Biden Admin. Fails to Appeal Injunction Blocking Socially Disadvantaged Farmer Debt Relief

USDA: 2.8 mil. acres accepted into CRP; accepts nearly 1.9 mil. acres general signup

In Today’s Digital Newspaper

Market Focus:

• USDA daily export sales for marketing year 2021-2022:

— 132,000 MT soybeans to China

— 125,300 MT corn to Mexico

• “Biden and the Fed wanted a hot economy. There’s risk of getting burned”: NYT’s Irwin

• Euro trading near its lowest level against dollar in nine months

• Bitcoin traded above $50,000 Monday

• WSJ: U.S. crops wither under scorching heat

• Commodity prices moderating, reducing inflation concerns

• Ag demand update

• Corrective buying continues in corn and soybean futures

• Corn, soybean CCI ratings continue to decline

• Cordonnier maintains U.S. yield projections after rains stabilize U.S. crops

• What another La Nina-plagued growing season might mean for S. America

• Erratic monsoon rains raise concerns about India’s crops

• Cattle contracts breakout to the upside

• Pork and cash hog prices slump to kick off week

Policy Focus:

• Pelosi, moderates struggle to reach deal to advance Biden agenda

• CFAP 2 payouts continue to edge higher

• Biden admin. fails to appeal injunction blocking socially disadvantaged farmer debt relief

• USDA: 2.8 mil. acres accepted into CRP; accepts nearly 1.9 mil. acres general signup

Afghanistan:

• Taliban rulers grappling with a new threat: economic collapse

• British PM Boris Johnson convening emergency virtual G7 meeting

• U.K. to pressure Biden to extend his Aug. 31 deadline for withdrawing U.S. forces

• U.S. forces have facilitated evacuation of more than 37,000 people

• CIA Director Burns met secretly with Taliban leader Abdul Ghani Baradar: WaPo

China Update:

• China on track to reach Phase 1 trade requirements

• SEC issues new requirements for Chinese companies listing in U.S.

• China releases additional guidelines on commodity price indexes, seeks public input

• China sends more Covid-19 vaccines to Vietnam on eve of Kamala Harris trip

Trade Policy:

• Status of U.S./Kenya trade talks still unknown

Energy & Climate Change:

• Some Senate Republicans urge EPA set 2021, 2022 RVOs below ethanol ‘blend wall’

Livestock, Food & Beverage Industry Update:

• U.K. Action on Sugar group calling for complete ban on child-friendly yogurt packaging

• No mask, no inspection

Coronavirus Update:

• Mandates may be only way to significantly increase vaccination rates

Politics & Elections:

• No mo’ Cuomo

Other Items of Note:

• CMA launches merger inquiry re: S&P Global Inc.’s anticipated acquisition of IHS Markit

MARKET FOCUS

Equities today: Global stock markets were flat to firmer overnight. The U.S. stock indexes are pointed to higher openings. Asian equities posted gains despite continued Delta COVID variant concerns. Japan’s Nikkei was up 237.86 points, 0.87%, at 27,732.10. Hong Kong’s Hang Seng rose 618.33 points, 2.46%, at 25,727.92. European equities are lower in early action. The Stoxx 600 is down 0.2% with most regional markets seeing losses of 0.2% to 0.6%. German markets, however, are seeing modest gains.

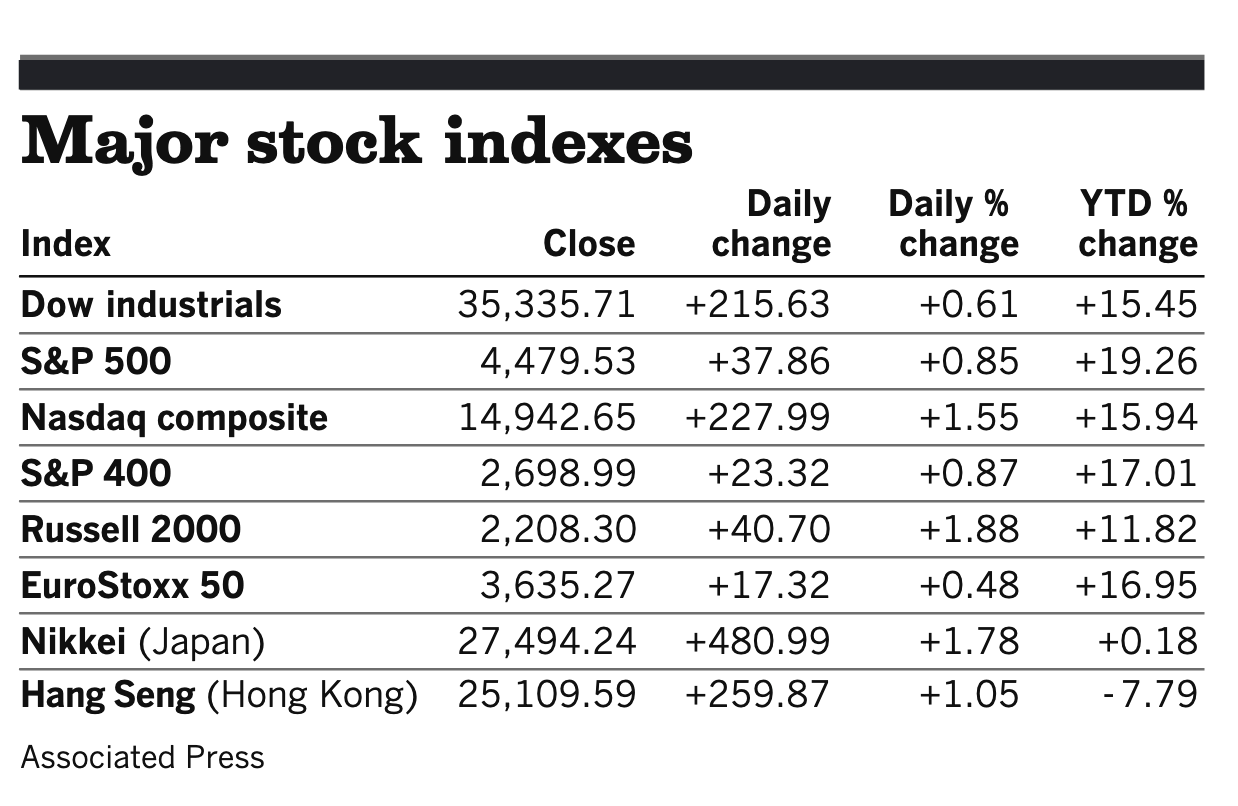

U.S. equities yesterday: Equities opened the week with gains, resulting in a new record finish for the Nasdaq. The Dow gained 215.63 points, 0.61%, at 35,335.71. The Nasdaq rose 227.99 points, 1.55%, at 14,942.65. The S&P 500 was up 37.86 points, 0.85%, at 4,479.53.

On tap today (see detailed list of events and reports below):

• U.S. new-home sales are expected to rise to an annual pace of 700,000 in July from 676,000 a month earlier. (10 a.m. ET)

• Richmond Fed's manufacturing survey is expected to fall to 25 in August from 27 a month earlier. (10 a.m. ET)

• President Biden will virtually meet with G7 leaders on Afghanistan. 9:30 a.m. ET.

• Biden will deliver remarks on Afghanistan in the Roosevelt Room. Noon ET.

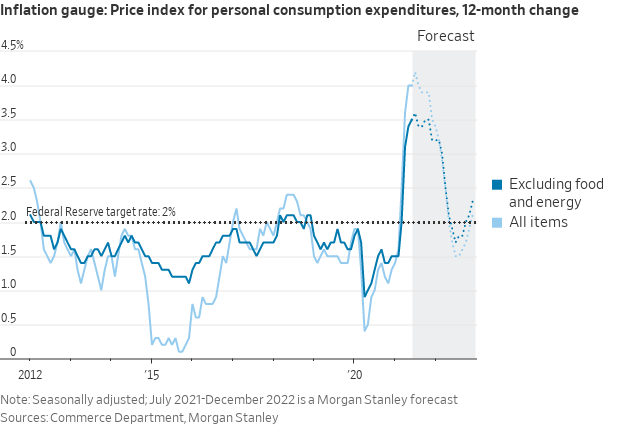

“Biden and the Fed wanted a hot economy. There’s risk of getting burned,” by NYT’s Neil Irwin: “The good news is that job openings are abundant, wages for people at the lower end of the pay scale are rising quickly, and it appears that the post-pandemic recovery won’t be like the long slog that followed the three previous recessions. But consumer prices have been rising faster than average wages — meaning that, on average, workers are seeing the purchasing power of their paycheck fall. People looking to buy a car or build a house or obtain a wide variety of other products are finding it hard to do so. And while much of that reflects temporary supply disruptions that should abate in coming months, other forces could keep prices rising. These include soaring rents and the delayed effects of higher prices from companies having to pay higher wages.” Link for details.

Fed Chairman Jerome Powell heads into the Kansas City Fed’s annual conference this week at the center of the debate over how long the currently higher inflation will last, and what the Fed should do about it. The Wall Street Journal (link) says he is “managing internal disagreement and weathering external criticism, with economic recovery thrown into renewed turmoil by the rise of the Delta variant.”

Market perspectives:

• Outside markets: The U.S. dollar index has edged higher ahead of U.S. economic data, with a mostly lower tone to foreign currencies against the greenback. The yield on the 10-year U.S. Treasury note has firmed slightly to trade just under 1.27% with a narrowly mixed tone to global government bond yields. Gold and silver futures are firmer ahead of U.S. economic updates, with gold around $1,807 per troy ounce and silver around $23.74 per troy ounce.

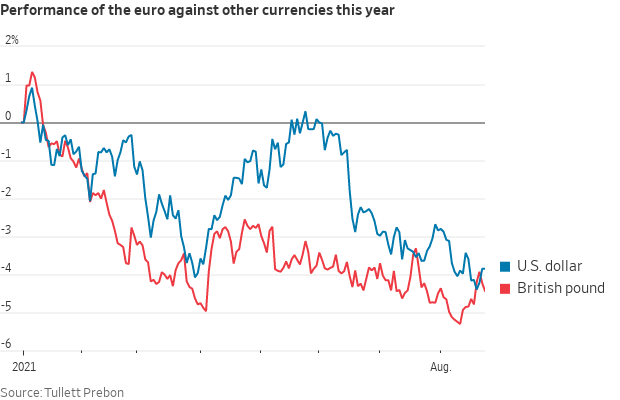

• Euro is trading near its lowest level against the dollar in nine months as investors bet that the eurozone will maintain lower interest rates and have a slower economic recovery than the U.S. The European Central Bank has indicated that it intends to keep financial conditions loose for the foreseeable future as it cushions the eurozone’s economic recovery. In contrast, Federal Reserve officials have signaled they are on track to begin reversing their easy-money policies later this year.

• Bitcoin traded above $50,000 Monday, the latest sign of a cryptocurrency surge that is drawing the attention of regulators and lawmakers around the world.

• Crude oil markets have continued to advance ahead of U.S. trading, with U.S. crude around $66.70 per barrel and Brent around $69.95 per barrel. Future edged higher in Asian action, with US crude up 11 cents at $65.75 per barrel while Brent was up 15 cents at $68.90 per barrel.

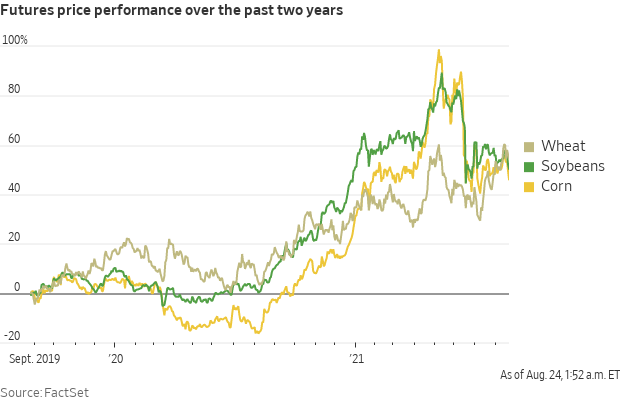

• WSJ: U.S. crops wither under scorching heat. The article notes that “inventories of grains world-wide are dwindling, further pushing up already high prices for corn and wheat.” Link.

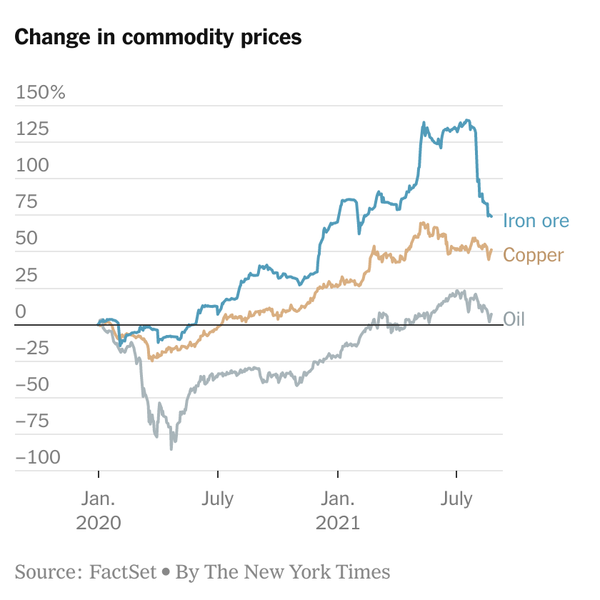

• Commodity prices are moderating, reducing inflation concerns. The decline in iron, oil, copper and other commodities from recent highs gives the Fed and other policymakers more room to operate. That is helping the Biden administration make the case that its spending plans won’t push inflation higher.

• Ag demand: Japan’s ag ministry is seeking to buy a total of 81.853 MT of food-quality wheat from the U.S. and Canada in a regular tender.

• USDA daily export sales for marketing year 2021-2022:

— 132,000 MT soybeans to China

— 125,300 MT corn to Mexico

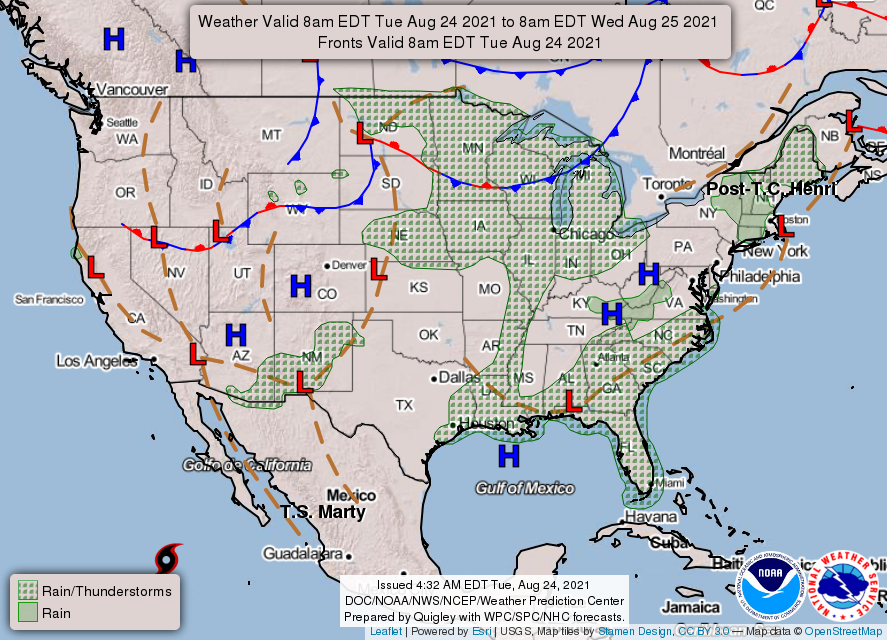

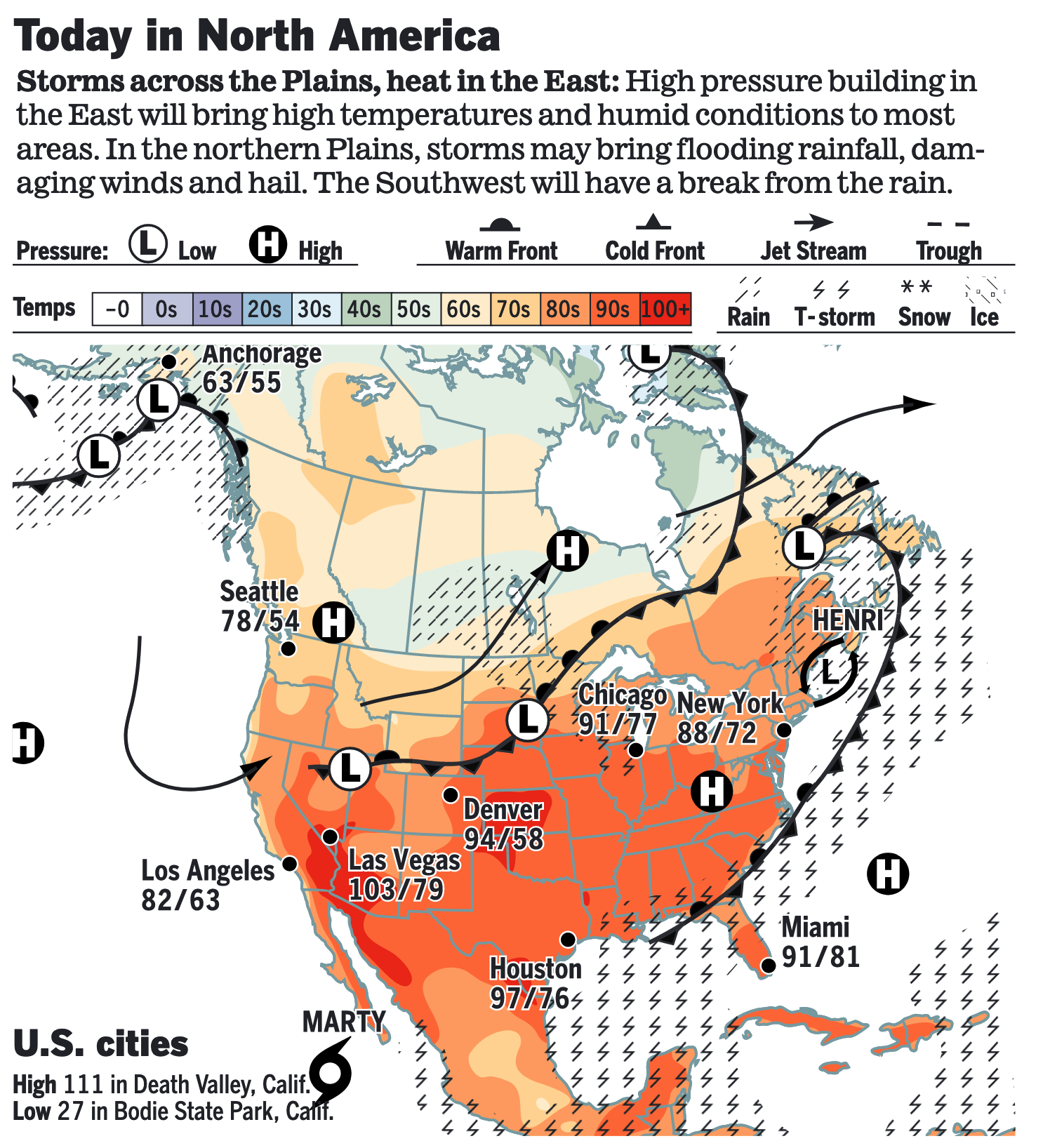

• NWS weather: Hot and humid throughout much of the central and eastern United States, with dangerous heat returning to the Southwest by Wednesday... ...Scattered showers and a few severe thunderstorms possible from the northern and central Plains into the Midwest over the next few days.

Items in Pro Farmer's First Thing Today include:

• Corrective buying continues in corn and soybean futures

• Corn, soybean CCI ratings continue to decline

• Cordonnier maintains U.S. yield projections after rains stabilize U.S. crops

• What another La Nina-plagued growing season might mean for S. America

• Erratic monsoon rains raise concerns about India’s crops

• Cattle contracts breakout to the upside

• Pork and cash hog prices slump to kick off week

POLICY FOCUS

— House exited shortly after midnight ET without any deal in place to advance the fiscal blueprint vital to passing President Joe Biden’s legislative agenda. At a caucus meeting Monday evening, House Speaker Nancy Pelosi (D-Calif.) and House Majority Leader Steny Hoyer (D-Md.) made a plea that the party shouldn’t “squander” its majority with intraparty bickering. But no members of the centrist “Mod Squad” bothered to actually attend that meeting to hear it.

Deeming proposal rejected so far. A Pelosi plan would essentially have folded the budget vote into the roll call vote on the rule — basically, it would deem the budget as passed without having to hold a separate vote. In return for their support, moderates were offered the guarantee of a vote on the bipartisan infrastructure bill by a deadline of Oct. 1. Pelosi has repeated said that the bipartisan infrastructure bill will not pass before the reconciliation bill.

Reports note five moderate Democrats are still opposed to a deal, and Pelosi can lose only three. “I’m bewildered by my party’s misguided strategy to make passage of the popular, already-written, bipartisan infrastructure bill contingent upon passage of the contentious, yet-to-be-written, partisan reconciliation bill,” Rep. Stephanie Murphy, a Florida Democrat, said in a op-ed Monday. “It’s bad policy and, yes, bad politics.”

Now what? The House will return for a 9 a.m. ET Democratic caucus meeting. At noon ET, leaders are currently expected to put the rule to a vote on the floor, hoping to have a deal by then. If not, some want to still put the rule up for a vote, daring moderates to kill off Democrats’ legislative plans. Asked about possible concessions to moderates on her way out of the Capitol on Monday night, Pelosi said: “We’ll see tomorrow, won’t we now?”

Bottom line: Wall Street analysts are telling clients to prepare for both measures to pass — eventually.

— CFAP 2 payouts continue to edge higher. Payments approved under the Coronavirus Food Assistance Program 2 (CFAP 2) moved up to $13.8 billion as of Aug. 22, up from $13.79 billion the prior week. CFAP 1 payments were little changed at $10.6 billion.

As for other pandemic assistance efforts, including the Pandemic Livestock Indemnity Program (PLIP) where producers could start applying for aid July 20, no additional payment information has been made available even as USDA said that payments would start to be made “shortly after applications are approved.”

— Biden administration fails to appeal injunction blocking socially disadvantaged farmer debt relief. The Biden administration did not file an appeal on the preliminary injunction issued by a U.S. District Court judge in Florida over the socially disadvantaged farmer debt relief/forgiveness effort, but no explanation was given. The Florida decision was one of several that put the program on hold that was part of the Covid aid package approved in March. "The United States Government will continue to fight these lawsuits in the district courts in the weeks and months ahead because providing debt relief is an important component of USDA's broader commitment to taking bold, historic action to root out generations of systemic racism," a USDA spokesperson told Politico.

Bottom line: This suggests the effort to forgive debt owed to USDA by socially disadvantaged farmers may remain on hold for a while.

— USDA announces 2.8 million acres accepted into CRP; accepts nearly 1.9 million acres via CRP general signup. USDA announced Monday that offers on nearly 1.9 million acres had been deemed acceptable out of just over 2.0 million acres offered via the general signup that concluded July 23, with another nearly 900,000 acres enrolled via continuous signup efforts so far in Fiscal Year (FY) 2021. In their announcement, USDA is clearly viewing acreage caps on the program under law as being targets for enrollment, which is not the intent of congressional language.

Details:

- Acres: 2.8 million acres were accepted into the CRP, almost 1.9 million acres enrolled via the general CRP signup that ran from January through July 23, and another 897,000 acres via the continuous signup for Fiscal Year (FY) 2021 that is still ongoing.

- CRP Grasslands signup effort closed Aug. 20, and USDA said that combined with the general and still-ongoing continuous signup, “USDA expects to enroll more acres into all of the CRP than the 3 million acres that are expiring.” That references contracts on 3 million acres that expire Sept. 30, including 2.55 million enrolled via general CRP signups and 450,000 enrolled via continuous signups.

- There were over 2.0 million acres offered in the general signup that ended July 23. USDA accepted 95% of the offers with an annual rental rate per acre of $53 per acre. Offers for the general signup are ranked on the Environmental Benefits Index (EBI), with a maximum possible score of 545 (395 for five environmental factors, 150 for the cost factor) for the general signup. Offers with an EBI score of 175 or greater were determined “basically acceptable” by USDA.

- Under the prior general signup held in 2020, there were 3.8 million acres offered and USDA said that 3.4 million acres of those were acceptable. The EBI cutoff for the last general CRP signup was 210, according to USDA. Of the 3.4 million offers deemed acceptable by USDA, 79% were for contracts that were to expire Sept. 30, 2020. However, not all of the 3.4 million acres deemed acceptable were enrolled. Initially in FY 2021, USDA put the actual enrollments from that general signup at 2.87 million acres and that level slowly declined to just above 2.8 million. But the data at the end of July now puts that at 2.75 million acres.

- USDA said that it allocated acres under the signup efforts using historical state enrollment rates using enrolled acres from 2007 through 2016. The agency said that based on this selection, acreage under “some” contracts that were scheduled to expire Sept. 30, 2021, will not be enrolled. However, USDA did not say the level of acreage that situation could apply to.

- It is unclear how many acres submitted for enrollment during the general signup were from CRP contracts that were scheduled to expire Sept. 30. In years past, typically far more than half of the acres offered for enrollment in general signups has been from acres that were in the program under contracts that were scheduled to expire as of September 30 that year.

- CRP acreage limits now labeled a ‘target’. In discussing the enrollment situation, which at the end of July was at 20.6 million acres, USDA stated that Congress in the 2018 Farm Bill had raised the “enrollment target” for CRP to 25 million acres for FY 2021. Despite the higher “target” referred to by USDA, the agency’s press release lamented that there have “been decreases in enrollment the past two years.” In the 2018 Farm Bill, the legislative language clearly states that the levels for CRP acres are a limit as opposed to a target. The CRP enrollment was increased in the legislation to “not more than” 24.5 million acres in FY 2020, not more than 25 million in FY 2021, not more than 25.5 million in FY 2022 and not more than 27 million acres in FY 2023.

- Biden administration announced several efforts earlier this year to increase rental payments, adding in a Climate-Smart Practice Incentive and also other incentives for environmental practices.

- Continuous signup: Data from FSA through the end of July showed only 35,411 acres were enrolled via the FY 2021 continuous signup. But USDA in their release Monday stated, “FSA has accepted offers from over 37,000 producers to enroll more than 897,000 acres through the continuous signup.” It is not clear where the nearly 900,000 acres are located or what the average rental rates were for those accepted offers. Future recaps of CRP data released by USDA presumably will include more information on this. If the figure of more than 897,000 acres is the end result, that would put enrollment via the continuous signup at its highest level since 1.35 million acres were enrolled each in FY 2015 and FY 2017. FY 2020 continuous enrollments were 444,012 acres.

- Bottom line: Despite USDA intentions, the overall acreage level in CRP may not increase all that much from the current 20.6 million acres that were in the program as of July 31. And it is not clear how many offers were submitted for land with a CRP contract that is to expire Sept. 30, 2021. It is also murky as to how many of those acres deemed acceptable will be actually enrolled in the CRP as history shows not all of the acceptable acres end up in the CRP. If only just over 2 million acres were offered, the incentives, higher rental rates and other actions by the Biden administration to try and attract acres into the program were not enough to compete against what were rising commodity prices during the general signup period.

AFGHANISTAN

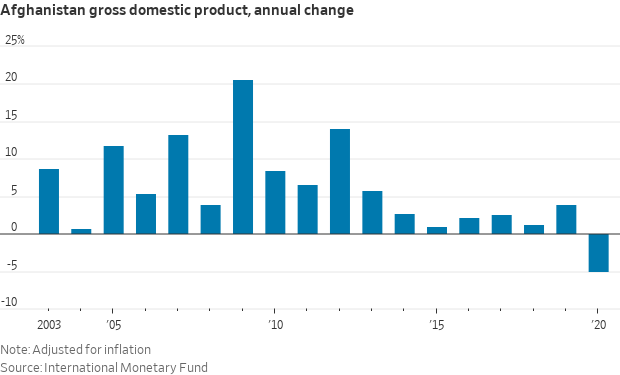

— Afghanistan’s new Taliban rulers are grappling with a new threat: an economic collapse that could fuel renewed challenges to their rule and has already put pressure on them to share power. Banks and money exchanges have remained shut and prices for basic commodities have surged. Economic activity has ground to a halt. So far, no nation has recognized the new regime in Kabul, inflicting an economic pain that could force the Taliban to form a more inclusive — and moderate — government that includes rival political forces, the Wall Street Journal reports (link). Beijing and Moscow, which have conducted public diplomacy with Taliban leaders for years, have yet to officially recognize the Taliban government. Both states have interests in Afghanistan.

— British Prime Minister Boris Johnson is convening an emergency virtual G7 meeting today to address the crisis in Afghanistan. At stake will be how the G7 countries — Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States — plan to approach the Taliban. When he announced the meeting on Sunday, Johnson focused on Afghanistan’s looming humanitarian crisis.

Another key focus will be sanctions. Johnson reportedly plans to advocate for economic sanctions against the Taliban and for only providing aid on the condition that the Taliban not commit human rights abuses or provide a safe haven for terrorist groups.

— U.K. reportedly intends to pressure President Biden to extend his Aug. 31 deadline for withdrawing U.S. forces from Afghanistan. (Britain currently has more than 1,000 armed forces personnel in Kabul and no fixed withdrawal date.) Biden hasn’t ruled out extending the deadline, but Taliban spokesman Suhail Shaheen has said that Aug. 31 is a “red line” and that any extension would “provoke a reaction.” Biden is expected to decide within the next 24 hours whether to extend the deadline, Reuters reports (link).

House Intelligence Chair Adam Schiff (D-Calif.) questioned the plausibility of Biden’s plan to withdraw U.S. forces by Aug. 31. “I think it’s possible, but I think it’s very unlikely,” Schiff said. “Given the number of Americans who still need to be evacuated, the number of SIVs, the number of others who are members of the Afghan press, civil society leaders, women leaders — it’s hard for me to imagine all of that can be accomplished between now and the end of the month.”

— Since Aug. 14, U.S. forces have facilitated the evacuation of more than 37,000 people, according to National Security Adviser Jake Sullivan. — But chaos persists at Kabul’s airport. The Wall Street Journal reports (link) that a gun battle erupted there Monday that involved U.S., German and Afghan troops, and left one Afghan soldier dead.

— CIA Director William J. Burns met secretly with Taliban leader Abdul Ghani Baradar in Kabul on Monday, in the highest-level meeting between the group and a U.S. official since militants took control of the city earlier this month, the Washington Post reported today (link). U.K. Defense Secretary Ben Wallace said that an extension of the deadline was “unlikely” because the situation on the ground is becoming more dangerous. The Taliban, meanwhile, have warned they may take action if foreign soldiers aren’t gone by September.

CHINA UPDATE

— China is on track to reach its Phase 1 trade requirements. China purchased an additional $2 billion worth of U.S. agricultural goods in June. Remember all those Phase 1 purchase naysayers? They are no longer being quoted any longer.

On Thursday, will make its first estimate of U.S. farm exports for fiscal year 2022 and update its current estimate for expected exports this fiscal year, which was last projected to hit a record $164 billion.

— SEC issues new requirements for Chinese companies listing in the United States. Some Chinese companies have reportedly begun receiving requests for more detailed disclosures about their use of offshore vehicles in IPOs. That follows a recent call from Gary Gensler, the SEC chairman, for a “pause” in Chinese listings on U.S. exchanges.

— China releases additional guidelines on commodity price indexes, seeks public input. New guidelines on the collection and usage of price information of goods and services and commodity price indexes and services have been released by China’s National Development and Reform Commission (NDRC). The government body is also seeking public consultation on the guidelines by Sept. 6 for the regs covering information that has “important impact” on commodity and services markets in China, the NDRC said. Those providing price indexes are to conduct self-assessments in each first quarter starting in 2022 and there is to be a six-month trial period for any commodity price indexes before they are launched. Those found in non-compliance or in violation of regs are to be suspended and they will be placed on a “dishonest enterprise” list. A Reuters report noted there was no further information offered on this “dishonest enterprise” list.

— China sends more Covid-19 vaccines to Vietnam on eve of Kamala Harris trip. Before leaving for Hanoi, Vice President Harris said Washington stands with its allies in facing Beijing’s threats in the region.

TRADE POLICY

— Status of U.S./Kenya trade talks still unknown. The status of the trade talks that were launched under the Trump administration remains unknown based on a readout of a virtual meeting between U.S. Trade Representative Katherine Tai and Kenya’s Ministry of Industrialization, Trade and Enterprise Development Cabinet Secretary Betty Maina. The two discussed “their shared worker-centered values, a resilient pandemic recovery, and strengthening the U.S./Kenya economic and trade relationship,” according to a readout of the meeting issued by the Office of the US Trade Representative. The two also agreed it was important to strengthen the relations between the two countries. But there was no mention made of the trade talks in the brief readout.

That contrasts with the recap of the first Tai/Maina meeting April 1 in which USTR noted the status of the talks were discussed. In that meeting, Tai “highlighted her ongoing review of the negotiations” to make sure any trade agreement would mesh with the Biden administration’s Build Back Better initiative. There has been no indication yet on the status of the reviews mentioned by Tai of the trade talks with Kenya or the U.K. stands or on the Phase 1 agreement with China.

ENERGY & CLIMATE CHANGE

— Some Senate Republicans urge EPA to set 2021, 2022 RVOs below ethanol ‘blend wall.’ Compliance costs remain elevated for the Renewable Fuel Standard (RFS) and a group of Senate Republicans contend the situation with Renewable Identification Numbers (RINs) has pushed those prices higher which is a factor in rising gasoline prices. Sen. Pat Toomey (R-Pa.) and 16 other lawmakers that often argue against the RFS penned the letter.

In a letter to EPA Administrator Michael Regan, the lawmakers said RIN prices surpassed $2 for the first time since the RFS was established and they also said uncertainty over the yet-to-be-proposed Renewable Volume Obligations (RVOs) for 2021 and 2022 has also played a role. Link to letter.

The lawmakers want EPA to “take concrete steps to stabilize the RFS compliance system by setting 2021 and 2022 RVOs below the blend wall,” the letter said. They noted EPA data indicates there are not enough RINs being generated to meet the mandate and there will likely “be an insufficient number of carryover RINs from last year (commonly referred to as the ‘RIN bank’) to make up the shortfall.” If the RINs are depleted, the lawmakers said that would leave refiners “little choice but to cut fuel production, increase fuel exports, or face non-compliance with the RFS. All of these outcomes would harm U.S. consumers, threaten union jobs, and curtail the ongoing economic expansion.”

The lawmakers also brought in the cyberattack on Colonial Pipeline, saying that drove up gasoline prices and underscored the need for a “stable, geographically diverse, and secure fuel supply.”

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— U.K. Action on Sugar group is calling for a complete ban on child-friendly yogurt packaging and on misleading nutrition and health claims following its new product survey, which it said shows only 5% of yogurts with child-friendly packaging contain low levels of sugar. Link for details.

— No mask, no inspection. Starting Wednesday, USDA inspectors will work at meat plants in counties with "substantial" or "high" community transmission of Covid-19 only if the plants’ workers follow CDC guidance on mask wearing. Link for details.

CORONAVIRUS UPDATE

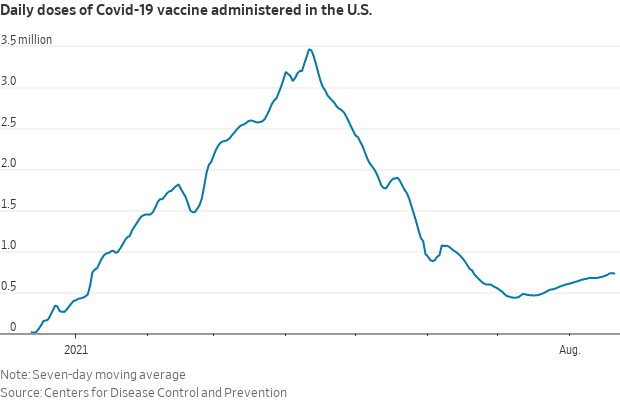

— Summary: Global cases of Covid-19 are at 212,610,603 with 4,442,545 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The US case count is at 37,939,681 with 629,411 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 363,267,789 doses administered, 171,088,954 have been fully vaccinated, or 51.1% of the US population.

— U.S. gave full approval for use of the Covid-19 vaccine from Pfizer and partner BioNTech on Monday, a move quickly followed by announcements from the Pentagon, the New York City school district and others that they would begin requiring vaccinations. President Biden seized on the moment. “If you’re a business leader, a nonprofit leader, a state or local leader, who has been waiting for full FDA approval to require vaccinations, I call on you now to do that,” he said. “Require it.”

Mandates may be the only way to significantly increase vaccination rates, given continued hesitancy about the shot. A recent poll found that three out of 10 unvaccinated people said that they would be more likely to get a fully approved FDA shot, though some experts believe that this figure could be exaggerated.

Moderna’s application for full approval of its vaccine was filed in June, a month after Pfizer. Johnson & Johnson is expected to apply for full approval soon.

POLITICS & ELECTIONS

— No mo’ Cuomo. At midnight, Andrew Cuomo’s resignation as governor of New York took effect. A few minutes later, Kathy Hochul was sworn in as his successor — making her the first woman in New York history to hold the post. The former governor reiterated that his instinct was to fight sexual harassment allegations but said that would lead to government paralysis.

OTHER ITEMS OF NOTE

— CMA launches merger inquiry re: S&P Global Inc.’s anticipated acquisition of IHS Markit. The U.K. Competition and Markets Authority (CMA) has launched a merger inquiry into S&P Global Inc.'s $44 billion anticipated acquisition of IHS Markit Ltd. The antitrust regulator said it is considering whether the deal may be expected to hurt competition within the U.K. The CMA said it has set an Oct. 19 deadline for its Phase 1 decision. S&P Global in November last year agreed to acquire IHS Markit, in a deal that would combine two of the largest providers of data to Wall Street.

EVENTS AND REPORTS

Tuesday, August 24

· Microbial drugs and food production. Global Leaders Group on Antimicrobial Resistance will issue a statement urging countries to significantly reduce the levels of antimicrobial drugs used in global food production.

· Petrochemicals and greenhouse gas emissions. Energy Department holds a meeting by teleconference to discuss the impacts petrochemical manufacturing, pipelines, and supporting infrastructure have on environmental and health conditions in local communities and on global greenhouse gas emission targets.

· Multilateralism and global crises. The Peterson Institute for International Economics (PIIE) holds a virtual discussion on "The Case for More (and Better) Multilateralism in Times of Global Crisis."

· Climate change and accounting. Federal Accounting Standards Advisory Board holds a meeting by teleconference of the Advisory Board, including updates on Climate Impact and Risk Reporting.

· U.S./German relations. The Business Council for International Understanding (BCIU) holds a virtual discussion on the business perspective in Germany and U.S./German relations after Chancellor Angela Merkel's recent visit to the United States.

· South China Sea issues. The Center for Strategic and International Studies (CSIS) holds its virtual 11th Annual South China Sea Conference: Session Two.

· Minnesota transit priorities. Senate Banking, Housing and Urban Affairs Housing, Transportation, and Community Development Subcommittee field hearing on "Examining Minnesota's Transit Priorities."

· Covid and future health threats. American University (AU) holds a virtual discussion on "the global response to Covid-19 and our vulnerability to future health threats."

· Economic reports. New Home Sales | Richmond Fed Manufacturing

· USDA reports. NASS: Poultry Slaughter