EPA, True to Form, Misses Self-Imposed March 1 SAF Credit Detail Announcement

EPA to unveil new ag/rural community office | WTO doldrums | ADM | JBS | Extreme weather

|

Today’s Digital Newspaper |

MARKET FOCUS

- NYCB plunges after taking a $2.4 billion hit to earnings

- ADM declines after delaying filing FY 2023 annual report

- Fed's Goolsbee: Policy 'restrictive,' more disinflation likely

- Fed’s John Williams still expects rate cuts later this year

- Eurozone inflation moderates

- Japan unexpectedly slips into recession

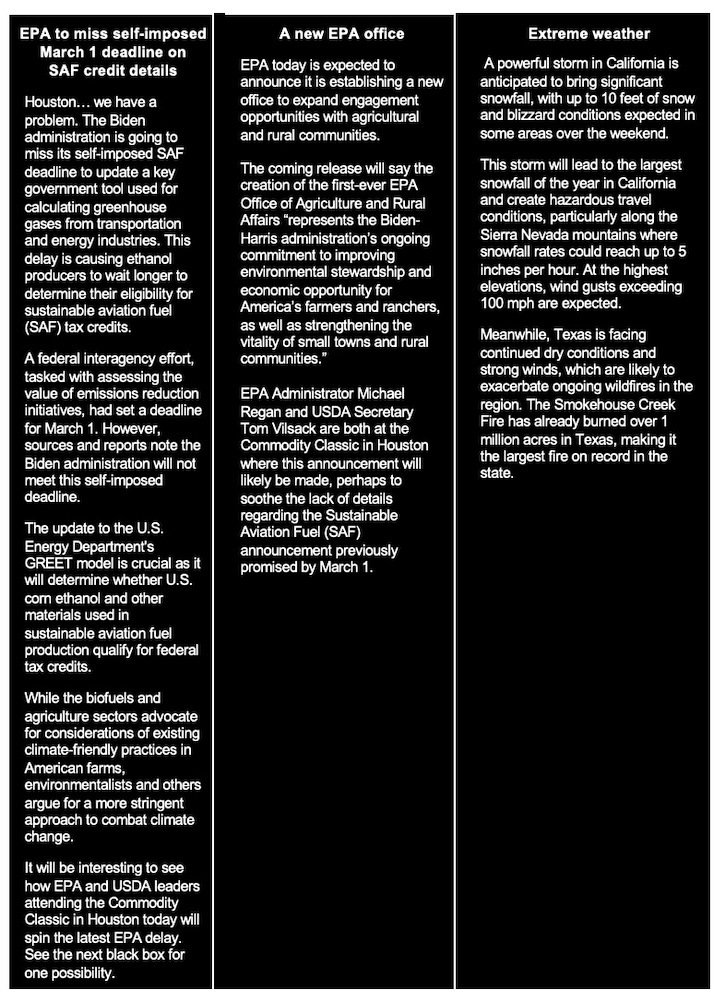

- China has highest-ever liquefied natural gas (LNG) imports for month of Feb.

- Ag markets today

- India’s rice output to drop, wheat crop expected to rise

- Exports of U.S.-grown peanuts hit record $889.5 million in 2023

- Ag trade update

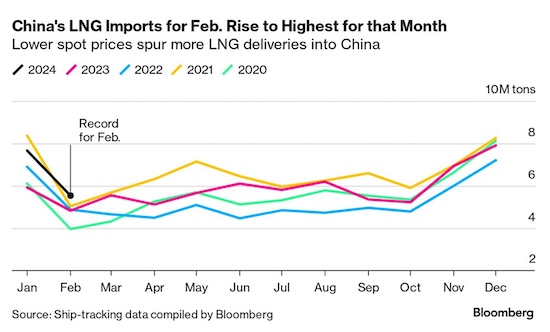

- A powerful storm in California

- Largest fire on record in Texas

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Congress clears another CR and leaves DC; six bills need final funding OK next week

- CBO: $20 billion IRS funding cut leads to $44 billion revenue loss

- Trump reportedly backs Sen. Daines for GOP Senate leader pre-McConnell exit

RUSSIA & UKRAINE

- Yellen urges U.S. aid for Ukraine despite frozen Russian assets

- Ukraine drafting crucial farm workers in desperate rush to bolster military

POLICY

- Spring crop insurance prices set

- Dairy Margin Coverage (DMC) payments for January triggered

- Sen. Chuck Grassley on a new farm bill

PERSONNEL

- Biden administration announces three nominees for FERC

- Brian Mulroney, Canada's Prime Minister from 1984 to 1993, passed away at age 84

CHINA

- China manufacturing shrinks for fifth month

- Biden orders probe into foreign-made car software, citing national security concerns

- What’s wrong with China’s economy, in eight charts

- China lowers sow retention target

- China sets 2024 rice minimum purchase levels

- China’s rural workers’ choice: stay in emptying villages, or move to job-scarce cities?

- U.S. sees China’s space threat growing at ‘breathtaking pace’

TRADE POLICY

- 13th Ministerial Conference (MC13) of WTO fails to reach any final agreements

ENERGY & CLIMATE CHANGE

- EPA to delay gas plant emission limits until after 2024 election

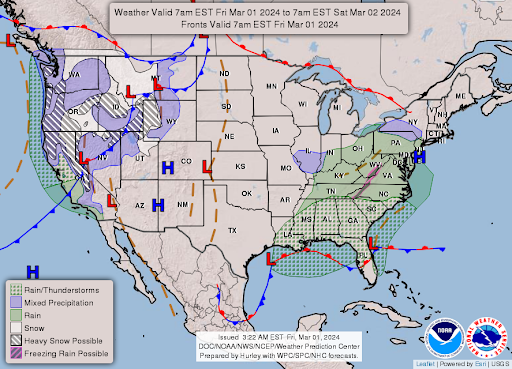

- California weighs climate benefits vs. food supply concerns in diesel production

- Fisker, electric vehicle (EV) startup, issues warning about its potential survival

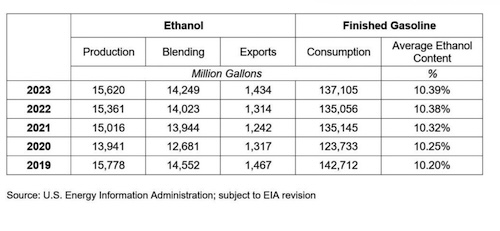

- Highest ethanol blend rate

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- New York Attorney General Letitia James files lawsuit against JBS

HEALTH UPDATE

- CDC reports around 98% of U.S. population has some form of immunity to Covid-19

POLITICS & ELECTIONS

- Montana Senate race: Tester faces tough competition

- Rep. Green reverses retirement decision after Trump's endorsement

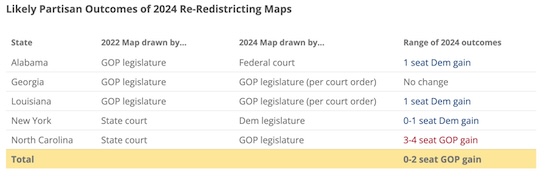

- David Wasserman on impact of redistricting on House races

OTHER ITEMS OF NOTE

- Cotton AWP at highest mark since late 2022

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mostly higher in overnight trading. U.S. Dow opened lower by around 25 points and is now around 120 points lower. In Asia, Japan +1.9%. Hong Kong +0.5%. China +0.4%. India +1.7%. In Europe, at midday, London +0.7%. Paris flat. Frankfurt +0.6%.

U.S. equities yesterday: All three major indices notched higher closes for the day and finished the month with gains as the Nasdaq registered its first record finish since 2021. On Thursday, the Dow rose 47.37 points, 0.12%, at 38,996.39. The Nasdaq gained 144.18 points, 0.90%, at 16,091.92. The S&P 500 was up 26.51 points, 0.52%, at 5,096.27.

For February, the Dow was up 2.2%, the Nasdaq was up more than 6% and the S&P 500 gained 5.2%. February was the fourth positive month in a row for each of the major averages.

— New York Community Bancorp (NYCB) dropped premarket after taking a $2.4 billion hit to earnings as it identified “material weaknesses” with its loan review process. Alessandro DiNello, who was appointed executive chairman in early February following a credit rating downgrade, is now stepping in as president and CEO, effective immediately. NYCB shares fell more than 20% in extended trading. The stock has been under pressure amid concerns around the bank’s commercial real estate exposure and operations.

— Archer Daniels Midland declined pre-market Friday after saying it will delay filing its FY 2023 annual report on Form 10-K and expects to report a material weakness in its internal control over financial reporting related to its accounting practices and procedures for intersegment sales. ADM is investigating certain accounting practices and procedures related to its Nutrition reporting segment, causing it to need additional time to prepare its financial statements. ADM sees no impact to its balance sheets, earnings and cash flows. The company intends to submit its 10-K filing by March 15, the end of the 15-day extension period.

— Ag markets today: Soybean futures posted corrective gains overnight, while the corn and wheat markets favored the downside in light trade. As of 7:30 a.m. ET, corn futures were trading mostly a penny lower, soybeans were 4 to 5 cents higher, winter wheat markets were 4 to 5 cents lower and spring wheat was steady to fractionally lower. Front-month crude oil futures were more than $1.00 higher, and the U.S. dollar index was down around 100 points.

Cash cattle start trading at steady prices. Light cash cattle trade occurred Thursday in the Southern Plains and the northern market at generally steady prices with week-ago. However, many feedlots continued to pass on those bids, despite pressure on live cattle futures Thursday, in hopes of securing higher prices.

Cash hog index inches higher, pork cutout slips. The CME lean hog index firmed another 24 cents to $80.15 as of Feb. 28. Aside from three days of strong gains last week, the seasonal climb in the cash index since the beginning of the year has been methodical. The pork cutout value slipped 12 cents on Thursday to $90.22. While prices have declined this week, the cutout remains above $90.00, a level that was acting as a price ceiling prior to last week.

— Agriculture markets yesterday:

- Corn: May corn rose a penny to $4.29 1/2 and closed nearer the session high.

- Soy complex: May soybeans fell 4 1/2 cents to $11.40 3/4, though traded as low at $11.28 1/2. May soybean meal rallied $1.7 to $329.2, settling nearer the session high. May bean oil closed 2 points higher at 45.21 cents.

- Wheat: May SRW wheat rose 1 1/2 cents to $5.76 1/4 and near mid-range. May HRW wheat closed up 6 1/4 cents at $5.87 1/4 and near the session high. May spring wheat futures rallied 3 cents to $6.59.

- Cotton: May cotton futures slipped 151 points before settling at 99.57 cents but ultimately settled in the upper third of today’s range.

- Cattle: April live cattle fell 77 1/2 cents to $185.35. May feeder cattle closed down $1.85 at $256.125. Both markets’ prices closed near mid-range levels.

- Hogs: Hog futures turned higher after testing support early in Thursday’s session. Nearby April rallied 62.5 cents to $86.625.

— Of note:

- Fed's Goolsbee: Policy 'restrictive,' more disinflation likely. Chicago Federal Reserve Bank President Austan Goolsbee said he believes last year's improvements in the supply of goods and labor set the stage for further declines in U.S. inflation this year, a signal he remains on board for interest-rate cuts later this year.

Meanwhile, the Federal Reserve Bank of New York President John Williams reiterated that he expects rate cuts later this year. Williams acknowledged that inflation has retreated from multi-decade highs, but he emphasized officials want to see inflation return to 2% and remain there on a sustained basis. “I expect us to cut interest rates later this year,” he said Thursday in a fireside chat at the Citizens Budget Commission’s annual gala in New York. “We’re going to move interest rates back to more normal levels.”

Mary Daly yesterday said central bank officials are ready to lower interest rates as needed but emphasized there’s no urgent need right now.

Raphael Bostic said recent inflation readings indicate “there are going to be some bumps along the way” to target,

More Fedspeak today:

— Federal Reserve Board Governor Christopher Waller and Federal Reserve Bank of Dallas President Lorie Logan will participate in the panel "2024 Report, Quantitative Tightening around the Globe: What Have We Learned?" before the 2024 U.S. Monetary Policy Forum hosted by the Chicago Booth School of Business in New York.

— Federal Reserve Bank of Atlanta President Raphael Bostic will speak on the economic outlook and real estate trends before the University of Florida's Kelley A. Bergstrom Real Estate Center 2024 Trends and Strategies Conference in Orlando, Florida.

— Federal Reserve Bank of San Francisco President Mary Daly and Federal Reserve Bank of Kansas City President Jeffrey Schmid (moderator) will participate in the panel "AI and the Labor Market" before the 2024 U.S. Monetary Policy Forum hosted by the Chicago Booth School of Business in New York.

— Federal Reserve Board Governor Adriana Kugler will speak on "Pursuing the Dual Mandate" before the 2024 Stanford Institute for Economic Policy Research Economic Summit in Stanford, California.

- 58,871: Average weekly coal carloads carried by major U.S. railroads in the first eight weeks of 2024, a 10.9% decline from the same period last year, according to the Association of American Railroads.

- “Connected vehicles from China could collect sensitive data about our citizens and our infrastructure and send this data back to the People’s Republic of China. These vehicles could be remotely accessed or disabled." — President Biden said in a statement Thursday on the national security risks to the U.S. auto industry. (Related item in China section.)

— Eurozone inflation moderates slightly. In February 2024, the consumer price inflation rate in the Euro Area decreased to 2.6% year-on-year, down from 2.8% in the previous month but slightly above market expectations of 2.5%. This marks the lowest rate in three months but remains above the European Central Bank's target of 2%. Energy prices experienced a decline of 3.7%, while price increases moderated for services (3.9%), food, alcohol & tobacco (4.0%), and non-energy industrial goods (1.6%). The core inflation rate, excluding volatile food and energy prices, also cooled to 3.1%, its lowest level since March 2022 but still above forecasts of 2.9%. On a monthly basis, consumer prices rose by 0.6% in February, following a 0.4% drop in January.

— Japan unexpectedly slips into recession. Japan unexpectedly slipped into a recession at the end of last year, losing its title as the world's third-biggest economy to Germany and raising doubts about when the central bank would begin to exit its decade-long ultra-loose monetary policy. Japan’s GDP fell an annualized 0.4% in the fourth quarter of last year after a 3.3% slump in the previous quarter.

Market perspectives:

— Outside markets: The U.S. dollar index was slightly lower, with the euro, yen and British pound higher against the greenback. The yield on the 10-year U.S. Treasury note was firmer, trading around 4.27%, with a higher tone in global government bond yields. Crude oil futures were registering solid gains, with U.S. crude around $79.65 per barrel and Brent around $83.25 per barrel. Gold and silver futures were higher ahead of US economic data and market action, with gold around $2,060 per troy ounce and silver around $22.90 per troy ounce.

— In February, China experienced its highest-ever liquefied natural gas (LNG) imports for that month, driven by a decline in spot prices prompting increased purchases. Ship-tracking data compiled by Bloomberg revealed that deliveries surged to over 5.5 million tons, marking a 15% rise compared to the same period last year. This milestone marks the first time China's monthly LNG imports have set a record since 2021, prior to the onset of the global energy crisis, which led to price surges, coupled with reduced demand due to virus-related lockdowns.

— India’s rice output to drop, wheat crop expected to rise. India’s rice production is set to fall for the first time in eight years because of below-average rainfall, while wheat production is expected rise 1.3% from a year ago, the government said. India’s ag ministry said 2023-24 rice production is expected to fall to 123.8 MMT, while wheat production could rise to 112 MMT from 110.6 MMT last year.

— Exports of U.S.-grown peanuts hit a record $889.5 million in 2023, up 24% from the previous year, with Mexico and Canada accounting for half of sales. Link for details.

— Ag trade update: Taiwan purchased 65,000 MT of corn expected to be sourced from the United States.

— NWS weather outlook: Winter storm brings heavy higher elevation mountain snow, widespread damaging winds, and cold temperatures to much of the West... ...Powerful blizzard in the Sierra Nevada through this weekend... ...Widespread showers and thunderstorms across portions of the Southeast and Mid-Atlantic Friday... ...Much above average, Spring-like temperatures for the Plains and Midwest once again heading into the weekend; Critical Fire Weather threat for the central/southern High Plains Saturday.

Items in Pro Farmer's First Thing Today include:

• Beans rebound, corn and wheat weaker overnight

• Weather likely impacted soy crush, ethanol production in January

• France’s wheat crop ratings decline

|

CONGRESS |

— Congress cleared another CR and leaves DC; six bills need final funding OK next week. The House and then the Senate passed a short-term spending bill Thursday that gives lawmakers more time to complete the 12 fiscal year (FY) appropriations bill. The stopgap bill maintains funding for the departments of Agriculture, Interior, Transportation, Housing and Urban Development, Veterans Affairs, Energy, Justice, Commerce, Energy and other offices through March 8. For the rest of the bills, which already had a March 8 deadline, the measure would extend that date to March 22.

Vote details: Senators voted 77-13 to send the funding measure to President Biden’s desk for his signature, just hours after the House voted overwhelmingly to pass the bill 320-99 and just a day before government funding was set to expire. GOP Sens. Marsha Blackburn (Tenn.), Mike Braun (Ind.), Ted Budd (N.C.), Mike Crapo (Idaho), Ted Cruz (Texas), Josh Hawley (Mo.), Ron Johnson (Wis.), Mike Lee (Utah), Roger Marshall (Kan.), Eric Schmitt (Mo.), Rick Scott (Fla.), Tommy Turberville (Ala.) and J.D. Vance (Ohio) voted against the measure.

The stopgap spending measure sets up a first tranche of spending bills. Legislative text of that package is expected to be released Sunday; if that schedule is maintained, it would set up a Wednesday vote in the House under the chamber’s 72-hour rule.

— CBO: $20 billion IRS funding cut leads to $44 billion revenue loss. According to a Congressional Budget Office (CBO) analysis, cutting $20 billion in IRS funding for tax enforcement would result in a $44 billion loss in federal revenue over the next decade. Senate Budget Committee Chair Sheldon Whitehouse (D-R.I.) requested the report, which indicates a higher cost than previously estimated last year.

— Trump reportedly backs Sen. Daines for GOP Senate leader pre-McConnell exit, signaling potential race. Former President Trump has been quietly encouraging Sen. Steve Daines of Montana to run for GOP Senate leader, even before Sen. Mitch McConnell (R-Ky.) announced his step aside, according to reports. While speculation initially focused on other contenders like the "three Johns" (Thune, Cornyn, and Barrasso), Trump's involvement suggests a potentially competitive race for the leadership post. Trump's support, combined with a successful November election, could position Daines for the Senate leadership role when the new Congress convenes in January. Despite Daines' reluctance to confirm his candidacy, he said he appreciates Trump's backing but remains focused on reclaiming the Senate majority in November.

Daines, who chairs the National Republican Senatorial Committee, endorsed Trump's 2024 presidential bid early on and is leading efforts to recruit and support Senate candidates. Although Trump has shown support for Senator John Barrasso as well, it's unclear if other candidates are being considered for the party's leadership role in the Senate.

Meanwhile, Senator John Cornyn of Texas has already announced his bid for the leadership post, joining contenders like Sen. John Thune of South Dakota and Barrasso of Wyoming. With a favorable Senate map for Republicans in the upcoming elections, Daines' ability to lead the party to a strong majority could bolster his chances for a leadership run. He has already recruited Trump allies and Republicans, including Trump critic Larry Hogan, potentially making contested Senate races more competitive.

|

RUSSIA/UKRAINE |

— Yellen urges U.S. aid for Ukraine despite frozen Russian assets. Treasury Secretary Janet Yellen stated that seizing or monetizing $282 billion in frozen Russian assets to aid Ukraine cannot replace urgently needed assistance from Congress. Despite offers of financing from the European Union and Japan, the funding falls short of Ukraine's needs. Yellen warned that without U.S. assistance, Ukraine may face severe shortfalls. However, over $60 billion in proposed U.S. aid to Ukraine has been delayed in Congress due to Republican demands on immigration policy.

With Russia's military offensive ongoing, there's a growing consideration of seizing the frozen Russian assets. Yellen asserts a strong legal and moral case for this action and seeks to address European concerns about potential retaliation and financial stability. While France, Germany, and the European Central Bank express reservations, they remain open to collaboration with the U.S.

G7 officials and lawyers are exploring options for tapping into the frozen assets, aiming to present plans at the G7 leaders' meeting in June.

— Ukraine is drafting crucial farm workers in a desperate rush to bolster its military, and that’s jeopardizing the nation’s standing as “the breadbasket of Europe.” Link to details via Bloomberg.

|

POLICY UPDATE |

— Spring crop insurance prices set. The average closing levels for December corn futures, November soybeans and September HRS futures during February set the spring crop insurance prices for those crops. The spring crop insurance price is $4.66 for corn (down $1.25 or 21.2% from last year), $11.55 for soybeans (down $2.21 or 16.1%) and $6.84 for spring wheat (down $2.03 or 22.9%).

— Dairy Margin Coverage (DMC) payments for January will be triggered due to the national average margin reaching $8.48 per hundredweight (cwt). Farmers with coverage levels at $8.50, $9, and $9.50 will receive payments, which will be processed after March 4. The payments will amount to 2 cents per cwt for the $8.50 coverage level, 52 cents per cwt for $9 coverage, and $1.02 per cwt for $9.50 coverage. DMC payments will be sequestered by 5.7% — the sequestration reduction is fully automated; therefore, no action is required by County Offices except to verify that it has been properly applied. USDA has opened signup for the 2024 DMC program, which was reauthorized by the extension of the 2018 Farm Bill. Those enrolling will automatically be eligible for the January payments.

— Sen. Chuck Grassley on a new farm bill:

Will Congress renew the Farm Bill this year?

Grassley: “The Senate Agriculture, Nutrition and Forestry Committee held its annual oversight hearing in late February to review operations at the U.S. Department of Agriculture. USDA Secretary Tom Vilsack appeared before the committee to answer questions and testify about various programs of the federal department. As a lifelong family farmer and longtime member of the Senate Ag Committee, I used the opportunity to press Secretary Vilsack on issues of particular importance to Iowa producers, including renewal of the 2018 Farm Bill that lapsed on Sept. 30, 2023. Currently, programs implemented by the Farm Bill are operating under a one-year extension, including commodity supports, ag conservation, nutrition, trade, research, bioenergy and rural development. One day before the oversight hearing, Sen. Debbie Stabenow, who chairs the Senate Agriculture Committee, indicated her preference to keep in place the 2018 law rather than reach a bipartisan agreement that would enact a full, five-year farm bill. That’s poppycock. For the last two years, I’ve heard from Iowa farmers about priorities they want to see in a new farm bill, notably to raise reference prices that factor in soaring production costs that have been eating into their bottom lines for the last several years. Reference prices are used to calculate payments to farmers in the Price Loss Coverage (PLC) or Agriculture Risk Coverage (ARC) programs if the national average market value of a commodity falls below that federal benchmark. Just as inflation has hammered families at the grocery store, farmers have been hard hit by historic input costs, from fertilizer to fuel, machinery and seeds that undercut their profitability. Facing high interest rates and stagnant commodity prices, the farm safety net ought to be updated to reflect these challenges. As one of only a few farmers in Congress, I work hard to ensure family farmers have a strong voice at the policymaking table, particularly when it comes to renewing the five-year farm bill.

“Not many people realize that 85% of farm bill funding goes towards nutrition programs, leaving only 15% for farm programs. In February, I held nine county meetings across Northeast Iowa. Iowans continue to make clear they want Washington to get on the stick and get the farm bill passed to deliver much-needed certainty for farmers who are gearing up for planting season. From roundtables and county meetings I’ve held across Iowa, farmers tell me they want the federal crop insurance program maintained and have shared concerns the Conservation Reserve Program (CRP) outbids young and beginning farmers looking to cash rent and cattle producers in search of haying and grazing acres for their livestock. I’m working to ensure the CRP program doesn’t allow the federal government to become an unfair competitor in the local market.

“With so much unfinished business on its plate, the path for Congress to secure a bipartisan agreement on a five-year Farm Bill has a short runway. If legislation doesn’t get to the president’s desk by the end of March, I predict Congress will pass another one-year extension.”

|

PERSONNEL |

— Biden administration announces three nominees for the Federal Energy Regulatory Commission (FERC): David Rosner and Judy Chang as Democratic members, and Lindsey See as a Republican member. The key will be whether Senate Energy and Natural Resources Committee Chair Joe Manchin (D-W.Va.) supports their nominations. Rosner, currently detailed from FERC's Office of Energy Policy and Innovation to the Senate panel, is expected to receive Manchin's backing.

FERC currently has three commissioners out of five, with Allison Clements' term expiring on June 30. Clements would still be able to remain on the panel until the end of the current session of Congress, even after her term expires, to maintain the quorum.

— Brian Mulroney, who served as Canada's Prime Minister from 1984 to 1993, passed away at the age of 84. He is celebrated for fostering strong relationships with US leaders, which significantly improved the sometimes-tense relationship between the two countries. Mulroney's efforts laid the groundwork for significant agreements, including the North American Free Trade Agreement (NAFTA), as well as treaties addressing issues such as acid rain and ozone layer depletion.

|

CHINA UPDATE |

— China manufacturing shrinks for fifth month. In February 2024, China's official NBS Manufacturing Purchasing Managers' Index (PMI) slightly decreased to 49.1 from 49.2 in the previous month, aligning with market expectations. This marks the fifth consecutive month of contraction in factory activity, primarily due to the impact of the week-long Lunar New Year break, during which most factories either closed or operated at reduced capacity.

Weakness persisted in new orders (49.0), foreign sales (46.3), employment (47.5), buying levels (48.0), and output (49.8). Delivery times lengthened (48.8) after a series of shortening over the past twelve months.

Input cost inflation eased to an eight-month low (50.1), while output prices fell at a softer pace (48.1). However, sentiment improved slightly (54.2) compared to its lowest point in seven months recorded in January.

— Biden orders probe into foreign-made car software, citing national security concerns. President Biden has directed the Commerce Department to investigate the use of foreign-made software in automobiles, citing concerns about Chinese technology posing a potential national security risk. The investigation could result in restrictions on the use of certain parts in cars in the U.S., particularly as Chinese automakers seek to expand their international sales. Biden highlighted the risks associated with connected vehicles collecting sensitive data and being vulnerable to remote access or disabling.

This probe is part of the White House's efforts to safeguard U.S. industries against the perceived threat of Chinese cyberattacks. Previous actions include advocating for U.S. ports to replace Chinese-made cranes and seeking to restrict imports of new rail cars from certain countries while prohibiting the use of "sensitive technology" from those countries in the equipment.

— What’s wrong with China’s economy, in eight charts. Challenges multiply after the country’s years of rapid growth. Link to WSJ article for the charts.

— China lowers sow retention target. China’s ag ministry adjusted the national target for normal retention of breeding sows to 39 million from 41 million head. It also adjusted the lower limit for normal fluctuations in the stock of breeding sows to 92% from 95% of the normal retention level.

— China sets 2024 rice minimum purchase levels. China has set the minimum purchase price for 2024 early indica rice at 127 yuan ($17.64), mid-late indica rice at 129 yuan, and japonica rice at 131 yuan per 50 kilograms, the National Development and Reform Commission said in a statement on Friday, according to Reuters.

— China’s rural workers face bleak choice: stay in emptying villages, or move to job-scarce cities? Chinese researchers have found the country’s rural population is struggling to keep up with their urban peers in terms of lifestyle, hampered by relative underdevelopment in social resources and a lack of job prospects in cities. Link for details via the South China Morning Post.

— U.S. sees China’s space threat growing at ‘breathtaking pace’. China is growing its military capabilities in space at a “breathtaking pace” to counter the American satellites in orbit and improve its ability to monitor and target forces on Earth, according to the head of the US Space Command. Link for details via Bloomberg.

|

TRADE POLICY |

— 13th Ministerial Conference (MC13) of the World Trade Organization (WTO) in Abu Dhabi failed to reach any final agreements, leading to the postponement of the closing session — WTO countries had not reached any final agreements as the ending session of the gathering loomed Feb. 29, prompting the world trade body to postpone the final session until 8 pm local time (10 am CT). The impasse is attributed to fragmentation among BRICS countries (Brazil, Russia, India, China, and South Africa), particularly due to disagreements between India and China on key issues. Negotiations on improving investment were also blocked due to lack of consensus among the 164 WTO member countries. Some officials have already left the United Arab Emirates, indicating significant differences remain unresolved.

The failure to reach agreements is not surprising given the ongoing discord between countries, particularly on issues like agriculture, where differences over public stockholding have divided developed and developing nations.

— Surge in duty-free packages to U.S. spurs lawmaker concerns. A surge in packages entering the U.S. under the de minimis provision, favored by e-commerce giants like Temu and Shein, is raising concerns among lawmakers. This provision allows duty-free entry for packages valued under $800, often criticized as a loophole enabling companies to evade tariffs and import bans on goods made with forced labor. In the first four months of fiscal year (FY) 2024, at least 485 million packages have entered the U.S. under this provision, compared to 685 million in FY 2022. Rep. Mike Gallagher (R-Wis.) highlights these figures, emphasizing the loophole's exploitation. Temu and Shein, alone, account for about a third of all de minimis shipments. While most Americans encounter the de minimis provision when returning from abroad, businesses like Temu and Shein use it to bypass customs scrutiny by directly shipping goods to U.S. consumers. The stance among U.S. businesses on the provision is split, with some raising concerns about its exploitation. Homeland Security Secretary Alejandro Mayorkas met with members of the National Council of Textile Organizations in January, hearing complaints about the provision's misuse.

|

ENERGY & CLIMATE CHANGE |

— EPA to delay gas plant emission limits until after 2024 election. The Environmental Protection Agency (EPA) plans to delay finalizing limits on emissions from gas-fired power plants to strengthen them significantly, with the rule likely not being finalized until after November. This delay means that the rule's fate will depend on the outcome of the 2024 election. The decision comes after pressure from environmental justice groups, who argued that the initial rule wasn't protective enough of disadvantaged communities near gas plants.

Background. EPA issued a proposed rule in May 2023 to curb greenhouse gas emissions from existing coal and gas plants. While rules for existing coal plants and new gas plants are expected to be finalized in April, the rule for existing gas plants will take longer and will cover additional harmful air pollutants. Power plants are a major contributor to greenhouse gas emissions in the U.S., and the tougher rules being considered for existing gas plants would address pollutants concerning neighboring communities. Environmental justice leaders and major environmental groups have urged EPA to strengthen the standards for existing gas plants.

The Trump administration replaced the Obama-era Clean Power Plan with a more lenient rule, but subsequent legal challenges have prompted revisions under the Biden administration. Joseph Goffman, head of the EPA's Office of Air and Radiation, hinted at potential tweaks to the power plant rules.

— California weighs climate benefits vs. food supply concerns in diesel production. California is grappling with the challenge of balancing the climate benefits of using crops to produce diesel fuel with the need to maintain adequate food supplies and stable prices. The state's Low Carbon Fuel Standard is undergoing potential revisions, with a surge in renewable diesel production triggering concerns about its impact on food markets, according to a Bloomberg assessment.

Environmentalists are urging limits on crop-based fuels to prevent exacerbating hunger, particularly as soybean oil, a staple for cooking, is diverted into fuel production. This shift has led to increased demand for palm oil, a controversial commodity linked to deforestation.

The postponement of a regulatory hearing (link) on the fuel standard allows for further consideration of sustainability measures, including the possibility of implementing "sustainability guardrails." While limits on biofuels were previously dismissed, the delay suggests that proposals for caps may be reconsidered.

However, industry groups such as Chevron Corp., Neste Oyj, and Diamond Green Diesel oppose the idea of a ceiling, arguing that it could increase costs and reduce the appeal of renewable diesel, potentially leading to greater reliance on traditional petroleum diesel.

Jeremy Martin of the Union of Concerned Scientists emphasizes the importance of learning from past crises, such as the 2022 surge in renewable diesel production coinciding with global food supply pressures. He advocates for policies that prioritize the needs of consumers and address the potential consequences of biofuel production on food markets.

— Fisker, an electric vehicle (EV) startup, issued a warning on Thursday about its potential survival, following a 15% reduction in its workforce. The company indicated that it might not be able to sustain operations due to insufficient resources to cover the next 12 months. However, Fisker stated it was in discussions with a major automaker for a potential investment and joint development partnership. Additionally, the firm mentioned ongoing talks with a debt holder regarding possible investment. Fisker reported lower-than-expected preliminary revenue of $200.1 million for the fourth quarter, resulting in a net loss of $463.5 million compared to $170 million a year ago. The identity of the major automaker involved was not disclosed by Fisker.

— Highest ethanol blend rate. The average gallon of gasoline sold in 2023 was 10.39% ethanol, the highest blend rate ever and a result of rising sales of E15. Link for details.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— New York Attorney General Letitia James filed a lawsuit against JBS, the world's largest meatpacking company, accusing it of making misleading statements about its efforts to reduce greenhouse gas emissions. The lawsuit alleges that JBS engaged in greenwashing by promoting environmentally friendly claims such as achieving net zero emissions by 2040, despite lacking proven agricultural practices to reduce emissions at its vast scale.

The lawsuit is a major setback for JBS, which is based in Brazil, as it pursues a listing on the New York Stock Exchange.

In a statement, JBS said it disagreed with the attorney general’s allegations. It said that it would continue to work with farmers and others “to help feed a growing population while using fewer resources and reducing agriculture’s environmental impact.”

|

HEALTH UPDATE |

— CDC reports that around 98% of the U.S. population has some form of immunity to Covid-19, whether through infection, vaccination, or both. However, health experts caution that this immunity provides only partial protection against infection or severe disease. In response, the CDC has recommended that individuals aged 65 and older receive an additional dose of the current Covid-19 vaccine.

The current Covid-19 vaccine, updated last fall, is considered highly effective and may reduce the chances of experiencing symptomatic infection by half. Additionally, the CDC is considering updating its Covid-19 isolation guidance to suggest that individuals no longer need to isolate once they have been fever-free for 24 hours and their symptoms are mild or improving.

|

POLITICS & ELECTIONS |

— Montana Senate race: Tester faces tough competition. The Montana Senate race is heating up, with Republicans aiming to unseat Democratic incumbent Jon Tester. Tester, seeking his fourth term, leads fundraising efforts, but the race is expected to be one of the country's costliest, according to OpenSecrets (link).

Top contenders:

- Jon Tester: Tester's robust fundraising surpasses his 2018 campaign. Key contributors include Treasure State PAC and corporate entities like Capital Group Companies.

- Tim Sheehy: Backed by Trump and the National Republican Senatorial Committee, Sheehy is Tester's leading challenger. His fundraising totals near $5.3 million.

- Jeremy Mygland: Lagging in fundraising, Mygland focuses on border security and fiscal responsibility.

- Brad Johnson: Johnson, a state politician, lags behind in fundraising efforts.

- Thomas Madigan: With insufficient funds reported, Madigan's campaign remains low-profile.

Of note: Rep. Matt Rosendale (R-Mont.) withdrew from the Senate race and is focusing on re-election for Montana's 2nd Congressional District.

— Rep. Green reverses retirement decision, opting for re-election after Trump's endorsement. House Homeland Security Chairman Mark Green (R-Tenn.) has decided to seek re-election after initially announcing his retirement earlier this month. Citing support from constituents, colleagues, and former President Donald Trump, Green reversed his decision, emphasizing his duty to the country. Trump publicly encouraged Green to run again, praising his leadership as Chairman of the Homeland Security Committee. Green's change of heart comes after his earlier statement expressing disillusionment with the state of Congress.

With this reversal, Green joins other GOP members, including Reps. Victoria Spartz (R-Ind.) and Pat Fallon (R-Texas), who have also decided against retirement.

— David Wasserman on impact of redistricting on House races. Wasserman, political analyst for the Cook Political Report with Amy Walter, writes: “The conclusion of New York's process means that the re-redistricting drama of 2024 has likely drawn to a close. And, it's pretty close to a wash: Democrats are poised to gain a seat each from Voting Rights Act rulings in Alabama and Louisiana, and may net one seat at most from the new map in New York. Meanwhile, Republicans are poised to gain three to four seats in North Carolina. Republicans might have come out slightly ahead, but not by much.”

|

OTHER ITEMS OF NOTE |

— Cotton AWP at highest mark since late 2022. The Adjusted World Price (AWP) for cotton rose to 77.47 cents per pound, effective today (March 1), up from 75.12 cents per pound the prior week and the highest since it was at 77.78 cents per pound the week of Nov. 18, 2022. This marked the seventh weekly rise in the AWP and fourth week it has been at 70 cents per pound or more. That puts it more than 20 cents above the level that would trigger any LDP. Meanwhile, USDA announced that Special Import Quota #20 will be established March 7 for 30,041 bales of upland cotton, applying to supplies purchased not later than June 4 and entered into the U.S. not later than Sept. 2.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |