Baltimore Bridge Collapse: Limited Impact on Trade Basis Channel Reopening Timeline

RFK Jr. VP | Dairy cattle bird flu update | John Deere layoffs | Dollar/yen exchange rate 34-year high

|

Today’s Digital Newspaper |

MARKET FOCUS

- Japan top currency official: speculative moves on yen can’t be tolerated

- Fed faces challenge in controlling inflation, particularly achieving its 2% target

- Concerns regarding economic growth in U.S.

- John Deere's Waterloo operations will lay off over 300 employees indefinitely April 29

- Ag markets today

- Biden's biofuel push may shift corn's dominance in U.S. crop planting

- Thai rice exports may top target

- Indonesia’s rice surplus narrowing

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

BALTIMORE BRIDGE COLLAPSE

- Latest on causes and impacts

CHINA

- Companies see China trade diminish amid geopolitical tensions, weak economy

- China’s hog herd still too big despite reductions

- More Chinese companies to be added to U.S. import ban list

- Xi tells U.S. CEOs China’s growth prospects remain ‘bright’

- Yellen to warn China against flood of cheap green energy exports

TRADE POLICY

- USTR reviewing China's WTO consultation on EV subsidies

ENERGY & CLIMATE CHANGE

- Tax credits and carbon capture: How ethanol plants offset costs

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Update on bird flu in dairy cattle

HEALTH UPDATE

- Data show significant increase in Medicare spending on Ozempic, similar drugs

POLITICS & ELECTIONS

- Expectation of dollar rally under 2nd Trump presidency contradicts historical trends

|

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened 240 points higher.

U.S. equities yesterday: The Dow ended down 31.31 points, 0.08%, at 39,282.33. The Nasdaq was 68.77 points lower, 0.42%, at 16,315.70. The S&P 500 lost 14.61 points, 0.28%, at 5,203.58.

— Ag markets today: Corn, soybeans and wheat extended Tuesday’s losses during the overnight session. As of 7:30 a.m. ET, corn futures were trading 4 to 5 cents lower, soybeans were 5 to 6 cents lower, SRW wheat was 1 to 2 cents lower, HRW wheat was 3 to 5 cents lower and HRS wheat was steady to a penny lower. Front-month crude oil futures were around 50 cents lower, and the U.S. dollar index is trading just below unchanged.

Signs point to lower cash cattle trade. Heavy selling in live cattle futures the first two days this week suggest cash cattle will decline, potentially sharply, from their record high of $189.56 last week. So far, trade has been limited around the $186.00 level in the northern market.

Cash hog fundamentals still seasonally strong. After a one-day decline, the CME lean hog index is up 22 cents to $83.69 as of March 25. The pork cutout value slipped 41 cents on Tuesday to $95.33, though the previous day’s price was the highest since last October.

— Agriculture markets yesterday:

- Corn: May corn futures closed down 5 1/4 cents at $4.32 1/2 and near the session low.

- Soy complex: May soybeans fell 10 1/4 cents to $11.99, while May soymeal fell $1.90 to $339.80. May soyoil fell 60 points to 48.42 cents, ending the session below the 10- and 100-day moving averages. Each soy derivative ended near their respective session low.

- Wheat: May SRW wheat fell 11 1/2 cents to $5.43 1/2. May HRW wheat dropped 12 1/4 cents at $5.77 1/4. May spring wheat fell 12 1/4 cents to $6.47 1/4. Prices closed near their session lows.

- Cotton: May cotton rose 139 points to 93.41 cents, a more than one-week high close.

- Cattle: June live cattle futures dropped $3.225 to $178.375, while nearby April futures tumbled $3.10 to $183.10. May feeder cattle futures fell $5.375 to $247.25, while nearby March futures sank $1.725 to $247.725.

- Hogs: Hog futures continued their recent advance, with nearby April rising 42.5 cents to $85.575, while most-active June slid 32.5 cents to $101.35.

— Quotes of note:

- Federal Reserve faces challenge in controlling inflation, particularly in achieving its 2% target. Torsten Slok, from Apollo, suggests that the current environment, marked by record-high stock prices, makes it increasingly difficult for the Fed to bring inflation down. He argues that the immediate positive impact on the economy from soaring stock prices outweighs the influence of monetary policy. Slok attributes the robustness of U.S. economic data to a rally in the stock market that began when the Fed adopted a dovish stance late last year. Since late October, the S&P 500 has surged by nearly 27%. Slok speculates that while the effects of Fed rate hikes may take 12 to 18 months to materialize, the impact of loose financial conditions on consumer spending is immediate.

- Concerns regarding economic growth in the United States. James Knightley, the chief international economist at ING, notes that despite a slight uptick in orders for durable goods in February, driven primarily by aircraft orders, it doesn't compensate for a significant decline earlier in the year. This indicates a reluctance among corporations to invest, which is likely to persist and weigh on the overall economy. Knightley emphasizes the critical role of consumer spending in driving growth, suggesting that U.S. consumers are the primary hope for economic expansion this year.

— John Deere's Waterloo operations will lay off over 300 employees indefinitely on April 29, as confirmed by the company on Tuesday and reported on by the WCF Courier (link) and the Des Moines Register (link). The affected workers, primarily production staff, were informed of the layoffs in meetings with factory leaders. Deere stated that the layoffs were necessary for optimizing the workforce at the Waterloo Operations, which currently employs approximately 5,500 individuals, with around 3,600 in production and maintenance roles. The announcement follows a recent decision by the company to lay off 150 workers at its Ankeny location. Despite significant earnings in fiscal year 2023, with $10.1 billion reported, Deere projects lower earnings of $7.5 billion to $7.75 billion for fiscal year 2024. The company's net income for the first quarter of 2024 decreased compared to the same period in the previous year. However, Deere announced the impending release of its largest and most powerful tractor, the "9RX," expected to begin production in mid-2024 at the Waterloo facility. Deere's next earning report is due May 17.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer, with the euro and yen both weaker against the greenback while the British pound was steady. The yield on the 10-year U.S. Treasury note was weaker, trading around 4.22%, with a lower tone in global government bond yields. Crude oil futures were under pressure, with U.S. crude around $81.05 per barrel and Brent around $85.05 per barrel. Gold and silver were stronger ahead of U.S. economic data, with gold around $2,207 per troy ounce and silver around $24.64 per troy ounce.

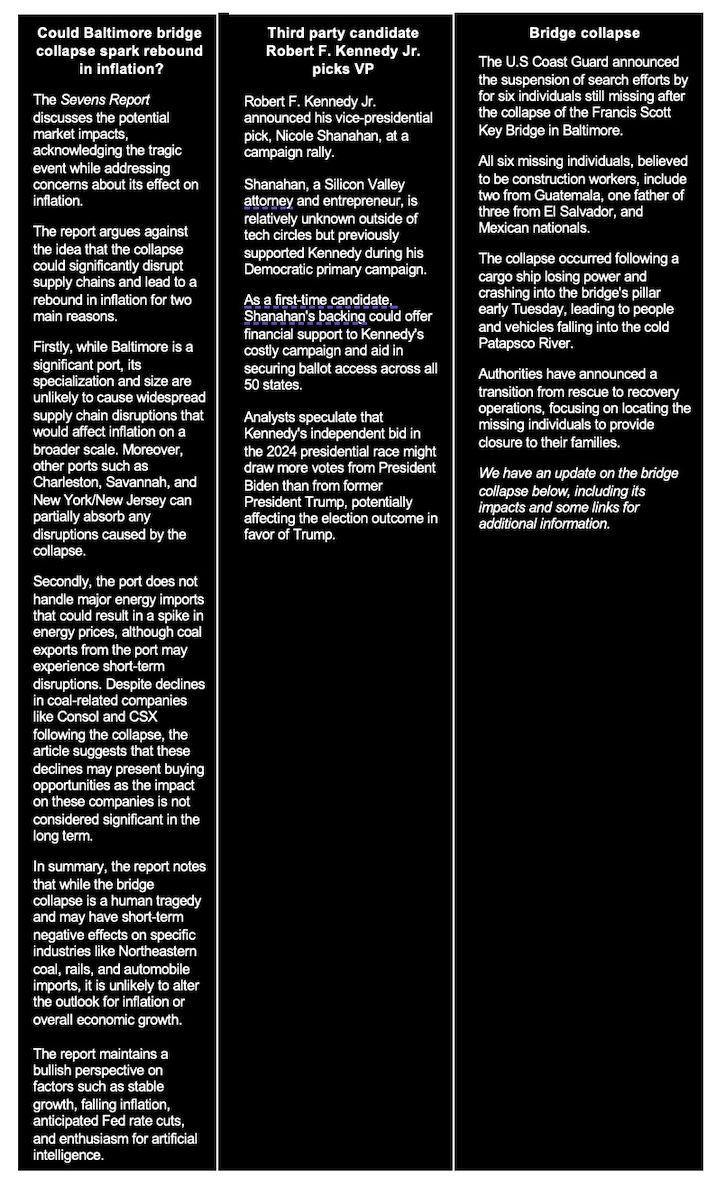

— The dollar/yen exchange rate hit a 34-year high, surpassing previous peaks from 2022 that drew intervention from the Bank of Japan at the time. The dollar has now jumped almost 20% against the yen since the beginning of last year. Japan's finance minister Shunichi Suzuki issued his strongest warning to date and said the authorities could take "decisive steps" — a phrase previously used in Autumn 2022 just before Japan stepped in to sell dollars on the open market. Link to Bloomberg report.

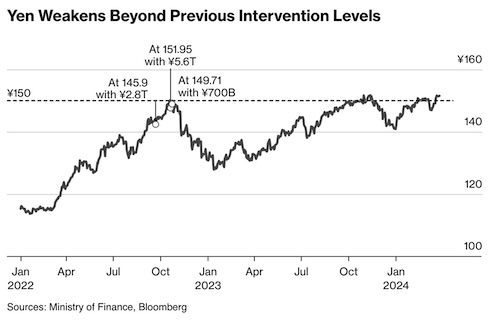

— Biden's biofuel push may shift corn's dominance in U.S. crop planting. A Bloomberg article (link) discusses the potential shift in U.S. crop planting dynamics, with soybeans possibly surpassing corn due to President Biden's decarbonization plan and increased demand for soybean oil for renewable diesel production. While corn has historically been favored by American farmers, the surge in green energy subsidies could lead to soybeans taking the top spot in the future. The biofuels initiative has prompted investments in soybean processing plants, potentially altering crop preferences. Despite challenges such as the proliferation of electric vehicles affecting corn demand, some experts remain skeptical about soybeans becoming the primary crop due to farmers' preference for crop rotation. While this shift may not happen immediately, soybeans are poised to become a significant player in U.S. crop planting in the longer term.

One U.S. analyst responds to the Bloomberg article: “Really? And Brazil is going to sit on their hands and not grow their number-one crop… soybeans. People in this article are very domestic focused.”

— Thai rice exports may top target. Thailand could export 8 MMT of rice this year, above the original 7.5 MMT target, the government said. The country shipped about 2.5 MMT of rice in the first quarter of this year, up 21% from the same period last year.

— Indonesia’s rice surplus narrowing. Indonesia’s domestic rice supply-demand gap is seen at a surplus of 1.7 MMT in the first half of 2024, narrowing from a 3.36 MMT surplus last year, an ag ministry official said. Total rice output between January and June is seen at 17.09 MMT, more than the 15.39 MMT total demand predicted for the period.

— Ag trade update: South Korea purchased 65,000 MT of corn to be sourced from the U.S. or South America and tendered to buy up to another 70,000 MT of corn to be sourced from South America or South Africa. Indonesia purchased around 300,000 MT of rice — 117,000 MT from Thailand, 108,000 MT from Vietnam and the rest from Pakistan and Myanmar.

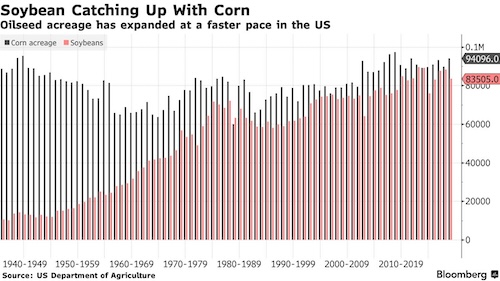

— NWS weather outlook: Rainy, stormy weather across the Southeast Coast through Thursday... ...Unsettled weather arrives over Northwest today... ...Warming trend begins over Central U.S. on Thursday.

Items in Pro Farmer's First Thing Today include:

• Followthrough selling in grains overnight

• China’s industrial profits rise

• Eurozone economic sentiment improves

• Argentina’s February beef export surge to 57-year high

|

BALTIMORE BRIDGE COLLAPSE |

— Update on Baltimore’s Francis Scott Key bridge collapse:

- A safety probe will include whether dirty fuel played a role in the giant cargo ship losing power and crashing into the span.

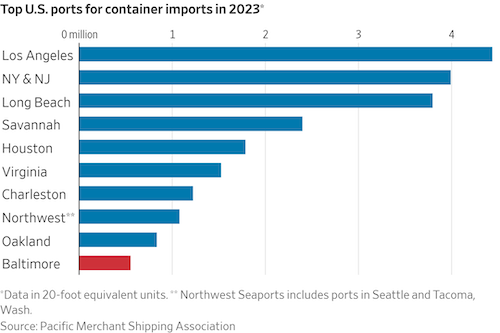

- Facts and figures: Fifth largest port on the East Coast by total tons of cargo handled, according to the Bureau of Transportation Statistics, and the seventeenth largest overall in the United States. Port is the twelfth largest container port in the U.S., according to Ryan Peterson, the CEO of Flexport. It was ninth in terms of the tonnage and value of foreign cargo, according to the governor of Maryland.

Link for U.S. agricultural port profiles. According to USDA, the port accounts for about 3% of U.S. ag imports, totaling around 1.794 million metric tons (MMT) in 2023. Baltimore was outside the top 12 ports for U.S. agricultural exports. The terminal was the second largest U.S. coal export facility, moving some 74 million tons last year.

- The port was the first in terms of the volume of automobiles and light trucks (including 847,158 cars and light trucks), heavy farm and construction machinery, imported sugar, and imported gypsum, the governor’s office says. According to Dean Croke, principal industry analyst at DAT Freight & Analytics, Baltimore is one of the nation’s leading gateways for farm equipment and construction machines like combines, tractors, hay balers, excavators and backhoes. March “is the peak import month in Baltimore for farming equipment ahead of planting season in the Midwest,” Croke told Bloomberg. It’s also a key port for construction materials like lumber and gypsum, he said. Everstream Analytics, a supply-chain risk assessment firm, said the port is also a critical hub for items like steel, aluminum and sugar, with some 30 to 40 container carriers stopping there each week. ASR Group, which operates a sugar mill in Baltimore, said it had six to eight weeks of sugar at the Baltimore facility, one of its largest, and all of its other production facilities and warehouses have "healthy inventories" of finished product that be tapped if needed. Reports said that a ship was unloading at the ASR facility in Baltimore when the collapse happened.

- "Around the world, about 40 ships, including 34 cargo vessels, have Baltimore listed as a destination, including 10 commercial ships with anchors dropped in nearby waters, according to MarineTraffic, which tracks ships," the New York Times reported Tuesday.

- Baltimore's port is the second largest terminal for coal exports, handling around 74 million tons of coal last year, according to Bloomberg. "The collapse of a major Baltimore bridge is likely to shut down coal exports for as many as six weeks and block the transport of up to 2.5 million tons of coal, said Ernie Thrasher, chief executive officer of Xcoal Energy & Resources LLC," Bloomberg reported (link).

- Port of Baltimore impact. The port announced late Tuesday morning that shipping traffic is suspended until further notice, but that trucks are still being processed at the port's marine terminals. There is no indication of how long shipping traffic will be halted, the port added in a statement. One economist says Maryland could lose $15 million per day in revenue as shipping is rerouted.

- Maryland’s governor said there’s no estimate on when operations will resume.

- How long it will take for shipping at the port — and elsewhere around the country — to return to normal is an open question. Some shipping officials have said it might take several months, particularly when it comes to the car and coal markets that depend on the Port of Baltimore. “I think there are a couple weeks disruption but I don’t think it’s going to be much longer than that,” Sridhar R. Tayur, a professor of operations management at Carnegie Mellon University, told Washington Business Journal. “Or they can reroute and manage for a longer period. I expect people will be thinking about rerouting to other ports on the East Coast.” Tayur said the Port of New York and New Jersey, a much larger complex, would be a natural fit. So would either Norfolk, Virginia, or Boston. “An issue is the size of the port and what kinds of ships it can take,” Tayur said. Bigger ships can’t go to smaller ports. And it would depend on the capability and capacity of the ports that take Baltimore’s load temporarily: Some are already at capacity with their own cargo. “Now the question is, how do you get stuff to the port and out of the port,” Tayur said. “I would look at this part very carefully.” Jim Barker, president of Rosebud Mining Co. in Kittanning, Pennsylvania, said Tuesday morning that he had been told that the port could start receiving and sending out ships within two or three weeks. Rosebud, like other coal producers in Pennsylvania, use the Consol Marine Terminal in Baltimore to load coal that will be exported overseas for power generation, industrial and steelmaking uses. Barker said he’s not concerned now about a potential backup of coal either at Rosebud’s mines or at the terminal due to the fact there’s storage on site in Baltimore. “We don’t see any [long-term] impact,” Barker said.

- President Joe Biden called for the federal government to foot the bill to rebuild the Francis Scott Key Bridge in Baltimore. Biden said the federal government should fund all reconstruction costs. Congress would have to approve any federal funding. Asked if the shipping company should be held responsible for the costs of reconstruction, Biden said the federal government should act before a determination of fault is made. “That might be, but we’re not going to wait for that to happen,” he said. “We’re going to pay for it to get the bridge rebuilt and open.” Biden said he would visit Baltimore “as quickly as I can” and that there is no indication of it being more than an accident.

- The reconstruction of a bridge across the Patapsco River faces uncertainty regarding its timeline. Compared to the 1970s when the bridge was initially built, current concerns over environmental impacts and bureaucratic hesitancy towards major infrastructure projects suggest a potentially prolonged reconstruction process. During the original construction in the 1970s, planning took several years before bidding commenced in 1970. Actual construction began in 1972, and the project was not completed until 1977. Given the current context, the reconstruction timeline is likely to be extended, reflecting the challenges associated with modern marine construction projects and bureaucratic approval processes.

- The disruption will lead to challenges in redistributing cargo shipments to other East Coast ports. The Port of Virginia in Norfolk and Virginia Gov. Glenn Youngkin said the commonwealth is already working to accommodate ships diverted from Baltimore. "The Port of Virginia has significant experience handling surges of import and export cargo and is ready to provide whatever assistance we can to the team at the Port of Baltimore," it said in its statement. Ford and GM said they’ll find workarounds to the top U.S. vehicle-handling port. While some ports may absorb part of the cargo, they may not have the capacity to accommodate the entirety of what would have gone through Baltimore. This situation mirrors the congestion experienced by ports during the pandemic, highlighting the potential for traffic jams in port operations. Experts suggest that considering the ongoing Red Sea crisis and the loss of Baltimore's port, shipping activities may increasingly shift towards the West Coast. However, this shift could lead to congestion issues at West Coast ports, exacerbating logistical challenges in the shipping industry. A 10% to 20% increase in volumes can lead to a compound feedback loop of congestion and delays.

- Supply and demand shocks equal inflation. Economists are labeling the collapse as a "supply shock," likely resulting in a resurgence of goods inflation and potential temporary shortages. Rerouting of shipping and congestion at other ports may cause delays in the delivery of goods, impacting even those not originally destined for Baltimore. According to Citigroup economist Andrew Hollenhorst, the recent period of goods deflation is likely ending, indicating a shift towards inflation. Additionally, there's a "demand shock" element. The efforts to clear the channel and rebuild the bridge will divert resources such as manpower, materials, and time from other projects, potentially leading to delays or postponements. This additional demand in a near full-employment economy could further fuel inflationary pressures. (But as noted in the black box item above, others discount the collapse fueling inflation.)

- Federal Reserve rate impact? Some say the collapse of the bridge could foreclose the chances that the Federal Reserve will cut interest rates this year. Although the futures markets have not shifted the odds of a cut yet — they're still pricing in a cut in June — some expect that will change as the costs of Baltimore become apparent.

|

CHINA UPDATE |

— Wall Street Journal: American companies face slowdown in China expansion amid rising tensions. An in depth article in the Wall Street Journal (link) shows a significant slowdown in the decades-long expansion of American companies into China. Several factors contribute to this stalling trend, including escalating geopolitical tensions, trade disputes leading to retaliatory measures, and China's pursuit of self-sufficiency.

In recent times, the attractiveness of the Chinese market has diminished. China's economic growth has decelerated to its slowest pace in decades, resulting in decreased consumer spending, particularly on foreign brands. Additionally, China's once dominant export sector is facing challenges.

Consequently, many multinational corporations are reducing their involvement with China. They are exporting fewer products to China and witnessing declines in their revenue from the country. This situation has prompted some companies to scale back their investments in China.

Previously, American and other multinational firms constituted over half of China's exports, but now they represent less than a third. China is increasingly favoring products from other countries and domestic manufacturers over those from the United States, impacting sectors such as automobiles, aircraft, and semiconductors.

The revenue generated by multinational companies from China has declined, with the share of total company revenue earned in China by U.S. firms dropping from 16% in 2006 to 10% in 2020, as per McKinsey Global Institute data. While Apple experienced a boost in iPhone sales in China following U.S. sanctions on Huawei, the Chinese tech giant has retaliated, gaining traction in high-end smartphone sales with its Mate 60 Pro.

American automakers like Ford and GM are losing market share in China, although Tesla's sales have increased. Nevertheless, Tesla faces stiff competition from Chinese rivals, and its market share has remained stagnant.

Bottom line: Given the challenging environment, American companies are increasingly opting to reduce their exposure to China, a strategy referred to as "de-risking." Foreign direct investment, which surged after China's accession to the World Trade Organization in 2001, is now being curtailed by U.S. firms, while the U.S. government is imposing restrictions on certain investments.

— China’s hog herd still too big despite reductions. China’s hog herd will remain in surplus this year, despite new government targets to tame oversupply. Earlier this month, Beijing adjusted the national target for normal retention of breeding sows to 39 million head from 41 million and issued new regulations to control the country’s pig production capacity. But increasingly productive sows and a reluctance in hog farms to destock will keep herd size at high levels and prices low. Shanghai JC Intelligence Co. said the sow herd needs to decline to about 35 million head. It forecasts China’s 2024 pig production at 717 million head, down 10 million head (1.4%) from last year.

— More Chinese companies to be added to U.S. import ban list. A list of companies banned over forced labor concerns is expected to grow in the next few months, says Laura Murphy, a Homeland Security adviser. Link to details via the Wall Street Journal.

— Xi tells U.S. CEOs China’s growth prospects remain ‘bright’. Beijing seeks to revive investor confidence as concerns mount about oversupply and potential dumping. Link to more via the Financial Times. Link to Bloomberg item on same topic.

Xi Jinping with the representatives in Beijing. Source: Ministry of Foreign Affairs/X

— Yellen to warn China against flood of cheap green energy exports. The Treasury secretary, who plans to make her second trip to China soon, will argue that the country’s excess industrial production warps supply chains. Link for details via the New York Times.

|

TRADE POLICY |

— USTR reviewing China's WTO consultation on EV subsidies. U.S. Trade Representative Katherine Tai is currently reviewing China's request for consultations at the World Trade Organization (WTO) regarding U.S. subsidies for electric vehicles (EVs). China claims that these subsidies, provided under the Inflation Reduction Act (Climate Bill), are discriminatory and have distorted the global EV supply chain market. Tai stated that the U.S. is carefully assessing China's consultation request. She also criticized China's own policies, accusing them of employing unfair practices to promote Chinese manufacturers globally. If the consultations fail to resolve the issue, China can request the establishment of a dispute settlement panel at the WTO.

|

ENERGY & CLIMATE CHANGE |

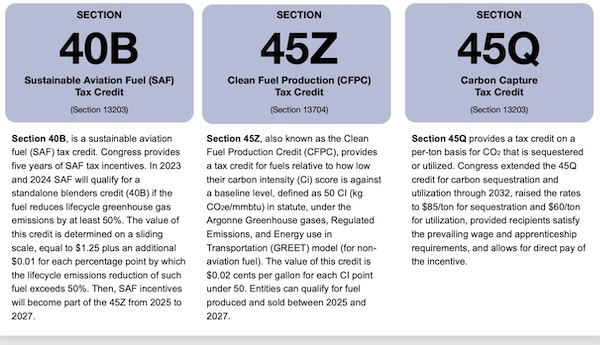

— Tax credits and carbon capture: How ethanol plants offset costs. Ethanol plants are exploring carbon capture technologies to reduce their carbon intensity (CI) scores and qualify for tax credits. Paul Neiffer, via his Farm CPA Report (link/paywall), says the two main methods are point source capture and carbon capture and storage (CCS). The Inflation Reduction Act (IRA) has increased tax credits for carbon capture under Section 45Q and reduced eligibility requirements (see graphic below). Ethanol plants utilizing point source capture can qualify for tax credits of up to $85 per metric ton, while those using CCS may indirectly benefit through reduced CI scores. Lower thresholds for carbon capture eligibility present new opportunities for ethanol plants, he notes. However, Neiffer says the Section 45Z credit, which provides benefits to ethanol plants, is only scheduled until 2027 and may need extension for continued benefits. Ethanol plants may also benefit from DOE funding. Overall, he says plants with carbon capture technology may have an economic advantage over those without it.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Update on bird flu in dairy cattle:

- USDA has identified infected cows in four dairy herds in Kansas and Texas, and tests of other herds are pending. Dairy cows in New Mexico have also exhibited symptoms of the illness.

- The locations of the infected herds in southwest Kansas and the panhandle of Texas are in the Central Flyway — a major migratory route that goes west of Iowa, through Nebraska and South Dakota.

- On Monday, tests of milk from the sick cows confirmed that they were infected by the avian flu. Those affected were older animals and typically comprised about 10% of the total herd, USDA reported. The infected cows have generally recovered from the illness, rather than dying. Milk from sick animals is discarded, and the most-affected herds produced about 40% less milk for about a week.

- Initial analysis by a USDA lab did not detect a genetic change in the virus to make it easily transmissible between mammals, which means the infected cows are unlikely to infect other cows or humans.

- A suspected source of infection is feed that gets contaminated by wild birds. Infected birds can pillage feed that is out in the open and defecate on it in the process.

- The disease can infect mammals, too. USDA has a list of more than 200 individual mammals that were infected with the bird flu in the past two years in the United States. The list includes fox, opossum, squirrels, dolphins and grizzly bears. Last week, Minnesota announced that bird flu had killed at least one young goat at a farm where poultry had been infected in February. It was the first known infection of U.S. livestock by the virus.

|

HEALTH UPDATE |

— Data show a significant increase in Medicare spending on Ozempic and similar diabetes drugs, reaching over $5.7 billion in 2022, a stark rise from $57 million in 2018, as indicated by a new study from the Kaiser Family Foundation (KFF). These medications, including Mounjaro and Rybelsus, have gained popularity not only for treating diabetes but also for weight loss, despite Medicare being legally restricted from covering drugs solely for weight loss purposes. Health experts express concerns that the combination of high demand, expanded usage, and exorbitant prices of these drugs could lead to heightened costs for both the federal government and Medicare enrollees at large. The KFF analysis underscores the potential health benefits of these medications but warns that their escalating popularity and costs may strain Medicare spending significantly.

|

POLITICS & ELECTIONS |

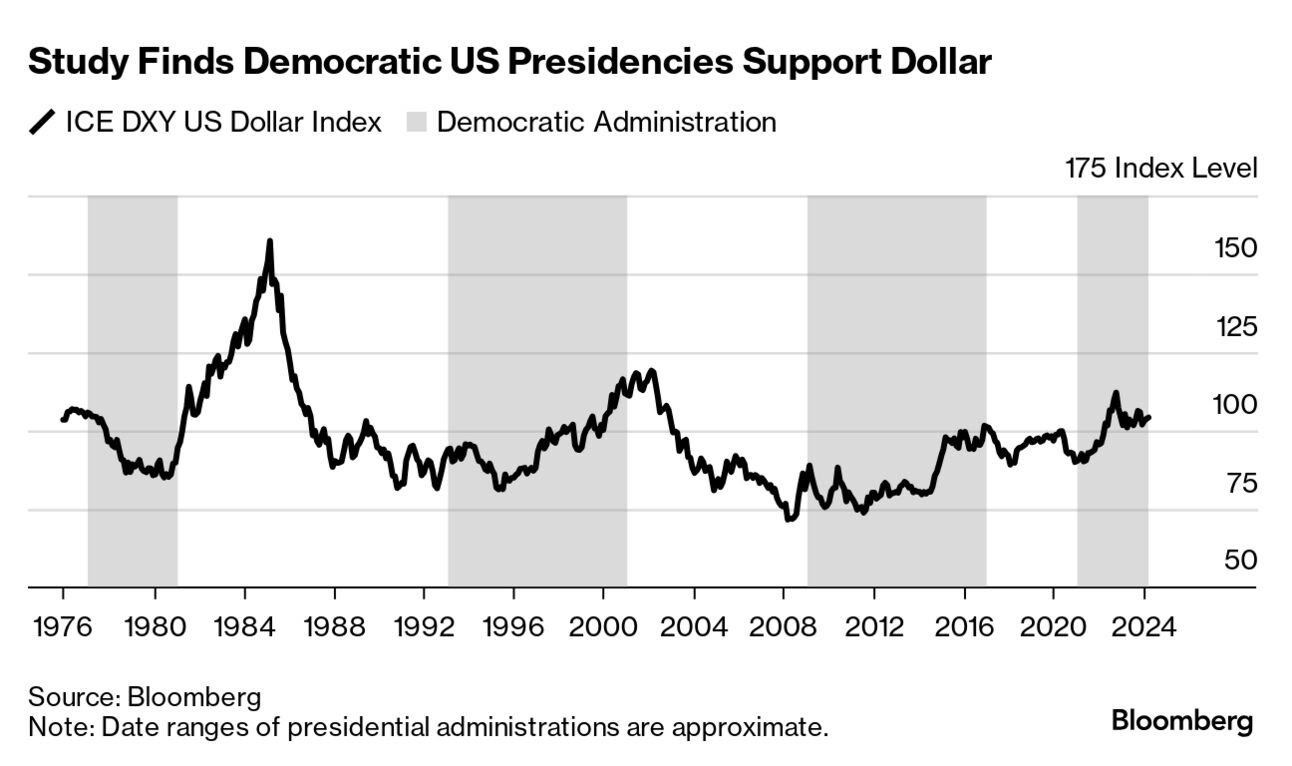

— Wall street's expectation of dollar rally under second Trump presidency contradicts historical trends. A working paper (link) that analyzed almost 40 years of data showed there’s a statistically significant relationship between FX returns and U.S. presidential cycles. The dollar on average climbs 4.2% a year when Democrats are in power and slides 1.3% with Republicans, according to the study. One working theory is that the kind of trade barriers often pursued by Republicans lead to retaliation, hurt global trade and ultimately reduce dollar demand.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |