FDA commissioner in the final year of the Obama administration. Still awaited, however, are roles at USDA, including the Undersecretary for Trade and Foreign Agricultural Affairs.

|

CHINA UPDATE |

— China’s upcoming big events: The Winter Olympics start in and around Beijing in February (no spectators from outside China; the ban does not apply to world leaders, who are invited by the host country, nor to accredited foreign media), followed by the annual March session of China’s rubber-stamp parliament. The five-yearly party congress in late 2022 is expected to confirm Xi Jinping as the country’s leader for at least another five years.

— China’s no-Covid policy continues, with some signaling it could last into 2023. Some China watchers say to look at Hong Kong for whether or not China moves away from its no-Covid strategy. Hong Kong city’s government wants to open its border with mainland China. It has had only a few new Covid cases in recent months. But the mainland authorities have refused. China wanted 80% of its population vaccinated by the end of 2021. But no foreign vaccines have been approved and its home-grown ones, including Sinopharm and Sinovac, are not very effective against Delta.

— Concerns are rising around the health of China’s property market. The country’s developers saw their shares slump in Hong Kong trading after media reports that China Evergrande Group has been ordered to tear down apartment blocks in a development in Hainan province. Trading of shares in Evergrande was suspended.

— Competition with China legislation. The Senate passed a sweeping, bipartisan measure (S 1260) in June that would provide $52 billion for the semiconductor industry and reauthorize federal science and research programs in the face of rising Chinese presence in both sectors. The effort then stalled as the House debated its own approach to bolstering U.S. competitiveness.

|

TRADE POLICY |

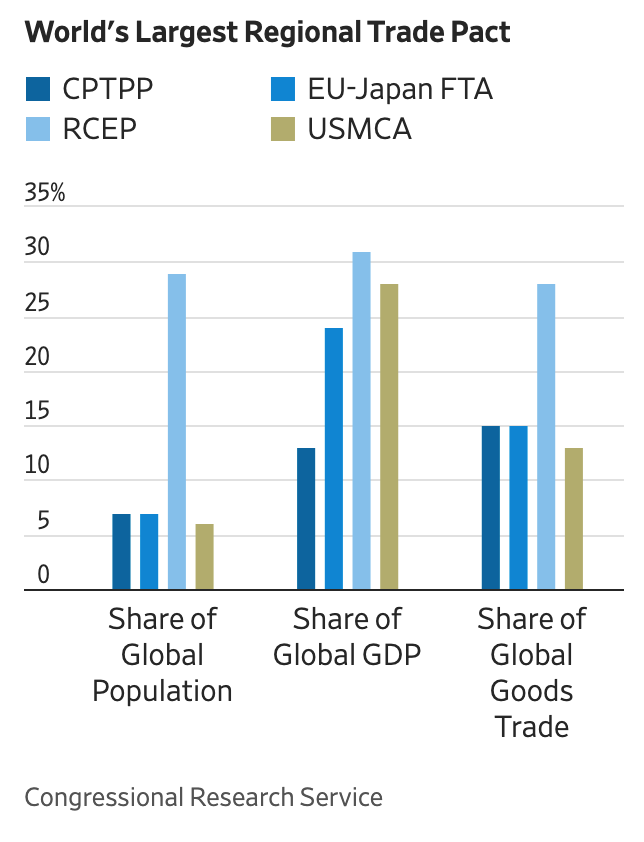

— China joined U.S. allies including Japan and Australia in a new Asia-Pacific trade agreement that launched Saturday — with the U.S. watching from the sidelines. The new Regional Comprehensive Economic Partnership, or RCEP, will eventually eliminate more than 90% of tariffs on commerce among its 15 member countries, in what economists say will be a boon to trade in the region. It will also give China a more prominent role in setting rules of trade in the Asia-Pacific region at the expense of the U.S., according to some analysts. “This will be a grouping of countries that will work together and try to develop new rules and new standards,” Wendy Cutler, vice president of the Asia Society Policy Institute and a former U.S. trade official, told the WSJ (link). “[The U.S. is] moving in the other direction.”

GOP senators recently urged President Biden to get involved in new trade accords. In a Nov. 8 letter, 13 GOP senators led by Mike Crapo (R-Idaho), the top Republican on the Senate Finance Committee, urged President Biden to get involved in new trade rulemaking in the Asia-Pacific region, saying the absence of the U.S. “encourages potential partners to move forward without us and ensures China will hold the reins of the global economy.”

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Biden, Garland and Vilsack meet with independent producers on concentration in the meat industry. The meeting begins at 1:30 p.m. ET. Link for a White House fact sheet. President Biden, USDA Secretary Tom Vilsack and Attorney General Merrick Garland this afternoon will announce “the Biden-Harris Administration’s Action Plan for a Fairer, More Competitive, and More Resilient Meat and Poultry Supply Chain,” the White House said in a media advisory. The announcement will take place during an online meeting that the White House said will be held “with family and independent farmers and ranchers to discuss his administration’s work to boost competition and reduce prices in the meat-processing industry, where corporate consolidation has led to rising prices for consumers and lower earnings for farmers and ranchers.” The White House said, “The meat producers will talk about the challenges they have faced as large conglomerates have absorbed more and more smaller processors.”

“The attorney general and the secretary of Agriculture will also attend and explain the steps the administration is taking to increase processing options for farmers and ranchers and to create fairer and more competitive markets. Vilsack will continue his aggressive work to tackle the causes of the higher prices American families have been facing.

“The president will explain that under his July Executive Order on Promoting Competition in the American Economy, the administration has been focused on tackling the lack of competition in agricultural markets. A small handful of meatpackers control the majority of the markets for beef, pork, and poultry, enabling them to squeeze farmers and ranchers while also raising prices on consumers.”

Bottom line: Antitrust actions remain in focus. Agriculture remains one of the focal points for the Biden administration on this front, with today’s virtual meeting aimed at discussing the administrations’ efforts to boost competition and reduce prices in the meat processing industry. The officials will listen to complaints about consolidation in the industry, while launching a new portal to allow farmers and ranchers to report unfair trade practices by meatpackers.

— Pricey chicken puts thighs on restaurant menus. Winston Churchill once mused about “the absurdity of growing a whole chicken to eat the breast or wing.” Now, short supplies and escalating costs of chicken breasts and wings are leading restaurants to add thighs and other dark poultry meat to menus and entrees, the Wall Street Journal reports (link). Poultry producer Perdue Farms Inc. has seen a 15% increase in boneless thigh sales in 2021 and a 20% increase in ground chicken, which is made of mostly dark meat, the company said. Products like thighs have two advantages for restaurants struggling with the high cost and tight supplies of breasts and tenders: they are cheaper and easier to get, industry officials said. “Chicken thighs are all about flavor,” said Nick Kenner, Just Salad’s chief executive. He said more customers are now choosing the product rather than the New York City-based chain’s chicken breast offerings.

— Mandatory bioengineered labeling begins this week. Jan. 1 brought a new set of regulations to U.S. food and agriculture: mandatory genetic engineered (GE) labeling. These new standards, outlined first by the Obama administration, requires food manufacturers, importers and other entities that label foods for retail sale to disclose information about genetically engineered food and food ingredients. Shoppers will no longer see labels marked "genetically engineered" or "genetically modified organisms." Instead of "GMO" or "GE," products will be marked "bioengineered" or include a QR code, website, or phone number for shoppers looking for more information. USDA said the change is in the name of consistency, to eliminate "a patchwork of state labeling regulations." Food safety advocates and others see confusion ahead and will challenge the matter in court.

USDA also opted to provide an exemption for "highly refined" ingredients if they did not contain detectable genetic material, a situation which translates into many processed foods made with ingredients that come from GMO crops not being subject to the labeling requirement.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 290,226,395 with 5,445,155 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 55,114,128 with 826,065 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 507,657,980 doses administered, 205,811,394 have been fully vaccinated, or 62.70% of the U.S. population.

10 million people globally tested positive for Covid-10 in the seven days through Sunday, almost double the previous weekly record for the pandemic.

— Clue on Omicron's milder symptoms: Compared with earlier variants, Omicron does less damage to the lungs, and instead stays in the upper airway (nose, throat and windpipe), animal research suggests. Link to details via the New York Times.

— Pentagon chief Austin says he has tested positive for Covid. Defense Secretary Lloyd Austin says he has tested positive for Covid-19 and is experiencing mild symptoms while quarantining at home.

— Supreme Court is scheduled to hear oral arguments Jan. 7 over challenges to the vaccination and mask requirements for large businesses. The Biden administration asked the Supreme Court to uphold its vaccine-or-testing mandate for large U.S. companies, as several business groups and GOP-led states seek to block the rule. In December, a federal appeals court reinstated the administration's Covid vaccination policy for large private businesses after an earlier court ruling halted one of President Joe Biden’s key measures to increase vaccination numbers. Biden announced the policy in September, stating that businesses with 100 or more employees must ensure their workforces are fully vaccinated, or require workers who aren't vaccinated to wear masks and show negative Covid test results at least once a week. Employers can face fines for not complying. In a 2-1 ruling, a panel for the Ohio-based 6th Circuit said the Occupational Safety and Health Administration (OSHA) workplace order for businesses with at least 100 employees was valid. OSHA has said that it would not issue citations tied to its Covid vaccination mandate before Jan. 10, so that companies have time to implement the requirements. The federal agency also said there would be no citations related to its testing requirements before Feb. 9. The mandate was previously slated to take effect Jan. 4.

— K-12 schools press to reopen as Omicron surges. Thousands of U.S. schools have announced that they will be closed starting Monday, but others have made tentative plans to bring students back to the classroom this week after the winter break. Their biggest challenge: getting enough rapid tests to be able to step up or launch “test-to-stay” strategies.

— Fauci: CDC considering adding negative Covid test to five-day isolation guidelines. Federal health officials are considering adding additional requirements involving testing to guidelines surrounding five-day quarantines. Dr. Anthony Fauci said that the Centers for Disease Control and Prevention (CDC) are considering including a negative coronavirus test alongside their five-day quarantine period guidelines, which were updated last week. "There has been some concern about why we don't ask people at that five-day period to get tested. The CDC is very well aware that there has been some pushback about that," Fauci said on ABC's This Week on Sunday. "Looking at it again, there may be an option in that, that testing could be a part of that, and I think we're going to be hearing more about that in the next day or so from the CDC." The CDC issued new guidelines on Tuesday, recommending a five-day isolation period if asymptomatic, followed by five days of masking around other people. These guidelines were the same for vaccinated and unvaccinated.

Fauci also noted the rise in reported cases, averaging around 400,000 a day. "We are definitely in the middle of a very severe surge and uptick in cases," he said. "The acceleration of cases that we've seen is unprecedented, gone well beyond anything we've seen before." This overwhelming surge has Fauci concerned about the omicron variant overwhelming healthcare providers and causing a "major disruption" in other essential services. "When I say major disruption, you're certainly going to see stresses on the system and the system being people with any kind of jobs ... particularly with critical jobs to keep society functioning normally," Fauci explained. "We already know that there are reports from fire departments, from police departments in different cities that 10, 20, 25, and sometimes 30% of the people are ill. And that's something that we need to be concerned about because we want to make sure that we don't have such an impact on society that there really is a disruption. I hope that doesn't happen."

— Deaths from Covid-19 in eastern Europe (including Russia) passed 1 million according to a tally produced by Reuters news agency. However, data collected by the Economist suggests the pandemic death toll is probably much higher. The region has seen more than 1.6 million “excess deaths” (those that exceed the average number in a given country prior to the pandemic). Russia alone has suffered more than 1 million such excess deaths since April 2020; it has officially recorded fewer than 270,000 Covid-19 deaths.

|

POLITICS & ELECTIONS |

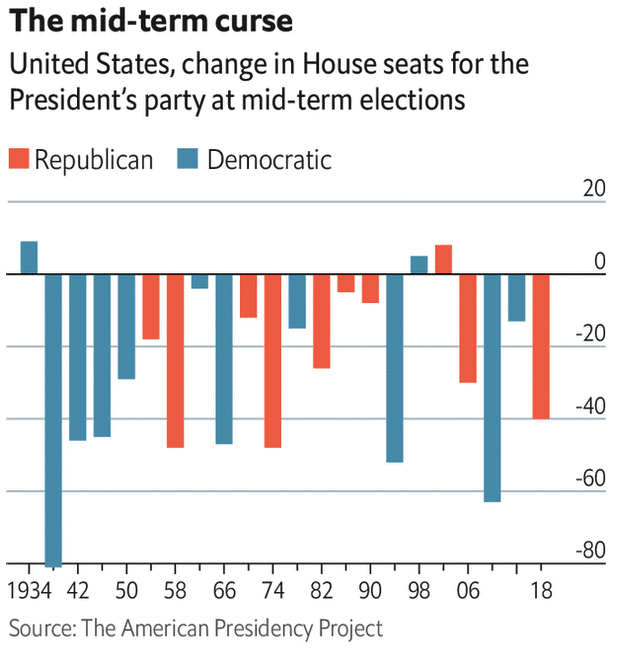

— Facts and figures of midterm elections. Between 1934 and 2018, according to the American Presidency Project at the University of California Santa Barbara, the party controlling the White House lost an average of 28 seats in the House of Representatives. They lost seats in all but three of the last 22 mid-term cycles, that is 86% of the time. The pattern is weaker in the Senate, where the ruling party lost an average of four seats since 1934. It lost seats in the Senate in 68% of mid-terms. (Remember, the Republicans gained 13 seats in 2020.)

— Rep. Marjorie Taylor Greene has been permanently suspended from Twitter for violating its Covid misinformation policy, the company said. Twitter said that Greene, a Republican of Georgia, had a fifth “strike,” which meant that her account would not be restored. The company had issued her a fourth strike in August after she falsely posted that the vaccines were “failing.”

— Washington prepares to mark one year since the Capitol riot. While Democrats plan to hold an anniversary vigil on Thursday, former President Donald Trump has promised a news conference at his Mar-a-Lago estate to revisit his claims of a rigged election, allegations that have not been backed up with proof.

Members of the House select committee investigating the attack on the U.S. Capitol say they have solid testimony that former President Donald Trump was urged to respond to the insurrection as it was happening. Wyoming Rep. Liz Cheney told ABC News yesterday that the panel has "firsthand testimony" that Trump’s daughter and senior adviser Ivanka Trump asked him to intervene, and Chairman Bennie Thompson told CNN the panel has "significant testimony" that the White House "had been told to do something."

|

CONGRESS |

— House Speaker update. House Speaker Nancy Pelosi (D-Calif.) holds a virtual briefing today on the "Speaker's New Year's Update."

— Harry Reid, the former Senate majority leader who died Dec. 28, will lie in state in the U.S. Capitol Rotunda on Jan. 12, Speaker Nancy Pelosi (D-Calif.) and Senate Majority Leader Chuck Schumer (D-N.Y.) said in a joint statement.

|

OTHER ITEMS OF NOTE |

— Russia/Ukraine update. As Russia amasses about 100,000 troops on Ukraine’s eastern frontier, Washington, Moscow and NATO member states are set to meet for talks in early January. President Biden conferred on Sunday with Ukrainian president Volodymyr Zelensky, promising that the U.S. and allies will act “decisively” if Russia further invades Ukraine (link for details). Vladimir Putin, the Russian president, has previously refused to rule out military action and has warned he has “all kinds” of options if his demands for “security guarantees” to limit NATO expansion are unmet.

— Kim Jong Un, North Korea’s dictator, said his countrymen face a “life and death struggle” and called for more efforts to tackle a worrying food shortage. Wrapping up a plenary session to mark his ten years in power, Kim unusually refrained from rattling his saber at America or South Korea, focusing instead on domestic challenges. He did, though, pledge to modernize North Korea’s arms.