Bridge in Baltimore Collapses into River Early Tuesday After Being Hit by Large Containership

Bird flu in U.S. dairy cattle | CEOs meet with Xi | Food prices | Donuts at McDonalds | Gas at $4?

|

Today’s Digital Newspaper |

MARKET FOCUS

- $15.6 million: Median pay for CEOs last year

- $90 Brent real possibility

- U.S. gas prices likely to climb to $4 a gallon: AAA

- Employment in nearly one-third of U.S. states below pre-pandemic levels

- USDA expects lower food price increases compared to previous forecasts

- Ag markets today

- American Sugar Coalition pushing for restrictions on sugar imports from Mexico

- Cocoa futures top record $10,000 a ton

- India's rice exporters facing additional duties on rice exports

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

BALTIMORE BRIDGE COLLAPSES

- Latest updates and impacts of Baltimore bridge collapse

ISRAEL/HAMAS CONFLICT

- Netanyahu cancels high-level talks in Washington

RUSSIA & UKRAINE

- Putin admits terrorist attack in Moscow perpetrated by ‘radical Islamists’

- Russia's ag regulator proposes reducing export quota of major grain trader, TD Rif

POLICY

- ERP payouts update

CHINA

- U.S. and Britain impose sanctions on elite Chinese hackers

- China files complaint to WTO against U.S.’ Inflation Reduction Act

TRADE POLICY

- Former Chinese trade negotiator condemns U.S. for ‘dismantling’ global trade system

ENERGY & CLIMATE CHANGE

- Environmental and refining groups contest EPA's RFS for 2023–2025

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Bird flu found in dairy cows in Texas and Kansas

- McKrispy: McDonald’s plans to sell Krispy Kreme donuts by end of 2026

- California law raising fast-food workers' wages prompt cost-cutting measures

POLITICS & ELECTIONS

- Biden gains ground against Trump in six of seven key swing states

|

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened about 50 points higher. In Asia, Japan flat. Hong Kong +0.9%. China +0.2%. India -0.5%. In Europe, at midday, London flat. Paris +0.2%. Frankfurt +0.5%.

U.S. equities yesterday: The Dow ended down 162.26 points, 0.41%. at 39,313.64. the Nasdaq fell 44.35 points, 0.27%, at 16,384.42. The S&P 500 was 15.99 points lower, 0.31%, at 5,218.19.

— Ag markets today: Corn, soybeans and wheat faced mild price pressure during a relatively quiet overnight session. As of 7:30 a.m. ET, corn futures were trading fractionally to a penny lower, soybeans were mostly 4 cents lower, SRW wheat was steady to fractionally lower, HRW wheat was mostly a nickel lower and HRS wheat was 1 to 3 cents lower. Front-month crude oil futures were modestly firmer while the U.S. dollar index was around 400 points lower.

Cash cattle post all-time high. Cash cattle prices averaged $189.56 last week, up $2.09 from the previous week and 81 cents above the previous high from June 2023. Despite the cash market strength, April live cattle futures dropped $1.30 on Monday and finished the day at a $3.36 discount to last week’s cash price, signaling traders sense a short-term top is close.

Cash hog index declines. The CME lean hog index is down 12 cents to $83.48 as of March 22, only the seventh daily decline since the seasonal rally started at the beginning of the year. As of Monday’s close, April lean hog futures held a $1.67 premium to today’s cash quota.

— Agriculture markets yesterday:

- Corn: May corn fell 1 1/2 cents to $4.37 3/4, ending near the session low.

- Soy complex: May soybean futures rallied 16 3/4 cents to $12.09 1/4 and settled on session highs. May meal futures rose $2.60 to $341.70 and settled nearer session highs. May bean oil futures surged 138 points to 49.02 cents and closed on session highs.

- Wheat: May SRW wheat rose 1/4 cent to $5.55 and nearer the session low. May HRW wheat closed a penny lower at $5.89 1/2, nearer the session low. May spring wheat futures slipped 1 1/2 cents to $6.59 1/2.

- Cotton: May cotton rose 59 points to close at $92.12 after dipping to a five-week low during Monday’s trading session.

- Cattle: June live cattle fell $1.30 to $181.60, nearer the session low and hit a three-week low. May feeder cattle fell $1.15 at $252.625, nearer the session low and hit a two-month low.

- Hogs: Despite signs of cash slippage, strong wholesale gains apparently powered hog futures gains. Nearby April futures rose 57.5 cents to $85.15, while most-active June surged $1.70 to $101.975.

— Of note:

- $15.6 million: The median pay for CEOs last year. Those with some of the highest paychecks include Hock Tan of chip maker Broadcom, who was given a $161 million stock award.

- “Geopolitics is a very transitory issue. Each government administration only lasts four or five years, but business relationships last for decades.” — Robin Zeng, founder and chairman of CATL, who is in talks with Tesla and other automakers to license its battery technology in the U.S.

- Employment in nearly one-third of U.S. states is below pre-pandemic levels, with California and New York facing the steepest declines.

- “It is the globalized economic and trade systems that are at stake… now the U.S. is dismantling the system.” — Long Yongtu, former vice-minister of China foreign trade.

— USDA revised its outlook for food prices, expecting lower increases compared to previous forecasts. The Consumer Price Index for all food is now projected to rise by 2.5% in 2024, down from the previous estimate of 2.9%. Prices for food away from home (restaurants) are anticipated to increase by 4.1%, a decrease from the previous forecast of 5%. Grocery prices (food at home) are expected to increase by 1.6%, consistent with the February outlook, which reversed two months of declines in grocery prices.

Specifically, USDA predicts a decrease in pork prices by 1.6%, a decline of 1.8% for fish and seafood, and a 1.2% reduction in dairy product costs compared to 2023. However, all other grocery price categories are forecasted to increase in 2024 compared to 2023.

USDA’s current outlook would put the increases for all food and grocery prices below their 20-year averages of a 3% rise for all food and an increase of 2.7% for grocery prices. Restaurant prices are still forecast to rise more than the 20-year average of 3.4%.

Bottom line: If these forecasts hold true, pork would be the only food category to experience price declines for two consecutive years.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker amid strength in the euro and British pound. The yield on the 10-year U.S. Treasury note was weaker, trading around 4.23%, with a mixed tone in global government bond yields. Crude oil futures were firmer, with U.S. crude around $82.10 per barrel and Brent around $86.20 per barrel, like levels seen in Asian trading. Gold and silver futures were higher ahead of U.S. economic data, with gold around $2,197 per troy ounce and silver around $24.98 per troy ounce.

— $90 Brent is now a real possibility. While demand uncertainty persists, geopolitical risk, a weakening U.S. dollar, and OPEC+ supply cuts have moved prices higher, say analysts.

— Gas prices are expected to surge to $4 per gallon, the highest level since the summer of 2022, due to rising oil prices and supply concerns, according to the AAA automobile club. Devin Gladden, a spokesperson for AAA, anticipates that this increase will prompt Americans to make lifestyle adjustments and become a focal point in the upcoming November presidential election. Gladden attributed the rise in prices to maintenance activities at U.S. refineries and unexpected disruptions caused by leaks and fires. Currently, the national average price at the pump stands at $3.54 per gallon. “One fire that could last for weeks that could really put supply in a tight crunch just like we saw in the Midwest this winter,” Gladden said, referring to the BP refinery in Whiting, Ind., in February. “If we see more incidents like that because of aging refinery infrastructure, that could certainly put a crimp on supply, particularly during the summer when we typically see higher demand levels.” Attacks on Russian refineries have taken about 600,000 barrels a day of capacity, further enforcing concerns.

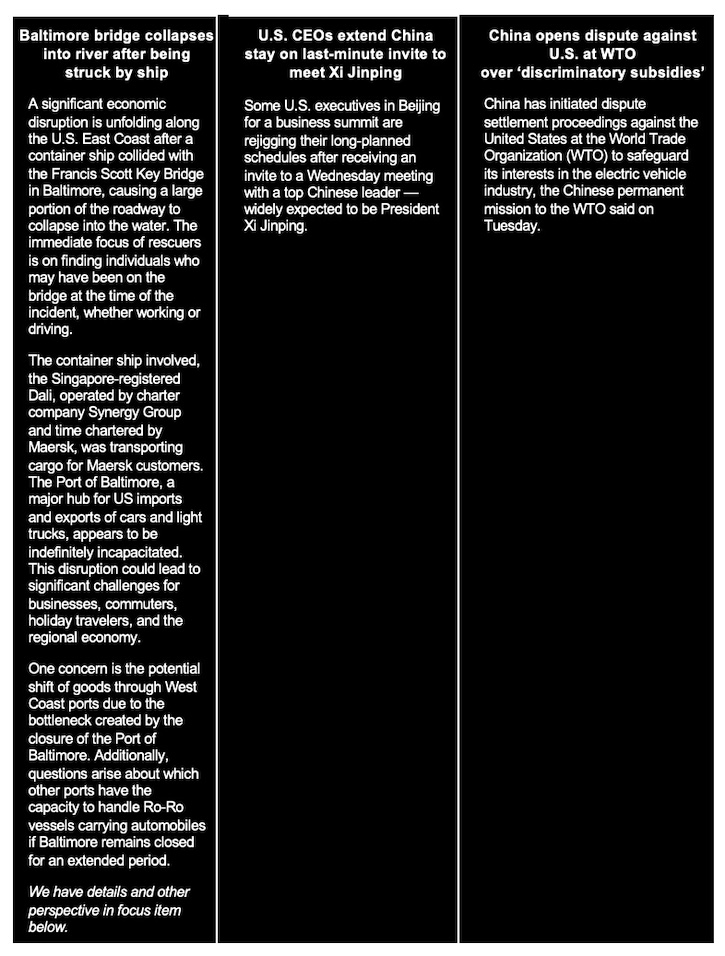

— American Sugar Coalition is pushing for restrictions on sugar imports from Mexico following concerns that some shipments may violate trade deal rules, Bloomberg reports (link). The coalition seeks a 44% reduction in Mexico's sugar exports to the U.S., effective from April 1, due to concerns about exceeding export limits and potential violations of trade regulations. Mexican sugar production has declined, yet exports to the U.S. have continued, prompting the U.S. Department of Commerce to investigate possible breaches of trade rules. The coalition's counsel emphasized the need for consultations with Mexico to ensure compliance with regulations. Reducing Mexico's export limit could strain global sugar supplies, leading to increased demand for imports from other countries. The U.S. sugar industry, facing tight regulations on overseas imports, aims to protect domestic profits and prevent market flooding by other nations. The proposed reduction in Mexico's export cap aims to address production shortages caused by dry weather, ensuring sufficient supply for domestic consumption and meeting U.S. quotas. The coalition previously raised concerns about inconsistent data and urged action to enforce trade agreement rules. The Mexican government has denied violating trade agreement terms, but responses from relevant agencies were not obtained. The American Sugar Coalition includes the American Sugar Cane League, the American Sugarbeet Growers Association, American Sugar Refining Inc., and the Florida Sugar Cane League. Link to letter.

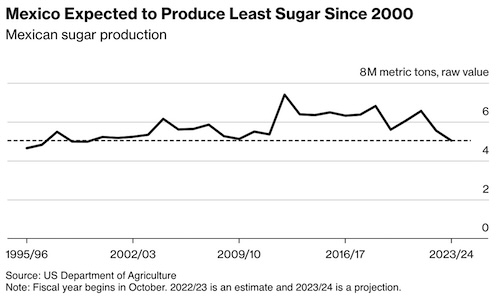

— Cocoa futures topped a record $10,000 a ton, extending a historic rally that’s already seen prices double this year.

— India's rice exporters are facing additional duties on rice exports, according to Reuters. Notices from India's customs agency have been received by four exporters, indicating that they owe duty differentials on rice exported over the past 18 months. India implemented a 20% export duty on white rice in September 2022 and on parboiled rice in August 2023 to manage domestic prices. The exporters have been instructed to pay based on transaction value rather than the Free on Board (FOB) value of rice, resulting in additional duty payments. However, exporters argue that overseas buyers are unlikely to cover the extra costs, making it challenging for them to pay the duty. The additional duty is estimated to be around $15 per metric ton of rice exported over the past two years, totaling approximately 15 billion Indian rupees ($180 million). Exporters are expected to contest the decision rather than pay the additional amounts.

— Ag trade update: South Korea purchased 134,000 MT of corn —66,000 MT expected to be sourced from South America and 68,000 MT expected to be sourced from South America or South Africa. South Korea also bought 77,774 MT of U.S. medium brown rice. Egypt tendered to buy an unspecified volume of soyoil from multiple sources.

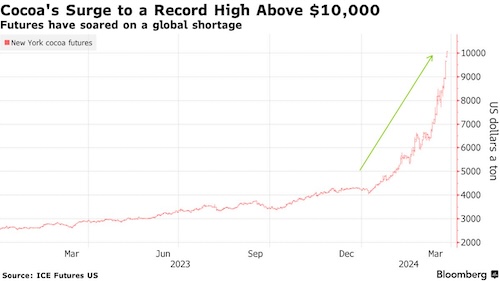

— NWS weather outlook: Winter Storm comes to an end over the Northern/Central Plains and Upper Midwest; well below average temperatures over Great Plains... ...Severe Weather potential over parts of the Midwest and central Gulf Coast today... ...Heavy to Excessive Rainfall possible over portions of the Southeast and Mid-Atlantic... ...Unsettled weather returns to the Northwest on Wednesday.

Items in Pro Farmer's First Thing Today include:

• Grains weaker overnight

• Cordonnier leaves South American crop estimates unchanged

• HRW wheat conditions continue to improve in March

• February frozen meat stocks signal strong demand

|

BALTIMORE BRIDGE COLLAPSES INTO RIVER |

— Baltimore’s Francis Scott Key Bridge collapses into river after being struck by a cargo ship at approximately 1:30 am local time. Local fire department reports suggest that approximately 20 people and several cars may have fallen into the water as a result of the collapse.

The rescue operation is compounded by freezing temperatures, limited visibility, and the threat of further sections of the four-lane bridge collapsing, making the situation more perilous for search and rescue teams.

“There is no indication of any nefarious intent,” a White House official says. President Biden has been briefed on the collapse of the bridge. He will get updates on the bridge throughout the day.

A preliminary investigation points to an accident and officials haven’t seen any credible evidence of a terrorist attack, according to Maryland Governor Wes Moore.

ABC is reporting that the ship that struck the bridge “lost propulsion” as it was leaving port and warned Maryland officials of a possible collision. The network is citing an unclassified Cybersecurity and Infrastructure Security Agency report.

The river leads to the Port of Baltimore, a major hub for shipping on the East Coast (third-largest port on the eastern seaboard). It was not immediately clear how the bridge collapse would affect access to the Port of Baltimore, one of the nation’s largest shipping hubs and a driver of the region’s economy. The port annually generates nearly $3.3 billion in total personal income, $2.6 billion in business income and more than $395 million in taxes, according to a Maryland state website. It handled 52.3 million tons of international cargo last year, which was valued at $80.8 billion.

The Baltimore port handled 847,158 autos and light trucks in 2023, the most of any U.S. port for the 13th straight year, according to a state of Maryland website. The port also handled large volumes of imported sugar, gypsum and coffee, as well as exported coal.

At least 21 ships are in waters to the west of the collapsed bridge. About half of them are tugs. There are also at least three bulk carriers, one vehicles carrier and a small tanker.

Aside from the gridlock for regional traffic that the shutdown will cause, several prominent companies have distribution warehouses or other facilities in an industrial park on the north end of the bridge. They include Amazon.com Inc., FedEx Corp., Under Armour Inc., the Home Depot Inc., BMW Group and Volkswagen Group of America, according to Google.

Opened in 1977, the bridge is named for the writer of “The Star-Spangled Banner.” It took about five years to build and cost of $60.3 million. About 11.3 million vehicles cross it per year.

Stephane Kovatchev, a credit analyst with Bloomberg Intelligence: “Maersk may not be directly responsible or liable for the tragic collapse of the Baltimore bridge, according to our preliminary analysis, as the Danish company had no crew on board and the ship was operated by a charter company. Maritime insurance will likely cover some of the costs, yet uncertainty around the total liabilities and who will pay for them will likely weigh on Maersk’s spreads in the near term.”

The collapsed Francis Scott Key Bridge after being struck by the Dali container ship, in Baltimore, on March 26. Photographer: Al Drago/Bloomberg

|

ISRAEL/HAMAS CONFLICT |

— Israeli Prime Minister Benjamin Netanyahu canceled high-level talks in Washington after the U.S. abstained from a UN vote on a cease-fire resolution in Gaza, clearing the way for the measure to pass. An Israeli delegation had been set to travel to the U.S. to discuss Israel's planned military operation in the southern Gaza city of Rafah. The abstention was a sign of the growing rift between the two allies. The Biden administration says it is perplexed by Israel's objection to the UN resolution.

|

RUSSIA/UKRAINE |

— Russian President Vladimir Putin admitted that the recent terrorist attack in Moscow was perpetrated by "radical Islamists," but he insinuated Ukraine's involvement without providing evidence. He claimed the assault was part of a series of attempts by the "neo-Nazi Kyiv regime." However, French President Emmanuel Macron stated that French intelligence supported the United States' assertion that the Islamic State was responsible for the attack.

— Russia's agriculture regulator has proposed reducing the export quota of a major grain trader, TD Rif, due to alleged "systematic inconsistencies" in grain safety and quality. This move risks disrupting shipments from Russia, the world's largest wheat exporter, Bloomberg reports (link). TD Rif has reported mounting pressure from authorities, with owner Petr Khodykin expressing concerns about blocked shipments leading to significant losses. The company claims it is being pressured to sell its assets at a low price.

The dispute reflects the Kremlin's efforts to tighten control over exports following Vladimir Putin's invasion of Ukraine. Western traders exited Russia's grain market last year amid calls to limit their role. Moscow has also sought to impose an unofficial minimum price for its grain.

While other Russian traders may compensate for TD Rif's reduced export quota, any slowdown in wheat shipments from Russia could increase demand for wheat from other sources and potentially raise global prices. Wheat futures in Chicago rose in response to these developments.

|

POLICY UPDATE |

— ERP payouts update. Total payments under the Emergency Relief Program (ERP) have stayed consistent at $8.64 billion as of March 24, despite a slight increase in Phase 2 payments. Phase 2 ERP payouts rose slightly from $883.94 million to $884.0 million in the most recent week, while Phase ERP payments remained largely unchanged at $7.75 billion.

|

CHINA UPDATE |

— China has filed a complaint to the World Trade Organization over U.S. rules that block electric vehicle manufacturers from sourcing materials from China and other foreign adversaries, according to a statement from the Ministry of Commerce. Beijing is challenging the Biden administration’s Inflation Reduction Act, which it calls discriminatory.

— U.S., UK accuse China of cyberespionage. U.S. and British officials on Monday filed charges, imposed sanctions and accused Beijing of a sweeping cyberespionage campaign that allegedly hit millions of people. Nicknamed Advanced Persistent Threat 31 or “APT31,” officials from both countries said the hacking group was an arm of China’s Ministry of State Security. Targets included White House staffers, U.S. senators, British parliamentarians and government officials across the world who criticized Beijing. China called the accusations “pure political maneuvering” and “completely fabricated and malicious slanders.” China’s foreign ministry said Beijing “will take necessary measures to safeguard China's legitimate rights and interests.”

— China wants banks to speed up new loans to property developers. Chinese regulators are pushing banks to speed up approvals of new loans to cash-starved private property developers in a bid to boost the floundering sector, people with knowledge of the matter told Reuters. The effort uses the “whitelist” mechanism, Beijing’s support measure aimed at easing the sector’s unprecedented liquidity squeeze and spurring home purchases, as new home prices fell in February for an eighth straight month. Most top domestic banks have so far shied away from significantly bolstering credit exposure to the crisis-hit sector despite repeated encouragement from Beijing.

— China’s sow herd, hog slaughter shrinks in February. China had 40.42 million sows at the end of February, down 0.6% from January and 6.9% less than last year, the ag ministry said. The number of pigs slaughtered in February fell 6.9% from last year to 21.04 million head, a 43.5% drop from January.

— China and Russia challenge U.S. claim to mineral-rich stretches of seabed. Critics say Biden administration risks losing race to mine resources in international waters. Link to details via the Financial Times.

|

TRADE POLICY |

— Former Chinese trade negotiator who backed Trump condemns Washington for ‘dismantling the system’ of global trade. Long Yongtu tells the Boao Forum for Asia that ‘globalized economic and trade systems are at stake’, and targeting Chinese companies in Mexico would mean higher prices for Americans. He was the former vice-minister of foreign trade, and China’s point man during its 15-year talks to join the World Trade Organization more than two decades ago. Link to details via the South China Morning Post.

|

ENERGY & CLIMATE CHANGE |

— Environmental and refining groups contest EPA's RFS for 2023–2025, alleging harms and oversight in analysis. Environmental organizations and refining groups are challenging the Environmental Protection Agency's (EPA) renewable fuel standards (RFS) for 2023–2025, claiming that the EPA's analysis is flawed. The Center for Biological Diversity and National Wildlife Federation argued that the EPA's decision to maintain biofuels volumes exacerbates climate, environmental, and justice harms instead of mitigating them, contrary to the goals of the Clean Air Act.

Background. The Renewable Fuel Standards program, mandated by the Clean Air Act, requires the EPA to establish annual volume targets for different categories of renewable fuel, aiming to reduce greenhouse gas emissions. However, the challenged final rule for 2023–2025, published in July and effective in September, faces criticism for its failure to properly consider climate effects and reliance on biofuels, particularly from corn and soy.

The environmental groups assert that biofuels harm habitats, air and water quality, and impose increased costs on consumers without demonstrating significant climate change mitigation benefits. They argue that the EPA's analysis only assessed modest changes, overlooking broader environmental impacts.

Multiple challenges have been consolidated, including objections from refiners who claim the EPA unlawfully imposed high biofuel mandates, leading to increased costs without boosting renewable fuel production. Refiners also accuse the EPA of setting unreasonably burdensome requirements for renewable fuel made from food waste, without adequate explanation or consideration of alternatives.

Various legal representatives are involved in the challenges, including the Center for Biological Diversity, Earthjustice, and other law firms representing different petitioners.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— USDA discovers bird flu in unpasteurized milk samples from dairy cattle at Texas and Kansas farms. USDA revealed (link) that unpasteurized milk samples from sick cattle at two dairy farms in Kansas and one in Texas, as well as an oropharyngeal swab from another dairy in Texas, tested positive for highly pathogenic avian influenza (HPAI).

USDA, along with various agencies and officials, is investigating cases of highly pathogenic avian influenza (HPAI) in dairy cattle across Texas, Kansas, and New Mexico. Samples from sick cattle in these states have tested positive for HPAI, with the illness believed to be linked to wild birds based on initial findings in Texas. However, no mutations indicating increased transmissibility to humans have been identified. Symptoms in affected cattle include decreased lactation, low appetite, and other systemic issues.

USDA reassures that there is no human health risk or risk to the milk supply, as milk from affected animals is either diverted or destroyed, and pasteurization effectively eliminates bacteria and viruses. Only around 10% of affected herds have been impacted, with minimal mortality reported. Additionally, the number of affected cattle is too small to significantly impact milk supply or prices.

Texas Ag Commissioner Sid Miller said that while the $50 billion Texas dairy industry faces challenges, he ensures consumers of safety measures to prevent contaminated milk entering the supply chain. Cattle with HPAI show flu-like symptoms and reduced milk production, prompting biosecurity measures and disposal of contaminated milk. Unlike poultry, Miller doesn't foresee depopulating dairy herds as cattle can recover. Texas Department of Agriculture pledges support and urges farmers to notify veterinarians of suspected cases.

Of note: A total of 79.7 million domestic birds, mostly egg-laying hens and turkeys being raised for human consumption, have died from HPAI or in eradication efforts since the first confirmed outbreak on Feb. 8, 2022. Since then, the disease has been confirmed in 1,059 flocks in 47 states.

Trade impacts: A group of dairy trade organizations released a joint statement on the outbreak urging U.S. trading partners to avoid placing bans on American dairy products in response to the detection. The International Dairy Foods Association, the National Milk Producers Federation, the U.S. Dairy Export Council and Dairy Management Inc. were among the groups that signed onto the statement. “It is essential that trading partners do not impose bans or restrictions on the international trade of dairy commodities in response to these and future notifications and rely on the science-based food safety steps taken in U.S. dairy processing, namely pasteurization, in preserving market access,” the groups said.

— New California law raises fast-food workers' wages to $20, prompting cost-cutting measures by restaurants. A new California state law is poised to raise fast-food workers' wages to $20 an hour starting in April. However, some restaurants are already taking measures to cut costs, including laying off staff and reducing hours for workers. State records show that several California restaurants, especially pizza joints, have planned to cut hundreds of jobs leading up to the wage mandate. Other operators have halted hiring or are scaling back workers' hours.

Supporters of the law argue that it will improve the lives of hundreds of thousands of local workers, and labor groups hope to replicate it in other states. The wage increase represents a 25% jump from California's broader $16 minimum wage. Larger chains like McDonald's, Chipotle Mexican Grill, and Jack in the Box have announced plans to raise menu prices in California to offset some of the costs.

Many restaurant operators in California are exploring various strategies to manage the increased expenses, such as reducing hours, adjusting operating hours, or offering menu items that require less preparation time.

Of note: The Congressional Budget Office found that raising the federal minimum wage to $17 an hour from $7.25 by July 2029 could raise pay for more than 18 million people. But it would also increase employers’ costs, who could raise prices and cut about 700,000 workers.

Industry impact: Amid rising wages affecting all competitors, some chains perceive an opportunity to gain market share. They intend to provide increased support for franchisees, including investments in advertising, product innovations, and technology updates. McDonald's CEO, Chris Kempczinski, stated that the company is in a favorable position compared to its competitors.

— McDonald's plans to sell Krispy Kreme doughnuts nationwide by the end of 2026, with the rollout starting in the second half of this year. The partnership will make McDonald's the exclusive fast-food partner for Krispy Kreme in the U.S. Krispy Kreme's efficient "hub and spoke" distribution model will facilitate this expansion, utilizing existing infrastructure to deliver to McDonald's and other outlets. The collaboration began with a successful test in nine McDonald's restaurants, which later expanded to approximately 160 locations in Kentucky. McDonald's customers will have access to original glazed, chocolate iced, and cream-filled doughnuts, available individually or in packs of six, sold all day. Krispy Kreme anticipates a significant increase in its distribution channels, aiming to reach over 100,000 points globally. However, concerns about competition from weight loss drugs have impacted Krispy Kreme's stock performance, while McDonald's has seen modest growth amidst consumer preferences for affordable food and drinks.

|

POLITICS & ELECTIONS |

— President Joe Biden has gained ground against Donald Trump in six of seven key swing states, and significantly so in at least two of them. The results make for the Democrat’s strongest position yet in a monthly Bloomberg News/Morning Consult poll. The shift was significant in Wisconsin, where Biden leads Trump by one point after trailing him by four points in February, and in Pennsylvania, where the candidates are tied after Trump held a six-point lead last month. They are also tied in Michigan. The move in the president’s direction comes after a State of the Union address that rallied Democrats and seemed to mitigate concerns about Biden’s age.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |