India, Four European Countries Reach Trade Pact While U.S. Trade Policy is Stuck in Neutral

Trump defends tariffs, dismisses threat of retaliatory moves; China cancels more SRW wheat

|

Today’s Digital Newspaper |

MARKET FOCUS

- China consumer prices rise for first time in 6 months

- Japan avoids recession in Q4

- Malanga: Fed's dilemma in a mixed economic environment

- Fed likely to maintain projected rate cuts, focus on lowering inflation: David Kelly

- 401(k) doing double duty as retirement account and source of emergency funds

- Average American household debt surges amid economic challenges

- Price of Bitcoin reaches record high, surpassing $71,000

- Regulations and drones

- Ag markets today

- Cancellations of sales of 264,000 MT SRW wheat to China, 2023-2024 marketing year

- Financial Times takes in depth look at biggest growth sector in Brazil: agriculture

- Australian farmers combat wine glut

- USDA Grain Stocks, Planting Intentions reports coming March 28

- Southern Ag Today looks at the 2024 rice market

- Ag trade update

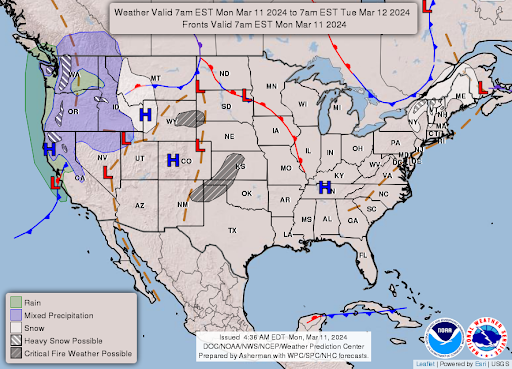

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Work continues on second of six-package FY 2024 spending bills

- Biden today to unveil FY 2025 budget proposals

ISRAEL/HAMAS CONFLICT

- Hopes dimmed for a ceasefire deal between Hamas and Israel

RUSSIA & UKRAINE

- Pope Francis faces criticism for suggesting Ukraine should negotiate with Russia

- Ukrainian grain exports so far in March reached 1.54 million metric tons

CHINA

- In February 2024, China's vehicle sales experienced significant decline of 19.9%

TRADE POLICY

- India and four European countries signed a free trade pact

- Trump defends plan to increase tariffs on Chinese imports if re-elected

ENERGY & CLIMATE CHANGE

- Federal judge upholds state veto power on polluting projects

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Pork exports start 2024 strong, beef shipments slow

- Western brands face boycott in Indonesia and Malaysia over Israel-Hamas conflict

HEALTH UPDATE

- Rural America sees higher disease-related mortality rates than urban areas: Report

Pro Farmer members: Please fill out our acreage survey. You should have received our annual spring acreage survey via e-mail. Please fill out the survey with your current planting intentions for this year. We’ll cover results and our acreage forecasts ahead of USDA’s March 28 Prospective Plantings Report. Click here to fill out the survey if you haven’t already responded. Please complete the survey only once.

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed in quieter overnight trading. U.S. Dow opened around 100 points lower. The only notable number over the weekend was Chinese CPI, which rose more than expected (0.7% vs. (E) 0.3%) and that’s being seen as a positive as deflation was a growing risk in the Chinese economy. In Asia, Japan -2.2%. Hong Kong +1.4%. China +0.7%. India -0.8%. In Europe, at midday, London -0.5%. Paris -0.4%. Frankfurt -0.6%.

U.S. equities Friday: All three major indices registered losses on Friday and for the week in the wake of the jobs update. On Friday, the Dow was down 68.66 points, 0.18%, at 38,722.69. The Nasdaq fell 188.26 points, 1.16%, at 16,085.11. The S&P 500 lost 33.67 points, 0.65%, at 5,123.69.

For the week, the Dow was down 0.9%, the Nasdaq was down 1.2% while the S&P 500 eased 0.3%.

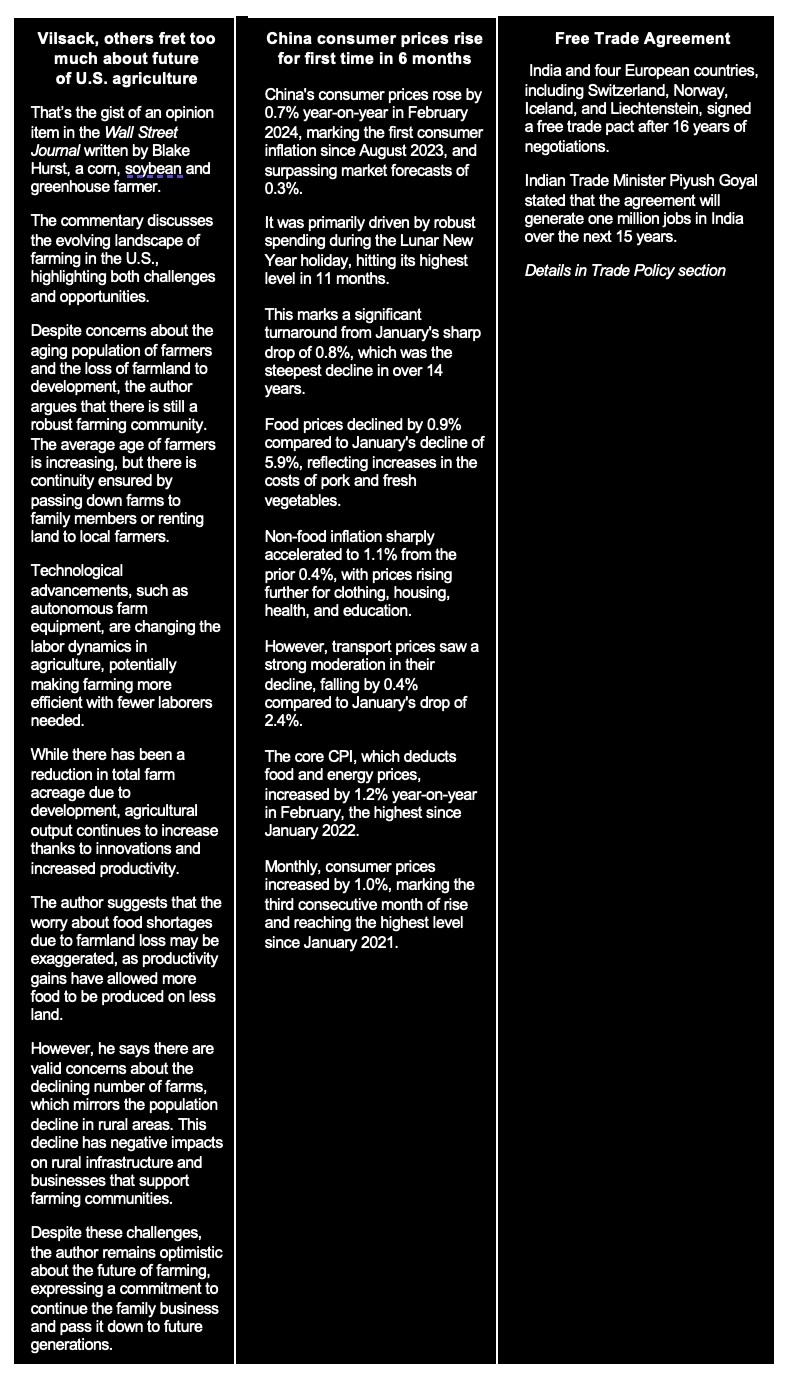

— A significant portion of Vanguard's 401(k) account holders, representing 3.6% of its plan participants, made early withdrawals from their accounts last year for financial emergencies, setting a record. Despite the intended purpose of retirement plans like the 401(k) to preserve Americans' savings for later in life, increasing balances have led more individuals to feel comfortable accessing these funds when necessary. Link to WSJ item for more.

— Ag markets today: Corn, soybeans and wheat pulled back from Friday’s corrective gains during the overnight session. As of 7:30 a.m. ET, corn futures were trading 3 to 4 cents lower, soybeans were 6 to 8 cents lower, SRW wheat was 2 cents lower, HRW wheat was mostly 6 cents lower and HRS wheat was 3 to 4 cents lower. Front-month crude oil futures and the U.S. dollar index were both modestly weaker.

Wholesale beef prices climbing. Wholesale beef prices firmed 43 cents for Choice to $307.04 and $1.17 for Select to $297.43 on Friday. That’s the highest price for Choice beef since late October of last year, while the Select price is the highest since late June 2023. Beef packer margins have improved amid the rising wholesale prices, but remain in the red.

Cash hog index unchanged, pork cutout firms. The CME lean hog index is unchanged at $81.48 as of March 7, hinting at a potential stall of the seasonal rally since the beginning of the year. April lean hog futures finished last Friday at a $2.895 premium to today’s cash quote. The pork cutout value firmed 96 cents on Friday amid gains in all cuts except loins.

— Agriculture markets Friday:

- Corn: May corn futures rose 1 3/4 cents to $4.39 3/4, marking a 15-cent gain on the week and the second consecutive week of gains.

- Soy complex: May soybeans rallied 17 3/4 cents to $11.84, marking the highest close since Feb. 1 and gaining 32 3/4 cents on the week. May soymeal rose $7.00 to $341.40 and picked up $9.10 week-over-week. May soyoil slid 18 points lower to 46.17 but rose 101 points from a week ago.

- Wheat: May SRW wheat futures rose 9 1/4 cents to $5.37 3/4 and nearer the daily high after setting a contract low early on. For the week, May SRW lost 20 cents. May HRW wheat futures gained 14 cents to $5.88 3/4 and near the session high. For the week, May HRW rose 24 1/4 cents. May spring wheat rose 8 cents to $6.62 3/4 and rose 19 cents on the week, notching the first weekly gain in six weeks.

- Cotton: May cotton fell the 400-point daily limit to 95.28 cents and gave up 29 points on the week.

- Cattle: April live cattle futures closed down $1.125 at $187.60 and nearer the session low after hitting a 4.5-month high early on. For the week, April cattle lost 85 cents. May feeder cattle futures lost $1.70 to $256.75 and near the daily low. For the week, May feeders fell $3.425.

- Hogs: Hog futures traded mixed to higher Friday, with the summer contract posting another round of modest gains, whereas nearby April and the deferred contracts slipped. April hogs ended the week at $84.375, down 15 cents on the day and $3.70 on the week.

— Quotes of note:

- Fed likely to maintain projected rate cuts, focus on lowering inflation, David Kelly, chief global strategist at J.P. Morgan Asset Management, told Barron’s (link). As the Federal Reserve prepares to convene later this month, he says the focus remains on monetary policy, with expectations centered around gradual rate cuts. The futures market has adjusted its projections, anticipating three rate cuts this year, he adds, aligning with the Fed's previous projections. These cuts, likely in June, September, and December, are primarily in response to lower inflation rather than economic weakness, he notes. Of note, he says that despite a healthy economy, the argument for rate cuts stems from preventing real rates from increasing due to declining inflation and adhering to the Fed's target of 2% inflation. Fed Chair Jay Powell has emphasized the importance of preemptive rate cuts before inflation reaches the target, considering the lag in monetary policy effectiveness. The Fed's approach to rate cuts will be nuanced, Kelly says, distinguishing between cuts prompted by lower inflation and those responding to economic weakness. While rate cuts may occur, quantitative tightening is expected to continue throughout 2024 to manage monetary policy.

- A soft spot. “If the economy can continue to add jobs, without triggering a resurgence in wage growth, the Fed will achieve its soft landing,” said Seema Shah of Principal Asset Management.

- Carbon proof it. The latest issue of Bloomberg Businessweek includes a profile of the Carlyle Group’s Meg Starr and her efforts to quantify private equity’s sustainability efforts. “We can go out and talk all we want about how carbon efficiency leads to better valuation multiples, but unless we have a statistically significant dataset,” Starr says, “we don’t actually know.” Link for details.

- Regulations and drones. “It’s not just hard to fly these drones on a technological level, on a regulatory level, it’s also just simply extremely hard to fly them in a cost-effective manner.” — Matthias Winkenbach of MIT’s Center for Transportation and Logistics.

— Malanga: Fed's dilemma in a mixed economic environment. Dr. Vince Malanga, president of LaSalle Economics, notes the potential economic scenario where growth stabilizes between 1.5% and 2% while inflation remains persistently between 2.5% and 3%. He says that raises the question of whether this situation constitutes a hard or soft landing, or possibly stagflation, with the interpretation likely influenced by political affiliations.

Fed Chair Powell's recent testimony suggests a commitment to maintaining a steady policy course, with hints of potential rate cuts in the future. However, Malanga argues that the Fed might be missing an opportunity for a more favorable outcome. The window for declining inflation could close soon, he believes, while risks from the commercial property sector are rising. Delayed action may exacerbate these conditions and invite criticism from both ends of the political spectrum, he predicts.

While there are factors mitigating inflation, such as the productivity boomlet and China's deflationary impact, Malanga adds that recent data shows a rise in core PCE deflator and other inflation indicators. The fiscal stimulus is significant, he reasons, and expected to continue, primarily driven by government spending initiatives, which could further complicate the economic picture.

Private sector activity showed signs of decline in January, with job growth slowing and wage growth decelerating in February. While some indicators, like ISM new orders, suggest strong future production, Malanga points out that weaknesses in the commercial property market and overall economic uncertainty pose risks.

Malanga questions whether the Federal Reserve is willing to take the risk of maintaining current policy settings in an election year. Delaying policy adjustments could invite criticism from both sides of the political spectrum, he says, adding that initiating rate cuts early might be the preferred course of action to navigate the complex economic landscape.

— Average American household debt surges amid economic challenges. Household debt in the U.S. reached $17.5 trillion by the end of last year, marking a significant increase of almost $3.5 trillion since 2019, before the onset of the Covid-19 pandemic. A recent report by the Federal Reserve Bank of New York revealed a resurgence in home equity lines of credit over the past two years, following a decade of declines. Credit card debt has surpassed $1 trillion, with credit limits rising for the 11th consecutive quarter.

LendingClub CEO Scott Sanborn highlighted the implications of this trend, noting that consumers, grappling with the highest inflation since the 1980s, have increasingly turned to debt, particularly through credit cards. The interest rates on these cards have reached record highs, with nearly half of the largest issuers offering cards with average percentage rates (APRs) exceeding 30%.

Despite half of Americans being unaware of the APRs on their cards, the Consumer Financial Protection Bureau announced measures to reduce credit card late fees, estimated to save consumers $10 billion annually. Fed data show rising delinquencies, though not yet at alarming levels.

The CFPB emphasizes the need for increased competition to address soaring interest rates, particularly among major credit card companies. This comes amid scrutiny of the proposed Capital One-Discover merger, with Fed Chair Jerome Powell confirming that the central bank has yet to receive an application for the merger.

— Japan avoids recession in Q4. In the fourth quarter of 2023, Japan's GDP experienced a modest growth of 0.1% quarter-on-quarter (qoq). This growth contrasts with the initial estimate, which suggested a 0.1% decline and the previous quarter's contraction of 0.8%. This positive growth helped the Japanese economy narrowly avoid a recession, as market expectations were for a 0.3% increase.

The growth was supported by a significant upward revision in capital expenditure, which expanded by 2.0% compared to the preliminary estimate and the previous quarter's 0.1% decline. This figure surpassed market consensus, which anticipated a 2.5% rise. Additionally, net trade made a positive contribution of 0.2 percentage points, unchanged from the initial estimate, with exports growing by 2.6% compared to 0.9% in the second quarter, outpacing the growth of imports at 1.7% versus 1.0%.

However, private consumption, a significant component contributing to about 60% of the economy, continued to decline for the third consecutive quarter, shrinking by 0.3%. This decline was more severe than the initial reading of a 0.2% drop and was preceded by a 0.3% fall in the third quarter. This decline in private consumption was attributed to elevated cost pressures and ongoing challenges within the domestic market.

Moreover, government spending saw a larger decline than initially anticipated, contracting by 0.2% compared to the flash data's -0.1%. This decline follows a 0.3% increase in the third quarter. Similarly, public investment also fell more than the initial estimate, with a decrease of 0.8% compared to the first estimate's -0.7% and a 1.0% decrease in the third quarter.

Market perspectives:

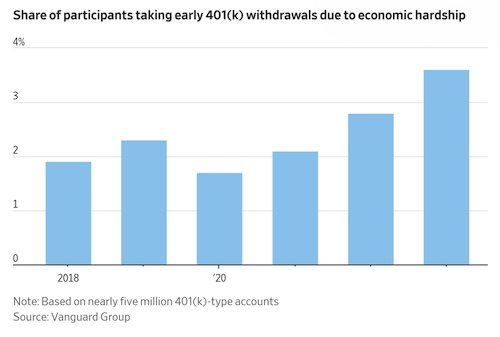

— Outside markets: The U.S. dollar index was slightly weaker, with only the euro managing a rise against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 4.07%, while global government bond yields were mixed. Crude oil futures were lower, with U.S. crude around $77.55 per barrel and Brent around $81.65 per barrel. Gold and silver futures were barely higher ahead of US trading, with gold around $2,186 per troy ounce and silver around $24.57 per troy ounce.

— Gold prices have been rising steadily despite the strong performance of the U.S. stock market and economy. Gold reached an all-time high of $2,195 per ounce, with a year-to-date gain of 5% and a 12-month gain of 19%. This surge in gold prices is unusual as it doesn't align with typical events that have historically driven gold to record highs, such as financial crises or pandemics.

The growth in gold prices is attributed to several factors:

- Slower economic growth in non-U.S. markets compared to the U.S., leading investors to seek alternative investments like gold.

- High demand from Chinese investors amidst economic instability in China, particularly in the commercial real estate sector.

- Concerns among U.S. investors about potential inflation, geopolitical instability, and upcoming events like the presidential election.

Analysts say factors to watch for include potential interest rate cuts, increased gold purchases by central banks, and geopolitical tensions.

Bottom line: Gold remains a popular investment due to its historical value retention during periods of inflation and conflict, with investors holding about $3.3 trillion worth of gold globally.

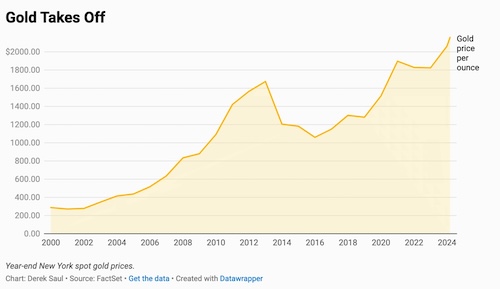

— The price of Bitcoin has reached a record high, surpassing $71,000. This surge comes after five consecutive days of rallying, with Bitcoin gaining over 60% since the beginning of the year. The increase in price can be attributed to a significant influx of capital into recently approved Bitcoin exchange-traded funds (ETFs). Additionally, British regulators announced on Monday their approval for the creation of similar cryptocurrency-related securities, which has likely contributed to the ongoing surge in Bitcoin's value.

— Private exporters reported cancellations of sales of 264,000 MT SRW wheat to China, 2023-2024 marketing year.

— Australian farmers combat wine glut. Amid a surplus of wine production in Australia, farmers are resorting to drastic measures. They are demolishing millions of vines to curb overproduction, a phenomenon that has led to plummeting grape prices and endangered the incomes of growers and winemakers. This action comes in response to a global trend of declining wine consumption, which has been a significant concern in recent earnings seasons. Producers are now taking decisive actions to restore equilibrium in the market's supply and demand dynamics. Link to Reuters for more.

— Grain markets: The March Grain Stocks report and Planting Intentions are on March 28. The acreage switch is expected to favor soybeans, say traders. The Commodity Traders report showed a record short in the soybean market. The corn position remained unchanged for the week, with a large short.

— Financial Times take an in depth look at the biggest growth sector in Brazil: agriculture. The article (link) explores the rapid transformation and economic boom experienced by Brazil's central-west region, particularly in towns like Boa Esperança do Norte, fueled by the agribusiness sector. This boom is characterized by significant growth in agriculture, with soybean production being a major driver, buoyed by global demand, especially from China. The region's economy has witnessed remarkable expansion, leading to newfound wealth and prosperity, evident in rising GDP and conspicuous consumption.

However, the article also highlights the looming threat posed by climate change, as evidenced by extreme weather events impacting agricultural productivity. Last year's record-breaking heatwave and drought significantly affected crop yields, signaling potential challenges ahead for Brazil's “agro” boom. Despite assurances from some locals attributing these issues to cyclical weather patterns like El Niño, there's a growing recognition among experts and larger producers of the need to adapt to a changing climate. Investments in technologies like genetically modified seeds and soil management techniques are being considered to mitigate these risks.

Moreover, concerns linger regarding increased competition from other regions and countries, as well as shifting patterns in global demand, particularly from China. While optimism remains high among locals and officials, there's acknowledgment of uncertainties and the need for resilience in the face of evolving market dynamics and environmental challenges.

— Southern Ag Today looks at the 2024 rice market. In an article (link), Southern Ag Today says the 2024 rice market has seen fluctuations influenced by various factors:

- Production Trends: After two years of decline, U.S. rice production increased to approximately 2.9 million acres in 2023. This rise followed high prices in 2022 and 2023 due to increased world consumption.

- Regional Influences: California faced an extreme drought in 2022, impacting rice production. Arkansas responded by increasing medium-grain rice acreage, but California rebounded in 2023, leading to an abundance of medium-grain rice.

- Global Conditions: An Eastern Pacific El Nino disrupted off-season rice production in Thailand, Burma, and Indonesia, impacting global supplies. India's export ban on non-basmati rice further strained global supplies, causing a significant decline in exports.

- Market Sensitivity: The 2024 rice market remains sensitive to global conflicts, weather, government policies, and shipping issues. Opportunities in the export market may arise if Mississippi River levels stabilize and India's export ban continues.

- Price Dynamics: The soybean-to-rice price ratio for November 2024 delivery has declined, reflecting a similar trend in other commodities' prices.

— Ag trade update: Turkey provisionally sold 150,000 MT of durum wheat to an unknown destination.

— NWS weather outlook: Heavy wet snow will continue into the morning hours on Monday across the higher elevations of the northern New England and portions of the lower Great Lakes... ...Unsettled weather is expected to persist across the Pacific Northwest and into the northern Rockies with multiple rounds of lower-elevation rain and higher elevation snow... ...Fire danger to increase across the central and southern High Plains from very dry conditions, gusty winds, and warm temperatures.

Items in Pro Farmer's First Thing Today include:

• Grains weaker to open the week

• Brazil forecast drier, Argentina wetter

• Canadian planting intentions out this morning

• Polish gov’t pledges grain surplus cut

— Some highlights of most recent Pro Farmer newsletter (link to subscribe; a subscription gives you access to profarmer.com which includes searchable copies of Updates, plus commentary on markets in the morning and evening, all sent to your email):

- Brazil soy exports surged in February, reaching 6.610 million metric tons (MMT), a 118% increase from January and a 31.8% increase from the previous year.

- China's soy imports during the first two months of 2024 decreased by 8.8% compared to the same period last year, reaching 13.04 MMT, the lowest level for this period since 2019.

- The UN Food and Agriculture Organization's global food price index dropped by 0.7% in February, marking the seventh consecutive monthly decline.

- The U.S. exported $14.90 billion of agricultural goods in January, while imports stood at $17.44 billion, resulting in a trade deficit of $2.54 billion.

- The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) raised its forecast for the 2023-24 Australian wheat crop to 26.0 million metric tons (MMT), up by 500,000 MT due to better-than-expected summer rainfall.

- Cattle slaughter and beef production have historically tended to rise and undercut prices into summer, but a repeat of mid-2022 and 2023 reductions could sustain support.

- Grocers have recently held the line on passing higher beef prices on to consumers, suggesting sustained cash gains into April.

- The sustained early-January industry cutbacks in pork production imply strengthening prices for lean hogs.

- Low corn prices are spurring export demand, with weekly export sales topping 1.0 million metric tons in six of the last eight weeks.

|

CONGRESS |

— One down and a bigger one to go sums up the latest saga regarding completing fiscal year (FY) 2024 funding measures, which should have been finished by Oct. 1 last year. Meanwhile, the Biden administration on Monday will release its proposals for FY 2025, with several hearings on the topic this week. Most of the White House proposals, especially regarding tax hikes, will go nowhere. For more on this topic and the week in Washington, check this link.

— Congress is currently in discussions over this year's budget, but attention is shifting towards negotiations for the fiscal year (FY) 2025 budget. Today, President Joe Biden will unveil his plan for the upcoming fiscal year. Given that Republicans control the House of Representatives, Biden's budget proposal is unlikely to pass into law. However, it serves as an opportunity for him to outline his priorities leading up to the presidential election.

Biden is expected to propose a revised version of his economic agenda, often referred to as Bidenomics. This plan may include increased spending on health insurance for the elderly, tax credits for young families, and investments in preschool education. To finance these initiatives, Biden will advocate for higher taxes on corporations and wealthy individuals. While Republicans are likely to criticize it as a reckless "tax-and-spend" budget, Biden will argue that it is crucial for the country's future.

Key aspects of Biden's plan include:

- Increasing the child tax credit, resulting in tax cuts averaging $2,600 for 39 million low- and middle-income families.

- Strengthening the Earned Income Tax Credit for low-wage workers without children, reducing taxes by an average of $800 per year for 19 million individuals or couples.

- Extending protections under the Affordable Care Act that are set to expire next year.

- Proposing a $2,000 cap on drug costs and $35 insulin for all, not just those on Medicare.

- Implementing corporate tax hikes and imposing a minimum tax rate of 25% on billionaires.

— Biden is proposing a $10,000 tax credit for Americans who sell their homes. This Mortgage Relief Credit acknowledges the current stagnation in the housing market due to high mortgage rates. The aim is to address the phenomenon known as "golden handcuffs," where homeowners are reluctant to sell their houses because they secured their mortgages during an era of low rates.

Here's how the proposal works:

- The $10,000 credit is designed to incentivize the sale of "starter homes," which are defined as homes below the area's median price.

- By encouraging homeowners to sell these starter homes, the intention is to free up inventory for first-time buyers.

- The credit is primarily targeted at middle-class families looking to move up the "housing ladder," according to the White House. Link to White House fact sheet.

|

ISRAEL/HAMAS CONFLICT |

— Hopes dimmed for a ceasefire deal between Hamas and Israel as the holy month of Ramadan began. Defying a warning from President Joe Biden, Binyamin Netanyahu, Israel’s prime minister, said he would press on with an assault on the southern Gaza city of Rafah. Egyptian officials, who have been trying to broker a ceasefire, said they remain in touch with both sides. Biden previously warned that an Israeli invasion of Rafah would represent a “red line” as cease-fire talks remained stalled.

|

RUSSIA/UKRAINE |

— Pope Francis faced criticism for suggesting that Ukraine should negotiate with Russia and have the "courage of the white flag" to end the war. His remarks, made in an interview on Saturday, drew a quick response from Kyiv, which emphasized its commitment to its national flag and resistance against Russian aggression. Ukraine's Foreign Minister, Dmytro Kuleba, reaffirmed the significance of the country's yellow and blue flag, stating that it represents their resilience and determination.

Of note: The director of the Holy See Press Office later clarified the Pope's comments, explaining that he used the image of the white flag, proposed by the interviewer, to symbolize a cessation of hostilities achieved through courageous negotiations, rather than suggesting surrender.

— Ukrainian grain exports so far in March reached 1.54 million metric tons (MMT), according to Agriculture Ministry data, down from 1.93 MMT during the same period in 2023. The shipments bring 2023-24 Ukrainian grain exports to 31.2 MMT, which includes 16.7 MMT of corn, 12.5 MMT of wheat, and 1.76 MMT of barley. The total compares with 34.2 MMT exported at this point during the 2022-23 marketing year.

|

CHINA UPDATE |

— In February 2024, China's vehicle sales experienced a significant decline of 19.9% compared to the same period a year earlier, totaling 1.58 million units. This downturn contrasts sharply with the previous month's notable 47.9% increase, largely due to disruptions caused by the Lunar New Year holiday, according to data from the China Association of Automobile Manufacturers (CAAM).

Furthermore, sales of new energy vehicles (NEVs) saw a notable decline of 9.2% in February, reversing from the substantial 78.8% surge observed in January. However, when considering the cumulative sales for the first two months of the year, total car sales increased by 11.1% to nearly 4.03 million units. This rebound marks a significant improvement from the 15.2% decline witnessed during the same period in the previous year. Notably, sales of new energy vehicles soared by 29.4% during January-February 2024.

Additionally, a separate report from the China Passenger Car Association (CPCA) revealed that NEV sales accounted for 33.5% of total car sales in January-February 2024, a notable increase from 28.3% during the same period a year earlier.

|

TRADE POLICY |

— India, four European nations ink 16-year trade pact; 1 million jobs expected. India and four European countries, namely Switzerland, Norway, Iceland, and Liechtenstein, have finally signed a free trade pact after 16 years of negotiations.

Impact: Indian Trade Minister Piyush Goyal announced that this agreement is expected to create one million jobs in India over the next 15 years.

Of note: The European bloc involved in the pact does not include any member countries of the European Union.

Give and take: Under the agreement, India will secure investment commitments from the European nations. In return, the European countries will gain easier access to the Indian market for processed food and beverages, electrical machinery, and other goods.

Bottom line: This agreement opens opportunities for European nations to tap into a potential market of 1.4 billion people in India.

— Former President Donald Trump defended his plan to increase tariffs on Chinese imports if re-elected. In an interview with CNBC’s Squawkbox on Monday, Trump said he was not concerned that potential retaliatory action from China would harm U.S. growth. “That’s OK, they might do that, but they didn’t do that with me,” he said. “Even if they do, let American companies come back to America,” emphasizing the importance of bringing American companies back to the U.S., even if tariffs are imposed.

Trump suggested imposing tariffs as high as 60% on Chinese imports and targeting Chinese manufacturers operating in Mexico. He criticized Chinese companies for relocating to Mexico to sell goods to the U.S. market.

Regarding TikTok, Trump acknowledged the app as a national security threat but indicated a shift in his stance, stating he no longer supports banning it in the US. He also criticized Facebook, suggesting that banning TikTok would benefit Facebook, a company he believes has had a negative impact on U.S. elections.

|

ENERGY & CLIMATE CHANGE |

— Federal judge upholds state veto power on polluting projects. A federal judge has upheld a rule granting states the authority to veto pipelines and other polluting projects, despite challenges from Louisiana and 10 other states. The judge rejected the plaintiffs' request for a preliminary injunction against the Environmental Protection Agency (EPA) rule, stating that it reinstates regulations from the pre-Trump era concerning the state approval process for federally permitted infrastructure projects that could pollute rivers or other streams considered Waters of the United States (WOTUS).

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Pork exports start 2024 strong, beef shipments slow. The U.S. exported 587.8 million lbs. of pork during January. While that was down 56.1 million lbs. (8.7%) from December, which was the highest monthly tally since May 2021, pork shipments increased 32.0 million lbs. (5.8%) from January 2023. USDA raised its 2024 pork export forecast and now expects a 4.8% increase to 7.130 billion pounds. Beef exports totaled 232.6 million lbs. during January, down 19.8 million lbs. (7.8%) from December and 10.0 million lbs. (4.1%) less than last year. USDA forecasts beef exports will fall 9.1% from last year to 2.785 billion pounds.

— Western brands face boycott in Indonesia and Malaysia over Israel-Hamas conflict. Popular Western brands from Unilever and McDonald's to Starbucks and Danone are being hit by a consumer boycott in Muslim-majority Indonesia and Malaysia, part of the fallout over the Israel-Hamas conflict.

Impact examples: Unilever, whose well-known products include Dove soap and Ben & Jerry's ice cream, and global fast food chain McDonald's are among the companies saying their businesses are suffering. "In Indonesia, we saw [a] double-digit sales decline in the fourth quarter, as sales of several multinational companies were impacted by geopolitically focused, consumer-facing campaigns," Unilever's Chief Financial Officer Fernando Fernandez said in an earnings call on Feb. 8.

Multinationals, for their part, have attempted to dispel the perception that they favor one side or the other in the conflict. “We are sad and concerned" over the conflict in the Middle East, Unilever Indonesia said, stressing its contribution to "serving consumers in Indonesia for 90 years. Our products are made, distributed and sold by the people of Indonesia."

In Malaysia, Berjaya Food, coffee chain Starbucks' main franchise owner in the country, reported a 38.2% drop in revenue in its second quarter ended in December. The revenue drop was primarily "attributed to an ongoing boycott" linked to the fighting, it said. "We condemn violence, the loss of innocent life and all hate and weaponized speech," Starbucks Malaysia said. "Despite false statements spread through social media, we have no political agenda. We do not use our profits to fund any government or military operations anywhere -- and never have."

Small and medium size businesses have also felt the impact of consumer anger.

|

HEALTH UPDATE |

— Rural America sees higher disease-related mortality rates than urban areas: USDA report. The mortality rate in the U.S. has seen a decline since the 1960s, but this decline has been more pronounced in urban areas compared to rural ones, particularly in recent years. According to a report (link) by three analysts from the USDA, a significant contributing factor to this trend is the higher death rate from diseases among working-age individuals in rural America.

In 2019, the natural-cause mortality (NCM) rates for the prime working-age population in rural areas were 43% higher than in urban areas, a stark increase from being only 6% higher in 1999. This increase among the working-age population stood out from the change in the overall rural population, which saw natural-cause mortality (NCM) death rates being 6% higher in 1999 and 20% higher in 2019.

The research found that females in rural areas had larger increases in prime working-age NCM rates compared to white males across all regions, with the most significant increases observed in the Western United States. This indicates a health disadvantage for rural populations, particularly among prime working-age individuals.

Background: The study, which analyzed death certificates for various factors including sex, race, ethnicity, residence, cause of death, and year of death, revealed that both urban and rural areas experienced increases in death rates from drug overdoses, suicide, and alcohol over the past two decades. However, rural areas alone saw increases in disease-related or natural-cause mortality rates among the prime working-age population.

Of note: The researchers found that while the urban rate decreased by 37 deaths per 100,000 people, the rural rate increased by 14 deaths per 100,000, resulting in a combined gap of 51 deaths per 100,000 people, indicating a growing rural health disadvantage. Moreover, the change in NCM mortality rates was most significant in the most remote areas, suggesting that differences in healthcare resources and health behaviors between urban and rural areas could contribute to the stagnation and even increasing mortality rates in rural areas.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |