Key to FY 2024 Issues: Will GOP Release Funding Language Today for Some Agencies

U.S./Mexico GMO corn-for-food flap | Kroger-Albertsons merger | Panama Canal | U.S. dollar

|

Today’s Digital Newspaper |

MARKET FOCUS

- U.S. durable goods orders fall sharply

- U.S. dollar experiencing surge in financial markets

- Bitcoin surges past $57,000, marking highest value since late 2021

- FTC, states sue to block Kroger-Albertsons merger over wage and price concerns

- Schmid: Fed should be patient in cutting interest rates with inflation above 2% target

- Yellen praises U.S. economy's strength amid global economic talks

- Dimon: Commercial real estate issues will remain limited to certain areas within sector

- Norfolk Southern pushes two new director candidates amid pressure from activist

- Ag markets today

- USDA daily export sale: 123,000 MT soybeans to unknown during 2023-2024 MY

- Vietnam imports husked brown rice from India for re-export

- Indonesia plans to double palm oil replanting subsidy

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Capitol Hill's focus on White House today as congressional leaders meet with Biden

ISRAEL/HAMAS CONFLICT

- Israel agrees to halt military activities in Gaza during Ramadan

RUSSIA & UKRAINE

- Macron: No consensus on troop deployment to Ukraine, vows action against Russia

- Ukraine: More U.S. aid critical to keeping Black Sea grain shipments safe

POLICY

- ERP payments show modest rise

- USDA details updates to Dairy Margin Coverage (DMC) program

PERSONNEL

- Review: Defense Secretary Austin and his team never acted with bad

- Acting Labor Secretary Julie Su faces Senate panel vote today

CHINA

- U.S. will allow further direct flights with China, though well below pre-Covid levels

- Chamber of Commerce CEO Suzanne Clark leading a delegation to China this week

- China props up renminbi ahead of leadership summit in March

TRADE POLICY

- Update on U.S./Mexico GMO corn-for-food issue

- Tester and Rounds introduce resolution against Paraguayan beef imports

ENERGY & CLIMATE CHANGE

- House Republicans question Biden's EV program progress, seek response

- Oil lobby challenges Biden's LNG export pause, market concerns raised .

- DOE seeking approximately 3 million barrels of oil for the Strategic Petroleum Reserve

- Indonesia anticipates a rise in biodiesel consumption in 2024

POLITICS & ELECTIONS

- Biden and Trump both schedule visits to U.S./Mexico border in Texas on Thursday

- N.Y. Dems reject bipartisan commission’s House Map, want their own

OTHER ITEMS OF NOTE

- Historic U.S. moon mission, led by Odysseus, ending prematurely images back to Earth.

- DC cherry blossoms expected to hit peak bloom as soon as March 19

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mostly higher in overnight trading. U.S. Dow is currently around 150 points lower. In Japan, the two-year bond yield climbed to the highest since 2011 after stronger-than-expected inflation boosted bets that the country’s long era of negative interest rates could end as early as March. In Asia, Japan flat. Hong Kong +0.9%. China +1.3%. India +0.4%. In Europe, at midday, London flat. Paris +0.1%. Frankfurt +0.4%.

U.S. equities yesterday: Major indices opened the week with losses, falling back from lofty marks struck last week. The Dow was down 62.30 points, 0.16%, at 39,069.23. The Nasdaq eased 20.57 points, 0.13%, at 15,976.25. The S&P 500 was down 19.27 points, 0.38%, at 5,069.53.

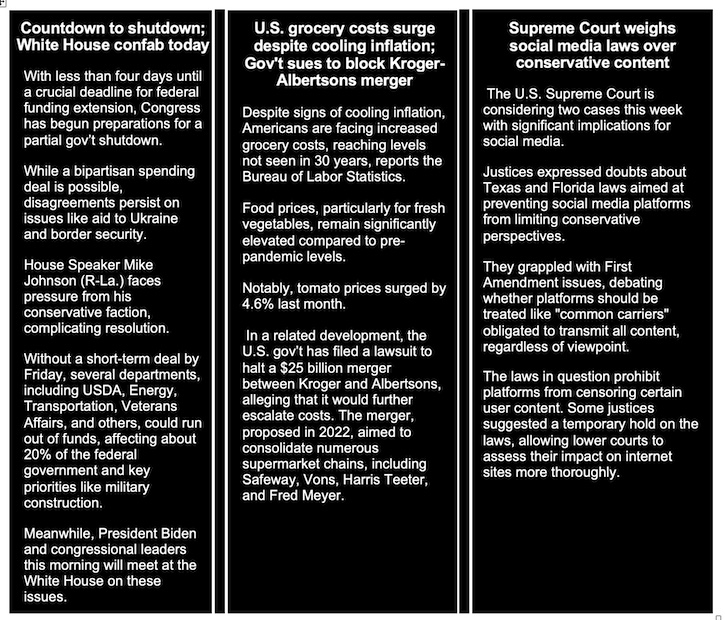

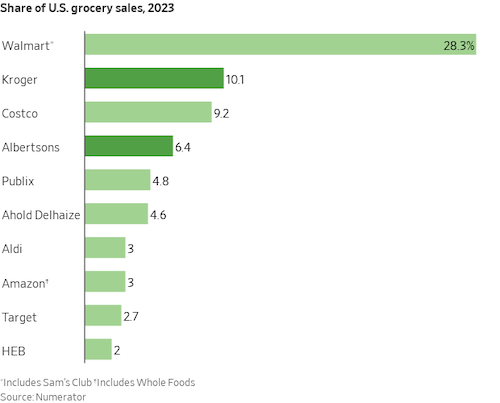

— FTC, states sue to block Kroger-Albertsons merger over wage and price concerns. The U.S. Federal Trade Commission, along with eight states and Washington DC, filed a lawsuit to block Kroger Co.'s $24.6 billion acquisition of Albertsons Cos., citing concerns over its potential negative impact on workers' wages and grocery prices. The merger, if allowed to proceed, would create the largest U.S. grocery deal in history, combining the two largest supermarket chains and resulting in nearly 5,000 stores across the country.

Both Kroger and Albertsons have defended the deal, emphasizing their plans to invest in reducing prices and raising worker wages and benefits. However, the FTC and states argue that the merger would harm consumers by reducing competition, leading to higher prices and poorer quality of service.

The complaint alleges that the deal would give the combined company increased leverage over workers, resulting in slower wage growth and worse benefits. Kroger and Albertsons have proposed divesting 413 stores to address antitrust concerns, but the FTC argues that this remedy would be inadequate.

Of note: The FTC says the acquisition would lead to higher food prices and lower wages for workers despite the companies’ plan to sell hundreds of stores. The companies argue the combination would have the opposite effect by making their operations more cost-efficient and better able to compete with Amazon, Walmart and Costco. The deal has been opposed by some farm groups because of its potential impact on supply chains. The tie-up aims to bolster the grocers’ scale, technology, and leverage in negotiations with suppliers. To try to alleviate antitrust concerns, Kroger and Albertsons agreed to sell 413 stores to C&S Wholesale Grocers, one of the sector's biggest suppliers.

The lawsuit reflects a broader trend of increased antitrust enforcement by the Biden administration, which has taken a more aggressive stance on mergers. Lawmakers and unions, including the Teamsters and United Food and Commercial Workers International, have also opposed the merger, citing concerns about job cuts and reduced wages.

The lawsuit underscores the intense competition in the U.S. grocery sector, where companies are vying for market share amid growing consumer demand for food and essentials.

Bottom line: Barron’s notes that the combined Kroger-Albertsons would operate 5,000 stores and have $228 billion in annual sales. Their combined market share of 15% to 20% would still be smaller than Walmart, which has more than 5,200 U.S. locations and makes more than a quarter of its sales in groceries.

— Ag markets today: Soybeans firmed amid followthrough buying overnight, while corn and wheat mildly favored the upside in light trade. As of 7:30 a.m. ET, corn futures were trading steady to fractionally higher, soybeans were 8 to 11 cents higher, SRW wheat was a penny lower to fractionally higher, HRW wheat was fractionally to a penny higher and HRS wheat was 4 to 7 cents higher. Front-month crude oil futures were marginally lower, and the U.S. dollar index was around 150 points lower.

Beef packer margins remain deeply negative. Wholesale beef prices continued their climb on Monday, with Choice up $1.18 to $301.79, while Select firmed $1.68 to $287.99. While wholesale beef prices are climbing as retailers begin purchases for post-Easter features, cash cattle prices firmed $2.60 last week to $182.95, the highest since the first week of November. As a result, packer margins remain deep in the red, which will keep them in management mode amid tight market-ready supplies.

Traders narrow hog futures premium to cash index. The CME lean hog index is up another 36 cents to $79.46 as of Feb. 23. After Monday’s decline, April lean hog futures finished at a $6.815 premium to today’s cash quote. Despite a persistent seasonal rise in the cash index, traders are hesitant to allow the premium in the nearby contract to get too wide. The five-year average increase in the cash index from now until mid-April is nearly $7.50.

— Agriculture markets yesterday:

- Corn: May corn rose 8 cents to $4.21 1/2, near the session high after forging a fresh contract low early on.

- Soy complex: May soybeans rallied 3 1/2 cents to $11.45 1/4. May soybean meal rallied 60 cents to $328.6, settling near the mid-point of today’s session. May bean oil rose 42 points to 45.02 cents.

- Wheat: May SRW wheat closed up 5 3/4 cents at $5.74 3/4 and nearer the session high. May HRW wheat rose 11 cents to $5.76 1/2 and nearer the session high. May spring wheat rose 6 cents to $6.52 3/4.

- Cotton: May cotton surged 131 points to 94.80, the highest close in more than a week.

- Cattle: April live cattle rose 20 cents to $188.10, nearer the session high and closed at a four-month-high close. May feeder cattle fell 50 cents to $261.575, nearer the session high and hit a 4.5-month high early on.

- Hogs: April lean hog futures dropped 92.5 cents to $86.275, settling near mid-range.

— Quotes of note:

- Fedspeak. The Fed should be patient in cutting interest rates with inflation above its 2% target and the job market still strong, Jeffrey Schmid said in his first major speech since taking the job six months ago as president of the Federal Reserve Bank of Kansas City.

- Yellen praises U.S. economy's strength amid global economic talks. Treasury Secretary Janet Yellen will highlight the U.S. economy's robustness as a significant factor in global economic resilience during meetings with top officials from G20 and developed nations in Sao Paulo, Brazil. Yellen's prepared remarks underscore that predictions of a worldwide economic slowdown in 2023, as forecasted by the International Monetary Fund and others, did not come to fruition.

- JPMorgan Chase CEO Jamie Dimon believes that issues in commercial real estate will remain limited to certain areas within the sector as long as the US economy avoids a recession. Speaking on CNBC, Dimon stated that many property owners can manage the current level of stress. He emphasized that lower valuations due to higher interest rates are not a crisis but rather a familiar occurrence. Dimon made these comments during an interview at JPMorgan's annual high-yield and leveraged-finance conference in Miami.

— U.S. durable goods orders fall sharply. In January 2024, new orders for manufactured durable goods in the United States experienced a significant decline of 6.1% compared to market expectations of a 4.5% fall, marking the largest monthly decrease since April 2020. This decline was primarily led by a sharp drop in orders for transportation equipment, which fell by 16.2%, driven by reduced demand for nondefense aircraft and parts as well as motor vehicles and parts. Additionally, orders decreased for fabricated metal products, primary metals, and capital goods. Excluding transportation, new orders decreased by 0.3%, while excluding defense, they fell by 7.3%. However, orders for non-defense capital goods excluding aircraft, a key indicator for business spending plans, saw a slight increase of 0.1% following a decrease in December.

— Surprise: The Panama Canal’s revenues jumped 14.9% in 2023 despite drought restrictions. In fiscal year (FY) 2023, the Panama Canal handled 511.1 million PC/UMS tonnes, slightly less than the previous year's 518.5 million. Despite facing transit restrictions due to water shortages caused by climate change, officials anticipate a 2.7% increase in revenues for FY 2024. The forecasted revenue distribution for FY 2024 includes 74.56% from tolls, 23.21% from maritime services, and smaller percentages from electricity and water sales. This revenue boost is attributed to a toll system implemented in January 2023, despite ongoing transit and draught restrictions. Canal Administrator Ricaurte Vásquez highlighted the need for additional water sources and proposed building an extra reservoir, emphasizing the canal's importance to both global trade and Panama's economy. However, such initiatives require government and legislative action.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker, with the yield on the 10-year U.S. Treasury note was nearly unchanged, trading around 4.28%, with a mostly higher tone in global government bond yields. Crude oil futures were weaker, with U.S. crude around $77.50 per barrel and Brent around $81.55 per barrel. Gold and silver futures were firmer with gold around $2,045 per troy ounce and silver around $22.61 per troy ounce.

— U.S. dollar is experiencing a surge in financial markets. It's approaching its pandemic-era peak and stands significantly higher against currencies of major trading partners, up 17% compared to the average over the past two decades. Several factors contribute to this trend: continuous inflows into US risk assets, the country's economic resilience, and reduced expectations for imminent interest rate cuts by the Federal Reserve. Additionally, economists have revised their forecasts for U.S. growth in 2024 to 2.1%, while the likelihood of an upcoming recession has decreased to 40%, according to Bloomberg surveys.

— Bitcoin has surged past $57,000, marking its highest value since late 2021. The recent rally has been fueled by the launch of new U.S.-listed ETFs in mid-January, attracting over $6 billion in investments. Additionally, MicroStrategy, a company actively purchasing Bitcoin, now holds approximately $10 billion worth of the cryptocurrency. CoinGecko reports that the total value of digital assets has reached around $2.2 trillion, a significant increase from the low point of about $820 billion during the bear market of 2022, which saw the collapse of platforms like FTX. The question now is how long the rally can hold.

— Norfolk Southern has put forward two new director candidates amid pressure from activist shareholder Ancora Holdings Group, which seeks to replace the CEO and revamp the board. The nominees, former Delta CEO Richard Anderson and ex-North Dakota senator Heidi Heitkamp (D), are part of a 13-member slate proposed by the company. Ancora Holdings Group has criticized Norfolk Southern's decision-making and performance, prompting the railroad to counter a potential proxy fight. This move comes amid challenges, including a costly derailment in East Palestine, Ohio, last year, which attracted significant public attention. Ancora’s slate of new directors includes former Ohio Gov. John Kasich and it wants to install former United Parcel Service executive Jim Barber and former CSX official Jamie Boychuk in the top two management posts. Norfolk Southern warns in its proxy materials that Boychuk has a reputation for extreme cost-cutting.

— Vietnam imports husked brown rice from India for re-export. Vietnam is importing husked brown rice from India for the first time in decades to process and export the refined, white variety, trade and government sources told Reuters. Vietnam imported at least 200,000 MT of husked brown rice from India between December and February, the sources said. Vietnam is receiving brisk export orders for rice after India, the world's biggest exporter, imposed a ban on white rice exports in 2023.

— Indonesia plans to double palm oil replanting subsidy. Indonesia plans to double its palm oil replanting subsidy to boost farmer participation in the program. The new subsidy will rise to 60 million rupiah ($3,833.87) per hectare, the country’s economy minister said, without giving a date of when the higher payments will be enacted. Farmers receive subsidies to buy palm seedlings and cultivate new palm trees to replace older, less fruitful trees. However, participation has been slow because of administrative hurdles and farmers’ concerns over loss of income while they wait for the trees to mature.

— USDA daily export sale: 123,000 MT soybeans to unknown during 2023-2024 MY

— Ag trade update: Taiwan tendered to buy up to 65,000 MT of corn from the U.S., Brazil, Argentina or South Africa. Indonesia tendered to buy 300,000 MT of 5% broken grade white rice from unspecified origins.

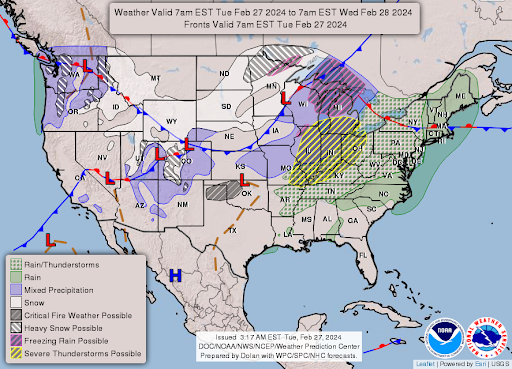

— NWS weather outlook: Heavy snow returns over parts of the Cascades, the Northern Intermountain Region, and Northern Rockies on Wednesday... ...Heavy snow over parts of the Upper Mississippi Valley and moderate to heavy snow over the Cascades to Central Rockies on Tuesday... ...Light to moderate snow over the Great Lakes, Central Appalachians, and Northeast on Wednesday... ...There is a Slight Risk of severe thunderstorms over parts of the Ohio Valley/Great Lakes on Tuesday.

Items in Pro Farmer's First Thing Today include:

• Grains mostly firmer overnight

• Cordonnier leaves South American crop estimates unchanged

• HRW crop ratings continue to improve in February

• Cold Storage Report: Friendly compared to seasonal tendencies

|

CONGRESS |

— Capitol Hill's focus is on the White House today as the top congressional leaders meet with President Joe Biden ahead of a possible gov’t shutdown at midnight Friday. Biden aims to pressure House Speaker Mike Johnson (R-La.) to move on a funding deal and foreign aid for Ukraine and other allies. Senate leaders oppose a shutdown and support Ukraine aid, leaving Johnson isolated. Pressure mounts on Johnson as he faces internal party divisions and potential repercussions. Despite Johnson's reluctance, a short-term funding bill remains a possibility.

Policy riders sought by conservative Republicans remain some of the major sticking points, with Senate Minority Leader Mitch McConnell (R-Ky.) calling for lawmakers to strike those from the bills and push forward with a “clean” appropriations package.

Extra funding for the Special Supplemental Nutrition Program for Women, Infants and Children (WIC) program is another hurdle, with Democrats pushing for $1 billion in extra funding while Republicans are seeking a much smaller level.

What’s missing? Language detailing the four-bill spending package that needs to pass by Friday at midnight. Any legislation must be released today for House Republican leadership to adhere to its three-day rule and still avert a shutdown Friday at midnight without passing a Continuing Resolution (CR).

Bottom line: Unless paperwork is released today, Congress might have to pass another funding extension until lawmakers can reach an agreement that satisfies both sides. However, House Freedom Caucus Chairman Bob Good (R-Va.) told Fox that a shutdown isn’t the worst thing, and that Republicans shouldn’t hold hands with Democrats just to show they are governing. That is not a universal conclusion among Republicans. Senate Majority Leader Chuck Schumer (D-N.Y.) warned a shutdown would “threaten higher food costs for all Americans, threaten critical services for farmers and rural communities, from home ownership programs to food banks and delay access to critical programs just as spring is arriving.”

|

ISRAEL/HAMAS CONFLICT |

— Israel agreed to halt military activities in Gaza during Ramadan, the Muslim holy month that begins on March 10, according to President Joe Biden, who said he hoped the ceasefire would be in place by next Monday. The U.S., Egypt and Qatar have been trying to secure a deal under which Hamas would release Israeli hostages in return for a pause in the fighting and more aid deliveries to Gaza. Hamas is reportedly considering the idea. Hamas officials countered that there were still “big gaps” that needed to be addressed in the ceasefire offer, according to Reuters. Indications are the effort does not cover the release of some Israeli hostages nor does it contain the Hamas demand that Israel include a permanent end to the war and for Israel to withdraw from Gaza.

|

RUSSIA/UKRAINE |

— Macron: No consensus on troop deployment to Ukraine, vows action against Russian dominance. After a meeting hosted by Emmanuel Macron in Paris, the French president stated that European and allied leaders did not come to a unified agreement on whether to deploy troops to Ukraine. Despite this, Macron did not dismiss the possibility entirely. He emphasized that efforts would be made to prevent Russia from achieving dominance, asserting, "we will do everything we can to make sure that Russia does not prevail."

— Ukraine says more U.S. aid critical to keeping Black Sea grain shipments safe. Ukrainian President Volodymyr Zelenskyy said that without new U.S. military aid his country would be unable to defend a Black Sea shipping corridor that has allowed the country to export millions of tons of grain to global markets. “We... created the new route in the Black Sea,” Zelenskyy told CNN in an interview, describing the shipping corridor as a “big success” for so far allowing the export of about 30 MMT of grain and other agricultural products. But he warned that if the U.S. Congress did not approve $60 billion in new security aid, then the future of the shipping corridor would be in doubt.

|

POLICY UPDATE |

— ERP payments show modest rise. There has been only a slight increase in Emergency Relief Program (ERP) payments, despite USDA's efforts to finalize payments under Phase 1. As of Feb. 25, total ERP payments stand at $8.63 billion, showing minimal change from the previous week. Phase 1 ERP payments have slightly risen to $7.75 billion from $7.74 billion, while Phase 2 payments having increased marginally to $883.1 million from $882.8 million.

— USDA announced updates to the Dairy Margin Coverage (DMC) program, allowing eligible dairy producers to enroll starting Feb. 28 with retroactive enrollment to Jan. 1. The details, published in the Federal Register (link), include a one-time adjustment to production history, extending DMC through 2024, and extending eligibility of multi-year contracts until Dec. 31, 2024. The discounted premium rate will apply to the adjusted production history. Signup runs until April 29, with past extensions common.

|

PERSONNEL |

— Defense Secretary Lloyd Austin and his team never acted with bad intentions when he failed to immediately disclose his recent hospitalization, according to a Pentagon review.

— Acting Labor Secretary Julie Su faces a Senate Health, Education, Labor, and Pensions Committee vote today for her renomination to the permanent position. Ranking member Bill Cassidy (R-La.), who opposes Su's nomination, had advocated for another hearing and expressed disapproval of the vote's scheduling in a recent floor speech.

|

CHINA UPDATE |

— U.S. will allow further direct flights with China, though they remain well below pre-Covid levels. Starting March 31, Chinese airlines will be permitted to fly 50 round trips a week, up from 35 currently, the Transportation Department said in a statement.

— Chamber of Commerce CEO Suzanne Clark is leading a delegation to China this week to engage with officials and executives from both countries, indicating a positive trend in relations between the world's largest economies. The group includes former U.S. gov’t officials and aims to foster dialogue and cooperation between the United States and China.

— China props up renminbi ahead of leadership summit in March. Strategists warn of sharp falls against dollar longer term if Donald Trump wins presidency in November and carries out tariffs threat. Link/paywall for details via the Financial Times.

|

TRADE POLICY |

— Update on U.S./Mexico GMO corn-for-food issue. In 2023, Mexico, the largest importer of U.S. corn, banned the use of genetically modified (GM) corn, prompting a trade dispute with the U.S. under the USMCA. The USMCA does not mandate GM crop authorization but requires science-based analyses for regulatory decisions. President López Obrador's decree aimed to promote food security and protect native corn varieties but posed concerns for U.S. corn exports. Despite U.S./Mexico consultations, the dispute remains unresolved. The U.S. initiated formal dispute proceedings, claiming the ban violates USMCA provisions. A dispute settlement panel was convened in August 2023, with oral arguments scheduled for June 2024. The panel's final report, expected in November 2024, will determine if Mexico must revoke the ban or face U.S. trade sanctions. Until then, Mexico's ban remains in place.

Perspective: We and U.S. government officials have contended all along this is primarily a domestic political issue in Mexico because López Obrador is from southern Mexico where most of the tortillas are made. This issue should go away after elections in June, when López Obrador is replaced by a new president.

— Tester and Rounds introduce resolution against Paraguayan beef imports over disease concerns. Populist Sens. Jon Tester (D-Montana) and Mike Rounds (R-S.D.) introduced a resolution to overturn USDA approval of chilled or frozen deboned beef imports from Paraguay due to concerns about the potential spread of foot and mouth disease. They cited worries about Paraguay's animal health standards and historical struggles to contain disease outbreaks. The resolution invokes a 1996 law that allows Congress to void federal agency rules through a resolution of disapproval, which can be signed or vetoed by the president. USDA's decision to allow imports followed a risk assessment by the Animal and Plant Health Inspection Service, which included conditions to prevent diseased cattle meat from entering the U.S. market. Despite assurances, eight cattle and farm groups opposed the imports, citing outdated data and lack of recent inspections of Paraguayan facilities by the USDA.

|

ENERGY & CLIMATE CHANGE |

— House Republicans question Biden's EV program progress, seek response from Secretaries Granholm and Buttigieg. House Republicans, led by Energy and Commerce Committee Chair Cathy McMorris Rodgers (R-Wash.), are questioning the effectiveness of Biden's electric vehicle (EV) program. In a letter (link/pdf), they highlight slow progress in EV infrastructure development, citing delays in charger delivery, labor contracting issues, and concerns about award distribution. Energy Secretary Jennifer Granholm and Transportation Secretary Pete Buttigieg are asked to address these issues by March 7.

— Oil lobby challenges Biden's LNG export pause, market concerns raised. Top oil industry lobbying groups, including the American Petroleum Institute, are challenging via a petition (link/pdf) the Biden administration's halt on approving new liquefied natural gas (LNG) exports. They argue that the indefinite delay contradicts a legal requirement for the Energy Department to issue permits for LNG exports unless it's clearly against the public interest. Additionally, a trade group representing LNG exporters expressed concerns about the pause, stating it could have adverse effects on the market, making it difficult for U.S. developers to secure financial commitments and complete projects before the next global supply surge.

— DOE is seeking approximately 3 million barrels of oil for the Strategic Petroleum Reserve for delivery in August, according to a notice yesterday. Bids are due no later than 11am CT on March 6.

— Indonesia anticipates a rise in biodiesel consumption in 2024, aiming for unblended biodiesel consumption between 12.5 million and 13 million kiloliters, compared to 12.2 million kiloliters in 2023. Energy Ministry official Edi Wibowo stated that biodiesel allocations are set at 13.4 million kiloliters, with hopes for realization within the specified range. The expected increase in biodiesel usage could potentially impact Indonesian palm oil exports, according to some analysts.

|

POLITICS & ELECTIONS |

— President Joe Biden and former President Donald Trump have both scheduled visits to the U.S./Mexico border in Texas on Thursday, setting the stage for a showdown over a key issue in the 2024 election. Biden plans to visit Brownsville, Texas, where he will advocate for a bipartisan Senate border security deal and meet with Border Patrol agents, law enforcement, and local leaders. Meanwhile, Trump will visit Eagle Pass, Texas, more than 300 miles away, highlighting the recent spike in border crossings.

Their competing visits come just before the Super Tuesday primaries on March 5, adding significance to the issue of immigration.

Biden's handling of the border crisis has become a political liability, with polls showing dissatisfaction among voters. He faces pressure to take action, but legal constraints limit his options.

Trump has vowed to implement strict border policies, including mass deportations and completing the border wall.

But the border issue has put Republicans on the defensive, especially after Trump torpedoed a bipartisan immigration deal. Biden will meet with congressional leaders Tuesday to discuss the border situation and a potential government shutdown. The Senate package, which was rejected by Republicans under Trump's urging, aimed to address border security and broader immigration reforms, as well as provide aid to Ukraine.

— New York Democrats plan congressional boundary redraw amid controversy. New York Democrats are moving to redraw congressional boundaries after rejecting a map approved by the Independent Redistricting Commission. This could disrupt campaign schedules and lead to further court battles. The Democrat-controlled Legislature will propose a new map, raising concerns of political manipulation. Critics argue that the rejection undermines reform efforts and creates uncertainty for candidates and voters. Legal challenges are expected, particularly regarding restrictions on where litigation can be filed. Republicans accuse Democrats of altering rules for political gain. The decision follows previous court interventions and disputes over redistricting. The situation remains fluid as further legislative action is awaited.

|

OTHER ITEMS OF NOTE |

— Historic U.S. moon mission, led by Odysseus, is ending prematurely as communication with the spacecraft has become difficult. Despite becoming the first U.S.-made spacecraft to land on the moon since the Apollo era, flight controllers anticipate losing contact with Odysseus soon. Intuitive Machines, the company behind Odysseus, shared grainy images following its rough landing, which hindered data collection and transmission. In a separate development, Japan's "Moon Sniper" unexpectedly reactivated on the lunar surface after a dormant period, transmitting new images back to Earth.

— DC cherry blossoms are expected to hit peak bloom as soon as March 19. The Capital Weather Gang’s prediction — between March 19 and 23 — is about 10 days earlier than normal. It would be one of the earliest peak blooms on record. Why so soon? Abnormally mild weather, which shows little sign of easing. It would fit into recent trends, fueled by human-caused climate change. Average peak has changed over the past century, from April 4 to March 30.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |