Stabenow Makes Clear: Cut SNAP, Rest of Farm Bill Will Be Pared Back, Too

Xi will visit Moscow next week for first time since Russia's invasion of Ukraine

Thanks for 50 great years!

On March 18, 1973, the first issue of Pro Farmer newsletter was published. The goal was to “provide America’s leading farmers with a competitive edge in marketing and financial management.” On our 50th anniversary, we maintain that same goal. For those Members that have been with us from the beginning, we are forever grateful. To those who have joined since then, thank you for helping us carry on the legacy. There’s a special message from co-founders Merrill Oster and Jerry Carlson on News page 4 of this week’s Pro Farmer newsletter.

|

In Today’s Digital Newspaper |

USDA daily export sale: 191,000 tonnes of corn to China during the 2022-23 marketing year. Total U.S. corn sales to China this week: 2.111 million tonnes.

A burst of U.S. exports to China is driving up charter rates for world’s biggest crude tankers.

Banks borrowed $165 billion from the Fed via the discount window and the new BTFP this week and that shows banks are using the Fed’s programs to shore up liquidity.

House Minority Leader Hakeem Jeffries (D-N.Y.) met with officials at the San Francisco Federal Reserve yesterday to “discuss the latest developments in the banking situation.” The SF Fed, which supervised Silicon Valley Bank before its collapse, has been under scrutiny from lawmakers in both parties.

SVB Financial files for Chapter 11 bankruptcy protection. The bankruptcy filing is the largest stemming from a bank failure since Washington Mutual in 2008. Silicon Valley Bank, now under the control of the Federal Deposit Insurance Corp., isn’t part of the Chapter 11 filing.

Peter Thiel, whose venture firm urged portfolio companies to withdraw their money from Silicon Valley Bank, had $50 million of his own money at the lender when it failed.

First Republic will get $30 billion in deposits from JPMorgan Chase, Bank of America and nine other banks in a deal to prevent a wider crisis. The rescue plan for First Republic is the latest bid to ease the fears of consumers and investors that the banking industry is in the midst of a growing crisis.

Sen. Tim Scott (R-S.C.), the top Republican on the Senate Banking Committee, told Treasury Secretary Janet Yellen that “instead of taking accountability for this blatant failure, regulators are now forecasting that they plan to increase regulations on the rest of the banking industry — in other words, the banks that made responsible business decisions and have not failed.”

Jimmy Fallon: “I heard that this year, Americans will bet more than $15 billion on March Madness. People are like, ‘Hey, at this point, it’s safer than putting money in the banks.’”

China says Xi Jinping will visit Russia next Monday to Wednesday, in an apparent show of support for Vladimir Putin.

Does the Chinese Communist Party own U.S. land? Check China section.

The Senate Ag hearing on Thursday proved interesting as several contentious items surfaced. Points and counterpoints occurred with USDA Secretary Tom Vilsack. See the Policy section.

Timeline for bird flu vaccine: a long wait. USDA Secretary Tom Vilsack said the government is a long way from developing a vaccine for high-path avian influenza or dealing with the questions about whether other countries would accept meat from vaccinated poultry. Vilsack said there are several vaccines in the U.S. that are being tested. Having a successful test of a vaccine is not the same as having a vaccine ready to be put into production and be ready for use in the marketplace, but efforts in the U.S. and around the globe are continuing to move forward at finding solutions.

A big push for canola acres in the U.S. south? See Energy and Climate section.

Biggest favorable legislative movement on H-2A in 30 years? Check Congress section.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. U.S. Dow opened around 100 points lower and are now around 250 points lower. Europe stocks opened higher but have fallen into negative territory. In Asia, Japan +1.2%. Hong Kong +1.6%. China +0.7%. India +0.6%. In Europe, at midday, London flat. Paris -0.2%. Frankfurt -0.1%.

U.S. equities yesterday: After falling lower at the open, all three major indices worked their way back into positive territory and ended with solid gains. The Down rose 371.98 points, 1.17%, at 32,246.55. The Nasdaq gained 283.22 points, 2.48%, at 11,717.28. The S&P 500 rose 68.35 points, 1.76%, at 3,960.28.

Major stock averages could come out ahead this week, on pace for a winning week despite the turmoil in the global banking sector. Through Thursday, the Dow is up 1.06%, the S&P 500 has risen 2.56%, and the Nasdaq Composite is up 5.19% — on track for its best week since November.

But today marks the periodic phenomenon known on Wall Street as “triple witching,” when stock index futures, stock index options and stock options all expire at the same time, which could bring some last-hour volatility.

FedEx raised its fiscal 2023 profit forecast despite weak market conditions, citing progress on its plan to shave $3.7 billion in costs from its global delivery business, sending its shares up more than 11%. The company said it now expects adjusted earnings for its fiscal year 2023 to come in between $14.60 and $15.20, up from a prior forecast of between $13.00 and $14.00. Executives have been carrying out an aggressive plan to reduce costs in the face of shrinking shipping volumes. The cost reductions have included layoffs, grounding planes, cutting office space and adjusting delivery services. “

Agriculture markets yesterday:

- Corn: May corn rose 6 1/4 cents to $6.32 3/4, the highest close since March 7.

- Soy complex: May soybeans rose 2 1/4 cents to $14.91 1/2 and near mid-range. May soybean meal fell $4.40 at $474.00 and nearer the session low. May bean oil gained 139 points at 57.73 cents and near the session high.

- Wheat: May SRW futures fell 3 3/4 cents to $6.99. HRW futures closed flat at $8.19 3/4, near session highs. May spring wheat futures closed 5 3/4 cents lower at $8.46 3/4, in the middle of the day’s range.

- Cotton: May cotton rose 5 points at 79.16 cents, nearer the session high after hitting a nearly four-month low early on.

- Cattle: April live cattle futures rose 80 cents to close at $162.35. Most-active April feeder cattle futures rose $1.90 to settle at $195.15.

- Hogs: Nearby April hog futures led the complex lower, plummeting $4.30 to $79.45 at the close.

Ag markets today: Corn, soybeans and wheat were supported by corrective buying and outside markets overnight. As of 7:30 a.m. ET, corn futures were trading 1 to 4 cents higher, soybeans were 3 to 4 cents higher, SRW wheat was 2 to 4 cents higher, HRW wheat was 4 to 5 cents higher and HRS wheat was 4 to 8 cents higher. Front-month crude oil futures were modestly firmer, and the U.S. dollar index was around 150 points lower.

Technical viewpoints from Jim Wyckoff:

Market expectations have skewed firmly towards a 25-basis point rate hike by the Federal Reserve at its monetary policy meeting next week. Today, the probability of a 25-basis point hike stood at about 75%, with about 25% probability of no hike.

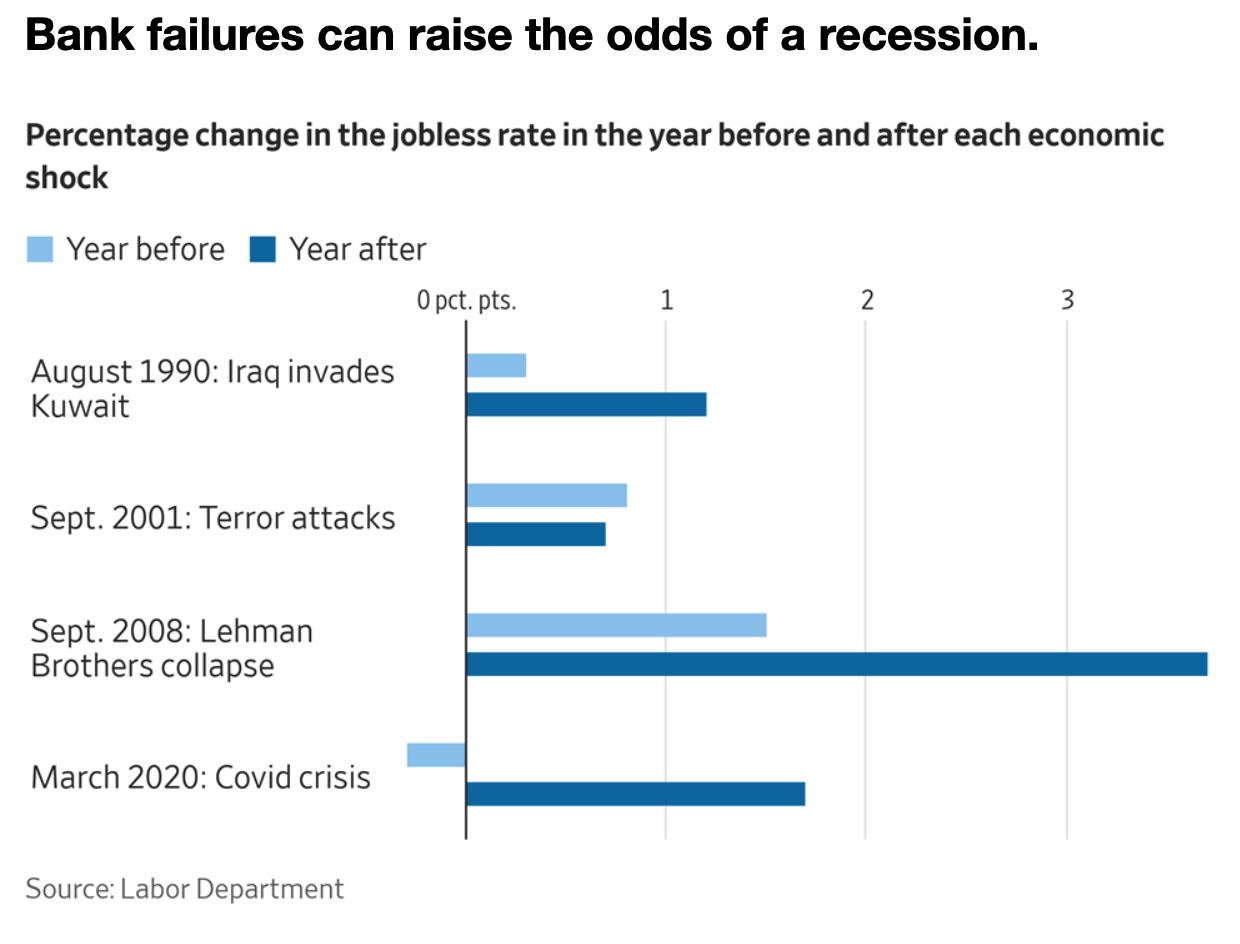

Goldman Sachs revises recession odds for the year. Before this week, the firm gave the U.S. a 25% chance of tipping into recession in 2023. Following the bank runs, bank failures, and bank stock volatility, those odds are now at 35%, strategists said Thursday, citing "increased near-term uncertainty" surrounding the effects of small bank stress. Thursday's research note followed a separate forecast from Goldman that slashed 2023 GDP outlook by 0.3%, to 1.2%.

Upshot: The economic outlook now hangs on two factors: private- sector confidence and Federal Reserve interest-rate policies.

Recessions in 1990, 2001, 2008 and 2020 were all accompanied by shocks, including, respectively, Iraq’s invasion of Kuwait, the Sept. 11 terrorist attacks, the collapse of Lehman Brothers and Covid-19. The collapse of SVB and Signature Bank, followed by stress at Credit Suisse and First Republic, represents a new threat, the Wall Street Journal reports (link), which could strain bank lending and the willingness of businesses to hire and households to spend. The economy’s strength remains its robust job market.

Even though Credit Suisse has secured a lifeline from the Swiss National Bank, the beleaguered lender's assets still show signs of stress. One sign investors and the bank's counterparties remain wary: The cost of insuring against default on five-year Credit Suisse senior debt is double what it was at the start of the week.

Top world airlines? Singapore’s Changi snatched back the title of world’s best airport after losing out to Qatar’s Hamad for two years. Paris Charles de Gaulle was Europe’s top performer, up one spot to fifth place. London Heathrow dropped nine places to 22nd. The U.S. had none in the top 10.

Meanwhile, the Federal Aviation Administration needs more air traffic controllers to address rising passenger demand, the chair of a Senate panel overseeing aviation issues said, amid investigations into a series of recent runway incidents.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker with the euro and British pound stronger against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 3.43%, with a mostly lower tone in global government bond yields. Crude oil was mixed, with U.S. crude firmer around $68.55 per barrel and Brent weaker around $74.65 per barrel. Gold and silver futures were higher, with gold around $1,938 per troy ounce and silver around $21.98 per troy ounce.

• Ag trade: Egypt purchased 120,000 MT of Ukrainian wheat.

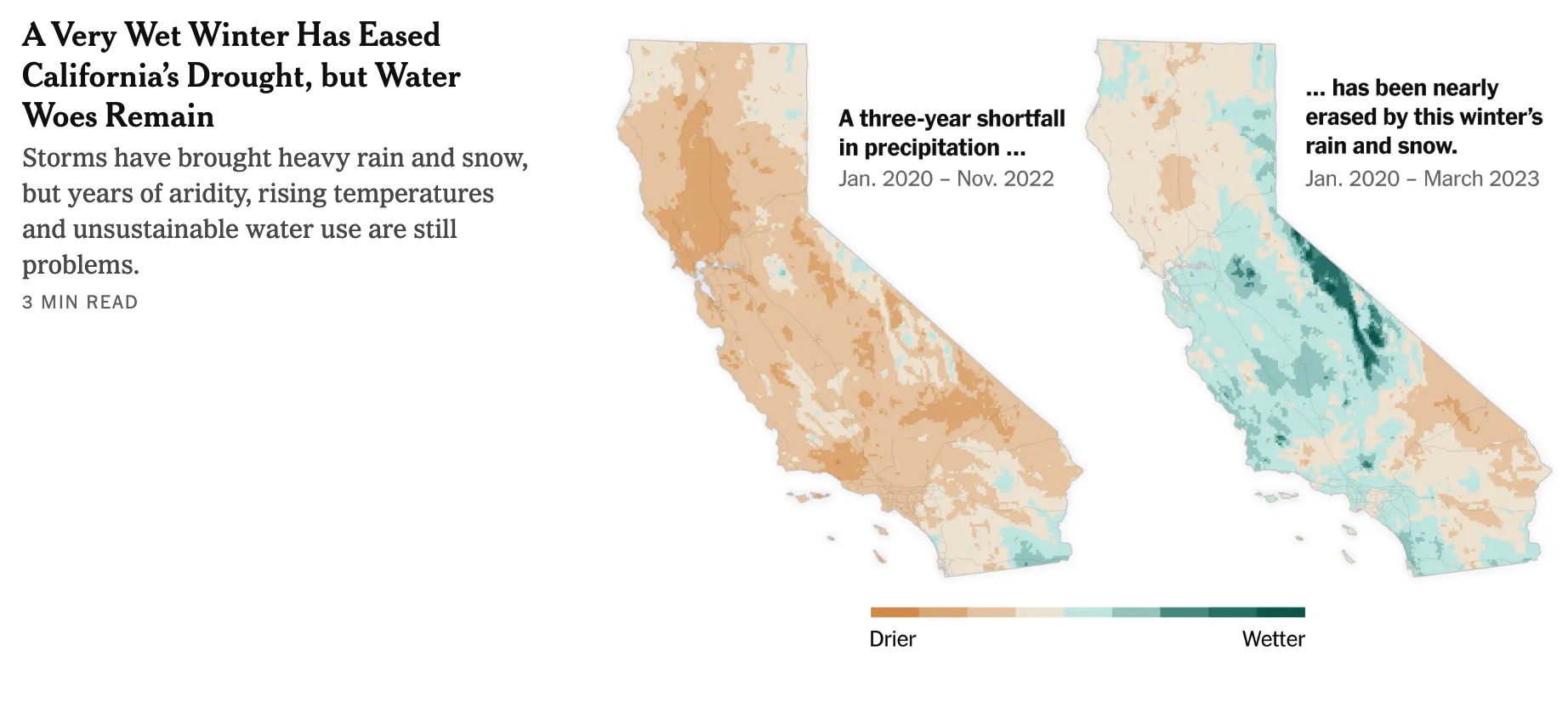

• Torrential rain and snow have again drenched California in recent weeks, amplifying an already wet winter season. The extreme precipitation has begun to ease the state’s long-term drought, the driest three-year stretch on record. But weather woes remain. Link to more via the New York Times.

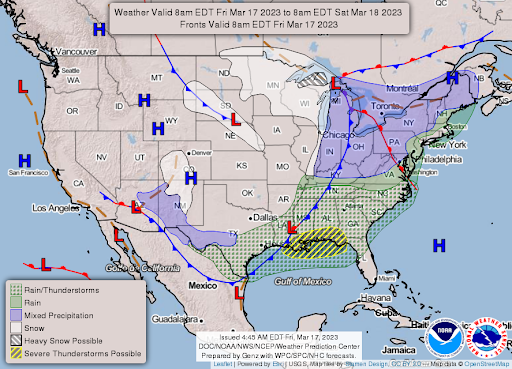

• NWS weather outlook: Heavy rain and possibly severe thunderstorms shift eastward into the Southeast and the central to eastern Gulf Coast today and into tonight... ...Snow departing the upper Midwest/Great Lakes today followed by intrusion of below to much below normal temperatures across the Plains and into the eastern U.S. going into the weekend.

Items in Pro Farmer's First Thing Today include:

• Firm grain commodity price tone overnight

• Exchange again slashes Argentine crop estimates

• Length of Black Sea grain deal extension remains unsettled

• Russia slightly lowers wheat export tax

• Indonesia pledges policy transparency with new palm oil exchange

• Cattle on Feed Report out this afternoon

• Wholesale pork price continue to drop

|

RUSSIA/UKRAINE |

— Russia starts recruitment efforts toward 400,000 new contract soldiers. Military registration and enlistment offices in more than half of Russia's regions have resumed issuing summons to local residents, Meduza reported. The majority of the summonses are not mobilization or conscription notices, but to "update military records" or participate in military training. The resumption of summons notices likely reflects the start of a renewed drive to coerce Russian citizens into voluntarily joining the army as Moscow pursues its plan to increase its military strength by 400,000 military personnel by 2025, some observers note. Adds one: “However, since this recruitment strategy failed in the summer of 2022 to produce sufficient manpower and led to Russia's September 2022 mobilization, the recent summonses are likely preparatory measures for another formal mobilization later in 2023.” Formal mobilization could begin as soon as May, once Russia's annual spring conscription season, which commences on April 1, is already well underway.

Upshot: A new video out of Crimea shows Russian efforts to recruit and indoctrinate kids by forcing them through military training exercises, including martial arts lessons and rifle-handling classes. Link for details.

— Chinese companies are shipping rifles, body armor to Russia. Customs data obtained by Politico reveals direct shipments of Chinese assault rifles, as well as drone shipments and body armor routed via Turkey and the UAE. Link for details. Chinese companies, including one connected to the government in Beijing, have sent Russian entities 1,000 assault rifles and other equipment that could be used for military purposes, including drone parts and body armor, according to trade and customs data obtained. The shipments took place between June and December 2022, according to the data provided by ImportGenius, a customs data aggregator. Russian entities also received 12 shipments of drone parts by Chinese companies and over 12 tons of Chinese body armor, routed via Turkey, in late 2022, according to the data.

— Xi to meet Putin next week in first visit to Russia since invasion of Ukraine. It will also be Xi’s first foreign trip since securing an unprecedented third term as president at the annual meeting of China’s rubber-stamp legislature last week. China’s Foreign Ministry said the visit will take place from Monday to Wednesday at the invitation of Putin and confirmed that the war in Ukraine would be a core part of the talks. “China’s proposition boils down to one sentence, which is to urge peace and promote talks,” foreign ministry spokesman Wang Wenbin said. The Kremlin said the two leaders will discuss “topical issues of further development of comprehensive partnership relations and strategic cooperation between Russia and China.”

“An exchange of views is also planned in the context of deepening Russian-Chinese cooperation in the international arena,” the Kremlin added. “A number of important bilateral documents will be signed.”

Xi and Putin declared a “no-limits” friendship in February last year, when the Russian leader visited Beijing for the opening ceremony of the Winter Olympics.

In recent weeks western officials have begun publicly raising concerns that China may be considering providing Russia with lethal military assistance, an accusation denied by Beijing.

|

POLICY UPDATE |

— USDA officially announces funding for emergency grain storage program. The funding (link) is under the Emergency Grain Storage Facility Assistance Program (EGSFP). The program helps grain producers with eligible disaster events that damaged or destroyed local commercial grain facilities.

USDA has set aside $20 million from the Commodity Credit Corporation (CCC) for the effort to address damage to facilities that took place from Dec. 1, 2021, to Aug. 1, 2022, saying the producers or groups of producers could be eligible under the effort for cost-share assistance “to construct needed storage facilities to meet on-farm grain storage capacity and handling needs necessary to support the marketing of grain. Grain producers in affected counties in Illinois, Indiana, Iowa, Kentucky, Minnesota, Missouri, North Dakota, South Dakota, Tennessee and any other affected counties” as determined by the agency.

The application deadline is Dec. 29, 2023, with funds available until they are exhausted. The payments will be subject to funding availability.

USDA specifically noted Kentucky grain producers have an “immediate” need for the help as the owners of a commercial grain facility in Mayfield, Kentucky, that was destroyed in December 2021 have not yet begun to rebuild it nor have they decided to rebuild the structure. Affected counties for the aid were identified using a 30-mile radius from the damaged facilities. Cost-share will be 75% will be available with 90% cost-share for underserved producers.

USDA will announce any additional counties by Oct. 27. Facilities and structures must have a useful life of three years and EGSFP can be used to renovate existing structures to store grain. Baggers and bags are deemed to be eligible.

— Food stamps, use of CCC funding, the new farm bill and big vs small farms were the primary and sometimes contentious topics during a Senate Ag Committee hearing Thursday.

- USDA Secretary Tom Vilsack returned to a favorite talking point when he said the next farm bill should create more markets for small- and medium-sized farmers. Vilsack said if lawmakers want to discourage population losses in rural America, they should help the smaller producers.

Vilsack said that even though the last two years have resulted in record farm net cash income, nearly 50% of farmers did not make money, while 40% made most of their income from off-farm jobs, leaving 10% to make most of the money. “This is not a small versus large situation but 90% of our farmers need help,” Vilsack said.

Sen. John Boozman (R-Ark.) said, “While 89% of the farms in the U.S. are classified as small by USDA and contribute nearly 18% of farm production, there are 3.2% of farms, classified as large, that contribute 46.5% of our nation’s farm production… All farms are valuable,” Boozman said. “This farm bill will not neglect the small nor punish the large.”

Vilsack acknowledged the importance of large, commercially successful farms, but recalled noted that Boozman had said “Based on the last Census, 53 of the 75 counties in Arkansas have lost population. That is 71% of Arkansas counties. Across the United States, 53% of our counties, or 1660 out of 3140, lost population.” - Vilsack also sparred over criticism over his use of tapping the Commodity Credit Corporation (CCC), sometimes called USDAs ATM machine. “It’s my belief that the USDA’s discretionary use of CCC undercuts this committee’s farm bill process,” Sen. Chuck Grassley (R-Iowa) said. “This farm bill will not be a success unless Congress takes back our responsibility of setting the nation’s farm programs.” Vilsack said his use of the CCC is not “discretionary” because he has been following the rules on what the secretary is allowed to do.

Sen. Roger Marshall (R-Kan.) said farmers in his state “feel like how you're using the CCC is outside of the law.” Vilsack said the $3.5 billion Partnerships for Climate-Smart Partnerships initiative grew out of suggestions from farm groups. When it comes to CCC funding, “We’re very careful to stay within the statutory language… and we never ever, ever put at risk farm programs,” he said. - SNAP/food stamp program issues were also contentious. Committee Chair Debbie Stabenow (D-Mich.) asked Vilsack to affirm that the 2018 Farm Bill directive to USDA to re-evaluate the Thrifty Food Plan used to determine SNAP benefit levels did not say it was supposed to be revenue-neutral, even though some previous directives included a budget-neutral provision. Vilsack said the directive did not contain a budget neutral provision, but Boozman said he said he doesn’t think Vilsack’s argument “holds water” because the Congressional Budget Office scored the provision as budget-neutral, based on information from USDA. The provision has added $300 billion to the cost of SNAP, Boozman noted.

Vilsack said the info came from USDA when Agriculture Secretary Sonny Perdue was in office during the Trump administration and that he was “not bound” by what Perdue said. “We are not bound by you finding loopholes,” Boozman said. “We are bound by the law and the directive of what we were supposed to do,” Vilsack countered. ”When you are going to spend $300 billion you come to Congress,” Boozman said. “I am not saying it didn’t need to be updated, that we didn’t need to spend some money.”

But it was Stabenow’s opening statement that had the key news item for the day’s hearing. Cut SNAP, she said, and the rest of the farm bill will be pared back, too. Stabenow said “threats we are hearing from some in the House in favor of reckless and indiscriminate mandatory budget cuts will result in cuts to all farm bill programs. We cannot go backward at a time when our farmers and families need us most.”

“I will continue to fight to expand or strengthen crop insurance and the farm bill disaster programs for all farmers,” said Stabenow. “We must also assure that the farm bill continues to support the nutrition programs that provide a lifeline to millions of people and families across this country.”

- Payment limitations. Sen. Chuck Grassley (R-Iowa) said he hopes the next farm bill imposes stricter payment limitations, but Vilsack said doing that correctly would be difficult. Grassley said that “some or maybe all of us” Republicans on the committee “are working on tightening work requirements for SNAP recipients. I hope we would also look at work requirements” for farm subsidies. “I support farmers only receiving commodity payments if they are actively engaged in farming,” said Grassley.

- Foreign ownership of U.S. farmland. Vilsack was asked his views on ownership of U.S. farmland by Russia, China, North Korea and Iran. Vilsack detailed that collectively, those countries own only 330,000 acres. Most foreign-owned farmland is in the hands of Canada, the Netherlands, the United Kingdom, Germany and Japan, he said, asking lawmakers writing a restrictive land ownership bill if they will restrict people from those countries too.

- Timeline for bird flu vaccine: a long wait. Vilsack said the government is a long way from developing a vaccine for high-path avian influenza or dealing with the questions about whether other countries would accept meat from vaccinated poultry.

Vilsack’s comments came as the Dutch government touts an effective vaccine test. “We're a long way away from having a vaccine that is effective and a long way from having a vaccine that the rest of the world accepts,” Vilsack said. The Dutch government announced that two vaccines they have tested in a veterinary research center proved effective against bird flu. "Not only did the vaccines give poultry used in the lab protection against disease symptoms but they also countered the spreading of the bird flu," the Dutch government said in a statement. "I'm happy that we have two vaccines with which we can take the vaccination process against bird flu forward. I'm putting in the next steps as quickly as possible but in a responsible way…," Piet Adema, Dutch agriculture minister, said in a statement.

Vilsack in his testimony also remarked that there are a “number” of vaccines in the U.S. that are being tested. Having a successful test of a vaccine is not the same as having a vaccine ready to be put into production and be ready for use in the marketplace, but efforts in the U.S. and around the globe are continuing to move forward at finding solutions.

- U.S. sugar, other commodity programs. Sen. John Hoeven (R-N.D.) asked Vilsack if he would maintain the sugar program, but Vilsack would only say: ”I understand the importance of the sugar program.”

As for other commodity programs, Hoeven pushed Vilsack on supporting and strengthening crop insurance and the farmer safety net programs like ARC and PLC. Vilsack said he’d be willing to work with the committee on that, but countered, “I hope that you will help and work with us, to ensure that in addition to all of that, which is important and necessary, that we focus on also market development, domestic market opportunities for small and mid-sized operators. Because as good as the countercyclical program is, as good as the crop insurance program is, we are still losing a lot of our small and mid-sized farming operations.” Hoeven countered that the U.S. needs productive farmers to which Vilsack said he agreed. “But I think we have to have a broader view on this. I think we also have to have a view of maintaining life and opportunity in rural places.”

- Pesticides: Following a letter from Sens. Roger Marshall (R-Kan.) and Chuck Grassley (R-Iowa) regarding the USDA/EPA relationship on pesticide regulation, Marshall asked Vilsack if the EPA consulted USDA. He asked if Vilsack supported legislative action requiring that EPA consult USDA’s experts on pesticides — Vilsack testified last May that USDA was not consulted. “There's an honest dispute and disagreement from time to time,” Vilsack continued, “when there’s a disagreement and EPA enacts whatever they're going to enact. Then it's our job at USDA to do what we can to mitigate the consequences of that.” But Vilsack warned against legislation that would allow departments to overrule each other. “I'm not sure I want the EPA telling me how to run the Department of Agriculture,” he said.

- Farmers of color: Sen. Raphael Warnock (D-Ga.) asked Vilsack about the department’s work to address its historic discrimination against farmers of color. Warnock said farmers tell him that they’re still waiting for financial assistance that’s been approved, and they’re still unclear about the process. Vilsack said he hoped the department would get those payments out by the end of 2023.

|

CHINA UPDATE |

— Does the Chinese Communist Party own U.S. land? Chinese investors’ ramped-up purchases of U.S. land in the past decade are drawing concerns among U.S. politicians who say this poses a national security threat. PolitiFact looked at this topic. Link to full article. Highlights:

- Chinese investors, entities and U.S. corporations with Chinese shareholders collectively owned 383,935 acres of agricultural and non-agricultural land in the United States, as of 2021.

- It is unclear how many of these acres are controlled by the Chinese Communist Party.

- An expert said that although the Chinese Communist Party could influence or coerce Chinese individuals or entities to use farmlands for spying or other purposes, there hasn’t been good evidence of such activity.

— China is fighting a resurgence of African swine fever, the deadly disease that previously wiped out almost half of its hogs, potentially raising prices of the nation’s favorite meat. Official data on the virus are hard to come by in China, so traders and analysts use their own surveys to assess the damage. The outbreak was pretty severe in January and February and the latest wave should cut production capacity and push up pork prices in the second quarter, Rabobank said.

— China cuts RRR to support economy. China’s central bank said on Friday it would cut the amount of cash banks must hold as reserves for the first time this year to help keep liquidity ample and support an economic recovery. The People’s Bank of China (PBOC) said it would cut the reserve requirement ratio (RRR) for all banks, except those that have implemented a 5% reserve ratio, by 25 basis points (bps), effective March 27.

— Chinese housing prices in major cities post first increase in 18 months. New home prices in 70 cities rose 0.3% year-on-year in February, adding to signs of recovery from a protracted housing slump.

|

TRADE POLICY |

— U.S., Kenya to hold TIP negotiations April 17-20. The U.S. and Kenya will hold an in-person negotiating round under the Strategic Trade and Investment Partnership (STIP) April 17-20 in Kenya, according to the Office of the U.S. Trade Representative (USTR). The two held “conceptual” discussions Feb. 6-10 in Washington on areas outlined in the July 2022 launch of the STIP. USTR previously announced the STIP will focus on agriculture, anti-corruption, digital trade, environment and climate action, good regulatory practices, micro, small, and medium size enterprises, protecting worker’s rights and protections, supporting the participation of women, youth, and others in trade, standards collaboration, trade facilitation and customs procedures, and services domestic regulation. It is not clear how much scope the agricultural negotiations will have compared with negotiations on a free trade agreement started under the Trump administration but shelved under the Biden administration.

— ITC to proceed with review of CVD, antidumping duties on Canadian softwood lumber. The U.S. International Trade Commission (ITC) will proceed with full reviews on whether revoking the countervailing duty (CVD) and antidumping duty (AD) order on imports of softwood lumber products from Canada would likely lead to a continuation or a recurrence of material injury to the U.S. industry. ITC said in a notice in today’s (March 17) Federal Register (link) it based the decision on information from the U.S. and Canadian industries. A schedule for the reviews will follow.

Upshot: This is one of the longer-running disputes between the U.S. and Canada.

— U.S., Taiwan move closer to trade, investment agreement. Taipei officials welcome release of draft statements, with both sides signaling progress. Link to more via the WSJ.

|

ENERGY & CLIMATE CHANGE |

— SAF set to drive a canola boom in southern U.S. Earlier this week we alerted that Chevron Corp. is teaming up with grains handler Bunge Ltd. and seed company Corteva Inc. to plant as many as 10 million additional acres of canola in the southern U.S.

The initial plan calls for farmers in Louisiana, Mississippi and Tennessee to sow the oilseed as a second seasonal crop after soybeans or cotton, boosting revenue potential and providing vegetable oils that are in high demand, according to Corteva.

Bunge Chevron Ag Renewables, a joint venture between Bunge and Chevron, will buy the winter canola crop from growers and use the oil to produce renewable fuel (Sustainable Aviation Fuel or SAF). Acreage will be driven by future capacity to process the canola into oil and meal. There’s potential for 10 million acres in the U.S. South, Corteva said.

The U.S. overall harvested almost 2.2 million acres of canola in 2022, a record amount.

Link for more on this topic via Bloomberg.

|

HEALTH UPDATE |

— Advisers to the FDA voted 16-1 on Thursday for full approval of Paxlovid, stating that the drug's benefits outweigh any risks for treatment of mild to moderate Covid-19 in high-risk adults. More than 8 million people in the U.S. have received Paxlovid since it became available under emergency use authorization in 2021. Before Paxlovid is fully approved, the FDA — which usually follows the recommendations of its advisory committee — must conduct its own review. That is expected be completed in May. Separately, questions remain about how the pandemic may have affected maternal mortality in the U.S. Experts say the U.S. maternal mortality crisis was compounded by Covid-19, which led to a "dramatic" increase in deaths.

— New study links Covid origins to animals. A global team of experts said yesterday that it had found data linking the coronavirus to raccoon dogs (link) that were sold at a Wuhan market, supporting the theory that the pandemic spread to humans from an infected animal. The FBI and the Energy Department have said in recent weeks that a lab leak was the most likely origin, but there is no consensus within the Biden administration.

|

CONGRESS |

— Focus expands to all major freight railroads. Senate Majority Leader Chuck Schumer (D-N.Y.) wants U.S. safety regulators to expand their audit of Norfolk Southern to include other major freight railroads.

— Biggest favorable legislative movement on H-2A in 30 years? That is how one legislative contact describes a legislative initiative from Sens. Tim Scott (R-S.C.), Ted Budd (R-N.C.) and Reps. GT Thompson (R-Pa.) and Ralph Norman (R-S.C.). They will offer CRA (Congressional Review Act) to disapprove DOL H2A regulation on wages. Says the contact: “I believe it could pass both chambers. Big issue. I’d bet it gets vetoed but if it proves it can pass both chambers alone, then it has life after that as part of larger package.”

Background on H-2A. The H-2A program, also known as the H-2A Temporary Agricultural Worker Program, is a U,S. visa program that allows U.S. employers to hire foreign workers to fill temporary agricultural jobs. This program is designed to help employers who anticipate a shortage of domestic workers to bring in foreign labor on a temporary basis. To participate in the H-2A program, employers must meet certain requirements, such as proving that there is a shortage of domestic workers, offering the same wages and working conditions to foreign workers as they would to U.S. workers, and providing housing and transportation to the foreign workers. The H-2A visa is valid for a maximum period of one year, but it can be extended in increments of up to one year, with a maximum stay of three years. After that, the worker must leave the U.S. and remain outside the country for at least three months before being eligible to apply for the H-2A visa again.

The Congressional Review Act (CRA) is a law that was enacted in 1996 as part of the Small Business Regulatory Enforcement Fairness Act (SBREFA). The CRA provides Congress with a mechanism to review and potentially overturn new federal regulations issued by executive agencies. Under the CRA, before a new regulation can take effect, federal agencies must submit the regulation, along with a report, to both the House of Representatives and the Senate. Upon submission, Congress has a period of 60 legislative days to review the regulation. If Congress disapproves of the regulation, they can pass a joint resolution of disapproval, which then needs to be signed by the President to become law. If the President signs the resolution, the regulation is invalidated, and the agency is prohibited from reissuing a similar regulation in the future without further authorization from Congress. The CRA has been used sparingly since its enactment, but its use has increased in recent years. It has typically been employed when there is a change in political party control of the White House and Congress, as the new majority party seeks to overturn regulations put in place by the previous administration.

Why this is so important: The American Farm Bureau Federation estimates there are roughly 2.4 million farm jobs that need to be filled annually, but there has been a drastic decline in workers each year. The AFBF says more than 73% of farm workers are immigrants from South America and Mexico. While the United States’ H2-A visa program has increased the number of accepted applications for immigrants to 250,000, this number is still just a drop in the bucket in terms of labor needs.

— Biden’s Cabinet secretaries and other administration officials appear before committees next week for hearings on the president’s fiscal year 2024 budget request, including:

- Office of Management and Budget Director Shalanda Young at House Budget on Wednesday.

- Treasury Secretary Janet Yellen Wednesday before Senate Appropriations.

- Yellen and Young Thursday at House Appropriations.

- Secretary of State Antony Blinken at Senate Appropriations Wednesday and House Appropriations Thursday.

- Defense Secretary Lloyd Austin and Joint Chiefs of Staff Chairman Gen. Mark Milley at House Appropriations Thursday.

- Energy Secretary Jennifer Granholm Thursday at House Appropriations.

- Health and Human Services Secretary Xavier Becerra at Senate Appropriations on Wednesday.

- Transportation Secretary Pete Buttigieg Thursday at Senate Appropriations.

|

OTHER ITEMS OF NOTE |

— Cotton AWP declines below 70 cents, first time in 16 weeks. The Adjusted World Price (AWP) for cotton declined to 68.58 cents per pound, effective today (March 17), down from 71.95 cents per pound the prior week. This marked the first time in 16 weeks the AWP has been under 70 cents per pound, and it was the lowest since it was 65.46 cents per pound for the week of Nov. 4, 2022. But the AWP remained more than 15 cents above the mark that would trigger any marketing loan benefits.

— The French government used executive powers yesterday to raise the retirement age by two years — to 64 — avoiding a vote in Parliament on a deeply unpopular bill. Impact: There were demonstrations across the country. In Paris, police made hundreds of arrests and fired tear gas and water cannons at protesters.

Now what? Macron invoked an article of the constitution that allows the government to pass legislation without a parliamentary vote. Article 49.3 also allows MPs to submit motions of no-confidence in the government; Marine Le Pen, a right-wing opposition leader, said she would file one.

— President Joe Biden is expected to designate nearly half a million acres of the southern Nevada Spirit Mountain area known by the Mojave name of Avi Kwa Ame as a national monument sometime next week, the New York Times reports (link), citing two people familiar with the matter. This would be the largest monument designated by Biden to date. The designation could put land that is suitable for wind and solar projects off limits.

— One in five Americans say they would support a "national divorce" in which Republican- and Democratic-leaning states split into separate countries, according to a new poll. Link to more vis Axios.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |