Fed Rate Decision, Updated Forecasts and Powell Presser on Wednesday

Trump threatens 100% tariffs on Mexican-made cars by China Firms | Lighthizer on tariffs

Washington Focus

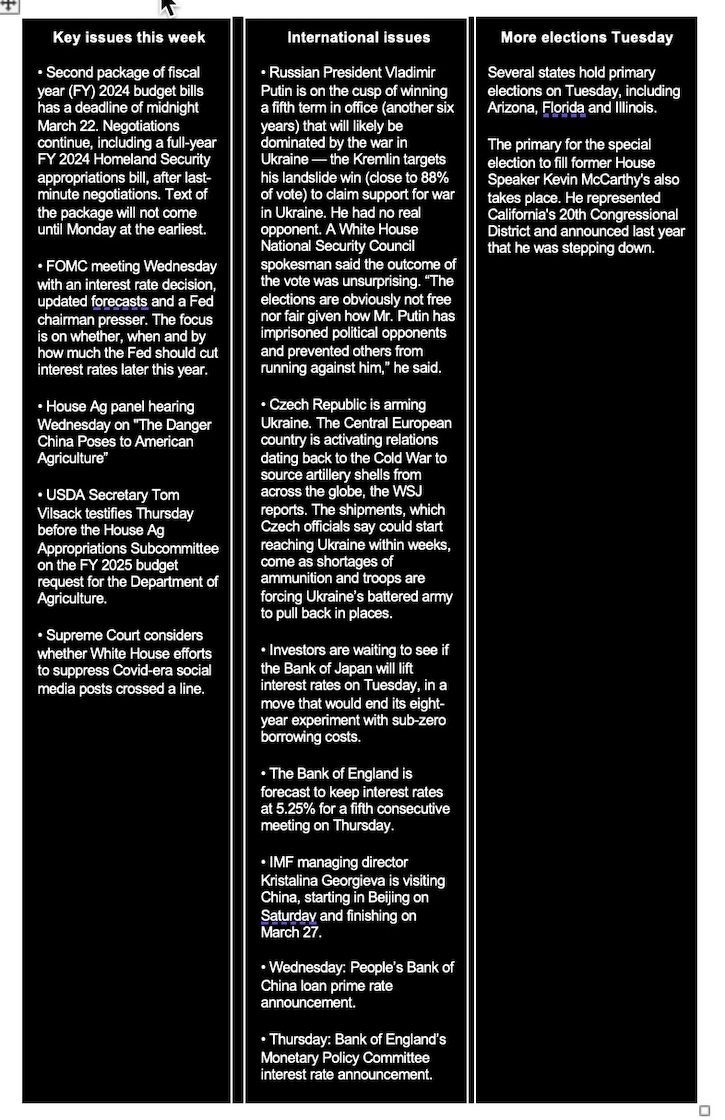

Focus this week: (1) A second package of fiscal year (FY) 2024 budget bills with a deadline of midnight March 22; (2) FOMC meeting Wednesday with an interest rate decision, updated forecasts and a Fed chairman presser; (3) a House Ag panel hearing Wednesday on "The Danger China Poses to American Agriculture”; and (4) USDA Secretary Tom Vilsack testifies Thursday before the House Ag Appropriations Subcommittee on the FY 2025 budget request for the Department of Agriculture.

The Senate is scheduled for a two-week recess starting after close of business March 22 and slated to return to the Capitol April 8. The House leaves for Easter recess after close of business March 22 and will return April 9.

— Lawmakers drafted a full-year FY 2024 Homeland Security appropriations bill after last-minute negotiations, prompted by White House intervention. Initially, a yearlong stopgap measure was being pursued, with negotiations on necessary changes as "anomalies" to the FY 2023 status quo. However, the White House's late request for $1.56 billion in border-related funding led to Republican rejection, citing insufficient ties to border protection and immigration enforcement. Despite initial resistance, ongoing discussions between the two sides led to a return to the fully fleshed out Homeland bill, indicating progress.

The release of the complete six-bill package, including Defense, Labor-HHS-Education, Financial Services, Legislative Branch, and State-Foreign Operations measures, is expected on Monday at the earliest.

Appropriators grappled with issues such as funding for Immigration and Customs Enforcement detention bed capacity and Transportation Security Administration pay raises.

House rules allot members 72 hours to read legislation before voting on it, and it usually takes the Senate a couple days to process any legislation. The package will also include the Defense, Labor-HHS-Education, Financial Services, Legislative Branch and State-Foreign Operations measures.

Bottom line: A full-year FY 2024 Homeland Bill, expected to exceed the current year's funding level, provides a platform for bipartisan negotiations, potentially incorporating additional funding for border and immigration-related accounts within nondefense limits through measures like rescissions and emergency spending designations.

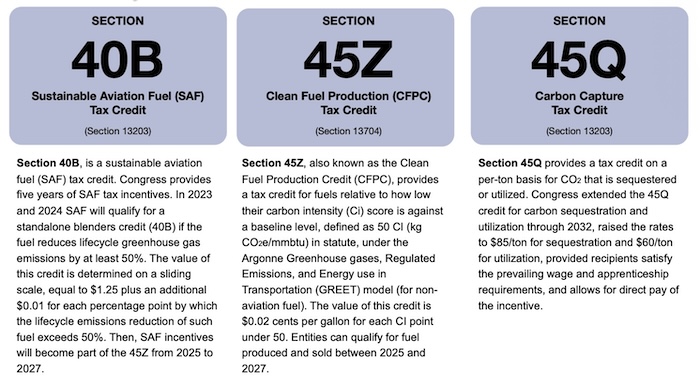

— Waiting on SAF details: Week 2. USDA Secretary Tom Vilsack at the Commodity Classic in Houston said it would be “weeks, not months” when detailed information comes out regarding the Sustainable Aviation Fuel (SAF) program after the initial by March 1 date was not met. The Treasury Department will release tax credit details for SAF. An updated Greenhouse Gases, Regulated Emissions and Energy Use in Technologies (GREET) model will come from USDA, EPA and the departments of Transportation and Energy.

Feedstock Carbon Intensity Calculator (FDCIC) is what a farmer gets at the field level in GREET. It encompasses factors such as crop inputs, grain yield, energy usage, fertilizer usage, location, farm practices and land practices, including indirect land use. Spreadsheets and other helpful tools will be available to determine how or if a farm operation qualifies, and to what degree. Start here.

The Inflation Reduction Act (IRA) enacted some new energy credits. Congress provides five years of SAF tax incentives. In 2023 and 2024 SAF will qualify for a standalone blenders credit (40B). Then tax incentives fall under Section 45z — Clean Fuel Production Credit. This credit is slated to start in 2025 and run through 2027 based on the current law.

Farmers who can prove their Carbon Intensity (CI) is lower than the standard for corn or soybeans may qualify for a premium from their ethanol/biofuels plant. But GREET alone won’t secure corn ethanol’s future in SAF. Ethanol producers need to shave off more CI points, says Lauren Lurkins, a strategist from Bloomington, Illinois. Today, GREET says corn ethanol has 43% less emissions of GHG than petroleum-based jet fuel. That must increase to 50% to unlock SAF tax credits. How? Land use change… environmental impacts when moving to corn production. What about corn produced with climate-smart practices? Also: Refining processes, carbon capture and sequestration (CCS), and/or some combination.

— GOP Whip Emmer calls for rethink on State of the Union invitations. House Majority Whip Tom Emmer (R-Minn.) suggested that GOP leadership should reconsider how presidents are invited to give the State of the Union address following President Biden's recent speech, which he deemed as "divisive." Emmer criticized Biden's remarks, describing them as a "hyper-partisan" campaign speech and expressing disappointment that the address lacked a more unifying tone.

Emmer emphasized that if Biden is re-elected and delivers a similar speech next year, he should not be invited to address Congress. While Emmer remains optimistic about former President Trump's chances of defeating Biden in the upcoming election, he stressed the importance of a more inclusive and unifying State of the Union address.

— Mexico rejects USDA’s new ‘Product of USA’ labeling rule, warning of potential challenges under the USMCA or WTO. The rule (link) requires meat, poultry, and egg products labeled "Product of USA" to be entirely sourced and processed in the United States. Mexico and Canada criticize the rule, fearing negative impacts on their exports. Mexico, a supplier of beef to the U.S., argues that the rule undermines regional trade integration and may lead to disruptions in supply chains. The Mexican government is urging the U.S. to reconsider the rule and emphasizes its commitment to resolving differences through dialogue but hints at potential legal action if necessary.

Of note: The Ministry of Agriculture and Rural Development (SADER) highlighted that Mexican cattle and beef exports to the U.S. were worth almost $3 billion last year, and noted that “Mexico continues to be one of the [United States’] main suppliers of beef and beef products.”

— Former President Donald Trump threatened to impose a 100% tariff on cars manufactured in Mexico by Chinese companies, doubling the previous proposed levy on automobiles made in Mexico. He directed this threat at Chinese President Xi Jinping during a rally in Ohio, stating that every car crossing the border would face the tariff. Trump emphasized the potential consequences if he were not to win the upcoming U.S. presidential election, describing it as a "bloodbath."

Earlier, Trump had suggested a 50% tariff on Chinese cars and proposed tariffs of up to 60% on all Chinese goods and 10% on goods produced globally. He expressed indifference to potential retaliatory actions from China or other nations, asserting a stance of reciprocal treatment: "You screw us, and we’ll screw you."

— Former USTR Lighthizer advocates tariffs for economic growth and security. Robert Lighthizer, former U.S. Trade Representative (USTR) under the Trump administration, argues for the implementation of tariffs, citing economic, geopolitical, and moral justifications. In a recent Economist commentary article (link), he contends that while tariffs have been historically vital for America's economic growth, they have been unfairly demonized in recent times by free-trade advocates. Lighthizer emphasizes the need for a nuanced discussion regarding tariffs, especially concerning Donald Trump's proposed tariffs on Chinese goods and those manufactured in Mexico by Chinese companies (see previous item).

Lighthizer points out that America's experiment with nearly eliminating tariffs since the Cold War has failed, resulting in significant trade deficits and foreign ownership of American assets. Lighthizer argues that tariffs can protect domestic industries and national security interests, citing examples of other countries' successful industrial policies.

Lighthizer criticizes the belief in the "comparative advantage" theory, arguing that other nations' industrial policies, particularly China's, have distorted global trade. He highlights the importance of a vibrant manufacturing sector for national security and economic prosperity, challenging the assumption that tariffs always lead to inflation or negative economic outcomes.

Drawing on data from the Trump administration, Lighthizer demonstrates that tariffs can stimulate domestic production and employment without significantly impacting consumer prices. He supports Trump's proposed tariffs to offset foreign trade distortions and boost American manufacturing, predicting potential increases in household income and job creation.

Lighthizer, appearing on a recent Larry Kudlow show on Fox Business, said that regarding potential inflation concerns from tariffs, argues that countries with significant economic intervention, like China, have not experienced inflation but in fact deflation. He dismisses the notion that tariffs would be inflationary, emphasizing the importance of revitalizing manufacturing to create high-paying jobs and restore American greatness.

Kudlow suggests offsetting tariff impacts domestically with measures like tax cuts, which Lighthizer agrees with, emphasizing the need to generate industries that create millions of high-paying jobs. Lighthizer also underscores the geopolitical threat posed by China, advocating for higher tariffs on Chinese goods for both moral and economic reasons.

Bottom line: Lighthizer asserts that tariffs, when strategically implemented, can address economic imbalances, protect domestic industries, and promote the well-being of American workers and communities.

Economic Reports and Events for the Week

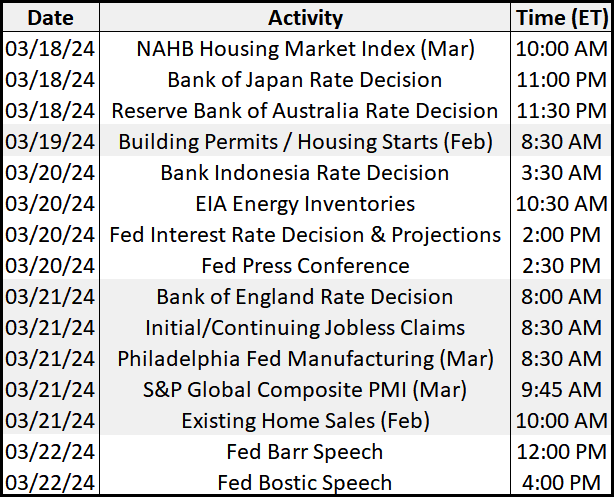

The Federal Open Market Committee (FOMC) will release its statement and summary of economic projections (SEP) on Wednesday, with Chair Jerome Powell's press briefing to follow. Given the absence of significant data changes before or after the FOMC meeting, the focus is on potential shifts in monetary policy.

Of note: Due to the blackout period, there was no fed commentary on the two inflation reports last week so the reaction from Powell will be important.

During his recent testimony, Powell hinted that the current fed funds rate may be at the peak of the tightening cycle. With little expectation for another rate hike, attention turns to the possibility of easing measures.

The SEP update is expected to update FOMC forecasts, with Powell suggesting potential rate cuts later in the year if economic data support them. However, recent data indicate a tight labor market and persistent inflation, particularly in shelter costs and non-housing services, which may alter previous rate cut projections.

Changes in the SEP are likely to dominate questions for Powell during the press briefing. Additionally, there may be discussions on quantitative tightening (QT), as policymakers plan to assess progress in reducing the Fed's reserve holdings. Powell has emphasized the need to reduce the Fed's balance sheet stimulus to return to relying on interest rate policy.

As of Friday, traders in the futures market were pricing in just three quarter-point cuts this year, in line with the Fed’s forecasts from its December dot plot.

Bottom line: Higher-for-longer when it comes to interest rates.

Monday, March 18

Tuesday, March 19

- NFIB Small Business Optimism Index

- Housing Starts: Commerce Department's Census Bureau is expected to report on Tuesday that overall housing starts likely rose to 1.435 million units in February from 1.331 million units in January.

- Bank of Japan interest rate announcement

- Statistics Canada will report the country's annual inflation rate. It is likely to have risen 3.1% in February, after increasing 2.9% the previous month, on a year-on-year basis. On a monthly basis, inflation print is expected to show a 0.6% rise in February.

Wednesday, March 20

- MBA Mortgage Applications

- Atlanta Fed Business Inflation Expectations

- FOMC meeting conclusion

- FOMC projections

- FOMC Chair press conference

- People’s Bank of China loan prime rate announcement

Thursday, March 21

- Jobless Claims: The National Association of Realtors is scheduled to report existing home sales decreased to 3.95 million units in February from 4 million units in the previous month.

- Philadelphia Fed Manufacturing

- Current Account

- PMI Composite Flash: S&P Global is expected to report that the flash manufacturing Purchasing Managers Index (PMI) likely fell to 51.7 in March from 52.2 in the prior month, while the flash services PMI likely slipped to 52 in the same period from 52.3 in February. The S&P Global flash composite PMI is also due.

- Leading Indicators

- Existing Home Sales

- Fed Balance Sheet

- Money Supply

- Bank of England forecast to keep interest rates at 5.25% for a fifth consecutive meeting

Friday, March 22

- Empire State Manufacturing

- Import & Export Prices

- Industrial Production

- Consumer Sentiment

- Federal Reserve Chair Jerome Powell will deliver welcome remarks at a "Fed Listens" event in Washington, where perspectives on current economic conditions and the pandemic's impact on the economy and workforce will be discussed.

- Federal Reserve Bank of Atlanta President Raphael Bostic will participate in a moderated conversation on "Household Finance" at the 2024 Household Finance Conference, organized by the Financial Services Innovation Lab at the Georgia Institute of Technology and the Federal Reserve Bank of Atlanta.

- Federal Reserve Board Governor Michelle Bowman will moderate "Panel 1: Evolving Conditions for Families and Job Seekers" at a "Fed Listens" event in Washington. Federal Reserve Vice Chair Philip Jefferson is scheduled to moderate "Panel 2: Industry Perspectives" at the same "Fed Listens" event in Washington.

Hearings & Other Events of Note

Monday, March 18

- President Joe Biden to travel to Reno and Las Vegas, Nevada.

- CERA Week. S&P Global 2024 CERAWeek conference in Houston, Texas. Energy Secretary Jennifer Granholm, Senate Energy and Natural Resources Committee Chair Joe Manchin (D-W.Va.), and Sen. Dan Sullivan (R-Ak.) are scheduled to deliver remarks.

- U.S., UK, Irish trade relations. Heritage Foundation discussion on “Perspectives on American, British, and Irish Trade Relations."

- SEC climate rules. House Financial Services Oversight and Investigations Subcommittee field hearing on "Victims of Regulatory Overreach: How the SEC's Climate Disclosure Rule Will Harm Americans."

Tuesday, March 19

- Meat and poultry processing workers. Aspen Institute virtual discussion on "Workers on the Line: Improving Jobs in Meat and Poultry Processing."

- Digital payments. PunchBowl News summit on "The Digital Payments Economy," focusing on "the future of commerce, exploring how digital payments support consumers, small businesses and the economy."

- Taiwan policy. Hudson Institute hold discussion on "America's Commitment to Defend Taiwan."

- Afghanistan withdrawal. House Foreign Affairs Committee hearing on "A 'Strategic Failure': Biden's Withdrawal, America's Generals, and the Taliban Takeover."

- Elections: Several states hold primary elections, including Arizona, Florida and Illinois. The primary for the special election to fill former House Speaker Kevin McCarthy's also takes place. He represented California's 20th Congressional District and announced last year that he was stepping down.

Wednesday, March 20

- China danger for U.S. agriculture. House Ag Committee hearing on "The Danger China Poses to American Agriculture." Witnesses include Rep. Mike Gallagher (R-Wis.) chair of the House Select Committee on the Chinese Communist Party; the committee’s top Democrat, Rep. Raja Krishnamoorthi (D-Ill.); South Dakota Gov. Kristi Noem; and Kip Tom, former ambassador to the UN Agencies for Food and Agriculture during the Trump administration.

- FY 2025 Budget: DOE. House Appropriations Energy and Water Development, and Related Agencies Subcommittee hearing on "FY 2025 Budget Request for the Department of Energy." Energy Secretary Jennifer Granholm testifies.

- FY 2025 Budget: HHS. House Appropriations Labor, Health and Human Services, Education and Related Agencies Subcommittee hearing on "FY 2025 Budget Request for the Department of Health and Human Services." HHS Secretary Xavier Becerra testifies.

- FY 2025 Budget: Social Security. Senate Finance Committee hearing on "The President's FY 2025 Social Security Administration Budget." Social Security Administration Commissioner Martin O'Malley testifies.

- FY 2025 Budget: SBA. Senate Small Business and Entrepreneurship Committee hearing on "Oversight of the US Small Business Administration and Review of the President's FY 2025 Budget Proposal." SBA Administrator Isabel Guzman testifies.

- PFAs. Senate Environment and Public Works Committee hearing on "Examining Per- and Polyfluoroalkyl Substances (PFAs) as Hazardous Substances."

- Future of the WTO. Peterson Institute for International Economics virtual discussion on "Can WTO (World Trade Organization) be saved? The way forward after the ministerial conference."

- Iran and US homeland security. House Homeland Security Committee hearing on "Examining the Current Status of Iran's Axis of Resistance and the Implications for Homeland Security and U.S. Interests."

- SEC reform. House Financial Services Capital Markets Subcommittee hearing on "SEC Overreach: Examining the Need for Reform."

- HHS. House Ways and Means Committee hearing on the Health and Human Services Department. HHS Secretary Xavier Becerra testifies.

- U.S. energy issues. Hoes Energy and Natural Resources Energy and Mineral Resources Subcommittee hearing on "Assessing Domestic Offshore Energy Reserves & Ensuring US Energy Dominance."

Thursday, March 21

- Federal Reserve. Fed Vice Chair for Supervision Michael Barr to deliver remarks (Due to the FOMC blackout period he cannot talk about the U.S. economy or monetary policy); the blackout period ends Friday.

- FY 2025 Budget: USDA. House Ag Appropriations Subcommittee hearing on "FY 2025 Budget Request for the Department of Agriculture." USDA Secretary Tom Vilsack testifies.

- FY 2025 Budget request. House Appropriations Financial Services and General Government Subcommittee hearing on "President Biden's FY 2025 Budget Request and Economic Outlook." Treasury Secretary Janet Yellen and Office of Management and Budget Director Shalanda Young testify.

- FY 2025 Biden Budget. Senate Finance Committee hearing on "The President's FY 2025 Budget." Treasury Secretary Janet Yellen testifies.

- FY 2025 Budget. House Budget Committee hearing on "The President's FY 2025 Budget Request." Office of Management and Budget Director Shalanda Young testifies.

- Rural roads. House Transportation and Infrastructure Highways and Transit Subcommittee hearing on "Rural Highway and Transit Challenges and Programs."

- China issues. U.S./China Economic and Security Review Commission hearing on "China's Evolving Counter Intervention Capabilities and Implications for the U.S. and Indo-Pacific Allies and Partners."

- Oil/energy market situation. Energy Department meeting of the International Energy Agency's Industry Advisory Board, IEA's Standing Group on Emergency Questions, and IEA's Standing Group on the Oil Market, including updates on the oil and gas market situation.

- Rail safety after East Palestine, Ohio, derailment. Federal Railroad Administration meeting of the Railroad Safety Advisory Committee to discuss potential safety improvements in response to the Feb. 3, 2023, freight train derailment in East Palestine, Ohio.

- FERC nominations. Senate Energy and Natural Resources Committee hearing on the nominations of David Rosner, Lindsay See and Judy Chang to be members of the Federal Energy Regulatory Commission.

- Countering China. House Foreign Affairs Committee hearing on "Countering China on the World Stage: Empowering American Businesses and Denying Chinese Military Our Technology."

- Global debt situation. Hudson Institute discussion on "Addressing the Developing World's Debt Crisis."

- The UN’s nuclear arm, the IAEA, will host its first summit in Brussels. Speakers will include representatives from the atomic agencies of South Korea, Japan, the U.S., China and France, plus executives from nuclear energy firms.

Friday, March 22

- Federal Reserve. Fed Chairman Jerome Powell to deliver remarks. Fed Vice Chair Philip Jefferson, Fed Governor Michelle Bowman, and Atlanta Fed President Raphael Bostic are scheduled to speak. Also, Fed Vice Chair for Supervision Michael Barr to deliver remarks.

- Global water situation. Center for Strategic and International Studies virtual discussion on "Living the Global Water Crisis."

Key USDA & international Ag & Energy Reports and Events

On the ag front, China’s second batch of trade data, including agricultural imports, will be published Monday, while a grain conference in Paris occurs Wednesday. London hosts a cargo insurance event on Thursday.

The energy sector this week will focus on officials from major energy companies and gov’t ministers for the industry’s CERAWeek conference in Houston, which starts on Monday.

Monday, March 18

Ag reports and events:

- Export Inspections

- China’s 2nd batch of Jan.-Feb. trade data, including agricultural imports

Energy reports and events:

- Angola preliminary loading program (May)

- International Maritime Organization marine environment protection committee

- CERA Week in Houston, Texas; runs through Friday

- China industrial output for January-February including coal, gas and power generation, as well as crude oil and refining

- China’s second batch of January-February trade data, including LNG and pipeline gas imports, oil products trade breakdown

- Earnings: Arabian Drilling

- Holiday: Mexico; Greece

Tuesday, March 19

Ag reports and events:

- Vegetables and Pulses Data

- Fruit & Tree Nut Data

- EU weekly grain, oilseed import and export data 4

Energy reports and events:

- API weekly U.S. oil inventory report

- Holiday: Venezuela

Wednesday, March 20

Ag reports and events:

- Broiler Hatchery

- Milk Production

- Grain Export Conference & Paris Commodities Exchange, Paris

- China’s 3rd batch of Jan.-Feb. trade data, including country breakdowns for commodities

- Malaysian palm oil export data for March 1-20

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- WTI April futures expire

- CPC loading program (April)

- China January-February output data for base metals and oil products

- China’s third batch of January-February trade data, including country breakdowns for energy and commodities

- Earnings: Hong Kong & China Gas

- Holiday: Azerbaijan; Japan

Thursday, March 21

Ag reports and events:

- Export Sales

- Livestock Slaughter

- Cargo Insurance London conference

- Port of Rouen data on French grain exports

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

- Singapore onshore oil product stockpile weekly data

- EIA Natural Gas Report

- U.S. National Oceanic & Atmospheric Administration publishes Spring Outlook

- The UN’s nuclear arm, the IAEA, will host its first summit in Brussels. Speakers will include representatives from the atomic agencies of South Korea, Japan, the U.S., China and France, plus executives from nuclear energy firms.

- Earnings: Cnooc; Enel

- Holiday: Azerbaijan; Kazakhstan; Iraq; South Africa; Namibia

Friday, March 22

Ag reports and events:

- CFTC Commitments of Traders report

- Cattle on Feed

- Chickens & Eggs

- Peanut Prices

- FranceAgriMer’s weekly crop condition report

Energy reports and events:

- ICE weekly Commitments of Traders report for Brent, gasoil

- Baker-Hughes Rig Count

- Holiday: Azerbaijan, Kazakhstan

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |