FOMC Day as Traders Await Any Signals on When Rates Will Be Cut

Updates on border security, tax package measures

|

Today’s Digital Newspaper |

MARKET FOCUS

- Fed to keep interest rates steady, hints on rate cuts eyed

- Mortgage applications in U.S. slumped 7.2% in week ending Jan. 26

- Boeing narrowed losses at end of last year, no signals on 2024 earnings

- Mondelez International reports increase in sales for fourth quarter

- Judge strikes down Elon Musk’s multibillion-dollar pay package at Tesla

- WGC: Global central banks continued to snatch up gold in 2023, will continue in 2024

- Lawmakers concerned about rising transportation costs due to Houthi attacks

- Ag markets today

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- House speaker to give first speech on the House floor since elected speaker

- House set to vote today on $78 billion bipartisan tax package

- House panel approves articles of impeachment against Alejandro Mayorkas

RUSSIA & UKRAINE

- EU plans extension of Ukrainian import duty suspension, ‘brake' on sensitive products

- Ag attaché raises Ukraine’s corn, wheat export forecasts

- Ukraine's food exports anticipated to decrease in January

POLICY

- Farmers, analysts respond to Stabenow’s crop insurance/safety net proposals

- Slight increase in payments under Phase 2 of Emergency Relief Program

PERSONNEL

- EPA nominee expected to be approved

CHINA

- China's manufacturing activity shrank for fourth straight month in January

- Chinese-made electric vehicles pose significant national security risks: Raimondo

- China reports human death from bird flu

- Group seeks action on alleged forced labor by Chinese seafood processors

ENERGY & CLIMATE CHANGE

- Biden admin. poised to loan $1.5 bil. to restart shuttered Michigan nuclear power plant

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Review of USDA ‘product of USA’ labeling plan continues at OMB

- Bill introduces new labeling rules for plant-based & cell-cultured meat products

- Vilsack to push full funding for WIC during trip to Minnesota today

|

MARKET FOCUS |

— Equities today: Asian stock markets were mixed in overnight trading. U.S. Dow is up around 100 points. In Asia, Japan +0.6%. Hong Kong -1.4%. China -1.5%. India +0.9%. In Europe, at midday, London +0.1%. Paris +0.2%. Frankfurt -0.1%.

U.S. equities yesterday: The Dow was able to score another record finish even as the Nasdaq and S&P 500 ended lower. The Dow was up 133.86 points, 0.35%, at 38,467.31. The Nasdaq lost 118.51 points, 0.76%, at 15,509.90. The S&P 500 eased 2.96 points, 0.06%, at 4,924.97.

— Boeing narrowed its losses at the end of last year but the manufacturer’s 737 Max 9 crisis raises questions about its financial targets. Aircraft demand and deliveries rose last year, helping results at Boeing’s commercial airplane unit. The company did not provide a 2024 outlook, weeks after a fuselage panel blew out midflight on a nearly new 737 Max 9 on Jan. 5.

— Mondelez International reported an increase in sales for the fourth quarter. However, the company noted that price increases had a negative impact on sales volumes. While price increases boosted profit margins for the 2023 fiscal year, there is now a softening of demand as consumers are pulling back due to higher prices. Mondelez achieved a gross profit margin of 37.3%, surpassing market expectations, and net revenue rose by 7.1% to approximately $9.31 billion in the quarter ending on Dec. 31, up from $8.70 billion in the same period the previous year. Despite falling overall inflation rates, pricing pressures continue to affect consumer activity results.

— Elon Musk is asking X users whether he should move Tesla’s incorporation to Texas. The poll comes after a Delaware judge struck down his $55 billion pay package at the carmaker.

— Ag markets today: Corn, soybeans and wheat pulled back from Tuesday’s strong corrective gains during overnight trade. As of 7:30 a.m. ET, corn futures were trading around a penny lower, while soybeans and wheat were 6 to 8 cents lower. Front-month crude oil futures were nearly $1.00 lower, and the U.S. dollar index was more than 100 points higher.

Beef movement builds as wholesale prices drop. Wholesale beef prices dropped $3.35 for Choice and $1.77 for Select on Tuesday, but movement increased to 134 loads, nearly as much as the two previous days combined. That signals there’s solid underlying retailer demand not far below the recent ceiling levels of $300.00 for Choice and $290.00 for Select.

Cash hog rallies builds, pork continues to pause. The CME lean hog index firmed another 88 cents to $71.48 as of Jan. 29, marking the biggest daily gain during this month’s seasonal rally. While the cash index continues to strengthen, the pork cutout value dropped 52 cents on Tuesday as primal bellies fell $9.35, more than offsetting gains in all other cuts. The cutout remained stalled in the upper $80.00 area.

— Agriculture markets yesterday:

- Corn: March corn futures rose 7 1/2 cents to $4.47 3/4 and near the session high. Prices hit a contract low early on.

- Soy complex: March soybeans rose 24 1/2 cents to $12.18 3/4, while March soymeal rallied $8.70 to $363 and March soyoil rose 45 points to 46 cents, all high-range closes.

- Wheat: March SRW futures surged 12 cents to $6.05 1/2, settling near session highs. March HRW futures jumped 12 1/2 cents to $6.30 3/4, settling within a penny of session highs. March spring wheat rose 6 1/2 cents to $6.99 3/4.

- Cotton: March cotton rose 52 points to 84.78 cents, ending in a high-range close.

- Cattle: April live cattle futures rallied 52.5 cents to $181.75, settling nearer session highs. Nearby February futures rallied 65 cents to $178.025. March feeder cattle futures jumped $2.70 to $241.325, closing near session highs.

- Hogs: April lean hogs closed up $1.475 at $84.90, near mid-range and hit a four-month high early on.

— Quotes of note:

- “A cardinal sin of central banking is to cut and have to reverse course,” says Diane Swonk, chief economist at KPMG. “This is the time to push back and stay the course.”

- ECB President Christine Lagarde said wage data will be vital in deciding when to begin monetary easing.

— U.S. mortgage applications decline 7.2% in latest week; home purchase applications drop 11.4%. In the week ending Jan. 26, mortgage applications in the U.S. declined by 7.2%, following a 3.7% increase in the previous period, according to data from the Mortgage Bankers Association. Applications for purchasing a home dropped by 11.4%, while those for refinancing a home loan increased by 1.6%. Meanwhile, the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) remained unchanged at 6.78%. An economist from the MBA, Joel Kan, noted that low housing supply is limiting options for potential buyers and keeping home-price growth high, which is affecting home purchase activity negatively.

Market perspectives:

— Outside markets: The U.S. dollar index was slightly higher, with weakness in the euro and British pound against the U.S. currency. The yield on the 10-year U.S. Treasury note was lower, trading around 4.01%, with a mostly lower tone in global government bond yields. Crude oil futures continued to move lower ahead of U.S. gov’t inventory data due later this morning, with US crude around $76.65 per barrel and Brent around $81.40 per barrel. Gold and silver were narrowly mixed ahead of US market action, with gold firmer around $2,055 per troy ounce and silver weaker around $23.21 per troy ounce.

— The World Gold Council reports global central banks continued to snatch up gold in 2023 and will continue to do so in 2024. Central banks’ collective purchases in 2023 were 1,037 tons, the WGC said. China’s central bank was the biggest buyer.

— A group of lawmakers expressed concerns about rising transportation costs due to Houthi attacks on commercial shipping in the Red Sea. They have called for swift action to address these issues and have written a letter to several Biden administration officials, emphasizing the need to prevent disruptions to the nation's supply chain. Additionally, the lawmakers have urged the Federal Maritime Commission (FMC) to monitor and ensure that any increases in shipping rates are reasonable, targeted, and transparent. They have called on the FMC to use its oversight authority to prevent any bad actors from taking advantage of the situation to inflate rates unnecessarily. The FMC is scheduled to hold a public hearing on the Red Sea situation next week, and there has also been a congressional hearing on the matter.

— Ag trade update: Indonesia purchased 500,000 MT of rice, with the bulk expected to be sourced from Vietnam and smaller amounts from Pakistan and Myanmar.

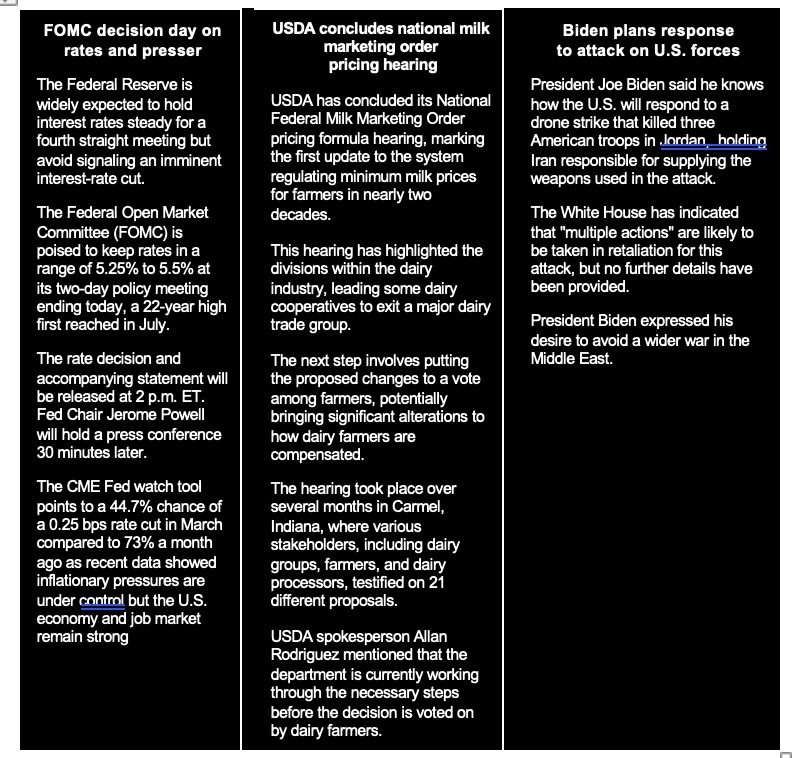

— NWS weather outlook: Heavy snow over parts of the Sierra Nevada Mountains, moderate snow over Upstate New York/Northern New England, light snow over the higher elevations of the West... ...There is a Slight Risk of excessive rainfall over parts of Northern/Central California on Wednesday and Southern California on Thursday... ...Temperatures will be 15 to 30 degrees above average from the Plains to the Upper/Middle Mississippi Valley.

Items in Pro Farmer's First Thing Today include:

• Grains weaker overnight

• Cattle Inventory Report out this afternoon

• China unveils new property support measures amid mounting concerns

• China's major state banks defend yuan as stock market slides

|

CONGRESS |

— House Speaker Mike Johnson (R-La.) is scheduled to give his first speech on the House floor since he was elected speaker. It is expected to be on border security. In the Senate, the focus will be on whether a border security deal will be announced today.

— The House is set to vote today on a $78 billion bipartisan tax package, with House Speaker Mike Johnson (R-La.) leading the effort despite facing opposition from some centrist Republicans, largely from New York. House Majority Leader Steve Scalise (R-La.) officially announced the bill will be coming up for a vote today. The package was negotiated with Senate Democrats and will be considered under the suspension of the rules, necessitating a two-thirds majority for passage.

The package gained strong bipartisan support in the House Ways and Means Committee with a 40-3 vote, which is crucial for its progress in the House. However, there are concerns among Republicans about certain provisions in the package, particularly its failure to address the state and local tax deduction (SALT) cap. While the package includes the continuation of the child tax credit, some Democrats are disappointed that it does not expand the credit further.

— House Homeland Security Committee approves articles of impeachment against Homeland Security Secretary Alejandro Mayorkas. The vote came shortly after 1 a.m. ET Wednesday and the articles will now be considered by the full House of Representatives at a later date. Republicans may not have enough votes in the full House for impeachment. A majority vote of the full chamber would make him the first Cabinet official to be impeached since 1876. The issue will go nowhere in the Democrat-controlled Senate.

|

RUSSIA/UKRAINE |

— EU plans extension of Ukrainian import duty suspension and 'emergency brake' on sensitive products. The European Commission is planning to extend the suspension of import duties for Ukrainian exports until June 2025, a one-year extension. However, they are also proposing an "emergency brake" mechanism for sensitive products like poultry, eggs, and sugar. This brake would allow the imposition of tariffs if imports exceeded their average levels from 2022 and 2023. Member countries would have the flexibility to implement temporary measures if their markets faced disruptions due to a surge in imports, especially for grains and other products.

Additionally, the Commission is suggesting an exemption for farmers in the EU from the requirement to maintain a minimum level of fallow land to continue receiving farm supports. Instead, farmers could cultivate nitrogen-fixing crops like lentils or peas or other crops between plantings of their main crops, without applying plant protection products. These measures are seen as a response to recent farmer protests in France and Belgium.

— Ag attaché raises Ukraine’s corn, wheat export forecasts. The USDA attaché in Ukraine reported, “By the end of 2023, Ukraine independently resumed operations of its major marine ports on the Black Sea, Chornomorsk, Odesa, and Pivdennyi. It increased the throughput of the Danube River export routes. The total volume of grain exports (wheat, corn, and barley) soared from around 2 MMT in September 2023 to 5.2 MMT in December 2023. Based upon the high December 2023 export rate, if Ukraine maintains average monthly exports of around 4 MMT for all grains combined for the remainder of the marketing year, they will export much of the harvest and reach the export estimates” of 29.2 MMT for corn (up 8% from 2022-23) and 17.7 MMT for wheat (up 3% from 2022-23). In the January WASDE Report, USDA forecast Ukraine’s 2023-24 exports at 21 MMT for corn and 14 MMT for wheat.

— Ukraine's food exports are anticipated to decrease in January to approximately 3.8 million metric tons, a drop from 6.1 million metric tons in December, as reported by Spike Brokers and cited by Reuters. By January 28, around 2.5 million metric tons of food had been exported through Ukrainian seaports, with an additional 874,000 metric tons expected to be shipped in the coming days. There are indications that an extra 500,000 metric tons of agricultural products could also be exported through Danube ports in the same month.

|

POLICY UPDATE |

— Farmers, analysts respond to Stabenow’s crop insurance/safety net proposals. Link to special report.

— There was a slight increase in payments under Phase 2 of the Emergency Relief Program (ERP), rising from $879.14 million to $880.25 million as of Jan. 28. However, the number of payment recipients has remained the same at 10,227. Despite this change, the total ERP payments remain at $8.33 billion. There is no information available yet regarding ERP payments for 2022.

|

PERSONNEL |

— EPA nominee expected to be approved. President Joe Biden's nominee for overseeing EPA's air regulations, Joseph Goffman, is expected to secure Senate confirmation today. Senators are scheduled to conduct a procedural vote on his nomination as an assistant administrator of the Environmental Protection Agency this afternoon. If they can reach an agreement to limit debate on his nomination, a confirmation vote will follow later today.

|

CHINA UPDATE |

— China's manufacturing activity shrank for the fourth straight month in January. The official NBS Manufacturing Purchasing Managers' Index (PMI) in China for January 2024 slightly increased to 49.2, up from December's figure of 49.0, which was the lowest in the past six months. This latest reading matches the expectations of the market. However, it is important to note that a PMI reading below 50 indicates a contraction in factory activity.

Several factors contributed to this fourth consecutive month of contraction in the manufacturing sector:

- Lunar New Year: The Lunar New Year had an impact on factory activity, potentially leading to a slowdown in production and business operations during the holiday season.

- Deflationary Pressures: China was experiencing deflationary pressures, which could have affected overall economic conditions and business confidence.

- Weak Global Demand: Weak global demand for Chinese goods and services played a role in the contraction, indicating challenges in exporting products to international markets.

Key highlights from the report include:

- New Orders: New orders continued to decline for the fourth consecutive month, although the rate of decline was slightly better than in December (49.0 vs. 48.7).

- Foreign Sales: Foreign sales experienced their tenth consecutive monthly decline, but the rate of decline was less severe than in previous months (47.2 vs. 45.8).

- Buying Activity: Buying activity also decreased, but at a slower pace compared to December (49.2 vs. 49.0).

- Employment: Employment in the manufacturing sector decreased for the eleventh consecutive month, with January seeing the sharpest decline in this sequence (47.6 vs. 47.9).

- Output Growth: Output growth improved to a four-month high (51.3 vs. 50.2), indicating increased production during the month.

- Delivery Time: Delivery times shortened the most in four months (50.8 vs. 50.3), which could suggest improved efficiency in the supply chain.

- Prices: Input cost inflation eased to a seven-month low (50.4 vs. 51.5), while output prices continued to fall (47.0 vs. 47.7), potentially impacting profit margins for manufacturers.

- Sentiment: Business sentiment in the manufacturing sector hit its lowest level since June (54.0 vs. 55.9), reflecting reduced confidence among manufacturers.

— Chinese-made electric vehicles pose significant national security risks, Commerce Secretary Gina Raimondo warned as the Biden administration weighs additional tariffs on autos from China.

— China reports human death from bird flu. China on Wednesday reported the death of a 63-year-old woman due to an infection of mixed H3N2 and H10N5 avian influenza. The woman from Anhui province died on Dec. 16 due to the severity of the disease. “The outbreak is an episodic cross-species transmission from bird to humans,” the National Disease Control and Prevention Administration said. The risk of the virus infecting people is low, and no human-to-human transmission has occurred, it added.

— Southern Shrimp alliance seeks action on alleged forced labor by Chinese seafood processors. The Southern Shrimp Alliance is urging the Department of Homeland Security to act against eight Chinese seafood processors under the Uyghur Forced Labor Protection Act. These processors are allegedly involved in employing Uyghur labor through programs, as reported by the Outlaw Ocean Project. Millions of pounds of Argentine shrimp are sent to these Chinese processors before being shipped to the U.S., and concerns have been raised regarding the use of forced labor in China. If the Department of Homeland Security validates these allegations, it could lead to restrictions on shipments from these processors.

|

ENERGY & CLIMATE CHANGE |

— The Biden administration is poised to loan $1.5 billion to restart a shuttered Michigan nuclear power plant, paving a way for a closed reactor to reopen in the U.S. for the first time. The funding, which is set to get conditional backing from the Energy Department, will be offered as soon as next month to closely held Holtec International Corp. to restart its Palisades nuclear plant in Michigan.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Review of USDA ‘product of USA’ labeling plan continues at OMB. The National Meat Institute (NMI) has already had a session with the Office of Management and Budget (OMB) on USDA’s final rule for putting in place a voluntary Product of USA label. Their session involved officials from USDA and the Office of the U.S. Trade Representative (USTR) and likely focused on issues raised by NMI in the comments they filed (link) during the request for public comment on the proposed rule released in 2023. A session today will have Canada detailing their position on the final rule via Edward Farrell, a lawyer with the OFW law firm in Washington, DC, who advised Canadian cattlemen in their challenge at the WTO over the U.S. Country of Origin Labeling program. Another meeting is currently scheduled for Feb. 6 with the National Turkey Federation. It is unclear how much USDA’s final rule will have differed from the proposed rule (link) released in 2023 but several U.S. meat industry stakeholders raised concerns about the rule and the potential impacts it could have on trade and other areas.

— Bipartisan bill introduces new labeling rules for plant-based and cell-cultured meat products. A bipartisan bill introduced in both the House and Senate, known as the Fair and Accurate Ingredient Representation (FAIR) on Labels Act of 2024, aims to establish new labeling requirements for plant-based and cell-cultured meat alternative products. The bill, introduced by Sen. Roger Marshall (R-Kan.) in the Senate and Rep. Mark Alford (R-Mo.) in the House, seeks to ensure clear labeling for consumers, including terms like "imitation" and "cell-cultured" on product labels. It addresses concerns about transparency in food labeling, especially for products designed to resemble traditional meat and poultry. Link to one-page summary of the bill.

The FAIR Labels Act introduces specific definitions for "imitation meat" and "imitation poultry" for plant-based meat alternatives. These definitions would apply to products that resemble meat but do not contain actual meat. The bill requires the use of "imitation" or similar terms on labels and mandates a disclaimer stating that these products do not contain meat or poultry.

For cell-cultured meat and poultry products, the bill establishes definitions and grants the USDA authority over their labeling. It requires the use of terms like "cell-cultured" or "lab-grown" on labels to clearly differentiate these products from traditionally farmed meat.

The bill has received support from various agricultural and livestock trade groups, who believe it will help prevent consumer confusion and protect the reputation of traditional meat products in the marketplace.

Plant-based meats accounted for 2.5% of retail packaged meat sales in 2022, according to the Good Food Institute.

— Vilsack to push full funding for WIC. USDA Secretary Tom Vilsack is visiting St. Paul, Minnesota, today to advocate for full funding for the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC). He will highlight that WIC faces a potential $1 billion shortfall in fiscal year (FY) 2024 unless Congress takes action. In contrast, Rep. Sanford Bishop (D-Ga.), a key member of the House Appropriations Committee, believes there should be sufficient funding for FY 2024, as the allocation provided to the panel is higher than the FY 2023 allocation. However, the allocation and allocation distribution within the subcommittee will be crucial factors in addressing this issue, according to the ranking Democrat on the agriculture subcommittee.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |