House GOP Farm Bill Briefings Being Scheduled, but Snags Continue

House GOP leaders mull possible rule change re: motion to vacate

|

Today’s Digital Newspaper |

Modified report today as I am speaking to the Virginia Cattlemen’s Assn. meeting in a beautiful part of the state.

— Equities: Asian and European stock indexes were mixed to firmer overnight. All three U.S. exchanges opened higher with the Dow still up around 0.3%. In Asia, Japan +0.3%. Hong Kong +0.8%. China +0.1%. India -0.6%. In Europe, at midday, London +0.2%. Paris +0.4%. Frankfurt flat.

— The recent decline of the Japanese yen to its lowest level in 34 years has prompted discussions among the U.S., Japan, and South Korea regarding foreign exchange matters. Following a dialogue among finance leaders from these countries, they issued a joint statement pledging to "consult closely" on actions in the foreign exchange market. The statement emphasizes cooperation to promote sustainable economic growth, financial stability, and well-functioning financial markets. Additionally, the countries express concerns about the recent sharp depreciation of the Japanese yen and the Korean won. While these discussions have raised expectations of potential intervention in the forex markets, Masato Kanda, a key Japanese currency official, refrained from commenting on the possibility of coordinated intervention. During the G7 meeting, finance ministers endorsed a Japanese proposal reaffirming their commitment to address excess volatility and disorderly movements in currency markets. However, some analysts worry that even intervention may not address the strength of the U.S. dollar, which has been supported by expectations that the Federal Reserve will postpone interest rate cuts due to persistent inflation and a stronger-than-expected U.S. economy.

— Corn and beans lower, wheat firmer overnight. Corn futures mildly extended Wednesday’s losses overnight, while soybeans erased gains from yesterday. Wheat was supported by light corrective buying. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents lower, soybeans were 6 to 7 cents lower, winter wheat markets were steady to a penny higher and spring wheat was 4 to 6 cents higher. Front-month crude oil futures and the U.S. dollar index were both modestly weaker.

— More U.S. wheat sales to China canceled. Additional cancelations of sales of U.S. wheat to China were reported in export sales activity for the week ended April 11 from USDA. Activity for the week included net reductions of 123,678 metric tons of wheat (gross sales of 112,811 metric tons and cancelations of 236,500 metric tons), net sales of 71,499 metric tons of corn, net reductions of 9,818 metric tons of sorghum, net sales of 131,020 metric tons of soybeans, and net sales of 92,593 running bales of upland cotton. Activity for 2024 included net sales of 3,573 metric tons of beef and 2,970 metric tons of pork.

— USDA daily export sale: Private exporters reported sales of 138,000 metric tons of soybean cake and meal for delivery to the Philippines during the 2023-2024 marketing year.

— Slow start to cash cattle trade. Cash cattle trade has been nonexistent so far, with packers slow to establish bids and feedlots seeking higher prices. Given the slow start to cash negotiations and this being a report week, active cash trade is not expected until Friday – potentially after USDA’s Cattle on Feed Report on Friday afternoon.

— Cash hog index continues to climb, pork cutout pauses. The CME lean hog index is up another 38 cents to $91.36 as of April 16. The index has surged $26.31 on the seasonal rally since the beginning of the year and is nearly $20.00 above last year at this time. The pork cutout value was unchanged at $99.55 on Wednesday. Pork cutout has rallied $14.79 since the beginning of the year and is nearly $22.00 above last year.

— China’s pork imports plunge in March. China imported 90,000 MT of pork in March, down 39.3% from last year. Through the first three months of this year, China imported 260,000 MT of pork, down 51.7% from the same period last year.

— Farm bill update: Several loose ends remain. Most important is for House Ag Chair G.T. Thompson (R-Pa.) to get some Dems on board because some House Republicans are expected to oppose whatever package is developed. Problem, though, is Dems are balking at any changes to the Thrifty Food Program where even no outright cut in the program is still labeled as one. Dems are trying to offer a compromise but that is proving a tough task. Some Dems are discussing an option that would nix any GOP proposal to limit future updates to the Thrifty Food Plan, while using Commodity Credit Corporation funding for SNAP investments.

Progress must be being made because commodity group lobbyists will get a briefing on the latest, supposedly next week. But briefings can always be postponed.

The ultimate test of the coming House GOP farm bill: Details on the “creative ways” found to garner the funding needed to truly improve the current safety programs and crop insurance. Conservative and especially rebel Republicans will look at how farm bill changes are scored.

As for the Senate, not much new, if anything, from Senate Ag Chair Debbie Stabenow (D-Mich.). Public statements by senators from both political parties profess they want a new farm bill, but Senate efforts to date do not match the work being done in the House. And farm bill policy focus in the Senate differs significantly between the two major political parties. Republicans favor a boost in reference prices and improvements in crop insurance, whereas Democrats know that any consistent percentage increase in reference prices for all farm program crops would bust the farm bill budget because of corn and soybean plantings versus other crops. That is why some GOP lawmakers are pushing variable rate increases. Because of lower plantings of some crops like rice, cotton and peanuts, the reference hike percentages can be higher for those commodities. But if that approach is taken, history shows there will be criticism of a North/South divide on farm policy.

— House lawmakers introduce bipartisan Risk Management Act, seeking to restore inflation adjustments and set minimum A&O for specialty crops. Rep. Austin Scott (R-Ga.), Rep. Jimmy Panetta (D-Calif.), and Rep. Tracey Mann (R-Kan.) have introduced the bipartisan "Ensuring Access to Risk Management Act of 2024." This legislation aims to reinstate the annual inflation adjustment for all Administrative and Operating (A&O) expenses, aligning it with the inflation adjustment from 2011 to 2015. Additionally, the bill proposes setting a minimum level of A&O for specialty crop policies, ensuring it is equal to or greater than 17% of what the Standard Reinsurance Agreement (SRA) would otherwise provide. While the House has introduced this legislation, a companion bill has yet to be introduced in the Senate.

— A lawsuit filed in Iowa challenges the constitutionality of the Swampbuster rule, a longstanding regulation by USDA. This rule prohibits farmers from accessing certain support programs if they plant crops on wetlands. CTM Holdings LLC, represented by conservative law firms including the Pacific Legal Foundation, argues that this rule violates the Fifth Amendment, specifically its clause regarding private property rights and compensation for public use. The Swampbuster rule, akin to the Sodbuster rule for grasslands, is part of an arrangement where farmers agree to modify their farming practices in exchange for subsidies or access to federally subsidized crop insurance. Historically, farmers have agreed to limit planting of certain crops when applying for these subsidies.

According to the law firms supporting CTM Holdings, the Swampbuster rule infringes upon property rights by making assistance programs contingent on landowners giving up their rights to use their land as they see fit. They argue that the designation of wetlands on a 71-acre tract owned by CTM Holdings rendered the entire farm impractical to cultivate, effectively amounting to a government takeover of the land.

The legal challenge gains context from a Supreme Court decision in May of the previous year, which narrowed federal protection of wetlands by specifying that the Clean Water Act only applies to wetlands with a direct surface connection to streams, oceans, rivers, or lakes. This decision, which replaced the broader "significant nexus" test established in 2006, was celebrated by the Pacific Legal Foundation as a victory for property rights.

Bottom line: The lawsuit contests the Swampbuster rule on grounds of property rights and argues that its enforcement by USDA is unconstitutional.

— USTR Tai pressured on lack of trade accords. The pressure on U.S. Trade Representative Katherine Tai regarding the absence of free trade agreements (FTAs) continues from both sides of the political aisle. Lawmakers express frustration over the Biden administration's lack of pursuit in FTAs, particularly in addressing barriers to U.S. agricultural goods and expanding market access. Tai defended the administration's approach by highlighting efforts to open access for agricultural products totaling $20 billion over the past three years. She emphasized that while comprehensive FTAs are not being negotiated, the administration is working to reduce non-scientific barriers and negotiating agriculture chapters addressing these issues.

“How about the easy FTAs? How about the U.K.?” asked Sen. John Thune (R-S.D.). “I think there are no easy FTAs,” replied Tai. The United Kingdom has refused to discuss agricultural market access with Canada, she said, and there are long-standing obstacles to expanding U.S.-EU food and ag trade. The strong U.S. dollar and the robust U.S. economy are among the reasons that food and ag exports are under pressure, she said. The United States is ahead of the world in economic recovery. “I would just say that I think ag always ends up being at the end of the line,” said Thune. Finance Committee member Debbie Stabenow (D-Mich.), who also chairs the Senate Agriculture Committee, said there was wide concern in farm country about expanding ag exports. “We need those markets and trade agreements,” said Stabenow.

Lawmakers also criticized Tai for not pursuing more trade cases with China, with Tai explaining the challenges of these actions and indicating frustration with China's response to WTO rulings. Tai mentioned discussions with China regarding their commitments under the Phase 1 agreement but didn't offer specifics on outcomes. She assured that the review of Section 301 tariffs on China would be completed soon but didn't provide a timeline for releasing results.

The hearings underscore lawmakers' focus on China and their disappointment with the absence of new FTAs. Tai's assertion that there are no easy FTAs reflects the challenges in achieving positive trade outcomes, indicating ongoing complexities in the Biden administration's trade policy.

— Wall Street is contemplating whether the Federal Reserve will decrease interest rates throughout 2024. Despite the Fed's consistent aim of achieving a 2% inflation target, inflation rates have been consistently around 3% for several months, complicating the Fed's efforts to reach its goal. Traders, as indicated by the CME Group's FedWatch gauge, are still anticipating rate cuts later in the year, with approximately a 71% probability that any rate adjustments won't occur until September. Bank of America economists predict a rate cut in December but caution that there's a significant possibility the Fed might not enact any cuts until at least March 2025.

— Following the collapse of the Francis Scott Key Bridge in Baltimore, the city's port has been closed for three weeks, leading to significant disruptions in America's supply chain operations. Railways, trucking companies, and shipping firms are devising alternative routes along the East Coast to circumvent the bottleneck created by the bridge collapse, aiming to avoid the congestion witnessed in previous years. While other ports such as The Port of New York and New Jersey are absorbing some of the traffic for various goods, the repercussions of the disruption persist. Peter Eavis of the New York Times highlights the widespread challenges: The trucking industry is particularly strained, struggling to allocate drivers and shipments efficiently to meet deadlines while maintaining profitability. Akram Ayyad, owner of 410 Transport in Maryland, notes a significant increase in costs as cargo now needs to be transported over longer distances to alternative ports like New York and New Jersey instead of Baltimore. Moreover, customers are resistant to paying the higher fees associated with the rerouted transportation.

— “Let the chips fall where they may — if I operated out of fear over a motion to vacate, I would never be able to do my job.” — House Speaker Mike Johnson (R-La.), when asked if he was risking his job in moving to a vote on the foreign-aid package. Johnson said would proceed with a vote on funding for Ukraine, Israel and other allies. The proposed package, which is worth $95 billion, will be put forward as three separate bills. President Joe Biden said passing the legislation would “send a message to the world” that America would not “let Iran or Russia succeed.” The measures would provide $26 billion to Israel and about $9.2 billion in humanitarian aid. For Ukraine, the package would provide $60.8 billion to help the country in its ongoing war against Russia, more than $23 billion of which would be used to replenish U.S.-provided weapons and stocks. Of that total, $13.8 billion of that would be for advanced weapons systems; and $26 million to bolster Ukraine aid oversight. The third Indo-Pacific bill would provide more than $8 billion in assistance to the region. The measures will win Democratic support, upsetting rebel Republicans.

— House Republicans mull rule change to shield Speaker amid party dissent over $95b foreign aid package. Top House Republican leaders and aides are discussing leveraging the debate over a $95 billion foreign aid package to strengthen Speaker Mike Johnson's (R-La.) position amid growing dissent within his party, Punchbowl News reports. Currently, any member can trigger a motion to vacate the chair, leading to a potential vote to remove the speaker. Rep Marjorie Taylor Greene (R-Ga.) has filed such a motion against Johnson, though she hasn't pursued a vote yet.

In response to Johnson's opposition from the House Freedom Caucus and other conservatives over the foreign aid package, GOP leadership reportedly is considering amending the rules for debating the legislation. They are contemplating raising the threshold required to file motions to vacate, a move that would make it harder for members to challenge the speaker. Previously, under Speaker Nancy Pelosi (D-Calif.), only party leaders could file such motions, but McCarthy lowered the threshold to one member in January 2023, which contributed to his ousting.

Johnson has not yet decided whether to pursue this change, the news service says, but he is facing pressure from numerous members to raise the threshold.

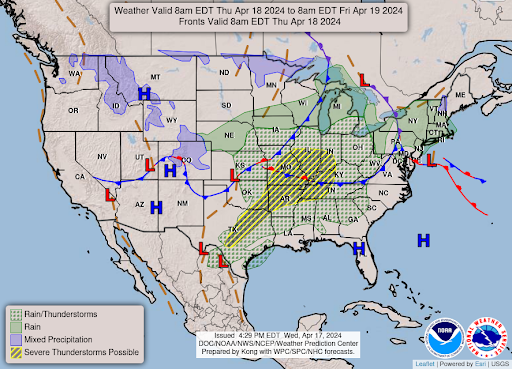

— NWS weather outlook: Severe weather and isolated flash flooding for the Middle Mississippi/Lower Ohio Valleys and Southern Plains Thursday......Showers, thunderstorms, and cooler weather for much of the Southern Plains Friday; wintry mix into the central High Plains... ...Unseasonably warm conditions for much of the southern U.S.; chillier weather expands across the northern Rockies/Plains and Upper Midwest.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |