Weaker commodity prices reduce farmer sentiment

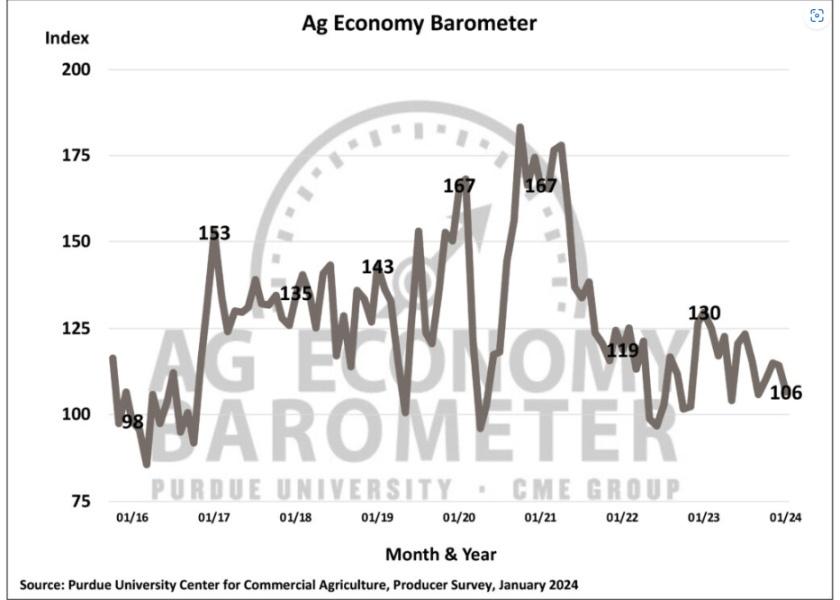

The Purdue University/CME Group Ag Economy Barometer fell 8 points (7.0%) from the previous month to a reading of 106 in January, down 24 points (18.5%) from a year-ago. Producers expressed a more pessimistic perspective about their farms’ current situation and future prospects. The Current Conditions Index fell 9 points, and the Future Expectations Index dropped 7 points from December. The anticipation of weaker farm income in 2024 contributed to the overall decline, reflected in the Farm Financial Performance Index, which posted a 12-point decrease from the previous month.

Declining prices for key commodities weighed on agricultural producer sentiment in January. The percentage of producers citing lower prices for crops and livestock as a top issue this month matched the percentage indicating input prices as a top concern. Previously, the response “higher input prices” was consistently chosen by producers as their top concern. The combination of high input costs and declining commodity prices generated a weaker financial performance outlook for 2024 and a weaker capital investment index. When asked to compare their farms’ operating loan size in 2024 to 2023, fewer producers than a year ago expected a larger loan. Among those anticipating an increase in loan size, fewer farms attributed it to rising input costs with more farms pointing to an increase in their operation’s size as a key reason.