Call Me by Your Name: Bovine Influenza A Virus (BIAV)

UC-Davis analysts warn of significant soybean increase for SAF | Trump on abortion

|

Today’s Digital Newspaper |

MARKET FOCUS

- Gold prices reached another record high overnight

- $100 oil is not likely, says Goldman Sachs

- U.S. interest rates: higher for longer

- Fed’s Bowman hints at possibility of further interest rate hikes to combat inflation

- Several countries, including Saudi Arabia, will close financial markets on Wed.-Fri.

- TSMC reveals plans to construct third semiconductor facility in Arizona

- Study: Immigration surge to U.S. driven by Latin America; concentrated in key states

- Jamie Dimon's annual shareholder letter outlines global agenda

- Jamie Dimon said AI may be biggest issue his bank is grappling with

- WSJ: Red Sea crisis fueling surge in international airfreight demand

- Ag markets today

- Ag trade update

- Total solar eclipse over North America

- NWS weather outlook

- Pro Farmer First Thing Today items

BALTIMORE BRIDGE COLLAPSE

- Response crews have commenced removal of shipping containers from Dali

RUSSIA & UKRAINE

- IAEA: Zaporizhia nuclear power station in Ukraine damaged by drone attacks

CHINA

- Yellen: Relationship between the U.S. and China is improving

- Tension mounts between China and EU regarding electric vehicles (EVs)

- China’s grain production increase faces bottleneck. China’s grain production increase faces a bottleneck, state media reported on Monday, without providing details. “Under the current situation where it is increasingly difficult to increase production, my country has launched a new round of action to increase grain production capacity,” state-run newspaper Economic Daily wrote.

- China’s support to regional governments tops 10 trillion yuan for second year

ENERGY & CLIMATE CHANGE

- UC-Davis analysts warn of significant soybean increase for SAF

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- AABP renames emerging cattle influenza to Bovine Influenza A Virus (BIAV)

- CDC issues health alert for BIAV

POLITICS & ELECTIONS

- Trump: Abortion law should be left to the states

OTHER ITEMS OF NOTE

- Biden unveils alternative student-debt relief plan, aims to forgive loans for millions

- Brazil's Supreme Court initiates investigation into Elon Musk

|

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened slightly higher, around 30 points. In Asia, Japan +0.9%. Hong Kong +0.1%. China -0.7%. India +0.7%. In Europe, at midday, London +0.2%. Paris +0.7%. Frankfurt +0.7%.

U.S. equities Friday: The S&P 500 advanced 57.13 points, 1.11%, to end the day at 5,204.34, while the Nasdaq Composite advanced 199.44 points, 1.24%, closing at 16,248.52. The Dow climbed 307.06 points, 0.8%, to settle at 38,904.04.

The benchmark S&P 500 posted its worst weekly performance of the year on Friday and only its fourth overall negative week of 2024.

— Several countries, including Saudi Arabia, will close their financial markets on Wednesday until the end of the week, as Eid al-Fitr marks the end of Ramadan.

— Ag markets today: Corn favored the downside in light trade overnight, while soybeans and wheat had a mixed tone. As of 7:30 a.m. ET, corn futures were trading around a penny lower, soybeans were a penny lower to 1 cent higher, SRW wheat futures were mostly a penny lower, HRW wheat was 4 to 5 cents higher and HRS wheat was fractionally to a penny higher. Front-month crude oil futures were around 75 cents lower, and the U.S. dollar index was modestly firmer.

Bulls on the defensive in cattle market. Cattle futures finished poorly last Friday, posting a technical breakdown and ending virtually on their weekly lows. That sets the cattle market up for followthrough selling to open this week with risk of further active long liquidation. To stop the short-term price decline, there likely needs to be stabilization in the cash cattle and wholesale beef markets.

April hogs hold premium to rising cash index. The CME lean hog index is up another 43 cents to $86.31 as of April 4, continuing the seasonal rise since the beginning of this year. April lean hog futures finished Friday at a $3.015 premium to today’s cash quote. The contract expires on Friday and will be settled against the cash index next Tuesday. May hog futures, which will assume lead-month status, finished last Friday $11.24 above today’s cash quote, while the June contract had a $21.59 premium.

— Agriculture markets Friday and for the week:

- Corn: May corn futures fell 1 cent to $4.34 1/4 and lost 7 3/4 cents on the week.

- Soy complex: May soybeans rose a nickel to $11.85 but lost 6 1/2 cents on the week, while May soymeal fell 40 cents and gave up $4.60 week-over-week. Meanwhile, May soyoil gained 74 points on the day and 94 points on the week.

- Wheat: May SRW wheat futures hit a five-week high today and closed up 11 cents at $5.67 1/4, near mid-range and for the week up 7 cents. May HRW rose 4 3/4 cents to $5.82 1/4, near mid-range and lost 3 cents on the week. May spring wheat rose 1 3/4 cents to $6.48 and gained 3 cents on the week.

- Cotton: May cotton slipped 89 cents to 86.25 cents and plummeted 513 points on the week. Nearby cotton futures slipped to more than a two-month low.

- Cattle: June live cattle futures plunged $3.80 to $172.05, nearer the session low, hitting a three-month low. For the week, June live cattle fell $8.20. May feeder cattle futures lost $5.70 at $238.175, nearer the daily low and hit a three-month low. For the week, May feeders dropped $8.625.

- Hogs: The hog and pork complex continues climbing seasonally. The expiring April hog contract ended Friday having risen 97.5 cents to $89.325, while most-active June jumped $2.90 to $107.90. That represented a weekly advance of $6.45.

— Of note:

- Higher for longer. Former Treasury Secretary Lawrence Summers said the March payroll surge illustrates the Fed is well off in its estimate of where the neutral rate is, and cautioned against any move to lower rates in June.

- Federal Reserve Governor Michelle Bowman hinted at the possibility of further interest rate hikes to combat inflation, suggesting that it may be necessary if progress on inflation stalls or reverses. In prepared remarks for a speech in New York on Friday, Bowman emphasized that while it's not her baseline outlook, the risk of future rate increases remains. Her comments follow a series of cautious statements from Fed officials, including Fed Chair Jerome Powell, indicating a reluctance to cut rates. This uncertainty surrounding future Fed policy has kept markets on edge.

- TSMC, the global leader in semiconductor manufacturing, revealed plans to construct a third semiconductor facility in Arizona. The Taiwanese company is set to receive funding of up to $6.6 billion from the U.S. government, aiming to boost its total investments in America to $65 billion. Despite U.S. eagerness to enhance domestic chip production, TSMC has encountered challenges such as obstinate labor issues and bureaucratic hurdles, which have impeded its progress in the country.

- JPMorgan CEO Jamie Dimon said AI may be the biggest issue his bank is grappling with, saying the technology could “augment virtually every job.”

— Goldman Sachs study: Immigration surge to U.S. driven by Latin America; concentrated in key states. Goldman Sachs Group Inc. has contributed to the growing body of research on the economic ramifications of the recent surge in immigration to the United States. Their analysis, based on court documents, reveals that the majority of unauthorized immigrants in this wave originate from South America, Central America, and Mexico. Moreover, more than half of these new migrants have relocated to Florida, California, Texas, and New York.

According to Goldman economist Elsie Peng, recent adult immigrants are predominantly young or in their prime working age, comprising 90% of the group, compared to 62% of the native-born adult population. Despite their higher labor-force participation rates, these immigrants also face higher unemployment rates than their native-born counterparts. They are often employed in sectors such as construction, food services, and accommodations, where wages are notably lower on average.

— JPMorgan Chase CEO Jamie Dimon's annual shareholder letter outlines a global agenda advocating for America, military strength, trade, capitalism, diversity, equity, and inclusion (DEI), while taking an anti-China stance. His 61-page manifesto, "Dear Fellow Shareholders," may find more favor with Democrats than with MAGA Republicans, even featuring a reprint of a 1992 Wall Street Journal column by George McGovern, described as a liberal presidential nominee.

Notably, Dimon highlights the importance of supporting Ukraine's struggle, aligning it with American interests. His rhetoric invokes patriotic sentiment uncommon in the annual reports of multinational financial conglomerates.

Dimon emphasizes America's unique role in leading and uniting the Western world, asserting that it's paramount for maintaining global freedom and democracy.

Dimon dedicates a significant portion of his letter to defending diversity, equity, and inclusion efforts, particularly focusing on initiatives like JPM's Advancing Black Pathways program aimed at strengthening Black communities' economic foundation.

In terms of foreign policy, Dimon's stance aligns closely with that of President Joe Biden. However, he criticizes bank regulation as duplicative, inconsistent, and costly, indicating a divergence from traditional Democratic policies in this area.

Other highlights:

- Resilient economy but government support raises concerns:

-

- Economy appears strong, with consumer spending and investor confidence indicating a soft landing.

- However, Dimon warns of reliance on government spending and rising deficits.

- Deficits are larger even in economic boom times, fueled by quantitative easing unprecedented since the financial crisis.

- Inflation poses sticky challenge:

-

- Markets estimate 70% to 80% likelihood of a soft landing, anticipating modest growth, declining inflation, and interest rates.

- Dimon suggests the actual odds are lower, indicating potential for persistent inflationary pressures.

- Global uncertainty looms:

-

- Conflicts in Ukraine and the Middle East threaten to disrupt energy and food markets, migration, and economic relationships.

- This instability coincides with a surge in public investment aimed at green transition, supply chain restructuring, trade relationship changes, and increased healthcare spending.

- Industrial policy is needed but should be limited and targeted. Dimon says the U.S. must be tough with China, but engage with Beijing. That includes establishing independence on supplies of materials crucial to national security, like rare earth, semiconductors and 5G infrastructure. (According to Dimon, the Inflation Reduction Act and the CHIPs Act get it right.)

Market perspectives:

— Outside markets: The U.S. dollar index was firmer, with the euro and British pound both weaker against the U.S. currency. The yield on the 10-year U.S. Treasury note was higher, trading around 4.46%, with a higher tone in global government bond yields. Crude oil futures were under pressure, with U.S. crude around $86.25 per barrel and Brent around $90.40 per barrel. Gold and silver futures are continuing their march higher, with gold around $2,352 per troy ounce and silver around $27.70 per troy ounce.

— Gold prices reached another record high overnight, with June Comex gold futures surging to $2,372.50. Broker SP Angel noted in an email dispatch today that this rally has surprised most analysts, particularly given the divergence from its usual correlation with U.S. Treasuries, which have experienced a sell-off in the past month. Additionally, the strength of the U.S. dollar, which typically bears negatively on gold and silver, has not deterred the surge in gold prices. Central bank buying has played a significant role in supporting gold prices, with reports indicating that China's People's Bank of China (PBOC) has been adding to its gold reserves for the 17th consecutive month. This sustained buying has fueled speculation regarding a potential devaluation of the Chinese yuan, along with geopolitical concerns surrounding increased aggression towards Taiwan. These factors have contributed to the continued bullish momentum in the gold market, defying conventional expectations.

— $100 oil is not likely, says Goldman Sachs. The commodities research team at Goldman, led by Dann Struyven, gives three reasons why the Brent price may not reach $100. The first, says Goldman, is that forecasts already assume global oil demand growth of 1.5 million barrels a day, which is above the IEA’s expectations. Second, Goldman says its ”base case assumes no additional hits to supply from any geopolitical escalation.” And third, Goldman reckons that high levels of spare capacity in OPEC+ will encourage the cartel to raise production, with crude supply from the eight countries which announced a package of cuts in June and November last year increasing by 1.2 million barrels per day from July through to November in 2024. “While still a close call, we assume that OPEC+ won’t push oil prices to extreme levels because the 2022 energy crisis showed that extreme prices destroy long-term residual demand for OPEC barrels by boosting non-OPEC supply and boosting capex in alternatives to oil,” says Goldman concludes. The main trigger that would push oil away from Goldman’s base case and above $100 a barrel center on geopolitics, particularly if Middle East tensions trigger a production response from OPEC+ or if Iranian supply is further disrupted.

— Red Sea crisis fueling surge in international airfreight demand, the Wall Street Journal reports (link). Airborne shipping is experiencing unseasonably strong double-digit growth. Increased demand is attributed to strong business from Asia and the Middle East to Europe. Companies are adjusting supply chains in response to geopolitical shock waves and disruptions. Attacks by Yemen's Houthi rebels on commercial shipping in the Red Sea are prompting ocean carriers to take longer routes around Africa. Rising volumes at European seaports are seem farther from the conflict, with more combined sea-air transport through hubs like Dubai. Bottom line: Average spot rates from the Middle East and South Asia to Europe were up 71% in March compared to last year, driving up airfreight prices.

— Ag trade update: Iran purchased 100,000 MT of soymeal expected to be sourced from Argentina or Brazil but made no purchases of corn or feed barley.

— Total solar eclipse over North America. Almost 32 million Americans reside in the eclipse's path, the last total solar eclipse visible in the U.S. for the next 20 years. It occurs when the moon passes directly in front of the sun. Total solar eclipses, where the moon entirely blocks the sun, occur roughly every 18 months but are often only visible from difficult-to-access areas. Only 13 total solar eclipses have been visible in the U.S. over the past century. Millions of Americans are traveling to view the eclipse, with Airbnb rentals booked along prime viewing locations. Eclipse glasses (ISO 12312-2 certified) are recommended to protect eyesight, as the eclipse can disrupt the instinct to turn away from the sun's rays.

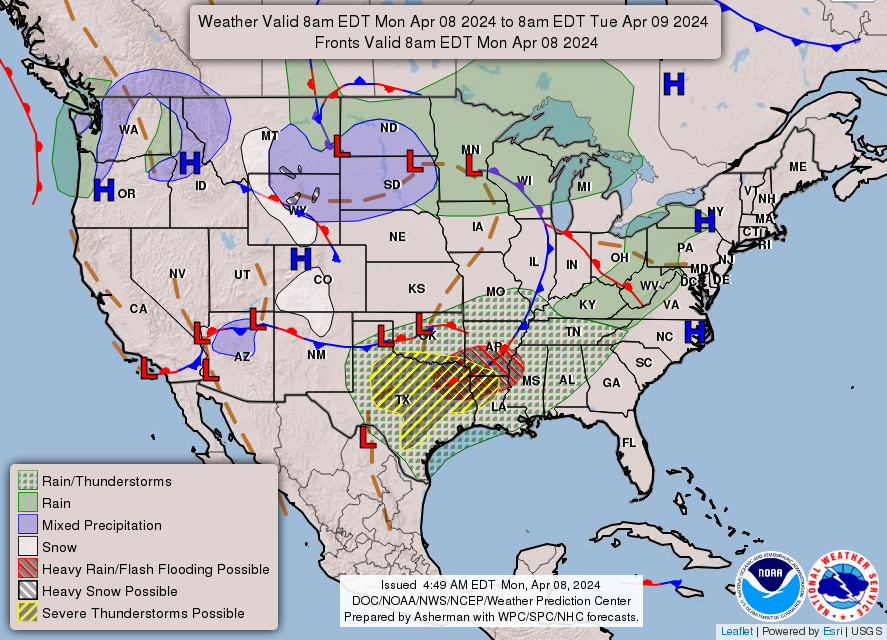

— NWS weather outlook: Northern New England remains the best location for clear viewing of the total solar eclipse this afternoon... ...Lingering wet snow across the Northern Plains expected to taper off later today while locally moderate rain moves across the Upper Midwest... ...Heavy rain, flash flooding and severe weather threat emerging across the Southern Plains to the lower Mississippi Valley on Tuesday... ...Critical fire danger shifts southward into western Texas by Tuesday.

Items in Pro Farmer's First Thing Today include:

• Varied price action in grains overnight

• Smaller Indian wheat crop expected

• Eurozone investor sentiment hits two-year high

|

BALTIMORE BRIDGE COLLAPSE |

— Response crews have commenced the removal of shipping containers from the Dali, the vessel responsible for the collapse of the Francis Scott Key Bridge. This action, facilitated by a floating crane barge, is a significant step toward reopening the Fort McHenry Channel. The Unified Command overseeing the operation is focused on lifting debris off the vessel's bow to alleviate its weight and facilitate movement. Concurrently, efforts are underway to restore normal access to the Port of Baltimore's main shipping channel by the end of May, with President Biden reaffirming federal support for the bridge's reconstruction. Despite challenges posed by adverse weather conditions, progress continues in clearing the channel and facilitating vessel passage.

|

RUSSIA/UKRAINE |

— The International Atomic Energy Agency (IAEA) reported that the Zaporizhia nuclear power station in Ukraine was damaged by drone attacks. Russia, which seized the plant shortly after invading Ukraine in February 2022, accused the Ukrainian armed forces of "nuclear terrorism," while Ukraine denied any involvement. The IAEA condemned the attacks as "reckless" but confirmed that radiation levels remained within normal limits. Meanwhile, Ukraine's President, Volodymyr Zelensky, appealed to international allies for increased air defense support for Kharkiv, Ukraine's second-largest city, which has faced intensified bombardment by Russian forces in recent times.

|

CHINA UPDATE |

— U.S. Treasury Sec. Janet Yellen said the relationship between the U.S. and China is improving as she concluded her six-day visit to China. During her visit, Yellen held discussions with Li Qiang, the Prime Minister of China, and other economic officials regarding China's economic strategy. The U.S. is apprehensive about China's increasing exports of green technology, which is perceived as a move to offset a decline in domestic demand, potentially undercutting foreign manufacturers. Yellen threatened sanctions on Chinese banks and exporters that help bolster Russia’s military capacity. The Treasury Secretary also implored Beijing to fundamentally rethink its economic growth strategy. Link to more on Yellen’s visit via The Week Ahead released Sunday.

— The tension between China and the European Union (EU) regarding electric vehicles (EVs) appears to be persistent. Commerce Minister Wang Wentao conveyed China's firm stance on EVs during a meeting in Paris with EU officials and Chinese EV companies. The meeting aimed to address Chinese investments in the EU's EV sector.

Chinese-made EVs have gained significant traction in the EU market, with their combined market share projected to increase from 19.5% in 2023 to 25.3% in the current year. In response to this success, the European Commission (EC) initiated an anti-subsidy investigation into China's EV exports in September. The EC indicated the possibility of imposing provisional tariffs as early as July, based on evidence of state subsidies found in March.

Wang used the meeting to refute the prospect of tariffs, asserting that Chinese EV companies' growth stemmed from technological innovation, supply chain integration, and market competition, rather than subsidies. He vowed to support companies in defending their rights against such accusations.

China's aggressive expansion in the EV sector poses a significant challenge to European industry, a cornerstone of the EU economy. Brussels is unlikely to tolerate this threat, and is expected to impose tariffs on Chinese EV exports later this year.

Bottom line: Given China's view of its EV industry as crucial for long-term economic and foreign policy objectives, Beijing is likely to respond forcefully to any trade barriers imposed by the EU.

— China’s grain production increase faces bottleneck. China’s grain production increase faces a bottleneck, state media reported on Monday, without providing details. “Under the current situation where it is increasingly difficult to increase production, my country has launched a new round of action to increase grain production capacity,” state-run newspaper Economic Daily wrote.

— China’s support to regional governments tops 10 trillion yuan for second year. The Chinese central government is allocating a budget of 10.2 trillion yuan ($1.4 trillion) for its so-called “financial transfer payments” to regional governments in 2024, according to the Ministry of Finance. That marks the second straight year that the redistributed sum has exceeded 10 trillion yuan. Link for details.

|

ENERGY & CLIMATE CHANGE |

— UC-Davis analysts warn of significant soybean increase for Sustainable Aviation Fuel (SAF). Two UC-Davis analysts in a report (link) highlighted that satisfying Sustainable Aviation Fuel (SAF) goals would require a significant increase in soybean plantings, almost by 50%. Conversely, relying solely on corn ethanol would necessitate a lesser increase in land area, around 9%, due to its higher yields per acre.

Professor Aaron Smith and doctoral student Andrew Swanson, in an article for the American Enterprise Institute, cautioned that a swift expansion into SAFs could reignite debates over the food versus fuel dilemma, potentially prompting changes in land use for conservation and crop production akin to those seen during the implementation of Renewable Fuel Standard (RFS) policies.

To produce 3 billion gallons of SAF by 2030, as targeted by the Biden administration, an estimated 8 to 11 million acres of corn or 35 to 50 million acres of soybeans would be required, depending on the rate of crop yield improvements over the next six years. Currently, SAF production stands at 16 million gallons annually.

Corn and soybeans collectively occupy a substantial portion of agricultural land in the United States, totaling nearly 179 million acres last year. Various strategies can be considered to meet the increased demand for these crops, including reallocating land from other competing crops.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— AABP renames emerging cattle influenza to Bovine Influenza A Virus (BIAV). Much discussion has been going on about the emerging cattle influenza situation. “Because this infection in cattle is not the same as highly pathogenic avian influenza (HPAI), after thoughtful consideration and discussion with many experts,” the American Association of Bovine Practitioners (AABP) will now refer to this as Bovine Influenza A Virus (BIAV) which it says more accurately depicts it. AABP says using BIAV is “consistent with our messaging and better distinguish the disease syndrome in cattle from the pathogenesis observed in birds." The group said their reasoning is that while the virus causes HPAI in birds, it does not cause deaths in cattle as it does in birds and said that they believe it is "important for the public to understand the difference to maintain confidence in the safety and accessibility of beef and dairy products for consumers." USDA's Animal and Plant Health Inspection Service (APHIS) links to details of the virus in mammals and now dairy cattle from their site which tracks HPAI infections and lists the situation in dairy cows as being "Confirmed Cases of HPAI in Domestic Livestock." Link for details.

— CDC issues health alert for BIAV. The Centers for Disease Control and Prevention (CDC) on Friday issued a health alert to inform clinicians, state health departments and the public of a case of BIAV in a person who had contact with dairy cows infected with the virus. The human infection was reported on April 1. To prevent infection from the virus, the CDC recommends the use of personal protective equipment, testing, antiviral treatment, patient investigations, and monitoring of persons exposed to sick or dead, wild and domesticated animals and livestock that may have been infected with the virus.

|

POLITICS & ELECTIONS |

— Trump: Abortion law should be left to the states. Former President Donald Trump stated in a video message that he believes abortion rights should be determined by individual states, a stance he has taken after several months of ambiguity. Trump emphasized that states should legislate on the matter, asserting that their decisions should be binding as the law of the land or state. He also expressed support for exceptions in cases of rape, incest, and threats to the mother's life. Trump's remarks, shared on his Truth Social platform, acknowledge the potential for varying state laws on abortion, noting that states may have different regulations, including differing gestational limits.

This shift in Trump's stance provides Democrats with an opportunity to highlight stringent state abortion laws, such as Florida's six-week ban, which Trump previously criticized as a "terrible mistake." Democrats have already begun leveraging this narrative on social media platforms. The episode underscores the broader challenge facing Republicans nationwide in navigating the aftermath of the Dobbs v. Jackson decision, which significantly rolled back abortion rights under Roe v. Wade just months before the 2022 midterm elections.

|

OTHER ITEMS OF NOTE |

— Biden unveils alternative student-debt relief plan, aims to forgive loans for millions. President Joe Biden introduced an alternative student-debt relief plan that could potentially forgive loans for up to 26 million Americans. This initiative mirrors his original program, which was invalidated by the Supreme Court, and faces similar legal challenges and regulatory hurdles.

The proposal targets borrowers meeting specific criteria, including those with debt surpassing their original principal amount, individuals eligible for federal programs but not enrolled, those who have made payments for over 20 years, attendees of low-value programs, and those facing financial hardship.

According to a White House fact sheet, approximately 25 million borrowers could have accrued interest partially or fully eliminated, over 10 million borrowers might see at least $5,000 in debt cancelled, and 4 million borrowers could have their balances cleared. Additionally, around 2 million eligible individuals could have their loans automatically forgiven.

Senior administration officials anticipate relief for borrowers with accrued interest possibly starting in the fall, but the timeline for full implementation remains uncertain.

Biden, facing a challenging re-election against former President Donald Trump, plans to unveil this proposal in Wisconsin, emphasizing his commitment to addressing college costs. He will meet with borrowers who benefited from previous initiatives during his visit.

The plan relies on the Higher Education Action law and must undergo a comment period before implementation, which could last 30 to 60 days. Some legal challenges have criticized the short timeframe for major regulations.

Since taking office, Biden's administration has already forgiven $146 billion in loans for 4 million individuals, primarily following the Supreme Court's rejection of his previous attempt to cancel up to $20,000 in debt for an estimated 40 million borrowers. This rejection prompted Biden to pursue an alternative "Plan B."

If executed, Biden's plan could potentially provide relief to over 30 million people when combined with actions already taken by his administration.

Next step: Biden's cabinet members, including Vice President Kamala Harris and Education Secretary Miguel Cardona, will be promoting the administration's efforts in various states on Monday.

— Brazil's Supreme Court initiates investigation into Elon Musk. Alexandre de Moraes, the chief justice, launched an inquiry after Musk announced plans to reactivate undisclosed X accounts that Moraes had ordered blocked. The investigation is part of Moraes' probe into "digital militias" allegedly responsible for disseminating disinformation.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |