House Clears Major Tax Package, But Hurdles Remain in Senate

Corteva results | Outlaw on Stabenow’s farm bill plan | U.S. officials warn of growing Chinese cyber threat | FOMC analysis | State ag officials fret over banks’ net-zero commitments

|

Today’s Digital Newspaper |

MARKET FOCUS

- Fed signals cuts are possible but not imminent

- November’s elections are complicating Powell’s task

- U.S. deficit would be even larger if not for the IRS holding back wave of more stimulus

- ISM Manufacturing PMI tops estimates

- Corteva surpasses projections, $1 billion stock repurchase, increased ‘24 net sales

- State ag officers note concerns over banks' net-zero commitments on ag, food security

- BOE holds rates steady but signals rate cuts ahead

- Jitters resurface in U.S. commercial real estate market

- In January, South Korea experienced a significant boost in its exports

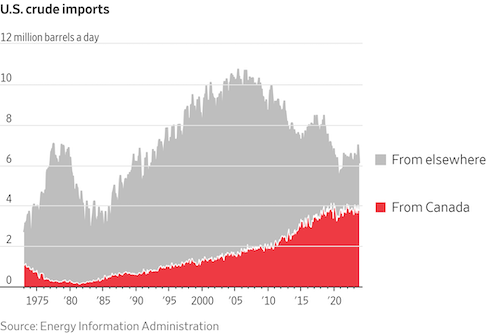

- U.S. faces potential rise in oil prices as Canadian oil becomes less affordable

- Calif. may force oil refiners to stockpile gasoline reserves to tame fuel-price volatility

- EIA will begin collecting data on electricity usage by commercial cryptocurrency miners

- Investor group takes big stake in Norfolk Southern and plans to run a proxy fight

- Argentina raises prices for biodiesel and bioethanol

- Ag markets today

- India rice prices extend record rally

- USDA daily export sale: 206,834 MT soybeans to Mexico, 2023-2024 marketing year

- Ag trade update

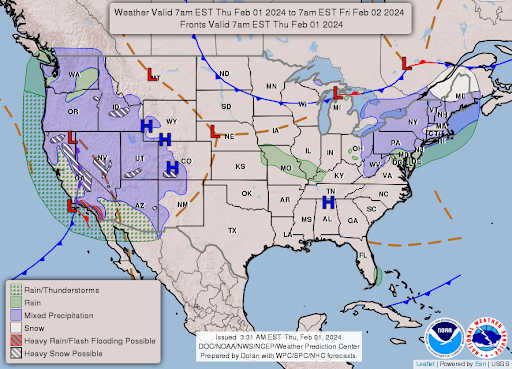

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- House passes a nearly $79 billion bipartisan tax bill, but hurdles in Senate

ISRAEL/HAMAS CONFLICT

- Israel’s prime minister urges UN to shut down its refugee agency operations in Gaza

RUSSIA & UKRAINE

- EU leaders agree on support package for Ukraine, sooner than expected

POLICY

- Outlaw: Stabenow's proposal raises concerns about expanding safety net choices

PERSONNEL

- Senate confirms Joe Goffman to lead EPA’s Office of Air and

- Biden selects senior White House advisor John Podesta to replace John Kerry

- Vacant seats at FERC and NRC raise urgency for White House nominations

CHINA

- Soybean, cotton sales to China for 2023-24 with sorghum cancellations for 2024-25 .

- China’s smaller factories again expand in January

- China pledges fiscal expansion to spur economy

- U.S. officials warn of growing Chinese cyber threats

ENERGY & CLIMATE CHANGE

- House to vote on overturning Biden freeze on liquefied natural gas export approvals

- Dakota Access Pipeline supporters warn Biden administration against shutdown

- Lawsuit from business advocates & farmers seek to kill Calif.’s emissions reporting law

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Unlikely allies want to bar Brazilian beef giant JBS from U.S. stock markets

- Enviros fret EPA prioritizing meatpacking capacity over protecting water quality

- FDA Commissioner Robert Califf outlined two key goals for the agency in 2024

HEALTH UPDATE

- Medical trial offering CRISPR treatment to individuals with hereditary angioedema

POLITICS & ELECTIONS

- Trump holds large lead over Haley in South Carolina, Post-Monmouth poll finds

- Trump promises to block Nippon Steel’s takeover of U.S. Steel if he’s re-elected

OTHER ITEMS OF NOTE

- European farmers, primarily from Italy and Spain, stage protest in central Brussels

- Migrants at U.S. southern border face humanitarian crisis

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed to weaker in overnight trading. U.S. Dow is currently up just over 100 points. In Asia, Japan -0.8%. Hong Kong +0.5%. China -0.6%. India -0.2%. In Europe, at midday, London +0.3%. Paris -0.8%. Frankfurt -0.1%. Traders are now focusing on Friday morning’s monthly U.S. jobs report from the Labor Department. The January non-farm payrolls component of the report is expected to show a rise of 175,000, compared to a gain of 216,000 in the December report.

U.S. equities yesterday: All three major indices registered losses, with the Dow falling after the press conference by Fed Chairman Jerome Powell in which he provided no definitive timeline for when the Fed would start to cut rates. The Dow dropped 317.01 points, 0.82%, at 38,150.30. The Nasdaq was down 345.89 points, 2.23%, at 15,164.01. The S&P 500 fell 79.32 points, 1.61%, at 4,845.65, its biggest single-day drop in more than four months.

All three major equity averages finished January in the green, with the Dow up 1.2% over the first month of the year, the S&P up 1.6% and the Nasdaq up 1%.

— Apple, Amazon and Meta all report after the market close. The trio of quarterly earnings results comes after Microsoft and Google-parent Alphabet each sold off earlier this week, despite strong quarters.

— Corteva surpasses projections, plans $1 billion stock repurchase, forecasts increased 2024 net sales. Agricultural chemical and seed producer Corteva has reported robust fourth-quarter results, surpassing expectations. Additionally, the company has disclosed its intention to buy back nearly $1 billion worth of shares in 2024. Corteva also anticipates higher net sales for 2024, with expectations ranging between $17.4 billion and $17.7 billion. The company attributes its fourth-quarter profitability partly to increased prices in its seeds division, which offset lower sales volumes. For the quarter ending on Dec. 31, net sales amounted to $3.71 billion, exceeding the projected figure of $3.62 billion. Link for details.

- Seed net sales grew 5% and organic sales increased 7%. Price was up 13% globally, led by continued execution on the company's price for value strategy and demand for new technology. Volume declines were driven by lower corn volumes in Latin America, the exit from Russia, and lower corn planted area in EMEA2, partially offset by increased corn acres in North America.

- Crop Protection net sales declined 9% and organic sales decreased 12%. Volume declines, largely in Latin America and North America, were driven by strategic product exits, inventory destocking, and delayed farmer purchases. Price gains reflected pricing for value and strong execution in response to cost inflation led by EMEA.

— Ag markets today: Corn, soybeans and wheat kicked off the new month with a round of fresh selling during the overnight session. As of 7:30 a.m. ET, corn futures were trading 3 to 4 cents lower, soybeans were 10 to 12 cents lower, winter wheat markets were 6 to 8 cents lower and spring wheat was 1 to 2 cents lower. Front-month crude oil futures were modestly firmer, and the U.S. dollar index was around 350 points higher.

Cattle Inventory Report neutral compared to expectations but underlying data bullish. USDA estimated there were 87.157 million head of cattle in the U.S. as of Jan. 1, down 1.684 million head (1.9%) from last year. The beef cow herd dropped 716,000 head (2.0%) to 28.233 million head. The 2023 calf crop was estimated at 33.593 million head, down 847,000 head (2.5%) from the previous year. The total cattle herd was the smallest since 1951 and last year’s calf crop was the smallest in 82 years. While the data was neutral compared to pre-report expectations, the underlying data was bullish as the U.S. cattle herd contracted further — and will continue to do so. Click here for more details.

Cash hog rally accelerating. The CME lean hog index is up another 90 cents to $72.38 as of Jan. 30. The cash index has firmed $7.33 this month, with $2.48 of that gain coming the last three days. February lean hog futures finished Wednesday $3.97 above today’s cash quote, suggesting traders anticipate the seasonal strength will continue for at least another two weeks. But the nearly $12.50 premium April hogs hold to the cash index may be getting too extended.

— Agriculture markets yesterday:

- Corn: March corn rose 1/2 cent to $4.48 1/4, ending just 1/4 cent from the session high.

- Soy complex: March soybeans rose 3 1/2 cents to $12.22 1/4. March soybean meal rose $5.30 at $368.30. March bean oil closed up 2 points at 46.02 cents. Prices in all three markets closed near their session highs.

- Wheat: March SRW wheat fell 10 1/4 cents to $5.95 1/4, while March HRW gave up 8 3/4 cents, closing at $6.22. March spring wheat fell 7 1/2 cents to $6.92 1/4, with low range closes featured across the wheat complex.

- Cotton: March cotton closed up 39 points at 85.17 cents and nearer the session high.

- Cattle: Nearby February live cattle futures ended Wednesday having sunk 67.5 cents to $177.35, while most-active April dropped $1.05 to $180.70. Nearby March feeder futures fell $1.175 to $240.15.

- Hogs: April lean hog futures gapped lower then rallied from the open, though the contract still lost 7.5 cents on the day to $84.825. Expiring February futures rallied 50 cents to $76.35.

— Quotes of note:

- Fedspeak. There will likely be no interest rate cut next month, although Fed Chair Jerome Powell signaled it could happen at some point this year. "I don’t think it's likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that," he said after the Fed maintained its policy rate at 5.25%-5.50% yet again. "We need to see more evidence that tells us we are on a sustainable path to 2% inflation."

- "Powell is concerned that the timing of the cut has to be immaculate," noted Yimin Xu, on behalf of Investing Group Leader Cestrian Capital Research. "Cutting too soon risks a return of inflation, but cutting too late can trigger an economic downturn."

- November’s elections are complicating Powell’s task. Allies of Donald Trump argue, without evidence, that the Fed is seeking to help President Biden by signaling that cuts are coming. And Trump has said that if he becomes president, he wouldn’t reappoint Powell.

- Competition. “Throughout my long career as a naval officer…I have never seen such intense competition on the oceans of the world.” — Retired U.S. Adm. James Stavridis.

- “Your product is killing people,” Sen. Josh Hawley (R-Mo.) flatly told Zuckerberg at yesterday’s hearing. Over 3.5 hours, members of the Senate Judiciary Committee laid into the Meta chief and the heads of Discord, Snap, TikTok and X over their policies. (Before the hearing began, senators released internal Meta documents that showed that executives had rejected efforts to devote more resources to safeguard children.)

— State ag officers express concerns over banks' net-zero commitments and their potential impact on agriculture and food security. In a letter (link) addressed to several prominent banking executives, the chief agriculture officers of various states express their concerns regarding the commitments made by these banks as part of the Net-Zero Banking Alliance (NZBA). They highlight potential negative impacts on the agriculture sector, specifically on food availability, consumer prices, credit access for farmers, and the overall economy. The letter underscores their commitment to safeguarding the interests of consumers, American farmers, and food security.

The agriculture officers request more information from the banks regarding their environmental commitments within the NZBA, which include transitioning all lending portfolios to align with net-zero emissions pathways by mid-century or sooner. They express concerns about the impact of such commitments on American farmers, which may entail significant changes in farming practices, including transitioning to electric machinery, installing renewable energy sources, and altering fertilizer use.

The letter warns that these changes could lead to increased food costs, decreased food production, and potential economic hardships, especially for lower-income individuals. It highlights the negative consequences experienced by Sri Lanka after adopting similar measures, including a significant drop in agricultural production and food insecurity.

The agriculture officers express unease about the role of the United Nations Environment Program (UNEP) in reviewing and monitoring the banks' climate targets, emphasizing concerns that these targets could jeopardize American agriculture and food security.

The ag officers request detailed information and documents related to the banks' NZBA commitments, their plans to achieve net-zero emissions in agriculture lending, and their consideration of greenhouse gas emissions in lending decisions. They seek clarity on the banks' current membership status with the NZBA and their level of involvement.

— U.S. deficit would be even larger if not for the Internal Revenue Service holding back a wave of more stimulus, according to the Wall Street Journal. The agency in September paused processing new claims for the Covid-era Employee Retention Credit owing to concerns over abuse and fraud. By one estimate, the IRS has a $244 billion backlog of claims, which will flood the economy when the IRS processes them.

— The Federal Reserve kept interest rates steady, with no specific timing for rate cuts. They have shifted their language from discussing rate increases to considering "any adjustments" to the Fed funds rate based on incoming data, the evolving economic outlook, and risk factors.

The Fed does not expect to cut rates until they have more confidence in inflation sustainably reaching their 2% target. They will continue with their balance sheet runoff as previously planned and remain committed to achieving their long-term goal of maximum employment and 2% inflation.

Fed Chairman Jerome Powell indicated that while rates might stay at their current level longer if necessary, the policy rate is likely at its peak for this tightening cycle. Powell emphasized the importance of not cutting rates too soon or too much, as it carries risks for inflation and economic activity.

Powell did not specify when rate reductions might start but mentioned that it depends on gaining confidence in inflation reaching the 2% target. He also noted that the March meeting is not the most likely starting point for rate cuts.

While the economy is performing solidly, Powell does not believe a soft landing has been achieved yet, and risks remain. The Fed will make data-driven decisions on a meeting-by-meeting basis.

Regarding the balance sheet runoff, the Fed will begin in-depth discussions at the March meeting, suggesting potential changes in their approach.

Bottom line: The Fed signaled a shift in its stance from rate hikes to potential rate cuts but has not provided a clear timeline. The timing of rate reductions will depend on data and the Fed's confidence in inflation reaching its target. These uncertainties are likely to continue until the March meeting when further economic forecasts may provide more guidance but not necessarily clarity on timing. The Fed appears cautious and deliberate in its approach to adjusting rates.

— BOE holds rates steady but signals rate cuts ahead. The Banks of England left its key interest rate at 5.25% and removed a mention in their statement that higher rates were still possible. The BOE said it would keep the rate at 5.25% and said that how long it stays at that level would be “under review.”

— Jitters resurface in U.S. commercial real estate market. New York Community Bancorp's decision to reduce its dividend and increase its reserves triggered a record 38% decline in its stock and had a negative impact on the KBW Regional Banking Index, resulting in its worst performance since the Silicon Valley Bank's collapse in March. These actions, which reverberated through global bond markets, were partly driven by apprehensions about the commercial real estate sector. These concerns were further exacerbated as two banks expressed unease overnight. Tokyo-based Aozora Bank saw its shares plummet by over 20% after warning of losses related to investments in U.S. commercial properties. Meanwhile, Germany's Deutsche Bank significantly increased its provisions for U.S. real estate losses to €123 million, more than quadrupling the amount.

— In January, South Korea experienced a significant boost in its exports, which grew by 18% compared to the same month the previous year, reaching a total of $55 billion. This impressive growth was primarily driven by increased sales of semiconductors, marking the most substantial year-on-year increase since May 2022. Notably, exports to the U.S. saw a remarkable surge, increasing by 27%. Meanwhile, exports to China, which had been on a decline for the past 19 consecutive months, showed signs of recovery with a 16% rise.

South Korea holds a pivotal role in the global electronics industry, particularly as a major supplier of semiconductors and other electronic components. Due to its strong presence in this sector, the country's export performance is often regarded as an important indicator of global demand trends, making these export figures significant in assessing the broader state of the global economy.

— ISM Manufacturing Purchasing Managers' Index (PMI) in the U.S. showed improvement in January 2024, reaching a reading of 49.1. This marks the highest level since October 2022, compared to the December reading of 47.1 and surpassing expectations of 47. While the manufacturing sector still indicates a contraction, the pace of contraction has slowed down considerably. Key highlights include:

- Demand improved moderately.

- Production remained stable.

- Input conditions were favorable.

- New orders rebounded to 52.5 from 47.

- Production increased to 50.4 from 49.9.

- Inventories decreased at a slower rate, with a reading of 46.2 compared to 43.9.

- Supplier deliveries were faster for the 16th consecutive month, registering 49.1 versus 47.

- Customers' inventories decreased further to 43.7 from 48.1, indicating a more favorable outlook for future production.

- Employment declined slightly more to 47.1 from 47.5.

- Backlogs of orders decreased at a faster pace, with a reading of 44.7 versus 45.3.

- Price pressures increased, with a reading of 52.9 compared to 45.2.

Overall, the data suggests a gradual improvement in the manufacturing sector, with increasing new orders and production, along with favorable supplier deliveries and pricing pressures. However, challenges remain, including a slight decline in employment and a faster reduction in backlogs of orders.

Market perspectives:

— Outside markets: The U.S. dollar index was solidly higher, with the euro, yen, and British pound weaker against the greenback. The yield on the 10-year US Treasury note was edging slightly higher, trading around 3.92%, with a positive tone in global government bond yields. The yield on the 10-year U.S. Treasury note was edging slightly higher, trading around 3.92%, with a positive tone in global government bond yields. Crude oil futures are up, with US crude trading around $76.50 per barrel and Brent around $81.20 per barrel. Gold futures and silver futures were down ahead of US trading, with gold around $2,051 per troy ounce and silver around $22.69 per troy ounce. ·

— U.S. faces potential rise in oil prices as Canadian oil becomes less affordable. For years, Americans have enjoyed the benefits of cheap Canadian oil, which has helped keep gasoline prices at the pump affordable. However, the WSJ reports (link) this era of low-cost Canadian oil may be coming to an end as an expanded pipeline from Canada's oil sands to the Pacific Ocean prepares to transport more of the country's crude to global markets. This development is expected to provide Canadian companies with greater pricing power and enhance Canada's position as a significant player in the global energy market. As a result, Americans may see an increase in oil prices soon.

— California may force oil refiners to stockpile gasoline reserves in a bid to tame fuel-price volatility in the state. Mandatory, minimum fuel inventories and related measures will be considered at a February meeting of the California Energy Commission, Siva Gunda, a member of the six-person panel, said during a media briefing yesterday.

— Energy Information Administration (EIA) will begin collecting data on electricity usage by commercial cryptocurrency miners, requiring them to provide details about their energy consumption. Additionally, the EIA will solicit public input regarding the collection of energy use data. EIA Administrator Joe DeCarolis stated that they intend to analyze and report on the implications of energy consumption by cryptocurrency miners. The focus will be on tracking the evolution of energy demand for cryptocurrency mining, identifying regions with significant growth, and quantifying the sources of electricity used to meet this demand.

— An investor group has taken a big stake in Norfolk Southern and plans to run a proxy fight aimed at overhauling the railroad operator’s board and replacing its chief executive. Link for details.

— Argentina raised prices for biodiesel and bioethanol through recently published resolutions in the country's official gazette. The new pricing structure sets biodiesel prices at 940.334 pesos ($1.11) per liter, up from the previous 923.590 pesos per liter. Ethanol derived from sugarcane will now be priced at 584.18 pesos per liter, up from 465.84 pesos, while corn-based bioethanol prices have increased to 536.983 pesos per liter, compared to the previous 463.911 pesos.

Additionally, the notice outlines payment terms, specifying that biodiesel payments must not exceed seven days, and bioethanol payments cannot extend beyond 30 consecutive days. Argentina has been grappling with inflation and has taken several measures under the new Milei administration to address rising prices and rebuild the country's economy.

— India rice prices extend record rally. Parboiled rice export prices from India extended their record rally this week, driven by tight supplies and firm demand due to higher prices from other exporters. India’s 5% broken parboiled variety was quoted at a record $537 to $546 per MT this week, up $4 per MT on both ends of the range. Vietnam’s 5% broken rice was offered at $635 to $640 per MT on Thursday, up from $630 a week ago. Thailand’s 5% broken rice prices was quoted at $640 to $658 per ton, slipping from $665 per ton last week.

— USDA daily export sale: 206,834 MT soybeans to Mexico, 2023-2024 marketing year

— Ag trade update: Turkey provisionally sold 150,000 MT of durum to an unknown buyer, subject to approval by the Turkish government.

— NWS weather outlook: Heavy snow over parts of the Sierra Nevada Mountains, light to moderate snow over Lower Great Lakes/Northern New England, light snow over the higher elevations of the West... ...There is a Slight Risk of excessive rainfall over parts of Southern California on Thursday... ...Temperatures will be 15 to 25 degrees above average from the Plains to the Upper/Middle Mississippi Valley.

Items in Pro Farmer's First Thing Today include:

• Grains lower overnight

• Record soy crush, big jump in corn-for-ethanol use expected

• Soyoil use in biofuels unchanged in November

|

CONGRESS |

— House of Representatives passed a nearly $79 billion bipartisan tax bill that includes provisions to expand the child tax credit for American families and reinstate some tax cuts for businesses. The bill, which was negotiated between Rep. Jason Smith (R-Mo.) and Sen. Ron Wyden (D-Ore.), received strong support in the House with a vote of 357-70. The bill needed significant bipartisan backing due to being fast-tracked under a tactic known as "suspension," which requires two-thirds support in the Republican-controlled House. Republicans voted for the bill by a margin of 169-47. The bill would devote about $33 billion to reviving a trio of business tax breaks and roughly the same amount to expand the child tax credit.

Key points of this legislation and its potential impact include:

- Child Tax Credit: While not reaching the levels of the boosted pandemic-era child tax credit, the bill proposes increasing the child tax credit to $1,800 per child in 2023, $1,900 per child in 2024, and $2,000 per child in 2025. It would also adjust the credit for inflation in 2024 and 2025. The bill keeps a threshold of a household having $2,500 in income to be eligible for refundable child tax credit payments (allowing families to use the previous year’s income to qualify for the child tax credit). Households benefitting as a result of the changes in the child tax credit would see an average tax cut of $680 in the first year, according to estimates from the nonpartisan Tax Policy Center.

- Benefits Beyond Parents: The legislation goes beyond aiding parents and includes tax benefits for individuals affected by natural disasters. Additionally, it strengthens the low-income housing tax credit and extends tax breaks for businesses through 2025. The bill also incorporates measures to support trade with Taiwan.

- House Republicans were anxious to restore full, immediate deductions that businesses can take for the purchase of new equipment and machinery, and for domestic research and development expenses. They argue such investments grow the economy and incentivize American companies to keep their manufacturing facilities and operations in the United States. The bill also provides businesses more flexibility in determining how much borrowing can be deducted. Some analysts note that these tax extenders are temporary, and they retroactively reward investments or move forward some by a year or two. This reduces their long-term growth impact.

- The bill also would enhance a tax credit for the construction or rehabilitation of rental housing targeted to lower-income households, adding an estimated 200,000 housing units around the country. That was a key priority of lawmakers from states with acute housing shortages and soaring prices.

- Funding Sources: The tax breaks offered in the bill would be funded by eliminating the employee retention tax credit, which was initially introduced during the pandemic to help businesses maintain their employees but has since been associated with fraudulent claims.

Some lawmakers have expressed opposition to the bill for different reasons:

- Ultraconservative lawmakers opposed it primarily due to concerns over the expanded child tax credit. They argued that it could benefit undocumented immigrants, although the bill only extends benefits to children with social security numbers who are already receiving the credits.

- Progressive lawmakers raised concerns that the bill doesn't go far enough in expanding the tax credit and appears to favor corporations over families. They argue that corporations should not receive tax cuts while families receive relatively small benefits.

There were also last-minute disputes in the House, with a group of moderate New York House Republicans raising concerns about the bill's lack of reform for a state and local tax deduction popular with their constituents. However, these lawmakers ultimately agreed to continue discussions on potential reforms to the program after meeting with House Speaker Mike Johnson (R-La.).

Johnson emphasized the importance of the bill moving through the House Ways and Means Committee before coming to the full House for a vote, saying it was a good example of how Congress is supposed to work.

The bill's future now depends on its reception in the Senate, where it faces additional challenges, with some Republicans demanding further changes before approving it. Several pressing legislative priorities, including crafting a national defense supplemental, addressing government shutdown deadlines, reauthorizing the FAA, and the possibility of an impeachment trial for Homeland Security Secretary Alejandro Mayorkas, create a legislative logjam in the Senate. Senate Republicans have also shown reluctance to embrace the bill, proposing changes and a markup that could slow down or derail the effort.

Of note: While lawmakers say the price tag of the tax package is close to $79 billion, Dan Clifton of Strategas Research Partners says the bill’s provisions would actually cut taxes by more than $200 billion in the first two years.

|

ISRAEL/HAMAS CONFLICT |

— Binyamin Netanyahu, Israel’s prime minister, urged the UN to shut down its refugee agency operations in Gaza. Israel has accused UNRWA staff of being involved in the attack by Hamas militants on Oct. 7. Earlier António Guterres, the UN’s boss, said the agency is “the backbone of all humanitarian response in Gaza.” Israeli forces continued to pound the enclave amid negotiations over a temporary truce.

|

RUSSIA/UKRAINE |

— EU leaders agreed this morning on a support package for Ukraine, sooner than expected. They agreed on a €50 billion ($54. billion) support package for Ukraine after months of obstruction by Hungary. Earlier this week, European officials and leaders reportedly threatened to harm Hungary’s economy to put pressure on its pro-Russian prime minister, Viktor Orban. Charles Michel, who heads the European Council, said the deal locked up “steadfast, long-term” support for Ukraine. Support from the U.S. remains held up in partisan gridlock.

The deal includes an annual discussion of the package and the option to review it in two years. There was no reaction from Hungary to the decision. The EU will now pivot to consideration of a military aid plan though expectations are they will not end up sending artillery shells to Ukraine.

|

POLICY UPDATE |

— Dr. Joe Outlaw: Stabenow's farm bill proposal raises concerns about expanding safety net choices for farmers. Senate Ag Chair Debbie Stabenow (D-Mich.) has proposed strengthening the farm safety net in the new farm bill with five key principles, including providing farmers with choices and flexibility. However, a Southern Ag Today article (link) says there are concerns about expanding safety net choices without addressing the existing challenges faced by cotton producers. The choice between ARC/PLC and STAX has been a source of difficulty for cotton producers, it says, and forcing this choice on other crops may not be the best solution. Instead, writer Dr. Joe Outlaw says there is a need to improve both Reference Prices in Title 1 and area-wide coverage in crop insurance to provide better support for all farmers.

|

PERSONNEL |

— Senate confirmed Joe Goffman to lead the EPA’s Office of Air and Radiation in a narrow 50-49 vote. Goffman's confirmation faced opposition from some Republicans due to concerns about the Biden administration's rules on power plants and its broader energy agenda. Goffman had been serving as the acting director of the office while awaiting full Senate approval, which he has now received.

— President Biden selected senior White House advisor John Podesta to replace John Kerry as the next U.S. Climate Envoy. Unlike Kerry, Podesta will continue working from the White House, circumventing the Senate confirmation required for State Department envoys.

— Vacant seats at FERC and NRC raise urgency for White House nominations amid climate rulemakings. Two key regulatory commissions, the Federal Energy Regulatory Commission (FERC) and the Nuclear Regulatory Commission (NRC), are grappling with major rulemakings while operating with vacant seats. This has increased the urgency for the White House to nominate new members during an election year. The issue of understaffed commissions is particularly critical because both FERC and NRC are addressing rules closely linked to the Biden administration's climate objectives of achieving a carbon-neutral power grid by 2035.

|

CHINA UPDATE |

— Soybean, cotton sales to China for 2023-24 with sorghum cancellations for 2024-25. USDA export sales data for the week ending Jan. 25 to China for 2023-24 included net sales of 15,598 metric tons of corn, 71,240 metric tons of sorghum, 134,775 metric tons of soybeans, and 133,203 running bales of upland cotton. However, for 2024-25 USDA reported net cancellations of 118,680 metric tons of sorghum to China. For 2024, net sales of 3,340 metric tons of beef and 12,638 metric tons or pork.

— China’s smaller factories again expand in January. The Caixin/S&P Global manufacturing purchasing managers index (PMI) held at 50.8 in January amid stable growth in output, quicker logistics and the first rise in new export orders since June. That marked the third straight month of growth in factory activity based on the private survey focused on smaller and privately owned plants, contrasting with official PMI data that showed extended contraction amid larger and state-owned factories ahead of a Lunar New Year celebration.

— China pledges fiscal expansion to spur economy. China will maintain fiscal expansion this year to spur an economic recovery, Vice Finance Minister Wang Dongwei said, reinforcing market views that public spending will be the government’s main tool to lift growth. Beijing will “increase the intensity of fiscal macroeconomic adjustments, implement a proactive fiscal policy to consolidate and enhance the positive trend of economic recovery,” Wang said. Authorities will “maintain a necessary intensity in fiscal spending” and keep a certain amount of transfer payments to local governments, he noted. Fiscal policy will focus on expanding domestic demand and the government will use fiscal subsidies, loan interest subsidies and tax incentives to support tech innovation and advanced manufacturing, he said.

— U.S. officials warn of growing Chinese cyber threats. In a congressional hearing, high-ranking officials from U.S. cybersecurity and intelligence agencies emphasized the growing threat of China-backed hacking activities against U.S. infrastructure and elections. They warned that Chinese hackers have become increasingly sophisticated and are attempting to infiltrate critical systems in the United States.

China is viewed as a preparative cyber force, probing networks for sensitive information and vulnerabilities that could be exploited in the future. This activity has raised concerns among lawmakers since at least 2012, with the officials stressing that Chinese cyber actors are exploiting fundamental flaws in American technology.

U.S. urged to go on offense. The Cybersecurity and Infrastructure Security Agency (CISA) Director, Jen Easterly, called for a "secure-by-design" approach in software development to embed security protections. However, it's uncertain if this concept will gain broad support within the committee. Harry Coker, the newly appointed National Cyber Director, emphasized the need for stronger public-private partnerships and workforce development in addressing cyber threats.

FBI Director Christopher Wray confirmed that China's cyber army is actively targeting U.S. economic security, engaging in large-scale theft of innovation and personal and corporate data. He noted that even if all FBI cyber professionals focused on China, the U.S. would still be at a significant disadvantage.

The hearing highlighted China's growing capabilities in state-sponsored hacking activities, including breaches of federal officials' email accounts, lurking in networking gear, and improving its ability to disrupt critical U.S. infrastructure.

The officials also discussed various aspects of cyber policy, such as quantum computing, surveillance power reauthorization, and communications infrastructure replacement.

The Pentagon's cyber strategy is adopting a more offensive stance against cyber adversaries like China and Russia, with a commitment to pursue cybercriminals and other threats.

The heightened cybersecurity concerns in 2024 are due to the upcoming presidential election and record-level cyberattacks on U.S. entities in recent years.

A warning: While Gen. Paul Nakasone, NSA and Cyber Command leader, expressed confidence in the security of the upcoming election, Easterly warned that foreign actors might still attempt to influence it.

Focus on Taiwan. Analysts are also closely monitoring the possibility of a Chinese invasion of Taiwan or other tensions in the South China Sea that could lead to a U.S. intervention, potentially triggering Chinese cyberattacks on critical infrastructure.

The hearing revealed the need for addressing security vulnerabilities stemming from decades of unpatched software, poor security configurations, and missing security features.

|

ENERGY & CLIMATE CHANGE |

— House is set to vote on overturning the Biden administration's freeze on liquefied natural gas (LNG) export approvals, according to Rep. Cathy McMorris Rodgers (R-Wash.), the chair of the House Energy and Commerce Committee. This vote is scheduled to take place in the week after next. President Biden's decision to halt new licenses for LNG exports while assessing their impact on climate change has faced criticism from industry leaders and top Republicans. While a stand-alone measure is unlikely to succeed in the Democratic-controlled Senate, Republicans may attempt to attach it as a rider to an emergency aid package for Ukraine, Israel, and Taiwan sought by Democrats. The issue will also be examined in two congressional hearings next week, with one focused on the benefits of American LNG exports and the other featuring Energy Department Deputy Secretary David Turk as a witness. The League of Conservation Voters has launched a $2 million campaign in support of Biden's decision on LNG exports.

— Dakota Access Pipeline supporters warn Biden administration against shutdown amid ongoing review. Supporters of the Dakota Access Pipeline, including North Dakota's congressional delegation led by Sen. Kevin Cramer (R), have cautioned the Biden administration against shutting down the pipeline during an ongoing environmental review. They are urging the administration to allow the pipeline to continue operating on its existing route. Pressure is mounting on President Biden to make a decision regarding the pipeline before the Nov. 5 elections, although the Army Corps, responsible for the review, is not expected to conclude it by December.

— Lawsuit from business advocates and farmers seek to kill California’s emissions reporting law. The U.S. Chamber of Commerce, American Farm Bureau Federation, and other business and ag groups have sued to stop California's emissions reporting law, which requires companies operating in the state to disclose their greenhouse gas emissions. These groups argue that the law compels speech from businesses in violation of the First Amendment and conflicts with federal laws on interstate commerce. This lawsuit comes as the Securities and Exchange Commission (SEC) targets April for the release of its corporate emissions reporting requirements, and companies have expressed concerns about their ability to provide accurate and cost-effective emissions disclosures. The Chamber and American Farm Bureau have also raised similar First Amendment concerns with the SEC, indicating potential legal challenges to the SEC's climate disclosure plans once they are finalized.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Environmental groups have expressed concerns that the EPA is prioritizing expanding meatpacking capacity over protecting water quality in its proposed slaughterhouse effluent standards. These standards aim to control slaughterhouse effluent in the Chesapeake Bay and other waterways nationwide by revising wastewater discharge guidelines for meat and poultry producers to reduce nitrogen and phosphorus pollution under the Clean Water Act. Environmental advocates argue that the EPA's preferred option in the proposed regulations is the least protective of the three options considered and may allow the meatpacking industry to continue polluting waterways. EPA is expected to finalize these guidelines in 2025.

— Just say no. Environmentalists and meat producers have formed an unlikely alliance to prevent the Brazilian beef giant JBS from listing on the New York Stock Exchange. Link to details via the New York Times.

— FDA Commissioner Robert Califf outlined two key goals for the agency in 2024: completing regulations for front-of-package nutrition labels and developing a new definition for foods that can be labeled as "healthy." Califf emphasized the importance of front-of-package labels as a simplified, at-a-glance summary to aid consumers in making healthier food choices. The FDA has been evaluating various label formats and is considering making them mandatory.

The FDA is also updating its definition of "healthy" for nutrient claims, which was last revised in 1994. The new definition aims to align with the latest nutrition science and dietary guidelines. Under the proposal, nutrient-dense foods consistent with the Dietary Guidelines for Americans, such as raw whole fruits and vegetables, would automatically qualify as "healthy." Conversely, products like white bread and highly sweetened items would be disqualified, while avocados, nuts, seeds, and certain fatty fish would become eligible for the "healthy" label.

|

HEALTH UPDATE |

— A medical trial offering CRISPR treatment to individuals with hereditary angioedema, a rare genetic swelling disease, yielded promising results. All ten participants in the trial experienced significant improvements in their condition. On average, the number of monthly swelling "attacks" decreased by an impressive 95%. The therapy involves the use of CRISPR, a molecular genome-editing tool, which is directed to the liver to correct a faulty gene responsible for the disease. While these findings are highly encouraging for individuals suffering from hereditary angioedema, the treatment is likely to be costly. Nevertheless, the potential benefits in terms of reducing the frequency and severity of attacks make it a promising development in the field of genetic medicine.

|

POLITICS & ELECTIONS |

— Donald Trump leads in South Carolina primary poll against Nikki Haley. In a recent Washington Post-Monmouth University poll, Trump is shown to have a significant lead in South Carolina ahead of the state's primary on Feb. 24. Trump aims to thwart Nikki Haley's presidential candidacy and add to his series of early victories in the Republican nomination race. The poll indicates that Trump enjoys 58% support among potential Republican primary voters, while Haley trails with 32%. In the previous New Hampshire primary, Haley secured 43% of the vote compared to Trump's 54%, and she has expressed her desire to improve upon that performance.

— Donald Trump promises to block Nippon Steel’s takeover of U.S. Steel if he’s re-elected. “I would block it instantaneously. Absolutely,” the former president said yesterday after meeting with members of the Teamsters union. The New York Times says the statement raises questions about whether Trump’s economic nationalism would impede foreign investment in the U.S., and how much he would let politics influence regulatory decisions.

|

OTHER ITEMS OF NOTE |

— Approximately 1,300 European farmers, primarily from Italy and Spain, staged a protest in central Brussels using trucks and tractors. Their demonstration aimed to voice their discontent with various issues, including the European Union's (EU) green regulations, the elevated expenses related to energy and fertilizers, and other concerns within the agricultural sector. This protest occurred concurrently with a two-day summit of EU leaders being held at the EU headquarters. Germany and France have recently taken steps to address some of the farmers' grievances by postponing planned tax increases, potentially in response to the mounting pressure and discontent within the agricultural community.

— Migrants at U.S. southern border face humanitarian crisis as Texas governor offers bus rides to sanctuary cities. A surge of migrants at the U.S. southern border is intensifying a humanitarian crisis during the harsh winter season. Texas Republican Governor Greg Abbott has extended an offer of free bus transportation for thousands of migrants to "sanctuary cities" primarily comprising New York, Chicago, or Denver, which are governed by Democrats. However, migrants' choices have been influenced by their beliefs that New York is too crowded, and that Chicago would be too cold. Consequently, many have opted for Denver. Nevertheless, as migrants gather in Denver seeking food and shelter, overnight temperatures have plummeted below zero degrees Fahrenheit, posing life-threatening conditions. In response to the escalating situation, the mayors of New York, Chicago, and Denver have jointly called for a national approach to address the arrival of migrants and the associated challenges.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |