Rainy Season Arrives at Panama Canal Amid Optimism Trade Bottleneck Will Ease

Archer Daniels Midland CFO to resign amid DOJ investigation

|

Today’s Digital Newspaper |

MARKET FOCUS

- No Fed speakers today but traders watching 2-Yr note auction

- General Motors revises its 2024 guidance upward

- Apple shares down after iPhone sales in China plunged last quarter

- CNN Fear/Greed Indicator at 38 (on a scale of 0-100)… that’s in the “Fear” zone

- Largest investment companies control sums rivaling economies of large countries

- PMI for Eurozone reached its highest point in 11 months in April

- Yen weakens, intervention watch heightens

- Gold extends losses after biggest daily decline in almost two years

- Rainy season arrives at Panama Canal, optimism trade bottleneck will ease

- Ag markets today

- ClimateAi launches AI-driven crop yield forecasts

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

BALTIMORE BRIDGE COLLAPSE

- Third temporary channel opened

RUSSIA & UKRAINE

- Biden tells Ukraine American weapons will arrive ‘quickly’

- Russia issues warning of escalating strikes on Ukraine following U.S. aid

- Ukraine’s April grain exports strong despite Russian strikes

- Egyptian wheat ships being delayed in Russian ports due to disputes

POLICY

- Minimal ERP changes

CHINA

- U.S. implementing sanctions targeting Chinese banks

- China’s economy is ‘failing,’ U.S. Indo-Pacific commander says

- China's demand for Russian coal decreases significantly

- Beijing is preparing retaliatory measures against U.S.

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Kroger and Albertsons to sell more stores as part of divestiture package

- CDC confirms seasonal flu meds effective against H5N1 in dairy cattle

OTHER ITEMS OF NOTE

- President Javier Milei announces Argentina’s first quarterly fiscal surplus since 2008

|

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened around 150 points higher. In Asia, Japan +0.3%. Hong Kong +1.9%. China -0.7%. India +0.1%. In Europe, at midday, London +0.6%. Paris +0.6%. Frankfurt +1.1%.

There are no Fed speakers today, but the Treasury will hold a 2-Yr Note auction at 1:00 p.m. ET which could offer insight into any changes in Fed policy expectations (the risk to stocks is an auction with weak demand that sends the 2-Yr yield to-or-through 5%).

U.S. equities yesterday: All three major indices finished higher even though they were nearly unchanged or slightly weaker ahead of midday. The Dow gained 253.58 points, 0.67%, at 38,239.98. The Nasdaq rose 169.30 points, 1.11%, at 15,451.31. The S&P 500 was up 43.37 points, 0.87%, at 5,101.60.

— General Motors revised its 2024 guidance upward following a strong performance in the first quarter. The company exceeded expectations both in terms of revenue and net income, largely driven by robust truck sales in its North American division. Revenue for the first quarter increased by 7.6% compared to the same period last year, while net income surged by 26%. As a result, GM shares have risen by approximately 4% in premarket trading. This positive outcome suggests a promising start to the year for GM, bolstered by strong sales figures and financial performance.

— Apple shares are down in premarket trading this morning after iPhone sales in China plunged last quarter. Meanwhile, Apple is set to sign another major sports streaming deal. The iPhone maker is expected to agree on terms with FIFA, soccer’s global governing body, on a package worth at least $1 billion to stream a new tournament in the U.S. next summer. A deal for the event, the Mundial de Clubes, could be announced as early as this month, the New York Times reports.

— Ag markets today: Wheat futures posted followthrough to Monday’s strong gains overnight, while buying was limited in corn and soybeans. As of 7:30 a.m. ET, corn futures were trading steady to fractionally higher, soybeans were narrowly mixed, SRW wheat futures were mostly 3 to 5 cents higher, HRW wheat was 5 to 6 cents higher and HRS wheat was 7 cents higher. Front-month crude oil futures were around 50 cents lower, and the U.S. dollar index was nearly 100 points lower.

Cash cattle uncertainty for this week. Cash cattle prices averaged $182.67 last week, down $1.17 from the previous week and the lowest price since mid-February. If cattle futures build on Monday’s strong gains it would set up the possibility of ending the four-week slide in cash, though showlist numbers are expected to be higher, especially in the Southern Plains.

Pork cutout rises. The pork cutout rose $1.61 on Monday, fueled by strong gains in bellies, ribs and picnics, while the other cuts were weaker. The cutout strength has allowed packers to maintain margins solidly in the black. The CME lean hog index is down 4 cents to $91.31 as of April 19, the second straight daily decline, though sustained weakness is not expected.

— Agriculture markets yesterday:

- Corn: May corn rallied 6 1/4 cents to $4.39 3/4, marking the highest close since March 28.

- Soy complex: May soybean futures rallied 10 1/2 cents to $11.61, though settled off session highs. May meal futures eked 60 cents higher to $344.3. May bean oil futures firmed 66 points to 45.04 cents.

- Wheat: July SRW wheat rose 20 3/4 cents to $5.87 1/2 and nearer the session high. Prices hit a nine-week high. July HRW wheat gained 19 1/2 cents at $6.02 1/3, nearer the session high and hit a 10-week high. July HRS futures rose 10 1/4 cents to $6.62 3/4.

- Cotton: July cotton rose 140 points to 82.42 cents, near the session high.

- Cattle: June live cattle rose $2.375 to $178.05, nearer the session high. May feeder cattle gained $3.175 at $245.175 and nearer the session high. Both markets hit three-week highs.

- Hogs: June lean hog futures surged 67.5 cents to $105.50, while nearby May futures climbed 47.5 cents to $96.70.

— Of note:

- CNN Fear/Greed Indicator currently sits at 38 (on a scale of 0-100). That’s in the “Fear” zone. The Fear/Greed Index has become more widely followed on the Street because it incorporates seven different momentum and sentiment indicators and, as such, provides a wide view of current investor and market sentiment. Concludes the Sevens Report: “The 38 reading puts this indicator in the “Fear” zone, so the “Extreme Greed” reading of a month ago has been removed. But this indicator is still a ways away from the “Extreme Fear” we’d want to see to imply investors are irrationally negative.”

- $43.5 trillion: The amount of assets controlled by traditional asset managers, private-fund managers and hedge funds control, according to a Wall Street Journal analysis of data from the Federal Reserve, HFR, ICI and Preqin. The largest investment companies now control sums rivaling the economies of many large countries.

— Purchasing Managers' Index (PMI) for the Eurozone, as reported by S&P Global, has reached its highest point in 11 months in April. The index increased to 51.4 from 50.3 in March, indicating an expansion as any value above 50 signifies growth. This uptick was primarily driven by growth in the services sector. These statistics imply that the Eurozone is gradually moving away from stagnation.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker, with the euro and British pound both firmer against the U.S. currency. The yield on the 10-year U.S. Treasury note was firmer, trading around 4.64%, with a mostly higher tone in global government bond yields. Crude oil futures shifted lower, with U.S. crude around $80.95 per barrel and Brent around $86.15 per barrel. Gold and silver futures were under significant pressure, with gold around $2,318 per troy ounce and silver around $26.99 per troy ounce.

— Yen weakens, intervention watch heightens. The yen hit multi-year lows against the dollar and the euro on Tuesday, keeping investors on heightened intervention watch ahead of this week’s Bank of Japan (BOJ) meeting. Japan’s finance minister today said the Japanese government will take appropriate measures against excessive currency moves, while the BOJ governor said it will raise short-term interest rates if inflation moves toward 2%.

— Gold extended losses after its biggest daily decline in almost two years, with easing tension in the Middle East and signs of higher-for-longer interest rates crimping demand. The metal traded near $2,300 an ounce.

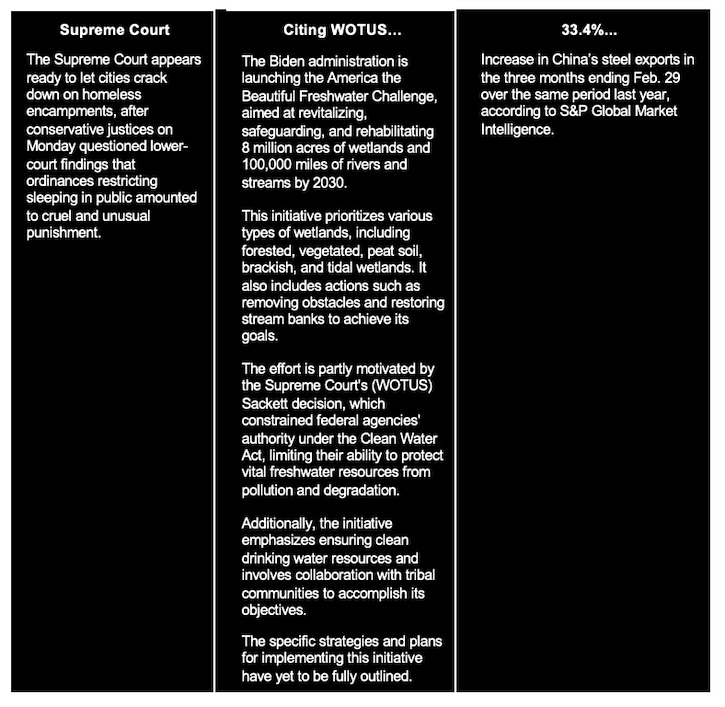

— As the rainy season arrives at the Panama Canal as expected, there is optimism that the trade bottleneck will ease, coinciding with the busy period for shipping. Data from IMF PortWatch shows that the daily vessel crossings at the canal have increased, with the seven-day moving average reaching 25 last week, up from a low of about 21 in late January. However, this is still below the long-term average of about 35 crossings per day before the drought. To accommodate increased traffic, the canal authority announced plans to lift booking slots to 31 daily transits in the second half of May and to 32 starting in June. Additionally, maximum draft rules, which limit the weight of a ship's cargo, will increase starting in June. The Institute of Meteorology and Hydrology in Panama has reported that the country is transitioning to a wetter seasonal pattern, which is expected to continue through mid-May. While Gatun Lake, a key water source for the canal, is not projected to reach healthy levels, it is forecast to recover somewhat over the next two months. The added rainfall combined with increased ship crossings is expected to gradually alleviate the restrictions on global trade resulting from canal disruptions since last year, particularly ahead of the peak shipping season from July to September.

Maersk has announced that its OC1 container-line service can resume using the canal from May 10, ending a workaround established in mid-January involving bypassing the canal using rail transit. However, a full return to normal operations at the Panama Canal may take until the end of the year or next year, according to an official with the canal authority, Argelis Moreno Lopez. He told Bloomberg he anticipates that the rainfall beginning in April will help reverse the situation, ultimately restoring normalcy in the coming months.

— ClimateAi launches AI-driven crop yield forecasts. ClimateAi announced the public launch of ClimateLens Monitor Yield Outlook. This offers climate-driven yield forecasts for key crops, including corn, soybeans, wheat, sorghum, barley, canola, oats, hops and potatoes, and insights into the climate factors driving the variability. The product offers weekly yield outlooks from planting through harvest for key production countries, states and specific sourcing locations, surfacing the key climate risk factors contributing to yield with models uniquely calibrated by crop and region.

— Ag trade update: Taiwan tendered to buy 106,675 MT of U.S. milling wheat. Algeria tendered to buy a nominal 50,000 MT of optional origin durum wheat. Indonesia purchased 300,000 MT of rice – 109,000 MT from Vietnam, 110,000 MT from Thailand, 56,000 MT from Myanmar and 25,000 MT from Pakistan. South Korea tendered to buy 116,900 MT of rice – 64,700 MT to be sourced from the U.S. and the remainder from Australia, Thailand and Vietnam.

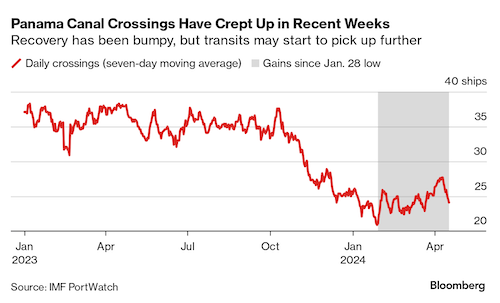

— NWS weather outlook: Unsettled weather and severe thunderstorm chances ramp up across parts of the central and southern Plains this week... ...Above average temperatures throughout the western and central United States, with cooler weather in the Great Lakes and much of the East.

Items in Pro Farmer's First Thing Today include:

• Followthrough buying in wheat overnight

• HRW, SRW crops headed in opposite directions

• South American crop estimates unchanged with a focus on corn

• Gold, silver futures plunge

|

BALTIMORE BRIDGE COLLAPSE |

— A third temporary channel has been opened at the site of the Francis Scott Key Bridge collapse. Commercial vessels can now use the Fort Carroll Temporary Alternate Channel, boasting a controlling depth of 20 feet, a 300-foot horizontal clearance, and a vertical clearance of 135 feet. However, this temporary channel is distinct from the limited access channel expected to open by the end of April.

The U.S. Army Corps of Engineers anticipates opening the limited access channel to the Port of Baltimore by the end of April, supporting one-way traffic for barge container service and certain vessels transporting automobiles and farm equipment.

The recently opened temporary channel is the result of proactive efforts to clear the SPAN-19 area, providing deeper water for vessel transit. Approximately 130 commercial vessels, primarily tugs and barges with shallow drafts, have already utilized this temporary route.

The forthcoming limited access channel, scheduled for the end of April, will accommodate deeper draft vessels typical in the port. It's projected to permit about 15% of the pre-collapse vessel traffic. The ultimate aim is to restore the entire Maryland Transportation System (MTS), achieve a 50-foot channel, and bolster the port's economy. A deeper channel facilitates increased cargo capacity for vessels traversing the Patapsco River.

|

RUSSIA/UKRAINE |

— President Joe Biden told Volodymyr Zelenskyy, Ukraine’s president, that American weapons will arrive “quickly.” Congress is expected to give final approval to a funding package that includes $61 billion in aid for Ukraine today or Wednesday, with Biden signing it into law later this week.

— Russia issued a warning of escalating strikes on Ukraine following the U.S. decision to approve a $61 billion aid package, which includes both military and economic assistance, to the Ukrainian government. Russian Defense Minister Sergei Shoigu announced plans to intensify attacks on logistics centers and storage bases for Western weapons within Ukraine. He also stated that Russia would bolster its armed forces and ramp up production of high-demand weapons and military equipment in response to the support provided by the U.S. and its allies to Ukraine. This statement underscores the heightening tensions in the region and the potential for further conflict escalation.

— Ukraine’s April grain exports strong despite Russian strikes. Ukraine grain exports might total 6 MMT to 7 MMT in April despite Russian attacks on Ukrainian port infrastructure on the Black Sea, industry sources told Reuters. Russia has stepped up attacks on Ukrainian seaports, damaging grain storage facilities in the Port Pivdennyi in Odesa region. Local media reported one of the strikes may have damaged railway tracks to the port of Chornomorsk cargo terminals in the region.

— Egyptian wheat ships are being delayed in Russian ports due to disputes between a major Russian grain trader, TD Rif, and local regulatory authorities, Bloomberg reports (link). The Wadi Almolouk, one of the ships, had been stuck in the Russian port of Novorossiysk for three weeks due to paperwork issues but has now been allowed to sail, with Egypt's Ministry of Agriculture facilitating its departure.

Impacts. The dispute between TD Rif and the Russian government has caused concerns about disruptions in grain exports from Russia, which could affect major importers like North Africa and the Middle East, including Egypt. Another Egyptian ship had faced similar issues earlier in the month, prompting intervention from Egypt's Foreign Ministry to ensure its departure.

Of note: While the Wadi Almolouk has been cleared to sail, two more Egyptian ships, the Edfu and Wadi Tiba, are still awaiting necessary documents. These ships are carrying grain loaded by TD Rif. Efforts to resolve the situation involved Egyptian officials holding urgent meetings with Russian delegates in Rome to secure the timely import of wheat, which is crucial for Egypt.

|

POLICY UPDATE |

— Minimal ERP changes. USDA still is not publicly providing amounts that have been paid out under the Emergency Relief Program (ERP) for 2022 but their site outlining the ERP Phase 1 and Phase 2 efforts that cover losses for 2020 and 2021 continue to show a slight rise for the Phase 2 payments. They now stand at $885.94 million as of April 21, up from $885.69 million the prior week. The rise was not enough to increase total ERP payments for 2020 and 2021 losses from $8.64 billion where it has been for several weeks.

|

CHINA UPDATE |

— U.S. is implementing sanctions targeting Chinese banks involved in facilitating trade between China and Russia. This trade has enabled Russia to bolster its military capabilities, raising concerns in the West about Russia's potential success in a prolonged conflict with Ukraine. Washington hopes to pressure China into altering its support for Russia by threatening the Chinese banks' access to the dollar and potentially disrupting trade relations with Europe, according to the Wall Street Journal (link). This gives Secretary of State Antony Blinken some diplomatic leverage as he heads to Beijing. Meanwhile, Citigroup is the only American bank left in Ukraine.

— China’s economy is ‘failing,’ U.S. Indo-Pacific commander says. The U.S. military commander in the Indo-Pacific said he didn’t believe the economic growth figures reported by China and described the country’s economy as failing. Link to details via the WSJ.

— China's demand for Russian coal has decreased significantly due to a combination of factors including import taxes, logistical challenges, and increased competition from cheaper alternatives. Shipments of Russian coal to China dropped by 22% in the first quarter, driven by Beijing's imposition of levies that made rival suppliers more attractive. Additionally, higher costs stemming from increased tariffs on Russian railways and a surcharge imposed by the Kremlin on exports to support the war in Ukraine have further diminished the competitiveness of Russian coal in the Chinese market.

China can't quit coal by 2040, researchers say, despite global climate goals. China will continue using coal despite a massive ramp-up in renewable generation, which will make up 88% of China's power generation mix in 2050, the report predicts.

— As the U.S. escalates economic sanctions against China, Beijing is preparing its retaliatory measures while cautiously considering the potential economic repercussions, the Wall Street Journal reports. The Biden administration's recent moves, including tariff hikes and investigations into Chinese trade practices, signal a tougher stance on China ahead of the presidential election.

Beijing's response to these actions is expected, given President Xi Jinping's previous directive to retaliate against U.S. pressure. However, Beijing is also mindful of the economic impact on its own country, especially as it seeks to recover from economic challenges.

China has already retaliated by imposing levies on U.S. imports of certain chemicals and is likely to take further steps. However, it aims to balance its response to minimize damage to its economy. Beijing's retaliation tactics have so far included measures like restricting popular apps in China, which serves both as a response to U.S. actions and as a means of bolstering censorship control.

Despite its desire to retaliate, China faces challenges in responding without causing harm to its own interests. Its reliance on Western high-tech products, for instance, constrains its ability to retaliate against certain U.S. actions without disrupting its own supply chains. While Beijing has developed tools for retaliation, such as its version of an export blacklist and an anti-foreign-sanctions law, it has been cautious in deploying them to avoid significant economic costs.

Bottom line: The mere existence of these tools serves as a deterrent to multinational companies operating in China, potentially increasing the cost for the U.S. in imposing further sanctions on China.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Kroger and Albertsons have agreed to sell more than 160 additional stores as part of a divestiture package to address concerns from competition regulators regarding their pending merger. Under the revised deal with C&S Wholesale Grocers, the companies will sell a total of 579 stores, an increase of 166 from the previous agreement. Additionally, Kroger will sell its Haggen banner based in Washington to C&S.

This decision follows the Federal Trade Commission's lawsuit to block Kroger's $25 billion acquisition of Albertsons, citing potential food price increases and negative impacts on workers' bargaining power. Regulators deemed the initial divestiture plan insufficient.

In the modified agreement, C&S will license the Albertsons and Safeway banners in certain states, while Kroger will re-brand its retained stores after the merger in those regions. Kroger's CEO Rodney McMullen emphasized that the updated plan aims to prevent store closures due to the merger and ensure the retention of all frontline employees and collective-bargaining agreements.

The new deal includes expanded distribution capacity and transition services agreements to support C&S, along with additional corporate and office infrastructure for the company. C&S will also acquire various private-label brands and other supermarket banner names.

Albertsons reported nearly flat revenue of $18.3 billion in the 12 weeks ended Feb. 24, with identical sales up 1%. However, the company's profit in the fiscal fourth quarter declined to $250.5 million, or 43 cents a share, compared to $311.1 million, or 54 cents a share, a year earlier. CEO Vivek Sankaran attributed this to factors such as prior-year food inflation, investments in wages and benefits, and reduced government assistance for customers, which are expected to continue impacting results in the first half of fiscal 2024.

— CDC confirms seasonal flu meds effective against H5N1 in dairy cattle; first human case reported. The Centers for Disease Control (CDC) reported that antiviral medications typically used to treat seasonal flu are effective against the H5N1 bird flu virus, which has been found in dairy cattle. The virus has been confirmed in 33 dairy herds across eight states since its identification on March 25.

In Texas, a dairy worker contracted bird flu on the job, resulting in conjunctivitis. This is the first known case of likely transmission from mammals to humans. However, authorities assure the public that the risk of H5N1 to humans remains low. Surveillance efforts will continue to monitor whether the virus is evolving to become more transmissible.

The CDC confirmed that the H5N1 virus is susceptible to FDA-approved neuraminidase inhibitor antivirals, such as oseltamivir, zanamivir, and peramivir, commonly used to treat seasonal influenza. Testing for the effectiveness of the antiviral baloxavir marboxil is ongoing.

Since February 2022, outbreaks of highly pathogenic avian influenza (HPAI) have resulted in the deaths of nearly 91 million birds in domestic U.S. flocks, primarily egg-laying chickens and turkeys raised for human consumption. In the current month alone, 8.7 million birds have died or been culled due to HPAI infections.

While HPAI is milder among dairy cattle, symptoms such as reduced appetite, decreased milk production, lethargy, and fever are observed, particularly in older cows. However, affected cattle typically recover within a few weeks.

The most recent case of HPAI in dairy cattle occurred in Idaho, marking its second infected herd. Texas has recorded the largest number of cases, with 12 herds affected (link). Wild birds are believed to spread HPAI, prompting animal welfare officials to advise farmers to implement robust biosecurity measures, such as restricting wild bird access, limiting farm access to outsiders, and using foot baths to sanitize boots before entering barns.

Some poultry farmers are employing various methods, including lasers, drones, air horns, and balloons, to deter wild birds from their properties. The New York Times reported (link) that dairy farmers are also adopting such measures, with some utilizing roof-mounted laser systems manufactured by Bird Control Group.

|

OTHER ITEMS OF NOTE |

— President Javier Milei announced Argentina’s first quarterly fiscal surplus since 2008 during a televised speech. “The fiscal surplus is the cornerstone from which we are building a new era of prosperity in Argentina,” Milei said Monday night, flanked by his economic team at the presidential palace in Buenos Aires. “We are making possible the impossible even with the majority of politics, unions, the media and most economic actors against us.” The crisis-prone South American nation posted a quarterly fiscal surplus of 0.2% of gross domestic product to start the year, as well as a third consecutive monthly surplus in March, Milei said. The libertarian economist pledged to stick with austerity because “inflation is robbery and fiscal deficit is the cause of inflation.”

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |