Bloomberg: Vilsack Links China's Reduced Ag Purchases to U.S. Policy Shifts

Brazil ethanol policy shows weakness of U.S. trade policy

|

Today’s Digital Newspaper |

MARKET FOCUS

- President Biden warns of an Iranian attack on Israeli assets

- The dollar is spiking

- Goldman Sachs & Morgan Stanley raise outlook for China’s economic growth this year

- Shifting expectations regarding Fed’s monetary policy, particularly concerning rates

- U.S. wholesale prices rose 0.2% in March, less than expected

- ECB maintains rate; Lagarde hawkish in briefing comments

- European gas futures surged by 5%, near highest level in two months

- Ag markets today

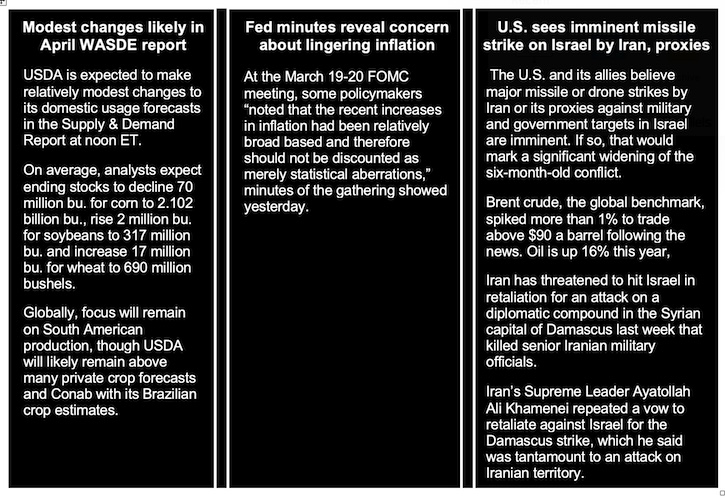

- Modest changes likely in April WASDE report

- Brazil's agricultural potential: Expanding cropland and overcoming challenges

- Ag trade update

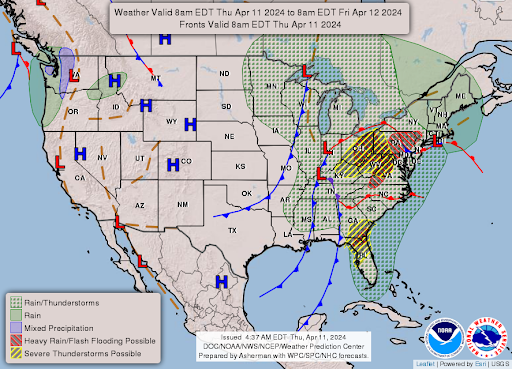

- NWS weather outlook

- Pro Farmer First Thing Today items

BALTIMORE BRIDGE COLLAPSE

- NTSB probes Dali ship's electrical system after Key Bridge collision

- Maryland Gov. Moore explores options to rebuild collapsed Baltimore bridge

CHINA

- Chinese inflation stalled in March, barely increasing from a year prior

- Vilsack links China's reduced ag purchases to U.S. policy shifts

- Modest U.S. ag product sales to China continue

- Chinese buyers cancel more Ukrainian corn cargoes

- China raises corn, cotton import forecasts

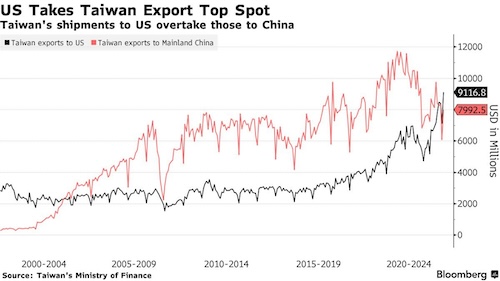

- U.S. again is largest destination for Taiwan’s exports

TRADE POLICY

- WTO conference addresses trade policy uncertainty and potential Trump tariffs

ENERGY & CLIMATE CHANGE

- Senate leadership joins call for year-round E15 with emergency action this summer

- Brazil intends to uphold tariffs on U.S. ethanol to safeguard its domestic industry

- Cleaner energy and big infrastructure investments to reverse decline of family farms

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- BIAV detected in North Carolina

- States taking measures to prevent spread of BIAV by blocking cattle movement

OTHER ITEMS OF NOTE

- U.S. rule to limit ‘forever chemicals’ in drinking water to cost $1.5 billion annually

|

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened around 100 points higher but is currently down around 250 points. In Asia, Japan -0.4%. Hong Kong -0.3%. China +0.2%. India closed. In Europe, at midday, London -0.3%. Paris -0.2%. Frankfurt -0.6%. U.S. Fed officials scheduled to speak include John Williams, Thomas Barkin, Susan Collins and Raphael Bostic.

U.S. equities yesterday: All three major indices fell after inflation data came in stronger than expected and finished the session with losses. The Dow dropped 422.16 points, 1.09%, at 38,461.51. The Nasdaq fell 136.28 points, 0.84%, at 16,170.36. The S&P 500 lost 49.27 points, 0.95%, at 5,160.64.

— Ag markets today: Corn, soybeans and wheat held in tight ranges during relatively quiet overnight trade ahead of USDA’s April crop reports later this morning. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents higher, soybeans were 4 to 5 cents lower, SRW wheat was 2 to 3 cents lower, HRW wheat was unchanged to 2 cents lower and HRS wheat was 1 to 4 cents lower. Front-month crude oil futures were around 50 cents lower, and the U.S. dollar index was trading just above unchanged.

Wholesale beef prices tumble. Wholesale beef prices dropped $3.86 for Choice and $3.88 for Select on Wednesday, with both now back below the $300.00 mark. Choice beef spent two days above that level, while Select only lasted one day above it. Packer cutting margins remain deep in the red, which will keep them on limited slaughter schedules and reduce needs for cash cattle purchases.

Pork margins weakening. The seasonal rise in the cash hog market is strengthening, with the CME lean hog index up another 90 cents to $88.78 as of April 9. Wholesale pork prices aren’t keeping pace, falling 46 cents on Wednesday. As a result, packer margins have tightened, with some now cutting in the red.

— Agriculture markets yesterday:

- Corn: May corn rose 3 cents to $4.34 1/4, ending nearer the session high.

- Soy complex: May soybeans fell 9 3/4 cents at $11.64 3/4, nearer the session low and hit a four-week low. May soybean meal closed down $4.70 at $330.90 and near the session low. May bean oil rose 8 points at 47.60 cents, nearer the session high after notching a four-week low early on.

- Wheat: May SRW wheat rose 3/4 cent to $5.58 1/2, near the session low, while May HRW rallied 17 1/4 cents to $5.94 1/2 and marked the highest close in nearly a month. May HRS wheat rose 1/2 cent to $6.51 3/4.

- Cotton: May cotton futures fell 73 points at 85.31 cents and near the session low. Prices hit a nine-week low.

- Cattle: Live cattle and nearby April feeder futures gave back a big portion of early-week gains, whereas deferred feeders dipped to fresh for-the-move lows. April live cattle dropped $1.625 to $179.075, while most-active June futures tumbled $2.00 to $172.85. Expiring April feeder futures dove $2.425 to $238.275, while the May contract plunged $3.925 to $236.525.

- Hogs: June lean hog futures plunged $3.025 to $105.55, though it closed off session lows. Expiring April futures rallied $1.15 to $91.75, settling on session highs.

— Of note:

- The dollar spiked overnight and traders slashed their bets on when — or whether — the Fed would cut interest rates this year. Larry Summers, the former Treasury secretary and a critic of the Fed’s handling of inflation, told Bloomberg that a rate increase can’t be ruled out. Such uncertainty could last for months and complicate President Biden’s bid for a second term.

- “Rate reductions later this year may be complicated by policymakers seeking to avoid the appearance of taking positions on the presidential election campaign, which revs into high gear this summer,” José Torres, an economist at Interactive Brokers, wrote in a client note yesterday. Deutsche Bank economists agree, saying the window for rate cuts could close this year if the inflation data doesn’t cool by July.

- Goldman Sachs and Morgan Stanley raised their outlook for China’s economic growth this year as factory activity and exports accelerate more than expected. China’s economy likely expanded at a 7.5% annualized pace in the first quarter from the prior three months, Goldman economists led by Hui Shan said in a note Wednesday — higher than their 5.6% prior estimate. The bank now sees 2024 growth forecast at 5%, in-line with Chinese policymakers’ target, versus 4.8% previously. Morgan Stanley also lifted its 2024 growth forecast, to 4.8% from 4.2% previously, citing better-than-expected export growth from resilient U.S. demand and robust export volume. Beijing’s increased focus on supply-chain upgrade is also expected to lead to stronger capital expenditure in the manufacturing sector, according to a report dated Wednesday.

— Shifting expectations regarding the Federal Reserve's monetary policy, particularly concerning interest rates. At the beginning of the year, there was a strong consensus among traders that the Fed would cut rates significantly, possibly by as much as 150 basis points. However, the situation has changed, with the first rate cut now only fully priced for November. This change reflects doubts among traders about Fed Chair Jerome Powell's ability to manage a soft landing for the economy. (Some bond traders are readying themselves for a scenario where the Fed doesn’t cut rates at all this year and preparing for yields on 10-year U.S. Treasuries to surpass 5%.)

In the minutes of its latest meeting, the Fed indicated a shift in its stance. Most officials now favor slowing the pace of shrinking its asset portfolio, indicating a more cautious approach to monetary tightening. Additionally, almost all officials agree that cutting rates at some point this year would be appropriate, suggesting a willingness to provide further monetary stimulus if needed.

Some observers say Powell would be wise at his next press conference on May 1 to signal caution about future rate cuts. The Fed’s inflation-fighting credibility is on the line as it works to recover from its pandemic-era mistake of dismissing inflation as “transitory.”

Meanwhile, the real average hourly wage in constant 1982-1984 dollars was $11.11 in March, up from $11.04 a year earlier. Seven cents. Since Biden took office in January 2021, average hourly earnings after inflation are down 2.54%.

The Fed’s preferred gauge, to be released later this month by the Commerce Department, has been running below the CPI. Core inflation using that measure was 2.8% in February.

— U.S. wholesale prices rose 0.2% in March, less than expected. Producer prices in the U.S. were up 0.2% month-over-month in March 2024, the smallest increase in three months, following a 0.6% rise in February and below forecasts of 0.3%. Prices for services rose 0.3%, the same as in February while goods cost went down 0.1%, following a 1.2% rise in the previous month.

— During its April meeting, the European Central Bank (ECB) kept interest rates at historically high levels, maintaining the main refinancing operations rate at 4.5% and the deposit facility rate at 4%. This marks the fifth consecutive meeting without a change in rates. The ECB signaled a potential easing of policy restrictions if it becomes more confident in inflation approaching the 2% target. While acknowledging a continued decline in inflation, especially in underlying measures and wage growth, officials noted persistent domestic price pressures, particularly in services, leading to high inflation in that sector.

Of note: ECB President Christine Lagarde's comments at today's press conference suggest that the timing of the first rate cut is not a done deal yet – and that it's going to be a hawkish move as concerns about inflation reaccelerating remain

Market perspectives:

— Outside markets: The U.S. dollar index was firmer, with the euro, yen and British pound all weaker against the U.S. currency. The yield on the 10-year U.S. Treasury note was higher, trading around 4.55%, with a mostly positive tone in global government bond yields. Crude oil futures were weaker, with U.S. crude around $85.90 per barrel and Brent around $90.25 per barrel. Gold and silver futures were narrowly mixed, with gold firmer around $2,350 per troy ounce and silver weaker around $28.03 per troy ounce.

— Brent crude futures hovered around $90.5 per barrel, with a 1.2% increase in the previous session, driven by concerns about escalating tensions in the Middle East. Ongoing violence in Gaza amid stalled ceasefire negotiations between Israel and Hamas, coupled with U.S. intelligence warnings of potential strikes from Iran, fueled fears of further disruptions to oil supply. Iran, the third-largest OPEC producer, faces heightened geopolitical tensions with Israel, raising concerns about oil production and distribution. Additionally, U.S. crude inventories surged by 5.841 million barrels last week, exceeding market expectations and indicating potential oversupply conditions.

— European gas futures surged by 5% to approximately €29/MWh, approaching their highest level in two months. This increase was propelled by concerns over potential attacks on Ukrainian gas storage facilities and escalating geopolitical tensions in the Middle East. Although Russian assaults on two Ukrainian underground storage sites heightened worries, operations at these facilities remained unaffected. Concurrently, oil prices remained at six-month peaks, driven by mounting concerns about escalating tensions in the Middle East. Additionally, Japanese LNG buyers are actively replenishing inventories, intensifying competition for global supplies, including in Europe. Despite this, the European gas market appears adequately stocked, with current stock levels reaching an all-time high of 60.87% capacity. Moreover, several bearish factors are influencing the market, including forecasts of warmer weather, increased wind power generation, robust French nuclear output, and enhanced Norwegian gas supply.

— Brazil's agricultural potential: Expanding cropland and overcoming challenges. Brazil's potential to significantly expand its agricultural output by converting degraded pastureland into cropland. According to analysts at FarmDoc (link), Brazil could increase its crop area by 35 %, adding approximately 70 million acres of cropland. This expansion could be facilitated by converting overgrazed and overgrown pastureland, particularly in key agricultural states like Mato Grosso. The analysts emphasize the suitability of degraded pastureland for conversion, which refers to land that is overgrazed, overgrown with weeds, and in need of restoration. They note that this doesn't necessarily reflect the productivity of the soil itself.

The potential for expansion isn't solely reliant on converting pastureland. The analysts suggest intensifying land use for second-crop corn, known as safrinha, which could be grown immediately after the soybean harvest each year. Currently, second-crop corn occupies about 40% of soybean land.

Of note: Challenges such as increasing fuel and fertilizer costs, limitations in credit and storage, an overburdened transportation system, and environmental preservation pressures could hinder the long-term growth of Brazilian agriculture. These factors underscore the complexities involved in realizing Brazil's agricultural expansion potential.

— Ag trade update: Japan purchased 121,485 MT of milling wheat via its weekly tender, including 27,470 MT U.S., 58,925 MT Canadian and 35,090 MT Australian. South Korea rejected all offers in a tender to buy up 140,000 MT of optional origin corn.

— NWS weather outlook: Powerful storm system to foster high wind potential over much of the eastern U.S. today with severe weather, heavy rain and flash flood threats for parts of the Southeast, upper Ohio Valley and into the northern Mid-Atlantic... ...High wind threat continues across the Great Lakes, Northeast, and into the Appalachians on Friday into early Saturday as flash flood threat will be confined to northern New England.

Items in Pro Farmer's First Thing Today include:

• Quiet overnight grain trade

• Exchange slashes Argentine corn crop estimate

• Strategie Grains raises EU wheat production forecast

• China to support equipment upgrades, consumer goods trade-ins

|

BALTIMORE BRIDGE COLLAPSE |

— NTSB probes Dali ship's electrical system after Key Bridge collision. The National Transportation Safety Board (NTSB) is investigating the electrical system of the Dali following its collision with the Key Bridge, which resulted in the bridge's collapse. NTSB Chair Jennifer Homendy testified before the Senate Commerce, Science, and Transportation Committee regarding her renomination to lead the agency, emphasizing the focus of the investigation on the ship's electrical system. Collaboration with Hyundai, the manufacturer of the engine-room equipment on the Dali, is underway to examine this system. Initial indications suggest a connection between the electrical system issue and the loss of control experienced by the ship. However, Homendy cautioned that this is preliminary, acknowledging that the investigation may take various directions. A preliminary report on the accident is expected in the first week of May. Homendy also suggested that transportation agencies responsible for managing bridges should assess whether existing protections are adequate to withstand such collisions, considering changes in the shipping industry.

— Maryland Gov. Moore explores options to rebuild collapsed Baltimore bridge, urges swift congressional action. Maryland Governor Wes Moore is exploring various financing options, including private partnerships and accessing capital markets, to rebuild the collapsed Francis Scott Key Bridge in Baltimore if the federal government cannot cover the costs as originally promised. Moore emphasized the importance of considering all possible avenues, including involvement from the public sector, private sector, and philanthropy. Maryland aims to clear the Baltimore channel and restore full service at the East Coast port by the end of May.

President Joe Biden has urged Congress to swiftly approve funds for the rebuilding effort following the bridge collapse late last month, emphasizing the urgency of the situation. However, Congress is currently facing deadlock on multiple fronts, including aid for Ukraine, Israel, and the U.S./Mexico border.

|

CHINA UPDATE |

— Chinese inflation stalled in March, barely increasing from a year prior and with a continued slump in industrial prices, underscoring the deflationary pressures facing the country’s economic recovery. In March 2024, China's consumer prices experienced a slight increase of 0.1% year-on-year (yoy), falling short of market expectations which anticipated a 0.4% rise. This uptick followed a 0.7% increase in the previous month. The slowdown in consumer price growth was primarily attributed to the diminishing impact of the Lunar New Year festivities. Notably, non-food inflation decelerated to 0.7% from 1.1% in February, driven by a sharp moderation in education costs (1.8% compared to 3.9% previously) and further declines in transport prices (-1.3% compared to -0.4%). However, inflation remained unchanged for clothing (1.6%), housing (0.2%), and health (1.5%).

On the food front, prices experienced a steeper decline of -2.7% compared to the previous month's -0.9%, primarily due to decreases in pork and fresh vegetable costs following increases in February. Core consumer prices, which exclude food and energy prices, increased by 0.6% yoy in March, marking a slowdown from the previous month's 1.2%, which was the quickest rise since January 2022.

Month-on-month, the Consumer Price Index (CPI) decreased by 1.0%, indicating the first decline in four months and a reversal from the 1.0% rise observed in February. This decline surpassed estimates of a 0.5% drop, indicating the most substantial monthly fall in three years.

— Vilsack links China's reduced agricultural purchases to U.S. policy shifts. USDA Secretary Tom Vilsack suggests that China's reduced purchases of American agricultural products, particularly corn and soybeans, may be linked to recent actions taken by the U.S., such as restrictions on foreign ownership of American farmland, according to a Bloomberg interview with Vilsack (link). Vilsack pointed out that China's agriculture minister mentioned Arkansas' enforcement of legislation forcing a Chinese-controlled company, Syngenta AG, to sell farmland. This action, taken under laws banning certain foreign entities from owning Arkansas farmland, could be seen as part of a broader pattern of Chinese retaliation against U.S. agricultural products.

Vilsack highlighted that China's purchases of US agricultural products have decreased by $6 billion compared to the previous year, and he questions whether this decline is solely due to increased purchases from Brazil or if there are other factors at play. He suggests that China's mention of Syngenta in discussions with him was a "signal" of their displeasure with U.S. actions.

Vilsack emphasizes the need for the U.S. to diversify its agricultural trade partners beyond China, suggesting closer collaboration with countries in Asia, Africa, and Latin America. However, he also expresses the desire to maintain trade relations with China despite the current challenges.

Of note: As a result of China's reduced purchases from the U.S., Brazil has become the world's leading exporter of both corn and soybeans, surpassing the United States in both commodities.

— Modest U.S. ag product sales to China continue. Weekly export sales data from USDA continues to show only modest activity to China, with data the week ending April 4 including net sales of 576 metric tons of wheat, 66,439 metric tons of corn, 73,201 metric tons of sorghum, 69,346 metric tons of soybeans, and 50,201 running bales of upland cotton. Activity for 2024 included net sales of 1,827 metric tons of beef and 7,153 metric tons of pork.

— Chinese buyers cancel more Ukrainian corn cargoes. Chinese importers won’t take delivery of four or five cargoes of Ukrainian corn previously booked for delivery between April and June, people familiar with the matter told Bloomberg. The sources noted more shipments could be canceled. The cancellations come after Chinese customs officials asked traders to limit deliveries of foreign corn into bonded areas in a move aimed at easing domestic oversupply and supporting prices for farmers before the planting season, as we reported last week. Traders can bring corn into bonded areas to be blended with other ingredients into animal feed, before importing it at a lower tax rate.

— China raises corn, cotton import forecasts. China’s ag ministry raised its forecast for 2023-24 corn imports by 2.5 MMT to 20 MMT, which would be up 1.29 MMT (6.9%) from last year. The ministry stated, “However, it is expected that the quantity entering market circulation will be limited and import volumes will decline significantly in the later period.” The ag ministry raised its 2023-24 cotton import forecast by 300,000 MT to 2.3 MMT, which would be up 870,000 bales (60.8%) from last year.

— U.S. once again is largest destination for Taiwan’s exports after decades of China sitting atop the list, new data showed this week. Details:

|

TRADE POLICY |

— WTO conference addresses trade policy uncertainty and potential Trump tariffs. During a press conference at the World Trade Organization (WTO), a reporter initially inquired about the rationale behind the recently released 2025 forecast and then directly addressed the potential impact of a return to the White House by former President Trump in January, particularly concerning his threats of imposing further tariffs on China.

WTO Chief Economist Ralph Ossa responded by highlighting the global uncertainty caused by numerous elections in approximately 50 countries, which contributes to policy and trade policy uncertainty. Ossa likened the WTO's role to that of a central bank, emphasizing the importance of managing not only trade costs but also expectations regarding trade costs. He stressed the significance of a rules-based trading system in reducing trade policy uncertainty compared to a power-based system. This exchange underscored the WTO's challenge in managing trade cost expectations, especially as international commerce transitions toward more digital transactions lacking globally agreed-upon rules.

WTO Senior Economist Coleman Nee elaborated on the forecasts, mentioning the inclusion of an "error range" but acknowledging the difficulty in predicting political variables. Nee highlighted the volatility of trade growth, which could range from as high as 5.8% to as low as minus 1.6% this year, surpassing the volatility of global GDP growth.

|

ENERGY & CLIMATE CHANGE |

— Senate leadership joins call for year-round E15 with emergency action this summer. The Senate leadership, including Majority Whip Dick Durbin (D-Ill.) and Minority Whip John Thune (R-S.D.), urged the Biden administration to permit the sale of E15 fuel year-round, extending the Reid vapor pressure (RVP) waiver nationwide for the summer driving season (June 1-Sept. 15). They addressed this request to President Biden, EPA Administrator Michael Regan, Energy Secretary Jennifer Granholm, and USDA Secretary Tom Vilsack.

The lawmakers highlighted ongoing global energy concerns, particularly citing the Russian invasion of Ukraine and Iran-backed aggression in the Middle East, as reasons to support E15 sales.

They also pointed out the EPA's decision to postpone the allowance of E15 in eight states until 2025.

Given past practice, it's expected that the Biden administration will grant the emergency action for 2024 as it did in 2022 and 2023. This action typically occurred on the last business day of April due to April 30 being a weekend day in those years.

Of note: The emergency waivers are only valid for 20 days and a total of seven waivers were issued during 2022 and 2023 to cover the entire summer driving season.

Link to the Renewable Fuels Association, U.S. Grains Council and Growth Energy jointly submitting comments within the Brazilian Chamber of Foreign Trade (CAMEX) regarding the Brazilian tariff on imported U.S. ethanol.

— Brazil intends to uphold tariffs on U.S. ethanol to safeguard its domestic industry, as stated by Agriculture Minister Carlos Favaro during a sugarcane industry conference. Favaro emphasized the need to avoid endangering Brazilian producers. Brazil is considering exporting ethanol to the U.S., and one potential strategy to adjust tariffs involves increasing levels under the Renewable Fuel Standard (RFS). This adjustment could lead to a reduction in tariffs on U.S. ethanol imports, aiming to create a larger market for both countries.

Of note: This moves places U.S. ethanol at a disadvantage, despite Brazilian ethanol enjoying duty-free access to the U.S. market and additional incentives under various U.S. environmental standards.

In March this year, Reps. Darin LaHood (R-Ill.) and Randy Feenstra (R-Iowa) led two letters to the Biden administration urging greater action in developing new markets for biofuels exports and calling on U.S. Trade Representative Katherine Tai and U.S. Secretary of Agriculture Tom Vilsack to continue working towards the full repeal of Brazil’s 18% tariff on American ethanol. Both LaHood and Feenstra serve on the House Ways and Means Committee, which enjoys jurisdiction over federal trade policy. In one letter, the lawmakers wrote, “As you know, on Feb. 1, 2023, CAMEX reinstated an import tariff on American ethanol exported to Brazil. Ethanol from the United States is subject to a 16% tariff, expected to rise to 18% this year, while ethanol shipped to the United States from Brazil receives duty-free treatment. Moreover, Brazilian ethanol imports are incentivized under the U.S. Renewable Fuels Standard and the newly created 40B Sustainable Aviation Fuel tax credit, as well as California’s, Oregon’s, and Washington’s Low Carbon Fuel Standard program. This treatment is not reciprocated for American corn ethanol in Brazil.”

— U.S. is banking on a shift towards cleaner energy and substantial infrastructure investments to reverse the decades-long decline of family farms, aiming to create new revenue avenues for growers and enhance their competitiveness globally. USDA Secretary Tom Vilsack, during an interview with Bloomberg, highlighted the need for change to prevent further loss of agricultural land and is directing significant funds towards climate-friendly farming practices, including opportunities in sustainable aviation fuel markets.

Initiatives also focus on enabling farmers to monetize excess renewable electricity and explore new selling avenues such as local markets and exports to regions like Africa and Latin America.

Despite challenges in reducing carbon footprints quickly enough, Vilsack anticipates rapid growth in crop-based sustainable aviation fuel (SAF) investment, especially with forthcoming federal tax credits.

The strategy aims to strengthen small farmers and rural communities while boosting America's position in global markets through improved infrastructure. Vilsack said his approach is not about taking on crop-handling behemoths like Cargill Inc. and Archer-Daniels-Midland Co. “This is about saying we ought to be able to create more options, and then the farmer can make the decision about what is best for his or her operation,” he said. “That’s the beauty of this — it complements, it doesn’t compete.”

Of note: While he declined to comment directly on this year’s elections, Vilsack said he sees little risk in a new administration coming in and possibly rolling back efforts to help rural America, as the shift toward clean energy will be hard to stop. He said farmers 10 years ago would have said “no thank you” to climate-smart programs, but now farm groups and growers are increasingly understanding the benefits.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— BIAV detected in North Carolina. Bovine Influenza A Virus (BIAV) was detected in a dairy herd in North Carolina, the state’s Agriculture Commissioner Steve Troxler said. This is the 21st case of BIAV and North Carolina is the seventh state with an outbreak of the virus, joining Texas (9), New Mexico (4), Kansas (3), Michigan (2), Ohio (1) and Idaho (1).

— States are taking measures to prevent the spread of BIAV by blocking cattle movement from areas where it has been detected in dairy cattle. A total of 17 states are now enforcing bans on the entry of dairy cattle from states where BIAV cases have been confirmed, following the initial cases identified in late March. These states include Alabama, Arizona, Arkansas, California, Delaware, Florida, Hawaii, Idaho, Kentucky, Louisiana, Mississippi, Nebraska, North Carolina, Pennsylvania, Tennessee, Utah, and West Virginia.

Of note: Despite these state-level actions, the federal Animal and Plant Health Inspection Service (APHIS) has stated in its April 2 guidance that it will not issue federal quarantine orders, nor is it recommending any state regulatory quarantines or official hold orders on cattle. Instead, APHIS strongly advises minimizing cattle movement as much as possible and discourages the transportation of sick or exposed animals. For those instances where cattle movement is unavoidable, APHIS recommends practicing "due diligence" by producers, veterinarians, and animal health officials. Additionally, APHIS suggests conducting premovement testing of milk samples from lactating cows and nasal swabs for non-lactating cattle.

|

OTHER ITEMS OF NOTE |

— Compliance with the first-ever U.S. rule to limit "forever chemicals" in drinking water is expected to cost about $1.5 billion annually, according to EPA, although an industry body expects the cost to be more than three times the amount. While American Water Works and California Water Service said they are prepared to meet the new standards, they are both pursuing government funding to mitigate compliance costs.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |