Former Top USDA Economists Give Advice on CCC Funding

Vilsack says Wednesday’s House Ag hearing was ‘wasted opportunity’

|

Today’s Digital Newspaper |

MARKET FOCUS

- Presidents Day schedule

- Fed Chair Powell to testify before Congress first week of March

- Bostic: No rush to cut interest rates in U.S. with labor market and economy still strong

- Inflation returns: CPI marks largest rise in five months

- U.S. housing starts plunge 14.8% month-over-month

- Deere's stock drops despite strong earnings; lower guidance sparks investor concerns

- U.S. gov’t will soon spend more on interest payments than defense

- Diesel price tops $4 per gallon

- DOE purchases another 2.95 million barrels of oil for SPR

- Ag markets today

- Corn prices continue to decline, reaching three-year lows

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Despite a lot of work to do, House and Senate leave for extended recess

- Momentum for popular House-passed tax bill diminished in Senate

- Rep. Emmer: House will not pass another temporary spending bill

- House clears bill to reverse Biden pause on new liquefied natural gas (LNG) exports

ISRAEL/HAMAS CONFLICT

- Israel raided largest functioning hospital in Gaza on Thursday

RUSSIA & UKRAINE

- Jailed Russian opposition figure and outspoken Kremlin critic Alexey Navalny has died

- Zelenskyy hails Ukraine defense deals with Germany and France

- Russia reportedly recruiting soldiers from Cuba to join fighting in Ukraine

POLICY

- Vilsack talks regulations, farm support, and climate goals

- Vilsack keeps talking about tapping CCC for farm bill, but lawmakers aren’t listening

CHINA

- China steps up ‘whitelist’ mechanism for property sector

- China goes to Mexico to sell Chinese cars to U.S.

- China revives Socialist ideas to fix its real-estate crisis

- Blinken, Chinese Foreign Minister Wang Yi to meet at Munich Security Conference

- The Philippines tries to deal with escalating tensions with China

ENERGY & CLIMATE CHANGE

- U.S. corn producers anxious as they await details on SAF from Treasury Dept.

- Japanese utilities concerned over extended U.S. LNG export pause

POLITICS & ELECTIONS

- Rosendale drops Montana Senate bid

- A likely Biden/Harris ticket: Cook Political Report with Amy Walter

- SEC approves deal to take Donald Trump’s social network public

OTHER ITEMS OF NOTE

- Report highlights Mexico's water crisis and urges action

- Cotton AWP rises again.

|

MARKET FOCUS |

— Presidents Day schedule. Markets and gov’t offices are closed Monday, Feb. 19, for Presidents Day. Grain markets will resume trading at 7:00 p.m. CT on Monday, Feb. 19, with the overnight session. Livestock markets will reopen at 8:30 a.m. CT on Tuesday, Feb. 20.

— Equities today: Asian and European stock markets were mixed in overnight trading. U.S. Dow opened around 60 points lower. In Asia, Japan +0.9%. Hong Kong +2.5%. China closed. India +0.5%. In Europe, at midday, London +1.1%. Paris +0.6%. Frankfurt +0.7%.

U.S. equities yesterday: The Dow gained 348.85 points, 0.91%, at 38,773.12. The Nasdaq rose 47,03 points, 0.30%, at 15,906.17. The S&P 500 was up 29.11 points, 0.58%, at 5,029.73.

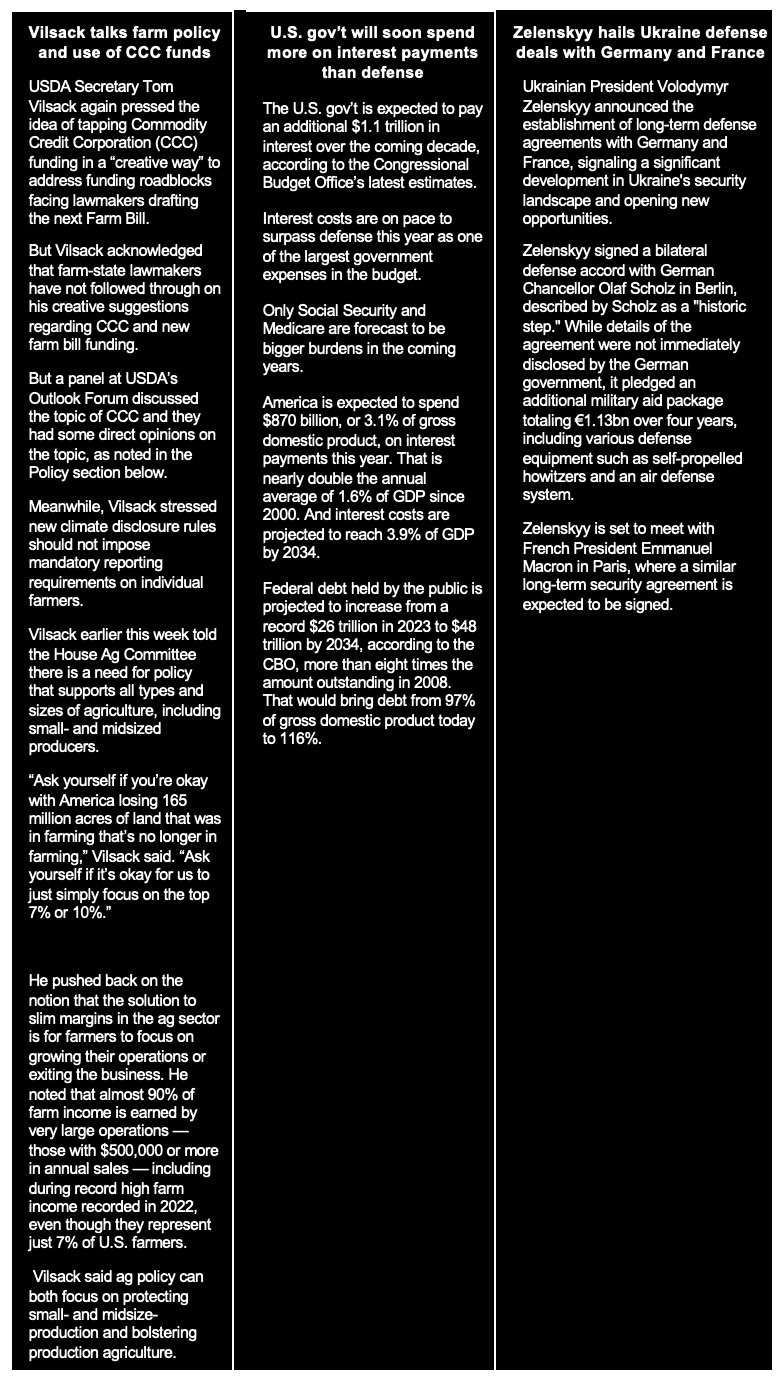

— Deere's stock drops despite strong earnings; lower guidance sparks investor concerns. John Deere's stock dropped by 5.55% despite reporting better-than-expected fiscal first-quarter earnings. The company's EPS of $6.23 from machinery sales of $10.4 billion exceeded Wall Street's estimates. However, guidance for the year pushed the stock lower, with Deere expecting lower net income compared to previous projections. Link for details.

During the company’s first quarter, Deere shipped fewer tractors globally but the reduced volume was partially offset by higher prices.

The company now anticipates a net income of around $7.6 billion for the year, down from the previously forecasted $8 billion. This adjustment contributed to investor nervousness, as Deere's expected EPS for the remaining three quarters is below analysts' estimates.

The world’s biggest farm-machinery producer is seen as a bellwether for the health of the agriculture industry,

Deere's CEO, John May, highlighted the company's effective operating model and dedicated workforce, but the agricultural cycle is on a downturn. Falling corn prices have led to reduced spending by farmers and a decline in Deere's sales year over year.

Deere is counting on product advancements to help draw in customers, such as crop sprayers that use artificial intelligence to identify weeds. It’s also been testing fully autonomous tractors. Deere in January announced a partnership with Elon Musk’s SpaceX to connect its farm equipment to the internet through Starlink satellites — which will help the company with its goals to generate recurring revenue through subscriptions even when equipment sales slow. “Customers are wanting higher levels of technology, and they want us to rapidly accelerate that in markets where they don’t have the infrastructure to support it,” Deere Chief Executive Officer John May said Thursday on a call with investors.

This trend is mirrored in Deere's peers' results. CNH Industrial reported earnings in line with expectations, while AGCO's guidance aligns with Wall Street's forecasts. Despite positive aspects like favorable inventories and technology adoption, agricultural machinery stocks have faced investor skepticism, with Deere's decline leading to relatively low valuation multiples compared to its peers.

— Ag markets today: Corn and soybeans posted corrective gains overnight, while wheat faced followthrough selling. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents higher, soybeans were 6 to 7 cents higher, winter wheat markets were 3 to 6 cents lower and spring wheat was around a penny lower. Front-month crude oil futures were around 50 cents lower, and the U.S. dollar index was near unchanged.

Beef prices strengthen, movement improves. Wholesale beef prices firmed $1.30 for Choice and $3.97 for Select on Thursday. Despite the strong price gains, packers moved 134 loads of product. With Choice above $295.00 and Select at nearly $288.00, retailer demand will be tested. Retailers have proven to be selective buyers at these levels since late last year.

Pork cutout surges back to resistance level. The pork cutout value firmed $4.04 on Thursday, led by gains of more than $6.00 in hams and bellies, though loins also jumped $4.70. At $89.95, the cutout is up against resistance that has capped price gains and slowed retailer buying in the recent past. Packers moved only 242.7 loads of product amid the strong price gains yesterday.

— Agriculture markets yesterday:

- Corn: March corn fell 6 1/2 cents to $4.17 3/4, a fresh contract low close.

- Soy complex: March soybean futures dropped 8 1/4 cents to $11.62 1/4 after marking a fresh for-the-move low. March soymeal settled $3.80 lower to $339.50, nearer session low. March soyoil slipped 35 points to 46.00 cents.

- Wheat: March SRW wheat fell 18 1/2 cents to $5.67, near the session low and hit a 2.5-month low. March HRW wheat dropped 12 cents to $5.75 3/4, nearer the session low and hit a contract low. March spring wheat futures slipped 4 1/2 cents to $6.58.

- Cotton: March cotton futures surged 115 points to 94.63 cents, the highest close in 16 months on the continuation chart.

- Cattle: April live cattle rose $1.60 to $185.60 and near the session high. March feeder cattle gained 87 1/2 cents to $247.10, also near the session high

- Hogs: Hog futures could sustain only a portion of early-Thursday gains. Nearby April futures ended the day 47.5 cents higher at $85.00.

— Quotes of note:

- Federal Reserve Chair Jay Powell is set to testify before Congress in the first week of March. The House Financial Services Committee will hear from the Fed chair on March 6, according to sources. The Senate Banking Committee will follow on March 7.

- There is no rush to cut interest rates in the U.S. with the country’s labor market and economy still strong, according to Federal Reserve Bank of Atlanta President Raphael Bostic. He cautioned that it remains unclear that inflation is heading sustainably to the 2% target, saying the evidence so far indicates “victory is not clearly at hand.” Treasuries fell after Bostic’s comments and have held the decline.

- “A reminder that nobody from @FTC will ever give you a badge number, ask you to confirm your Social Security number, ask how much money you have in your bank account, transfer you to a CIA agent, or send you texts out of the blue.” — Lina Khan, the FTC chair, responding to an article in The Cut by Charlotte Cowles, a financial columnist, about how she got scammed out of $50,000 that has since gone viral. Link for details.

- A well Wells Fargo. “We feel really good about the plans we put in place…It’s not a matter of if, it’s a matter of when we resolve the remaining issues.” — Scott Powell, Wells Fargo’s chief operating officer.

— U.S. producer prices in January experienced a 0.3% increase month-over-month, marking the largest rise in five months. This followed a 0.1% decline in December and exceeded forecasts of 0.1%. Service costs notably rose by 0.6%, the most significant increase since July, driven by a 2.2% surge in hospital outpatient care prices. Additionally, prices for chemicals and allied products wholesaling, machinery and equipment wholesaling, portfolio management, traveler accommodation services, and legal services saw upticks. Conversely, goods prices declined by 0.2%, marking the fourth consecutive decrease, primarily due to a 3.6% drop in gasoline prices. Other goods, including electric power, hay, hayseeds, and oilseeds, beef and veal, ethanol, and iron and steel scrap, also experienced declines in prices. Year-on-year, producer prices rose by 0.9%, slightly lower than December's 1% but surpassing expectations of 0.6%.

— In January 2024, housing starts in the U.S. experienced a significant decline, dropping by 14.8% month-over-month to an annualized rate of 1.331 million, the lowest since August. This figure fell short of market expectations of 1.46 million and marked the largest decrease since April 2020. Single-family housing starts decreased by 4.7% to 1.004 million, while the rate for units in buildings with five units or more plummeted by 35.8% to 314 thousand. Regionally, housing starts declined across the board: in the Northeast (-20.6% to 104 thousand), the Midwest (-30% to 142 thousand), the South (-9.7% to 753 thousand), and the West (-15.7% to 332 thousand).

Market perspectives:

— Outside markets: The U.S. dollar index was weaker ahead of U.S. inflation data, with the British pound weaker and the euro largely steady against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 4.22%, with a mostly higher tone in global government bond yields. Crude oil futures were lower, with U.S. crude around $77.50 per barrel and Brent around $82.20 per barrel. Gold and silver futures were firmer ahead of wholesale inflation data, with gold around $2,019 per troy ounce and silver around $23.03 per troy ounce.

— Brent crude futures held steady near $83 per barrel on Friday, poised for a second consecutive weekly gain, supported by geopolitical tensions in the Middle East and efforts by OPEC+ to restrict oil supply. Oil prices rose over 1% on Thursday following weaker-than-expected U.S. retail sales data, which led to a dollar selloff. However, the International Energy Agency (IEA) cautioned in its monthly report that global oil demand is losing momentum, citing a significant decline in Chinese demand. The IEA revised its 2024 global oil demand forecast downward to 1.22 million barrels per day from 1.24 million bpd and predicted a supply increase of 1.7 million bpd for this year, surpassing its previous estimate of 1.5 million bpd.

— Diesel price tops $4 per gallon. For the week ending Feb. 12, the U.S. average diesel fuel price increased 21.0 cents from the previous week to $4.109 per gallon — surpassing $4 per gallon for the first time since Dec. 4, 2023, according to USDA’s weekly Grain Transportation Report. Despite the large jump, the most recent price was still 33.5 cents below the same week last year. The most recent price jump is the sixth largest since Russia invaded Ukraine on Feb. 24, 2022, and the largest since the rise of 22.2 cents per gallon for the week ending July 31.

In the Midwest, the average diesel price rose the most of all the regions — by 30.4 cents per gallon. The Midwest price increase follows a Feb. 1 power outage that halted operations at a BP plant in Whiting, Indiana. The largest refinery in the Midwest, BP Whiting has a capacity to process 435,000 barrels of crude daily. BP intends to keep the refinery closed for up to three weeks.

— DOE purchases another 2.95 million barrels of oil for SPR. The Department of Energy (DOE) announced it purchased 2.95 million barrels of crude for the Strategic Petroleum Reserve (SPR) from four companies. It purchased oil for June delivery from Atlantic Trading & Marketing (1.5 million barrels), Macquarie Commodities Trading (800,000 barrels), Exxon Mobil (350,000 barrels), and BP Products North America (300,000 barrels). The average purchase price was $77.81 per barrel. DOE has now bought nearly 23.1 million barrels of crude to put back in the SPR since their restocking effort started in 2023, with an average purchase price of $76.34 per barrel.

— Corn prices continue to decline, reaching three-year lows as Chicago corn futures hit just under $4.20 per bushel, close to their lowest levels since December 2020. This drop is attributed to abundant global supplies and subdued demand forecasts. USDA's annual outlook forum projected a surge in U.S. corn stocks to 2.532 billion bushels by the end of the 2024-25 season, a 17% increase from the previous year and the highest level since 1987-88. Additionally, USDA forecasts a reduction in corn planting and an increase in soybean planting in 2024 compared to the previous year. Meteorological forecasts predicting rainfall in South America further support the notion of a supply surplus.

— Ag trade update: Egypt purchased 180,000 MT of wheat, including 120,000 Ukrainian and 60,000 MT Romanian.

— NWS weather outlook: Swath of accumulating snow will spread from Midwest today to Mid Atlantic tonight... ...Heavy Rain and mountain snow to impact California this weekend... ...Chilly air sweeps across much of the central and southern parts of the country this weekend.

Items in Pro Farmer's First Thing Today include:

• Corn and beans firmer, wheat lower overnight

• French wheat crop rating at four-year low

|

CONGRESS |

— Despite a lot of work to do, both the House and Senate leave for extended recess. The House exited a day early and will be gone for a nearly two-week Presidents Day recess. The House will return Feb. 28, just three days before the first government funding deadline on March 1 (including for USDA). The Senate is out until Feb. 26, but several members are overseas for the annual Munich security conference.

— Momentum for the popular House-passed tax bill has diminished in the Senate. Despite wide bipartisan approval in the House last month, the Tax Relief for American Families and Workers Act of 2024, which includes temporary revival of three business tax breaks and enhancements to the refundable part of the child tax credit, has hit some hurdles in the Senate, as we alerted a few weeks ago. The delay is attributed to the Senate's focus on other pressing matters. Also, some Senate Republicans are pushing for alterations to the tax bill while others such as Sen. Chuck Grassley (R-Iowa) want to wait until after Nov. 5 elections and a new Congress to ink a new tax cut package. While optimism remains among congressional tax writers for eventual passage, it is clear any action on the bill will likely be postponed for weeks or even into spring.

— House will not pass another temporary spending bill to prevent a partial government shutdown, according to Rep. Tom Emmer (R-Minn.), the Republican majority's top vote-counter. With the current funding set to expire March 1 for some agencies including USDA and March 8 for others, Emmer's statement increases the possibility of a shutdown as Congress faces limited time to finalize the fiscal year 2024 spending measure. Although Emmer remains hopeful that a shutdown can be avoided, conservative demands for policy changes pose a challenge to negotiations. Emmer also criticized the White House for not engaging in border security talks to release Ukraine aid, suggesting a potential reduction in aid levels to focus on military support.

— House passed a measure 224-200 to reverse the Biden administration's pause on new liquefied natural gas (LNG) export approvals. However, it's unlikely that the Democratically controlled Senate will consider the plan. Nine Democrats joined Republicans in voting for the measure. There's speculation that similar language could be inserted into government funding measures for fiscal year 2024 that still require approval.

|

ISRAEL/HAMAS CONFLICT |

— Israel raided the largest functioning hospital in Gaza on Thursday after receiving intelligence that the bodies of hostages were being held inside the facility. The Hamas-run health ministry said four patients died after electrical power was lost and oxygen supplies were interrupted at the hospital. Meanwhile, Egypt is building a new walled buffer zone more than two miles wide on Gaza border.

|

RUSSIA/UKRAINE |

— Jailed Russian opposition leader Alexei Navalny is dead, the prison service of the Yamalo-Nenets region where he had been serving his sentence said on Friday. According to the agency’s website, Navalny felt unwell after a walk and subsequently lost consciousness. He was attended to by medical workers at the prison facility, but they were unable to revive him, the statement adds. An exact cause of the death is yet to be established.

— Russia is reportedly recruiting soldiers from Cuba to join the fighting in Ukraine, offering salaries of around $2,000, which are significantly higher than the monthly wages available in Cuba. According to Maryan Zablotskyi, a member of the Ukrainian parliament, between 1,500 and 3,000 Cubans have enlisted due to the economic challenges in Cuba. Additionally, Ukrainian authorities claim that Russia has recruited fighters from other countries, including the Central African Republic, Serbia, Nepal, and Syria, to support its war effort in Ukraine.

|

POLICY UPDATE |

— Vilsack talks regulations, farm support, and climate goals. USDA Secretary Tom Vilsack addressed regulations during a session with reporters at USDA's 100th Outlook Forum near Washington, DC. Vilsack reiterated his stance against focusing farm bill support to larger farmers, citing Census of Agriculture data to support the need for assistance to small- and medium-sized farmers. He expressed concerns about potential conflicts between the Securities and Exchange Commission (SEC) climate reporting rule and USDA's efforts to promote climate-smart commodity practices, advocating for incentives over mandates to achieve climate goals. Vilsack also defended USDA's regulatory efforts, particularly regarding electronic animal ID tags for cattle and bison, emphasizing their importance in disease outbreak mitigation despite their relatively small cost to ranchers.

More on SEC rule: During a press conference, Vilsack said the SEC’s proposed rule requiring publicly listed companies to disclose likely climate impacts and risks runs counter to USDA’s efforts to encourage climate-smart agricultural practices. “From a standpoint of agriculture, I don’t know that it’s necessarily helpful to have mandates,” said Vilsack. He added that incentives would be more effective so “[farmers] don’t feel like they have to go off the farm and work 40 hours a week to be able to keep doing what they love to do.” The SEC has said the rule won’t require farmers to disclose climate impacts of their operations, but it would affect companies in the agribusiness space. That has led to fears among producers and major farm groups that they may be subject to informal reporting requirements in order to be part of larger agriculture supply chains.

— Vilsack keeps talking about tapping CCC for farm bill safety net funding, but lawmakers aren’t listening. At USDA's 100th Agricultural Outlook Forum, Secretary Tom Vilsack again proposed innovative approaches, such as utilizing Commodity Credit Corporation (CCC) funds creatively, to address funding challenges without compromising other priorities. Vilsack highlighted the need to balance support for both production agriculture and smaller producers, rejecting the idea that farming success should solely be measured by expansion. He advocated for programs like the Partnerships for Climate-Smart Commodities (PCSC) to provide new revenue opportunities for all farmers.

Key farm-state lawmakers have not directly addressed Vilsack’s repeated overtures regarding tapping CCC as a farm bill revenue stream, dubbed as USDA’s ATM machine. “In the past, we figured out creative ways to use the CCC, but there has to be a willingness to be open to the conversation,” said Vilsack. Vilsack on Thursday called his appearance before the House Ag Committee this week a “wasted opportunity” to dig into specifics about farming and the creative process, and instead had to confront members “with a point to make… It was an opportunity to explain the importance of a farm bill to everybody, not just a handful of farmers. It was an opportunity to talk about how the farm bill contributes to the rest of the country,” Vilsack told reporters. Vilsack cited recent Census data that revealed the loss of about 142,000 farms from 2017 to 2022. The trend should fuel arguments for policies that safeguard small- and mid-sized farms, Vilsack said in his opening remarks at the Forum.

But some former USDA top economists addressed the topic during USDA’s Forum, with some advocating for Congress to reintroduce restrictions on USDA’s use of CCC, which grants broad authority to support farm income. Joe Glauber, former chief economist at USDA, highlighted the significant expansion of CCC usage under the Trump and Biden administrations since restrictions were lifted during the Obama era. Glauber emphasized the need for congressional oversight on CCC utilization. Bob Thompson, a Reagan administration official, described the CCC as a "license to steal," advocating for overdue restrictions on its use. Similarly, Dan Sumner, who served in the George H.W. Bush administration, supported imposing limitations on the CCC. But Rob Johansson, former USDA chief economist during the Trump administration, urged caution, emphasizing CCC's role in responding swiftly to unforeseen events like the trade war with China. Johansson suggested that while Congress may address concerns about CCC usage, it has allowed USDA to react promptly to situations beyond the scope of traditional farm bill provisions.

During a news conference, Vilsack complimented Senate Agriculture Committee chair Debbie Stabenow (D-Mich.) for an imaginative proposal to provide higher levels of crop insurance coverage to row-crop growers if they forgo traditional crop subsidies. He also said that Senate Majority Leader Chuck Schumer (D-N.Y.) “says he’s going to bring $5 billion into the [farm] program… He’s obviously got a mechanism for getting those resources into the program outside of the [budget] baseline,” said the secretary, when asked about the reach of congressional accounting rules. “Where there’s a will, there’s a way.”

|

CHINA UPDATE |

— China steps up ‘whitelist’ mechanism for property sector. Five state-owned Chinese banks have been matched with more than 8,200 residential projects for development loans under the “whitelist” mechanism aimed at injecting liquidity into the crisis-hit sector, government-backed media The Paper reported. The high number of projects already approved for possible support highlights the government’s efforts to free up funding for the debt-riddled industry, although it is unclear how many will secure loans. Under the “project whitelist” mechanism launched on Jan. 26, city governments are recommending to banks residential projects suitable for financial support and are coordinating with financial institutions to meet projects’ needs. A sixth state bank, Postal Savings Bank of China, has already approved some loans after receiving “whitelist” projects with 5.7 billion yuan ($792.5 million) of financing needs, although it has not given details on the number of projects involved, The Paper reported.

— China goes to Mexico to sell Chinese cars to U.S. High tariffs on China imposed during the Trump administration and retained by the Biden administration have helped keep BYD out of the U.S., but the company is eyeing a plant in Mexico that American carmakers fear can be used to make inroads under the USMCA trade agreement. "Last year, 25% of all vehicles sold in Mexico were sourced in China," Ford's CEO Jim Farley declared. "The world is changing." BYD recently surpassed Tesla as the world’s biggest seller of EVs. Locating a plant in Mexico could enable the carmaker to export to the U.S. without incurring hefty tariffs, but it would face stiff opposition from American rivals, the Wall Street Journal reports (link).

— China revives Socialist ideas to fix its real-estate crisis. Xi Jinping aims to put the state back in charge of the crumbling property market, part of a push to rein in the private sector. Link to details via the Wall Street Journal.

— Blinken, Chinese Foreign Minister Wang Yi to meet Friday at Munich Security Conference. Secretary of State Antony Blinken and Chinese Foreign Minister Wang Yi are likely to discuss planning for a phone call this spring between President Joe Biden and Chinese leader Xi Jinping. Link to more via Politico.

— The Philippines is taking proactive measures to mitigate potential economic repercussions from escalating tensions with China. Amid strained relations over maritime disputes, which have strained bilateral trade, the Philippines is diversifying its trade partners to build resilience. Foreign Affairs Secretary Enrique Manalo highlighted the need to explore trade opportunities with other nations to reduce reliance on China, which accounted for $40 billion in trade last year.

Manalo emphasized the importance of not solely depending on one trading partner to minimize the impact of potential economic retaliation. The Philippines is expanding its economic ties with countries in Asia, Europe, and the United States, as well as seeking free trade agreements with the European Union. Despite tensions, trade sanctions from China are not immediately expected, but the Philippines remains prepared for any eventuality.

The territorial dispute in the South China Sea has hindered the Philippines' plans to explore oil and gas reserves. While open to negotiations with China, the Philippines is adamant about retaining control of any joint ventures in accordance with its laws.

|

ENERGY & CLIMATE CHANGE |

— U.S. corn producers are anxious as they await details on the green jet fuel tax credit (Sustainable Aviation Fuel/SAF). Lawmakers, including Democratic Sen. Amy Klobuchar (Minn.) and Tammy Duckworth (Ill.), Republican Sen. John Thune (S.D.), and 40 others, wrote a letter (link) to the Biden administration on Thursday to ensure that American farmers can benefit from tax credits aimed at reducing climate-change pollution through the production of lower-emission jet fuel.

The concern centers around the potential revision of the Energy Department's emissions-measuring method, known as GREET, which could impact the ability of the corn-ethanol industry to claim subsidies.

The lawmakers are calling for the Biden administration’s Treasury Department to act by March 1 and ensure that the update properly credits practices like regenerative farming and carbon capture, recognizes the contributions of U.S. agriculture in indirect land-use changes, and rewards modern practices like precision agriculture that increase per-acre yields.

The Treasury Department previously said in a statement (link) that its green jet fuel guidance will include a revised version of the Energy Department’s emissions-measuring method known as GREET, a model for calculating greenhouse gas emissions backed by ethanol makers.

Background: The Treasury Department’s guidance provides important clarity around eligibility for the SAF Credit. The credit incentivizes the production of SAF that achieves a lifecycle greenhouse gas emissions reduction of at least 50% as compared with petroleum-based jet fuel. Producers of SAF are eligible for a tax credit of $1.25 to $1.75 per gallon. SAF that decreases GHG emissions by 50% is eligible for the $1.25 credit per gallon amount, and SAF that decreases GHG emissions by more than 50% is eligible for an additional $0.01 per gallon for each percentage point the reduction exceeds 50%, up to $0.50 per gallon. U

Under the guidance, numerous fuels will qualify for the credit, including valid biomass-based diesel, advanced biofuels, cellulosic biofuel, or cellulosic diesel that have been approved by EPA under the Renewable Fuel Standard (RFS). Fuels that achieve a 50% or greater reduction in lifecycle greenhouse gas emissions under the most recent Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) standard will continue to qualify under the guidance.

In addition, EPA, DOT, USDA, and DOE announced their commitment to release an updated version of DOE’s GREET model by March 1, 2024. Pending further guidance from the Treasury Department, the updated GREET model will provide another methodology for SAF producers to determine the lifecycle GHG emissions rates of their production for the purposes of qualifying for the SAF Credit for SAF sold or used during calendar years 2023 and 2024.

The updated model will incorporate new data and science, including new modeling of key feedstocks and processes used in aviation fuel. The updated model will also integrate other categories of indirect emissions like crop production and livestock activity, in addition to best available science and modeling of indirect land use change emissions. The updated model will also integrate key greenhouse gas emission reduction strategies such as Carbon Capture and Storage, Renewable Natural Gas, Renewable Electricity, and Climate-Smart Agriculture Practices.

— Japanese utilities concerned over extended U.S. LNG export pause. Kazurhiro Ikebe, who heads Japan's federation of electric utilities, conveyed these concerns during a news conference held in Tokyo. Ikebe acknowledged that if the pause in LNG export approvals from the U.S. were to last longer than a short-term interval, it could have adverse effects on Japanese utilities. However, he also noted that the impact might be limited since projects that have already received permits would not be affected by the pause. Despite these concerns, Ikebe emphasized that Japan expects the U.S. to maintain a responsible stance in stabilizing global energy supply and demand, given its status as the largest exporter of LNG in the world. However, he clarified that the federation is not presently planning to engage in lobbying efforts with the U.S. government regarding this issue.

|

POLITICS & ELECTIONS |

— Rosendale drops Montana Senate bid. GOP Rep. Matt Rosendale is dropping his Montana Senate bid less than a week after he officially launched it. Rosendale had publicly explored a campaign for months and announced his entry into the race last Friday. The reversal from the conservative firebrand congressman is a boon to national Republicans, who are backing veteran Tim Sheehy and are eager to avoid a damaging primary. His decision comes after former President Donald Trump endorsed Sheehy in his race against incumbent Sen. Jon Tester (D-Mont.).

— A likely Biden/Harris ticket. Despite all the wish-casting and conspiracy theories out there, Biden/Harris (barring some sort of health or other emergency, of course) will be the Democratic ticket this fall, according to the Cook Political Report with Amy Walter. “There are many reasons why a last-minute ‘White Knight’ scenario will not happen — the most important being that state deadlines for primary ballot access in all but six states will have passed by the end of February,” says Walter.

— SEC approves the deal to take Donald Trump’s social network public. Shares in Digital World Acquisition Corporation, the blank-check company that agreed to merge with Trump’s Truth Social, jumped 16% on the news. At current prices, Trump’s stake in the post-merger company is worth nearly $4 billion on paper.

|

OTHER ITEMS OF NOTE |

— Report highlights Mexico's water crisis and urges action. The Mexican Institute for Competitiveness (IMCO) highlights Mexico's water crisis, noting severe drought affecting over 1,600 municipalities. Mexico City's affluent neighborhoods, like Polanco, face water restrictions, with some households relying on tanker truck deliveries for days due to shortages. The latest data from Mexico's Drought Monitor shows worsening drought conditions nationwide.

IMCO attributes the increase in droughts to climate change, with Mexico experiencing a 1.6°C temperature rise in the last 40 years. It also points out deficiencies in water infrastructure, including outdated dams and inadequate management.

IMCO calls for better coordination among government agencies and investment in water infrastructure. Despite the existence of the National Water Commission (CONAGUA), decision-making remains fragmented among numerous municipal water authorities.

The report emphasizes the significance of water management, given that 76% of water usage in Mexico is allocated to agriculture. IMCO stresses the importance of modernizing water resource management to address the crisis effectively.

While water may not be a central issue in the country’s presidential campaign, it's gaining importance. IMCO suggests that candidates prioritize infrastructure modernization and maintenance to prevent water scarcity issues.

— Cotton AWP rises again. The Adjusted World Price (AWP) for cotton increased to 73.44 cents per pound, effective today (Feb. 16), up from 70.04 cents per pound the prior week and the fifth consecutive weekly increase. USDA also announced that Special Import Quota #18 would be established Feb. 22 for 30,041 bales of upland cotton, applying to supplies purchased not later than May 21 and entered into the U.S. not later than Aug. 19.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |