SOTU Address: Biden’s Campaign Message for Re-election

U.S. job growth totaled 275,000 in February, exceeding expectations | Sugar updates

|

Today’s Digital Newspaper |

MARKET FOCUS

- U.S. economy added 275,000 jobs in February 2024, beating forecasts of 200,000

- Assessing Employment report

- Fed Chair Powell hints at possibility of lowering interest rates

- FBI issues grand jury subpoenas to both current and former employees of ADM

- Ag markets today

- Cancellation of sales of 110,000 MT SRW wheat to China during 2023-2024 MY

- U.S. agricultural exports dip in January, trade deficit surges

- March S&D Report likely to feature modest adjustments

- USDA announces rise in FY 2024 raw cane sugar TRQ

- Johansson: ‘U.S. does not face a looming sugar supply crisis’

- Farmers in Brazil filing for bankruptcy protection at ‘concerning’ pace

- India’s rice prices score another new high

- NWS weather outlook

- Pro Farmer First Thing Today items

STATE OF THE UNION (SOTU) ADDRESS

- Biden delivers defiant argument for second term in State of the Union speech

- Key takeaways of SOTU speech

CONGRESS

- Senators working to pass $460 billion government-funding package today

- House Budget Committee advances fiscal year 2025 budget resolution

POLICY

- Bipartisan report on agricultural labor issues and H-2A program reform

CHINA

- Export sales activity to China

- China is preparing a record-breaking chip fund of over $27 billion

- Concerns growing over potential Chinese espionage through port container cranes

- GOP pushes bill to force TikTok sale amid China surveillance fears

- China’s EV sales growth slows but market share rising

ENERGY & CLIMATE CHANGE

- Vilsack on concerns about potential impact of renewable energy projects on farmland

- South Dakota lawmakers pass bills protecting landowners in carbon pipeline project

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- FAO food price index drops for seventh consecutive month

- Grocery giants race for speedy home delivery.

POLITICS & ELECTIONS

- Valadao leads in House primary

OTHER ITEMS OF NOTE

- Cotton AWP eases

Pro Farmer members: Please fill out our acreage survey. You should have received our annual spring acreage survey via e-mail. Please fill out the survey with your current planting intentions for this year. We’ll cover results and our acreage forecasts ahead of USDA’s March 28 Prospective Plantings Report. Click here to fill out the survey if you haven’t already responded. Please complete the survey only once.

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed in overnight trading. U.S. Dow opened around 20 points lower and is currently up around 70 points. In Asia, Japan +0.2%. Hong Kong +0.8%. China +0.6%. India closed. In Europe, at midday, London -0.4%. Paris +0.1%. Frankfurt -0.1%.

U.S. equities yesterday: All three major indices registered gains Thursday, with the Dow well off its highs for the session. The Dow rose 130.30 points, 0.34%, at 38,791.35. The Nasdaq gained 241.83 points, 1.51%, at 16,273.38. The S&P 500 was up 52.60 points, 1.03%, at 5,157.36.

— The FBI has issued grand jury subpoenas to both current and former employees of ADM (Archer Daniels Midland) in relation to an ongoing investigation into the company's accounting practices. Sources cited by Reuters indicate that these subpoenas suggest the existence of a criminal probe regarding ADM's accounting issues. The subpoenas specifically request information, communications, and devices containing those communications concerning certain aspects of ADM's accounting, such as details on goods and cash transfers between different segments of the company. This development suggests a deepening investigation into potential irregularities within ADM's financial operations.

— Ag markets today: Grain trade was light overnight ahead of USDA’s March crop reports later this morning. As of 7:30 a.m. ET, corn futures were trading 1 to 3 cents lower, soybeans were fractionally to a penny lower in most contracts, winter wheat markets were steady to 3 cents higher and spring wheat was steady to fractionally lower. Front-month crude oil futures were around 50 cents lower, and the U.S. dollar index was trading just below unchanged.

Cash cattle trade higher. Light cash cattle trade started around $185.00 in the northern market on Thursday, which was up from week-ago and a high for this year. Activity remained quiet in the Southern Plains, though cash sources also expect trade at higher prices there today.

Cash hog index continues methodical climb. The CME lean hog index is up another 17 cents to $81.48 as of March 6. The index is up $16.43 since marking a seasonal low at the beginning of this year and $2.39 above last year at this time. April lean hog futures finished Thursday at a $3.045 premium to today’s cash quote.

— Agriculture markets yesterday:

- Corn: May corn rose 9 1/4 cents to $4.38, marking the highest close since Feb. 13 and the largest daily gain since Nov. 13.

- Soy complex: May soybeans surged 18 cents to $11.66 1/4 and settled near session highs. May meal rallied $4.00 to $334.40, closing near session highs. May bean oil jumped 103 points to 46.35 cents, also settling near session highs.

- Wheat: May SRW wheat fell 2 1/2 cents to $5.28 1/2 and near the session low. Prices hit another contract low today. May HRW wheat closed up 18 1/2 cents at $5.74 3/4 and nearer the session high. May spring wheat futures settled 9 1/2 cents higher to $6.54 3/4.

- Cotton: May cotton futures surged the daily limit, settling 400 points higher to 99.28 cents.

- Cattle: April live cattle rose $1.475 to $188.725 and near the session high. May feeder cattle gained 67 1/2 cents to $258.45 and near the session high.

- Hogs: Nearby April hog futures slipped 47.5 cents to $84.525 Thursday, while the deferred contracts posted modest gains.

— Quotes of note:

- Federal Reserve Chair Jerome Powell hinted at the possibility of lowering interest rates, suggesting that the central bank is nearing the confidence threshold necessary for such a move. Powell emphasized that rate reductions are likely to commence this year and that policymakers are mindful of the risks associated with delaying these cuts. His remarks contributed to a drop in benchmark 10-year Treasury yields to a one-month low. Additionally, Powell assured lawmakers that the U.S. banking system is not significantly threatened by the accumulation of bad commercial real estate loans. While acknowledging ongoing discussions with lenders to address potential losses, particularly in light of recent issues at New York Community Bancorp, Powell dismissed concerns about systemic risk.

- Chinese espionage via cranes. “We have found, I would say, openings, vulnerabilities, that are there by design.” — Rear Adm. John Vann, who leads the Coast Guard cyber command, on China-manufactured container cranes at U.S. ports.

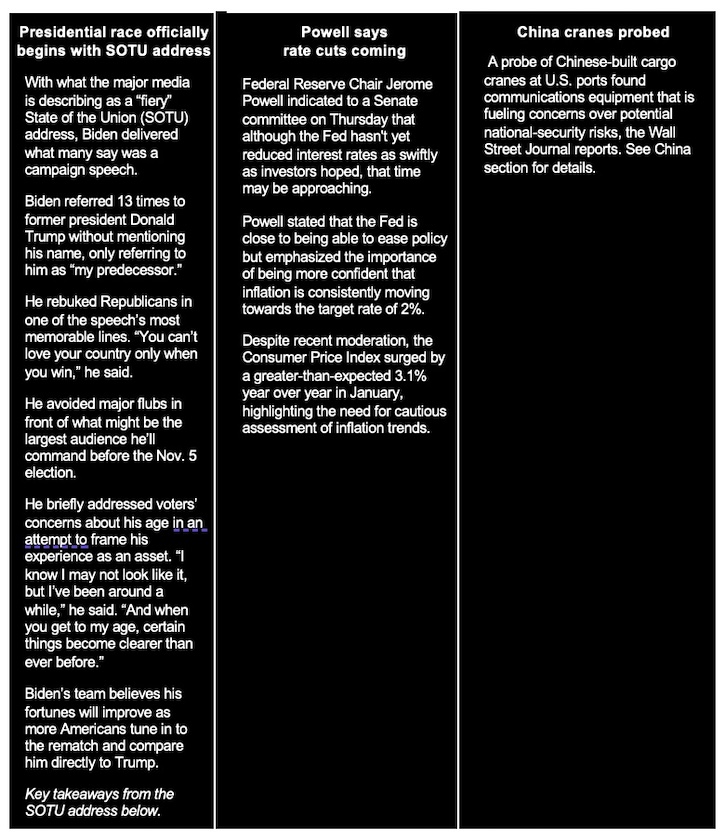

— The U.S. economy added 275,000 jobs in February 2024, beating forecasts of 200,000 and higher than a downwardly revised 229,000 in January. Job gains occurred in health care (67K), mostly health care services (28K) and hospitals (28K); government (52K), namely local government, excluding education (26K); food services and drinking places (42K), after changing little over the previous three months; social assistance (24K); and transportation and warehousing (20K), as couriers and messengers added 17K jobs, after losing 70K jobs over the prior 3 months. Employment also increased in construction (23K) but changed little in other major industries, including manufacturing (-4K). The January reading was revised sharply lower from an initial 353K which was the highest in a year. The December reading was also revised lower by 43K to 290K. With the January and December revisions, employment combined is 167K lower than previously reported.

— In February 2024, the U.S. economy added 275,000 jobs, surpassing expectations of 200,000 jobs and higher than the downwardly revised figure of 229,000 in January. Job growth was observed in several sectors:

- Health care added 67,000 jobs, with significant gains in health care services and hospitals.

- Government employment increased by 52,000, particularly in local government excluding education.

- Food services and drinking places saw an increase of 42,000 jobs, rebounding after little change over the previous three months.

- Social assistance added 24,000 jobs, while transportation and warehousing saw an increase of 20,000 jobs, driven partly by gains in courier and messenger roles, which had previously experienced losses.

- Construction added 23,000 jobs, but other major industries, including manufacturing, saw minimal change or a slight decrease (-4,000 jobs).

The January figures were revised sharply downward to of 229,000 from an initial report of 353,000 jobs, which had been the highest in a year. Similarly, the December figures were revised downward by 43,000 to 290,000. With these revisions, employment for January and December combined is now reported to be 167,000 lower than previously stated.

The unemployment rate came in at 3.9%, higher than forecasts of 3.7%, where it was in January. That’s the highest unemployment rate since January 2022. Though it’s up from its 54-year low of 3.4% set early last year, the national unemployment rate has stayed comfortably below 4%, a fairly surprising feat considering inflation’s downward trend.

Average hourly wages rose by 0.1% from January to February on a seasonally adjusted basis, well below January’s 0.6% month-over-month growth and estimates of 0.3%, with annual wage growth coming in at 4.3%. Wage growth is well above inflation, which most recently came in at 2.8% as measured by the Federal Reserve’s favored core personal consumption expenditures metric, as the swelling of Americans’ pay stubs outpaces how much they need to spend on goods and services.

Of note: The next major economic report is Tuesday’s Consumer Price Index report, which economists project to reveal a modest uptick in core inflation.

Says ING Economics: “U.S. nonfarm payrolls rose 275k in February, but big downward revisions, weak wages and rising unemployment suggest things are not quite as robust as the headline indicates. Moreover, lead indicators are clearly weakening, and a slowdown looks to be on the way. It's not enough for the Fed to relax just yet, but we think things will be in place for a June rate cut.”

Useful link:

— U.S. agricultural exports dip in January, trade deficit surges. In January, U.S. agricultural exports fell by 3.9% to $14.90 billion, while imports rose 4.4% to $17.44 billion, leading to a monthly trade deficit of $2.54 billion — a significant increase from December's $323 million gap.

For fiscal year (FY) 2024, agricultural exports total $63.14 billion against $66 billion in imports, resulting in a $2.85 billion deficit. To meet the USDA's forecast, exports must average $13.42 billion and imports $16.88 billion over the next eight months.

Comparing January 2024 to January 2023, agricultural exports dropped by 12.5%, while imports rose by 1.9%. From February to September 2023, exports averaged $13.70 billion, and imports averaged $16.16 billion.

USDA attributes these trends to the strengthening U.S. economy and a robust U.S. dollar, factors expected to shape agricultural trade for FY 2024.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker with the euro and British pound both firmer against the greenback. The yield on the 10-year U.S. Treasury note was lower, trading around 4.06%, with a mostly lower tone in global government bond yields. Crude oil futures were lower, with U.S. crude around $78.45 per barrel and Brent around $82.50 per barrel. Gold and silver futures were higher ahead of US market action, with gold around $2,173 per troy ounce and silver around $24.68 per troy ounce.

— Cancellation of sales of 110,000 MT SRW wheat to China during 2023-2024 marketing year. Trade sources say there will likely be additional cancellations. China still has more than 1 MMT on the books that haven’t been shipped.

— March S&D Report likely to feature modest adjustments. USDA is expected to make minor adjustments to its U.S. usage forecasts in the Supply & Demand Report at noon ET, which would lead to slight changes to 2023-24 domestic ending stocks. Analysts expect USDA to project U.S. ending stocks at 2.159 billion bu. for corn (down 13 million bu. from February), 319 million bu. for soybeans (up 4 million bu.), 657 million bu. for wheat (down 1 million bu.) and 2.72 million bales for cotton (down 80,000 bales). A greater focus will be USDA’s changes to South American crop forecasts, especially for Brazil, which will impact global ending stocks.

— USDA announces rise in FY 2024 raw cane sugar TRQ. USDA announced an increase of 125,000 metric tons raw value (MTRV) in the fiscal year (FY) 2024 cane sugar tariff rate quota (TRQ) after determining that “additional supplies of raw cane sugar are required in the U.S. market.” USDA also said it would continue to monitor the situation ahead and will make “further program adjustments during FY 2024 if needed.” The increase is based on a conversion factor of 1 metric ton raw value equaling 1.10231125 short tons raw value. With this increase, the overall FY 2024 raw sugar TRQ is now 1,242,195 MTRV. The Office of the U.S. Trade Representative (USTR) will allocate this increase among supplying countries and customs areas.

— “The U.S. does not face a looming sugar supply crisis despite drought and mismanagement in Mexico,” says Rob Johansson, Director of Economics and Policy Analysis at the American Sugar Alliance. In reaction to a recent sugar outlook item in this space, Johansson writes: “The U.S. is projected to produce a near record amount of sugar from domestically grown sugarbeets and sugarcane. Due to the short crop in Mexico, it is likely that high-tier imports will grow to record levels in 2023-24. In fact, U.S. sugar importers say they will likely resort to more high-tariff imports to compensate for Mexico’s lower production. USDA currently estimates high-tier entries at 715,000 STRV for 2023-24. Those imports have been rising over the past few years and totaled 454,706 STRV last year. Given that, the U.S. market is supplied with sugar from more than 60 countries, and the raw price in the U.S. has been tethered to the world raw price (separated by transportation costs and the high-tier tariff) for several years now. As world prices go up or down, so will U.S. prices.”

Johansson adds: “Recent projections by USDA at the Agricultural Outlook Forum in February indicate a rebound in Mexican sugar production for the upcoming year (2024-25), although not enough to offset high-tier imports, which are expected to be in the range of 400,000 STRV. That will be contingent on how USDA decides to utilize their authorities to reallocate the TRQ shortfall, to increase the TRQ (see related item above), or to allow additional access to Mexico. It is possible that U.S. sugar users may be forced to rely on additional high-tariff alternatives. It is unlikely that the level of high-tier imports would have much impact on U.S. prices, which are more determined by world raw and refined prices and transportation costs in the current economic environment.”

“It is unavoidable that the shortage in Mexican sugar production will impact U.S. imports,” Johansson reasons, “since in most years Mexico is the major supplier to the U.S. market. Given USDA anticipates a partial rebound in Mexican production in the upcoming year, it is likely that the level of high-tier imports will decline in 2024-25. Additionally, adverse weather conditions globally, such as caused by El Niño, may further strain world sugar producers, contributing to higher global prices, which would push U.S. prices up. Of course, with a record 2023-24 sugar export year in Brazil (the world’s largest exporter) and the potential for additional production in 2024-25, any projections of next year’s supply and prices remain preliminary.”

— Farmers in Brazil are filing for bankruptcy protection at a “concerning” pace as high interest rates and falling prices squeeze profits, according to credit data provider Serasa Experian.

— India’s rice prices score another new high. India’s rice export prices surged to a record high this week as traders sought clarity over how the export levy is calculated. India’s 5% broken parboiled variety was quoted at a record $552 to $560 per metric ton, up from $546 to $554 last week. Thailand’s 5% broken rice prices rose to $620 to $622 per metric ton, from $615 last week. Vietnam’s 5% broken rice was offered at around $580, down from $600 a week ago.

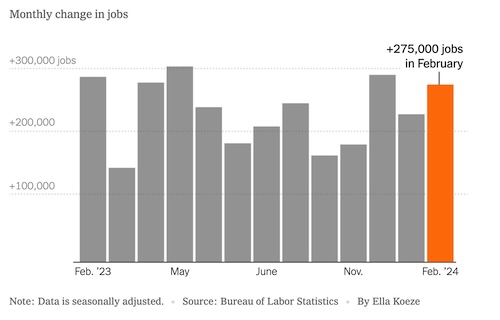

— NWS weather outlook: Snow gradually tapering off over the central High Plains as well as central/southern Rockies... ...Threat of flash flooding and severe weather expected to sweep across the Deep South to the Southeast through the next couple of days... ...An intensifying low-pressure system will bring locally heavy rain and strong winds from the Ohio Valley to New England late Saturday into Sunday... ...Wet snow expected across the Great Lakes to northern New England late Saturday to Sunday as next round of rain and mountain snow reaches the Pacific Northwest.

Items in Pro Farmer's First Thing Today include:

• Quiet overnight grain trade

• French wheat crop ratings unchanged

• Eurozone economic growth inches up from year-ago

|

STATE OF THE UNION (SOTU) ADDRESS |

— President Joe Biden delivered a defiant argument for a second term in his State of the Union speech Thursday night. Biden fired multiple broadsides at Trump without ever mentioning him by name. Key takeaways:

- Biden led his address with Ukraine, Jan. 6, abortion and the state of the U.S. economy.

- Ukraine. Biden accused “my predecessor” of “bowing down” to Russian President Vladimir Putin, saying it is “outrageous, it is dangerous and it is unacceptable.” Biden called for funding Ukraine in its war against Russia. Biden warned that Russia’s aggression would “not stop at Ukraine.”

- Jan. 6. Biden referenced the Jan. 6, 2021, U.S. Capitol riot and said Republicans are undermining U.S. democracy with false claims about widespread fraud in the 2020 presidential election. “My predecessor and some of you here seek to bury the truth of Jan. 6,” he said. “You can’t love your country only when you win,” he added.

- The U.S. will build a pier on the Gaza coast to receive humanitarian aid, including food. "Tonight, I'm directing the U.S. military to lead an emergency mission to establish a temporary pier in the Mediterranean on the Gaza coast that can receive large ships carrying food, water, medicine and temporary shelters," Biden said. "No U.S. boots will be on the ground. This temporary pier would enable a massive increase in the amount of humanitarian assistance getting into Gaza every day." Biden added, “But Israel must also do its part. Israel must allow more aid into Gaza and ensure that humanitarian workers aren’t caught in the crossfire. …Humanitarian assistance cannot be a secondary consideration or a bargaining chip.” The Biden administration has said Israel Prime Minister Benjamin Netanyahu isn’t doing enough to allow the flow of humanitarian assistance into Gaza.

Biden stressed the need for a temporary cease-fire and called for hostages to be released. - Abortion. Biden directly confronted the Supreme Court over its decision. While not explicitly using the term "abortion," Biden emphasized the significance of women's electoral and political power, delivering a rebuke to the Court. Despite his past reluctance on the issue, Biden has embraced abortion rights, aligning with the Democratic base driven to the polls by the 2022 Supreme Court ruling. Although he didn't name Trump, Biden criticized the former president for appointing justices who played a role in overturning Roe v. Wade. He also condemned Republican efforts to restrict access to abortion and highlighted the impact of a state Supreme Court ruling in Alabama on in vitro fertilization services. Biden underscored his stance with the presence of guests in the first lady's box affected by reproductive rights issues.

- Shrinkflation. Called on Congress to pass a bill sponsored by Sen. Bob Casey (D-Pa.) to stop “shrinkflation” in food packages. “Too many corporations raise their prices to pad their profits charging you more and more for less and less. That’s why we’re cracking down on corporations that engage in price gouging or deceptive pricing from food to health care to housing,” Biden said. “In fact, snack companies think you won’t notice when they charge you just as much for the same size bag but with fewer chips in it,” he added.

- High-speed affordable internet. Biden said his policies are “providing affordable high-speed internet for every American no matter where you live. Urban, suburban, and rural communities — in red states and blue states. Record investments in tribal communities.”

- Farm sector. Biden said: “Because of my investments, family farms are better able to stay in the family and children and grandchildren won’t have to leave home to make a living. It’s transformative.” He added, “Because of my investments in the family farm led by my secretary of Agriculture who knows more about this than anybody I know, we’re better able to stay on those farms so their children and grandchildren won’t have to leave home, leave home to make a living. It’s transformative.”

- Border. Biden said he “will not demonize immigrants saying they ‘poison the blood of our country’ as he said in his own words,” referencing his “predecessor” without naming Donald Trump. Biden continued, “Unlike my predecessor, on my first day in office I introduced a comprehensive plan to fix our immigration system, secure the border, and provide a pathway to citizenship for Dreamers and so much more… We can fight about the border, or we can fix it. I’m ready to fix it. Send me the border bill now!” Biden rebuked Republicans for opposing a bipartisan border agreement in the Senate. Trump has opposed the measure, calling it a “gift” to Democrats in an election year. Biden called on Republicans to work with him. “We can fight about fixing the border, or we can fix it,” he said. Biden has been weighing executive action on immigration, but has yet to make such a move.

- Climate. Biden said, “We are also making history by confronting the climate crisis, not denying it… I’m taking the most significant action on climate ever in the history of the world. I am cutting our carbon emissions in half by 2030,” he said.

- Infrastructure. Biden knocked Republicans for touting the flood of cash that has been funneled into their districts from bills that they opposed, such as the infrastructure law. “If any of you don’t want that money in your district, just let me know,” Biden said.

- Taxes. Biden said he wants to raise the minimum tax for multinational corporations to 21%, as well as lift the corporate tax rate to 28% from the current 21%. The president also hopes to:

— Stop letting corporations get tax deductions for all employee salaries over $1 million (the current rule applies only to C-suite pay) and make it harder for companies to write off executives' private jet travel.

— Raise the tax on corporate stock buybacks from 1% to 4% to encourage companies to spend more of their revenue on salaries and improving productivity.

— Make billionaires pay a minimum of 25% income tax.

- Homeownership. Biden unveiled a scheme to boost homeownership by offering a $5,000 credit to first-time homebuyers for the first two years of their mortgage. "I want to provide an annual tax credit that will give Americans $400 a month for the next two years as mortgage rates come down to put toward their mortgage when they buy a first home or trade up for a little more space,” Biden said. “My administration is also eliminating title insurance fees for federally backed mortgages. For millions of renters, we're cracking down on big landlords who break antitrust laws by price-fixing and driving up rents. I've cut red tape so more builders can get federal financing, which is already helping build a record 1.7 million housing units nationwide. Now pass my plan to build and renovate 2 million affordable homes and bring those rents down."

- Manufacturing. "Where is it written that we can't be the manufacturing capital of the world? We are. We will. Instead of importing foreign products and exporting American jobs, we're exporting American products and creating American jobs - right here in America where they belong. And thanks to our CHIPS and Science Act, the United States is investing more in research and development than ever before. It takes time, but the American people are beginning to feel it.”

- China. Biden said, “Our trade deficit with China is down to the lowest point in over a decade. We’re standing up against China’s unfair economic practices. We want competition with China, but not conflict.”

Bottom line: Biden’s SOTU address was clearly his effort to begin the national presidential re-election campaign. He directly referenced his age at times. “I’ve been told I’m too old,” he said as he concluded his speech. “Whether young or old, I’ve always known what endures… The issue facing our nation isn’t how old we are,” he said. “It’s how old are our ideas.”

Reaction: As with most things related to our nation’s capital, responses primarily fell across political lines. Biden proponents and much of the media characterized the speech as “feisty.” The speech amounted to a general election preview, referring to former President Donald Trump 13 times only as “my predecessor.” Biden opponents thought his address was “angry” with no real message of bipartisanship. Trump responded to the speech in real time on his Truth Social site, defending himself and blasting Biden for what he said “may be the Angriest, Least Compassionate, and Worst State of the Union Speech ever made.”

|

CONGRESS |

— Senators are working to pass a $460 billion government-funding package today to avert a partial shutdown before the weekend. The package, consisting of six bills, received overwhelming support in the House. The Senate plans to conduct a procedural vote at noon ET today to advance the funding bill. Meanwhile, work is ongoing on the remaining six bills, which include larger and more challenging appropriations measures such as Defense, Labor-HHS-Education, and Homeland Security. The Senate aims to address these bills before the March 22 midnight deadline.

— House Budget Committee advances fiscal 2025 budget resolution in a 19-15 party-line vote. Chair Jodey Arrington (R-Texas) earned plaudits for getting his work done early but was criticized for relying on unrealistic estimates to project deficit reductions. The document assumes 3% annual economic growth and a 50% reduction in improper federal payments, according to a summary that accompanied the budget resolution. Arrington touted a plan to balance the budget within a decade, though a document accompanying the resolution shows it projects to balance on-budget spending and revenue, which excludes nearly all Social Security spending — more than $2 trillion per year later in the decade.

Of note: The measure includes a statement in favor of work requirements for those relying on the Supplemental Nutrition Assistance Program, saying, “While it is critical families have access to food, it is equally critical work capable households are encouraged to make more responsible choices.” Democrats offered an amendment to remove that statement, but Republicans kept it in. “What we don’t want is for the safety net to become a hammock and a lifestyle,” Arrington said.\

|

POLICY UPDATE |

— Bipartisan report on agricultural labor issues and H-2A program reform. The Bipartisan House Agriculture Labor Working Group recently published a report (link) focused on identifying workforce issues within the nation’s agricultural sector and proposing policy recommendations to address shortcomings in the H-2A visa program. Chaired by Reps. Rick Crawford (R-Ark.) and Don Davis (D-N.C.), the working group's report comprises 21 recommendations, with 15 receiving majority support and six lacking it. Additionally, five recommendations were considered but ultimately omitted.

Of note: Although the House Agriculture Committee lacks direct authority over the H-2A program, which falls under the Labor Department's jurisdiction, the chances of enacting legislation to implement the proposed changes appear slim. Immigration is under the purview of the House and Senate Judiciary committees. “It is our hope that our work on this report will be used by the committees of jurisdiction to develop legislation that will positively impact the agricultural labor community,” said the working group.

Commenting on the report, American Farm Bureau Federation President Zippy Duvall noted that while the recommendations do not fully tackle all labor challenges faced by farmers, they offer vital solutions. These include streamlining H-2A employee recruitment and hiring processes, expanding the program to accommodate year-round needs, implementing a pay structure based on daily duties, and reforming wage calculation standards to ensure stability in farmworker pay rates. Duvall emphasized the urgent need to address the broken workforce system, citing its contribution to the rapid decline of farms in America. He underscored bipartisan consensus on the imperative to enhance the H-2A program for the benefit of the agriculture sector.

The Labor Department certified 378,513 H-2A positions in agriculture in fiscal year 2023, up by more than 100,000 positions from fiscal 2020. While half of the positions were in five states — Florida, California, Georgia, Washington, and North Carolina — there were H-2A positions in every state, said the Farm Bureau.

|

CHINA UPDATE |

— Export sales activity to China include soybean, sorghum sales, net reductions for cotton in weekly data. Weekly Export Sales figures for China for the week ended Feb. 29 for 2023-24 included net sales of 4,194 metric tons of wheat, 2,000 metric tons of corn, 134,459 metric tons of sorghum, 269,125 metric tons of soybeans, and net reductions of 30,281 running bales of upland cotton which reflected cancellations of 40,300 running bales. Net sales of 1,457 metric tons of beef and 12,564 metric tons of pork were also reported for 2024.

— China is preparing a record-breaking chip fund of over $27 billion to advance its technological capabilities. Dubbed the Big Fund and supported by the state, this initiative aims to accelerate the development of cutting-edge technologies. This move coincides with the United States' plans to intensify technology restrictions, particularly targeting Chinese advancements in chip manufacturing and artificial intelligence.

Recent reports reveal that despite efforts to become self-reliant, Chinese companies like Huawei and SMIC still rely on U.S. technology for producing advanced chips. For instance, they utilized U.S. technology to manufacture a sophisticated 7-nanometer chip in China last year. This suggests that China continues to face challenges in fully replacing certain foreign components, especially those crucial for high-tech products such as semiconductors.

— Concerns are growing over potential Chinese espionage through port container cranes, as a congressional probe has identified communications equipment on some of these cranes, fueling fears of national security risks, the Wall Street Journal reports (link). The investigation revealed the presence of over a dozen cellular modems on crane components at one U.S. port, with another modem found in a server room at another port.

While it is common for modems to be installed on cranes for remote monitoring and maintenance tracking, some ports using cranes manufactured by China's ZPMC had not requested this capability. Lawmakers noted that ZPMC had repeatedly sought remote access to U.S.-based cranes and other maritime infrastructure.

Of note: This discovery is likely to bolster White House efforts to replace the Chinese-made cranes with equipment and technology sourced from the United States, as outlined in a recent maritime security directive.

— GOP pushes bill to force TikTok sale amid China surveillance fears. A top Republican lawmaker plans to push for a House vote next week on a bill that would compel TikTok's Chinese parent company to sell the app or face a ban in the U.S. The legislation, which received committee approval by a vote of 50-0, aims to sever ties between TikTok and the Chinese Communist Party.

Rep. Steve Scalise (R-La.) announced his intention to bring the bill to the House floor, emphasizing the need to address security concerns regarding China's potential surveillance of Americans through the app. While the bill lacks a sponsor in the Senate, lawmakers highlight months of preparation for this latest effort.

TikTok attempted to rally its users against the bill, but the campaign failed to prevent lawmakers from advancing the legislation. Both Democrats and Republicans have raised national security concerns over TikTok's ties to ByteDance, fearing data collection and propaganda dissemination by the Chinese government.

The Biden administration cautiously supports the proposal, emphasizing the importance of safeguarding personal data. TikTok has denied sharing U.S. user data with Beijing and criticized the bill, arguing that it infringes on free speech rights and harms small businesses.

Divesting TikTok from its Chinese parent presents challenges, but ByteDance may attempt to separate its U.S. business while retaining operations elsewhere. However, Beijing's opposition to an outright sale could complicate negotiations, given its sensitivity to data security concerns involving major internet firms.

— China’s EV sales growth slows but market share rising. China’s electric vehicle (EV) sales growth slowed in the first two months of this year. Sales of battery-powered EVs rose 18.2% in January-February versus 20.8% for all of 2023, based on data from the China Passenger Car Association. Together with plug-in hybrids, new energy vehicle (NEV) sales jumped 37.5% in the two-month period, versus 36.2% for 2023. The result outpaced the overall passenger vehicle market’s 16.3% growth as widespread discounts fueled demand. NEVs accounted for 33.5% of total car sales in January-February versus 28.3% in the same period a year earlier, grabbing market share from gas-powered cars for which sales rose 7.8%.

|

ENERGY & CLIMATE CHANGE |

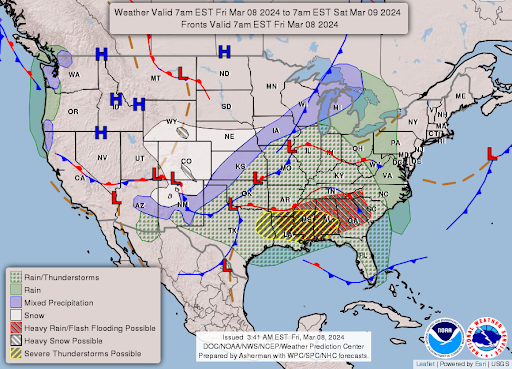

— U.S. farmers are increasingly turning to solar power as a means of stabilizing their incomes amid fluctuating crop prices and growing expenses. With cash receipts for staple crops like corn, soybeans and other commodities expected to plummet by double-digit percentages this year, many farmers are seeking alternative revenue streams.

This shift towards solar energy is a significant component of the renewable energy movement in the U.S., with a substantial portion of future solar development projected to occur on agricultural land. President Joe Biden's Inflation Reduction Act (IRA/Climate Bill), which offers tax incentives for solar developers, is expected to further accelerate this trend, with the country's top agricultural states set to receive substantial clean power investments by 2030.

The adoption of solar energy by farmers comes in various forms, including leasing land to developers or installing their own solar panels. This trend is evident in the significant increase in the number of farms with solar installations over the past five years.

However, some farmers express concerns about the potential impact of widespread solar development on agricultural land. They fear that valuable farmland will be lost, exacerbating existing challenges faced by the farming community. Despite these concerns, many farmers view solar energy as a valuable asset that complements traditional farming practices, providing a stable source of income and acting as a form of insurance against market volatility.

— USDA Secretary Tom Vilsack this week addressed concerns about the potential impact of renewable energy projects on farmland. Vilsack acknowledged these concerns while advocating for the use of non-prime farmland for renewable energy initiatives. He emphasized the importance of considering the impact on farming when discussing renewable energy projects and introduced the RAISE initiative to support farmers in installing small-scale wind projects.

Vilsack noted the increasing need for solar collectors to meet clean energy goals by 2050, with tax credits provided for renewable energy projects under the 2022 climate, healthcare, and tax law. USDA's allocation of $2.2 billion aims to improve electrical service for rural areas, focusing on new infrastructure, smart grid technology, and renewable energy systems.

Specific projects receiving funding include Sumter Electric Cooperative in Florida and Charles Mix Electric Association in South Dakota. Vilsack also announced the first awards through the Powering Affordable Clean Energy (PACE) program, which supports solar power generation and battery storage projects in various states. PACE was established with funding from the 2022 climate law.

— South Dakota lawmakers pass bills protecting landowners in carbon pipeline project. In South Dakota, after years of debate surrounding a proposed carbon dioxide pipeline, lawmakers at the state Capitol passed three bills aimed at bolstering protections for landowners while maintaining a regulatory path for the project. The bills were approved by both the state House of Representatives and Senate, and are now awaiting the governor's final approval, according to the Bismarck Tribune (link).

Governor Kristi Noem expressed her intention to sign the bills, emphasizing the importance of providing new protections for landowners while facilitating economic growth through a transparent process.

One of the legislators, Rep. Jon Hansen, voiced concerns about the level of protection for landowners, citing the lack of safeguards seen in other states like Minnesota. He criticized the bills' proponents, accusing them of paving the way for the project without adequate consideration for landowners.

However, House Majority Leader Will Mortenson defended the legislation, stating that opponents were offering a "do-nothing solution" and highlighting the importance of implementing policies that support farmers.

The proposed pipeline, by Summit Carbon Solutions, aims to collect carbon dioxide from ethanol plants across several states and transport it to North Dakota for underground storage. The project is intended to take advantage of federal tax credits incentivizing carbon dioxide removal.

The bills address various issues related to the project, including surveying, easement agreements, compensation for landowners, and liability for damages caused by the pipeline. They also outline new landowner benefits and protections, including restrictions on easement durations and requirements for pipeline burial depth.

While some lawmakers and outside groups have raised concerns about the project's environmental impact and potential tax burdens, others have praised the legislation for providing regulatory certainty and protections for landowners and businesses.

Bottom line: Overall, the passage of these bills represents a compromise aimed at balancing economic interests with environmental and landowner concerns in the context of the proposed carbon dioxide pipeline project in South Dakota.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— FAO food price index drops for seventh consecutive month. In February 2024, the FAO Food Price Index (FPI) reached its lowest level in three years at 117.3 index points, down from an upwardly revised 118.2 in January. Cereal prices saw a significant decline of 5%, driven by decreases in corn and wheat prices. Vegetable oil prices also fell by 1.3%, mainly due to lower prices for soy, sunflower, and rapeseed oils, despite slightly higher palm oil prices.

Conversely, dairy prices rose by 1.1% to a nine-month high, with butter prices experiencing the most significant increase. This uptick was supported by increased import demand from Asian buyers and a seasonal decrease in milk production in Oceania. Meat prices also saw an increase of 1.8%, marking a reversal from seven consecutive months of decline. Poultry meat and bovine prices saw the most significant increases in international price quotations.

Additionally, sugar prices rose by 3.2% for the second consecutive month due to ongoing concerns about the upcoming season in Brazil and forecasts predicting production declines in Thailand and India.

Bottom line: The FPI was at 124.7 in 2023 after reaching 144.7 in 2022 and 125.8 in 2021. If the trend in the index continues, it suggests the FPI will be headed to its lowest value in 2024 since it was at 98.1 in 2020.

— Grocery giants race for speedy home delivery. Major grocery retailers like Walmart, Target, and Kroger are engaged in a fierce competition to offer swift home grocery delivery, leveraging both new and existing subscription services. With the grocery market becoming more competitive, these retailers are prioritizing convenience to attract customers and encourage more frequent orders. Walmart, holding the top spot as the largest U.S. grocer by market share, and Kroger, ranking second, are heavily investing in this trend. Target, positioned ninth in market share, views its newly introduced paid membership option as a strategy to boost sales in the grocery segment.

|

POLITICS & ELECTIONS |

— Valadao leads in House primary. With the vote partially counted, GOP Rep. David Valadao had 34% of the vote in U.S. House District 22 in California’s Central Valley, followed by Democrat Rudy Salas, with 28%, and Republican Chris Mathys, with 22% percent. Link.

|

OTHER ITEMS OF NOTE |

— Cotton AWP eases. The Adjusted World Price (AWP) for cotton declined to 76.88 cents per pound, effective today (March 8), falling from 77.47 cents per pound the prior week. This marked the fifth straight week the AWP has been at 70 cents per pound or more. Meanwhile, USDA said that Special Import Quota #21 will be established March 14 for the import of 29,975 bales of upland cotton, applying to supplies purchased not later than June 11 and imported into the U.S. not later than Sept. 9.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |