Countdown to Shutdown, Part 4: FY 2024 Funding Hurdles Remain Ahead of Tuesday Talks

House Speaker Johnson admits funding snags impacting new farm bill timeline

|

Today’s Digital Newspaper |

MARKET FOCUS

- Key financial reports this week

- Morgan Stanley: New U.S. population estimates may boost economic resilience

- Economists upping predictions for U.S. economic growth, lowering recession odds

- Malanga: Recent data suggest challenging path towards reaching Fed’s 2% inflation

- Bank of Japan received increased support for plan to end negative interest rate policy

- Ag markets today

- Cocoa futures climbed as much as 4.6% on Monday

- Indonesia allocates additional rice import quotas

- Grain trader and analyst Richard Crow sizes up soybean market

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Biden calls congressional leaders to WH or Tuesday talks on budget, Ukraine aid

ISRAEL/HAMAS CONFLICT

- Israel cautiously optimistic about potential progress in hostage & ceasefire negotiations

RUSSIA & UKRAINE

- Navalny body given to his mother by Russian officials

- Update on war in Ukraine

- Ukraine has exported 30 MMT ag goods through its Black Sea and Danube ports

- ‘Russia more isolated from global economy than at any point since end of old War’

- Kyiv urges Polish punishment for Ukrainian grain spills

POLICY

- Speaker Johnson acknowledges appropriations logjam holding up new farm bill

- Beginning Feb. 28, 2024, dairy producers can enroll in 2024 DMC program

- Farm groups urge USDA Action on milk pricing issue

- Minnesota Ag official denies discrimination allegations by white male farmer

CHINA

- China's trade strategy: Building an alternative architecture

- China explores ways to attract foreign investment

- China's sow herd liquidation continues

- Biden administration criticizes China's slow biotech approval, impacting U.S. farms

- BYD, prominent Chinese auto group, refutes EU allegations of success via state aid

TRADE POLICY

- WTO holding 13th biennial ministerial meeting in Abu Dhabi this week

- WTO chief urges reform amid global trade weakness

ENERGY & CLIMATE CHANGE

- Financial Times looks at role of America’s Strategic Petroleum Reserve

- USDA grants $144 mil. for farmers to adopt renewable tech; Energy offers $4 mil.

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Biden planning to address issue of food "shrinkflation" in SOTU address March 7

- Food price inflation is back in the outlook

- Walmart’s rethinking food, other costs

OTHER ITEMS OF NOTE

- SCOTUS this week confronts clash of views about free-speech protections on internet

- AT&T offering $5 credit to Wireless customers

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed in overnight trading. U.S. stock index futures are set to open narrowly mixed. In Asia, Japan +0.4%. Hong Kong -0.5%. China -0.9%. India -0.5%. In Europe, at midday, London -0.3%. Paris -0.3%. Frankfurt +0.1%.

U.S. equities Friday: The Nasdaq again flirted with a record finish but ended lower for the session but still ended the week in positive territory. The Dow and S&P 500 both registered new record finishes on Friday and posted gains for the week. The Dow rose 62.42 points, 0.16%, at 39,131.53. The Nasdaq lost 44.80 points, 0.28%, at 15,996.82. The S&P 500 ended up 1.77 points, 0.03%, at 5,088.80.

The S&P 500 rose 1.7% for the week and is up nearly 7% thus far in 2024. The Nasdaq composite saw a weekly gain of 1.4%. It is now up almost 7% so far this year. The Dow was up 1.3% for the week.

— Energy prices on Friday: Brent crude futures dropped 2.34% to $81.71 a barrel, while U.S. West Texas Intermediate crude futures slipped 2.57% to $76.59 per barrel.

— Ag markets today: Corn, soybeans and wheat traded lower overnight, with nearby corn and soybeans falling to new contract lows. As of 7:30 a.m. ET, corn and soybean futures were trading 2 to 3 cents lower, while wheat futures were 5 to 8 cents lower. Front-month crude oil futures were around 40 cents lower, and the U.S. dollar index was nearly 200 points lower.

Limited reaction expected to Cattle on Feed Report. USDA’s Cattle on Feed Report showed the Feb. 1 feedlot inventory up 0.4% from year-ago, while placements dropped 7.4% and marketings inched down 0.1%. The underlying data in the report is bullish as there continues to be a tightening supply of cattle moving into feedlots, with placements down from year-ago levels for a third straight month – a trend that will continue. But with placements near the top end of the wide range of pre-report estimates, it could take away some of the friendliness of the data. Still, we expect limited market response, especially after reports of higher cash cattle trade after the report Friday afternoon.

Cash hog index continues to rise, pork cutout drops. The CME lean hog index is up 32 cents to $79.10 as of Feb. 22, extending the seasonal price climb. The pork cutout value dropped 73 cents on Friday to $91.16, as a $9.36 decline in primal bellies more than offset gains in the other cuts.

— Agriculture markets Friday:

- Corn: March corn futures lost 6 1/4 cents to $3.99 3/4, settling nearer session lows. March futures lost 16 3/4 cents on the week.

- Soy complex: May soybeans fell 10 3/4 cents to $11.41 3/4 and lost 34 1/2 cents on the week. May soymeal fell $3.40 to $328.00, marking a $10.90 week-over-week loss. May soyoil fell 20 points to 44.60 cents and gave up 148 points on the week.

- Wheat: May SRW wheat futures prices fell 10 1/4 cents to $5.69 and for the week gained 10 cents. May HRW wheat lost 6 cents to $5.65 1/2 and for the week rose 4 cents. May spring wheat futures fell 8 3/4 cents to $6.46 3/4 and fell 8 3/4 cents on the week.

- Cotton: May cotton fell 97 points to 93.49 cents and gave up 93 cents on the week.

- Cattle: April live cattle futures rose $1.35 to $187.90, a four-month-high close and on the week up 35 cents. May feeder cattle futures gained $2.75 to $262.075, near the session high and hit a four-month high. For the week, May feeders rose $6.45.

- Hogs: Nearby April lean hog futures settled at $87.20 today, unchanged on the day, but up $1.975 on the week.

— Of note:

- Tyler Loudon, a Houston resident, pleaded guilty to insider trading after overhearing his wife, a former BP executive, discussing a planned acquisition while she worked from home. He made $1.76 million trading shares based on the information he heard, facing charges filed by the Securities and Exchange Commission.

- Morgan Stanley: New U.S. population estimates may boost economic resilience. Morgan Stanley economists suggest that new U.S. population estimates released by the Congressional Budget Office earlier this month, incorporating an increase in immigration, could help explain the unexpected resilience of the economy in 2023. Ellen Zentner, the bank's chief U.S. economist, posits that if the CBO's projections hold true, it could imply significantly higher steady-state payroll growth rates than previously believed. Previously, Zentner estimated the potential monthly payroll gain in the U.S. at 90,000, indicating a very strong recent trend averaging 248,000 over the past six months. However, a faster expansion of the prime-working-age population, as suggested by the CBO's figures, could elevate the country's potential for economic growth. Zentner emphasizes the variance between the CBO's figures and those of the Census Bureau, underscoring the importance of monitoring potential revisions, particularly concerning undocumented immigrants, which could impact both population estimates and economic projections.

- Supreme Court this week confronts a clash of views about free-speech protections on the internet, in a pair of cases pitting such social-media giants as Meta and Google against the states of Texas and Florida over legislation curbing the platforms’ power to moderate users’ posts.

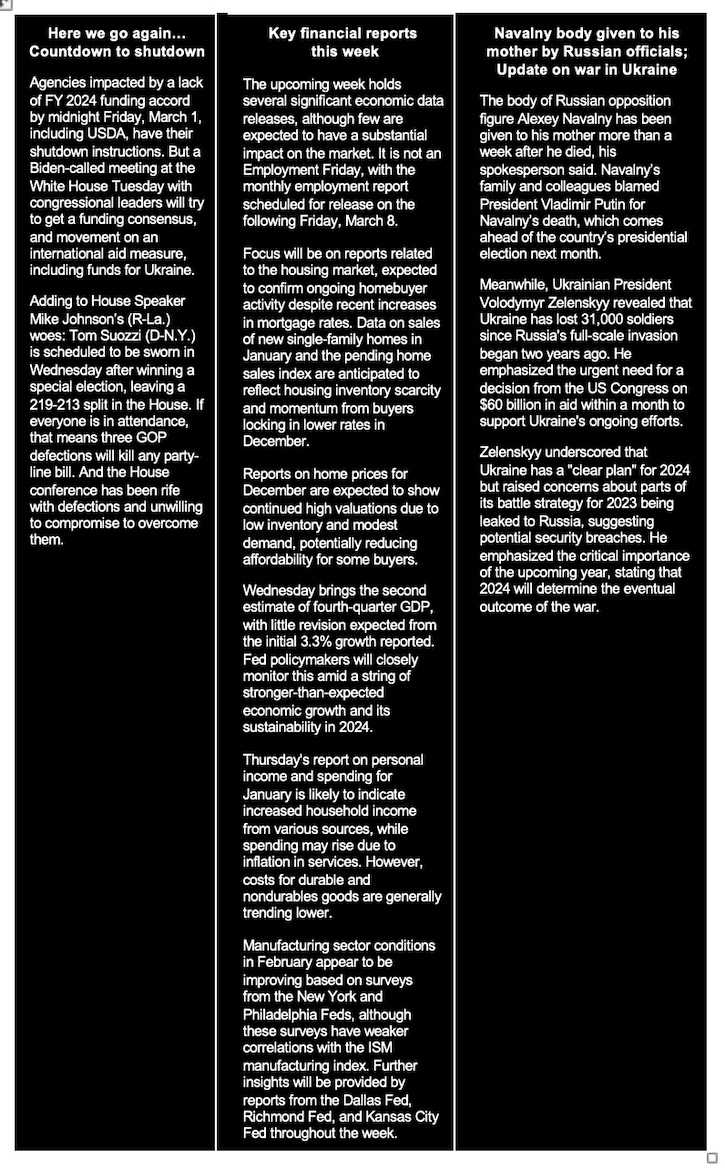

— Economists are upping their predictions for U.S. economic growth and lowering their expectations for a recession this year on stronger household demand and government spending. A Bloomberg monthly survey of economists forecast a 2.1% annualized rate of expansion this year, up from 1.5% expected in January.

— Malanga: Recent data reports suggest a challenging path towards reaching the Fed’s 2% inflation target and achieving a soft economic landing. Vince Malanga, President of LaSalle Economics, says January's performance highlighted evidence of slowing growth and persistent inflation, painting a concerning picture. However, he notes seasonal adjustments may be clouding the data, as this January experienced wintry conditions compared to the more spring-like weather of last January. Despite this, real GDP, hours worked, industrial production, housing starts, and retail sales all declined in January. Government spending continued to expand, with an additional $1.5 billion allocated from the Chips Act.

As weather conditions normalize in February, data reports are expected to show a rebound, Malanga believes. Overall, the expectation remains for real GDP growth of about 2% annually. Layoffs and restructurings have been occurring but have yet to be fully reflected in data reports. Jobless claims remain low, while continuing claims are rising steadily.

The downward trend in inflation halted in January, although the yearly rate decreased slightly. Malanga says this is concerning for several reasons, including the need for more progress on inflation before spring and the potential for rising oil and gasoline prices in the coming months. Additionally, signs indicate that China's deflation may be ending as its economy stabilizes.

Despite expectations for an early rate cut from the Federal Reserve, recent rhetoric suggests the Fed is hesitant to take this path. Malanga concludes this leaves the Fed reliant on steady price moderation. However, if inflation remains stubborn while the economy struggles, or if nominal GDP growth is driven by inflation rather than real growth, the Fed may face difficult decisions. The possibility of stagflation looms, Malanga adds, raising concerns about political interference and prolonged inflation beyond 2024. Despite this, optimism remains about rising productivity positively impacting profits.

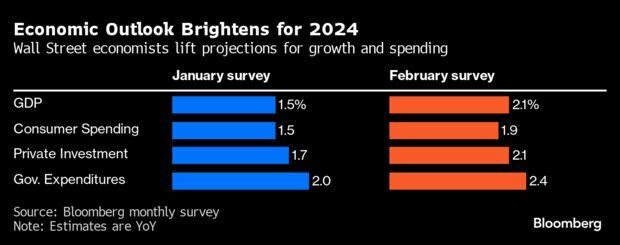

— Bank of Japan (BOJ) received increased support for its plan to end its negative interest rate policy due to the recent surge in Japan's stock market, with the Nikkei Stock Average hitting a record high not seen in 34 years. This rise in stock prices, coupled with previous gains, has provided a buffer against potential negative impacts from an anticipated rate hike, which would mark the first monetary tightening in 14 years. Investors are anticipating a rate hike to 0-0.1% in April, with the Japanese yen nearing a 34-year low against the dollar due to the BOJ's ultra-loose monetary policy. The rise in stock prices is seen as creating a conducive environment for the BOJ's policy shift, according to analysts. A potential policy tightening by the BOJ could also signal its readiness to counter excessive asset price inflation and alleviate downward pressure on the yen. The BOJ is expected to abandon its negative interest rate policy, introduced in 2016, this spring, with a majority of economists anticipating a policy shift in either March or April. BOJ Governor Kazuo Ueda has reassured that any rate hike would be gradual and would not harm the economy accustomed to accommodative monetary policy. The depreciating yen has benefited Japanese exports and contributed to the rally in Tokyo stocks, potentially reinforcing arguments for rate hikes.

Market perspectives:

— Outside markets: The U.S. dollar index was lower, with the euro, yen and British pound stronger against the greenback. The yield on the 10-year U.S. Treasury note fell was trading around 4.24%, with a mixed tone in global government bond yields. Crude oil futures were lower, with U.S. crude trading around $76.20 per barrel and Brent around $80.50 per barrel. Gold and silver futures were down, with gold around $2,043 per troy ounce and silver around $22.58 per troy ounce.

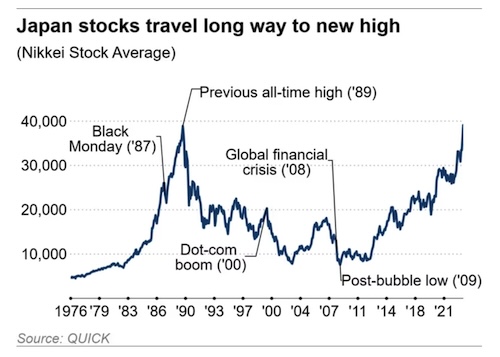

— Cocoa futures climbed as much as 4.6% on Monday, after capping the biggest weekly jump since 1999. Prices have soared as drought and disease ravaged crops in key West African producers, threatening to raise costs for chocolate makers that risk being passed on to consumers. Bloomberg notes (link) there are persistent signs of tightening supplies from key exporters. Bean arrivals at ports for shipment in top grower Ivory Coast are running about a third behind last year’s pace, while Nigerian exports were down in January.

— Indonesia allocates additional rice import quotas. Indonesia allocated an additional rice import quota of 1.6 MMT for 2024, as dryness linked to the El Niño weather pattern caused domestic supply concerns. The latest import quota, which is on top of 2 MMT previously approved for 2024, comes amid expectations the January-March harvest will be lower than last year due to below-normal rains in Java – the country’s key rice growing region.

— Grain trader and analyst Richard Crow sizes up the soybean market: The soybean cash markets currently indicate a lack of urgency among traders to fulfill business needs. Despite an inverted bean spread, there has been a recent weakening, suggesting a decrease in demand. Soybean sales within the U.S. have also slowed down. In Brazil, the basis has weakened as harvest progresses, resulting in Brazilian soybeans being priced at a significant discount compared to U.S. soybeans. This has prompted Eastern processors in the U.S. to take advantage, with three Brazil-bound boats already loading for shipment, and rumors of four additional cargoes being traded late last week. Brazil's harvest is nearing the halfway mark, indicating ongoing progress in the supply of soybeans from this major producer.

— Ag trade update: South Korea purchased 172,300 MT of wheat – 85,900 MT U.S., 50,000 MT Australian and 36,400 MT Canadian.

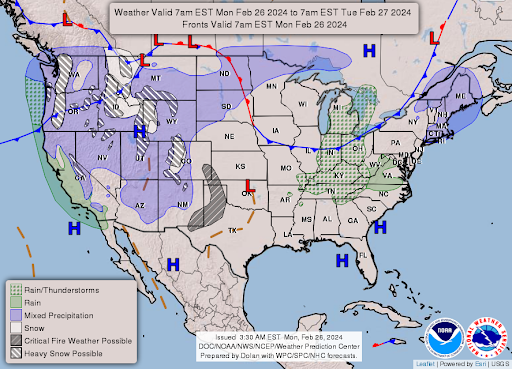

— NWS weather outlook: Heavy snow over parts of the Cascades, the Northern Intermountain Region, Northern/Central Rockies, Sierra Nevada Mountains, and higher elevations of the Great Basin... ...Moderate to heavy snow over parts of the Upper Midwest... ...There is a Slight Risk of severe thunderstorms over parts of the Ohio Valley/Great Lakes on Tuesday.

Items in Pro Farmer's First Thing Today include:

• Grains lower to start the week

• AgRural cuts Brazilian soybean crop forecast

• South American weather mostly favorable this week

• Cold Storage Report out this afternoon

|

CONGRESS |

— Biden calls congressional leaders to White House for Tuesday talks on budget, Ukraine aid. The Senate reconvenes today after the Presidents Day recess, while the House returns on Wednesday. Looming over this week is the recurring issue of a potential gov’t shutdown, as Congress has yet to approve any of the annual spending bills for fiscal year (FY) 2024, nearly five months into the fiscal year.

If lawmakers fail to act, a partial shutdown will occur at midnight Friday (including USDA), with a full shutdown possible on March 8, just ahead of President Joe Biden’s State of the Union address on March 7. To deal with this potential, President Biden invited the leaders of both parties, including Speaker Mike Johnson (R-La.), Senate Majority Leader Chuck Schumer (D-N.Y.), Senate Minority Leader Mitch McConnell (R-Ky.), and House Minority Leader Hakeem Jeffries (D-N.Y.), to the White House on Tuesday morning to discuss the matter and to urge Speaker Johnson to pass a foreign aid package.

Negotiations hit a snag over the weekend, with House GOP conservatives refusing to compromise on various issues, including funding for the Women, Infants, and Children (WIC) program, a Senate provision regarding veterans’ benefits and gun purchases, earmarks, and demands for increased border security funding.

|

ISRAEL/HAMAS CONFLICT |

— Israeli officials are cautiously optimistic about potential progress in hostage and ceasefire negotiations, with negotiators set to travel to Qatar following discussions in Paris. The proposed deal entails the release of around 40 hostages held by Hamas in Gaza, including women, children, and vulnerable individuals, in exchange for a six-week pause in hostilities. However, concerns persist as Israel's planned assault on Rafah, a town where over half of Gaza's population is seeking refuge, hangs over the talks. Prime Minister Benjamin Netanyahu stated that while a ceasefire could delay the invasion of Rafah, the operation remains inevitable. Netanyahu also expressed skepticism about Hamas' demands, suggesting they are unrealistic. Despite these challenges, an agreement is not guaranteed, and negotiations continue amid uncertainty.

|

RUSSIA/UKRAINE |

— Since August, Ukraine has exported 30 million metric tons (MMT) of agrarian goods through its Black Sea and Danube ports, marking a significant increase. Ukrainian Infrastructure Minister Oleksandr Kubrakov shared this information on the social media platform X, noting that this accounts for over 90% of all agricultural exports during this period. Specifically, more than 18 MMT of agrarian products were transported directly via the Black Sea corridor. Kubrakov expressed optimism, stating that Ukraine is nearing pre-war export levels. In December and January alone, approximately 6.7-6.8 MMT of agricultural products were exported. Additionally, Ukraine aims to boost exports via the Danube and encourages global businesses to utilize container barge caravans to circumvent blocked grain shipments at Poland's border.

Ukrainian grain exports totaled nearly 4.7 MMT so far in February, according to Ukrainian Agriculture Ministry data, about the same level for the same period in 2023. The total included 15.4 MMT of corn, 11.3 MMT of wheat and 1.6 MMT of barley. So far in 2023-24, Ukrainian grain exports have been 28.6 MMT, down from 31.8 MMT at this point in the 2022-23 marketing year.

— “Russia is more isolated from the global economy now than at any point since the end of the Cold War.” — Deputy Treasury Secretary Wally Adeyemo, in prepared remarks delivered Friday to the Council on Foreign Relations.

— Kyiv urges Polish punishment for Ukrainian grain spills. Kyiv has urged Poland to punish those responsible for spills of a Ukrainian grain cargo at the border over the weekend, Deputy Prime Minister Oleksandr Kubrakov said. Around 160 MT of Ukrainian grain were destroyed at a Polish railway station amid protests in what a senior Ukrainian official said on Sunday was an act of “impunity and irresponsibility.” Polish farmers are protesting what they describe as unfair competition from Ukraine and European Union environment regulations, blocking border crossings with Ukraine and deliberately spilling trains loaded with Ukrainian grain.

|

POLICY UPDATE |

— House Speaker Mike Johnson acknowledges the appropriations logjam is holding up the new farm bill. Johnson (R-La.) conveyed to his colleagues during a private conference call on Friday night that while he had initially aimed to complete the farm bill by this March, the ongoing funding issues have forced a delay in this timeline. This delay has been widely expected among lawmakers, with Johnson's acknowledgment making it clear that a farm bill won't progress in the coming weeks, possibly not until early April. Johnson emphasized that the completion of appropriations bills is a prerequisite for advancing the farm bill, underscoring the interconnectedness of legislative priorities. He also mentioned the possibility of another short-term stopgap measure on the call. Farm bill watchers know that the appropriations snags are just one of the hurdles stopping farm bill development as major differences linger over additional funding and policy issues, with differences also evident among the House and Senate approaches.

Bottom line: It now appears unlikely that a new farm bill will move through the House Agriculture Committee by the end of March, given the current circumstances.

— Beginning Feb. 28, 2024, dairy producers can enroll in the 2024 Dairy Margin Coverage (DMC) program. This program aims to assist producers by offering price support to offset disparities between milk and feed prices. The enrollment period for the 2024 DMC coverage will run until April 29, 2024, with payments potentially commencing as early as March 4, 2024, for any eligible payments triggered in January 2024.

The Farm Service Agency (FSA) has revised the DMC regulations, allowing eligible dairy operations to make a one-time adjustment to their established production history. This adjustment involves combining previously established supplemental production history with DMC production history for dairy operations that participated in the Supplemental Dairy Margin Coverage in prior coverage years. Additionally, the authorization for DMC has been extended through calendar year 2024, following a 2018 Farm Bill extension that mandated regulatory changes to the program.

The program, proven by the issuance of over $1.2 billion in payments to producers in 2023, offers a relatively affordable risk management tool, with coverage available for as low as $0.15 per hundredweight for $9.50 coverage.

Details: DMC functions as a voluntary risk management program, providing protection to dairy producers when the margin between the all-milk price and average feed price falls below a certain dollar amount chosen by the producer. In 2023, DMC payments were triggered in 11 months, including two months where the margin fell below the catastrophic level of $4.00 per hundredweight, marking a significant development for the program.

For the 2024 DMC coverage, adjustments have been made to extend coverage retroactively to January 1, 2024, and to offer adjustments to production history for smaller dairy operations with less than 5 million pounds of production. Furthermore, dairy producers can establish one adjusted base production history through DMC for each participating dairy operation.

Various coverage levels are available under the DMC program, including an option that is free for producers, with only a $100 administrative fee. This fee is waived for dairy producers who are considered limited resource, beginning, socially disadvantaged, or military veterans. Producers can use the online dairy decision tool to determine the appropriate level of DMC coverage for their operations.

DMC payments are calculated using updated feed and premium hay costs, reflecting actual dairy producer expenses. Moreover, USDA offers other risk management tools for dairy producers, such as the Dairy Revenue Protection (DRP) plan and the Livestock Gross Margin (LGM) plan, both offered through the Risk Management Agency.

For more information on DMC and enrollment procedures, dairy producers are encouraged to visit the DMC webpage (link) or contact their local USDA Service Center (link).

— Farm groups urge USDA Action on milk pricing issue. Top farm groups, including the American Farm Bureau Federation (AFBF) and National Farmers Union (NFU), are urging USDA to expedite an interim rulemaking process to address a milk pricing issue stemming from the 2018 Farm Bill. This change, supported by the farm groups, aims to revert the Class I milk pricing formula to its pre-2018 version, known as the "higher of" formula.

Background. The current formula, implemented since May 2019, averages the prices of Class III and Class IV milk, whereas the previous formula paid farmers based on the higher of the two prices. The farm groups argue that the current formula has resulted in significant revenue losses for dairy farmers, amounting to over $1 billion since its implementation.

The groups emphasize the need for an expedited return to the previous formula, especially given ongoing market dynamics and persistent losses faced by dairy farmers. They highlight that waiting for the full rulemaking process could prolong these losses and threaten farmers' livelihoods.

To address this issue promptly, the farm groups urge USDA to issue an interim final decision to expedite the change to the Class I milk pricing formula. They suggest that this could speed up implementation by six months or more, providing much-needed relief to dairy farmers facing financial challenges.

— Minnesota Ag official denies discrimination allegations by white male farmer. Minnesota's top agricultural official, Thom Petersen, has denied allegations of discrimination against a white male farmer, Lance Nistler, in response to a lawsuit filed by Nistler last month. Nistler, a resident of Kelliher, Minnesota, claimed that the state's grant program for "emerging" farmers unfairly prioritized applicants from protected status groups over his application.

In the legal filing, Petersen's lawyer argued that Nistler's claims are unfounded. While Nistler was selected ninth overall in a lottery for the grant program last summer, his identity as a white male did not influence his current waitlisted status for funding. The attorney representing Petersen emphasized that regardless of Nistler's demographic background, he would still need to fulfill additional documentation and purchase requirements before receiving funding.

Furthermore, the filing stated that Nistler has not suffered any discernible injury, and the state requested that the lawsuit be dismissed. The lawsuit revolves around Minnesota's down payment assistance grants administered by the Rural Finance Authority (RFA), which provide funding for farmers meeting certain criteria, including income thresholds and lack of prior land ownership.

The program's popularity prompted lawmakers to increase funding to $1 million for both 2023 and 2024. However, updates to the program prioritize applicants fitting the definition of "emerging farmers," which includes various demographic groups such as women, military veterans, individuals with disabilities, Indigenous people, farmers of color, LGBTQ individuals, and those under 35 years old or residing in urban areas.

While Nistler applied for the grant last summer, his application was impacted by the program's revised criteria, which favor certain demographic categories. Notably, the latest U.S. Department of Agriculture census reveals that most Minnesota farmers are white males, raising questions about the implications of the program's eligibility criteria.

Despite the lawsuit, the Minnesota Department of Agriculture (MDA) intends to proceed with the down payment assistance grant in the 2024 funding cycle, according to an MDA spokesman.

Link to more on this via the Minneapolis StarTribune.

|

CHINA UPDATE |

— China's trade strategy: Building an alternative architecture. Amid escalating trade tensions with the West, China is accelerating efforts to construct its own trade ecosystem, focusing on developing nations and bolstering bilateral and regional free trade agreements (FTAs), according to the Financial Times (link/paywall).

Key points:

- China's trade strategy shifts focus towards the "global south," leveraging the Belt and Road Initiative (BRI) to foster ties with over 140 countries.

- The country aims to establish a China-centric network of FTAs to counterbalance the faltering WTO and reduce dependence on traditional markets like the U.S. and EU.

- Despite geopolitical challenges, China's trade expansion shows significant progress, with FTAs covering a substantial (40%) portion of its exports.

- China's investments in regions like ASEAN and Africa signal a shift in global trade dynamics, with emerging markets increasingly aligning with China.

- However, uncertainties loom as trade friction with the U.S. and EU persists, posing risks to China's trade growth despite its alternative architecture efforts.

Bottom line: As tensions escalate, Chinese companies explore strategies like transshipment and nearshoring to navigate trade challenges, yet face uncertainties amid evolving trade policies in major markets.

— China explores ways to attract foreign investment. Chinese cabinet officials said they would take further steps to optimize China’s business environment and stabilize foreign investment. Foreign direct investment (FDI) into China fell 11.7% annually to 112.71 billion yuan ($15.66 billion) in January. Compared with the previous month, however, FDI surged 20.4%.

— China’s sow herd liquidation continues. China’s sow herd totaled 40.67 million head at the end of January, down 1.8% on a monthly basis and 6.9% below year-ago, according to ag ministry data. Hog slaughter jumped 28.6% from year-ago during January to 37.25 million head, though that was down 6.4% from the previous month.

— Biden administration criticizes China's slow biotech approval, impacting U.S. farms. The U.S. Trade Representative’s annual review highlights China's failure to expedite the approval process for agricultural biotechnology products, despite a pledge made in 2020. The lengthy and opaque review process, lasting more than two years on average, disrupts U.S. farm exports and the introduction of new crop strains. China's inconsistent enforcement of regulations and lack of adherence to science-based international standards further complicate agricultural trade. Despite being the world's largest importer of certain agricultural products, including cotton and soybeans, China's approach to biotechnology remains a significant obstacle, with approval times exceeding the agreed-upon target of 24 months. Additionally, China maintains restrictions on imports of U.S. pork, beef, and poultry due to concerns about growth stimulants and disease outbreaks. U.S. Trade Representative Katherine Tai emphasizes China's departure from WTO norms, posing a challenge to the international trading system. Link to report.

— BYD, a prominent Chinese auto group, refuted EU allegations of success through state aid, attributing its achievements to unique technology and high management efficiency. The European Commission's probe into Chinese electric vehicle competitiveness may result in increased tariffs, a move criticized by China's ambassador to Europe as "unfair." BYD's European president, Michael Shu, highlighted the company's minimal manufacturing subsidies from China and emphasized its focus on technology investment. Despite concerns from European carmakers about cheaper Chinese models, BYD remains confident in its ability to offer competitive prices. The company plans to expand its presence in Europe, aiming to become one of the top EV sellers in the region by 2030. Additionally, BYD's upcoming EV factory in Hungary aims to produce at least 150,000 cars annually, with discussions ongoing regarding financial support from the EU. The company's innovative approach includes launching its own car-carrying vessel, reducing emissions and transportation costs.

|

TRADE POLICY |

— World Trade Organization is holding its 13th biennial ministerial meeting in Abu Dhabi this week. East Timor and Comoros become the latest nations approved to join the WTO, bringing the Geneva-based institution to 166 members. Link to more on the ministerial meeting. Meanwhile, a Politico article (link) says questions about the WTO are growing ahead of a major meeting this week that may fail to yield agreement on digital trade and food security.

— WTO chief urges reform amid global trade weakness. The head of the World Trade Organization, Ngozi Okonjo-Iweala, stated during a press conference in Abu Dhabi that global commerce, despite its resilience during the pandemic, is performing weaker than forecast due to various economic challenges and a trend towards protectionism. She emphasized the need to repair and reform the multilateral trading system, highlighting that demand is sluggish across major economies except for the U.S. and India.

Additionally, Okonjo-Iweala mentioned geopolitical tensions between the U.S. and China, which have affected the WTO's functioning.

The WTO is updating its predictions for merchandise trade volumes, acknowledging the risks of a less optimistic outlook for 2023 and 2024. Despite these challenges, she expressed optimism about developments at the WTO conference, including the addition of Timor-Leste and Comoros as WTO members and progress towards ratification of anti-subsidy fisheries agreements.

|

ENERGY & CLIMATE CHANGE |

— Financial Times looks at the role of America’s Strategic Petroleum Reserve, arguing that its purpose and operations should change as energy markets have undergone a dramatic transformation since its creation. Link/paywall to article.

— USDA grants $144 million for farmers to adopt renewable tech; Energy Dept. offers $4 million boost. USDA today announced $144 million in grants to assist farmers in adopting underutilized renewable energy technology, including small-scale windmills. Agriculture Secretary Tom Vilsack emphasizes the potential for these investments to reduce costs and increase income for farmers, providing long-lasting economic benefits to their families, businesses, and communities. The initiative, known as RAISE (Rural and Agricultural Income and Save from Renewable Energy), aims to help 400 farmers deploy smaller-scale wind projects initially, with eligibility also extending to other clean energy applications such as small-scale hydropower, geothermal, and biomass-based systems.

Additionally, the Energy Department offered $4 million in related funding, with $2.5 million allocated for testing, certification, and commercialization of distributed wind technologies, and $1.5 million for outreach and development of business models utilizing the technology, which ranges from single turbines for on-farm electricity needs to larger setups for electricity generation for the local grid.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— In his March 7 State of the Union address, President Biden is planning to address the issue of food "shrinkflation" along with broader concerns regarding corporate greed, according to reports. This focus comes amid Biden's economic approval facing challenges, particularly due to the persistent rise in food prices, which has been a significant concern for voters regarding the state of the economy. Sources note Biden and his team are deliberating on the extent to which they will address the issue of high grocery prices and corporate responsibility in the upcoming address. However, some advisors are cautious about placing too much emphasis on food inflation, recognizing the limited ability of the president to directly influence prices. Large food companies and grocers have been caught off guard by the White House's renewed focus on this issue and are working to avoid being targeted as scapegoats in the lead-up to the Nov. 5 elections.

— Food price inflation is back in the outlook for all food, food at home (grocery), and food away from home (restaurant) prices in 2024, according to the latest update from USDA. The Consumer Price Index (CPI) for all food is expected to increase by 2.9% in 2024, a significant jump from the previous outlook of just 1.3%. Grocery prices are forecasted to rise by 1.6% in 2024, returning to an upward trend after briefly being forecasted to fall. Restaurant prices are also expected to accelerate, with a projected increase of 5% in 2024, the highest level forecasted so far.

While price increases continue to ease compared to previous years, consumers can still expect higher costs for food. USDA's monthly update indicates that prices increased for most food categories in January 2024 compared to December 2023. The forecast for 2024 suggests price increases for 11 food-at-home categories and decreases for 4 categories, although uncertainty remains.

USDA now anticipates prices to fall for pork, fish and seafood, eggs, and cereals and bakery products in 2024, albeit at smaller rates than previously projected. Conversely, the largest increases are expected for fats and oils, sugar and sweets, and nonalcoholic beverages, surpassing January's outlook.

Despite these forecasts, food prices in 2024 are expected to rise less than the 20-year averages, but dining out will cost more than the five-year average. The increases, while significant, remain below those seen in 2023 and 2022, the latter of which saw the highest increases in over 40 years.

Higher costs for dining out are also attributed to rising food component prices, alongside increased labor and other expenses for restaurants. Overall, food price inflation continues to be a significant economic factor, even as overall inflation rates ease. The expectation of grocery prices falling in 2024 has diminished, with USDA's forecast indicating a range from a 1.8% decrease to a 5.3% increase.

Of note: Grocery prices have only declined twice in data going back to the 1970s, highlighting the uncertainty surrounding USDA's previous forecast for a decline in 2024.

— Walmart’s rethinking food, other costs. Walmart said late last year that it may soon see deflation in certain items, but the big-box retailer walked back that sentiment last week. Many companies either are still contending with rising prices — or downplaying areas where prices are falling because it could signal weakness about their businesses or the economy. While deflation may hit some segments like food later this year, it remains to be seen how it could affect the prices shoppers pay.

|

OTHER ITEMS OF NOTE |

— AT&T is offering a $5 credit to Wireless customers, including both consumers and small businesses, who were most affected by a recent network outage. The credit, equivalent to the "average cost of a full day of service," will be applied within two bill cycles. CEO John Stankey stated that this reimbursement aligns with the company's 2024 business objectives. However, some customers expressed dissatisfaction on social media, arguing that the reimbursement was insufficient. AT&T attributed the outage, which impacted thousands of customers and attracted federal attention, to an update glitch rather than a cyber attack.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |