Congress Returns to Work on Sensitive Issues While Farm Bill Drags On

Aid to Ukraine | House speaker | FISA | Japan PM | Food inflation | WASDE | CPI | Bridge

Washington Focus

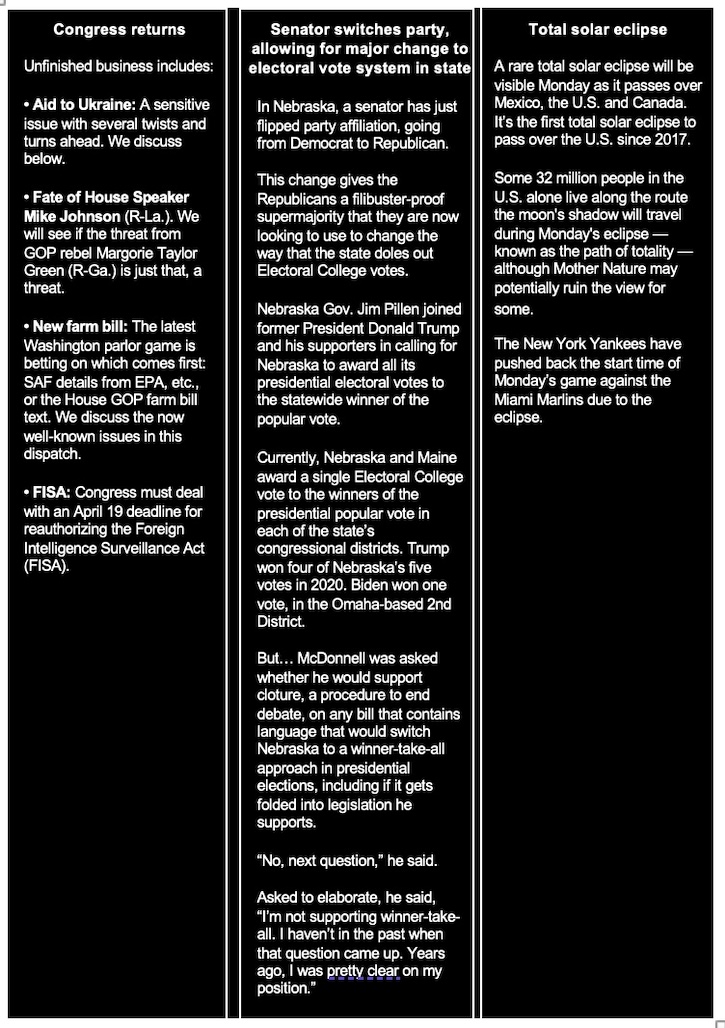

The Senate returns Monday and the House on Tuesday.

— Initial focus will be on the House to see whether GOP rebel Margorie Taylor Green (R-Ga.) follows through with her typical hand grenade move, this time to oust Speaker Mike Johnson (R-La.).

Greene alienated many of her colleagues on the right and got kicked out of the House Freedom Caucus. Moderate Rep. Mike Lawler (R-N.Y.), has called her move against Johnson “idiotic,” while even rebel Rep. Bob Good (R-Va.), the current Freedom Caucus chairman, accused her of “grandstanding.” Even lead-rebel Matt Gaetz (R-Fla.) doesn’t support what Greene has done, despite him being the main thrust in axing former Speaker Kevin McCarthy (R-Calif.).

Johnson has had to rely on Democratic votes to pass legislation and keep the government open, and will likely need them again to push an aid bill for Ukraine. If so, he would be testing Greene and her support, if any.

— President Joe Biden pressed Congress to quickly approve funds to rebuild a collapsed Baltimore bridge. Visiting on Friday the site of a disaster that killed six people and shut a major shipping and transportation artery, Biden said that Baltimore’s port would be able to accept some commercial traffic by the end of April and fully reopen its shipping channel by the end of May, thanks to recovery efforts. But he said the federal government must do more to fully restore the bridge and port, including paying for “all” of the rebuilding costs. “I call on Congress to authorize this effort as soon as possible,” the president said. “We will support Maryland and Baltimore every step of the way to help you rebuild and maintain all the business and commerce that’s here now.”

White House budget director Shalanda Young sent a letter to Congress ahead of Biden’s visit asking for a “100% federal cost share” for rebuilding the bridge. She said that was consistent with a bipartisan measure lawmakers approved in response to a 2007 bridge collapse in Minnesota. Federal officials have told Maryland lawmakers that replacing the 1.6-mile (bridge would cost at least $2 billion, including cleanup. The Department of Transportation has allocated an initial $60 million to defray costs. Biden said he is “committed” to ensuring companies responsible for the catastrophe will “pay to repair the damage and be held accountable to the fullest extent the law will allow.”

— Will mid-April finally be the time when a House GOP farm bill is unveiled? That is what farm bill insider Dr. Joe Outlaw signaled last week. However, other sources say it could be into May before an official unveiling. Key topics:

- Funding: The bill already has baseline spending of $1.51 trillion over ten years. But key Republicans want more. A lot more. While they say there is a need for $75 billion to $100 billion more to handle farm bill funding needs, that will be throttled to a $40 billion to $50 billion funding boost if current indications are accurate.

- Where is the funding coming from? If there is one word that describes this farm bill from others it is “creative,” a word both Democratic and Republican farm-state lawmakers have used for at least a year leading into the latest farm bill saga. Another farm bill phrase of note is “put farm in the farm bill.” To do that, a significant boost in baseline farm bill spending is needed. Where from? Sources say GOP leaders do not plan to cut SNAP. They apparently aim to ensure that the Thrifty Food Plan (TFP) provision of SNAP can’t be used to increase or decrease the program like before. That prevents a big increase but also prevents a cut. Regarding the Inflation Reduction Act (IRA/Climate Bill), GOP farm bill writers say USDA can’t spend it all by Sept. 30, 2031, and it all dries up afterward. Using the amount that would otherwise go down the drain and extending the whole program is a win-win, they argue.

GOP lawmakers and staff have reportedly come up with $40 billion to $50 billion in extra money. Some of the ways would run smack into strong Democratic resistance.

Language tapping USDA’s Commodity Credit Corporation (CCC) is possible if not likely, with “guardrail language” included to make sure any Ag Secretary doesn’t use it for items not to some lawmakers’ acceptance.

But there will likely be additional creative approaches. Farm bill staffers of the past were as good as Federal Reserve officials in “printing money” needed for spending not included in the baseline or as a quick offset for spending elsewhere.

- What will the additional funding be used for? One is increasing reference prices at a variable rate depending on the commodity. Another is improving crop insurance (several possibilities, including encouraging more farmers to buy higher levels of coverage via the traditional program or more incentivized area wide programs like SCO and ECO). Other needs for the additional funding include trade promotion funds (MAP, FMD, likely backloaded), and more funding for biosecurity.

- Timeline for House GOP farm bill: Whenever the text of the chairman’s mark is officially released (between mid-April and Memorial Day recess), supporters will want to accelerate action at both the House Ag Committee markup level and on the House floor. The longer the coming farm bill text is out before such action, the more opponents will find things not to their liking. House lawmakers have frequently said two weeks after a chairman’s mark is released, further action will take place. Key will be whether any Democrats approve the bill in panel markup. Farm bill writers had plenty of time to write a new farm bill, despite their saying they are waiting on scores from the Congressional Budget Office (CBO).

- Can a farm bill even be passed by the House and Senate? The Democratic-led Senate will have a different farm bill that will come in some form after unveiling of the House measure. Ag Chair Debbie Stabenow (D-Mich.) is a farm bill veteran who knows how to get an omnibus bill passed in committee and on the Senate floor. However, that was in the past. There has been a farm bill “red line” drawn by Ag panel ranking member John Boozman (R-Ark.) regarding the need for an adequate boost for reference prices. The Senate bill is a no go unless Stabenow finds a way to accommodate Boozman as 60 votes are needed to move a bill in the upper chamber. Passage hurdles could also develop in the House, which has a recent history of defeating some farm bills. A combination of Democratic naysayers and House GOP rebels against what they will likely say is a bloated farm bill could be enough to sink the measure if a vote is held.

— House to send Mayorkas impeachment articles to Senate. The House of Representatives on Wednesday plans to send the impeachment articles against Department of Homeland Security Alejandro Mayorkas to the Senate. This marks the next procedural step towards holding an impeachment trial in the Senate. Senate Majority Leader Chuck Schumer's (D-N.Y.) office has acknowledged the letter, noting that senators will be sworn in as jurors the day after.

Mayorkas was impeached by the House in February by a slim margin, becoming the first Cabinet secretary to face impeachment in nearly 150 years. While the Democratic-controlled Senate is not expected to convict Mayorkas, there is potential for the impeachment to be swiftly dismissed. However, Schumer has not provided specific details on how the Senate will handle the trial.

— President Biden will host Japanese Prime Minister Fumio Kishida for an official visit to the U.S. this week, which will include a joint news conference and a state dinner on Wednesday. The visit and state dinner — the fifth Biden has hosted as president — are intended to emphasize the importance of the alliance between the U.S. and Japan as both countries seek to counterbalance China’s influence.

A joint meeting of the House and Senate will be held to hear from the Japanese prime minister.

— Triad summit. On Thursday, President Ferdinand Marcos Jr. of the Philippines will join Biden and Japan Prime Minister Kishida at the White House for the first trilateral U.S.-Japan-Philippines leaders’ summit. The summit will talk about the growing security threat from China and how to counter it.

Meanwhile, Tokyo and Manila are expected to agree a reciprocal access agreement that could see Japanese troops deployed in the Philippines and conducting joint military exercises with the U.S.

— Pennsylvania governor concerned over Biden's LNG project halt. Pennsylvania's Governor, Josh Shapiro, a Democratic ally of Joe Biden, has expressed concern over Biden's recent decision to halt approvals for new liquefied natural gas (LNG) projects. Shapiro warned that this policy pause is negatively impacting Pennsylvania, a crucial swing state for the 2024 presidential election, where the shale gas industry is a significant employer.

Republicans are seizing on this issue to criticize Biden's climate policies, positioning themselves as supporters of the fossil fuel industry, particularly in states like Pennsylvania. Polls suggest a tight race between Biden and former President Donald Trump in Pennsylvania, making it a focal point for both campaigns.

Shapiro argues that natural gas can be part of the transition to green energy without sacrificing jobs, emphasizing that policymakers can prioritize both economic growth and environmental protection.

A recent poll indicates that a majority of Pennsylvanians oppose the Biden administration's pause on LNG projects, which could have implications for the upcoming election.

Pennsylvania is a significant producer of shale gas, and the fracking industry has boosted the state's economy. However, Biden's pause on LNG projects has created uncertainty and led to concerns about job losses in the industry.

Of note: In Washington, the LNG pause has become a bargaining chip, with Republicans suggesting that its reversal could be tied to funding requests, such as aid for Ukraine (see next item) or infrastructure projects. The Biden administration has defended the LNG pause, citing the need to update the approvals process considering significant changes in both domestic and global natural gas markets.

— House Speaker Mike Johnson (R-La.) is facing significant challenges in bringing up a vote on Ukraine aid in the House of Representatives. Despite his pledge to do so soon after Congress reconvenes from Easter recess, uncertainties persist regarding the form of the bill and the level of support it will garner, given fractures among both Republicans and Democrats.

The Senate has already passed a $95 billion package for Ukraine, Israel, and Taiwan with bipartisan support. However, Johnson has resisted pressure to simply bring the Senate bill up for a vote in the House, opting instead to craft his own bill with additional provisions. He's considering splitting Ukraine aid and Israel aid into separate votes to maximize support, particularly from Democrats for Ukraine aid and from Republicans for Israel aid.

Various policy proposals have been floated, including converting some Ukraine aid to a loan, using seized Russian assets to fund Ukraine’s reconstruction, and lifting the moratorium on new liquefied natural gas export projects. However, the details remain unclear.

Johnson may bring the House aid bill up under suspension of the rules, which would require a two-thirds supermajority for passage, making him heavily reliant on Democratic votes. However, opposition among some House Democrats to aid for Israel complicates the math, which is one of the likely reasons why there may be separate aid measures.

— Food inflation in wealthy nations has decreased to its lowest level since before the full-scale invasion of Ukraine by Russia. This decline in price growth has relieved pressure on households affected by the two-year surge in food costs. Factors contributing to the surge included rising energy costs, decreased trade due to the war in Ukraine, droughts, and supply chain disruptions related to Covid-19. However, agricultural commodity prices have dropped significantly since their peak following the invasion of Ukraine, leading to a disinflationary effect. Supply chains have normalized, gas prices have reduced, and Ukraine's grain exports have resumed, contributing to the decrease in food prices.

The annual change in consumer food prices across 38 industrialized countries eased to 5.3% in February, down from 6.2% in the previous month and well below a peak of 16.2% in November 2022, according to the latest OECD data.

The Organization for Economic Co-operation and Development (OECD) is expected to comment on the food price figures, which are the lowest since October 2021, in its broader inflation update on Monday.

The UN Food and Agriculture Organization (FAO) reported a slight increase in the food commodity price index in March but noted a decrease compared to the previous year. While food price inflation has eased in developed and emerging markets, some countries still face challenges, particularly those with exchange rate pressures and reliance on imports. Turkey and Nigeria, for instance, experienced significant food inflation due to currency devaluation and reliance on food imports, respectively. Additionally, countries dependent on Indian rice imports, such as the Philippines and Bangladesh, saw continued food price inflation following India's ban on rice exports.

Despite falling wholesale agricultural prices, consumer food prices have not decreased significantly due to various factors affecting retail costs beyond commodity prices, including labor, marketing, and distribution. However, the recent decline in agricultural prices is expected to eventually translate into lower grocery prices.

— Hezbollah: Iran response to attack on Damascus consulate ‘inevitable.’ The leader of Lebanon’s Hezbollah militant group said that the strike on the Iranian consulate in Damascus widely blamed on Israel marked a “turning point” and vowed that Iran’s response would be “inevitable.” Iran has vowed to respond to the attack, which killed 13 people, including a senior general. “Rest assured that the Iranian response to the attack on the Iranian consulate will inevitably come,” Hassan Nasrallah told his followers in a public address commemorating Quds Day, an annual event marking support for Palestinians and opposition to Israel’s occupation. He deferred to Iran’s supreme leader on when and what form that retaliation would take. Ayatollah Ali Khamenei has vowed to respond, saying “Israel would regret its crimes.”

Of note: Israel says it has pulled out of Khan Younis to prepare for a move on Rafah. “Our forces left the area in order to prepare for their future missions, including their mission in Rafah,” Israeli defense minister Yoav Gallant said after meeting senior officers of the army’s southern command. An army statement said the minister had been briefed on preparations for the destruction of Hamas’s Rafah Brigade, “an achievement which will finalize the dismantling of Hamas as a military authority in Gaza.”

— Treasury Secretary Janet Yellen addressed concerns over China's increasing exports of low-cost electric vehicles and green energy products, emphasizing the potential threat to American jobs and urging China to adjust its industrial strategy. During talks with her Chinese counterpart, Vice Premier He Lifeng, Yellen also cautioned against Chinese companies supporting Russia's actions in Ukraine, warning of "significant consequences."

The discussions, spanning two days in Guangzhou, aimed to tackle trade and geopolitical tensions between the world's largest economies, seeking to stabilize relations strained in the previous year. Both parties agreed to future discussions on combating international money laundering and promoting balanced growth to address worries about China's export-driven economic approach distorting global markets.

Yellen's focus on China's heavily subsidized green technology exports reflects concerns in the Biden administration, which has invested in similar sectors domestically. She expressed the U.S.'s apprehensions regarding Chinese industrial strategies potentially inundating American markets and harming local firms' competitiveness.

Before the official talks, Yellen met with American and European business leaders in China, discussing their concerns about China's treatment of foreign companies and the global implications of China's export strategies.

While Yellen received a positive reception in Guangzhou, China defended its export policies as beneficial globally, emphasizing the scarcity of high-quality industrial capacity and productive forces worldwide.

Both sides acknowledged the complexity of the issues discussed, with China expressing concerns about U.S. economic measures and Yellen recognizing the challenges faced by China in addressing these issues promptly.

Besides economic matters, Yellen and her Chinese counterpart discussed Russia's conflict in Ukraine, with the U.S. expressing worries about Chinese companies indirectly supporting Russia's military efforts. Yellen expressed hope for cooperation on this front, noting China's stance against providing direct military support to Russia.

Yellen continued her diplomatic engagements, traveling to Beijing for further discussions with Chinese officials, including Premier Li Qiang and Beijing's mayor, Yin Yong.

Other Events of Note This Week

Monday, April 8

- U.S./China relationship. Treasury Secretary Janet Yellen news conference on the U.S. and China bilateral economic relationship from Beijing.

- NPPC priorities. National Pork Producers Council (NPPC) virtual media briefing on "the industry's current policy priorities."

- Climate-smart agriculture and the U.S. & China. Wilson Center's China Environment Forum holds a virtual discussion on "The Lay of the Land for Sustaining Climate-Smart Agriculture in the U.S. and China."

- Japan PM visit preview. Center for Strategic and International Studies discussion on "Previewing Prime Minister Kishida's Visit to Washington."

- Analyzing Mexican presidential debate. Wilson Center's Mexico Institute virtual discussion on "Mexico's First Presidential Debate."

- LNG export pause. House Energy and Commerce Energy, Climate, and Grid Security Subcommittee field hearing on "Biden's LNG (liquid natural gas) Export Ban: How Rush-to-Green Politics Hurts Local Communities and US Energy Security."

Tuesday, April 9

- Rural healthcare. PunchBowl News summit on "The Future of Rural Healthcare."

- Greener trade. Peterson Institute for International Economics virtual discussion on "How Can Trade Become Greener?"

- Climate change. Atlantic Council's Global Energy Center discussion on "the most impactful ways to adapt to and mitigate against climate change."

- Public benefits modernization. Aspen Institute virtual Financial Resilience Summit on "The Future of Public Benefits Modernization." USDA Deputy Secretary Xochitl Torres Small among those to deliver remarks.

- CFTC panel meets on climate, other issues. Commodity Futures Trading Commission meeting of the Market Risk Advisory Committee to discuss current topics and developments in the areas of central counterparty risk and governance, market structure, climate-related risk, and innovative and emerging technologies affecting the derivatives and related financial markets.

- FY 2025 Budget: DOD. Senate Armed Services Committee hearing on the Defense Department budget request for FY 2025 and the Future Years Defense Program. Defense Secretary Lloyd Austin testifies.

- FY 2025 Budget: USAID. Senate Appropriations State, Foreign Operations and Related Programs Subcommittee hearing on "Review of the FY 2025 Budget Request for the US Agency for International Development (USAID)." USAID Administrator Samantha Power testifies.

- Global economy. Peterson Institute for International Economics virtual discussion on "Global Economic Prospects: Spring 2024."

Wednesday, April 10

- President Joe Biden hosts Japanese Prime Minister Kishida Fumio at the White House with the two holding a press briefing.

- Federal Reserve. Fed Governor Michelle Bowman participates in a Discussion on Basel Capital Requirements; Chicago Fed President Austan Goolsbee scheduled to speak.

- SEC climate rule. House Financial Services Committee hearing on "Beyond Scope: How the SEC's Climate Rule Threatens American Markets."

- Urban agriculture session. USDA's Natural Resources Conservation Service virtual meeting of the Urban Agriculture and Innovative Production Advisory Committee to discuss proposed recommendations for the Secretary of Agriculture on the development of policies and outreach relating to urban, indoor and other emerging agriculture production practices.

- FY 2025 Budget: Homeland Security. House Appropriations Homeland Security Subcommittee hearing on "FY 2025 Request for the Department of Homeland Security." Homeland Security Secretary Alejandro Mayorkas testifies.

- FY 2025 Budget: USAID. Senate Foreign Relations Committee hearing on the proposed FY 2025 budget request for US Agency for International Development. USAID Administrator Samantha Power testifies.

- FY 2025 Budget: CBO, other offices. House Appropriations Legislative Branch Subcommittee hearing on "FY 2025 Request for the Government Accountability Office, the Government Publishing Office, and the Congressional Budget Office." CBO Director Phillip Swagel, others to testify.

- FY 2025 Budget: U.S. Forest Service. Senate Appropriations Interior, Environment, and Related Agencies Subcommittee hearing on "A Review of the President's FY 2025 Budget Request for the U.S. Forest Service." Forest Service Chief Randy Moore testifies.

- FY 2025 Budget: Homeland Security. Senate Appropriations Homeland Security Subcommittee hearing on "A Review of the President's FY 2025 Budget Request for the Department of Homeland Security." Homeland Security Secretary Alejandro Mayorkas testifies.

- Rural healthcare. Health Resources and Services Administration holds a meeting of the National Advisory Committee on Rural Health and Human Services to discuss technology and innovation in rural health and quality reporting by rural health clinics; runs through Thursday.

- Tax impact on small businesses. House Small Business Committee hearing on "Tax Day: Exploring the Adverse Effects of High Taxes and a Complex Tax Code."

- U.S. trade and investment in Africa. Brookings Institution discussion on "Leveraging the African Continental Free Trade Area to Accelerate U.S. Trade and Investment in Africa."

- China influence on UN. House Foreign Affairs Global Health, Global Human Rights, and International Organizations Subcommittee hearing on "The Chinese Communist Party's Malign Influence at the United Nations — It's Getting Worse."

- STB, NTSB nominations. Senate Commerce, Science and Transportation Committee hearing on the nominations of Jennifer Homendy to be chair of the National Transportation Safety Board; and Patrick Fuchs to be a member of the Surface Transportation Board.

- USAID priorities. House Foreign Affairs Committee hearing on "USAID's Foreign Policy and International Development Priorities in the Era of Great Power Competition." USAID Administrator Samantha Power testifies.

- Energy threats. Senate Energy and Natural Resources Water and Power Subcommittee hearing on "Federal and Non-Federal Role of Assessing Cyber Threats to and Vulnerabilities of Critical Water Infrastructure in our Energy Sector."

Thursday, April 11

- Federal Reserve. New York Fed President John Williams, Atlanta Fed President Raphael Bostic scheduled to speak. San Francisco Fed President Mary Daly scheduled to speak.

- FDA oversight. House Oversight and Accountability Committee hearing on "Oversight of the Food and Drug Administration." FDA Commissioner Robert Califf testifies.

- Global economy. Atlantic Council virtual discussion with International Monetary Fund Managing Director Kristalina Georgieva on "The State of the Global Economy."

- House Appropriations Agriculture subcommittee 'member day.' House Appropriations Agriculture, Rural Development, Food and Drug Administration, and Related Agencies Subcommittee hearing on "Member Day."

- Farm Credit System performance. Farm Credit Administration meeting for a quarterly report on economic conditions and Farm Credit System condition and performance.

- CFTC Agriculture Advisory Committee. Commodity Futures Trading Commission meeting of the Agricultural Advisory Committee to discuss topics related to the agricultural economy and recent developments in the agricultural derivatives markets.

- FY 2025 Budget: USAID. House Appropriations State, Foreign Operations and Related Programs Subcommittee hearing on "FY2025 Request for the United States Agency for International Development." USAID Administrator Samantha Power testifies.

- FY 2025 Budget: VA. House Veterans' Affairs Committee hearing on "US Department of Veterans Affairs Budget Request for FY 2025 and FY 2026."

- FY 2025 Budget: FBI. House Appropriations Commerce, Justice, Science, and Related Agencies Subcommittee hearing on "FY 2025 Request for the Federal Bureau of Investigation." FBI Director Christopher Wray testifies.

- Inland waters user board. U.S. Army Corps of Engineers meeting of the Inland Waterways Users Board to discuss several issues including lock and dam modernization.

- Cyber security risks to the electric grid. United States Energy Association virtual discussion on "Managing Cybersecurity Risks in A Rapidly Expanding Electric Grid."

- Immigration and border security. Institute of World Politics conference on "U.S. Sovereignty: The Border Challenges."

- Expanding 2017 tax cuts. House Ways and Means Committee hearing on "Expanding on the Success of the 2017 Tax Relief to Help Hardworking Americans."

Friday, April 12

- Federal Reserve. Atlanta Fed President Raphael Bostic, San Francisco Fed President Mary Daly scheduled to speak

- Renewable energy. Environmental and Energy Study Institute virtual briefing on "Funding the Future: The Impact of Federal Clean Energy Investments," focusing on the Energy Department's Office of Energy Efficiency and Renewable Energy's plans for future investments.

- Japanese Prime Minister Fumio visit to U.S. Henry L. Stimson Center discussion on "Prime Minister Kishida's Visit to Washington: A Way Forward for U.S./Japan Relations."

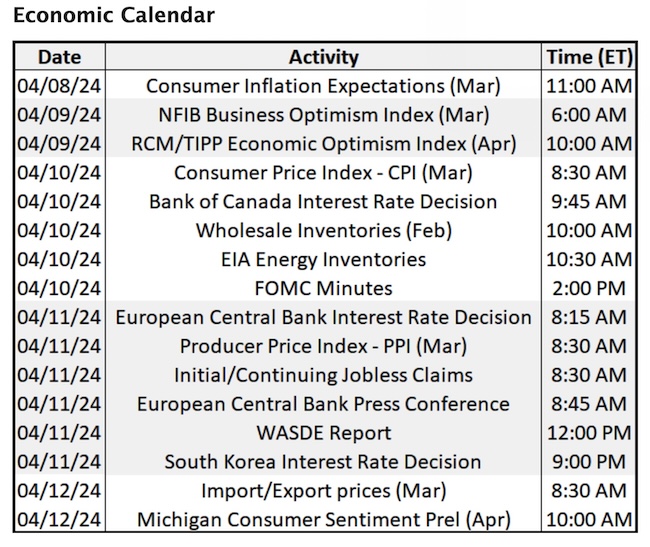

Economic Reports and Events for the Week

This week, investors' focus will primarily be on Wednesday's release of the consumer price index (CPI) report for March. The headline CPI is expected to show a 0.4% increase compared to the previous month, remaining unchanged from February. On a year-over-year (Y/Y) basis, the anticipated increase is 3.1%, slightly lower than the prior month's 3.2%. Core CPI, which excludes volatile food and energy prices, is forecasted to show a deceleration both on a monthly (M/M) and yearly basis, with expected increases of +0.3% and +3.7%, respectively. Traders late last week pushed back their predictions for the Fed’s first rate cut to come in July, rather than in June.

On Wednesday, investors will get the release of the minutes from the Federal Reserve's March meeting. This follows last week's release of robust labor market data, which diminished expectations for interest rate cuts. Market participants will scrutinize both the minutes and the consumer inflation report for any insights into the future trajectory of monetary policy.

This week will commence the first quarter earnings season, including JPMorgan, Citi, State Street, Wells Fargo and BlackRock on Friday. Other company data includes Boeing reporting first-quarter deliveries on Tuesday. These will add to the already heightened market scrutiny and potentially impacting investor sentiment and market dynamics.

Monday, April 8

- Conference Board releases its employment trends report.

- JPMorgan CEO Jamie Dimon to publish his annual letter to shareholders.

- Minneapolis Fed President Neel Kashkari to participate in conversation with Missoula community members and University of Montana faculty and students.

Tuesday, April 9

Wednesday, April 10

- MBA Mortgage Applications

- CPI for March is expected to rise 0.3%, after climbing 0.4% in February. In the 12 months through March, the CPI likely increased 3.4%, after advancing 3.2% in the prior month.

- Treasury Budget

- Wholesale Trade

- FOMC Minutes

- Federal Reserve. Fed Governor Michelle Bowman participates in a Discussion on Basel Capital Requirements; Chicago Fed President Austan Goolsbee scheduled to speak.

- World Trade Organization publishes its outlook and statistics report.

- Bank of Canada interest rate decision.

Thursday, April 11

- Jobless Claims is expected to show initial claims for state unemployment benefits at 215,000 for the week ended April 6, down by 6,000 from the previous week.

- PPI-FD

- Fed Balance Sheet

- Money Supply

- Federal Reserve. New York Fed President John Williams, Atlanta Fed President Raphael Bostic scheduled to speak. San Francisco Fed President Mary Daly scheduled to speak.

- European Central Bank meets in Frankfurt to debate interest rates. The consensus is that it is a bit too soon to start lowering them. However, inflation in Europe is dropping faster than other regions, making many think rates could go down before those in the U.S. or the UK.

Friday, April 12

- Import & Export Prices

- Consumer Sentiment

- Vote by U.S. Steel shareholders on whether to accept the acquisition offer by Nippon Steel.

Key USDA & international Ag & Energy Reports and Events

USDA’s World Agricultural Supply & Demand Estimates (WASDE) will be released on Thursday, while China will publish its first batch of trade data for March, including imports of edible oils.

On the energy front, the International Energy Agency will publish its monthly oil market report on Friday, a day after OPEC issues its outlook. The U.S. Energy Information Administration releases its Short-Term Energy Outlook on Tuesday.

Monday, April 8

Ag reports and events:

- Export Inspections

- Honey: Statistical Bulletin

- Crop Progress

- Sugar production and cane crush data from Brazil’s Unica (tentative)

Energy reports and events:

- Global LNG & Hydrogen Conference, Beijing; runs through Wednesday

- BTC loading programs due (May)

- FT Commodities Global Summit, Lausanne (through April 10)

- Holiday: Indonesia; Thailand

Tuesday, April 9

Ag reports and events:

- EU weekly grain, oilseed import and export data

Energy reports and events:

- API weekly U.S. oil inventory report

- EIA releases its monthly Short-Term Energy Outlook, or STEO

- Holiday: Indonesia; Philippines; India; Saudi Arabia; Kuwait

Wednesday, April 10

Ag reports and events:

Energy reports and events:

- Genscape weekly crude inventory report for Europe’s ARA region

- EIA Petroleum Status Report

- Weekly Ethanol Production

- Holiday: Singapore; South Korea; Indonesia; Nigeria; Libya; Azerbaijan; Saudi Arabia; UAE; Iraq; Qatar; Kuwait; Turkey

Thursday, April 11

Ag reports and events:

- Weekly Export Sales

- Cotton: World Markets and Trade

- Grains: World Markets and Trade

- Oilseeds: World Markets and Trade

- World Agricultural Production

- WASDE

- Livestock and Meat International Trade Data

- Crop Production

- China’s agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans

- Brazil’s Conab issues production, area and yield data for corn and soybeans

- Port of Rouen data on French grain exports

Energy reports and events:

- Insights Global weekly oil product inventories in Europe’s ARA region

- Singapore onshore oil product stockpile weekly data

- EIA Natural Gas Report

- OPEC monthly Oil Market Report

- ICE gasoil futures for April expire

- Holiday: India; Indonesia; Nigeria; Libya; Azerbaijan; Saudi Arabia; UAE; Iraq; Qatar; Kuwait; Turkey

Friday, April 12

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- China’s first batch of March trade data, including edible oil and meat & offal imports

- Malaysian palm oil export data for April 1-10

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- ICE weekly Commitments of Traders report for Brent, gasoil

- China’s first batch of March trade data, including oil, gas and coal imports; oil products imports and exports

- IEA to publish monthly oil market report.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |