Republicans to Counter Stabenow Via Crop Insurance Proposal to be Unveiled Today

U.S. deficit soars; interest on debt now more than defense outlays

|

Today’s Digital Newspaper |

Different format today as I am en route to Salt Lake City for a speaking event.

— Equities: Investors are waiting for March’s consumer price index report on Wednesday as the latest gauge on inflation. CPI is expected to show an increase of 0.3% last month. But analysts expect that core CPI, which strips out the volatile fuel and food price fluctuations, could cool to 3.7%, from 3.8%. The New York Fed’s monthly inflation survey yesterday showed that respondents think inflation will rise by about 3% during the next year. That’s still above the Fed’s 2% target, but it would be below the projections for tomorrow’s CPI data. In Asia, Japan +1.1%. Hong Kong +0.6%. China +0.1%. India -0.1%. In Europe, at midday, London +0.1%. Paris -0.5%. Frankfurt -0.7%.

— Gold hits record high for eighth straight day. Gold prices posted a record high for an eighth consecutive day overnight on support from speculative buying and geopolitical tensions. Traders are waiting for the Fed monetary policy meeting minutes and U.S. consumer inflation data on Wednesday for fresh signals on the path of interest rates, which appears it will be higher for longer. Elevated interest rates usually constrain the appeal of holding non-yielding gold, but traders have been ignoring this factor. Spot silver prices hit their highest level since June 2021 during overnight trade.

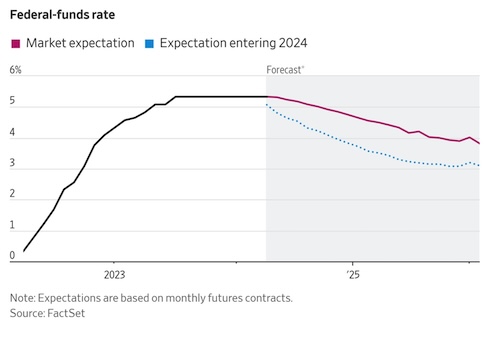

— Economists are now predicting increased growth alongside a sustained period of higher inflation and interest rates. Traders are anticipating fewer than three rate cuts this year, which is a departure from the Fed's own projections. Initially, there were expectations for up to six rate cuts in 2024 due to a slowing economy and weakening labor market, but this outlook has significantly shifted.

— The federal budget deficit in the first six months of fiscal 2024, ending in March, reached $1.064 trillion, according to the Congressional Budget Office (CBO). While tax revenue increased by 7% from the previous year to $2.19 trillion, individual income tax, payroll tax, and corporate income tax all saw significant rises. Total government outlays for the period increased by 6% to $3.25 trillion, with Medicare payments rising by 10% and Social Security benefits by 9%. Entitlement spending, including Medicare and Social Security, is a primary driver of deficits and debt.

Of note: There was a significant increase in net interest on federal debt held by the public, which rose by 43% to $440 billion. This increase in interest payments now exceeds defense spending, highlighting the substantial burden of debt on the budget.

— Grains weaker overnight. Corn, soybeans and wheat faced pressure during a lightly traded overnight session. As of 7:30 a.m. ET, corn futures were trading a penny lower, soybeans were 3 to 4 cents lower, winter wheat markets were 6 to 9 cents lower and spring wheat was 4 to 6 cents lower. Front-month crude oil futures were trading just above unchanged, while the U.S. dollar index was around 100 points lower.

— USDA daily export sale: 124,000 metric tons of soybeans for delivery to unknown destinations during the 2023-2024 marketing year.

— Strong gains in wholesale beef prices. Wholesale beef prices jumped $4.90 for Choice and $5.57 for Select on Monday, hinting the market may be stabilizing after recent heavy price pressure. Both categories pushed above the $300.00 level, with Choice at $302.07 and Select at $300.27.

— Strong day for wholesale pork, too. The pork cutout value firmed $2.58 on Monday, fueled by an $11.40 rise in primal bellies. The cutout topped $100.00 for the first time since September of last year. The CME lean hog index is up another 74 cents to $87.05 as of April 5.

— One-quarter of Mato Grosso’s corn will go to ethanol production. The Mato Grosso Institute of Agricultural Economics (Imea) estimates the state’s corn production at 45.29 MMT this year, with 11.65 MMT (25.7%) expected to be utilized for ethanol production. Mato Grosso’s corn exports are projected to fall 18.2% from last year to 24.39 MMT, including 4.54 MMT to other Brazilian states.

— ERP Phase 2 payments continue to edge higher. Payments under Phase 2 of the Emergency Relief Program (ERP) moved up slightly to $885.69 million as of April 7, up from $885.17 million the prior week. But the increase was not enough to move adjust total ERP payments which stand at $8.64 billion. ERP Phase 1 payments are at $7.75 billion.

— Key Senate Republicans from the Agriculture Committee today will introduce a new bill aimed at improving the affordability of crop insurance, in opposition to Senate Democrats' approach on the issue. This move directly challenges the proposal put forth by Senate Ag Chair Debbie Stabenow (D-Mich.) earlier in the year, which focused on offering lower-cost crop insurance options but required producers to opt out of certain risk management programs (ARC/PLC) to maintain funding for farm bill nutrition and climate initiatives.

The Republican bill, called the FARMER Act and led by Sens. John Hoeven (R-N.D.) and John Boozman (R-Ark.), aims to make crop insurance more accessible without mandating producers to opt out of other risk management programs. It includes provisions to increase premium support for certain coverage levels and enhance the Supplemental Coverage Option. Details on how the bill will be funded remain unclear.

Republicans plan to unveil their bill during a press conference today, but they are not expected to discuss specifics regarding funding or their broader farm bill framework.

— Vilsack calls for agricultural market competition boost at antitrust conference. During an antitrust conference hosted by the Federal Trade Commission and Justice Department, USDA Secretary Vilsack highlighted the need for more efforts to promote competitive markets in the agricultural sector. He specifically mentioned plans to revitalize the Packers and Stockyards Act, a competition law dating back to 1921. USDA has already finalized two rules aimed at clarifying this law and bringing transparency to contracts between poultry farmers and companies. Vilsack indicated that additional rules would be advanced this year to further reform the system for poultry producers, aiming for better balance.

Vilsack underscored the importance of educating both the public and lawmakers about the administration's anti-monopoly efforts to prevent a repeat of past congressional resistance, which hindered reform during the Obama administration. Vilsack emphasized the need for effective messaging to garner support and avoid opposition, particularly from industries such as the meat sector, which has threatened legal action against USDA's competition regulations. Vilsack views this as a continuation and expansion of efforts over the past three years, aiming to secure broader understanding and backing to avoid obstacles like riders in appropriations bills.

— Norfolk Southern agrees to pay $600 million in a class-action lawsuit settlement related to an Ohio train derailment in February 2023, according to the Associated Press. The company said Tuesday that the agreement, if approved by the court, will resolve all class action claims within a 20-mile radius from the derailment and, for those residents who choose to participate, personal injury claims within a 10-mile radius from the derailment.

— The National Pork Producers Council (NPPC) is lobbying Congress to address state animal welfare laws within the farm bill. They emphasize the negative impacts of California's Prop 12 law, including higher prices and reduced availability of pork. NPPC is seeking bipartisan support for federal legislation to preempt state laws and ensure consistency across states. While standalone legislation like the EATS Act hasn't passed, NPPC remains hopeful for a solution in the next farm bill.

“We are looking forward to the farm bill as finding a federal solution for Prop 12,” said NPPC President Lori Stevermer, regarding a legislative fix. “That's what the Supreme Court said — it's an issue and it said that Congress needs to fix it — so we're looking to Congress to fix it. Stevermer said some of the negative impacts of the law warned about by NPPC and other opponents have come to pass. “We're seeing prices of select pork products [that are] 20% higher in California now that Prop 12 is in effect, versus before Prop 12. We're also seeing consumption of fresh pork declining 8% to 10%,” she noted, citing reduced availability and higher prices for the decline.

NPPC CEO Bryan Humphreys added that those impacts are “exactly what [USDA Secretary Tom Vilsack] was referring to when he testified before Congress about the chaos that would ensue, partially in California for consumers, but also with a patchwork across the country, making it almost impossible for producers to comply.”

— Rep. Abigail Spanberger (D-Va.) is urging USDA to address supply chain issues following the collapse of the Key Bridge in Baltimore. She emphasizes the importance of USDA communicating with producers to assess the impact of the bridge collapse on their operations and connecting them with available resources to alleviate supply chain disruptions. Spanberger believes that such actions from USDA can be pivotal in helping agricultural businesses affected by the crisis to navigate through it and maintain their operations. Additionally, she calls on USDA to inform Congress whether legislative action is necessary to tackle the challenges posed by this crisis for the agriculture sector.

— Russian grain exporter RIF has ceased operations at the Azov terminal due to a dispute with Russian authorities, resulting in a slowdown of grain exports. Petr Khodykin, speaking to Reuters, stated that the company's activities are obstructed, preventing them from shipping goods, and they have halted both receiving and shipping agricultural products. The Russian agricultural watchdog, Rosselkhoznadzor, reported an uptick in complaints from importing nations regarding noncompliance with grain quality and quarantine standards, specifically mentioning RIF's supplies. In March, RIF had grain-loaded ships unable to depart due to the absence of phytosanitary certificates. While certificates have since been issued, seven vessels remain anchored at the port, indicating ongoing repercussions from the stalemate.

— Egypt's Foreign Ministry resolves wheat shipment standoff with Russia. In the recent incident involving two ships carrying wheat, Egypt's Foreign Ministry intervened following a disagreement between Russia's agriculture regulator and a major grain trader, according to Bloomberg. The conflict had resulted in the ships being detained, causing concerns about potential disruptions in Egypt's wheat supply. One of the vessels was permitted to proceed towards Egyptian ports after Cairo's foreign ministry engaged with Russian authorities. The ships, transporting wheat from an export partner of a prominent Russian trader, TD Rif, were initially held back by local authorities citing paperwork issues. Egypt, a significant buyer of wheat, had expected the two vessels, Wadi Almolouk and Wadi Safaga, to depart by the end of March. Rosselkhoznadzor, the Russian agricultural agency, clarified that it does not detain vessels but is responsible for ensuring compliance with the quarantine and phytosanitary requirements of importing countries. The agency previously cited "systematic inconsistencies" in grain safety and quality as the reason for restricting some exports by RIF, the trading company involved.

The Wadi Safaga was eventually issued a phytosanitary certificate on April 4, allowing it to proceed after Egypt's state buyer agreed to accept the cargo. However, details regarding the current status of the ships remain uncertain, with ship-tracking data indicating the Wadi Safaga near Istanbul.

— States, organizations sue Biden admin over EV fuel economy rule. Several states and organizations filed lawsuits against the Biden administration's recent revision of the calculation method for determining the fuel economy of electric vehicles (EVs). The Department of Energy (DOE) published a final rule on March 29, which sparked controversy. Critics argue that the DOE overstepped its authority in making these changes and failed to conduct an environmental impact assessment as required by the National Environmental Policy Act.

In their filings with the U.S. Court of Appeals for the Eighth Circuit, the plaintiffs contend that the DOE lacked the statutory power to implement a factor that adjusts the fuel efficiency of electric cars. They also claim that the DOE did not fulfill its obligation to assess the environmental impact of the revised standards.

The DOE's action was prompted by a 2021 petition for rulemaking submitted by the Natural Resources Defense Council and Sierra Club. The American Free Enterprise Chamber of Commerce and attorneys general from several states, including Iowa, Arkansas, Florida, and others, have joined the legal battle against the DOE's decision.

Of note: Legal challenges to regulatory changes typically result in delays to their implementation as the cases proceed through the courts.

— Global backlash against China's exports is intensifying as countries such as the U.S., Europe, Brazil, India, Mexico, and Indonesia impose trade barriers and import-related measures, the Wall Street Journal reports (link). The resistance is fueled by concerns over the influx of cheap Chinese goods, which threaten local suppliers with undercut prices. Efforts by China to boost economic growth through exports are met with growing opposition, highlighting tensions in global trade and the potential for a split in the global economy between those seeking to reduce dependence on China and those aligned with its supply chains.

— China’s Q1 EV sales growth slowest in nearly a year. Sales of electric vehicles (EVs) in China rose 10.5% in March from the same month a year earlier, as automakers deepened discounts and offered financing tools to boost consumer purchases. New energy vehicles, including all-electric models and plug-in hybrids made up 41.5% of overall passenger car sales in March, which jumped 5.7% to 1.71 million vehicles. During the first quarter of 2024, EV sales totaled 1.03 million, up 14.7% from the same period last year — the slowest quarterly growth since the second quarter of 2023, data from the China Passenger Car Association (CPCA) showed.

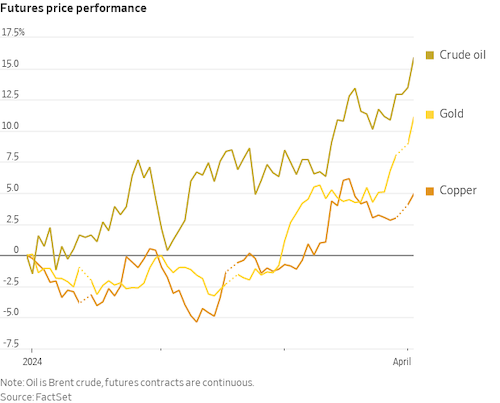

— Raw material prices surge on economic expansion optimism. Rising prices for raw materials used in manufacturing and transportation indicate investor confidence in an extended economic expansion. The S&P GSCI, a global commodities price index, has surged 12% this year, with copper and oil gaining approximately 10% and 17% respectively. Optimism stems from expectations of increased demand from the U.S. and China, along with sustained momentum in industrial supply chains. A report from Macquarie Group suggests that real income growth has stimulated global goods demand, likely pushing commodity prices even higher. This rally contrasts with an 18-month decline following Russia's invasion of Ukraine, which caused prices of oil, natural gas, grains, and industrial metals to soar. However, the surge in industrial material prices also poses a risk of triggering new inflation.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |