USDA’s Initial Look at 2024-25 Supply and Demand

Star wars | Vilsack at House hearing | Dicamba | Global shipping | Japan in recession

|

Today’s Digital Newspaper |

MARKET FOCUS

- Japan and Britain are in recession

- Waiting period shortened for White House officials to weigh in on economic releases

- U.S. retail sales fall more than expected

- U.S. import prices in January surged by 0.8% compared to the previous month

- U.S. export prices unexpectedly rose by 0.8% month-over-month

- U.S. jobless claims unexpectedly fall

- Study: Black Americans own low percentage of homes relative to population size

- IEA: Oil demand losing momentum

- WSJ: Enviva, largest exporter of wood pellets in U.S., facing bankruptcy

- Increase in interest expenses on farmland debt could pose challenges to profitability

- Ag markets today

- U.S. ag export sales of soybeans, cotton and pork to China continue

- USDA releases initial 2024-25 supply and demand guesstimates

- Richard Crow on USDA 2024-25 S/D guesstimates out this morning

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- House rejects change to $10,000 cap on state and local tax, or SALT, deduction

- House Speaker halts debate on spy law revision; renewal postponed

ISRAEL/HAMAS CONFLICT

- Israel’s military entered Nasser hospital, largest in Khan Younis

RUSSIA & UKRAINE

- Russian missiles struck civilian and infrastructure targets across Ukraine

POLICY

- Highlights of Vilsack appearance Wed. before House Ag Committee

- Vilsack today blamed for supporting industrial agriculture via poultry industry

- Southern Ag Today: The farm bill debate: Stuck in neutral

HEALTH UPDATE

- FTC investigating drug wholesalers, purchasing firms re: drug shortages

POLITICS & ELECTIONS

- Fourth high-ranking Republican committee leader opting out of seeking re-

- Nebraska House race flips to toss-up

- Putin prefers Joe Biden to be America’s next president over Donald Trump

OTHER ITEMS OF NOTE

- EPA to allow farmers to use some existing dicamba supplies

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed to firmer in overnight trading. U.S. Dow opened slightly higher and then rallied to almost 200 points higher. In Asia, Japan +1.2%. Hong Kong +0.4%. China closed. India +0.3%. In Europe, at midday, London flat. Paris +0.8%. Frankfurt +0.7%.

U.S. equities yesterday: The Dow rose 151.52 points, 0.40%, at 38,424.27. The Nasdaq was up 203.55 points, 1.30%, at 15,859.15. The S&P 500 gained 47.45 points, 0.96%, at 5,000.62.

— Ag markets today: Corn, soybeans and wheat extended Wednesday’s losses during the overnight session. As of 7:30 a.m. ET, corn futures were trading steady to fractionally lower, soybeans were 1 to 3 cents lower and wheat futures were 2 to 5 cents lower. Front-month crude oil futures were around 60 cents lower, and the U.S. dollar index was down about 180 points.

Cash cattle trade lower. Cash cattle started trading at mostly $2.00 lower prices in the Southern Plains Wednesday afternoon. The initial sales in reaction to sharp losses in futures suggest additional cash cattle trade will occur at lower prices this week, breaking the four-week string of strong gains.

Traders build premium in April hogs. The CME lean hog index is up 48 cents to $74.60 as of Feb. 13, extending the seasonal price rebound. After surging on Wednesday, April hogs took over lead-month status at nearly a $10.00 premium to today’s cash quote, which is about the average seasonal gain in the cash index from now until mid-April.

— Agriculture markets yesterday:

- Corn: March corn fell 6 1/2 cents to $4.24 1/4, a fresh contract low close.

- Soy complex: March soybeans fell 15 3/4 cents to $11.70 1/2, near the session low and hit an 8.5-month low. March soybean meal lost $1.50 at $343.30, nearer the session low and closed at an 11-month low close. March bean oil closed down 95 points at 46.35 cents and nearer the session low

- Wheat: March SRW wheat closed 12 cents lower at $5.85 1/2, the lowest close since Jan. 18. March HRW fell 8 1/4 cents to $5.84, a mid-range close. March spring wheat fell 9 1/4 cents to $6.62 1/2.

- Cotton: March cotton rose 196 points to 93.44 cents, near mid-range and hit a 1.5-year high.

- Cattle: The cattle and feeder complex continued this week’s pullback but rebounded significantly from their daily lows. Expiring February live cattle dropped $1.35 to $182.40 and most-active April fell $1.10 to $184.00. March feeder futures tumbled $1.775 to $246.225.

- Hogs: April lean hog futures surged $3.45 to $84.525 and settled nearer session highs. February futures went off the board at noon, up 95 cents at $75.175.

— Of note:

- Fedspeak. There are two Fed speakers today, Waller (1:15 p.m. ET) and Bostic (7:00 p.m. ET), and Waller could move markets as he is part of Fed leadership.

- “Looking forward, the market is trading more on economic growth and earnings projections than interest rates and inflation,” said Dylan Kremer, chief investment officer at Certuity.

- Biden administration has shortened the waiting period for White House officials to weigh in on economic releases — including GDP, inflation and jobs data — to 30 minutes from one hour, starting Monday. "This change reduces the delay after official release time before commentary from employees of the Executive Branch, while retaining a necessary time delay between policy-neutral release of statistics and subsequent Executive Branch interpretations," said the Office of Management and Budget. A major reason behind changing the "gag period" is that data can now be widely accessed instantly through the internet, although concerns have been raised over the potential for market confusion and data manipulation.

- $77 billion: The amount that Chinese companies have raised from U.S. initial public offerings in the past decade, according to Dealogic. Bankers must answer a lot of tricky questions. Defining a Chinese company is one of the hardest, the WSJ reports.

— Britain and Japan fell into recession last year, new data shows. Japan has slipped into a recession, marked by two consecutive quarters of negative economic growth. In the fourth quarter, Japan's GDP contracted by 0.4%, following a 3.3% decline in the third quarter. As a result, Japan's nominal GDP now stands at $4.21 trillion, pushing it behind Germany, which has now become the world's third-largest economy with a nominal GDP of $4.46 trillion. The recession in Japan was driven by weakened private consumption and capital expenditures, both of which declined for the third consecutive quarter. This downturn raises concerns about the Bank of Japan's ability to transition away from its accommodative monetary policy, which it has been preparing to do. However, despite these challenges, some analysts point to a tight labor market and continued strong corporate spending as factors that may prompt the BOJ to ease its ultra-loose monetary policy.

in Britain, it could speed up rate cuts by the Bank of England. (In other global economic news, the European Commission lowered its growth forecast for the EU and the Eurozone.)

— In January 2024, retail sales in the U.S. contracted by 0.8% compared to December, marking the largest decline since March of the previous year. This downturn contrasts with a modest 0.4% increase in December and falls short of market expectations, which had anticipated a 0.1% decrease. The decline was widespread across various sectors, with notable decreases observed in sales of building materials and garden equipment (-4.1%), miscellaneous store retailers (-3%), gasoline stations (-1.7%), and motor vehicles and parts (-1.7%). Other sectors experiencing declines include health and personal care stores (-1.1%), nonstore retailers (-0.8%), electronic and appliance stores (-0.4%), clothing (-0.2%), and sporting goods, hobby, musical instruments, and books (-0.2%). However, some sectors saw growth, such as furniture stores (up 1.5%), food services and drinking places (up 0.7%), and food and beverage stores (up 0.1%), while sales remained steady at general merchandise stores. January typically sees a decline in retail sales following the strong December holiday shopping season. It's important to note that these figures are adjusted for seasonal variations but not for price changes.

— U.S. import prices in January surged by 0.8% compared to the previous month, marking the end of a three-month decline streak and surpassing market expectations of a flat reading. This increase, the largest monthly rise since March 2022, was driven by higher costs for both fuel and nonfuel imports. Import fuel prices saw a notable 1.2% uptick, rebounding from sharp declines in the previous months, with petroleum costs rising by 2.7% despite a significant drop of 24.5% in natural gas prices. Additionally, nonfuel import prices rose by 0.7%, the largest one-month increase in nearly two years, driven by elevated costs for consumer goods, capital goods, automotive vehicles, and foods, feeds, and beverages. Import prices recorded a 1.3% decline on a yearly basis in January.

— U.S. export prices unexpectedly rose by 0.8% month-over-month in January 2024, defying market expectations of a 0.1% decrease. This rebound follows three consecutive months of declines and contrasts with a 0.7% decrease in December. Nonagricultural export prices increased by 0.9%, marking the first monthly advance since September 2023, driven by higher prices for industrial supplies and materials, capital goods, automotive vehicles, and nonagricultural foods. Conversely, agricultural export prices fell by 1%, primarily due to lower prices for soybeans, animal feeds, corn, vegetables, and fruit. On an annual basis, export prices declined by 2.4%.

— U.S. jobless claims unexpectedly fall. In the week ending Feb 9, the number of individuals claiming unemployment benefits in the U.S. dropped by 8,000 to reach 212,000, significantly below market expectations of 220,000 and marking the lowest reading in nearly a month. This decline aligns with the latest jobs report, which highlighted tightness in the US labor market, providing the Federal Reserve with room to maintain a hawkish stance. However, the four-week moving average, aimed at reducing week-to-week volatility, increased by 5,750 to 218,500 during this period. On a non-seasonally adjusted basis, initial claims decreased by 12,565 to 222,164, with declines in Missouri and Pennsylvania offsetting increases in Kentucky and California. Conversely, continuing claims rose by 30,000 to 1,895,000 in the previous week, indicating that the unemployed population is encountering challenges in securing suitable employment opportunities.

— A recent study by LendingTree reveals that Black Americans still own a disproportionately low percentage of homes relative to their population size. The study found that between 2021 and 2022, the percentage of homes owned by Black individuals remained stagnant, averaging around 10.15% in the largest metropolitan areas of the country. Key obstacles to achieving homeownership among Black Americans include income inequality and issues within the tax system.

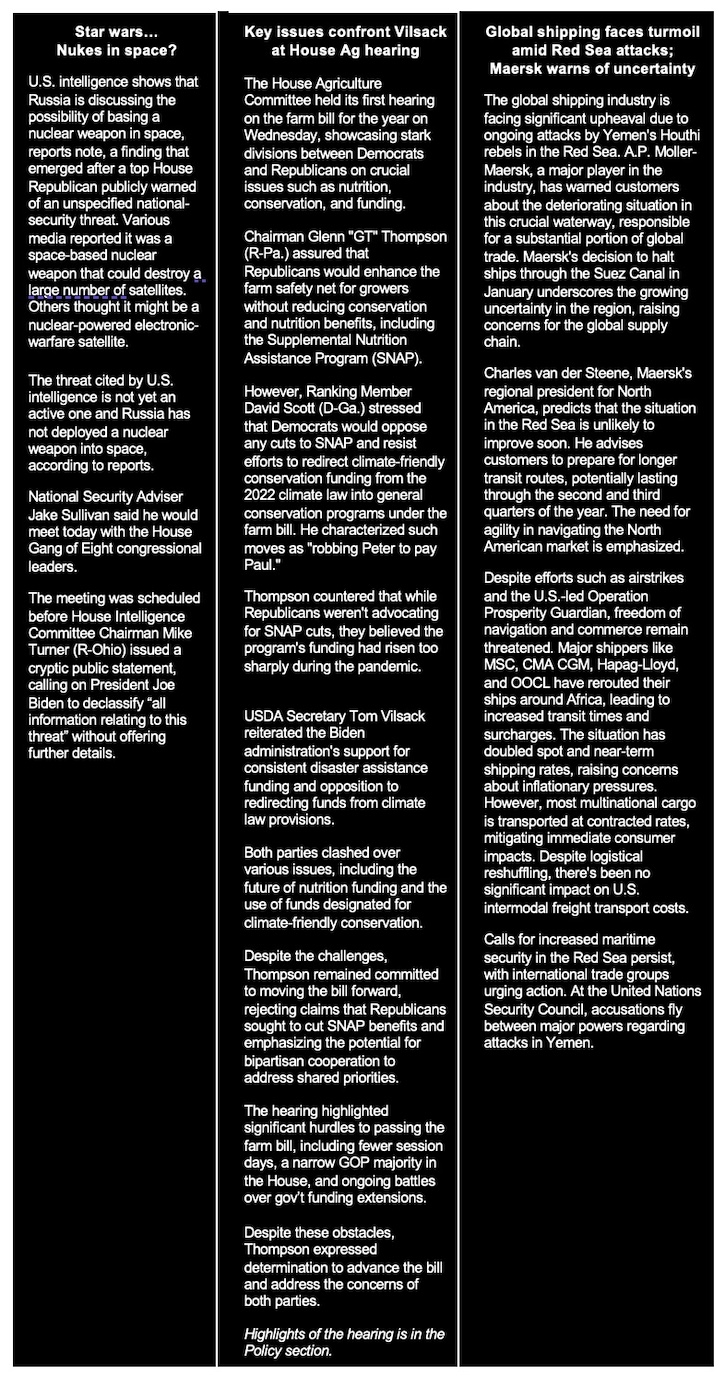

— Increase in interest expenses on farmland debt could pose significant challenges to farm profitability. Farmland values and interest rates rose from 2021 to 2023, leading to higher interest expenses for crop producers. This surge in interest costs may considerably reduce returns for producers with high levels of land debt, requiring substantial cash down payments to achieve profitability with new or refinanced debt, according to a report (link) from the Federal Reserve Bank of Kansas City.

Agricultural real estate values surged during 2021 and 2022, accompanied by historically high farm incomes and low interest rates. However, in 2023, while farmland values remained firm, interest rates increased, resulting in higher interest expenses on land loans. These increased expenses could squeeze profitability for crop producers, particularly those with high leverage.

The rise in financing costs occurred alongside a decline in farm operational costs. While expenses for an average corn and soybean farm without new land debt stabilized in 2023, expenses for farms with new land debt continued to rise. Interest expenses per acre increased in 2023, particularly for operations with large amounts of new debt.

The increase in financing costs could lead to thinner profit opportunities for all crop producers, especially those with large amounts of land debt. Farms with higher leverage and higher shares of newly financed land debt are likely to face the most pressure on their profit margins.

Higher interest costs are expected to impact both new land purchases and the incomes of borrowers refinancing existing debt. Many farmland loans are scheduled to be repriced in the coming months, with borrowers refinancing debt facing considerably higher interest payments than when the loan was originated.

Reducing financing costs may require producers to have significant amounts of cash on hand for down payments. With interest rates more than doubling since the beginning of 2022, the amount of funds needed to reduce debt balances and lower loan payments has increased.

Bottom line: In the current interest rate environment, crop producers with new or newly refinanced land debt may struggle to achieve profitability without strong equity positions or large cash down payments. While recent strength in farm income has bolstered working capital for some operators, high financing costs could reduce demand for newly financed agricultural real estate purchases and pose challenges for highly leveraged crop producers.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker with only the euro registering a gain against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 4.22%, with a negative tone in global government bond yields. Crude oil futures were weaker, with U.S. crude around $76.45 per barrel and Brent around $81.40 per barrel. Gold and silver futures were firmer ahead of US economic updates, with gold around $2,010 per troy ounce and silver around $22.75 per troy ounce.

— IEA: Oil demand losing momentum. The International Energy Agency (IEA) trimmed its 2024 growth forecast to 1.22 million barrels per day (bpd) from 1.24 million bpd, due in part to a sharp slowdown in Chinese consumption. IEA estimated global oil supply will grow 1.7 million bpd this year, up from its previous forecast of 1.5 million bpd. IEA now expects supply to grow to a record high of about 103.8 million bpd, almost entirely driven by producers outside OPEC+, including the U.S., Brazil and Guyana. Given the robust outlook for supply outside OPEC+, IEA expects a slight build in inventories in the first quarter. OPEC, meanwhile, expects oil use to keep rising for the next two decades. Monthly reports this week from the two forecasters underlined their starkly different estimates for 2024 oil demand. IEA now sees global oil demand to grow by 1.22 million bpd in 2024, slightly below their month-ago forecast of 1.24 million bpd.

— U.S. ag export sales of soybeans, cotton and pork to China continue. USDA weekly Export Sales data for the week ended Feb. 8 included sales activity to China for 2023-24 including net sales of 2,146 metric tons of wheat, net reductions of 2,083 metric tons of sorghum, 414,121 metric tons of soybeans, and 57,812 running bales of upland cotton. There were also cancellations of 60,000 metric tons of sorghum for 2024-25, wiping out all sales that had been made to China for 2024-25 relative to sorghum. For 2024, there were net sales of 19,537 metric tons of pork and net sales of 3,729 metric tons of beef.

— USDA Outlook Forum forecast highlights for U.S. crops, livestock and dairy:

- Corn: Planted area of 91.0 million acres with harvested acres at 83.1 million and a national average yield of 181 bushels per acre would bring a crop of 15. 040 billion bushels. Feed and residual use is pegged at 5.750 billion bushels with total food, seed and industrial use of 6.805 billion bushels which includes 5.400 billion bushels used for ethanol, bringing total domestic use to 12.555 billion bushels. With exports of 2.150 billion bushels, that would swell ending stocks to 2.532 billion bushels with a season-average farm price of $4.40 per bushel.

- Soybeans: Planted acres of 87.5 million with harvested at 86.6 million bushels and a national average yield of 52 bushels per acre brings a crop of 4.505 billion bushels. Crush is expected at 2.400 billion bushels with exports falling to 1.875 billion bushels for total use of 4.400 billion bushels and carryover at 435 million bushels. Season average price is forecast at $11.20 per bushel.

- Wheat: All wheat planted acres of 47.0 million and harvested at 38.4 million with a national yield of 49.5 bushels per acre brings a crop of 1.900 billion bushels with imports at 120 million bushels. Feed & residual use is at 110 million bushels, food and seed use at 1.024 billion bushels with exports of 775 million for total use of 1.909 billion bushels and carryover at 769 million bushels. Season average price is seen at $6 per bushel.

- Rice: Planted area of 2.9 million and harvested at 2.9 million acres with an average yield of 7,641 pounds per acre nets a crop of 218.0 million cwt. Total domestic and residual use is pegged at 167.0 million cwt. with 91.0 million cwt. in exports for ending stocks of 46.5 million cwt. and a season-average price of $16.80 per cwt.

- Cotton: Planted acres of 11.0 million with harvested at 9.29 million (18.3% abandonment) and a yield of 827 pounds per acre puts production at 16.0 million bales. With exports of 13.8 million bales and domestic use of 1.8 million bales, carryover would be at 3.5 million bales with a season-average price of 80.0 cents per pound.

- Cattle/Beef: Beef production for 2024 is forecast at 26.19 billion pounds (down 3% vs 2022) with marketings declining over the course of the year as the number of feedlot animals decline, with total beef exports of 2.79 billion pounds and imports at 3.43 billion pounds. The 5-area steer price is seen at a record $180.0 per cwt. in 2023.

- Hogs/Pork: Commercial production is seen at 27.88 billion pounds (up 2% from 2023) on an increase in market-ready supplies and higher carcass weights. Pork exports are seen at 7.08 billion pounds, up slightly from 2022, with imports at 1.20 billion pounds. The national base 51% -52% lean, live equivalent prices is seen at $60 per cwt.

- Broilers: Record-large production of 46.8 billion pounds with broiler meat exports seen at 7.22 billion pounds. National composite wholesale broiler price forecast at a record $1.27 per pound, up slightly from 2023.

- Dairy: Milk cow numbers are seen lower in 2024 than 2023 with milk production seen at 228.2 billion pounds, up 0.7% from 2023 as production per cow is seen rising 0.9% from 2023. Tight global milk production is seen benefitting U.S. exports, with them rising 10% with a 1% increase in domestic use on a fat basis while use on a skim-solids basis is seen declining 1% but remain above the five-year average.

— Commodity analyst and trader Richard Crow on USDA 2024-25 S/D guesstimates out this morning: “The outlook numbers showed bean acres 800,000 larger than the guess and corn acreage 600,000 acres less. The yields were 181 for corn and 52 for beans. The corn carryout was 2.5 billion bushels, and beans were 435 million. The numbers were the direction of trade thoughts. It is the anticipation of growing stocks that has dominated the trade. The Outlook conference had stocks growing to 720 million bushels for wheat. One has to remember all the numbers are variable and can change but signal the growth of stocks.”

— Enviva, the largest exporter of wood pellets in the U.S., is facing bankruptcy due to a failed bet on commodity futures prices. The Bethesda, Md.-based company is preparing to file for chapter 11 protection after missing a $24 million interest payment, the WSJ reports (link). Despite high demand for wood pellets as an energy source in European and Asian power plants, Enviva's financial troubles arose from an attempt to capitalize further on its market position. Their plan to purchase pellets for resale at a profit backfired when the value of the products plummeted below their purchase price. Enviva, which operates 10 plants across the South and six marine terminals, has become a significant player in export markets in recent years.

— Ag trade update: South Korea purchased 68,000 MT of corn to be sourced from South America or South Africa. Japan purchased 115,035 MT of milling wheat in its weekly tender, including 54,695 MT U.S., 30,190 MT Canadian and 30,150 MT Australian. Egypt tendered to buy an unspecified amount of wheat from various countries.

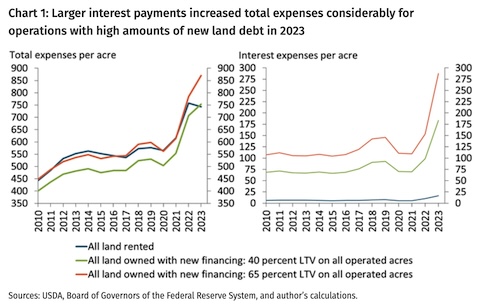

— NWS weather outlook: A Pacific storm system pushing into the West Coast will bring locally heavy rain near the coast, and heavy high elevation snowfall into the Intermountain West over the next couple of days... ...Quick-hitting storm system to produce accumulating snowfall across the Great Lakes today and into the Interior Northeast Thursday night and Friday morning... ...Next round of snow expected to quickly spread from the central Plains and Ohio Valley on Friday, then into the Central Appalachians and Mid-Atlantic Friday night into Saturday morning.

Items in Pro Farmer's First Thing Today include:

• Followthrough grain selling overnight

• Record January NOPA crush expected.

• Eurozone GDP forecast cut

|

CONGRESS |

— House on Wednesday rejected the smallest proposed change yet to the $10,000 cap on the state and local tax, or SALT, deduction. The bill from Rep. Mike Lawler (R-N.Y.) would double the cap for married couples to $20,000, only for tax year 2023 and only for those making less than $500,000. New York and California Republicans in blue districts were seeking a victory ahead of potential tight re-election races in November. The tally was 195 yes to 225 no votes.

— House Speaker halts debate on spy law revision; renewal postponed. In response to criticism and the need for further consensus, House Speaker Mike Johnson (R-La.) decided to forego the debate on extending and revising Section 702 of the Foreign Intelligence Surveillance Act (FISA). The temporary extension of this controversial spy law, which allows U.S. agencies to collect electronic communications of non-U.S. citizens abroad, is set to expire on April 19. Johnson had intended to present a compromise measure for extending and revising Section 702. However, considering the need for more time to reach consensus on reforming FISA while preserving national security programs, the debate on this matter will be postponed to a later date, according to Raj Shah, the Speaker's spokesman.

Critics, including members of Congress and civil liberties groups, have raised concerns about the sweeping nature of the surveillance permitted under Section 702, which can lead to the collection of data from American citizens. The absence of a warrant requirement has been particularly contentious, with opposition coming from both sides of the political spectrum.

House leaders face a delicate balancing act in attempting to reauthorize and revise this spy law. A strong coalition of both conservative and liberal members would oppose the bill if it does not include provisions for requiring warrants. However, the Biden administration and the intelligence community are against such warrant requirements for communications involving American citizens.

|

ISRAEL/HAMAS CONFLICT |

— Israel’s military entered Nasser hospital, the largest in Khan Younis, a city in southern Gaza. Thousands of people were sheltering in the facility. Israel said that the bodies of hostages taken on Oct. 7 could be in the facility, according to Reuters. Earlier, nine people were killed in Israeli air strikes against Lebanon.

|

RUSSIA/UKRAINE |

— Russian missiles struck civilian and infrastructure targets across Ukraine. No damage was reported in Kyiv, the capital. At least 11 people were injured in other parts of the country. Meanwhile, Volodymyr Zelensky, Ukraine’s president, and Emmanuel Macron, France's president, announced they would sign “a bilateral security agreement” in Paris. Zelenskyy will visit Germany on Friday.

|

POLICY UPDATE |

— Highlights of USDA Secretary Tom Vilsack’s appearance Wednesday before the House Ag Committee. Vilsack is expected to testify before the Senate Agriculture Committee in the coming weeks to discuss agricultural issues further. Link to watch a video of the hearing or to read Vilsack’s testimony.

- California Proposition 12: Vilsack stressed the potential for turmoil in the agricultural marketplace if the impact of the U.S. Supreme Court ruling on California's Proposition 12 is not addressed. The Biden administration had supported the industry's position before the Supreme Court. "If we don’t take this issue seriously, we’re going to have chaos in the marketplace," Vilsack said. "When each state has the ability to define for itself and its consumers exactly what farming techniques or practices are appropriate, it does create the possibility of 50 different sets of rules and regulations," he said. Prop 12 was fully implemented as of Jan. 1, 2024. The ruling, upheld last May, allows states to impose their own farm production regulations on farmers outside their borders, bypassing federal food safety standards. This could lead to trade complications, particularly with Canada, as Californian regulations on pig farming affect Canadian producers who export to U.S. finishing farms. Vilsack cited a USDA study showing significant price increases in certain pork products. He warned that without Congressional action, “chaos” could ensue in the marketplace as more states follow California's lead, potentially disrupting the national pork market. Vilsack mentioned discussions with Canadian officials who seek clarity on how the U.S. is responding to these regulatory changes, indicating international trade implications.

While Vilsack isn’t confident Congress will pass any legislation this term to address the situation, he recommended members take the issue seriously.

“Why did the Supreme Court decide what they decided? They decided it because they believed that each and every producer had their own choice to participate in this market. They basically said it didn't violate the Commerce Clause because it didn't discriminate against any particular producer,” Vilsack said. “Well, the problem, I think, is that it didn't anticipate the impact of 12% of the market changing the rules on the entire market. And I think that there's a risk of that occurring all across the country."

During the testimony, House Ag Committee Chairman GT Thompson (R-Penn.) expressed concern for smaller producers being shut out due to Prop 12. “Hearing from smaller producers, the larger producers who were prepared to go into that market have found that the volume that they prepared for is not there in California. So, they're dumping product into other states, crowding out small producers,” Thompson said. Thompson also pointed out the impact Prop 12 is already having on consumers as well as the supply chain. “Preliminary data from a pending study at USDA's Office of the Chief Economist shows that prices of certain pork products have risen as much as 41% since the implementation of Proposition 12,” Thompson said. “A 2023 study found that the costs associated with Prop 12 are widespread and extensive. That same study expressed that these costs have a more severe impact on smaller independent operations, and that the stress is placed upon the entire production and marketing chain will lead to ever increasing consolidation and concentration of the industry.” - New farm bill: House Ag Chair G.T. Thompson (R-Pa.) assured that Republicans would enhance the farm safety net for growers without reducing conservation and nutrition benefits, including the Supplemental Nutrition Assistance Program (SNAP). The committee’s top Democrat, Rep. David Scott (D-Ga.), said his party would hold the line against any cuts to SNAP — including cuts in future benefits — as well as GOP efforts to move billions of dollars in climate-friendly conservation funding in the 2022 climate law into more general conservation programs under the farm bill. “Let’s put aside first and foremost this proposal to cut SNAP,” said Scott, who likened efforts to shift the climate conservation funding as “robbing Peter to pay Paul.”

Thompson argued that Republicans aren’t pushing SNAP cuts, but note that program funding that increased dramatically during the Covid-19 pandemic to a level conservatives contend created too high a baseline. The Congressional Budget Office (CBO) projects a decline of approximately 1 million participants per year over the next 10 years in an updated projection released this week. Thompson has said that SNAP spending has increased substantially — by $484 billion, or 73% according to CBO’s estimate — since the 2018 Farm Bill’s enactment.

Rep. Alma Adams (D-N.C.) said Republican claims they were committed to protecting SNAP were “just disingenuous,” because they were “pulling cuts from future benefits and calling them savings.” Adams pointed to the possibility that Republicans would reverse 2021 reforms in in the Thrifty Food Program, part of SNAP, which she argued would go back to “absurd assumptions about how low income families have to stretch their food budgets… For example, prior to 2021 the Thrifty food plan as soon weekly diet family of four would include 12 pounds of potatoes, 25 pounds of milk, 20 pounds of orange juice, five pounds of fresh oranges. and I don’t think any of us could reasonably eat a diet consisting substantially of potatoes, milk and oranges for long periods of time.”

In comments to Vilsack, Rep. Scott Desjarlais (R-Tenn.) argued that SNAP funds could be going to undocumented immigrants — something he has sparred with the secretary about at past hearings. “People who are not here legally are not getting SNAP,” Vilsack said. “I agree with you that we need to make sure that we’re keeping an eye on fraudulent activities. I’m just afraid hungry Americans are not going to receive the benefits they need.”

Vilsack also said the Biden administration continues to oppose Republican efforts to pull funding from the climate law provisions in the Inflation Reduction Act — which provided $20 billion over 10 years for climate-friendly conservation — for use in more general farm bill conservation efforts.

One example Republicans have presented to Democrats is leaving $8 billion in IRA funding within farm bill conservation programs, while moving the roughly $7 billion in remaining IRA funds into other bipartisan priorities, including the farm safety net.

Thompson hopes to release text of a committee bill in the weeks ahead, saying he remains committed to plowing forward with the bill this year. “Considerable opportunities exist — within our jurisdiction — to not only fund the safety net, but fund a substantial number of shared, bipartisan priorities” including nutrition, Thompson said. “I continue to implore my Democrat colleagues to think, in earnest, about those priorities, priorities that can be funded without cutting a SNAP benefit or eliminating the important conservation programs we have all come to appreciate,” he said. “Folks think a farm bill is impossible,” Thompson said, and “that politics will prevail over good policy.” He vowed to press on, in the face of “significant headwinds to Congress’ success” on the farm bill. “I have not given up on March,” he told reporters afterward, referring to his goal of House passage of a bipartisan farm bill in March. “A lot of things [are] out of my control.” The chair said another extension of the 2018 Farm Bill was possible. - CCC Charter Act: Vilsack, in remarks with reporters after the hearing, suggested a partial escape hatch exists: Using the Commodity Credit Corporation (CCC) to provide additional funding for the farm bill. “The reality is that there’s [CCC] money left on the table almost every year,” Vilsack said. “To get people unstuck I think you have to throw something into the equation that’s a little bit different. And I think that’s something that’s a little bit different.” Thompson told reporters the leftover funds would be “perfect to be able to use over a 10-year period as a pretty respectable pay for.”

Of note: Vilsack told reporters there hasn’t been any interest in his proposal. - Farm bill priorities: “In what seemingly is a daily occurrence, taxpayer dollars are being sent to every corner of the country, yet nothing has changed,” Thompson said. “We are not producing more fertilizer. We are not reducing the cost of production. We are not making food more affordable. However, we are burdening the taxpayer. We are losing ground on the world stage. We are a net agricultural importer,” he added. “We are less independent, less resilient, and less competitive.” One major way that Republicans have proposed to lower those food costs is to increase subsidies to farmers — which requires finding new funds from someplace.

“Secretary Vilsack, have you talked to any farmers about how much fertilizer costs, how much diesel costs, or about the cost of land rent?” asked Rep. Austin Scott (R-Ga).

Of note: Vilsack today at USDA’s Ag Outlook Forum was interrupted by a woman who blamed him for supporting industrial agriculture via the poultry industry... USDA top economist Seth Meyer tried to get her to stop after a while and she eventually left the room. Vilsack quipped that yesterday he was accused of not supporting commercial agriculture enough when appearing before the House Ag Committee while the woman was accusing him of supporting commercial agriculture too much. - Conservation program funding, participation. David Scott (D-Ga.) noted that there isn’t enough money in popular farm bill programs like the Environmental Quality Incentives Program (EQIP) to give money to all of the farmers who apply — even those who USDA deems have worthy projects. “Almost three out of every four EQIP applications across the country were denied — and only about half of all those approved applications got funded,” Rep. Nikki Budzinski (D-Ill.) told Vilsack. “I constantly hear from farmers in my district that they want better access to these conservation programs, that their demand is meeting or even exceeding expected outlays of IRA money to bridge this gap,” Budzinski added. Vilsack said that the agency lacked “adequate staff and adequate technical assistance” and the resources needed to get funds “into the field more quickly.” But if the agency loses access to $19.5 billion in conservation funds granted by Congress under the Inflation Reduction Act, ”obviously that’s going to impact and affect our ability to do more work.”

- Ag disaster programs: Vilsack defended Biden administration farm bill priorities including a more consistent funding stream for disaster assistance for growers. Congress needs to abandon its “ad-hoc” approach to providing supplemental disaster assistance bills, Vilsack said, which are typically limited to statewide or regional storm damage and dependent on swift congressional attention.

Rep. Frank Lucas (R-Okla.) said large operators did not get the share they deserved of a recent disaster program. “In my view, the federal government should either support producers or get out of the way,” added Rep. Tracey Mann (R-Kan.). - Declining ag trade exports: Vilsack suggested that America’s declining global exports came from a failure of investment. “One of the reasons why the competition is steeper is because folks in the past in our competition invested more for them to essentially squeezed the difference in the gap that we once had,” he said — something that he argued that the 2021 bipartisan Infrastructure Law helped fix. Such support would do more to support American agriculture than new free trade agreements, Vilsack said, while also casting doubt on Congress’s ability to pass sweeping trade reforms.

When Rep. Randy Feenstra (R-Iowa) complained that the administration has not produced new free trade agreements, Vilsack said that congressional sentiment has turned protectionist: “Can you pass TPA [Trade Promotion Authority] in this Congress? Why not?” TPA laws define U.S. goals in negotiations, lay out consultation requirements, and assure an up or down vote on agreements with no amendments. - Livestock protection. Republican representatives from livestock states repeatedly rose to ask what USDA would do to help protect American poultry, pork and beef from potentially ruinous outbreaks of infection disease.

- Vilsack: U.S. ‘18 months or so’ away from finding bird flu vaccine: U.S. veterinarians are “18 months or so” away from identifying a vaccine for the current strain of highly pathogenic avian influenza (HPAI) and USDA is developing a process to distribute it, Vilsack said. USDA plans to discuss poultry vaccinations with trading partners, amid concerns that other countries could restrict imports of vaccinated U.S. poultry, Vilsack said. The U.S. does not allow poultry imports from countries affected by HPAI or from flocks vaccinated against the disease. France’s decision last year to vaccinate ducks against HPAI prompted import restrictions.

- Slaughterhouse issue: Rep. David Rouzer (R-N.C.) demanded to know why the USDA had refused to agree to new speed increases on how fast workers at slaughterhouses can work — and why the team appointed to study the proposal had come from the University of California.

- Rouzer offered his own theory of why America’s small farms were failing. “It’s only the larger farms that can survive the onslaught of the government — federal, state and local. So, the smaller ones go out of business and the bigger ones get bigger because it’s the only way they can survive.”

- Wage rates for temporary foreign workers. Rep. Rick Crawford (R-Ark.) questioned Vilsack about wage rates under the H-2A program. He referenced Vilsack's previous commitment to work with the committee on legislation addressing this issue, mentioning the Farm Workforce Modernization Act as a potential solution. This legislation, supported by Democrats, aims to provide temporary workers with three-year visas and amend the formula for calculating hourly wages. Crawford, co-chair of the committee's Agricultural Labor Working Group, emphasized the adverse effect wage rate as a significant challenge for producers participating in the H-2A program. He expressed interest in reforming this aspect of the program to improve efficiency and functionality. Vilsack promised Crawford he would be willing to work with committee members in passing legislation addressing the matter.

- Environmental rule process with USDA rural development programs. Crawford suggesting cumbersome rules hinder participation and resource deployment in rural America. He queried Vilsack on the department's response to recent changes aimed at expediting the permitting process and narrowing the scope of environmental assessments.

- Climate change: Rep. Mary Miller (R-Ill.) lambasted Vilsack for his presence at the UN climate conference, and for the administration’s support for cutting emissions from agriculture. “Farmers are not on board with this climate cult agenda,” she said. “Front and center as part of this: Do you agree with John Kerry that we have to get farmers to net zero?” she asked. “I agree that that’s an opportunity for farmers to make more money — for small and midsize producers to actually stay in the fight,” Vilsack said. “These are voluntary programs.” “We’re not gonna let you jeopardize our nation’s food supply for the current climate change agenda,” Miller said. Miller said farmers would face a 34% increase in expenses because of Biden efforts to slow global warming. “The majority of farmers are not on board with [this] climate cult agenda,” she said.

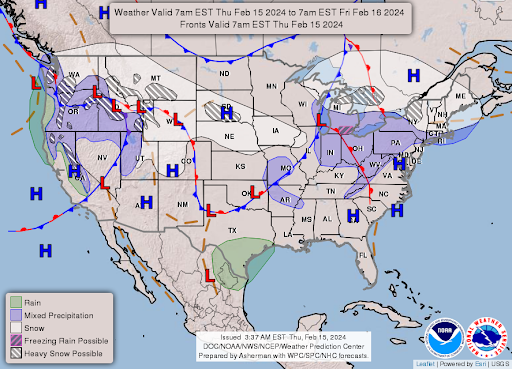

— Southern Ag Today: The farm bill debate: Stuck in neutral. The farm bill, a crucial piece of legislation encompassing both farm and nutrition policies, historically requires a delicate balance to pass due to the need for both rural and urban support, according to an article written by Dr. Bart Fischer and Dr. Joe Outlaw in Southern Ag Today (link). Figure 1 (below) illustrates the evolving relationship between spending on the Supplemental Nutrition Assistance Program (SNAP) and the farm safety net over the years. Here are some key observations, according to Fischer and Outlaw:

- For 40 years until 2001, spending on SNAP and the farm safety net remained roughly equivalent.

- However, in the last two decades (2002-2021), SNAP spending has surged ahead of farm safety net spending by 242%, despite periods of Republican control in the House.

- The Biden Administration's revision of the Thrifty Food Plan market basket in 2021 is expected to further increase SNAP spending, exacerbating the gap between SNAP and farm safety net spending.

- In contrast, farm safety net spending has remained flat over the past two decades, even declining in inflation-adjusted terms.

These observations highlight the challenges in passing a farm bill, the authors note, as the increasing disparity between SNAP and farm safety net spending strains the historic coalition necessary for its passage. Moreover, concerns from growers about the lagging farm safety net further complicate the debate.

|

HEALTH UPDATE |

— Federal Trade Commission (FTC) is investigating the role of drug wholesalers and purchasing companies in contributing to drug shortages. This move comes in response to an unprecedented strain on medicine availability, including generic drugs and cancer therapies. Both the FTC and the Department of Health and Human Services are soliciting public feedback on the practices of these intermediaries in the pharmaceutical industry. They aim to assess whether these entities are lowering drug prices in ways that deter competition among suppliers.

|

POLITICS & ELECTIONS |

— A fourth high-ranking Republican committee leader is opting out of seeking re-election, highlighting potential GOP fears of a lost majority in 2025 or frustration with a party in power that’s crippled by infighting. Homeland Security Chairman Mark Green (R-Tenn.) will retire at the end of the year, he announced yesterday. He has served in Congress since 2019 and led the committee for the past year, didn’t say whether he’s leaving the House to run for governor, as is widely expected. When asked, he said: “I have learned in my time in Congress that the fight isn’t in Washington, the fight is with Washington.”

— Nebraska House race flips to toss-up. Democratic state Sen. Tony Vargas “is solidly positioned for a challenger” to Nebraska Republican Rep. Don Bacon, a member of the House Agriculture Committee, and their race is now considered a toss-up, a shift from the previous rating of “leans Republican.” Link for details via Sabato’s Crystal Ball.

— In a state television interview Vladimir Putin said he would prefer Joe Biden to be America’s next president over Donald Trump. Putin described Biden as “more experienced” and “predictable.” It is the first time Russia’s leader has spoken publicly about America’s upcoming elections. On Tuesday Biden claimed Trump had “bowed down to a Russian dictator” by opposing more funding for Ukraine.

|

OTHER ITEMS OF NOTE |

— EPA to allow farmers to use some existing dicamba supplies. The Environmental Protection Agency (EPA) announced its decision to allow farmers to use some existing stocks of dicamba products. This decision follows a Feb. 6 court ruling in the US District Court of Arizona that invalidated registrations for the dicamba products XtendiMax, Engenia, and Tavium.

The EPA's Existing Stocks Order permits limited sale and distribution of dicamba products that were already in the possession of growers or in the channels of trade prior to Feb. 6. "Existing stocks" are defined as products that were packaged, labeled, and released for shipment before this date. Products are considered released for shipment when they are packaged and labeled for sale or distribution or stored in areas designated for shipment. Any remaining products can only be moved for disposal or export.

The order specifically authorizes the sale and distribution of existing stocks that are already in the possession of individuals other than the registrant, providing clarity on the handling of these products following the court ruling.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |