Total Cost, ‘Creative’ Ways of Funding for Coming House GOP Farm Bill Are Big Issues

USTR confident in U.S. victory over Mexico in GMO corn dispute, focuses on Indo-Pacific trade expansion

|

Today’s Digital Newspaper |

MARKET FOCUS

- Federal Reserve interest rate cut timing and number changing

- Likelihood of Federal Reserve rate cuts shifts from question of when to if

- Earnings season in full bloom

- Childcare costs big hurdle

- Treasury Dept. proposes granting expanded powers to CFIUS

- Mortgage rates climbing again

- ADB forecasts robust growth for Asia despite China slowdown

- Rising auto insurance expenses contributed to increased U.S. inflation in March

- Dollar surges amid inflation data, impacting global markets

- Commodities market experiencing significant activity and price movements

- IEA revises down its oil demand growth forecast for 2024

- Fed/ECB divergence pressures Euro, sparks parity talks

- Ag markets today

- USDA daily export sale: 124,000 MT soybeans, unknown destinations, 2023-24 MY

- NWS weather outlook

- Pro Farmer First Thing Today items

BALTIMORE BRIDGE COLLAPSE

- White House monitoring ag supply chains post-Baltimore bridge collapse

CONGRESS

- House advances revised FISA bill after floor revolt, setting up final vote

ISRAEL/HAMAS CONFLICT

- Diplomats urge Iran to exercise caution after U.S. warning

RUSSIA & UKRAINE

- Ukraine needs aid

POLICY

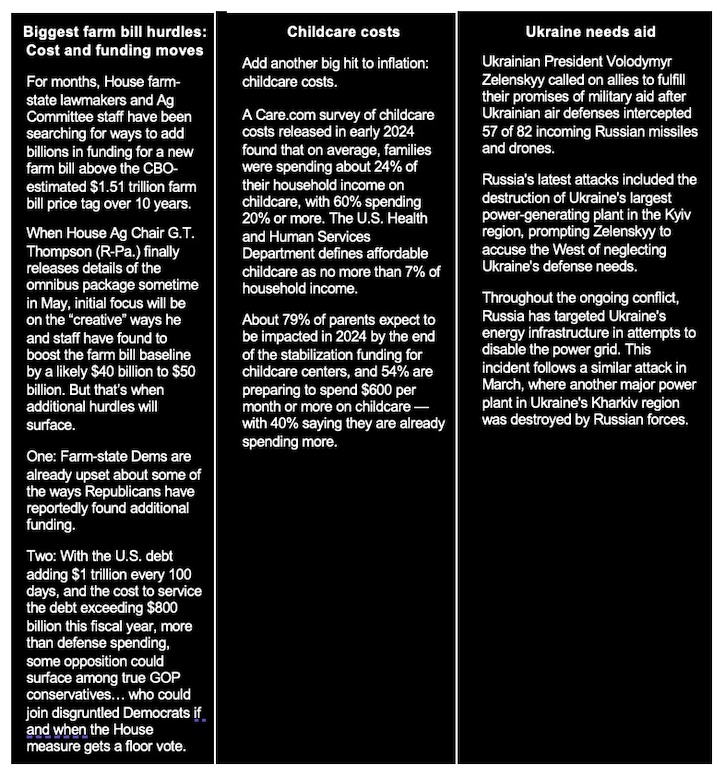

- Total cost, ‘creative’ ways of funding for coming House GOP farm bill are big issues

- House GOP farm-state lawmakers, staff try to woo Democrats with farm bill gimmes

CHINA

- Setback in China's economic recovery, particularly in realm of trade

- China’s soybean imports fall to four-year low for March

- Chinese meat imports slow dramatically in Q1

- USTR Tai suggests end to China tariff review soon

- U.S. airlines ask Biden admin not to approve more flights between U.S. and China

TRADE POLICY

- Bill introduced to extend AGOA until 2041 benefits for four nations due to concerns over human rights and democracy.

- USTR confident in U.S. victory over Mexico in GMO corn dispute

ENERGY & CLIMATE CHANGE

- EPA report: U.S. ag accounted for 10% of emissions in 2022

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Eight states have confirmed BIAV/HPAI in dairy herds

- USDA report: Military food insecurity double civilian rate

HEALTH UPDATE

- Drug shortages

- U.S. sees 100 measles cases this year, prompting concern from CDC

POLITICS & ELECTIONS

- Politico: Texas Ag Commissioner Sid Miller at top of Trump’s early list for USDA

- Charlie Cook asks: Can GOP supersize a Senate majority?

OTHER ITEMS OF NOTE

- Cotton AWP declines further

- Biden cancels $7.4 billion of student debt in another round of loan forgiveness

|

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened around 240 points lower and are now seeing declines of around 350 points. In Asia, Japan +0.2%. Hong Kong -2.2%. China -0.5%. India -1.1%. In Europe, at midday, London +1.1%. Paris +0.8%. Frankfurt +0.8%.

U.S. equities yesterday: The Dow was down 2.43 points, 0.01%, at 38,459.08 after falling lower late in the session. The Nasdaq gained 271.84 points, 1.68%, at 16,442.20. The S&P 500 was up 38.42 points, 0.74%, at 5,199.06.

— Earnings season in full bloom. Coming up this morning are Q1 earnings from JPMorgan Chase, Citigroup and Wells Fargo. Goldman Sachs will follow on Monday, with Morgan Stanley and Bank of America releasing quarterly numbers on Tuesday. JPMorgan Chase, the biggest U.S. bank by assets, reported first-quarter profit and revenue that beat expectations. Despite the beat, shares of JPMorgan fell roughly 4% in premarket trading. Wells Fargo shares also fell in early trading Friday after the bank reported first-quarter earnings that beat expectations but showed a decline in interest income.

— Treasury Dept. proposes granting expanded powers to the Committee on Foreign Investment in the U.S. (CFIUS), the panel responsible for reviewing foreign investments. This move is aimed at enhancing oversight of U.S./China investment activities. Under the proposal, CFIUS would gain easier access to information through enhanced subpoena authority and could impose higher fines, increasing the maximum penalty from $250,000 to $5 million for certain violations.

— Ag markets today: After weaker trade early in the overnight session, corrective buying gradually built in corn and soybeans, while wheat is narrowly mixed this morning. As of 7:30 a.m. ET, corn futures were trading fractionally higher, soybeans were mostly 1 to 3 cents higher, while wheat was trading a penny on either side of unchanged. The U.S. dollar index was around 575 points higher, and front-month crude oil futures were more than $1.00 higher.

Limited cash cattle trade. Cash cattle trade has been light so far this week, with most of the sales taking place around $2.00 lower than last week. Given the sharp increase in weights and reduced slaughter runs, packer demand for cash cattle is limited.

Cash hog index, pork cutout jump. The CME lean hog index is up another $1.06 to $89.84 as of April 10. The pork cutout value firmed $1.04 to $101.29 on Thursday. Both the cash index and pork cutout value marked new highs in the seasonal price climb that’s showing no signs of slowing.

— Agriculture markets yesterday:

- Corn: May corn fell 5 1/2 cents to $4.28 3/4, marking a low-range close.

- Soy complex: May soybean futures fell 5 1/2 cents to $11.59 1/4 though settled well off session lows. May meal futures surged $4.70 to $335.6, settling near session highs. May bean oil futures plunged 158 points to 46.02 cents.

- Wheat: May SRW wheat fell 6 3/4 cents to $5.51 3/4 and nearer the session low. May HRW wheat closed down 11 1/4 cents at $5.83 1/4 and near the session low. May spring wheat futures plunged 14 3/4 cents to $6.37.

- Cotton: May cotton futures dropped 194 points to 83.37 cents, marking the lowest close since Jan. 17.

- Cattle: June live cattle rose $1.05 to $173.90 and nearer the session high. May feeder cattle gained $1.625 at $238.15 and nearer the session high after hitting a three-month low early on.

- Hogs: Expiring April lean hog futures slipped 30 cents to $91.45 Thursday, while most-active June posted a 25-cent bounce from Wednesday’s big breakdown, closing at $105.80.

— Quotes of note:

- Sevens Report: “In order for inflation to decline and the Fed to cut rates, we must see demand for services decline and the only way to do that is via higher rates, so we should prepare for higher-for-longer rates (at least for the next few weeks/months).”

- Boston Fed president forecasts two rate reductions in 2024, bucking earlier expectations. Boston Fed President Susan Collins adjusted her forecast for rate cuts in 2024, anticipating two reductions despite earlier expectations of three. The shift follows stronger-than-expected March employment data but is primarily influenced by recent inflation figures, notably the Consumer Price Index. While wholesale inflation data showed some improvement, CME Fed funds futures indicate a steady rate path until at least the July meeting, with expectations for a reduction not leading until September.

Fed officials Raphael Bostic and Mary Daly, both voters on the FOMC this year, are set to deliver remarks, reflecting a broader trend towards fewer rate cuts than previously anticipated by the Fed and market participants. Inflation concerns persist, shaping speculation about the Fed's response, with clarity expected after the next FOMC meeting on May 1.

- Likelihood of Federal Reserve rate cuts has shifted from a question of when to if, the Wall Street Journal reports. Despite the Fed's attempt to achieve a soft landing by scaling back interest rate hikes, a recent inflation report exceeding expectations poses a significant challenge to this goal. With strong hiring and the possibility of inflation remaining around 3%, rather than the Fed's 2% target, there are doubts whether rate cuts can be delayed until later in the year without evidence of a more pronounced economic slowdown. Some analysts say the best key ahead is to watch the U.S. unemployment rate. If it goes over 4% then odds of a rate cut rise.

- More economists are paring bets that the Fed will cut rates after the latest Consumer Price Index report. Yesterday, Goldman Sachs forecast two rate cuts (instead of three) this year; Bank of America and Deutsche Bank shifted from two cuts to one. They all argue that sticky inflation will force the Fed to keep borrowing costs higher for longer.

- “Self-reporting credit is real and the benefits to you are significant.” — Ian McGinley, the director of enforcement for Commodity Futures Trading Commission, encouraging companies to come forward to report their own misconduct.

- “People think of universities as absolutely essential to the workforce and talent development, the most important supply chain of all in the end.” — Purdue University President Mung Chiang, on the challenge of staffing planned U.S. semiconductor production centers.

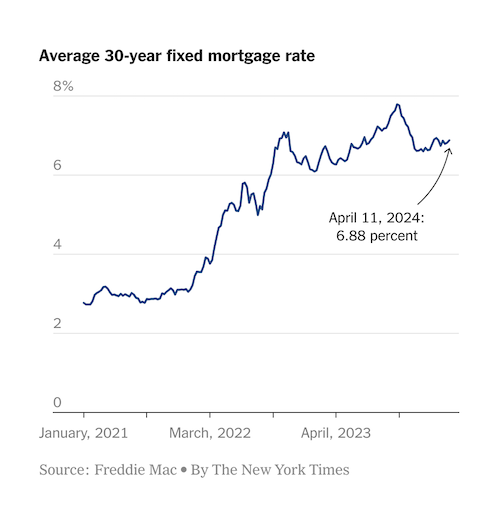

— Mortgage rates are climbing again. The average 30-year mortgage rate rose to roughly 6.9% this week, according to Freddie Mac. That’s down slightly from highs reached last fall. But the rate on one of the most popular mortgages has nearly doubled in the past two years, a jump that coincides with the Fed’s aggressive effort to tamp down inflation.

Note: Watch the yield on 10-year Treasury notes. They have spiked again in recent weeks as Wall Street figures the Fed will keep rates elevated. Mortgage rates — plus rates on many types of consumer loans — tend to tick higher as yields climb.

— ADB forecasts robust growth for Asia despite China slowdown. The Asian Development Bank (ADB) predicts that despite a slowdown in China and uncertainties globally, Asia's economic growth will remain robust this year. The bank, based in Manila, Philippines, revised its forecasts for the region, anticipating that developing economies will benefit from strong domestic demand. The ADB now forecasts a 4.9% expansion for developing Asia in 2024, up from the 4.8% growth projected in December.

— Rising auto insurance expenses contributed to increased U.S. inflation in March, reflecting ongoing financial burdens for vehicle owners. Data released Wednesday shows a 2.7% unadjusted rise in car insurance prices within the consumer price index, marking a significant 22.2% increase year over year. This upward trend in auto insurance costs has persisted since December 2021. According to Sean Tucker, a senior editor at Kelley Blue Book, factors such as the high replacement costs of new cars and expensive repairs due to advanced car technology contribute to this inflationary pressure.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer. with the euro, yen and British pound all weaker against the US currency. The yield on the 10-year U.S. Treasury note was weaker, trading around 4.51%, with a mixed tone in global government bond yields. Crude oil futures were rising ahead of U.S. trading, with U.S. crude around $86.25 per barrel and Brent around $90.80 per barrel. Gold and silver futures were sharply higher ahead of US economic data and market action, with gold around $2,409 per troy ounce and silver around $29.10 per troy ounce.

— Dollar surges amid inflation data, impacting global markets. The recent surge in the U.S. dollar's strength, marking its most robust weekly performance since 2022, has been attributed to significant U.S. inflation figures, causing reverberations across global markets. Against a basket of six currencies, the dollar has appreciated by 1.5% this week, the most substantial gain since September 2022, as traders adjusted their expectations regarding early interest rate cuts by the Federal Reserve. The euro and sterling have weakened to their lowest levels against the dollar since November, reaching $1.0646 and $1.2469, respectively, while the yen plummeted to ¥153.26, marking a fresh 34-year low. This shift in market sentiment has widened the spread between benchmark 10-year U.S. and German government bond yields to its highest level since 2019.

Impacts: The sustained strength of the dollar could pose challenges for countries aiming to implement rate cuts without depreciating their currencies and fueling inflationary pressures. Consequently, central banks are cautious about significant currency depreciation, as it could lead to increased inflation through higher import costs. Market expectations favor multiple rate cuts by the ECB by the end of the year, in contrast to the Fed's anticipated one or two reductions. Among major currencies, the Japanese yen has been particularly affected by the rise in U.S. rate expectations, reaching its weakest level since 1990. This has prompted concerns within Japan, with authorities signaling readiness to intervene in the foreign exchange market if necessary, although such measures are seen as costly and temporary.

— Commodities market is currently experiencing significant activity and price movements across various sectors Here's a breakdown:

- Gold: Prices are surging and have reached a new record high. This suggests a high demand for gold, possibly due to economic uncertainty or inflation concerns, driving investors to seek safe-haven assets like gold.

- Copper: Prices have surged to their highest level since June 2022. This could indicate strong demand for copper, which is often seen as a barometer of global economic activity due to its widespread use in various industries, including construction and manufacturing.

- Zinc: Prices are trading at their highest level in a year. Like copper, zinc is used in various industrial applications, so its price increase could also reflect strong demand from sectors such as construction and infrastructure.

- Iron ore: Prices are on track for their best week in two years. This suggests increased demand for iron ore, which is a key raw material in steel production. Strong demand for steel could be driven by infrastructure projects and construction activities.

- Oil: Prices are also rising, with Brent crude surpassing $90 a barrel. Despite concerns about demand (see next item), possibly due to economic slowdown fears or shifts towards renewable energy, oil prices are still climbing. This could be influenced by various factors such as supply constraints, geopolitical tensions, or expectations of increased oil demand as economies recover from the pandemic.

— International Energy Agency (IEA) revised down its oil demand growth forecast for 2024, citing several factors contributing to the adjustment. Here's a breakdown of the key points:

- Lower than expected demand: The IEA highlights that demand from developed countries, particularly OECD nations, has been weaker than anticipated. This could be attributed to various factors such as slower economic growth or changes in consumer behavior.

- Declining factory activity: The IEA also points out a decline in factory activity, particularly in advanced economies. This slump in industrial activity has led to reduced demand for industrial fuels, impacting overall oil demand.

- China's oil demand: After a surge in oil demand in China following the easing of Covid restrictions, there has been a slowdown in pent-up demand. This contributes to the overall moderation in global oil demand growth.

- Unusually warm weather: The IEA mentions that unusually warm late-winter weather has curtailed heating fuel use in OECD countries more than usual. This weather anomaly further dampened oil demand during the period.

Looking ahead to 2025, the IEA forecasts a further easing of demand growth to 1.1 million barrels per day (bpd). This projection is based on expectations of stabilized global GDP growth and continued expansion of electric vehicle (EV) adoption. As the global economy stabilizes and EVs become more prevalent, traditional oil demand growth is expected to slow down.

— Fed/ECB divergence pressures Euro, sparks parity talks. There's increasing speculation that the Federal Reserve and the European Central Bank will take different paths regarding interest-rate cuts. This divergence is pressuring the euro, which has dropped to its lowest level against the dollar in five months, sparking discussions about the possibility of euro/dollar parity. Meanwhile, reduced expectations for a Fed rate cut are dampening hopes for continued gains in the government bond market after last year's successes.

ECB Governing Council member Yannis Stournaras highlighted the need for policy divergence between Europe and the U.S. ECB President Christine Lagarde emphasized that the ECB is not reliant on the Fed. Bank of England policymaker Megan Greene commented on the contrasting economic situations across the Atlantic, describing the U.S. consumer as "relentless."

— USDA daily export sale: 124,000 MT soybeans, unknown destinations, 2023-24 marketing year.

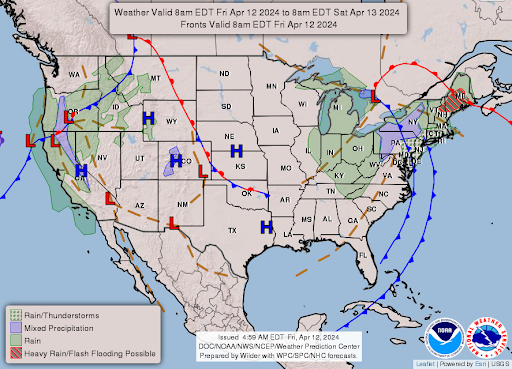

— NWS weather outlook: Powerful low-pressure system to produce gusty winds and heavy rain across parts of the Great Lakes, Ohio Valley, and Northeast through Friday... ...Lower elevation rain and mountain snow to enter California on Saturday... ...Well above average temperatures forecast to surge into the northern/central Plains this weekend.

Items in Pro Farmer's First Thing Today include:

• Corn and beans mildly firmer, wheat mixed

• French wheat crop ratings continue to decline

• British economy shows signs of exiting recession

|

BALTIMORE BRIDGE COLLAPSE |

— White House monitoring ag supply chains post-Baltimore bridge collapse. Following the bridge collapse in Baltimore, White House officials remain cautiously optimistic about the immediate economic impact on the agriculture sector. However, they are closely monitoring key supply chains such as soybeans, fertilizer, and sugar for any signs of strain, according to Politico and other reports. Any disruptions in these supply chains could exacerbate the already volatile food costs, especially considering recent inflation reports that have put pressure on grocery prices. To address potential challenges, officials from President Biden's economic team and USDA have been engaging with food and agriculture stakeholders since the incident. One of the primary concerns for shippers is navigating the logistics and permitting necessary to redirect their shipments for distribution. Reports note the White House is aware of the potential for detention fees to become a significant issue among agriculture stakeholders if firms fail to move their products out of alternative ports quickly enough.

|

CONGRESS |

— House advances revised FISA bill after floor revolt, setting up final vote. The House this morning advanced a bill to reauthorize the U.S.’ warrantless surveillance authority, opening the measure up for debate two days after a band of conservatives blocked a previous version of the legislation from moving forward. The House passed the rule to consider reauthorizing FISA. The vote was 213-208. Five House Republicans didn't vote. No House Republicans voted against the rule. The House will now debate the bill and several amendments before a final vote this afternoon.

|

ISRAEL/HAMAS CONFLICT |

— Diplomats urged Iran to exercise caution after the U.S. warned that the Islamic Republic could launch a “significant attack” against Israel. Germany’s foreign minister urged her Iranian counterpart to exert “maximum restraint”; the Kremlin said it was critical for Middle Eastern countries to avoid “a complete destabilization of the situation.” The U.S. asked other countries, including China and Turkey, to urge Iran not to attack Israel. “Whoever harms us, we will harm them,” said Benjamin Netanyahu, Israel’s prime minister.

|

POLICY UPDATE |

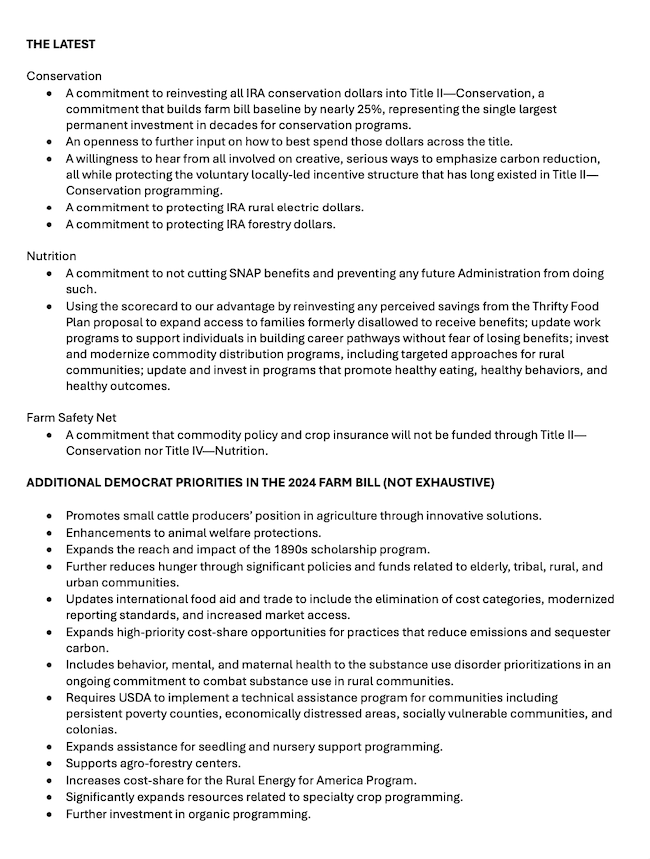

— House GOP farm-state lawmakers, staff try to woo Democrats with farm bill gimmes. House Ag Democrats are facing internal tension and uncertainty as they struggle to formulate a response to the GOP's farm bill proposal. In a closed-door meeting, Democrats expressed frustration over the lack of progress in negotiations and pressed Ranking Member David Scott (D-Ga.) for more information on discussions with House Agriculture Republicans. The meeting also involved deliberations on a one-page document outlining the GOP's proposal (see below).

Democrats reportedly remain divided on how to proceed, with no consensus reached on a counteroffer. The meeting did not result in any concrete decisions or votes on specific policies. Despite this, Scott indicated that Democrats will be prepared to respond when necessary, although they have not finalized a counteroffer.

One contentious aspect of the GOP's proposal involves reallocating future nutrition funding, particularly regarding updates to the Thrifty Food Plan, which has sparked controversy among Democrats.

|

CHINA UPDATE |

— Setback in China's economic recovery, particularly in the realm of trade. Here's a breakdown:

- Export slump: China's exports experienced a significant decline of 7.5% in dollar terms in March compared to the previous year. This is worse than what economists had anticipated. This decline in exports is crucial because there were hopes that strong overseas sales would compensate for weak domestic demand and propel economic growth.

- Import decline: Import numbers also disappointed, falling by 1.9% unexpectedly. This suggests that domestic demand within China might be weaker than anticipated.

- Trade surplus: Despite the decline in both exports and imports, China still managed to maintain a trade surplus of nearly $59 billion for the month.

- Impact on growth target: China's goal of achieving around 5% economic growth this year is now facing challenges due to the setback in exports and weak domestic demand. Earlier positive signs in March data had fueled optimism, but this recent trade data is dampening expectations.

- External demand: Expectations that China would rely on demand from other countries to meet its growth targets have led to trade tensions with various countries, including the U.S. and Europe. However, despite the slowdown in March, some contentious areas of China's foreign sales are still growing, such as steel exports.

- Product-specific trends: Certain sectors, such as steel, cars, and semiconductors, have seen growth in exports, while others like fertilizer have experienced significant declines. The decline in phone sales in dollar terms contrasts with an actual increase in the number of phones shipped overseas, indicating price reductions by Chinese firms.

- Economic outlook: The upcoming release of first-quarter GDP data, along with other economic indicators like retail sales and industrial production, will provide a clearer understanding of China's economic outlook.

- Challenges ahead: Falling export prices and persistent deflation in producer prices pose challenges for Chinese firms, as increased demand may not necessarily translate into higher profits. Additionally, the unexpected drop in imports suggests that Chinese consumers, affected by a prolonged real estate downturn, are reluctant to spend, highlighting ongoing economic challenges domestically.

— China’s soybean imports fall to four-year low for March. China imported 5.54 MMT of soybeans last month, according to preliminary customs data, down nearly 20% from last year and the lowest for the month in four years. During the first quarter of 2024, China imported 20.83 MMT of soybeans, down 10.8% from the same period last year and a four-year low.

— Chinese meat imports slow dramatically in Q1. China imported 578,000 MT of meat during March, down 11.5% from last year. For the first quarter of this year, China imported 1.68 MMT of meat, down 270,000 MT (13.8%) from the same period last year. China doesn’t break down meat imports by category in the preliminary data, but the decline is due to reduced pork arrivals.

— USTR Tai suggests end to China tariff review soon. U.S. Trade Representative Katherine Tai hinted that the review of Section 301 tariffs on China, imposed during the Trump administration, could conclude "soon." Although no specific timeline was provided, Tai acknowledged the ongoing statutory four-year review of these tariffs and expressed hope for an imminent announcement of the outcome. Addressing the National Council of Textile Organizations, Tai emphasized the value of input from the textile industry, which has largely supported maintaining the tariffs. Speculation arose regarding the investigation's results, especially concerning the textile industry's concerns. Attention is now focused on Tai's upcoming appearance before congressional trade panels next week, raising questions about whether this will serve as the platform for revealing the findings. However, Tai did not entertain questions from reporters following her remarks at the textile organization's annual meeting.

— U.S. airlines ask Biden admin not to approve additional flights between the U.S. and China. Large U.S. airlines and some of their unions are asking the Biden administration to stop approving any more flights between the United States and China because of what they call “anti-competitive” policies that China imposes on U.S. carriers. Link to AP article.

|

TRADE POLICY |

— Bill introduced to extend the African Growth and Opportunity Act (AGOA) until 2041, providing duty-free access to the U.S. market for about 40 sub-Saharan African nations. The current AGOA, enacted in 2000, is set to expire in 2025. Sens. Jim Risch (R-Idaho) and Chris Coons (D-Del.) spearheaded the legislation, aiming to offer businesses certainty and encourage investment in sub-Saharan Africa. The extension is seen as crucial for boosting economic development and strengthening U.S. engagement in the region, particularly as companies seek to diversify their supply chains away from China. Last year, President Biden revoked eligibility for AGOA benefits for four nations due to concerns over human rights and democracy.

— USTR confident in U.S. victory over Mexico in GMO corn dispute, focuses on Indo-Pacific trade expansion. In an interview with Politico, USTR's Doug McKalip defends U.S. trade policy and predicts success in the GMO corn challenge with Mexico under USMCA. McKalip emphasizes the importance of science-based decision-making and vows to see the case through.

While avoiding speculation on potential tariff actions against China, he stresses the Biden administration's commitment to diversifying trade partnerships in the Indo-Pacific region.

Despite not pursuing new free trade agreements, efforts are directed towards facilitating agricultural exports by addressing market entry barriers.

Bottom line: McKalip echoes concerns raised by USDA Secretary Tom Vilsack about the trade deficit in the agriculture sector, highlighting challenges posed by a strong U.S. economy and dollar. The administration seeks to reassure the agriculture community amid growing concerns over trade deals and widening trade deficits.

|

ENERGY & CLIMATE CHANGE |

— EPA report: U.S. ag accounted for 10% of emissions in 2022. The Environmental Protection Agency’s annual report (link) on U.S. greenhouse gas emissions said that agriculture accounted for 10% of emissions in 2022, a level consistent with estimates in recent years.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Eight states now have confirmed BIAV/HPAI in dairy herds. USDA has now added South Dakota to the list of states where has been confirmed Bovine Influenza A Virus (BIAV) in dairy cattle. As of April 10, USDA said that cases are now confirmed in Texas, New Mexico, Kansas, Michigan, Ohio, Idaho, North Carolina, and South Dakota.

— USDA report: Military food insecurity double civilian rate. A USDA report (link) sheds light on a troubling issue within the U.S. military: food insecurity. The findings indicate that a significant proportion of military personnel, around 25.3%, have experienced food insecurity, a rate more than double that of the civilian population, which stands at 10.1%.

The data highlights specific demographics within the military that are particularly vulnerable to food insecurity. This includes active-duty personnel under the age of 25 who identify as belonging to minority groups and whose spouses are unemployed. Despite typically earning higher incomes and having more stable employment compared to civilians with similar education levels, military families encounter unique challenges that contribute to food insecurity. Factors such as long working hours, frequent deployments, and relocations present obstacles for military spouses in securing employment, thereby affecting household income levels.

Addressing food insecurity within the military necessitates a multifaceted approach that acknowledges the complexities of the issue. It is not solely an economic concern but also one influenced by the unique circumstances and challenges faced by military families. Comprehensive efforts are required to support military households in accessing sufficient nutrition, which may involve targeted interventions aimed at improving employment opportunities for spouses and addressing structural barriers within the military community.

|

HEALTH UPDATE |

— Drug shortages. During the first quarter of 2024, the U.S. experienced a record-high level of drug shortages, with 323 medications affected, according to data from the American Society of Health-System Pharmacists. This marks the highest level since tracking began in 2001. While shortages impact various drug classes, particularly concerning are generic sterile injectable medications, such as chemotherapy and emergency drugs. Factors contributing to shortages include disruptions in the supply chain, intense price competition, and high demand, as seen with popular weight-loss drugs.

— U.S. has seen over 100 measles cases this year, prompting concern from the CDC about a potential resurgence of the disease, endangering the country's status of measles elimination achieved in 2000. Between January 2020 and March 2024, there were 338 reported cases. A significant portion (96%) of these cases were linked to international travel, with 61% occurring among unvaccinated or undervaccinated U.S. residents. Health experts stress the importance of vaccination coverage to prevent prolonged outbreaks in the U.S., even as imported cases are expected.

|

POLITICS & ELECTIONS |

— Texas Ag Commissioner Sid Miller is at the top of former President Donald Trump’s early list of potential second-term USDA chiefs, Politico reports. The report (link) suggests that if President Trump were to secure a second term, he might consider nominating Sid Miller, a controversial figure for the top post at USDA. This prospect has stirred significant discussion and concern within political circles, as Miller's appointment would mark a significant departure from past leadership at USDA and could have far-reaching implications for agricultural and food policy. As Agriculture Secretary, the report says Miller would likely oversee efforts to reverse the Biden administration's initiatives aimed at addressing climate change in agriculture and reducing the size of nutrition programs for low-income Americans. Additionally, while Politico says he could play a crucial role in shaping the next farm bill, a major legislative package that affects agriculture, nutrition, and rural policy, history shows farm-state lawmakers are the key in writing the farm bill, not the Agriculture secretary.

However, Miller's potential nomination faces obstacles, not only from Democrats but also from within the GOP. Some Republicans are skeptical of Miller's suitability for the role, citing his past conflicts with fellow Republicans and agricultural groups in Texas. Concerns about his willingness to heed advice and his history of ethics investigations have raised doubts about his candidacy.

Despite the criticism, Miller remains defiant, dismissing detractors as "the Establishment" and suggesting that their opposition is a sign of his effectiveness in advocating for farmers and ranchers. Nevertheless, some former Trump officials doubt that Trump would ultimately choose someone as divisive as Miller for the USDA position, considering the opposition he faces within the GOP.

Other potential candidates. While Miller is a prominent and polarizing figure among those being considered for the USDA job, other potential candidates, such as Kip Tom and Sherry Vinton, have also been mentioned in discussions about the post. Ultimately, whether Miller or another candidate with more policy experience is selected will depend on various factors, including political considerations and Trump's preferences.

— Can the GOP supersize a Senate majority? Rather than looking at whether Republicans will seize control of the Senate, Charlie Cook writes (link) the better question is whether their majority will be small, medium, or large.

|

OTHER ITEMS OF NOTE |

— Cotton AWP declines further. The Adjusted World Price (AWP) for cotton is at 65.43 cents per pound, effective today (April 12), down from 69.48 cents per pound the prior week and the sixth straight weekly decline. However, the AWP remains more than 13 cents above a level that would trigger an LDP. Meanwhile, USDA said that Special Import Quota #26 would be established April 18 for the import of 31,702 of upland cotton, applying to supplies purchased no later than July 16 and entered into the U.S. no later than Oct. 14.

— President Joe Biden canceled $7.4 billion of student debt in another round of loan forgiveness Friday, pushing ahead with his signature relief programs in the face of fierce Republican opposition to the issue that’s a flashpoint in the 2024 elections.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |