President Biden Talks Trade, TikTok and More with China’s Xi Jinping

Texas farmers sue USDA | Fed watch | Oil, gold prices surge | Immigration surge and U.S. economy

|

Today’s Digital Newspaper |

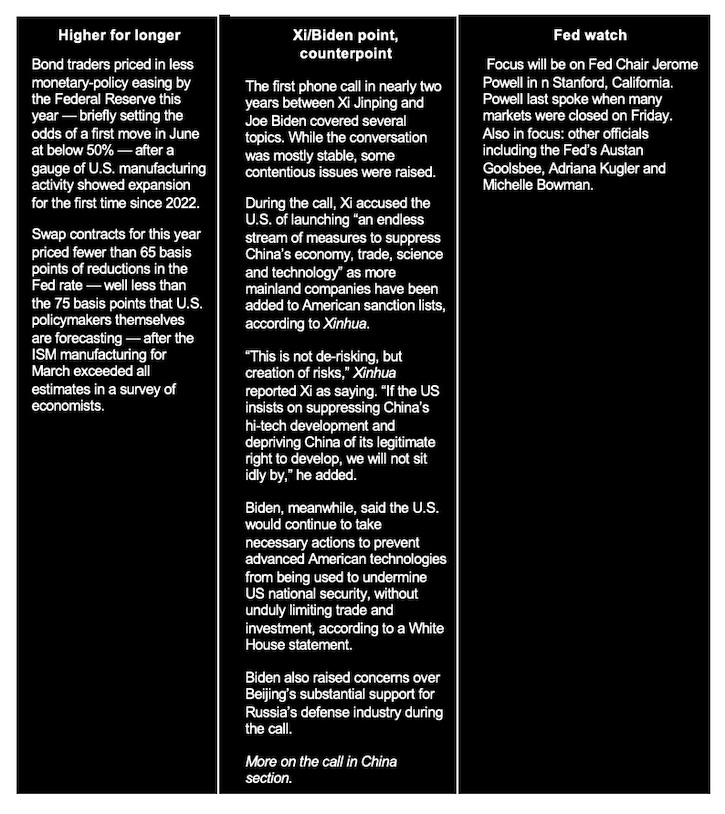

MARKET FOCUS

- Fed officials warn that they’re in no hurry to cut interest rates

- ADP reports biggest increase in hiring in eight months

- Gold futures notched fresh all-time high on Wednesday, above $2,300 an ounce

- U.S. oil prices have surged nearly 20% this year

- Immigration surge in 2023 explains job growth discrepancy: WSJ

- Ag markets today

- Ag trade update

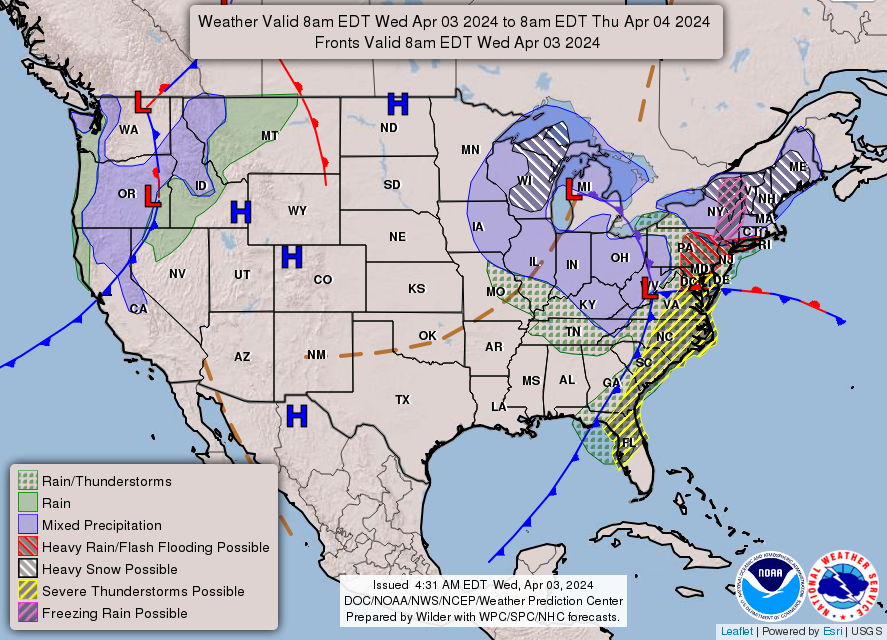

- NWS weather outlook

- Pro Farmer First Thing Today items

BALTIMORE BRIDGE COLLAPSE

- ‘The good news is the entire port is not closed.’

- Surveys indicating wreckage on bottom of 50-foot channel is far more extensive

- 2nd temporary alternate channel opens near wreckage of Key Bridge

- Buttigieg advocates for immediate federal funding of bridge

- Emergency funds for Key Bridge likely for existing recovery efforts

ISRAEL/HAMAS CONFLICT

- Biden: Israel hadn’t done enough to protect civilians

- Charity World Central Kitchen halts operations in Gaza

RUSSIA & UKRAINE

- White House rejects GOP proposal to link Ukraine aid to LNG policy reversal

- Ukraine’s grain exports fall nearly 7%

- NATO to discuss five-year military aid package for Ukraine worth $100 billion

POLICY

- Texas farmers challenge constitutionality of USDA's disaster aid programs

- Grassley doubts likelihood of farm bill progressing

- Hoeven propels N.D. as agricultural research leader with $50 million funding

PERSONNEL

- Rep. Lauren Boebert successfully underwent surgery

CHINA

- President Biden talks trade, TikTok and more with China’s Xi Jinping

- Yellen embarks on second trip to China in nine months

- How China could respond to U.S. sanctions in a Taiwan crisis

- Yuan nears weaker end of its onshore trading band, despite positive economic data

- Major 7.4 magnitude earthquake in Taiwan

- U.S. attaché expects China’s corn, wheat production to rise

- China solar industry faces shakeout, but rock-bottom prices to persist; EU probes

TRADE POLICY

- Trump's tariff plan could drive inflation, pressure Fed: report

- USTR expands hearings on supply chain resilience and enforcement

ENERGY & CLIMATE CHANGE

- EU exits winter with gas storage at record

- E15 sales set record

- Iowa House delays ethanol dispenser requirements

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Largest egg producer in U.S., Cal-Maine Foods Inc., culls 3.6% of its flock

- Despite challenges posed by HPAI, Cal-Maine announces strong earnings

- Biden officials briefed congressional committees and leadership on bird flu , as the disease struck an egg facility in Texas on Tuesday. Briefing were reps from

- Mexico taking ‘preventative measures’ in wake of U.S. HPAI outbreak in dairy cattle

- Can Africa turn into food exporter?

HEALTH UPDATE

- Bird flu in humans, explained… Washington Post primer

- U.S. health insurers stock declines after Biden Medicare payment announcement

POLITICS & ELECTIONS

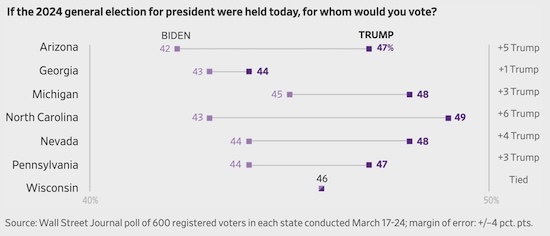

- Trump leads Biden in battlegrounds

- Maryland Senate race in focus

OTHER ITEMS OF NOTE

- Taiwan rocked by worst earthquake in decades

- Biden mandates two-person crews for freight trains after safety concerns

- EPA issued notice on final conditions for dicamba product usage

- Mexico postpones ban on glyphosate, which was initially set for April 1

- Iowa’s Senate approves bill to limit lawsuits against Bayer, producer of Roundup

- KC rejects stadium tax

|

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mostly lower overnight. U.S. Dow opened slightly lower and then went higher. Aiding the turnaround: ADP reported private businesses in the U.S. hired 184,000 workers in March 2024, following an upwardly revised 155,000 in February, and beating forecasts of 148,000. It is the biggest increase in hiring in eight months, with employment rising in services (142,000), namely leisure/hospitality (63,000), trade/transportation/utilities (29,000), education/health (17,000), financial activities (17,000) and information (8,000) while professional/business activities shed 8,000 jobs. In Asia, Japan -1%. Hong Kong -1.2%. China -0.2%. India flat. In Europe, at midday, London -0.3%. Paris +0.2%. Frankfurt +0.3%.

U.S. equities yesterday: The Dow closed down 396.61 points, 1.00%, at 39,170.24. The Nasdaq fell 156.38 points, 0.95%, at 16,240.45. The S&P 500 lost 37.96 points, 0.72%, at 5,205.81.

— U.S. oil prices have surged nearly 20% this year, reaching over $85 a barrel, prompting speculation about potential political backlash. (On Tuesday, WTI traded up $1.44 or 1.7% to close at $85.15. Brent traded up $1.50 or 1.7% to close at $88.92.) This increase in crude prices significantly impacts retail gasoline prices in the U.S., which have soared to nearly $3.54 per gallon, marking one of the highest levels since October. Former President Trump seized the opportunity to address the issue during a rally in Michigan, remarking, "Energy’s going up again, in case you hadn’t noticed." While recent tensions in the Middle East have contributed to the spike in oil prices, underlying factors such as robust global demand and reduced output from the OPEC+ alliance have been instrumental. The OPEC+ alliance is anticipated to maintain production cuts during its upcoming meeting on Wednesday. Moreover, Chinese manufacturing data released this week indicated signs of economic revival in the world's leading oil importer.

Markets are looking ahead to Wednesday's ministerial panel meeting of OPEC+, the Organization of the Petroleum Exporting Countries (OPEC) and allied producers. The panel is unlikely to recommend any change in oil output policy, OPEC+ sources told Reuters.

— Ag markets today: Corn, soybeans and wheat firmed amid mild corrective buying during overnight trade. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents higher, soybeans were 2 to 3 cents higher, SRW wheat was mostly a nickel higher, HRW wheat was 7 to 9 cents higher and HRS wheat was 5 to 6 cents higher. Front-month crude oil futures were around 70 cents higher, and the U.S. dollar index was about 100 points lower.

Wholesale beef prices continue to drop. Wholesale beef prices rallied sharply during a five-week stretch from mid-February but have been on a near-daily retreat since peaking nearly two weeks ago. Choice beef fell another $1.58 and Select dropped $2.80 on Tuesday. Packer margins have declined along with wholesale beef prices and are deep in the red once again. That’s likely to keep pressure on cash cattle prices after they retreated from the all-time high during last week’s trade.

Seasonal strength continues for cash hogs, pork cutout. The CME lean hog index is up another 14 cents to $84.92 as of March 30. The pork cutout value firmed another 52 cents on Tuesday to $97.13. While the cash market continues to strengthen seasonally, the rise in wholesale pork prices has been strong enough to keep packer margins solidly in the black.

— Agriculture markets yesterday:

- Corn: May corn futures plunged 9 cents to $4.26 1/2, settling near session lows.

- Soy complex: May soybeans fell 11 3/4 cents to $11.74, marking a near four-week low close, while May meal slid $5.10 lower to $328.30, marking the lowest close since Feb. 28. May soyoil rose 36 points to 48.60 cents, above the 100-day moving average.

- Wheat: May SRW futures dropped 11 3/4 cents to $5.45 1/4, settling near session lows. May HRW futures sunk 12 1/4 cents to $5.63 1/4, settling on session lows. May HRS fell 7 1/4 cents to $6.27 1/2.

- Cotton: May cotton plummeted 195 points to 90.81 cents, near the session low.

- Cattle: June live cattle rose $1.05 to $176.375, while nearby April futures rose $1.70 to $181.775. May feeders rallied $3.075 to $243.50.

- Hogs: June lean hog futures rallied 22.5 cents to $103.725, though settled well off intraday highs.

— Quotes of note:

- Loretta Mester raises long-term rate estimate to 3%, cautious on immediate rate cuts. Mester, president of the Cleveland Federal Reserve and a voting member of the Federal Open Market Committee, announced in a speech that she has revised her estimate of the longer-term federal funds rate from 2.5% to 3%. Additionally, she emphasized the need for further evidence of inflation trending towards the central bank's 2% target before considering lowering borrowing costs, which currently stand at a 23-year high of 5.25%. Mester indicated that she finds it unlikely to advocate for a rate cut by the policy vote scheduled for May 1, citing the necessity for more data. However, she acknowledged the possibility of a rate cut at the mid-June meeting, contingent upon clearer indications of inflation moving towards the desired level. This stance contrasts with investors' expectations, which have shifted towards anticipating a rate cut in June. Mester's explicit declaration marks the first time a committee member in the moderate position has explicitly ruled out a rate cut until June.

- Three cuts. Mary Daly, president of the San Francisco Fed and another voting member of the FOMC, told an event in Las Vegas that three cuts remained “a very reasonable baseline.” She added, however: “A projection is not a promise.” Markets are also expecting three cuts.

- “I wanted to have you on a podcast, and Apple asked us not to do it.” — Jon Stewart, a host of The Daily Show. On his most recent episode, he told his guest, the FTC. chair and aggressive antitrust enforcer Lina Khan, that when he had an Apple TV+ show, the tech giant urged him not to interview her.

— Immigration surge in 2023 explains job growth discrepancy: WSJ. The current discrepancy between job growth and rising unemployment rates has puzzled economists. However, an emerging explanation points to a surge in immigration in 2023, according to a Wall Street Journal article (link). This influx not only resolves inconsistencies in job data but also implies that the economy can continue generating jobs without overheating. Consequently, this scenario suggests that the Federal Reserve may still contemplate interest rate cuts.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker, with the euro and Japanese yen both firmer against the greenback. The yield on the 10-year U.S. Treasury note was firmer, trading around 4.39%, with a mixed tone in global government bond yields. Crude oil futures were moving higher ahead of U.S. gov’t inventory data due later this morning. U.S. crude was around $85.85 per barrel while Brent was around $89.70 per barrel. Gold and silver continued to advance ahead of U.S. market action, with gold around $2,290 per troy ounce and silver around $26.37 per troy ounce.

— Gold continues its surge, achieving its highest levels in eight years with a peak of $2,300 per ounce. Gold prices have risen 9% this year, outpacing the 10.6% increase in the yield on 10-year bonds. Analysts speculate that gold's resilience stems from its status as a near-zero yield asset, particularly in a climate where high nominal yields prevail.

Chinese demand plays a significant role in supporting gold prices. The People's Bank of China has been aggressively acquiring gold reserves, while Chinese consumers are increasingly investing in gold, partly due to economic and stock market concerns. This heightened demand is evident in booming gold-related ETF investments and a substantial increase in Chinese gold imports.

Silver, often considered gold's more volatile counterpart, is also experiencing a resurgence, nearing a 52-week high and exhibiting a 9% increase in prices this year. Technical analysts predict further upside potential for silver, with targets set at $30 and potentially $40 per ounce.

— Ag trade update: Jordan tendered to buy up to 120,000 MT of optional origin milling wheat. Tunisia tendered to buy 50,000 MT of optional origin soft milling wheat. Iran tendered to buy 120,000 MT of corn (sourced from Brazil, Europe Union, Russia, Ukraine or other Black Sea region countries), soymeal (sourced from Brazil or Argentina) and feed barley (sourced from Europe Union, Russia, Ukraine or other Black Sea region countries).

— NWS weather outlook: Heavy snow over the Upper Great Lakes, Upstate New York, and Northern New England on Wednesday; Heavy snow over the Sierra Nevada Mountains and Central Appalachians on Thursday... ...There is a Slight Risk of excessive rainfall over parts of the Mid-Atlantic and Southern New England on Wednesday... ...There is a Sight Risk of severe thunderstorms over parts of the Mid-Atlantic Coast to the Southeast Coast and Florida peninsula on Wednesday.

Items in Pro Farmer's First Thing Today include:

• Grains post corrective gains overnight

• PBOC will make efforts to expand demand, boost confidence

• Eurozone inflation unexpectedly eases

|

BALTIMORE BRIDGE COLLAPSE |

— Updates:

- “The good news is the entire port is not closed. The operations are severely reduced because the channel is closed,” Maryland Senate President Bill Ferguson said. Some activities like “value-added manufacturing” are continuing, and Tradepoint Atlantic is accepting some shipments, he said. “Until that channel is cleared, we will have severely disrupted operations,” said Ferguson, a Democrat.

- “Surveys are indicating the wreckage on the bottom of the 50-foot channel is far more extensive than we could have imagined,” Army Corps of Engineers Col. Estee Pinchasin said at a news conference Tuesday afternoon. “It’s not just sitting on the seabed, it’s actually below the mud line. That makes it very difficult to know where to cut and how to cut, and how to rig and lift.”

- 2nd temporary alternate channel opens near wreckage of Key Bridge. On Monday two vessels, fuel and scrap barges, passed through a temporary channel on the northeast side of the bridge with a depth of 11 feet, and Tuesday afternoon around 1:15 p.m. ET, crews opened a second channel with a depth of 14 feet. For reference, the center of the Key Bridge is 50 feet deep and large cargo ships carrying vehicles typically require depths of at least 35 feet.

- Transportation Secretary Pete Buttigieg advocates for the immediate federal funding of the Baltimore Francis Scott Key Bridge's reconstruction, prioritizing the restoration of critical infrastructure over addressing liability concerns related to the foreign-flagged cargo ship. This approach may encounter opposition from congressional Republicans. Buttigieg emphasized expediting the port's reopening and bridge repair without delay. Last week, the Transportation Department allocated $60 million as a preliminary step, referring to it as a "down payment." Buttigieg mentioned the emergency relief account holds approximately $950 million, and the department is exploring potential flexibility within its funding limitations.

- Emergency funds for Key Bridge likely for existing recovery efforts. Sen. Ben Cardin (D-Md.) stated that the emergency appropriations requested by the White House for the Key Bridge will likely be directed towards replenishing existing funds already allocated to recovery efforts. Maryland's congressional delegation plans to meet with the Office of Management and Budget next Tuesday to ascertain which funds from Congress's recent annual appropriations have already been allocated to the recovery process. Cardin expressed confidence that there would be sufficient funds for Baltimore's recovery but cautioned against diverting resources from other parts of the country. He anticipated the need for a supplemental funding package, which may not solely focus on Maryland's recovery efforts but could also encompass assistance for other potential disasters.

|

ISRAEL/HAMAS CONFLICT |

— President Biden said Israel hadn’t done enough to protect civilians after the death of seven aid workers, in some of his sternest criticism yet of the country’s conduct in the months since it launched a military campaign against Hamas in Gaza. “This conflict has been one of the worst in recent memory in terms of how many aid workers have been killed,” Biden said in a statement released last night. The sharply worded statement highlighted growing U.S. frustration with Israel’s prosecution of its war and the mounting civilian death toll.

The charity World Central Kitchen said it halted operations in Gaza after an Israeli military attack killed seven of its workers who were traveling in a convoy; Israel's prime minister said the nation "deeply regrets this tragic incident."

|

RUSSIA/UKRAINE |

— White House rejects GOP proposal to link Ukraine aid to LNG policy reversal. The White House rejected a proposal from House Speaker Mike Johnson (R-La.) to connect aid for Ukraine to lifting the Biden administration's suspension of new liquefied natural gas (LNG) export licenses. The administration emphasizes the urgency of providing aid to Ukraine to defend itself against Russian aggression and supports the temporary halt on new LNG export licenses for evaluation of economic and environmental impacts. While there were earlier reports suggesting openness to reconsidering the pause on LNG export approvals, the White House denies these claims. Johnson had discussed the idea of linking aid for Ukraine and Israel to reversing the LNG export license pause with President Biden but was met with opposition.

Of note: Despite this, Johnson intends to introduce a Ukraine aid package that may include language to reverse the pause upon the House's return from recess. He asserts that allowing natural gas exports would hinder Vladimir Putin's military efforts.

— Ukraine’s grain exports fall nearly 7%. Through the first nine months of the 2023-24 marketing year, Ukraine exported 35.4 MMT of grain, down 2.6 MMT (6.8%) from the same period last year. The exports included 19.1 MMT of corn, 14 MMT of wheat and 1.96 MMT of barley. Ukraine’s ag ministry said it has exportable grain supplies of about 50 MMT for 2023-24.

— NATO will convene to discuss a proposal for a five-year military aid package for Ukraine worth $100 billion during the alliance's upcoming foreign ministers' meeting on Wednesday. This plan is seen as a strategy to safeguard assistance for Ukraine, aiming to mitigate concerns that the United States might reduce support if Donald Trump were to win the presidential election.

|

POLICY UPDATE |

— A group of Texas farmers is challenging the constitutionality of USDA's disaster assistance and pandemic relief programs, alleging discrimination based on sex and race, according to Law360. Led by Rusty Strickland, they claim USDA prioritizes minority groups, resulting in less aid for nonminority farmers. They reference a USDA notice introducing progressive factoring and limited insurance premium refunds to underserved farmers. The farmers argue this unfairly benefits specific demographics, violating the Constitution's equal protection clause. They seek to invalidate the programs, alleging unauthorized allocation of funds by USDA based on race or sex. USDA has yet to respond. The farmers are represented by attorneys from Southeastern Legal Foundation and Mountain States Legal Foundation.

Comments: Asked to respond to the Texas development, one farm policy contact emailed: “The department is so blatantly violating the Constitution and the law that this is not at all surprising. After the court overturned the debt forgiveness scheme, one would have thought the department would have sought to come into compliance. But it may take another, stronger rebuke by the courts to cut off this behavior. Departments willfully violating the constitution: ‘threat to our democracy’”?

— Sen. Chuck Grassley expressed skepticism about the likelihood of the farm bill progressing swiftly, despite calls from Senate Majority Leader Chuck Schumer to prioritize it before summer. Grassley (R-Iowa) emphasized the necessity of advancing the bill through the Ag Committee soon to initiate any progress. The main point of contention revolves around the farm safety net and conservation funding, with key Republican and Democratic negotiators at odds over several aspects.

Republicans, led by Sen. John Boozman (R-Ark.), seek to relax climate guardrails on a portion of remaining IRA conservation funds and include them in the farm bill baseline. They also aim to raise statutory reference prices in farm safety net programs with different percentage increases for farm program crops. However, Democrats, led by Ag Chair Debbie Stabenow (D-Mich.), are resistant to relaxing climate guardrails or using IRA funds for a reference price increase, although they are open to including the funds in the baseline.

Grassley emphasized the importance of adjusting reference prices in the new farm bill to reflect current input costs but also stressed the need for sensible payment limitations. He highlighted the disproportionate distribution of payment subsidies, with a small percentage of farms receiving the majority of subsidies, despite potentially having better resources to cope with agricultural challenges. Grassley reiterated his commitment to directing farm payments towards benefiting farmers actively engaged in agriculture.

— Sen. Hoeven propels N.D. as agricultural research leader with $50 million funding. Sen. John Hoeven (R-N.D.) facilitated significant advancements in agricultural research and policy shaping, positioning the state as a leader in these domains. Through his role as Ranking Member of the Senate Agriculture Appropriations Committee, Hoeven secured substantial funding, exceeding $50 million, to support various initiatives aimed at enhancing North Dakota's agricultural research capabilities.

Highlights of Hoeven's efforts include:

- Establishment of an Agriculture Policy Research Center at NDSU: Hoeven has allocated $2 million to establish a new agriculture policy research center at North Dakota State University (NDSU). This center, funded through the Office of the Chief Economist at the U.S. Department of Agriculture (USDA), aims to address farm and agribusiness challenges through comprehensive policy and economic analysis. It will focus on improving agriculture risk management tools, complementing similar centers at other prestigious institutions like the University of Missouri and Texas A&M University.

- Allocation of Research Funding: Hoeven has secured more than $50 million in funding for various agriculture research initiatives across North Dakota. This funding encompasses research conducted by the Agricultural Research Service (ARS) and the National Institute of Food and Agriculture (NIFA) at NDSU and other research stations. Additionally, funding supports priority initiatives at NDSU and facilitates further renovations at the ARS Edward T. Schafer Agricultural Research Center in Fargo.

- Support for AgTech Cooperative Agreement: Hoeven has increased funding to $2 million for the AgTech Cooperative Agreement between Grand Farm, NDSU, and ARS, aimed at advancing precision agriculture technology. This investment builds upon previous funding secured in fiscal years 2022 and 2023.

- Focus on Research Priorities: The allocated funding supports a range of research priorities, including autonomous systems, agricultural data security, predictive crop performance, fusion machine learning, controlled environment agriculture, agricultural measurement and monitoring innovation, unmanned aerial systems in precision agriculture, chronic wasting disease (CWD), and the Mandan ARS Healthy Soils Initiative. Additionally, research benefits production and disease prevention for various commodities such as barley, oats, pulse crops, soybeans, and wheat.

- Complementarity with Existing Initiatives: Hoeven's efforts complement existing initiatives like the NDSU-led FARMS partnership, which is receiving significant funding under the National Science Foundation's Regional Innovation Engines program.

|

PERSONNEL |

— Rep. Lauren Boebert successfully underwent surgery to remove a blood clot and insert a stent following severe swelling in one of her legs, CBS News Colorado reports, citing a statement. The Colorado Republican was previously diagnosed with May-Thurner Syndrome and is expected to fully recover from the surgery.

|

CHINA UPDATE |

— Chinese President Xi Jinping and President Joe Biden engaged in a phone conversation aimed at addressing their countries' shared interests amidst escalating tensions. The discussion covered a range of topics, including cooperation on counter-narcotics, AI safety, the restoration of military communication channels, and climate issues. The call also highlighted upcoming visits by top U.S. officials to China and anticipated military talks (see next item).

Both leaders affirmed their commitment to direct communication, as established during their previous summit.

Xi expressed concerns about U.S. measures affecting China's interests, particularly in science and technology, while Biden emphasized targeted protections for sensitive technology.

The conversation also touched on Taiwan, with Xi urging the U.S. not to support its independence or arm it, while Biden reiterated Washington's stance on the island's status quo.

“TikTok came up today, yes,” White House spokesman John Kirby told reporters following the call. Biden reiterated to Xi his concerns about Chinese ownership of the popular video-sharing app. “This was not about a ban of the application, but rather our interest in divestiture, so that the national security interests and the data security of the American people can be protected,” Kirby said. The U.S. House passed a bill last month to ban the video-sharing app if its Chinese owner, ByteDance Ltd, does not divest its stake. Biden has said he would sign the bill. Its fate in the U.S. Senate is unclear.

The call reflects ongoing efforts to manage competition and prevent conflict between the two nations. Other topics discussed included economic issues, human rights concerns in Xinjiang, Tibet, and Hong Kong, as well as regional security matters such as the Korean peninsula, Ukraine, and the South China Sea.

— U.S. Treasury Secretary Janet Yellen is embarking on her second trip to China in nine months, aiming to address concerns about the country's industrial overcapacity, which poses threats to global economies. Yellen will spend two days in Guangzhou before heading to Beijing for talks with high-ranking Chinese officials, including Vice Premier He Lifeng and Finance Minister Lan Fo’an. Despite ongoing differences, bilateral engagement has increased since President Biden's meeting with Xi Jinping in November, including a telephone call between the two leaders this week (see related item).

Yellen has previously criticized China's industrial policies, particularly subsidies benefiting key industries, and will advocate for fair treatment of American workers and businesses. The agenda also includes discussions on American manufacturing support, debt restructuring, combating money laundering, financial stability, China's economic growth targets, and the property sector. Additionally, Yellen will engage with Guangdong officials and participate in events hosted by the American Chamber of Commerce in China and Peking University during her visit.

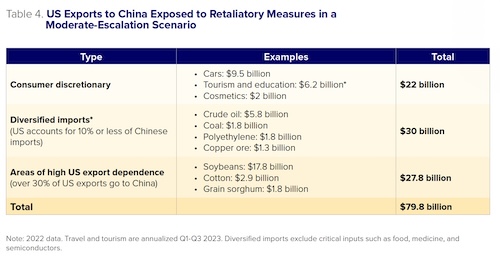

— How China could respond to U.S. sanctions in a Taiwan crisis. New research (link) from the GeoEconomics Center and Rhodium Group examines China’s ability to address potential U.S. and broader G7 sanctions, focusing on its possible retaliatory measures and its means of sanctions circumvention. analyzes Beijing's response to potential economic sanctions from the United States and other G7 countries, particularly in the context of a crisis related to Taiwan. Here are the key findings:

- Expansion of China's economic statecraft toolkit: China has significantly broadened its range of statecraft tools over the past five years, including tariffs, import bans, boycotts, and inspections. This expansion makes China's response to potential sanctions more formidable compared to Russia.

- Focus on trade and investment: China's statecraft toolkit primarily revolves around trade and investment rather than financial measures. This includes potential risks to US exports worth $79 billion in a moderate scenario and $358 billion in G7 exports in a severe scenario, along with significant G7 direct investment assets in China.

- Short- and medium-term costs for China: If China deploys economic statecraft tools, it would face substantial economic and reputational costs, particularly in terms of job losses and reduced foreign investment.

- Preference for strategic responses: China is unlikely to engage in tit-for-tat retaliation due to the significant costs involved. Instead, it may target sectors where it can inflict disproportionate damage, such as export controls on critical goods.

- Efforts to divide the G7: China may attempt to divide the G7 to mitigate the impact of sanctions, leveraging varying relations and commitments to Taiwan among G7 members. Positive inducements and bilateral lending to other countries could also be used to circumvent or reduce the implementation of G7 sanctions.

- Development of renminbi-based financial networks: China is working to create alternatives to the dollar-based financial system, including renminbi-denominated transaction networks. While not likely to replace the global financial system, these networks can provide alternative mechanisms for financing and trade transactions, enhancing China's resilience to sanctions.

- Timing's impact on statecraft tools: The timing of any crisis significantly affects the effectiveness of statecraft tools for both the G7 and China. Efforts to de-risk and shift supply chains may reduce China's capacity for retaliation over time, while the expansion of renminbi-based financial networks provides China with more options to mitigate Western sanctions.

As for U.S. ag-related trade with China, the report says:

“China could target areas based on how much the United States depends on China as an export market. In 2022, over half of U.S. exported soybeans went to China, as did 83% of its exported sorghum. U.S. dependence on China for its agricultural goods informed China’s decision to target these goods in response to the Section 301 tariffs. Yet the costs to China for imposing tariffs on these products would also be high: the United States supplied 31% of China’s imported soybeans and 64% of its imported sorghum. China would likely tailor the strength of its import restrictions depending on global agricultural conditions and whether alternative supply could be found elsewhere. Tariffs or bans on U.S. imports could also provide China with an opportunity to drive wedges between the United States and other countries. Sustained demand from Chinese consumers amid higher restrictions on U.S. imports would increase demand for imported goods elsewhere. As a group of advanced industrial economies, the G7’s exports overlap substantially with U.S. exports that could be at risk from Chinese trade barriers.”

— The yuan is nearing the weaker end of its onshore trading band, despite recent positive economic data failing to support the Chinese currency. On Tuesday, it reached a four-month low against the dollar in onshore trading, coming close to the lower limit set by the central bank. In the offshore market, the yuan has consistently traded weaker than the onshore daily limit for eight consecutive sessions, indicating sustained pressure. A Bloomberg item (link) says this pressure suggests traders anticipate Beijing may allow a weaker yuan to stimulate growth, especially as there's a lack of significant stimulus measures. However, managing this involves preventing disorderly capital outflows.

— There was a major 7.4 magnitude earthquake in Taiwan. The temblor was the strongest in a quarter century and may have impacted the region’s semiconductor industry. The epicenter of the quake was in Hualien County on the island’s east coast, with the United States Geological Survey (USGS) measuring it at a 7.4 magnitude, while Taiwan’s monitoring agency said it was 7.2 magnitude. The BBC, citing Taiwan’s government, said at least nine people are said to have died in the quake and more than 800 were injured. According to Reuters, at least 26 buildings have collapsed on the island and more than 50 people sustained injuries.

TSMC, the world's biggest manufacturer of advanced chips, evacuated workers from some of its factories and paused work on some machinery after the earthquake. But the company later told media outlets that all its workers were safe and many had started returning to the factory floor. It is unclear if the disruption will have any significant impact on the chipmaker. Shares in the company, which makes chips for the likes of Apple and Nvidia, were down 1.27% in afternoon trading in Taipei.

— Attaché expects China’s corn, wheat production to rise. The U.S. ag attaché in China projects the country’s corn production will increase 2.4% to 296 MMT this year amid an expected increase in yields and slightly larger planted area. The post projects China’s wheat production will rise 1% to 138 MMT on an expected rise in yields and steady planted area. China’s corn imports are forecast to decline 3 MMT to 20 MMT in 2024-25, while wheat imports are likely to be steady at 10 MMT. The attaché projects China will import 7.5 MMT of sorghum in 2024-25, unchanged from the current marketing year.

— China solar industry faces shakeout, but rock-bottom prices to persist. China accounts for 80% of solar module production capacity after years of subsidies, driving oversupply that has triggered a collapse in global prices. Link to details via Reuters.

Meanwhile, the EU launched two probes into China solar manufacturers, saying subsidies distort European market in a “strategically important” sector.

|

TRADE POLICY |

— Trump's tariff plan could drive inflation, pressure Fed: report. Donald Trump has proposed a tariff plan, which includes imposing 60% tariffs on imports from China and 10% tariffs on imports from the rest of the world. According to Bloomberg Economics, implementing such tariffs would likely lead to inflation exceeding the Federal Reserve's target and could prompt the central bank to raise interest rates. Bloomberg Economics utilized a model to estimate the impact of Trump's tariff plan on the U.S. economy. The model suggests that implementing the proposed tariffs would negatively affect U.S. economic growth and increase the cost of living for Americans. Specifically, it projects that the core personal consumption expenditures price index, the Fed's preferred measure of inflation, could rise to 3.7% by the end of the following year, well above the policymakers' 2% target. Economists surveyed by Bloomberg, on average, expect 2.1% inflation in 2025.

According to the model, Trump's tariffs would result in consumer prices being 2.5% higher and gross domestic product (GDP) being 0.5% lower after two years. This situation could force the Fed to decide between raising interest rates to combat inflation or cutting them to stimulate economic growth.

However, there is uncertainty surrounding these projections. Tom Orlik, chief economist and one of the report's authors, acknowledges the difficulty in forecasting the impact due to various variables and the lack of recent precedent for tariffs at such high levels. Nonetheless, he suggests that significant tariffs could have a substantial impact, emphasizing the associated risks.

Regarding Trump's previous trade war with China during his first term, a study by the U.S. International Trade Commission found limited inflationary effects from the tariffs imposed on Chinese goods. Despite this, Trump's current tariff proposal is broader in scope compared to his previous actions, which included tariffs of up to 25% on Chinese goods.

— USTR expands hearings on supply chain resilience and enforcement. The U.S. Trade Representative (USTR) announced (link) additional public hearings to collect information on advancing supply chain resilience in trade negotiations and enforcement efforts. The hearings are scheduled for May 14 in Minnesota, a virtual session on May 24, and May 28 in New York City. Originally, a public hearing was set for May 2 in Washington, DC, but it has been extended to include these additional dates. The deadline for post-hearing written comments has also been extended to June 4 from the initial May 16 deadline. This expansion of sessions indicates the Biden administration's focus on strengthening supply chains and enforcing existing agreements, rather than negotiating new free trade agreements. The information gathered may also contribute to discussions on investment frameworks.

|

ENERGY & CLIMATE CHANGE |

— EU exits winter with gas storage at record levels. Analysts say region may hit replenished capacity targets by summer. Gas storage for the EU at the end of March, considered the end of the winter season by the industry, stood at 58.72% full, according to industry body Gas Infrastructure Europe. That is about 3 percentage points higher than the previous high, set last year. As the EU refills its storages over the summer, analysts warn that the bloc may need to scale back imports of liquefied natural gas in the coming months to avoid capacity filling too early.

— E15 sales set record. Nationwide sales of E15, a higher blend of ethanol into gasoline than the traditional 10 percent, rose by 8 percent to a record 1.1 billion gallons in 2023, thanks to competitive prices and the growing number of stations that sell E15, said a trade group. Link for details.

— Iowa House delays ethanol dispenser requirements. An Iowa House committee unanimously approved House Study Bill 742, which aims to delay requirements for gas stations to install fuel dispensers capable of handling higher ethanol blends. Currently, new gas stations and those undergoing updates must use dispensers compatible with E85 (85% ethanol, 15% gasoline). The proposed modification suggests that new dispensers should be compatible with at least E15 until next year, E40 until 2030, and E85 thereafter.

The intention behind this modification is to facilitate smoother transitions to higher ethanol blends in the future. However, concerns have been raised by some gas station owners regarding their ability to acquire the necessary dispensers. A similar bill in the Senate was approved by a committee the previous month.

Supporters of the bill emphasize the importance of backing farmers and the agricultural industry, as ethanol production heavily relies on corn, with over half of Iowa's corn being used for ethanol. This bill aligns with efforts to boost ethanol consumption and support the state's ethanol production, making it a welcomed move by proponents.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— The largest egg producer in the United States, Cal-Maine Foods Inc., has had to cull approximately 3.6% of its flock due to an outbreak of avian flu among birds at one of its facilities in Texas. This outbreak has resulted in the destruction of nearly 1.6 million laying hens and 337,000 pullets (or young hens), leading to the temporary cessation of production at the affected plant. Cal-Maine said it is trying to secure production at other plants to minimize disruption. The company's shares experienced a significant decline, dropping by as much as 6.1% initially before rebounding.

This incident marks the most significant avian flu outbreak in the United States since Dec. 7, when 2.6 million birds were culled at an egg farm in Ohio due to the virus. Cal-Maine had also reported an outbreak at another facility in Kansas in December, affecting 684,000 hens.

The current outbreak raises concerns as highly pathogenic flu is also spreading in dairy cattle herds, including in Texas. This situation could potentially impact the broader food chain. The company is collaborating with authorities and industry groups to minimize the risk of future outbreaks. However, it reassures consumers that properly handled and cooked eggs are safe, and no eggs have been recalled because of this outbreak.

Texas Agriculture Commissioner Sid Miller said the state’s agriculture department would continue to monitor and provide guidance to producers and consumers, adding that safety measures and pasteurization ensure that dairy products remain unaffected by bird flu.

Cal-Maine said it is dedicated to robust biosecurity programs. “There is no known risk related to [highly pathogenic avian influenza] associated with eggs that are currently in the market and no eggs have been recalled,” Cal-Maine said. It added it’s working with federal, state, and local government officials and certain industry groups to lessen the risk of future outbreaks.

Despite the challenges posed by the outbreak, Cal-Maine announced strong fiscal third-quarter earnings, with earnings of $3 a share on revenue of $703 million. Analysts expected earnings of $2.45 and revenue of $692 million. The upbeat earnings were attributed to robust consumer demand, which led to record egg sales by volume. Despite the temporary disruption caused by the outbreak, the price of eggs has remained relatively stable, with last week's cost at $2.47 per dozen, significantly lower than the record high observed in December 2022.

— Senior Biden administration officials briefed congressional committees and leadership on bird flu, as the disease struck an egg facility in Texas on Tuesday. Briefing were reps from FDA, CDC, Administration for Strategic Preparedness and Response and USDA.

— Mexico taking ‘preventative measures’ in wake of U.S. HPAI outbreak in dairy cattle. Mexico’s agriculture ministry on Tuesday said it is taking preventative measures to increase surveillance and reinforce inspections of U.S. livestock imports after highly pathogenic avian influenza (HPAI) was found in dairy cattle. The Mexico-United States Commission for Prevention of Foot-and-Mouth Disease and other Animal Exotic Diseases (CPA) will visit livestock farms to take samples for lab analysis, a statement by Mexico's agriculture ministry said. Officials from Mexico's agriculture sanitation authority Senasica will also increase surveillance of cattle entering the country for any sign of respiratory distress.

— Can Africa turn into food exporter? The Financial Times asks whether Africa, a major net importer of food, may one day produce enough not only to sustain itself but even help feed the world’s growing population. Link/paywall for details.

|

HEALTH UPDATE |

— Bird flu in humans, explained. A Washington Post primer (link) discusses how it spreads, the symptoms and more.

— U.S. health insurers stock declines after Biden Medicare payment announcement. Major U.S. health insurers experienced a significant decline in their stock prices on Tuesday following the Biden administration's announcement regarding payments for private Medicare plans. The decision, which fell short of industry and investor expectations for a larger boost in payments, has heightened pressure on these companies already grappling with high medical costs.

Humana, particularly reliant on Medicare Advantage plans compared to its competitors, bore the brunt of the impact, with its stock plummeting by 13% on Tuesday. CVS Health and UnitedHealth Group also witnessed sharp declines, with their shares falling by over 7% each.

|

POLITICS & ELECTIONS |

— Maryland Senate race in focus. A new Goucher College Poll survey in partnership with the Baltimore Banner shows U.S. Rep. David Trone holds a slight lead over Prince George's County Executive Angela Alsobrooks in the Democratic primary for the U.S. Senate. And both Democrats would be locked in a tight race with former Gov. Larry Hogan, the favorite to win the Republican nomination. The survey of 800 Maryland registered voters was conducted by landline and cellphone from March 19 to March 24. The poll has a margin of error of 3.5 percentage points. The poll also surveyed 408 likely Democratic voters about the primary. Those questions had a 4.9 percentage point margin of error. Link for results.

— A new WSJ poll finds that Donald Trump is leading President Biden in six of the seven most competitive states in the 2024 election, propelled by broad voter dissatisfaction with the economy and deep doubts about Biden. The poll shows Trump holding leads of between 2 and 8 percentage points in six states — Pennsylvania, Michigan, Arizona, Georgia, Nevada and North Carolina — on a test ballot that includes third-party and independent candidates. Trump holds similar leads when voters are asked to choose only between him and Biden. The one outlier is Wisconsin, where Biden leads by 3 points on the multiple-candidate ballot, and where the two candidates are tied in a head-to-head matchup. Link for details.

WSJ bottom line: “Overall, the poll shows substantial unhappiness with Biden among voters who will have the most influence on the outcome of the election.”

|

OTHER ITEMS OF NOTE |

— Biden administration mandates two-person crews for freight trains after safety concerns. The Biden administration issued a new rule through the Transportation Department aimed at enhancing safety measures in freight rail transportation following a notable derailment incident last year that led to the release of toxic chemicals. The final rule mandates that crews operating freight trains must consist of at least two individuals. This requirement aligns with the longstanding demand from rail worker unions, who assert that having a second crew member helps prevent worker fatigue and overexertion. Rail safety has garnered significant attention in Washington, particularly following the derailment of a train carrying hazardous materials such as toxic vinyl chloride in Ohio last year.

— EPA issued a notice detailing the final conditions for dicamba product usage after revoking their registration. The notice (link) outlines an existing stocks order for XtendiMax®, Engenia®, and Tavium® for over-the-top use on dicamba-tolerant cotton and soybeans. The agency defined existing stocks as products registered before Feb. 6, 2024, and laid out timelines for the end of sale and distribution, ranging from May 13 to the end of June, depending on the state. Final use dates vary from June 12 to July 30 across different states.

— Mexico has postponed the ban on glyphosate, which was initially set for April 1. The government cited concerns about potential disruption to crop production and the absence of viable alternatives to the herbicide. Conditions outlined in the February 2023 decree have not been fulfilled. However, this delay is not expected to affect the portion of the decree regarding the cessation of Mexican imports of GMO corn for food use. The United States has challenged this decision under the U.S.-Mexico-Canada Agreement (USMCA), with a hearing scheduled for June and a final decision expected by year-end.

— Iowa’s Senate approves bill to limit lawsuits against Bayer, the producer of Roundup, a widely used herbicide, concerning its potential health effects. This bill, Senate File 2412, would protect Bayer from failure-to-warn claims if the product is labeled according to federal regulations. Bayer hopes that this legislation, combined with a potential U.S. Supreme Court decision favoring federal law overruling such claims, would significantly reduce Roundup-related litigation. Despite claims by the U.S. Environmental Protection Agency that Roundup's primary ingredient, glyphosate, is not likely to cause cancer, the International Agency for Research on Cancer has classified glyphosate as "probably carcinogenic to humans." The bill's proponents argue that the health risks associated with Roundup are overstated, and the litigation is burdensome for farmers and the industry. However, opponents, particularly Democrats, view the bill as favoring corporate interests over public health and justice, emphasizing the importance of legal recourse for individuals harmed by products like Roundup. The bill passed with a 30-19 vote in the Senate, with most Democrats opposed and a few Republicans joining them. The bill's fate in the House remains uncertain. Bayer, meanwhile, is taking steps to address concerns, including removing glyphosate from its lawn and garden products and developing alternatives.

— KC rejects stadium tax. Last night, Kansas City voters overwhelmingly denied a sales tax that would’ve kept the Chiefs and Royals in the metropolitan area for the next 25 years. The tax would’ve provided about $2 billion to help renovate Arrowhead Stadium and build a new Royals stadium. Both Chiefs and Royals owners don’t appear to have a Plan B right now. Critics said it would have given a large subsidy to the teams’ wealthy owners. They were also concerned about the Royals’ plans to move to a popular neighborhood downtown, which could potentially push out small businesses and cause area rents to increase. The leaders of both teams have said that leaving Kansas City would be an option if the tax measure didn’t pass. “We would just have to look at all our options,” Chiefs’ President Mark Donovan said in an interview with KSHB.com before the vote. He said those options would “have to include” leaving Kansas City, but the team’s goal is to stay.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |