Vilsack to Testify This Morning Before House Ag Committee

Aid to Ukraine, Israel hits House hurdle | Mayorkas House impeachment | 2022 Ag Census

|

Today’s Digital Newspaper |

MARKET FOCUS

- Two Fed officials scheduled to speak today

- Futures market this morning pricing in three to four interest rate cuts this year

- Yellen: ‘Significant progress’ in bringing down inflation

- Bitcoin tops $51,000 for first time since the very end of 2021

- Japanese yen falls below 150 per dollar, reaching lowest point in three months

- Instacart cutting about 250 employees, or roughly 7% of staff

- Britain's annual inflation rate holds steady at 4%

- Eurozone Q4 GDP confirmed up 0.1% from year-ago

- KC Fed report: Ag real estate values in Tenth District remained resilient in 2023

- 2022 Ag Census: Farm numbers decline but average size increases

- Ag markets today

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- House Republicans voted by narrowest-possible margin to Mayorkas

- House GOP leaders balk at clearing Senate-passed $95 bil. international aid package

RUSSIA & UKRAINE

- Ukraine reports sinking Russian warship

- Ukraine grain exports in February reached nearly 2.4 million metric tons (MMT)

- Ukraine winter grains remain mostly favorable

CHINA

- Biden administration mulls expanding controls on Chinese smart car imports

TRADE POLICY

- WTO reform document lacks details on appeals process

- Modi, UAE leader advance India-Middle East-Europe corridor despite conflict

ENERGY & CLIMATE CHANGE

- Possibility of enacting carbon border tax in U.S. under discussion

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- U.S. CPI data shows surging inflation, led by grocery prices

POLITICS & ELECTIONS

- Democrat Tom Suozzi wins New York House race to succeed George Santos

OTHER ITEMS OF NOTE

- Bill advanced by Iowa Senate subcommittee changes nutrient management plans

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed in overnight trading. China is celebrating its Lunar New Year holiday this week and many China markets are still closed. U.S. Dow opened around 100 points higher but has since tempered those gains.

There are no notable economic reports, but two Fed officials are scheduled to speak at the open and close: Goolsbee (9:30 a.m. ET), Barr (4:00 p.m. ET). Goolsbee is notably an FOMC voting member who leans towards the dovish camp and could potentially add support for a relief rally today after yesterday’s sharp decline. VIX futures expiration could also impact money flows in early trade.

U.S. equities yesterday: All three major indices registered losses in the wake of the hotter-than-expected CPI data. The Dow dropped 524.63 points, 1.35%, at 38,272.75. The Nasdaq fell 86.95 points, 1.80%, at 15,655.60. The S&P 500 was down 68.67 points, 1.37%, at 4,953.17.

— Lyft shares soared over 60% in after-hours trading after Lyft's earnings release accidentally added an extra zero to a profitability metric. An executive corrected the error on a call with analysts, but shares were still up 17% premarket. (Instead of margins rising 500 basis points, or 5%, this year, the company meant to say that they would increase 50 basis points, or 0.5%.)

— Ag markets today: Wheat futures led broad losses in the grain and soy complex during the overnight session as markets weakened amid technical selling and a lack of supportive news. As of 7:30 a.m. ET, corn futures were trading mostly 2 cents lower, soybeans were 5 to 8 cents lower, winter wheat markets were 10 to 15 cents lower and spring wheat was 7 to 10 cents lower. Front-month crude oil futures were modestly firmer, and the U.S. dollar index was mildly weaker.

Packers slowing cattle slaughter to manage supplies. Cattle slaughter through the first two days of the week was estimated at 240,000 head, 10,000 behind last week and 8,835 lower than last year’s pace. Estimates for this week’s slaughter are just over 600,000 head as packers reduce runs to manage supplies instead having to actively bid for cattle for a fifth straight week.

Cash hogs continue seasonal climb. he CME lean hog index is up another 41 cents to $74.11 as of Feb. 12, the highest since Nov. 20, though still roughly $3.00 below last year at this time. February lean hog futures, which expire today and are cash-settled on Friday, finished Tuesday 11.5 cents above today’s cash quote. April hogs held nearly a $7.00 premium to the cash index.

— Agriculture markets yesterday:

- Corn: March corn futures rose 1/4 cent to $4.30 3/4 and near mid-range.

- Soy complex: March soybeans fell 6 3/4 cents to $11.86 1/4, while March soymeal fell $4.10 to $344.80. Both notched low-range closes. March soyoil rose 40 points to 47.30 cents.

- Wheat: March SRW futures settled unchanged on the day at $5.97 1/2, though deferred contracts closed lower. March HRW futures slipped 4 1/4 cents to $5.94 1/2. March spring wheat fell 10 3/4 cents to $6.71 3/4.

- Cotton: March cotton rose 99 points to 91.52 cents, a near mid-range close, while December cotton rose 31 points to 83.61 cents. March cotton reached a fresh near-term high.

- Cattle: April live cattle futures dropped 82.5 cents to $185.10, while nearby February futures slid 50 cents to $183.75. March feeder futures slipped 82.5 cents to $248.00.

- Hogs: April lean hogs fell 5 cents to $81.075 and settled near mid-range.

— Quotes of note:

- The futures market this morning is pricing in three to four interest rate cuts this year, down from the six to seven projected at the start of the year and all but silencing rate-cut bulls. Such predictions “made no sense in our view,” Mohit Kumar, an economist at Jefferies, wrote in a research note.

- Treasury Secretary Janet Yellen in a Pittsburgh speech said the Biden administration has made “significant progress” in bringing down inflation, which has declined by around two thirds from its peak, including lower prices for gas, eggs, and airline tickets. She said lowering high healthcare costs remains a priority, including making prescription drugs more affordable, cutting the cost of common health treatments such as insulin, enabling Medicare to negotiate drug prices, expanding access to the Affordable Care Act, and fighting hidden fees.

- Instacart is cutting about 250 employees, or roughly 7% of staff, as it focuses on profitability amid heated competition in the grocery-delivery business and rising food costs. “This will allow us to reshape the company and flatten the organization so we can focus on our most promising initiatives.” — Instacart Chief Executive Fidji Simo, in an investor letter.

- Jeff Bezos has sold a stake valued at $2.08 billion in Amazon, according to a U.S. Securities and Exchange Commission filing. The executive chair of the e-commerce giant has sold in the past few days roughly 12 million shares at a price of $173.30 each. Bezos remains the largest shareholder of the company he founded in 1994.

— In January, Britain's annual inflation rate held steady at 4%, contrary to expectations of a rise. This outcome provides support for the Bank of England, which might consider reducing interest rates to address sluggish economic growth. Since 2019, GDP has only increased by 1.5%, indicating a slow pace of economic expansion. Core inflation, which excludes volatile categories like food and energy, reached a peak of 7.1% year-on-year in May of the previous year.

— Eurozone Q4 GDP confirmed up 0.1% from year-ago. The Eurozone economy expanded 0.1% annually in the last three months of 2023, matching the first estimate. Among the bloc’s largest economies, GDP in Germany contracted 0.2% while France grew 0.7%, Italy expanded 0.5% and Spain jumped 2%.

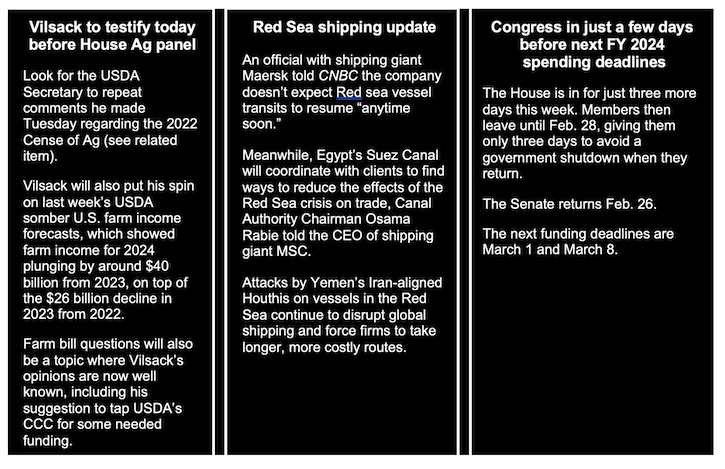

— Agricultural real estate values in the Tenth District remained resilient in 2023, despite challenges such as higher interest rates and a moderation in farm income, according to a report (link) from the Federal Reserve Bank of Kansas City. Nonirrigated farmland values saw an average growth of around 10% from the previous year, while irrigated farmland and ranchland values experienced slightly slower growth rates. Despite the slowdown in capital spending and increased financial strain, all types of farmland values saw an increase of about 8% on average from the previous year. Demand for farm loans increased toward the end of 2023, driven by lower crop prices and stable production expenses, putting pressure on margins for some farm borrowers.

Farmland values varied throughout the District, with notable increases seen in Western Missouri and Nebraska. Despite some shifts in demand, overall farmland values remained robust. Cash rents for farmland stabilized despite continued growth in farmland values, with ranchland rents slightly decreasing while nonirrigated and irrigated rents remained largely unchanged. The volume of farmland sales slowed across the region, likely due to limited land availability rather than a decline in demand.

The share of farmland purchased by farmers increased across the District, reaching its highest level since 2015. Despite increased costs and risks associated with higher interest rates, most agricultural lenders expected farmland values to remain stable or increase moderately in 2024. However, concerns remain regarding a potential increase in interest rates and the repricing of farmland loans, with a significant portion of loans scheduled to reprice in the coming months. Despite these challenges, demand for farm loans grew at the fastest pace in nearly three years by the end of 2023, signaling ongoing financial resilience within the sector.

— 2022 Ag Census: Farm numbers decline but average size increases. The 2022 Agriculture Census reveals a decline in total farms but highlights significant trends in American agriculture. Despite a 7% decrease in the number of farms, new, beginning, and young producers are on the rise. Family-owned farms still dominate, managing 84% of farmland. Economic growth is evident, with U.S. farms generating $543 billion in agricultural products, resulting in a net cash income of $152 billion. Technological advancements include increased internet access and renewable energy usage. Direct sales to consumers have grown by 16%. Larger farms, though fewer in number, account for the majority of agricultural sales. Oilseed and grain production, as well as beef cattle production, are the most common farm types. The average age of producers has slightly increased, but there's a notable rise in younger farmers. Female participation in farming is significant, with women representing 36% of all producers. The census, with a 61% response rate, remains a comprehensive agricultural data source managed by USDA NASS since 1997. Link for details.

Highlights:

- There were 1.9 million farms and ranches (down 7% from 2017) with an average size of 463 acres (up 5%) on 880 million acres of farmland (down 2%). That is 39% of all U.S. land.

- Family-owned and operated farms accounted for 95% of all U.S. farms and operated 84% of land in farms.

- U.S. farms and ranches produced $543 billion in agricultural products, up from $389 billion in 2017. With farm production expenses of $424 billion, U.S. farms had net cash income of $152 billion. Average farm income rose to $79,790. A total of 43% of farms had positive net cash farm income in 2022.

- Farms with internet access continued to rise from 75% in 2017 to 79% in 2022.

- A total of 153,101 farms and ranches used renewable energy producing systems compared to 133,176 farms in 2017, a 15% increase. The majority of farms (76%) with renewable energy systems reported using solar panels.

- In 2022, 116,617 farms sold directly to consumers, with sales of $3.3 billion. Value of sales increased 16% from 2017.

- The 105,384 farms with sales of $1 million or more were 6% of U.S. farms and 31% of farmland; they sold more than three-fourths of all agricultural products. The 1.4 million farms with sales of $50,000 or less accounted for 74% of farms, 25% of farmland, and 2% of sales.

- Nearly three-fourths of farmland was used by farms specializing in two commodity categories: oilseed and grain production (32%) and beef cattle production (40%).

- The average age of all producers was 58.1, up 0.6 years from 2017. This is a smaller increase than the average age increases between prior censuses.

- There were just over 1 million farmers with 10 or fewer years of experience, an 11% increase in the number of beginning farmers from 2017. Beginning farmers are younger than all farmers, with an average age of 47.1.

- The number of producers under age 35 was 296,480, comprising 9% of all producers. The 221,233 farms with young producers making decisions tend to be larger than average in both acres and sales.

- In 2022, 1.2 million female producers accounted for 36% of all producers. Some 58% of all farms had at least one female decision maker.

The farm number/size of operations trend aligns with historical patterns, as did the average age of farmers, which increased slightly to 58.1 years, although the increase was smaller compared to previous censuses. However, there was an 11% rise in the number of farmers with 10 or fewer years of experience, totaling over one million farmers. Beginning farmers, with an average age of 47.1 years, comprised a significant portion of the agricultural workforce.

Female producers accounted for 36% of all producers, with 58% of farms having at least one female decision maker. Additionally, young producers under the age of 35 represented 9% of all producers.

Despite high net farm incomes reported in the 2022 Census, subsequent declines in 2023 and a forecasted decline in 2024 were not reflected. However, the data highlighted the importance of programs aimed at creating additional income streams for smaller and medium-sized farmers, as emphasized by USDA Secretary Tom Vilsack. These efforts include initiatives focusing on renewable energy, ecosystem markets, sustainable aviation fuels, and smaller independent livestock and poultry processing.

Vilsack stressed the need for policymakers to shift their focus from solely productivity to supporting a model that enables middle-sized producers to sustain their livelihoods without needing additional employment. He cited early signs of success in the current administration's approach, such as record-high net farm income and rural population growth (despite a recent significant downturn in forecast farm income for 2024 vs 2023).

Outlook: USDA Undersecretary for Research, Education, and Economics Chavonda Jacobs-Young expressed confidence that the Census confirmed the allocation of resources in the right direction, indicating a positive outlook for future agricultural policies and initiatives.

Comments: Look for Vilsack during his appearance today before the House Ag Committee to bring up certain facets of the 2022 Census of Ag report. On Tuesday, Vilsack said the report was “a wake-up call to everyone who plays a role in agriculture policy or who shares an interest in preserving a thriving rural America — we are at a pivotal moment, in which we have the opportunity to hold tight to the status quo and shrink our nation’s agriculture sector further, or we can choose a more expansive, newer model that creates more opportunity, for more farmers.”

Market perspectives:

— Outside markets: The U.S. dollar index was weaker, with the euro slightly firmer against the greenback. The yield on the 10-year U.S. Treasury note was lower, trading around 4.29%, with a mixed tone in global government bond yields. Crude oil were higher ahead of U.S. gov’t inventory data due later this morning, with U.S. crude around $77.95 per barrel and Brent around $82.90 per barrel. Gold and silver futures were lower ahead of US trading with gold around $2,003 per troy ounce and silver around $22.07 per troy ounce.

— Bitcoin topped $51,000 for the first time since the very end of 2021. Some traders are even more optimistic. Wagers in the options market are targeting prices beyond its previous record of almost $69,000.

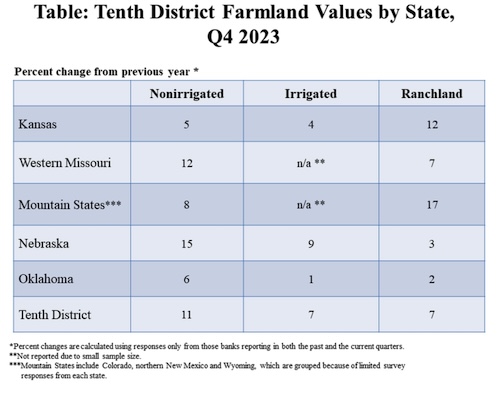

— The Japanese yen fell below 150 per dollar, reaching its lowest point in three months due to a higher-than-expected U.S. inflation reading, reducing the likelihood of early interest rate cuts by the Federal Reserve. Japanese Finance Minister Shunichi Suzuki issued a warning, stating that authorities are closely monitoring the market but did not confirm intervention plans. Vice Finance Minister Masato Kanda emphasized Japan's readiness to take appropriate actions in the foreign exchange market, noting that sharp yen depreciation is detrimental to the economy. Despite intervening three times in 2022 when the yen hit a 32-year low against the dollar, Japan has not intervened further. Investors are also evaluating the Bank of Japan's monetary policy outlook, especially its stance on interest rates, amid indications that it may not raise rates aggressively even if it abandons negative rates.

— Ag trade update: Japan tendered to buy 60,000 MT of feed wheat and 20,000 MT of feed barley. Jordan tendered to buy up to 120,000 MT of optional origin milling wheat.

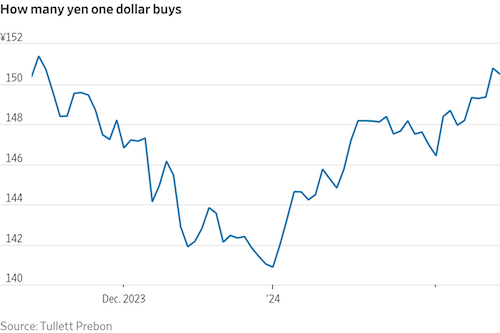

— NWS weather outlook: Quick-hitting wave of low pressure will bring a round of heavy, accumulating snowfall across the Northern Plains, Upper Midwest, and the Great Lakes today and Thursday... ...Next Pacific storm system will bring locally heavy rain along the West Coast and heavy high elevation snowfall into the Intermountain West over the next couple of days.

Items in Pro Farmer's First Thing Today include:

• Grains weaker overnight

• France raises wheat export forecast

|

CONGRESS |

— House Republicans voted by the narrowest-possible margin to impeach Homeland Security Secretary Alejandro Mayorkas. Republicans prevailed 214-213 because of the return of Majority Leader Steve Scalise (La.), who was absent last week. The Cuban-born Mayorkas, 64, the first Latino and immigrant to head the department, becomes the second Cabinet member in U.S. history — and the first in almost 150 years — to be impeached. There is little chance the Democrat-led Senate will follow suit.

Of note: The Senate will start the trial for Mayorkas when the chamber returns from the Presidents Day recess. Senate President Pro Tempore Patty Murray (D-Wash.) will oversee the proceedings. No other business can happen on the Senate floor during an impeachment trial.

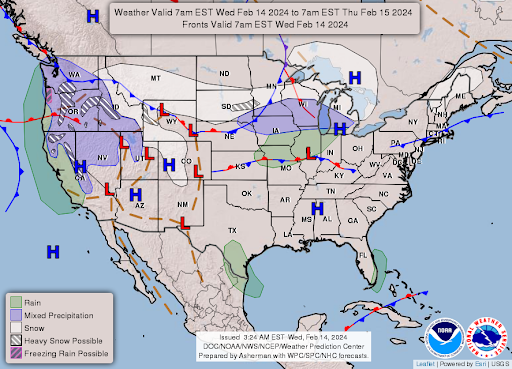

— Very low odds House GOP leaders will do anything with Senate-passed $95 billion international aid package. There are legislative maneuvers that the minority can employ to force a House vote on the Senate-passed legislation. That would need at least 111 Republicans willing to vote for the $95 billion package, but that is far from reality at this juncture.

Some Republicans still want tighter restrictions at the U.S. border to support the foreign aid package, which includes about $60 billion for Ukraine. House Republicans rejected an earlier Senate-negotiated border funding package, and former President Donald Trump opposes more Ukraine aid. Besides Ukraine, the aid package also provides $14.1 billion for Israel; $9.15 billion for food, water, and humanitarian aid to Gaza, the West Bank, and Ukraine; and $2.4 billion to support U.S. operations related to protecting global shipping operations in the Red Sea.

|

RUSSIA/UKRAINE |

— Ukraine has reported sinking a Russian warship, the Caesar Kunikov, near the coast of Crimea. According to Ukraine's military, the vessel was targeted by drones while navigating in Ukrainian waters. This successful strike underscores Ukraine's growing control over the Black Sea, following the destruction of another Russian ship, the Ivanovets, just two weeks prior.

— Ukraine grain exports in February reached nearly 2.4 million metric tons (MMT), slightly lower than the 2.7 MMT recorded during the same period in 2023, according to data from the Ukrainian Agriculture Ministry. Overall, grain exports for the 2023-24 marketing year have totaled 26.3 MMT, down from 29.7 MMT at this point in the previous year. Of these exports, corn accounted for 14.4 MMT, wheat for 10.4 MMT, and barley for 1.5 MMT.

— Ukraine winter grains remain mostly favorable. Winter weather conditions have been mostly favorable for Ukrainian winter crops, APK-Inform consultancy quoted state meteorologists as saying. The forecaster said fields in most of the country’s regions had sufficient soil moisture and only some areas in the southern Kherson and Odesa regions had levels that were “less than the average long-term values.”

|

CHINA UPDATE |

— Biden administration mulls expanding controls on Chinese smart car imports over data security concerns. The Biden administration is contemplating measures to restrict imports of Chinese "smart cars" and related components beyond tariffs, focusing on data security concerns, Bloomberg reports (link). These measures would encompass electric vehicles and parts originating from China, irrespective of their final assembly location, to prevent circumvention through third countries like Mexico.

Concerns about data security stem from the significant amount of data collected by modern vehicles, especially connected and autonomous ones, making them potential targets for hacking.

While existing Commerce Department authorities may be utilized to regulate information and communications technology transactions, no final decision has been made as officials conduct a comprehensive policy study. Additionally, an executive order on data privacy is anticipated soon, with potential adjustments to tariffs on Chinese EVs also under consideration.

The administration's broader effort aims to counter potential evasion of tariffs by Chinese companies and includes measures to strengthen screening of foreign investments, particularly from China, in countries like Mexico.

|

TRADE POLICY |

— WTO reform document lacks details on appeals process revival. A confidential document outlining reforms at the World Trade Organization (WTO) lacks specifics on how to revive the dormant appeals process. Despite being the seventh and final version of the reform proposal, the document does not provide details on an appeal mechanism to replace the defunct Appellate Body, which ceased operations in 2019 due to repeated U.S. actions blocking judge appointments. The document was presented during a special session in preparation for the 13th Ministerial Conference (MC13) scheduled for Feb. 26-29. While the document offers options for resolving trade disputes informally and establishes new deadlines for their resolution, it suggests that the MC13 may still be unable to revive the appeals process at the WTO. Currently, more than 30 appeals are pending without the ability for adjudication.

— Modi, UAE leader advance India-Middle East-Europe corridor despite conflict. India's Prime Minister Narendra Modi and UAE leader Sheikh Mohammed bin Zayed Al Nahyan agreed to continue work on the India-Middle East-Europe Economic Corridor (IMEC) despite ongoing regional conflict stemming from the Israel-Hamas war. The agreement was reached during Modi's visit to Abu Dhabi, where discussions heavily focused on the conflict in the Red Sea region. According to India’s Foreign Secretary Vinay Kwatra, both leaders have taken the initial steps to operationalize part of the IMEC.

|

ENERGY & CLIMATE CHANGE |

— Possibility of enacting a carbon border tax in the U.S. is under discussion as trade partners, including the EU, are moving forward with similar measures. Both Democratic and Republican lawmakers have proposed carbon border tax schemes to ensure fair competition for U.S. producers, focusing on issues like taxing both domestic and foreign products and harmonizing carbon accounting methods.

Discussions at the Washington International Trade Association's conference highlighted proposed legislation aiming to implement a carbon border adjustment mechanism (CBAM) to impose tariffs and fees on carbon-intensive imports. Key proposals include the Clean Competition Act from Sen. Sheldon Whitehouse (D-R.I.) and Rep. Suzan DelBene (D-Wash.), which compares the carbon intensity of imports with U.S. standards, and Sen. Bill Cassidy's (R-La.) Foreign Pollution Fee, which targets imports with higher carbon intensity compared to domestic counterparts.

The purpose of CBAMs is to address the "carbon loophole" in global trade, where goods produced with higher carbon intensity in one country are exported to another. This aims to provide a more accurate picture of a country's carbon intensity and level the playing field for less carbon-intensive U.S. production. U.S. fertilizer producers, for example, support CBAMs as they seek policy certainty for investments in decarbonization.

However, challenges remain in striking a balance between policy comprehensiveness and administrative feasibility. The adoption of carbon accounting rules and mutual recognition across industries and trade partners globally is crucial. While concerns exist about potential political pressure if CBAMs raise costs for domestic consumers, proponents argue that they provide long-term benefits by incentivizing greener production and making U.S. products more sustainable and valuable in global markets.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— U.S. CPI data shows surging inflation, led by grocery prices. The latest Consumer Price Index (CPI) data in the U.S. revealed stronger-than-expected inflation, with grocery prices experiencing the most significant rise in a year.

Overall prices increased by 0.3% in January, surpassing expectations of a 0.2% increase. Core CPI, excluding food and energy, rose by 0.4%, matching December's level. Although headline inflation fell to 3.1% from 3.4% in December, it exceeded the expected rate of 3% or less. Core CPI remained at 3.9%, surpassing expectations of a slowdown to 3.7%. Grocery prices increased by 0.4%, the highest monthly rise since January 2023, with annualized grocery prices up by 1.2%.

Food prices overall rose by 2.6%, slightly lower than December's 2.7%. Despite the decline in the rate of inflation, consumers are still experiencing higher prices at the grocery store, indicating ongoing challenges despite the data showing a decrease in the inflation rate.

Sticky inflation. The last CPI report is a vivid reminder of the challenges that the Fed faces in bringing down inflation to its 2% target. Even after excluding volatile energy and food prices, inflation is holding roughly steady and is well above where the central bank feels comfortable. Shelter costs, including rents, also rose above expectations, and “supercore inflation,” a measure the Fed closely follows that includes common “services” expenditures — like haircuts and lawyer fees — rose 4.3% year-on-year, its highest level since May, according to Deutsche Bank data.

Of note: The data shifted rate-cut expectations based on CME Fed funds futures, with the probabilities for a steady rate decision in May at just over 64% this morning after being at around 36% one week ago. Rate-cut probabilities for June are now north of 50% which would indicate the first reduction from the current 5.25% to 5.5% level.

Next key reports: Besides Friday’s Producer Price Index, the Fed tends to look more closely at another measure of inflation called the core personal-consumption expenditures index. The Bureau of Economic Analysis releases that report on Feb. 29.

|

POLITICS & ELECTIONS |

— Democrat Tom Suozzi won the New York House race to succeed George Santos, narrowing the GOP’s razor-thin majority in the House of Representatives. Just before midnight, Suozzi had 53.9% to 46.1% for Mazi Pilip, with 93% of the votes counted, according to the AP. Suozzi represented the district for three terms until 2023.

Former President Donald Trump lashed out at fellow Republican Pilip — claiming she lost Tuesday’s special election to replace disgraced ex-Rep. George Santos because she didn’t endorse him for president. Trump bashed Pilip on Truth Social and asked for “a real candidate” in the November general election to face off against Democrat Tom Suozzi, who beat Pilip to claim New York’s 3rd Congressional District seat.

Impact: The Suozzi victory means the House Republicans’ majority will further shrink to 219-213 with three vacancies. That’s a two-vote edge.

|

OTHER ITEMS OF NOTE |

— A bill advanced by an Iowa Senate subcommittee proposes changes to nutrient management plans, allowing livestock feedlots to spread manure without state regulator approval under certain conditions. Senate Study Bill 3152 aims to modify regulations concerning these plans, which the Iowa Department of Natural Resources (DNR) uses to regulate manure application on fields, ensuring they don't exceed their nutrient capacity and risk water pollution. Link to details via Iowa Capital Dispatch.

The proposed bill permits feedlots to utilize their proposed plans before DNR approval, even if rejected, pending an appeal process. Critics argue this could lead to unapproved or inaccurate plans, potentially polluting waterways. The bill's introduction follows a previous case where a cattle facility faced months of manure disposal issues due to a nullified plan.

Opponents express concerns over potential pollution and delays in DNR decisions. While amendments are proposed, specifics are undisclosed, indicating complexity surrounding the issue. Despite reservations, the bill advances for further consideration, prompting varied responses from senators involved.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |