Analysis Begins on GREET Model and 45Z Program Impacts

FY 2024 funding | Border tensions | Paraguayan beef trade | Labeling of cell-cultured meat & poultry products

|

Today’s Digital Newspaper |

MARKET FOCUS

- Apple's stock plummeted 4.1%, resulting in loss of $112 billion in market capitalization

- Bayer’s CEO has new management plan

- Target doubling bonus payments for salaried employees this year

- Housing demand on a steady rise

- Offshore yuan depreciates beyond 7.25 per dollar, lowest point in four months

- U.S. urges Ukraine to halt attacks on Russia’s energy infrastructure

- Ag and food markets today

- Global chocolate market is facing significant challenges

- USDA daily export sale: 263,000 MT corn to Mexico

- Upper Mississippi River shipping season opens

- Mississippi River at risk of bottlenecks for third straight year

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Hurdles in House, Senate re: second FY 2024 funding bill

- Key Issues addressed by Vilsack at House Ag Appropriations Subcommittee hearing

- Farm bill update: Creative, creative, creative

ISRAEL/HAMAS CONFLICT

- Russia and China veto U.S.-led Gaza cease-fire resolution at UN

RUSSIA & UKRAINE

- IMF approves release of $880 million to Ukraine as part of $15.6 billion loan program

- Russia reacts to EU’s proposal to impose tariffs on grain imports from Russia, Belarus

- Russia conducts most extensive airstrike on Ukraine's energy infrastructure

CHINA

- China’s Xi Jinping to woo U.S. CEOs in Beijing

- EU, U.S. discussed how to address China's role as conduit for goods to Russia

TRADE POLICY

- Senate repeals Biden rule allowing Paraguayan beef imports

ENERGY & CLIMATE CHANGE

- Theme at CERAWeek conference: inefficient infrastructure permitting in U.S.

- Ag and biofuel sectors await update on GREET modeling, SAF credits

- Some wondering if there will be much impact re: 45Z program

- Biden's EV push faces political, legal, and market hurdles

- Challenge re: natural gas exports

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- USDA sends OMB proposed rule re: labeling of cell-cultured meat & poultry products

- Regulators highlight how large grocery chains leveraged size during pandemic

- DoorDash, Wendy's, and Alphabet's drone unit Wing offer drone delivery services

- France chooses Boehringer Ingelheim and Ceva for bird flu vaccines

OTHER ITEMS OF NOTE

- Cotton AWP falls another week

|

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened slightly higher. Focus will return to the Fed today, and anything officials say that challenges the idea of three rate cuts in 2024, amid a stronger economy will likely spur some profit taking after this week’s robust post-Fed decision rally. In Asia, Japan +0.2%. Hong Kong -2.2%. China -1%. India +0.3%. In Europe, at midday, London +0.8%. Paris -0.1%. Frankfurt +0.1%.

U.S. equities yesterday: All three major indices notched another day of gains, with the Dow up 269.24 points, 0.68%, at 39,781.37. The Nasdaq rose 32.43 points, 0.20%, at 16,401.84. The S&P 500 gained 16.91 points, 0.32%, at 5,241.53.

Headed into the final session of the week, the Dow is up 2.7% since Monday, the S&P has gained 2.4% and the Nasdaq is 2.6% higher.

Of note: The S&P 600 index, which tracks American small-cap stocks, just turned positive for the year. That’s good news for Wall Street, because smaller companies generate most of their revenue from U.S. customers, making them bellwethers of the U.S. economy.

— Apple's stock (AAPL) plummeted by 4.1%, resulting in a loss of $112 billion in market capitalization, following a lawsuit filed by the Department of Justice and 16 state attorneys general for antitrust violations. Attorney General Merrick Garland emphasized Apple's significant market presence, particularly in the smartphone industry, attributing its success partly to the iPhone. However, Garland alleged that Apple maintained monopoly power by violating federal antitrust laws, citing restrictions imposed on developers and third-party apps.

Wedbush analyst Daniel Ives predicts that the lawsuit will likely endure for years in the court system, underscoring the seriousness of the matter. He anticipates no immediate changes to Apple's business model but emphasizes the need for Apple to eventually settle the case, pay a substantial fine, and reach a compromise with developers regarding the structure of the App Store in the future.

Apple responds. “This lawsuit threatens who we are and the principles that set Apple products apart in fiercely competitive markets,” an Apple spokesman said in a statement. “If successful, it would hinder our ability to create the kind of technology people expect from Apple — where hardware, software, and services intersect.”

— Bayer’s CEO has a new management plan to renovate the 160-year-old company: fewer bosses and fewer rules. Link to details via the Wall Street Journal. The company has around 34 billion euros in debt, recently cut its dividend and faces billions of dollars in payouts for lawsuits related to the weedkiller Roundup. Bayer’s acquisition of crop-science company Monsanto, which makes Roundup, “is commonly viewed as one of the worst corporate deals in years,” the article notes. Bayer, which has a market value of $28 billion, paid $63 billion for Monsanto in 2018.

— Ag markets today: Soybean futures posted sharp losses overnight, while corn and wheat traded mildly lower. As of 7:30 a.m. ET, corn futures were trading 2 to 3 cents lower, soybeans were10 to 13 cents lower, winter wheat markets were 3 to 4 cents lower and spring wheat was steady to a penny lower. Front-month crude oil futures were trading just above unchanged, and the U.S. dollar index was nearly 1,000 points higher.

Cash cattle trade higher. Cash cattle trade was active in the $188.00 to $190.00 range in the Plains on Thursday, with the highest prices in the northern market. It appears this week’s cash cattle activity will top the all-time high of $188.75 posted in June 2023. Despite the cash strength, buyer interest was relatively limited in nearby live cattle futures on Thursday.

Cash hog index continues to rise. The CME lean hog index extended its seasonal climb, rising another 33 cents to $83.54 as of March 20. Despite the cash strength, traders continue to narrow the premium April lean hogs hold to the index with it dropping to $1.36 as of Thursday’s close.

— Agriculture markets yesterday:

- Corn: May corn rose 1 3/4 cents to $4.40 3/4, ending the session above the 10- and 40-day moving averages.

- Soy complex: May soybeans futures rallied 2 1/2 cents to $12.12, though settled nearer session lows. May soymeal futures rose $1.8 to $344.3, near the middle of today’s range. May bean oil futures slipped 21 points to 48.79 cents.

- Wheat: May SRW wheat rose 1 3/4 cents to $5.46 3/4. May HRW wheat gained 1 1/4 cents at $5.81 3/4. Prices closed near their mid-ranges. May spring wheat futures rose 1 1/2 cents to $6.56 1/2.

- Cotton: May cotton futures rose 3 points before settling at 92.21 cents.

- Cattle: April live cattle rose 57 1/2 cents to $188.375. May feeder cattle fell 72 1/2 cents to $258.075. Both markets closed near their mid-ranges.

- Hogs: A big drop in wholesale prices seemed to undercut hog futures Thursday, with nearby April falling 40 cents to $84.90, whereas the summer contracts fell over $1.00 on the day. The cash hog market continues its ongoing advance, with the CME confirming Tuesday’s preliminary figure at $83.21, up 39 cents from Monday.

— Quotes of note:

- “Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices." — Lawrence Yun, National Assn. of Realtors chief economist.

- Target is doubling bonus payments for its salaried employees this year, citing improved profits after a rocky couple of years. Eligible employees will receive 100% of their annual bonus amounts after receiving 50% last year. “Based on Target’s performance in 2023, including the $2 billion in additional profit growth our team delivered that exceeded the goals we set at the beginning of the year, we’re rewarding our team accordingly,” the company said in a statement.

- “Consumers should not have to pay higher prices because companies break the law.” — Attorney General Merrick Garland at a news conference, alleging that ”Apple has maintained monopoly power in the smartphone market not simply by staying ahead of the competition on the merits but by violating federal antitrust law.”

— Offshore yuan has depreciated beyond 7.25 per dollar, reaching its lowest point in four months. This decline reflects market expectations that China will implement further policy easing measures to support its economy. A senior official from the People's Bank of China suggested that the central bank has room to reduce banks' reserve requirement ratio and utilize other policy tools. Investors are closely monitoring upcoming data on Chinese manufacturing and services activity to assess the country's economic condition.

Additionally, the yuan faces pressure from a strengthening dollar, fueled by speculation that U.S. interest rates may remain elevated compared to other major economies. Consequently, traders are seeking refuge in the dollar for its carry and haven status.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer ahead of remarks from several Fed officials on the schedule today. The euro, yen, and British pound were all weaker against the greenback. The yield on the 10-year U.S. Treasury note was lower, trading around 4.22%, with a mostly lower tone in global government bond yields. Crude oil futures turned higher, with U.S. crude around $81.20 per barrel and Brent around $85.35 per barrel. Gold and silver were under pressure ahead of US trading, with gold around $2,169 per troy ounce and silver around $24.81 per troy ounce.

— U.S. urges Ukraine to halt attacks on Russia’s energy infrastructure, warning that drone strikes risk driving up global oil prices and provoking retaliation, the Financial Times reports (link).

— USDA daily export sale: 263,000 MT corn to Mexico. Of the total, 173,000 metric tons is for delivery during the 2023-2024 marketing year and 90,000 metric tons is for delivery during 2024-2025 marketing year.

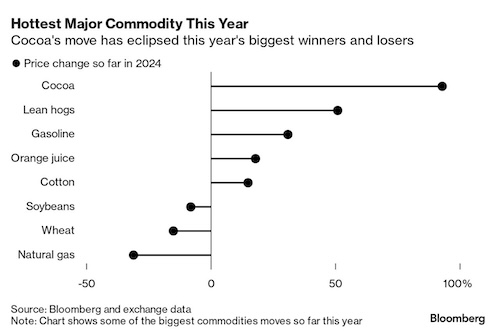

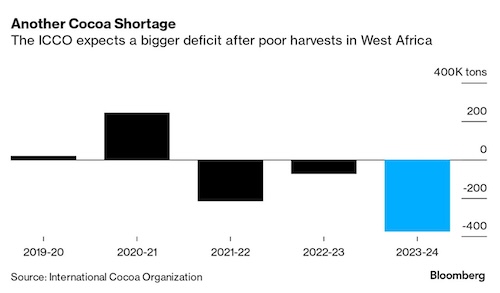

— Global chocolate market is facing significant challenges beyond the approaching Easter season. Shortages and soaring prices of cocoa, the main ingredient in chocolate, are causing widespread concern, Bloomberg reports (link). Guan Chong, one of the world's largest cocoa processors, described the situation as panic-inducing. Cocoa prices have surged to unprecedented levels, doubling since the beginning of the year and surpassing $8,500 per ton, with $10,000 becoming a real possibility. Poor harvests in West Africa due to drought and disease, coupled with decades of underinvestment and inadequate support for farmers, are major contributing factors.

To address shortages, companies like Malaysia's Guan Chong are seeking cocoa from alternative sources and paying premiums to secure beans. Candy manufacturers are responding to the price surge by either reducing the amount of cocoa in their products or eliminating it altogether, passing on the increased costs to consumers. However, the cocoa supply crunch shows no signs of abating, and major chocolatiers like Barry Callebaut anticipate persistent shortages in the upcoming season.

Europe, the largest consumer of chocolate globally, is particularly affected by the cocoa crisis. Proposed EU regulations targeting products linked to deforestation may further complicate efforts to secure cocoa supplies for chocolate makers in the region. Concerns also surround the upcoming mid-crop harvest, which is expected to shrink, exacerbating the ongoing deficit in cocoa supply.

Analysts warn that aging trees and crop diseases could prolong the cocoa shortage, creating a structural supply issue that keeps prices elevated. As a result, consumers may not see relief in chocolate prices or Easter egg costs for the foreseeable future.

— Upper Mississippi River shipping season opens. On March 17, a tow with 12 barges moved through Lock and Dam 2 in Hastings, MN, opening the Upper Mississippi River to shipping after its cyclic winter shutdown. In winter, the Upper Mississippi River closes to barge traffic because of cold weather and icy conditions. As the widest location on the river, Lake Pepin also has the slowest current, so its ice is typically the last to break up. This year, unusually warm weather prompted the U.S. Army Corps of Engineers to cancel the annual Lake Pepin survey in February. Despite the warm weather, however, the locks remained closed for winter maintenance that was completed on March 15. The average start date for the navigation season is March 22, and the earliest has been March 4, in 1983, 1984, and 2000. (Source: USDA Grain Transportation Report.)

— Mississippi River is at risk of bottlenecks for a third straight year as warm, dry spring weather and low winter snowpack limit the amount of water feeding into it, according to the National Oceanic and Atmospheric Administration. The U.S. will get warmer-than-average spring temperatures from April through June, and for the first time since 2021 there is no region at risk of major flooding, according to the agency’s Spring Outlook report (link) issued Thursday. Drought conditions are expected to persist or worsen across parts of the Great Plains and Rocky Mountains. More than a trillion pounds of freight per year travel on the Mississippi and the rivers that flow into it. It’s a critical transport route from a region that produces 92% of U.S. agricultural exports.\

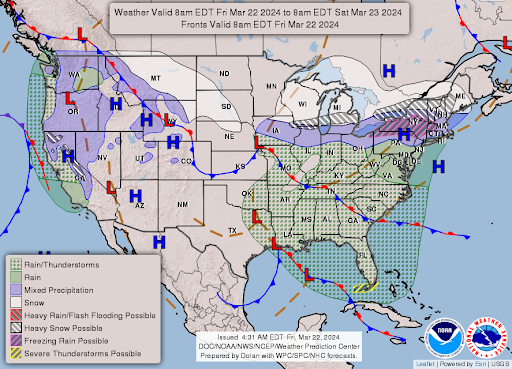

— NWS weather outlook: Heavy snow likely for portions of the Lower Great Lakes and interior Northeast... ...A wet weekend ahead for the East and West Coasts... ...Significant Winter Storm likely across the Northern Plains and into the Upper Midwest late this weekend into early next week.

Items in Pro Farmer's First Thing Today include:

• Soybeans lead overnight price pressure

• Big jump expected in February cattle placements

|

CONGRESS |

— Key Issues addressed by Vilsack at House Ag Appropriations Subcommittee hearing. The Ag secretary doesn’t appear before Congress that often but when he or she does, Pro Farmer likes to give as much information from such hearings as possible, and that’s what we did in a special report (link) Thursday evening regarding the latest hearing, which dealt with many issues, including WIC, CCC funding, SNAP, bifouels/GREET/SAF, China, farm income, ag aid and dairy, among other topics. The Subcommittee heard from USDA Secretary Tom Vilsack regarding USDA’s fiscal year (FY) 2025 budget request, totaling $25.1 billion, representing a $2.2 billion increase from the previous year.

— Three words describe what’s coming in new House farm bill: Creative, creative, creative. That’s what insiders inform. House GOP lawmakers and staffers have mined what they could regarding creative approaches in finding some additional $40 billion to $50 billion in funding beyond the $1.51 trillion 10-year baseline. “There will be no robbing of one title to help another,” one source said, although there will be some changes in SNAP that generated additional funding, something that if confirmed, will be fiercely opposed by Democrats. As previously reported, there will be increases in reference prices but not via uniform percentage, with some commodities getting a bigger boost than others on a percentage basis. Other areas seeing funding gains and/or reform include MAP/FMD programs, crop insurance and biosecurity.

Timing of the House farm bill is between post-Easter and around Memorial Day. Ag Chair G.T. Thompson (R-Pa.) reportedly wants to unveil text and then hold a House Ag Committee markup on the bill within the following week, with House floor actions around two weeks after that.

As for the Senate, Ag Chair Debbie Stabenow (D-Mich.) attended the left-leaning League of Conservation Voters’ annual dinner in D.C. She told the audience: “I can assure you that I'm not going to let one dime of our climate-smart agriculture, conservation money to be used for anything else.”

|

ISRAEL/HAMAS CONFLICT |

— Russia and China veto U.S.-led Gaza cease-fire resolution at UN. The U.S. proposed a six-week ceasefire and the release of 40 Israeli hostages in return for hundreds of imprisoned Palestinians. U.S. Secretary of State Antony Blinken has been advocating for this during his ongoing visit to the Middle East. Blinken held discussions with Israeli leaders in Tel Aviv, while U.S. intelligence officials engaged in talks in Qatar, aiming to bridge the gap between Israel and Hamas regarding a ceasefire.

|

RUSSIA/UKRAINE |

— International Monetary Fund (IMF) approved release of $880 million to Ukraine as part of a $15.6 billion loan program. This disbursement aims to bolster Ukraine's finances amid stalled assistance from the United States, its key ally. The IMF's executive board met to finalize the decision, marking the first of four tranches totaling over $5.3 billion scheduled for release in 2024. Despite uncertainty surrounding U.S. assistance, the IMF continues to support Ukraine's efforts to stabilize its economy amid the ongoing conflict with Russia.

The disbursement will significantly increase Ukraine's international reserves, surpassing $40 billion, a historic milestone for the country.

The IMF is set to review another disbursement for Ukraine in mid-June, contingent upon the government meeting specific conditions. If met, Ukraine could receive over $2.2 billion in the next installment of funds.

— Russia has reacted to the European Union's (EU) proposal to impose tariffs on grain imports from Russia and Belarus. Kremlin spokesman Dmitry Peskov stated that Russia has numerous alternative export markets for its grain besides the EU. Peskov emphasized the necessity for experts to assess whether Russia or the EU would suffer negative consequences from the proposed restrictions. The European Commission formally recommended imposing import duties, exempting supplies transiting through the EU to other destinations, as well as financing, insurance, storage, and transport of these shipments. Data reveals that in 2023, Russia exported 4.2 million metric tons of grains, oilseeds, and related products to the EU, valued at approximately 1.3 billion euros ($1.4 billion), which constitutes roughly 1% of the EU market, according to a Commission official.

— Russia conducted its most extensive airstrike on Ukraine's energy infrastructure on Friday, targeting a significant dam and leaving over one million people without power, as reported by Ukraine. Despite the attack, company officials assured that there was no risk of a breach. To mitigate the blackouts affecting seven regions, Ukraine received emergency power supplies from Poland, Romania, and Slovakia. Russia defended the strikes as legitimate actions aimed at weakening the enemy.

|

CHINA UPDATE |

— China’s Xi Jinping to woo U.S. CEOs in Beijing. The Chinese leader plans to meet a group of American business leaders after a government-sponsored forum in Beijing, amid an exodus of foreign capital. Link for details via the Wall Street Journal. Link to Financial Times article on the topic.

— EU, U.S. discussed how to address China's role as conduit for goods to Russia. The EU has imposed sanctions on some entities in China and Hong Kong that it sees as part of procurement networks for buying European products for export to Russia, and will continue to do so. Link to details via Reuters.

|

TRADE POLICY |

— Senate repeals Biden rule allowing Paraguayan beef imports. The U.S. Senate passed a resolution (link to text) with bipartisan support to repeal a Biden administration rule permitting the importation of beef from Paraguay. The resolution, introduced by Sens. Jon Tester (D-Montana) and Mike Rounds (R-South Dakota), invoked the Congressional Review Act, enabling Congress to nullify executive branch regulations within a specified timeframe. The Senate passed, 70-25, SJRes. 62, which would reverse a December rule that ended the decades-long embargo on the shipment of beef for Paraguay. The vote margin would be enough to overcome a presidential veto.

It’s the first time a Democrat has forced a vote to unravel a Biden administration policy under the Congressional Review Act, which allows the Senate to pass legislation overturning regulations with a simple majority — though two-thirds would be required to override a veto.

The targeted rule, issued by USDA's Animal and Plant Health Inspection Service, authorized the import of Paraguayan beef meeting certain criteria, including a lack of foot-and-mouth disease diagnosis in the region for at least a year. The U.S. had not allowed such imports since 1997.

The push. Sens. Tester and Rounds, representing significant beef-producing states, voiced concerns over potential risks associated with foot-and-mouth disease, emphasizing the importance of safeguarding American beef producers and consumers.

A similar resolution has been introduced in the House by Rep. Ronny Jackson (R-Texas).

Rounds and Tester’s bipartisan resolution is supported by the National Cattlemen’s Beef Association (NCBA), United States Cattlemen’s Association (USCA), R-CALF USA, Livestock Marketing Association and National Farmers Union. “USDA’s decision to allow Paraguayan beef imports into the U.S. creates an unnecessary risk to the health and safety of the U.S. cattle herd. U.S. cattle producers are held to the highest food safety and animal health standards in the world and any trade partner must be able to demonstrate they can meet those same standards,” said Kent Bacus, Executive Director of Government Affairs for the National Cattlemen’s Beef Association (NCBA). “Given Paraguay’s long history of foot-and-mouth disease outbreaks, it is simply too risky to allow Paraguayan imports without recent site visits to confirm Paraguay’s safety claims. U.S. cattle producers are thankful for the leadership of Senators Jon Tester and Mike Rounds for applying the Congressional Review Act to hold USDA accountable and protect our nation’s cattle herd.”

Foot-and-mouth disease poses significant risks to livestock. While the U.S. has not reported cases since 1929, other countries, including Paraguay, have experienced outbreaks. However, South American cattle were reported to be mostly free of the virus as of September 2022.

The Biden administration opposed the resolution, arguing that USDA had thoroughly reviewed the risk and deemed Paraguayan imports low. The White House expressed concern that repealing the rule could strain relations with Paraguay. The Office of Management and Budget argued the USDA rule helps Paraguay recover lost exports to Russia and China over the two adversaries’ military aggression against Ukraine and Taiwan, respectively. They also stood by the USDA’s “rigorous scientific evaluation” of the country’s cattle stock. OMB warned scrapping the rule “would undermine the credibility of long-standing science-based decision-making processes respected by the U.S. and upheld in our trade agreements, and could in turn severely threaten fair access to new and existing export markets for U.S. farmers and ranchers.” Tester on Wednesday dismissed the Biden administration’s attempt to “play nice” with Paraguay. “Import wine, don’t import beef,” Tester said.

Rounds comments. “South Dakota is known for having high quality beef produced by hard-working farmers and ranchers across the state. We have very high standards regarding the quality of our beef. Unfortunately, Paraguay does not have the same history of enforcing health and safety standards that we do,” said Rounds. “Our inspectors haven’t been to Paraguay in 10 years. Consumers deserve to have a high degree of confidence in the quality and safety of beef they want to serve their families. There is more work that needs to done with Paraguay before introducing their beef in American markets. Filing this resolution has been a bipartisan effort to protect American consumers while standing up for our producers.”

“President Biden butchered this decision,” said Tester. “By cutting corners to resume beef imports from a country with a recent history of foot and mouth disease, the Biden administration is jeopardizing our food supply and giving Montana consumers and producers a raw deal. We cannot allow beef imports from Paraguay until we have data that shows they are meeting same high animal health standards as American ranchers, and I’m proud to have secured overwhelming bipartisan support in the Senate to force the Biden Administration to reverse course.” Tester and Rounds highlighted that U.S. inspectors had not visited Paraguay since 2014, raising additional concerns about oversight and safety standards.

|

ENERGY & CLIMATE CHANGE |

— Dominant theme at this week’s CERAWeek conference in Houston was inefficient infrastructure permitting in the United States. From oil and biofuel pipelines to wind farms to critical metal mines, the country’s energy transition is at risk of stalling for want of a better permitting system. Link to Reuters item.

— Ag and biofuel sectors await the administration's update on GREET modeling for sustainable aviation fuel (SAF) feedstocks, crucial for guiding the Treasury Department in determining eligibility for IRA's 40B SAF tax credit. It’s been two full weeks since thousands of farmers at the Houston-based Commodity Classic were surprised when EPA administrator Michael Regan and USDA Secretary Tom Vilsack pulled back from a prior commitment to announce SAF tax incentive and SAF-related details “by March 1.” Vilsack at the time said it would be “weeks, not months” before the details were released. It’s been weeks.

Vilsack made some comments on the topic yesterday during a House Ag Appropriations hearing (link for details). Rep. Ashley Hinson (R-Iowa) commented on the impacts of biofuels on the economy and the importance of supporting American farmers. She expressed concerns about the revisions to the GREET model and its potential effects on Iowa farmers. She sought an update on the status of the revision and emphasized the need to ensure that scientists are driving the review process.

Hinson told Vilsack: “As a fellow Iowan, you know the impacts of the biofuels industry on our economy, the importance of supporting American farmers as they're growing crops that feed and fuel the world and the administration's revisions to the GREET model which will affect, of course, the value that Iowa farmers are able to receive for their products is absolutely critical for industry and for long-term. And it's really important that Iowa farmers are recognized not only for their conservation practices, but I certainly appreciate your work to advocate for our farmers as this model is being revised. So, I'm wondering… if you can provide an update for us on the status of that revision for GREET and thoughts to ensure that scientists are driving that review of GREET?”

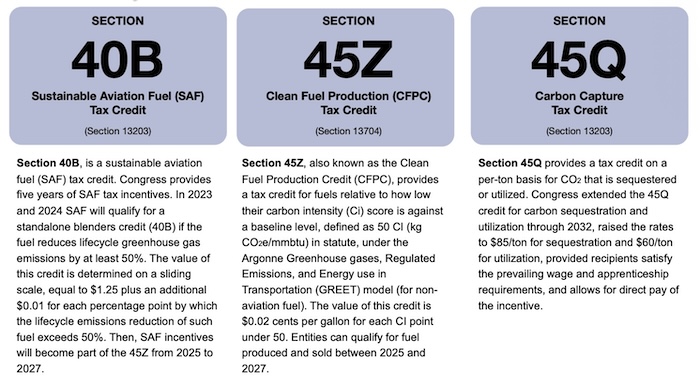

Vilsack said “there are two tax credits that are involved here, 40B and 45Z. Critically, we want to make sure the signals are properly sent on 40B, so first and foremost was getting an acknowledgment and appreciation for the use of the GREET model, which we've been able to accomplish. And now is making sure that the Treasury Department and others are fully aware of what steps farmers do in fact take to be more sustainable in the production of corn, soybeans as a feedstock for sustainable aviation fuel. I'm confident that there's a recognition that no till cover crops, energy efficient fertilizer are the kinds of things that ought to be included as factors to calculate whether or not a particular sustainable aviation fuel meets the threshold of more than 50% improvement. So, I'm confident we're going to send the right signal. And then I think there is an opportunity for a much broader conversation on 45Z, to see whether or not there are other aspects of climate smart agriculture or sustainable agriculture that ought to be considered. I think the right signal is going to be sent. I think there's a recognition that farmers are going to play an integral role in the development of this fuel.”

— Now that the GREET model and other details are near, some are wondering if there will be much impact. Ag tax expert Paul Neiffer was on Agri-Talk this week (link) and while he generally focused on proposed tax cut extensions trying to make their way through the Senate (facing big hurdles), Neiffer also reviewed the chances of Section 45Z actually helping farmers. He said: "I believe that Congress will need to mandate airlines to use SAF before corn and soybean farmers would get enough credit. If Section 45Z expire in 2027, then none of the carbon pipelines would be built by then, therefore, the credit may be of little value to farmers. However, I still believe it is important to know what your CI score is and how to improve. I would love to be proved wrong about Section 45Z."

Here is what a veteran biofuel analyst told us Thursday: “Neiffer is right about the short tenure of the credit. For that matter, several of the IRA energy tax credits could be short lived and even abbreviated further given that Congress will have to rewrite a lot of the Tax Code by then. If Congress were intellectually honest or consistent, then jet fuel would be a covered, obligated fuel under the RFS. That means refiners would have to either acquire RINs or blend an obligated percentage of jet fuel as renewable fuel just like they must do now with gasoline and diesel based on projected motor vehicle fuel use. That’s the whole thing: SAF could generate RINs but it’s not an obligated fuel. Meaning refiners don’t have to blend any amount of renewable in jet. Also, jets are a 25–30-billion-gallon market. Last year the U.S. made 15 million gallons of SAF. I don’t know that a three-year tax credit is going to change that trajectory. SAF feels a lot like cellulosic was the first five years of the RFS…a great sound bite. A great talking point. But a unicorn fuel. A smaller, less important but interesting angle is that the private jet crowd will realize more of the economic tax incentive than you or I sitting in coach on United. Private jets have fewer passengers but still fill up with the same jet fuel at the airport. Again, I wonder whether we will ever see commercially significant volumes but if we did that’s an interesting angle.”

An official from an ethanol company told us: “45Z is a Clean Fuel Producers tax credit for all low CI liquid fuels, i.e. Ethanol, Biodiesel, Renewable Diesel, SAF, etc. I can't speak for anyone in the Biodiesel, RD, or SAF production space. However, I can comment that there are enough reductions available for ethanol plants that have invested in technology that increases their output or lowers their inputs enough to get them UNDER the 50kg/mmBTU of CO2e and ‘in the money.’ I share this with you not as an idea that ethanol companies don't 'need/want' the farmer involved. It's quite the contrary. The global ethanol market, heck, let's go as far as the global fuel market, cares about efficiency and is counting carbon — no matter the origin. We want producers to be involved in the reduction calculation of GHG's. To be competitive long term, we need farmers to pull on the plow just as hard as we are with investments and innovation of their own. Without each other, both groups lose. The bar will continue to go up. We all will need to focus on getting our work done more safely, more efficiently, and more sustainably. That will not change. Producers should strongly consider keeping good records (preferably digital ones) and also educate themselves about how big of an opportunity this is for Ag. We do not want to go back to just being a food business. You and I both know what would happen to land values and farm income if that happened. This is a long-term play. Sequestration will be an essential part of lowering the CI for biobased feedstocks until scalable utilization technologies are available. Believe me, we're looking high and low for opportunities. We would much rather make a product than sequester the CO2. I've engaged with numerous groups that want to turn CO2 into a product. Most of these technologies are at the bench scale or whiteboard stage....”

— Biden's EV push faces political, legal, and market hurdles. The Biden administration introduced new regulations aimed at accelerating the transition to electric vehicles (EVs) in the United States, with plans for the majority of new cars and light trucks to be electric or hybrid by 2032. However, several challenges threaten to hinder this ambitious plan, the New York Times details in a report (link):

- Political Divide: EVs have become a contentious topic in the political arena, with a significant gap between Republican and Democratic attitudes toward them. Former President Trump has strongly opposed EVs, framing them as detrimental to the economy and American jobs.

- Lobbying and Legal Challenges: The fossil fuel industry and Republican lawmakers are expected to push back against the new Environmental Protection Agency (EPA) rules, with lobbying efforts and potential lawsuits. This resistance could pose legal hurdles and delay implementation.

- Dealer Resistance: Car dealerships, which heavily rely on servicing vehicles for profits, have been slow to embrace EVs due to lower profit margins and infrastructure requirements. Additionally, political influence and protectionist legislation in some states pose barriers to direct EV sales.

- Demand Issues: While EV sales have grown, there are concerns about slower-than-expected demand, especially for electric pickup trucks and SUVs. High prices, limited model availability, and range anxiety among consumers contribute to this tepid demand.

- Charging Infrastructure: The lack of adequate charging infrastructure remains a significant challenge, particularly in rural areas. Despite federal funding allocated for EV charger installations, progress has been slow, exacerbating concerns about range and accessibility for EV owners.

Bottom line: Despite these obstacles, the article notes there are reasons for optimism. Carmakers are expected to introduce more affordable and high-performing EV models in the coming years, while efforts to standardize charging infrastructure and private investments in network expansion could improve accessibility. However, the success of the EPA rule hinges on overcoming these challenges and navigating potential legal and political opposition.

— Challenge re: natural gas exports. Sixteen U.S. states — including Texas and Louisiana — challenged the Biden administration’s suspension of new licenses to export natural gas via ocean-going tankers. The lawsuit was filed in Louisiana federal court.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— USDA has moved forward with a proposed rule to OMB regarding the labeling of cell-cultured meat and poultry products. This rule, titled "Labeling of Meat and Poultry Products Made Using Animal Cell Culture Technology," stems from feedback gathered through an advance notice of proposed rulemaking in 2021, as well as consultations with the Food and Drug Administration and industry stakeholders. USDA asserts that new regulatory measures for labeling are necessary to ensure truthful and accurate labeling of cell-cultured products, given their novel production method, which may result in substantive differences from conventionally produced meat and poultry.

The proposed rule will mandate unique labeling terminology to enable consumers to accurately identify the nature and source of such products. While the USDA has not disclosed the specific options being considered, they have pledged to explore alternatives. Notably, the USDA has previously announced that the "Product of USA" label can only be used on cell-cultured products if all cell preparation and processing steps occur within the United States.

USDA aims to publish the proposed rule in May.

— Federal regulators have highlighted how large grocery chains leveraged their size to edge out smaller competitors during the pandemic, ensuring their shelves remained stocked amidst product shortages and distribution challenges. According to a new report (link) from the Federal Trade Commission (FTC), these major retailers utilized their scale to exert pressure on suppliers, implementing stricter delivery requirements and imposing fines on non-compliant vendors. As a result, many suppliers redirected their food and household goods toward these larger retailers to meet their demands. This report scrutinizes the competitive dynamics within retail markets during the pandemic, focusing on the influence wielded by companies of substantial size. The FTC also notes that while grocers experienced revenue growth surpassing supplier price increases, the heightened profits warrant further investigation. The release of this report coincides with consumers grappling with elevated prices for everyday items at grocery stores.

— DoorDash, Wendy's, and Alphabet's drone unit Wing are collaborating to offer drone delivery services, starting in Christiansburg, Virginia. This service allows certain local customers to order eligible menu items from Wendy's through the DoorDash marketplace and have them delivered by a Wing drone, usually within 30 minutes. While analysts recognize the potential utility of drones in scenarios such as disaster relief or critical healthcare support, there's debate regarding the viability and success of using drones for delivering discretionary items like fast food.

— France chooses Boehringer Ingelheim and Ceva for bird flu vaccines. France has chosen German company Boehringer Ingelheim and French firm Ceva Animal Health to supply a second round of vaccines for highly pathogenic avian influenza (HPAI), according to company officials speaking to Reuters. France initiated vaccination against bird flu in October 2023, aiming to vaccinate all ducks. Initially, France procured 80 million doses from the German firm, prompting a legal challenge from France's Ceva. However, Ceva announced last month that it would withdraw its appeal. For the second round, France is seeking 61 million doses, with 34.2 million to be supplied by the German firm. Deliveries of the vaccine are scheduled to commence in April.

|

OTHER ITEMS OF NOTE |

— Cotton AWP falls another week. The Adjusted World Price (AWP) for cotton is at 72.50 cents per pound, effective today (March 22), down from 76.10 cents per pound the prior week and the fourth weekly decline and the lowest level since the week of Feb. 9 when it was 70.04 cents per pound. However, it still remains well above the 52-cent level that would trigger an LDP. Meanwhile, USDA announced the Special Import Quota #23 will be established March 28 for 29,975 bales of upland cotton, applying to supplies purchased no later than June 25 and entered into the no later than Sept. 23.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |