Your Pro Farmer newsletter (February 17, 2024) is now available

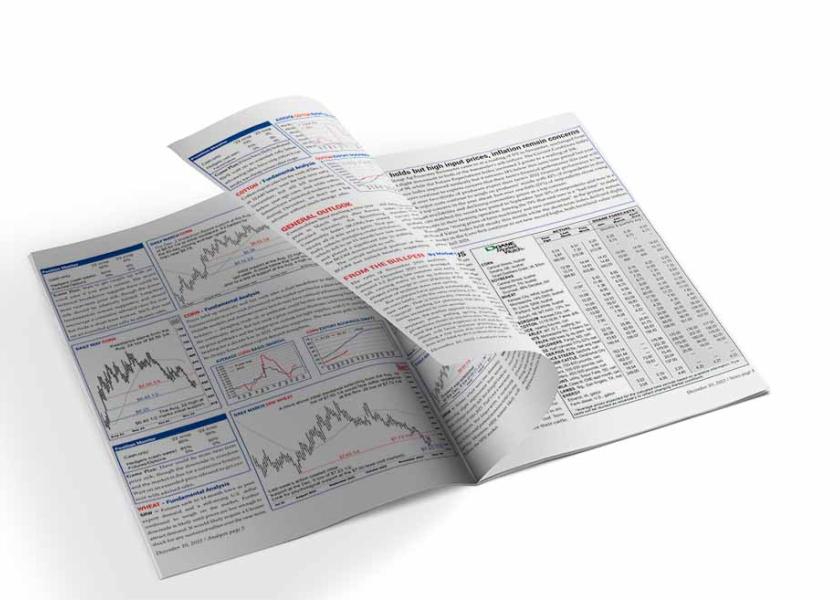

Grain markets continued to sell off as supportive news remains scarce and the path of least resistance is down. While funds are heavily short across the grain and soy complex, there’s no incentive for them to actively cover shorts. USDA’s initial projections for 2024-25 added fuel to bears’ fire. While these are USDA’s be guesstimates at this time and conditions will change, the projected increases in ending stocks paint an even bleaker long-term picture. The extended weather forecast through May suggests generally favorable weather for spring planting. The drought that began in 2020 may be coming to an end. However, a bout of heat and dryness may develop in late spring/early summer. On the policy front, the farm bill remains stuck in neutral with increasing disparity between SNAP/food stamps and farm safety net spending providing a major wedge in talks. Our News page 4 feature this week is key gleanings from USDA’s Ag Outlook Forum. We cover all of these items and much more in this week’s newsletter, which you can download here.