Stabenow Threatens to Block New Farm Bill Over House GOP Proposals

FY 2024 funding update | Biden protest vote in Michigan | Beyond Meat | Higher swine line speeds until 2025

|

Today’s Digital Newspaper |

MARKET FOCUS

- U.S. GDP growth revised slightly lower

- G20 draft communique signals growing chance of soft landing for global economy

- Fed’s Bowman says too soon to begin rate cuts

- Goldman Sachs CEO cauts against excessive confidence on ‘soft landing’

- OPEC+ mulls extending voluntary oil output cuts

- Beyond Meat Q4 sales decline, stock surges; challenges persist

- Justice Dept. launches antitrust investigation into UnitedHealth Group

- U.S. migrant impact: Urban centers and Southern states attracting attention

- Dry-bulk vessel Rubymar stranded in Red Sea and taking on water

- Ag markets today

- RINs fall to three-year lows

- Ag trade update

- Out-of-control wildfires scorch Texas Panhandle

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Schumer: House Speaker Johnson vows to avert shutdown

- Data suggest any temporary gov’t shutdown unlikely to impact stock market

- WIC funding and food stamp changes key topic of ongoing FY 2024 talks

- House Speaker to hold ceremonial swearing-in for Rep.-elect Tom Suozzi (D-N.Y.)

ISRAEL/HAMAS CONFLICT

- Israel, Hamas, and Qatar doubt Biden's Gaza ceasefire timeline

RUSSIA & UKRAINE

- Tapping Russian assets

- Kremlin cautions against NATO ground intervention in Ukraine

POLICY

- Stabenow threatens to block new farm bill over House GOP proposals

- 24 states looking to undo EPA’s wetlands and waters rule (WOTUS)

- Podcast: Wiesemeyer & Haney: Mexican tortillas, grocer merger, and farm bill follies

PERSONNEL

- EPA’s hiring spree prompting questions

- Gooden confirmed as USDA undersecretary

CHINA

- Brazil announces China has eliminated tariffs on Brazilian poultry

- China authorizes pork imports from three Russian enterprises

- China’s property woes worsen with Country Garden petition

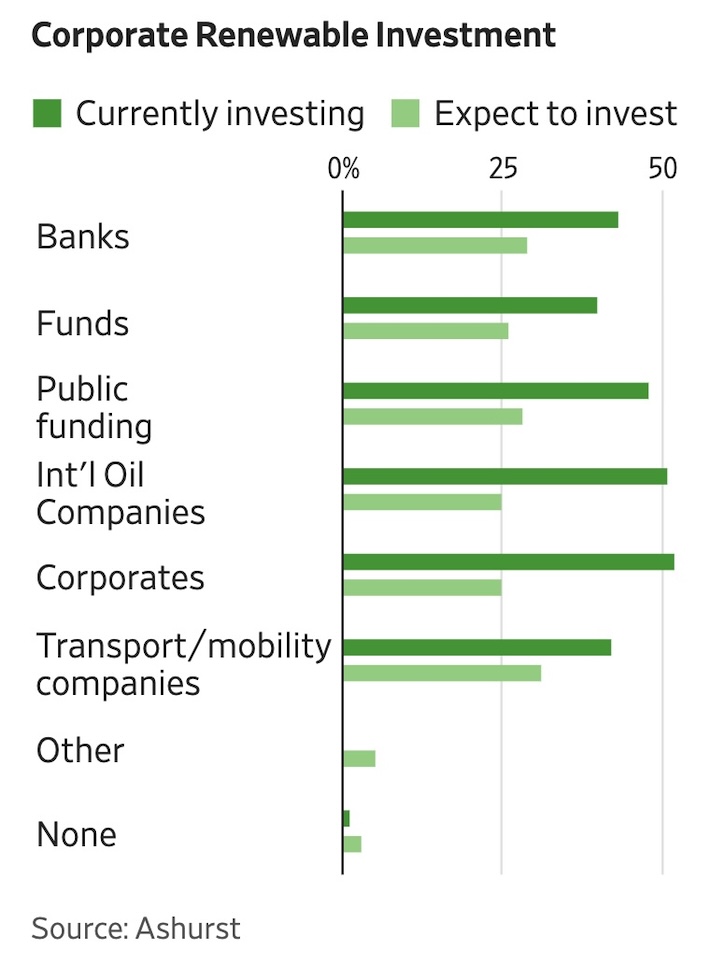

ENERGY & CLIMATE CHANGE - Corporate pressure driving carbon footprint reduction: Ashurst report

- Southwest Airlines partners with LanzaJet to produce SAF from corn

- Nuclear and hydropower push for tax credit in hydrogen debate

- Apple pulls plug on attempt to build electric car

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- USDA begins trial allowing higher swine line speeds until 2025

- Americans adapting eating, shopping, and lifestyle habits re: record food inflation

HEALTH UPDATE

- Alabama proposes IVF protection bill after court ruling

POLITICS & ELECTIONS

- Biden wins Michigan primary despite sizeable Gaza protest vote

- Trump's easy win in Michigan primary failed to conceal division in his party

- Both political parties aim to secure more favorable congressional maps in key states

- President Biden and Trump to visit U.S./Mexico border this Thursday

- Wasserman's latest prediction on House outcome following Nov. 5 elections

OTHER ITEMS OF NOTE

- French banks offer preferential rates to farmers amid crisis, including loan suspension

- France banning terms like "fillet" and "ribeye steak" for plant-based products

- Biden EO to restrict sale of sensitive data to China, Russia, four other countries

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mostly lower in overnight trading. U.S. Dow opened around 180 points lower. In Asia, Japan -0.1%. Hong Kong -1.5%. China -1.9%. India -1.1%. In Europe, at midday, London -0.7%. Paris -0.1%. Frankfurt +0.2%.

U.S. equities yesterday: The Dow ended with losses while the Nasdaq and S&P 500 moved higher for the day on Tuesday. The Dow was down 96.82 points, 0.25%, at 38,972.41. The Nasdaq gained 59.05 points, 0.37%, at 16,035.30. The S&P 500 rose 8.65 points, 0.17%, at 5,078.18.

— Justice Department launches antitrust investigation into UnitedHealth Group, owner of the nation’s biggest health insurer, a leading manager of drug benefits and a sprawling network of doctor groups. Investigators have asked about the possible effects of the company’s doctor-group acquisitions on rivals and consumers. UnitedHealth executives have said Optum and UnitedHealthcare don’t favor one another, and routinely work with competitors. UnitedHealth, based in Minnetonka, Minn., had $372 billion in revenue last year. Its insurance unit covers about 53 million people, across a range of plans including employer, Medicaid and Medicare coverage. After years of acquisitions, Optum includes about 90,000 physicians, as well as surgery centers, an array of health data and technology units, and one of the largest pharmacy-benefit managers.

— Ag markets today: Corn and soybeans are trading near unchanged this morning after light two-sided trade overnight, while wheat futures have weakened. As of 7:30 a.m. ET, corn futures were trading fractionally on either side of unchanged, soybeans were steady to a penny higher, SRW wheat was 4 to 5 cents lower, HRW wheat was 7 to 9 cents lower and HRS wheat was 3 to 5 cents lower. Front-month crude oil futures were around 75 cents lower, and the U.S. dollar index was about 275 points higher.

Cotton futures surged to the highest level since mid-September 2022 on the continuation chart during overnight trade. While futures have gone parabolic and there could be more near-term upside potential, prices have only reached these levels three other times previously

Packers continue to reduce cattle slaughter. Estimated cattle slaughter was only 247,000 head through the first two days this week, 2,930 head behind last year. With plants running 32-hour shifts and little to no Saturday kills, this week’s tally could fall as low as 580,000 head. Packers continue to reduce slaughter runs as a means of managing tight market-ready supplies amid deeply red margins. The reduced beef supply is supporting wholesale beef prices. While Choice beef slipped a nickel on Tuesday, prices are solidly back above $300.00 and Select is notably above $285.00 – both of which have acted as recent price ceilings.

Pork cutout rebounds. After declining the two previous days, the pork cutout value firmed 88 cents on Tuesday to $91.87. While the cash hog market continues to strengthen seasonally, gains in the pork cutout have risen enough to keep packer margins solidly in the black.

— Agriculture markets yesterday:

- Corn: May corn futures closed up 2 cents at $4.23 1/2 today and near mid-range.

- Soy complex: May soybeans fell 4 3/4 cents to $11.40 and closed at a contract low close. May soymeal hit a new contract low and fell $3.70 to $324.90. Both markets ended near session lows. May soyoil rose 51 points to 45.53 cents, a near mid-range close.

- Wheat: May SRW futures rallied 9 1/2 cents to $5.84 1/4 but closed over a nickel off session highs. May HRW futures rose 9 1/4 cents to $5.85 3/4, settling nearer session highs. May spring wheat rose 9 1/2 cents to $6.62 1/4.

- Cotton: May cotton rose the daily limit of 400 points to 98.80 cents, a contract high close. Cotton futures surged the limit to the highest level in more than year amid technical buying and snug supplies.

- Cattle: April live cattle futures dropped 37.5 cents to $187.725, while expiring February futures fell 12.5 cents to $185.60. March feeder cattle futures slipped 5 cents to $253.00.

- Hogs: April lean hogs fell 37 1/2 cents to $85.90 and nearer the session low.

— Quotes of note:

- Fedspeak. Federal Reserve Governor Michelle Bowman said again that she expects inflation will continue to decline further with interest rates held at their current level, but said it’s too soon to begin rate cuts.

Fed speakers today: Federal Reserve Bank of Boston President Susan Collins speaks and participates in a fireside chat before an event hosted by the Center for Business, Government and Society at the Dartmouth College Tuck School of Business. Additionally, Federal Reserve Bank of New York President John Williams participates in a hybrid economic briefing organized by the Long Island Association.

- Goldman Sachs CEO David Solomon cautioned against excessive confidence in the Federal Reserve's ability to achieve a "soft landing" for the U.S. economy amid inflationary pressures and geopolitical risks. Speaking at a UBS conference, Solomon highlighted uncertainties despite expectations for a gentle economic slowdown. He noted market optimism regarding Fed actions but expressed skepticism, emphasizing the complexities ahead. Solomon observed a divergence between the strong upper economy and slowing consumer spending in the lower tier. His current stance contrasts with previous remarks indicating higher chances of a soft landing.

- “We’re seeing that the energy transition is an area that is firmly embedded in the thinking of investors, corporates, governments and others, so there is a real emphasis on setting and acting on these plans now.” — Michael Burns, global co-head of energy at Ashurst.

— U.S. GDP growth revised slightly lower. In Q4 2023, the U.S. economy expanded at an annualized rate of 3.2%, slightly below the initial estimate of 3.3% and down from 4.9% in Q3. The downward revision was primarily due to a decrease in private inventories, which subtracted 0.27 percentage points from growth. However, consumer spending was revised higher to 3%, led by services, while goods rose less. Government spending increased significantly more than anticipated, and both exports and imports saw higher-than-expected growth.

Non-residential investment was revised higher, driven by intellectual property products and investment in structures, although investment in equipment was revised lower. Residential investment exceeded expectations.

For the full year 2023, the U.S. economy grew by 2.5%, compared to 1.9% in 2022.

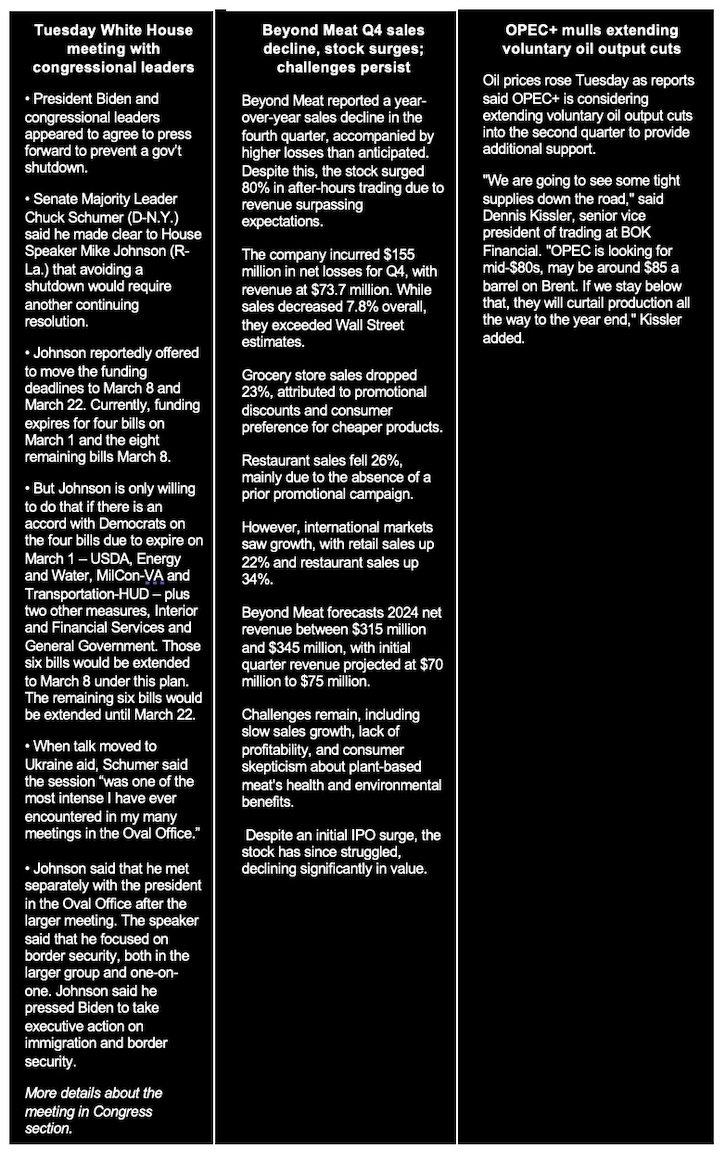

— G20 draft communique suggests a growing chance of a soft landing for the global economy, citing faster-than-expected disinflation as an upside risk. Despite divisions over conflicts in various regions, the draft reflects a relatively optimistic outlook, highlighting receding inflation and improved economic conditions thanks to appropriate monetary policies.

Treasury Secretary Janet Yellen emphasized the U.S. role in underpinning global growth, despite acknowledging risks such as prolonged conflicts and debt troubles in low-income nations.

The meeting in Sao Paulo was marked by haggling over language regarding conflicts like Russia's invasion of Ukraine, with ministers aiming to address various global issues amid divisions.

The final communique will outline the consensus view on the world economy and challenges ahead.

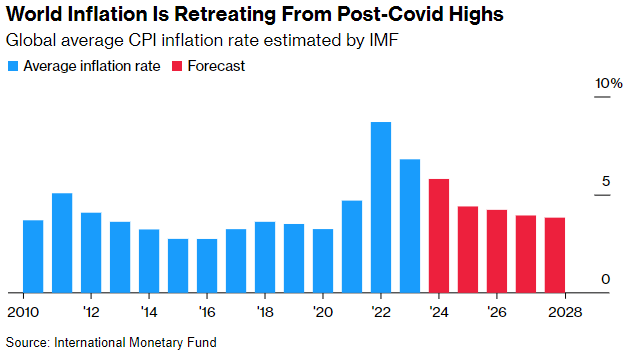

— U.S. migrant impact: Urban centers and Southern states attracting attention. The impact of migrants arriving in the U.S. has garnered attention, particularly in major cities like New York, Illinois, and Colorado. A Bloomberg assessment (link) says immigration court records indicate that these states have seen significant increases in migrant arrivals. However, Texas and Florida, despite longstanding concerns about accommodating newcomers, remain top destinations for migrants.

Illinois witnessed a nine-fold increase in migrants listing an address for immigration court cases in 2023 compared to two years earlier, with similar spikes seen in Colorado and New York. Surprisingly, New York had the highest number of migrant arrivals per capita in 2023. Migrants are dispersing throughout the U.S., including rural areas with meatpacking and agriculture industries, where migrant employment is common.

While the data isn't flawless, as it relies on addresses provided by migrants to U.S. officials, it offers insight into migration patterns. The surge in migration has led to a substantial backlog in U.S. immigration courts, resulting in an average four-year wait for the first asylum hearing. Moreover, family clusters now represent a significant portion of arrivals at the border, a departure from previous trends dominated by single adults. Additionally, the composition of migrants has evolved, with fewer cases involving individuals from Mexico and neighboring countries, and increasing numbers from Colombia, Ecuador, Venezuela, Cuba, and Haiti.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer, with the euro and British pound both weaker against the greenback. The yield on the 10-year U.S. Treasury note was lower, trading around 4.27%, with a mixed tone in global government bond yields. Crude oil futures were under pressure ahead of U.S. gov’t inventory data due later this morning, with US crude around $78.30 per barrel and Brent around $82.05 per barrel. Gold and silver were under pressure ahead of US economic data, with gold around $2,039 per troy ounce and silver around $22.58 per troy ounce.

— RINs fall to three-year lows. U.S. biomass-based diesel and ethanol compliance credit prices have slumped to three-year lows on declining feedstock costs and are set to stay low as renewable diesel output rises, the Energy Information Administration (EIA) said. Renewable Identification Numbers (RINs) generated from renewable diesel and biodiesel output (D4) and from ethanol production (D6) are both trading at their lowest since 2020. Declining prices of soybean oil, a widely used feedstock for renewable diesel and biodiesel production, are a primary driver behind the slump in RINs, EIA said. Rising global production and lower demand in China have boosted soybean stockpiles, while increasing exports from Brazil have put more pressure on soyoil prices, the agency noted.

— Dry-bulk vessel Rubymar is stranded in the Red Sea and taking on water after an attack by Houthi rebels in Yemen. A WSJ video report (link) looks at the plight of the ship, which is holding a load of fertilizer that officials say poses a serious environmental danger to the region. The cargo vessel, owned by Blue Fleet Group, was hit on Feb. 18 and has already left an 18-mile oil slick in its wake. Meanwhile, the U.S. has struck 230 targets in Yemen following Houthi-led attacks against shipping in the Red Sea, a top Pentagon official announced, offering the most detailed public accounting of the strikes up to this point.

— Ag trade update: Thailand purchased 60,000 MT of European Union feed wheat. Jordan tendered to buy up to 120,000 MT of optional origin milling wheat.

— Multiple uncontrolled wildfires are currently endangering towns in the Texas Panhandle, leading to evacuations of residents. The largest among them, the Smokehouse Creek Fire, has consumed over 370,000 acres of land since igniting on Monday afternoon, as reported by the Texas A&M Forest Service. The region is also battling several other wildfires, exacerbated by strong winds and dry conditions. Evacuation orders have been issued for various communities in northern Texas and neighboring towns in Oklahoma. Reports indicate structures have been destroyed and farmlands charred, with some ranchers expressing difficulty evacuating their livestock amidst the rapidly spreading flames.

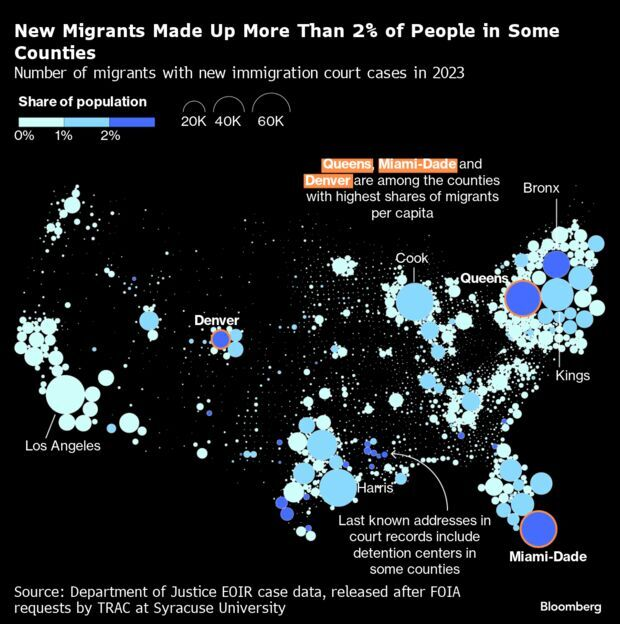

— NWS weather outlook: Heavy snow over parts of the Cascades, the Northern Intermountain Region, Northern California, and Sierra Nevada Mountains... ...Light to moderate snow over the Great Lakes, Central Appalachians, and Northeast... ...Temperatures will be 10 to 25 degrees above average over parts of the Northeast and Mid-Atlantic.

Items in Pro Farmer's First Thing Today include:

• Grains mixed this morning

• Ukraine grain exports jump in February

• Eurozone economic sentiment deteriorates in February

|

CONGRESS |

— Schumer: House Speaker Johnson vows to avert shutdown. During a private meeting with President Joe Biden and congressional leaders, House Speaker Mike Johnson (R-La.) expressed a clear commitment to avoid a gov’t shutdown, Senate Majority Leader Chuck Schumer (D-N.Y.) reported. The leaders emerged from the meeting optimistic about preventing a shutdown, with discussions primarily focused on keeping the gov’t operational. However, the meeting also addressed intense concerns regarding Ukraine. Schumer emphasized the urgency of taking action to assist Ukraine, particularly after Republicans blocked a bipartisan proposal related to border security earlier this year.

Of note: CIA Director Bill Burns also joined the meeting, highlighting the administration’s sense of urgency about securing fresh funding for Ukraine and a temporary cease-fire in Gaza.

Johnson comments. “We have been working in good faith around the clock every single day for months and weeks and over the last several days, quite literally around the clock to get that job done. We’re very optimistic,” Johnson told reporters on the White House lawn. “We believe that we can get to agreement on these issues and prevent a government shutdown, and that’s our first responsibility,” he added.

Biden emphasized during the talks on Tuesday that a bipartisan funding bill should be “free of any extreme policies,” according to a meeting summary provided by White House officials.

Schumer said he made clear to Johnson that avoiding a shutdown would require another continuing resolution (CR). Johnson reportedly offered to move the funding deadlines to March 8 and March 22. Currently, funding expires for four bills on March 1 and the eight remaining bills March 8. But Johnson is only willing to do that if there is an accord with Democrats on the four bills due to expire on March 1 – USDA, Energy and Water, MilCon-VA and Transportation-HUD – plus two other measures, Interior and Financial Services and General Government. Those six bills would be extended to March 8 under this plan. The remaining six bills would be extended until March 22.

Johnson several times in the meeting brought up the southern border relative to security needs. “The first priority of the country is our border and making sure it’s secure,” Johnson said. “I believe the president can take executive authority right now today to change that.” Johnson made clear he is prepared to continue to hold up aid to Ukraine over the border. Schumer said he’s willing to negotiate a new border bill with Johnson but that it will take a while. Senate Minority Leader Mitch McConnell (R-Ky.) reportedly asked House Minority Leader Hakeem Jeffries (D-N.Y.) if the House can break up the supplemental. Jeffries said no. McConnell said the House cannot waste time coming up with its own bill given the urgency of the situation in Ukraine.

Democrats said the discussion in the private meeting got passionate at times, particularly on the subject of billions of dollars in stalled aid for Ukraine. "The meeting on Ukraine was one of the most intense I've ever encountered of my many meetings in the Oval Office," said Schumer, who just returned from a trip to Ukraine. "We said to the speaker: Get it done!"

Despite the looming deadlines of March 1 and March 8, congressional negotiators have yet to release the text of a spending agreement for the initial batch that covers around 20% of government funding. Talks have continued while the House is on a 12-day recess that ends today.

Bottom line: If the House and Senate can’t finish the combination bill by the end of the day Friday, lawmakers will need to pass a stopgap of several days to avoid a weekend shutdown. Thursday is the earliest the initial funding bills could be posted, sources advise. That would put House consideration on Sunday due to the 72-hour rule. That’s two days into a partial shutdown and would push Senate action into next week.

The House comes back into session this evening. House Republicans will meet Thursday morning, their first session in a couple of weeks.

— In event of a temporary government shutdown, historical data suggests that it's unlikely to impact the stock market. Research from Fundstrat indicates that over the last five decades, the median return of the S&P 500 during a government shutdown has been 0%. Moreover, in the month following a shutdown, markets have typically risen with a median return of 1.3%. The average duration of a shutdown has been approximately five days.

— WIC funding and food stamp changes key topic of ongoing FY 2024 talks. Senate Democrats have requested an additional $1 billion for the federal food assistance program for women, infants and children, known as WIC. The program has seen an enrollment surge since the start of 2023, drawing down federal funds faster than anticipated. President Biden requested the $1 billion to plug that gap. In exchange for that funding, House Republicans — led by the chief agriculture bill negotiator, Rep. Andy Harris (R-Md.), an anesthesiologist — want changes to the Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps. The proposal would launch a pilot program that would restrict participants’ purchases to “nutrient dense” items. “It’s no secret Dr. Harris would like to see the Supplemental Nutrition Assistance Program returned to what it was originally authorized in Congress to do,” a spokesperson for Harris said in a statement, “which is to ‘safeguard the health and well-being of the Nation’s population by raising levels of nutrition among low-income households.’” Democrats and anti-hunger activists strongly oppose the GOP effort.

— House Speaker Mike Johnson will hold a ceremonial swearing-in for Rep.-elect Tom Suozzi (D-N.Y.). After Suozzi swears in, there will be 219 Republicans to 213 Democrats with three vacancies, giving Johnson a two-vote margin.

|

ISRAEL/HAMAS CONFLICT |

— Israel, Hamas, and Qatar doubt Biden's Gaza ceasefire timeline. Israel, Hamas, and Qatar have expressed skepticism about President Biden's optimism regarding the possibility of a ceasefire in Gaza by the end of the week. Biden stated on Monday his hope for a ceasefire in the Israel-Hamas conflict by "next Monday" as the death toll in Gaza rises. However, an Israeli official told CNN on Tuesday that Israel was surprised by Biden's use of the word "Monday" and the mention of a ceasefire. Basem Naim, a member of Hamas' political bureau, also told CNN on Tuesday that the group was unaware of any ceasefire agreement that could be reached by next Monday, stating, "There is nothing." Additionally, Qatar, a key mediator alongside the U.S. in negotiations between Israel and Hamas, has suggested a different timeline.

|

RUSSIA/UKRAINE |

— Tapping Russian assets. Treasury Secretary Janet Yellen called on the world’s biggest economies to find a way to “unlock the value” of immobilized Russian assets to help bolster Ukraine’s defense and for reconstruction. “There is a strong international law, economic and moral case for moving forward,” Yellen said Tuesday in Sao Paulo in remarks before meeting with counterparts from the world’s top economies. “The G7 should work together to explore a number of approaches that have been suggested.” Her comments come as Group of Seven nations are debating what to do with sovereign assets that were frozen at the outbreak of the invasion, with Ukraine’s financing needs remaining persistently high and the war now in its third year with no sign of abating.

Yellen said that beyond simply seizing the assets, other ideas include using them as collateral to borrow from global markets. Unlocking the assets to help Ukraine “would be a decisive response to Russia’s unprecedented threat to global stability,” Yellen said. “It would make clear that Russia cannot win by prolonging the war and would incentivize it to come to the table to negotiate a just peace with Ukraine.”

Russian Finance Minister Anton Siluanov said the U.S. plan is “destructive” because it makes countries’ reserves susceptible to political decisions. He said Russia can respond “because we have frozen on our side a sizeable amount of foreign assets.”

Siluanov said that the rhetoric about asset freezes is undermining “trust in the reserve currencies.” Following the freezing of Russian assets and sanctions on the country, several emerging nations have called for reducing the role of the dollar in global trade and finance. But Yellen in her remarks Tuesday suggested little concern on that front. “Realistically there are not alternatives to the dollar, euro, yen, so I’m not too worried about that,” she said. “With regard to financial stability I suppose a risk would arise if there were a massive shift away from currencies, but I think that is extremely unlikely — especially given the uniqueness of this situation, a situation where Russia is brazenly violating international norms.”

Of note: The EU is slowly making progress on plans to at least apply a windfall tax to the profits generated by the immobilized funds. Last year, the funds enabled profits of €4.4 billion ($4.77 billion). Ursula von der Leyen, the president of the European Commission, said that the EU should use windfall profits from Russian central-bank assets in Western accounts to procure weapons for Ukraine. It is the first time the EU has linked the use of frozen Russian assets to arm Ukraine. More than €200 billion ($216 billion) of Russian assets are frozen in the bloc.

— Kremlin cautions against NATO ground intervention in Ukraine after President Macron's comments, sparking discussions among European leaders. Remarks from President Emmanuel Macron of France, suggesting potential NATO troop deployments to Ukraine, were met with clarifications from Poland, Germany, Sweden, Spain, Italy, and the Czech Republic, emphasizing they are not considering such action. France clarified Macron's intent, highlighting the need for new support strategies for Ukraine. The discussions underscore NATO's challenges in addressing the conflict, with options beyond ground intervention being explored amid tensions between Russia and the West. Despite discussions, the possibility of NATO ground intervention remains unlikely, with efforts focused on alternative support measures for Ukraine's defense needs.

The Kremlin warned Tuesday that a ground intervention by any NATO country would lead to a direct clash between the Western military alliance and Russian forces, fraught with potential dangers, and called the open discussion of such a step as “a very important new element… This is of course not in the interest of these countries,” Dmitri S. Peskov, the Kremlin spokesman, said in comments to reporters.

|

POLICY UPDATE |

— New farm bill continues to go backwards with Stabenow threatening to block it over House GOP proposals. Senate Ag Chairwoman Debbie Stabenow during a White House event on anti-hunger said she would rather forego a new farm bill than strike a deal with Republicans on their priorities, Politico reported. House Republicans are insisting they need to repurpose billions of funding from the Inflation Reduction Act’s climate-smart ag funding and limiting new updates via the Thrifty Food Plan to increase reference prices until Title I farmer safety net programs. “I'm not going to do it. So, if that means we continue the policies of the 2018 Farm Bill, which were pretty good if I do say so myself, then that's OK,” Stabenow said. “That's OK with me, because we're not going to go backwards on feeding people, and we're not going to go backwards, by the way, on the climate conservation money that we also have there that is so critical.”

USDA Secretary Tom Vilsack nodded in agreement as he sat next to Stabenow, Politico reported. “God, you’re tough. That’s great,” Vilsack said after Stabenow spoke.

Vilsack has repeatedly suggested using USDA funding from the Commodity Credit Corporation to help pay for some programs to overcome the impasse in the farm bill negotiations. Vilsack could make similar comments when he testifies this afternoon before the Senate Ag Committee.

Perspective from a veteran farm bill watcher: “If Trump is elected and he reverses Vilsack’s Thrifty Food Plan action that increased spending by $250 billion, House Ag Chairman G.T. Thompson’s (R-Pa.) idea to remove the Secretary’s authority to unilaterally increase — or decrease — SNAP funding in this way may look very appealing in hindsight. Under Biden, IRA climate dollars can’t all be spent before they expire. This may be even more true under Trump. And a budget reconciliation could cut the funding off altogether even before 2031 when all funding currently dries up, again making Thompson’s idea look very attractive. Those who fail to see opportunity in Thompson’s ideas ought to reread the children’s book, The Bull and the Beauty. The argument that Thompson’s ideas would set back SNAP or IRA are ideological, not based in fact and anybody who knows Thompson — and the details of his ideas — knows that. Maybe preventing a farm bill is all just election year politics?”

Link to video of the White House conference, including Stabenow’s remarks.

— 24 states looking to undo EPA’s wetlands and waters rule (WOTUS). A coalition of 24 states, led by West Virginia, is challenging the Environmental Protection Agency's (EPA) updated wetlands and waters rule, alleging that it disregards court rulings and imposes hefty fines and penalties on citizens for noncompliance. The states argue that the EPA violated the Clean Water Act and the Administrative Procedure Act when revising the Waters of the United States (WOTUS) rule to align with the Supreme Court's Sackett v. EPA decision. The Sackett ruling narrowed federal water protections by requiring a continuous surface connection to larger navigable bodies of water for waters and wetlands to be considered WOTUS. The EPA's revised rule, issued without public comment, failed to define key terms such as "relatively permanent" and "continuous surface connection," leaving intermittent streams and disconnected wetlands susceptible to federal protections. The plaintiffs seek to vacate the amended rule, urging the court to instruct the agencies to revise it within legal boundaries. The case, led by West Virginia v. EPA, involves a diverse coalition of states and intervenors from various industries challenging the EPA's regulatory approach.

— Wiesemeyer and Haney: Mexican tortillas, major grocer merger on the brink, and Farm Bill follies. Link to the podcast/video.

|

PERSONNEL |

— EPA’s hiring spree is prompting questions from leaders of the House Energy and Commerce Committee. Chair Cathy McMorris Rodgers (R-Wash.) and Environment subcommittee Chair Buddy Carter (R-Ga.) wrote to agency Administrator Michael Regan in a Feb. 22 letter (link) requesting a categorized breakdown of the almost 2,000 new agency employees.

— Gooden confirmed as USDA undersecretary. The Senate confirmed Basil Gooden, a USDA rural development official, as the agency's undersecretary for rural development, succeeding Xochitl Torres Small, who was elevated to deputy secretary last July.

|

CHINA UPDATE |

— Brazil announced that China has eliminated tariffs on Brazilian poultry. In 2019, China imposed tariffs ranging from 17.8% to 34.2% on Brazilian poultry imports to prevent "dumping" on its market. To address concerns about pricing, Brazilian poultry firms signed "price commitments" with the Chinese government. However, President Luiz Inácio Lula da Silva stated on social media that the tariffs have now dropped to zero. Brazil's Foreign Ministry confirmed that the tariff expired on Feb. 17, signaling improved competitiveness for Brazilian poultry in the Chinese market.

— China authorizes pork imports from three Russian enterprises. China’s customs service authorized three Russian enterprises to ship pork to the country from Feb. 28, Russian agricultural watchdog Rosselkhoznadzor said. Pork products packaged after that date of registration will be allowed for delivery into China.

— China’s property woes worsen with Country Garden petition. Chinese developer Country Garden said on Wednesday a liquidation petition has been filed against it for non-payment of a $205 million loan, clouding its debt revamp prospects and undermining Beijing’s effort to restore confidence in the property sector. Country Garden said in a regulatory filing to the Hong Kong Stock Exchange it would “resolutely” oppose the petition, which was filed by a creditor, Ever Credit Limited, a unit of Hong Kong-listed Kingboard Holdings. A court hearing had been set for May 17. The petition comes a month after China Evergrande Group was ordered to be liquidated by a Hong Kong court.

|

ENERGY & CLIMATE CHANGE |

— Corporate pressure driving carbon footprint reduction: Ashurst report. A recent report (link) indicates that the impetus for companies to reduce their carbon footprint is increasingly originating from within their own organizations rather than from external sources such as customers or regulators. According to a survey by law firm Ashurst, three-quarters of business leaders in the Group of 20 nations cited pressure from their corporate boards as the primary driver for investing in renewable energy. Specifically, 77% of U.S. business leaders described this pressure as either extreme or significant. Ashurst noted that the corporate push to decarbonize is gaining momentum, with 30% of business leaders reporting extreme pressure from their boards, up from 25% in 2022. Link to details via the Wall Street Journal.

— Apple is reportedly discontinuing its efforts to develop an electric car to compete with Tesla, according to Bloomberg's report (link) on Tuesday. The team responsible for this project, known as the Special Projects Group, employed thousands of employees. However, this initiative diverged from Apple's core business of electronics and online services. Reports about Apple's electric car program initially emerged in 2014, but the company has kept its plans largely under wraps since then.

— Southwest Airlines partners with LanzaJet to produce sustainable aviation fuel (SAF) from corn, investing $30 million in a U.S. plant. The move aligns with growing pressure on airlines to reduce emissions and taps into gov’t incentives for cleaner fuel. LanzaJet aims to utilize U.S. ethanol, predominantly corn-based, signaling potential opportunities for U.S. farmers.

The companies also plan to collaborate on advancing SAF production from corn residue through Saffire Renewables. The plant construction is anticipated to take three to four years, with the goal of producing 1 billion gallons of SAF annually by 2030.

— Nuclear and hydropower push for tax credit in hydrogen debate. Nuclear and hydropower sectors are urging the Biden administration to permit up to 20% of low-emission power plants to qualify for a lucrative tax credit aimed at promoting hydrogen production without raising emissions from the power grid. This issue has become a central point of contention as the Treasury Department finalizes the 45V Clean Hydrogen Production Tax Credit. The incentive has sparked heated debate within the hydrogen industry and environmental organizations, with concerns raised that such a provision could lead to a significant increase in emissions, potentially violating the intent of the Inflation Reduction Act (Climate Bill). The Treasury Department is expected to gather further input from stakeholders during a public hearing scheduled for March 25.

The Treasury Department’s proposed rules would overly restrict the industry and “stifle the capital-intensive investments necessary to develop the sector,” West Virginia Sen. Shelley Moore Capito (R) told the department. Capito, ranking member of the Environment and Public Works Committee, said the so-called “Three Pillars” rules in the proposed guidance imposing stricter environmental and power sourcing standards for hydrogen production credit eligibility would stifle the nascent industry and hinder investment activity. Expanding the use of hydrogen can take place only if technology-neutral policies are implemented, she said. “By contrast, your agency’s guidance that substitutes wishful thinking for a balanced approach that will grow multiple types of hydrogen production will choke off nascent technologies and ensure that a hydrogen based economy does not happen,” she said in her letter (link).

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— USDA begins trial allowing higher swine line speeds until 2025. USDA's Food Safety and Inspection Service (FSIS) has initiated a new time-limited trial (TLT) allowing certain slaughter facilities to operate at swine line speeds up to 1,106 head per hour (hph) and higher speeds until Jan. 15, 2025. The trial involves on-site visits, worker interviews, and observations of plant operations to assess safety and efficiency. Participating establishments must meet original TLT criteria and provide relevant data. Worker safety agreements with unions or representatives remain mandatory, with documentation required quarterly. Results from the study will inform potential rulemaking on line speeds. The TLT was launched in November 2021 following legal actions regarding the New Swine Slaughter Inspection System (NSIS). However, a third-party evaluation found insufficient data on the impact of faster line speeds on worker safety, leading to a 90-day extension granted in November 2023.

— Americans are adapting their eating, shopping, and lifestyle habits in response to record food inflation. A Wall Street Journal article (link) highlighted this trend, prompting hundreds of reader responses. Individuals are implementing new strategies such as reducing dining out, relying on coupons, purchasing items in bulk, and decreasing consumption of packaged food, meat, and organic vegetables. While some consumers feel healthier due to these changes, others are facing challenging sacrifices.

|

HEALTH UPDATE |

— Alabama proposes IVF protection bill after court ruling. Alabama's Senate and House introduced bills aimed at safeguarding providers of in vitro fertilization (IVF) treatments in response to a recent Alabama Supreme Court ruling. The ruling categorized frozen embryos as children, creating the possibility of legal liability for those involved in destroying them. Considering this decision, several fertility treatment facilities in Alabama have suspended certain IVF programs due to concerns about potential legal repercussions for their staff. Additionally, a proposed bill in Florida, which sought to define a fetus as an "unborn child" and extend liability for wrongful death lawsuits, has been indefinitely delayed following the Alabama ruling.

|

POLITICS & ELECTIONS |

— Biden wins Michigan primary, faces dissent over Gaza policy. President Biden secured a decisive victory in the Michigan Democratic primary, garnering over 80% of the vote with 95% of the ballots counted. However, despite this overwhelming win, Biden and his party face political vulnerabilities. A notable aspect of the primary was the significant portion of voters — more than 13% statewide — who expressed disapproval of Biden by casting their ballots as "uncommitted." In Wayne County, which includes Dearborn and has a substantial Arab American population, the "uncommitted" vote reached 17% of the Democratic primary result. This reflects sentiments critical of U.S. policy in Gaza, particularly regarding antiwar views. Notably, in Dearborn itself, the "uncommitted" option triumphed over Biden by a significant margin. This outcome underscores the presence of dissent within the Democratic Party, with a notable segment of voters using the primary as a platform to express dissatisfaction with certain policies and positions, particularly those related to international affairs such as the situation in Gaza. Despite Biden's strong showing in the primary, these dissenting voices highlight potential challenges for both the president and his party moving forward.

Impact: Link to the New York Times’ The Tilt to see various potential ramifications.

Bottom line: While Biden handily won the state’s Democratic primary, more than 100,000 votes for “uncommitted” were cast to protest his support for Israel regarding the war in Gaza. That could spell danger for his re-election bid: He won the state in 2020 by just 150,000 votes.

— Trump's easy win in Michigan primary failed to conceal the division in his party. Roughly 68% of Republicans voted for Trump while 27% voted for former South Carolina Gov. Nikki Haley — indicating a sizable group of Republicans are either firmly opposed to him or still to be won over.

— Both political parties aim to secure more favorable congressional maps in key states to enhance their chances of winning the House in the upcoming fall elections. Of note:

- In New York and Wisconsin, Democrats are pursuing changes to achieve more competitive House districts.

- In Louisiana, a lawsuit has been filed by minority voters to block a new congressional map that includes a second majority-Black district.

- Meanwhile, Republicans in North Carolina anticipate gaining seats with a redrawn House map, although legal challenges may impact its implementation before November.

These redistricting battles hold significant implications for the balance of power in Congress and are closely watched as the election approaches.

— President Biden and former President Donald Trump are both scheduled to visit the U.S./Mexico border this Thursday. During Biden's visit to Brownsville, Texas, he plans to meet with border patrol agents, law enforcement, and local leaders to discuss the necessity for a border agreement. Reports suggest Biden is contemplating significant executive actions aimed at limiting the ability of migrants to seek asylum if they enter the country illegally.

Meanwhile, Trump is expected to deliver remarks in Eagle Pass, Texas, following an endorsement from Texas Governor Greg Abbott. Abbott has actively worked to challenge Biden's border policies, aligning himself with Trump's stance on immigration.

— Wasserman’s latest prediction on House outcome following Nov. 5 elections. David Wasserman of the Cook Political Report with Amy Walter says: “The House is probably Democrats' best chance at holding a lever of power in 2025. But, I still think it's only a 33%-40% chance.”

|

OTHER ITEMS OF NOTE |

— French banks offer preferential rates to farmers amid crisis, including loan suspension option. It pays to protest, at least in France. French Finance Minister Bruno Le Maire announced that banks, including Credit Agricole SA and BNP Paribas SA, will offer preferential lending rates to farmers, ranging from 0% to 2.5%. This initiative is part of the government's efforts to address the ongoing crisis in the agriculture industry, which has led to weeks of protests. Additionally, farmers facing financial difficulties will have the option to negotiate a one-year suspension of existing loans and extend repayment schedules for up to three years beyond that. Le Maire emphasized that these measures will provide significant relief to farms facing the greatest challenges amid falling prices and increasing regulatory pressures from the European Union.

— France is banning terms like "fillet" and "ribeye steak" for plant-based products to enhance transparency and reduce consumer confusion. The government's decree, effective in three months, prohibits 21 terms, aiming to clarify labels. A previous attempt in 2022 was suspended due to vagueness. Additionally, animal-based products can use meat labels if plant content stays below specified thresholds, such as 0.5% for bacon and 3.5% for nuggets.

— President Biden will issue an executive order today to restrict the sale of sensitive data to China, Russia and four other countries, a first-of-its-kind attempt to keep personally identifying information from being snagged for blackmail and scams. The action, administration officials said, is designed to counter a growing national-security risk posed by the often-revealing data generated by mobile apps, smartwatches, car sensors and other ubiquitous digital devices. That data can be repurposed and weaponized as a means of intelligence collection by foreign spy agencies.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |