Biden Invites Congressional Leaders to White House on Tuesday Re: FY 2024 Funding

SAF details coming by March 1 | Vilsack testifies Wed. | Senate WRDA hearing | WTO ministerial meeting

Washington Focus

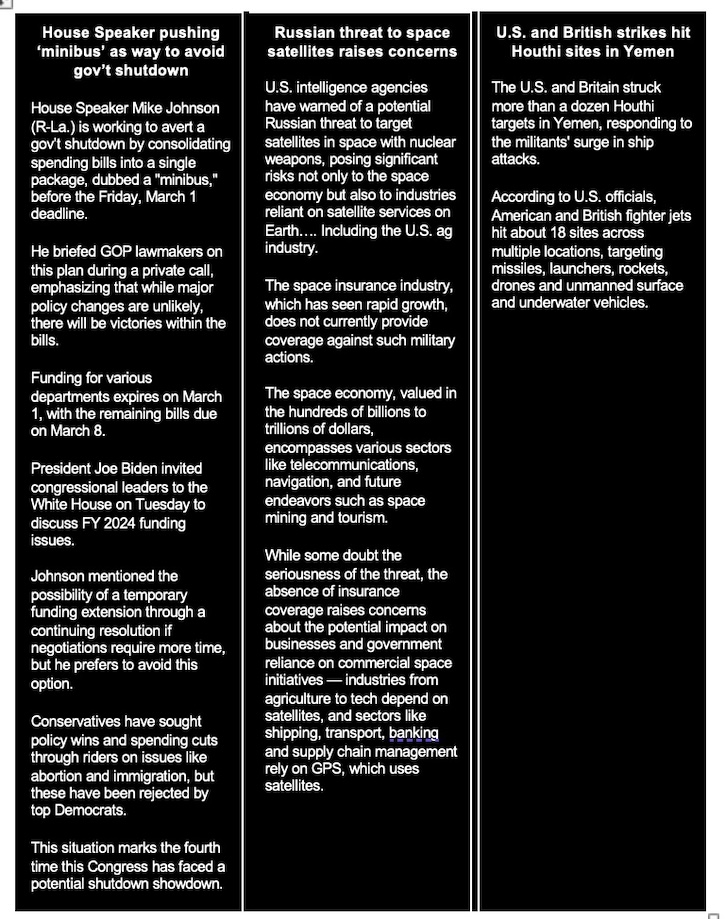

President Joe Biden has invited top congressional leaders to the White House Tuesday for a meeting, just days ahead of a partial gov’t shutdown. Biden will meet with the Big Four: Speaker Mike Johnson (R-La.), Senate Majority Leader Chuck Schumer (D-N.Y.), Senate Minority Leader Mitch McConnell (R-Ky.) and House Minority Leader Hakeem Jeffries (D-N.Y.).

Another threat of a partial gov’t shutdown looms if spending measures aren’t passed by midnight March 1 for 20% of agencies (Agriculture, Energy-Water, Military Construction-VA and Transportation-HUD bills); March 8 for the rest.

During the weekend, news broke that Johnson was working on a “minibus” group of fiscal year (FY) 2024 appropriations bills (apparently including one for USDA) that would avoid the need for another stopgap spending bill ahead of the initial March 1 midnight deadline.

Others say time constraints and recess schedules make another temporary funding bill still possible. On a Friday night call, Johnson expressed cautious optimism that Congress would meet the first deadline on at least some of the spending bills. But he didn't promise which ones would be in the first package. And a short extension might be needed to buy more time for bills that aren't ready by then. GOP leaders raised the possibility that some of the bills with a March 8 expiration date, but which are closer to being completed, might shift up into the first batch due next week. Lawmakers are considering a stopgap spending measure for some, if not all, of the bills to March 22, which would give appropriators more time to work out the remaining issues.

Members of the House Freedom Caucus sent a letter (link/pdf) to Johnson listing policy riders the group wants included in FY 2024 appropriations bills. These include eliminating Homeland Security Secretary Alejandro Mayorkas' salary and blocking funding to Biden administration climate priorities, among others.

Jeffries reiterated Sunday that House Democrats are “willing to find common ground” with Johnson on legislation, including ways to keep the government funded past the initial March 1 deadline.

Of note: If there’s no new budget for FY 2024 by April 30, it will trigger a 1% across-the-board spending cut. Democrats won’t back a stopgap bill beyond this date.

Schumer criticized Republicans for what he called "a harmful and unnecessary government shutdown," emphasizing the potential economic and safety risks it poses to the American people. Schumer noted ongoing discussions between bipartisan leadership and top appropriators. While spending bills have been crafted, partisan riders remain a significant hurdle in negotiation, as noted. Democrats are pressuring Republicans to reject these "poison pills." Schumer criticized House Republicans for causing delays, urging Johnson to "buck the extremists" in his caucus and prioritize legislation over chaos.

The Senate is in session from Feb. 26 while the House returns Feb. 28.

The House will be getting an extra day to do something with given it’s a leap year. Maybe that is needed to avoid a gov’t shutdown.

— The House will take up a two-month extension of Federal Aviation Administration authorities expiring on March 8 under suspension of the rules.

— USDA Secretary Tom Vilsack testifies Wednesday before the Senate Agriculture Committee on Wednesday. The topics he and panelists will address are well known, but Vilsack recently said a similar appearance before the House Ag Committee was a “missed opportunity” when it came to discussing his ideas for tapping the Commodity Credit Corporation (CCC) for additional new farm bill funding. Republicans have taken Vilsack to task for focusing too much on small- and mid-sized farming operations and not very much on production agriculture. If there is one word that sums up Democrats’ policy in agriculture and other sectors it is equity — and that involves income redistribution.

— As for the new farm bill, the issues are now so well known that the topic itself is simply boring. The past few weeks have seen various Ag panel leaders spin their views via op-ed items. But that is something that usually happens at the beginning of a farm bill process, not what many hope is the end.

Meanwhile, House Ag leaders and staff continue scrambling in a search for around $50 billion in additional spending, but the avenue for such hefty new spending is via changes in food stamp policy and tweaks to conservation program spending, but those are a no-no for Democrats and thus will not be accepted (the House GOP rebels will also not like the additional farm bill spending if it ever makes it into a bill taken up on the House floor).

In the Senate, Ag Chair Debbie Stabenow (D-Mich.) has garnered around $5 billion in additional funding beyond the $1.51 trillion 10-year baseline, but that is nowhere near what is needed to get a legitimate boost in reference prices. Senate Ag Ranking Member John Boozman (R-Ark.) insists reference prices must be raised. With the Republicans likely winning Senate control after Nov. 5 elections, Boozman may believe 2025 would be a better timeline for a new farm bill. As for Stabenow, this is her last farm bill since she is not running for re-election. But via the Inflation Reduction Act (Climate Bill), she already garnered an additional $20 billion in conservation program spending, and ample food stamp (SNAP) funding is already available as that program is essentially an appropriations entitlement. Thus, Stabenow likely thinks she has some farm bill leverage as well.

The event that could put pressure on farm-state lawmakers to finish the omnibus bill: Corn prices going under $4 and soybeans under $11.

— The biofuels industry and corn producers await a Biden administration update of the Energy Department’s GREET, a model for calculating greenhouse gas emissions. Revisions expected to be unveiled by March 1 will determine how easy or tough it will be for makers of sustainable aviation fuel (SAF) from farm products to take advantage of lucrative tax credits. With both USDA Secretary Tom Vilsack and EPA Administrator Michael Regan at this week’s Commodity Classic where they both appear on Friday, expect them to comment on the announcement, likely putting their spin on the details.

Vilsack told ethanol producers last week that he’s pushing to ensure they can qualify for tax incentives aimed at encouraging production of more climate-friendly airplane fuel from farm crops including corn. “I’m working to make sure that as we create these incentives, they include room for climate smart agricultural practices,” he said at the Renewable Fuels Association’s annual ethanol conference in San Diego. “I’m confident that it will happen.”

Vilsack said he was puzzled by recent media reports about the upcoming GREET changes. Reuters reported last week (link) that the White House is set to back a tougher climate model for ethanol, making it more difficult for producers to qualify for SAF tax credits. Vilsack said American farmers are taking steps to improve their land and productivity, and the resiliency of their farms. “This GREET model I think reflects that.”

Note: The Treasury Department said in a statement Dec. 15 (link) that its green jet fuel guidance will include a revised version of the Energy Department’s emissions-measuring method known as GREET, a model for calculating greenhouse gas emissions backed by ethanol makers. The statement said the update “will incorporate new data and science, including new modeling of key feedstocks and processes used in aviation fuel. The updated model will also integrate other categories of indirect emissions like crop production and livestock activity, in addition to best available science and modeling of indirect land use change emissions. The updated model will also integrate key greenhouse gas emission reduction strategies such as Carbon Capture and Storage, Renewable Natural Gas, Renewable Electricity, and Climate-Smart Agriculture Practices.”

Farm-state lawmakers on Feb. 15 wrote a letter (link/pdf) asking the Biden administration to act by March 1. The said the GREET update should: properly credit practices like regenerative farming and carbon capture; ensure valuations of indirect land-use changes recognize contributions of U.S. agriculture; and reward modern practices like precision agriculture that lead to higher per-acre yields.

The corn and equity markets will tell us quickly what they think about the possible watered-down SAF rules and regulations coming from the Treasury Dept. since it is a tax deduction.

More on the SAF credits: The credit incentivizes the production of SAF that achieves a lifecycle greenhouse gas emissions reduction of at least 50% as compared with petroleum-based jet fuel. Producers of SAF are eligible for a tax credit of $1.25 to $1.75 per gallon. SAF that decreases GHG emissions by 50% is eligible for the $1.25 credit per gallon amount, and SAF that decreases GHG emissions by more than 50% is eligible for an additional $0.01 per gallon for each percentage point the reduction exceeds 50%, up to $0.50 per gallon.

— WTO ministerial meeting this week in Abu Dhabi. The 13th World Trade Organization (WTO) Ministerial Conference takes place on Feb. 26-29, in Abu Dhabi, United Arab Emirates. Held every two years, the WTO’s Ministerial Conference serves as the highest decision-making body of the WTO, bringing together trade ministers from member countries to discuss and negotiate trade-related issues.

WTO Deputy Director-General Angela Ellard recently discussed the state of reform talks ahead of the upcoming 13th Ministerial Conference (MC13), highlighting optimism for the restoration of full WTO dispute settlement in 2024. She addressed various issues, including prospects for agricultural reform and the implementation of the fisheries agreement. Ellard emphasized the importance of MC13 in defining a path forward on complex issues.

Regarding dispute settlement reform, Ellard mentioned ongoing discussions and the need to address outstanding issues while expressing hope for a successful outcome at MC13.

She also touched upon broader reform efforts within the WTO, noting the diversity of member perspectives and the need for a healthy discussion.

On agriculture talks, Ellard acknowledged the challenge of reconciling different priorities but emphasized MC13's role in setting a roadmap for future negotiations. Additionally, she highlighted efforts to support developing countries in implementing the fisheries agreement, including the establishment of a trust fund to provide technical assistance and capacity building.

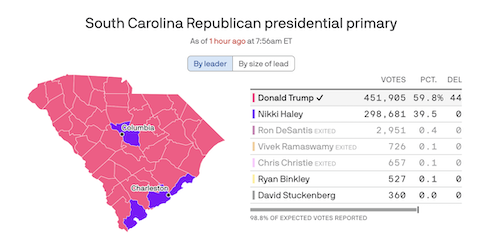

— Former President Donald Trump emerged victorious over former South Carolina Governor Nikki Haley in the state's primary on Saturday, further solidifying his path towards securing the Republican nomination. The win, declared by the Associated Press immediately after polls closed, brings Trump closer to surpassing the 1,215-delegate threshold needed to clinch the nomination, with his campaign estimating it could happen as early as March 12. South Carolina awards a total of 50 delegates, with 29 going to the statewide winner and 21 distributed among winners in each of the state's seven counties.

Haley to continue campaigning. Haley, who had served as South Carolina's governor before resigning to become United Nations ambassador under Trump, faced significant polling deficits against Trump, with latest indications showing Trump beat Haley with around 60% of the vote versus around 40% for Haley. Haley beat expectations of a loss spread of around 30 points. Despite calls for her to step down following losses in previous primaries and caucuses, Haley has expressed determination to remain in the race, citing her desire to offer voters an alternative to Trump and Biden, whom she has characterized as "grumpy old men."

Trump's delegate count prior to the South Carolina primary stood at 63, compared to Haley's 17, with projections suggesting he could secure the nomination by March 12 as more states, including Hawaii, Washington, Mississippi, and Georgia, hold their GOP primaries. To become the official nominee, a candidate must secure the majority of the 2,249 GOP delegates, with the final decision made at the Republican National Convention in July.

President Biden had previously won the South Carolina Democratic primary on Feb. 3, marking the first official contest of the 2024 election cycle. The upcoming primary in Michigan, scheduled for Tuesday, will include both GOP and Democratic contests — Trump will appear on the Republican ballot after the state’s Supreme Court last year rejected an attempt to remove him based on the U.S. Constitution’s “insurrectionist ban.” As for President Joe Biden, Michigan Democratic Rep. Rashida Tlaib, an outspoken critic of Biden’s handling of the Israel-Hamas war, is calling on residents to vote “uncommitted” in the primary.

On Saturday, Idaho and Missouri hold their Republican presidential caucuses.

Meanwhile, Sen. John Thune (R-S.D.), the second-ranking Republican in the Senate, has officially endorsed Donald Trump in the GOP presidential primary. Thune stated to Fox News Digital that Trump's success in South Carolina indicates he will be the Republican nominee for the upcoming presidential election, presenting voters with a clear choice between Trump and President Joe Biden. Thune pledged his support for Trump's campaign and expressed his commitment to ensuring a Republican majority in the Senate to work alongside Trump. His endorsement is significant as he is the highest-ranking Republican in the Senate to support Trump's presidential bid. This move contrasts with Senate Minority Leader Mitch McConnell's (R-Ky.) stance, who has not endorsed Trump following their fallout after the January 6, 2021, Capitol insurrection. Despite Trump's previous criticism of Thune and McConnell, including calling for a primary challenger for Thune in 2022, Thune comfortably won re-election. McConnell had previously stated his disengagement from the matter, indicating he would stay out of the endorsement process for the time being.

— Immigration was again the top issue of concern based on South Carolina primary polling, followed by the economy. That echoes similar surveys following the Iowa Caucuses and the New Hampshire primary.

The surge of immigrants entering the U.S. through the southern border is placing significant strain on the budgets of several major American cities. An analysis conducted by S&P Global Ratings reveals that out of the 100,000 immigrants transported by Texas since 2022, a staggering 84% were directed to Denver, Chicago, and New York.

Denver, in particular, stands out as the city with the highest concentration of immigrants per capita across the nation. To cope with the increased demand for services, Denver is reallocating a minimum of $5 million from its budget to sustain support for the immigrant population. However, these budgetary adjustments have led to cutbacks in various areas, including reduced operating hours at Department of Motor Vehicles (DMVs) and recreational centers, as well as a temporary halt in the hiring of certain city staff members.

— Trump promises further tax cuts, faces criticism. Former President Donald Trump pledged to implement further tax cuts if re-elected, building upon the 2017 tax legislation passed during his previous term. He emphasized this promise during a rally in South Carolina, just ahead of the state's primary.

Meanwhile, Trump again indicated intentions to increase tariffs on foreign goods while significantly reducing taxes for American workers and families. However, economists caution that tariffs often result in higher costs for consumers.

Trump insiders are considering how to address expiring tax measures from the 2017 tax cut law, many of which affect households and small businesses. While Trump previously advocated for a corporate tax rate of 15%, he now reportedly prefers maintaining it at 21%. His tax policies have garnered support from some business groups, donors, and voters despite criticism of other aspects of his presidency.

— Hunter Biden on Wednesday will undergo a closed-door deposition as part of House Republicans' impeachment inquiry into his father, President Biden. This follows a recent closed-door interview where James Biden, the President's brother, faced intense questioning from Republicans. Despite the recent arrest of a former FBI informant accused of lying about the Biden family's connections to a Ukrainian energy company, the impeachment inquiry proceeds.

— Other events of note this week include:

- Monday: AFFI Frozen Food Convention, San Diego, Calif., Feb. 24-27.

- Monday: International Sweetener Colloquium, Aventura, Florida., Feb. 25 -28.

- Monday: National Potato Council’s annual Washington Summit, Feb. 26-March 1.

- Tuesday: Nomination. Senate Health, Education, Labor and Pensions Committee meeting to consider the nomination of Julie Su to be secretary of Labor.

- Tuesday. Climate and taxes. Brookings Institution online forum, “Meeting Climate Goals Through Tax Reform.”

- Tuesday: AI and agriculture. Farm Foundation forum, “Seeds of Change: Exploring AI Solutions for Agriculture Today and Tomorrow.”’

- Tuesday: Michigan presidential primary elections.

- Wednesday: WRDA. Senate Environment and Public Works Committee hearing on "Water Resources Development Act (WRDA) 2024: USACE Water Infrastructure Projects, Programs and Priorities."

- Wednesday. Commodity Classic. Thorough Saturday, Houston, Texas.

- Wednesday. USDA Secretary Tom Vilsack appears before the Senate Ag Committee.

- Wednesday: Nominations. Senate Commerce, Science and Transportation Committee hearing for the nominations of Daniel B. Maffei and Rebecca F. Dye to be members of the Federal Maritime Commission.

Economic Reports and Events for the Week

The latest Personal Consumption Expenditures Price Index data is due Thursday. Core PCE is seen rising 2.8% year over year. The release is considered the Federal Reserve's favored inflation gauge and could move the meter with interest rate expectations.

The earnings season is coming to an end with Workday, Lowe's, American Tower, AMC, HP, Salesforce, TJX Companies, and Dell set to report.

Monday, Feb. 26

- New Home Sales increased to 664,000 units in December from 615,000 units in November of 2023. New Home Sales is expected to be 680,000.

- Dallas Fed Mfg Survey

- Federal Reserve: KC Fed President and CEO Jeffrey Schmid speaks.

Tuesday, Feb. 27

- The Commerce Department's Census Bureau will likely report a 4.8% decline in orders for durable goods for January. Excluding transport, orders for durable goods for January are expected to show a 0.2% gain, compared to a 0.5% rise in the previous month.

- Conference Board will likely show its consumer confidence index came in at 114.8 in February, unchanged from the previous month.

- FHFA Housing Price Index

- S&P Case-Shiller Home Price Index. Consensus: 6.0% for December.

Wednesday, Feb. 28

- MBA Mortgage Applications

- Second estimate for fourth-quarter gross domestic product (GDP), which likely increased at a 3.3% annualized rate — sturdy, but cooler than the 4.9% of the previous quarter.

- Advance International Trade in Goods

- Advance Retail Inventories

- Advance Wholesale Inventories

- Federal Reserve Bank of Atlanta President Raphael Bostic speaks on monetary policy and the economy before the Greater North Fulton Chamber of Commerce.

- Federal Reserve Bank of Boston President Susan Collins speaks and participates in a fireside chat before an event hosted by the Center for Business, Government and Society at the Dartmouth College Tuck School of Business.

- Federal Reserve Bank of New York President John Williams participates in a hybrid economic briefing organized by the Long Island Association.

Thursday, Feb. 29

- Initial Jobless Claims in the U.S. decreased to 201,000 in the week ending Feb. 17 of 2024 from 213,000 in the previous week. Initial Jobless Claims is expected to be 210,000 in the week ending Feb. 24.

- Personal consumption expenditures (PCE) price index increased 0.3% in January after rising 0.2% in December. On a year-on-year basis, the PCE price index advanced 2.4% in January. Excluding the volatile food and energy components, the PCE price index likely climbed 0.4% last month, compared to a 0.2% rise in the previous month. In the 12 months through January, the core PCE price index gained 2.8% in January after a 2.9% rise in December.

- Consumer spending is likely to show a rise of 0.2% in January, lower than the 0.7% rise posted in the previous month.

- Personal Income

- Chicago PMI

- Pending Home Sales

- Kansas Fed Index

- Fed Balance Sheet

- Money Supply

- Atlanta Fed’s Bostic speaks on the economic outlook, monetary policy and the state of the banking industry before the 2024 Banking Outlook Conference hosted by the Federal Reserve Bank of Atlanta.

- Federal Reserve Bank of Chicago President Austan Goolsbee speaks virtually on "Monetary Policy at an Unusual Time" before a webinar hosted by the Princeton University Bendheim Center for Finance.

- Federal Reserve Bank of Cleveland President Loretta Mester speaks on "Financial Stability/Regulation" before the Columbia University/Bank Policy Institute 2024 Bank Regulation Research Conference.

Friday, March 1

- ISM manufacturing PMI is likely to show a reading of 49.5 for February, up from 49.1 recorded in the previous month.

- S&P Global manufacturing PMI reading for February

- University of Michigan's final consumer sentiment data for this month.

- Construction Spending

- Atlanta Fed’s Bostic speaks on the economic outlook and real estate trends at the University of Florida's Kelley A. Bergstrom Real Estate Center 2024 Trends and Strategies Conference on Friday.

- Federal Reserve Bank of San Francisco President Mary Daly (discussant) and Federal Reserve Bank of Kansas City President Jeffrey Schmid (moderator) will participate in the panel "AI and the Labor Market" before the 2024 U.S. Monetary Policy Forum hosted by the Chicago Booth School of Business.

- Adriana Kugler, member of Federal Reserve Board of Governors, Ford Motor Company chief executive Jim Farley, Nvidia boss Jensen Huang and former Secretary of State Condoleezza Rice speak at Stanford University’s SIEPR Economic Summit.

Key USDA & international Ag & Energy Reports and Events

A Black Sea grain conference will be held in Prague Tuesday and Wednesday. A WTO ministerial conference takes place in Abu Dhabi (Feb. 26-29).

On the energy front, industry conferences will be held in London, including International Energy Week. The Nigeria International Energy Summit will be staged in Abuja.

Monday, Feb. 26

Ag reports and events:

- Export Inspections

- Cold Storage (delayed from last week)

- Chickens and Eggs

- Crop Values

- Peanut Stocks and Processing

- Trout Production

- Unica cane crush, sugar production (tentative)

- MARS monthly EU crop conditions report

- Malaysia Feb. 1-25 palm oil export data

- WTO ministerial conference, Abu Dhabi (through Feb. 29)

- Earnings: FGV

Energy reports and events:

- Brent April options expire

- S&P Global Commodity Insights’ London Energy Forum 2024 (through Feb. 27)

- Kpler Market Insight Forum, London

- Nigeria International Energy Summit (through March 1), Abuja

- Earnings: Sasol, Kosmos Energy

- Holiday: Kuwait, Thailand

Tuesday, Feb. 27

Ag reports and events:

- Weekly Weather: State Stories

- Cattle, Statistical Bulletin

- Black Sea Grain Europe conference in Prague (Feb. 27-28)

- WTO ministerial conference, Abu Dhabi (second day)

Energy reports and events:

- API weekly U.S. oil inventory report

- International Energy Week starts in London (through Feb. 29

- Argus Oil & Future Fuels Forum 2024, London

- S&P Global Commodity Insights’ London Energy Forum 2024 (last day)

- Nigeria International Energy Summit (second day), Abuja

- Earnings: Woodside Energy, Pemex, Devon Energy

- Holiday: Israel (municipal elections)

Wednesday, Feb. 28

Ag reports and events:

- Broiler Hatchery

- Agricultural Exchange Rate Data Set

- Livestock and Meat Domestic Data

- Outlook for U.S. Agricultural Trade

- Egg Products

- Poultry Slaughter, Annual Summary

- WTO ministerial conference, Abu Dhabi (third day)

- Earnings: Golden Agri-Resources Q4 earnings, Olam Group earnings

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- International Energy Week in London (second day)

- Nigeria International Energy Summit (third day), Abuja

- Earnings: Seadrill, Uniper

- Holiday: Taiwan

Thursday, Feb. 29

Ag reports and events:

- Weekly Export Sales

- Agricultural Prices

- Cold Storage, Annual

- Port of Rouen data on French grain exports

- Vietnam preliminary commodity-export data for February

- Malaysia February palm oil export data

- WTO ministerial conference, Abu Dhabi (last day)

Energy reports and events:

- Brent April futures expire

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

- Singapore onshore oil-product stockpile weekly data

- International Energy Week in London (last day)

- Nigeria International Energy Summit (fourth day), Abuja

- Earnings: Helleniq, Technip Energies, Drax, Canadian Natural Resources

Friday, March 1

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- Cotton System Consumption and Stocks

- Cotton System Consumption and Stocks, Annual

- Fats and Oils: Oilseed Crushings, Annual

- Fats and Oils: Oilseed Crushings, Production, Consumption and Stocks

- Grain Crushings and Co-Products Production

- FranceAgriMer’s weekly crop conditions report

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- ICE weekly Commitments of Traders report for Brent, gasoil

- Nigeria International Energy Summit (last day), Abuja

- Earnings: Vallourec, Maurel & Prom

- Holidays: South Korea

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum | Debt-limit/budget package |