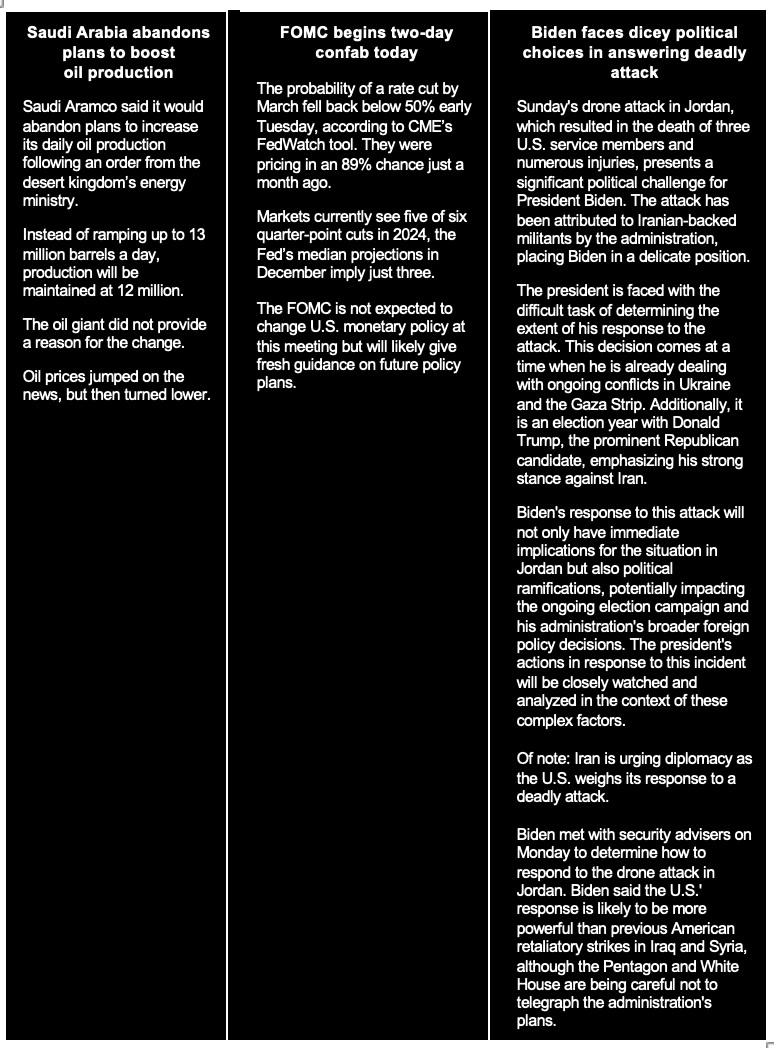

In Major Reversal, Saudi Arabia Orders Aramco Maintain Its Oil Production Capacity

Haley takes on Trump’s proposed ATB tariffs on all imports; AEI panel addresses trade issues

|

Today’s Digital Newspaper |

MARKET FOCUS

- Iran urged the U.S. to use diplomacy to ease tensions in the Middle East

- Aramco abandons plan to boost its oil output capacity

- Nippon Steel secures $16 bil. financing from Japanese banks for U.S. Steel acquisition

- Sevens Report on upcoming FOMC decision

- Eurozone escapes recession

- Asia’s liquefied natural gas buyers have begun looking for alternatives

- Ag markets today

- Pakistani rice exports expected to be record-large

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- House Republicans moving forward with bipartisan tax package despite opposition

- Vilsack to appear before House, Senate Agriculture panels in February

ISRAEL/HAMAS CONFLICT

- Israeli military says troops for first time are fighting in tunnels beneath Gaza

POLICY

- USDA making investments in specialty crops

PERSONNEL

- Sarah Bianchi, President Biden’s deputy trade representative, joins Evercore ISI

CHINA

- China’s soyoil, soymeal futures tumble to over six-month low on slowing demand

- China's 10-year treasury futures hit record high on heightened easing expectations

TRADE POLICY

- Nikki Haley criticizes Trump's tariffs, fears household cost rise

- AEI panel discusses trade policy in Biden and Trump administrations

- Biden administration reinstating sanctions on

- Macron urges EU's Von der Leyen to halt Mercosur trade deal amid farmer protests

ENERGY & CLIMATE CHANGE

- Gas stoves pass energy efficiency standards, avoiding U.S. ban

- POET & Summit Carbon Solutions to capture and store carbon dioxide emissions

- SAF expected to play significant role in decarbonizing aviation

HEALTH UPDATE

- First human patient receives a brain implant: Elon Musk

OTHER ITEMS OF NOTE

- Super Bowl tickets most expensive ever, going for average $9,815 each

|

MARKET FOCUS |

— Equities today: Asian stock markets were mixed in overnight trading, while European stock indexes were mostly up. U.S. stock index futures are set to open slightly lower. In Asia, Japan +0.1%. Hong Kong -2.3%. China -1.8%. India -1.1%. In Europe, at midday, London +0.5%. Paris +0.5%. Frankfurt +0.3%. China’s equities and bond markets are giving a clear signal to policymakers that they need to take more steps to revive investor confidence.

U.S. equities yesterday: U.S. stocks hit records again after the U.S. Treasury cut its quarterly estimate for federal borrowing for January through March — contrary to the increase seen by many strategists. All three major indices finished with gains as the Dow and S&P 500 notched fresh record closes (their sixth record closes of the year). The Dow was up 224.02. points, 0.58%, at 38,333.45. The Nasdaq gained 172.68 points, 1.12%, at 15,628.04. The S&P 500 rose 36.96 points, 0.76%, at 4,927.93.

— Nippon Steel secures $16 billion financing from Japanese banks for U.S. Steel acquisition amid White House scrutiny and lawmaker criticism. Nippon Steel secured commitments for $16 billion in financing from three Japanese megabanks — Sumitomo Mitsui Financial Group, Mitsubishi UFJ Financial Group, and Mizuho Financial Group — for its acquisition of U.S. Steel. This financing is contingent on the deal's successful completion. The deal, worth $14.9 billion, has drawn attention from the White House, which has promised to subject it to "serious scrutiny." Additionally, lawmakers from both the Democratic and Republican parties have expressed criticism. According to Bloomberg, the loans are expected to be repaid within one year, and Nippon Steel plans to raise additional funds through bond issuance and the issuance of new shares after finalizing the acquisition. Concerns raised by the White House and others revolve around national security considerations related to steel production by the U.S. company involved in the deal.

— Ag markets today: Corn, soybeans and wheat extended Monday’s losses during the overnight session. As of 6730 a.m. CE, corn futures were trading 2 to 3 cents lower, soybeans were fractionally to a penny lower, winter wheat markets were 5 to 8 cents lower and spring wheat was 2 to 3 cents lower. Front-month crude oil futures were around 40 cents lower, and the U.S. dollar index was about 175 points lower.

Packers continue to manage cattle supplies. Packers purchased 83,000 head of cattle in the negotiated market last week as the average price rose $1.68 to $175.44, the highest since the week ended Nov. 24, 2023. But packers continued to limit their slaughter runs, including a small Saturday kill, suggesting they will keep closely managing their supplies. With fresh contract supplies available on Thursday, that could limit their willingness to actively bid for cash cattle this week.

Cash hog rally picks up. The CME lean hog index firmed another 70 cents to $70.60 as of Jan. 26, marking the second largest daily increase during this month’s seasonal rally. While futures are also climbing, relatively modest gains suggest traders are waiting on consistently bigger daily increases in the cash index before sharply building premiums.

— Agriculture markets yesterday:

- Corn: March corn fell 6 cents to $4.40 1/4, a new contract low-close.

- Soy complex: March soybeans dropped 15 cents to $11.94 1/4 cents, settling near session lows. March meal futures rallied $5.30 to $354.30. March bean oil futures dropped 138 points to 45.55 cents.

- Wheat: March SRW wheat fell 6 3/4 cents at $5.93 1/2. March HRW wheat closed down 6 1/2 cents at $6.18 1/4. March spring wheat futures dropped 10 1/4 cents to $6.93 1/4. Each market closed nearer their session lows.

- Cotton: March cotton fell 11 points to 84.26 cents, marking a two-week low close.

- Cattle: April live cattle lost 45 cents to $181.225. March feeder cattle closed down $1.075 at $238.625. Both markets closed nearer their session lows and hit 2.5-month lows today.

- Hogs: April lean hogs closed 17.5 cents higher to $83.425, near session highs. Expiring February futures rallied 35 cents higher to $75.275.

— Quotes of note:

- JPMorgan’s Marko Kolanovic said tech earnings will be crucial in determining whether current stock valuations are sustainable. It’s the busiest earnings week of the season, with 19% of companies in the S&P 500 set to report. Investors are eagerly awaiting results from many of the Big Tech companies that have led this year’s rally so far, including Microsoft and Alphabet, which are reporting today after the market close.

- Oil market what if: RBC Capital Markets analyst Helima Croft sees a “very real risk” of returning to the situation in 2019, when more than half of Saudi Arabia’s production was curtailed after militant attacks around the Persian Gulf, noting that the Strait of Hormuz is the oil market’s “most crucial supply chokepoint.”

- Sevens Report on upcoming FOMC decision:

— What’s Expected: “The Fed says they aren’t hiking anymore but also don’t promise rate cuts anytime soon.”

— Hawkish If: “The Fed says they aren’t hiking anymore but also says rate cuts aren’t coming anytime soon.”

— Dovish If: “The Fed says they aren’t thinking about hiking anymore and that rate cuts are possible going forward.”

— Eurozone escapes recession. In the fourth quarter, the Eurozone economy experienced an unexpected stall, failing to meet forecasts of a 0.1% contraction after a 0.1% contraction in the third quarter, according to preliminary estimates. The Eurozone’s seasonally adjusted GDP was flat compared with the previous quarter and expanded by 0.1% versus the previous year. Spain, Italy, and Portugal exceeded growth expectations, whereas the French economy remained stagnant, and German GDP contracted by 0.3%.

The Eurozone’s divergence from the U.S. is growing, Bert Colijn, senior economist at ING, said in a note, citing a bigger drop in inflation-adjusted wages, industrials getting hit by energy prices and less fiscal support. The U.S. blew past expectations and saw a 3.3% expansion in the fourth quarter.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker, with the euro firmer while the yen and British pound shifted between being higher and lower versus the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 4.07%, with a mostly lower tone in global government bond yields. Crude oil futures turned lower, with U.S. crude around $76.05 per barrel and Brent around $81.05 per barrel. Gold and silver were mixed, with gold stronger around $2,052 per troy ounce, and silver weaker around $23.22 per troy ounce.

— Saudi Arabia made a significant policy reversal by dropping its plan to expand its daily oil production capacity. Oil prices jumped on the news. State-run Saudi Aramco had originally aimed to increase its maximum sustainable production capacity from 12 million barrels per day (b/d) to 13 million b/d by 2027. This decision deviates from the industry trend, where many are reducing oil production investments due to climate concerns and future demand uncertainties. Saudi Aramco plays a vital role in the global oil market, accounting for about 10% of the world's daily oil consumption, which is approximately 100 million barrels. This change represents a shift in the kingdom's strategy, as Saudi Aramco CEO Amin Nasser had previously advocated for increased investment in oil production to address fragility in the global oil system due to a lack of investment.

Over the past 18 months, Saudi Arabia has repeatedly reduced oil production as part of OPEC's efforts to stabilize prices amidst slowing demand growth and increased output from the United States and other producers. Currently, Saudi Aramco is producing around 9 million b/d, down from an average of 10.2 million b/d in early 2022. This means the company already possesses 3 million b/d of spare production capacity, allowing it to respond to sudden increases in demand without the immediate need for further capacity expansion.

Analysts note this shift in policy may reflect a recognition within OPEC+ that excess production capacity is impacting oil prices. Analysts believe that it makes little sense for Saudi Arabia to invest heavily in expanding its production capacity under these circumstances. The decision could have far-reaching implications for Aramco's capital spending, the Gulf supply chain, and OPEC+ oil policy.

Saudi Arabia also plans to free up an additional 1 million b/d of oil for export by replacing liquid fuels used for power generation within the kingdom with gas.

— Asia’s liquefied natural gas buyers have begun looking for alternatives to offset potential delays to U.S. projects hit by a moratorium on new approvals, in a potential boost for rival exporters. Link to more via Bloomberg.

— Pakistani rice exports expected to be record-large. Pakistan’s rice exports are likely to jump to a record high in 2023-24 as rival India’s decision to curb its own shipments forces buyers to purchase more from the country. Pakistan’s rice exports could jump to 5 MMT in 2023-24, up from the last year’s 3.7 MMT, the chairman of Rice Exporters Association of Pakistan told Reuters. Some industry estimates are as high as 5.2 MMT as basmati rice exports could jump 60% this year to 950,000 MT, while non-basmati exports could surge 36% to 4.25 MMT.

— Ag trade update: South Korea purchased 198,000 MT of corn – 133,000 MT to be sourced from the U.S., South America or South Africa and 65,000 MT to be sourced from the U.S. or South America — and 86,200 MT of U.S. milling wheat. The Philippines purchased an unknown volume of Australian feed wheat.

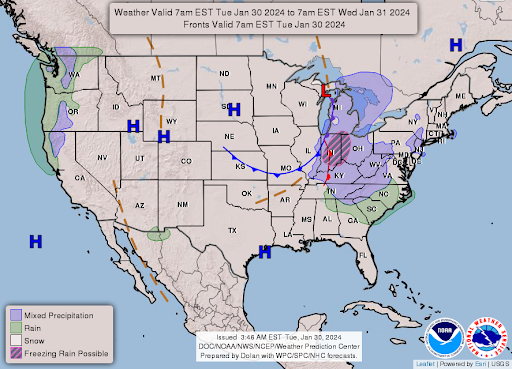

— NWS weather outlook: Heavy snow over parts of the Sierra Nevada Mountains on Wednesday... ...There is a Slight Risk of excessive rainfall over parts of Northern/Central California... ...Snow over parts of the Great Lakes/Central Appalachians into the Northeast.

Items in Pro Farmer's First Thing Today include:

• Followthrough selling in grains overnight

• Cordonnier keeps South American crop estimates unchanged

• HRW crop ratings improve further in January

|

CONGRESS |

— House Republicans are moving forward with a bipartisan tax package despite facing opposition from lawmakers with differing perspectives. Speaker Mike Johnson (R-La.) indicated that the bill would likely be advanced through suspension, requiring two-thirds of lawmakers' support to pass while avoiding procedural obstacles.

The bill, approved by the House Ways and Means Committee, is aimed at extending three business tax breaks and expanding the child tax credit. However, it faces opposition from various groups:

- Hard-right Republicans oppose the bill because it expands the child tax credit.

- Liberal Democrats plan to vote against it, arguing that it doesn't expand the child tax credit sufficiently.

- Some moderate Republicans object to the bill because it doesn't restore the state and local tax deduction, a key concern for high-tax states like New York.

Rep. Nick LaLota (R-N.Y.) and others from districts won by President Biden in 2020 are considering holding up unrelated business on the House floor in protest of the bill's exclusion of state and local tax provisions (SALT). They argue that they have consistently supported conservative priorities and now seek reciprocity.

Bipartisan support. The legislation, drafted by Ways and Means Committee Chairman Jason Smith (R-Mo.) and Senate Finance Committee Chairman Ron Wyden (D-Ore.), has garnered bipartisan support but faces challenges from both ends of the political spectrum. Some Democrats believe it falls short in expanding the child tax credit, while some Republicans are concerned about the bill's impact on tax credit recipients and its potential increase in government spending.

The use of the suspension procedure has caused concerns among Freedom Caucus members, as it limits opportunities for amendments and can deny rank-and-file lawmakers the chance to voice their concerns. Some members are contemplating votes against other rules in protest.

Of note: Heritage Action, the conservative policy group affiliated with the Heritage Foundation think tank, informed lawmakers Monday of its opposition to the package. The group said the measure “continues a long-standing push by Congress to claim welfare benefits as ‘tax relief'” said that the measure claims phony savings from ending the “deficit funded, fraud ridden” employee retention tax credit.

— Vilsack to appear before House, Senate Agriculture panels in February. USDA Secretary Tom Vilsack will go before the House Ag Committee on Feb. 14 and the Senate Ag Committee Feb. 28, according to Politico. This marks the first appearance by Vilsack in quite some time, suggesting lawmakers will likely have many questions including the use of Inflation Reduction Act (IRA) funds and the Commodity Credit Corporation (CCC) authority. USDA nutrition programs are always a topic of interest, especially as this is one of the debate items in a lingering new farm bill.

|

ISRAEL/HAMAS CONFLICT |

— Israeli military said troops are for the first time fighting in the tunnels beneath Gaza, and added that eliminating the Hamas threat may take all of 2024 or longer.

|

POLICY UPDATE |

— USDA is making investments in specialty crops, including a $65 million initiative called the Assisting Specialty Crop Exports program to boost exports and reach new markets. Additionally, nearly $73 million in grant funding will be available for the Specialty Crop Block Grant Program, aimed at enhancing the competitiveness of specialty crops such as fruits, vegetables, tree nuts, and more. These investments are part of efforts to address concerns over the growing agricultural trade deficit.

|

PERSONNEL |

— Sarah Bianchi, President Biden’s deputy trade representative, joins Evercore ISI. Bianchi is joining Evercore ISI this week, taking on a role as senior managing director and chief strategist of international political affairs and public policy.

|

CHINA UPDATE |

— China’s soyoil, soymeal futures tumble to over six-month low on slowing demand. Soybean oil prices on China’s Dalian Commodities Exchange fell for a third consecutive session on Tuesday, with soymeal prices also declining as demand slowed. Soybean oil contract for May delivery fell 3.8% to a seven-month closing low of 7,204 yuan ($1,003.79) a metric ton. That was it biggest daily decline in more than a year. The most-active soymeal contract fell for a fourth straight session to 2,944 yuan ($410.21) per ton, its lowest close since mid-July 2023. Demand from China is weakening as stockpiling ahead of the Spring Festival (Lunar New Year) ends and animal feed demand declines.

— China's 10-year treasury futures hit record high on heightened easing expectations. Chinese government bonds advanced on Tuesday with 10-year treasury futures hitting record highs amid market expectations that the central bank will soon ease monetary policy to support the faltering economy. China 10-year treasury futures for March rose to their highest level since the contract was launched in 2015. Yields on benchmark 10-year government bonds slid below 2.47% to their lowest levels since June 2002, while 30-year government bonds dropped below 2.70% to a record low. Traders said persistent deflationary pressure in China justifies interest rate reductions as falling prices have raised real borrowing costs.

|

TRADE POLICY |

— Nikki Haley criticizes Trump's tariffs, fears household cost rise. Former South Carolina Gov. Nikki Haley has criticized Republican front-runner Donald Trump's proposed tariffs on imported goods, highlighting the potential negative impact on American households. “This is a man who now wants to go and put 10% tariffs across the board, raising taxes on every single American. Think about that for a second,” Haley told CNBC’s Squawk Box. She argued that Trump's plan would raise taxes on all Americans, estimating an increase of $2,600 in annual household expenses. Haley expressed concern that such tariffs would affect various consumer products, from baby strollers to appliances, making them more expensive for middle-class families.

Additionally, Trump had reportedly discussed the possibility of a massive 60% tariff on all imports from China and suggested using tariffs to compel automobile manufacturers to establish plants in the United States. ″[I] would require China, and other countries, through TARIFFS, or otherwise, to build plants here, with our workers,” Trump wrote on Truth Social.

Experts in the field have found it challenging to predict the consequences of the trade policies Trump was proposing, particularly regarding their second and third-order effects. Some believed that Trump aimed to re-industrialize the United States by creating barriers to imports, potentially reshaping global trade dynamics. During his previous trade war with China, it was estimated that 245,000 American jobs were lost, according to the U.S.-China Business Council.

Haley's opposition to Trump's tariff proposals aligned with concerns from Wall Street investors about the potential impact of such policies on the global economy.

— Trump's tariff threats, if realized, could trigger new trade wars that could be damaging to the U.S. ag and food sectors. A panel composed of former U.S. trade officials, a top economist, and agri-food consultants warned that such a move could reignite trade wars with China and potentially other trade partners. The discussion took place Monday (Jan. 29) during an event hosted by the American Enterprise Institute (AEI).

“The last seven years have been an interesting one for U.S. agriculture, and for trade policy,” said AEI Senior Fellow Joe Glauber. “I think we've seen a reversal, some would say sharp reversal, in fact, over the last seven years, from the long 75 years or so that we saw of general liberalization in the world in terms of trade policy.”

Retaliation likely. “When you start slapping on tariffs, a country that is trying to look to retaliate is going to look where they are importing a lot and that happens to be agriculture, as far as China is concerned,” Glauber warned.

Trump trade war payments. During the previous trade war, the Trump administration provided more than $25 billion in trade aid payments to help buffer the impact of lost markets. “If not for the $25 billion, I think… farm incomes would have been hit very, very hard,” said Glauber, adding that regardless of that short-term aid the U.S.’ loss of market share from the trade war with China persists. But Gregg Doud, the ag trade negotiator in the Trump administration, said tariffs were “the only tool in the toolbox” and Trump was right to use them in the past. The U.S. is obliged to hold other nations to account for unfair trade behavior that hurts its citizens, he added. “The problem with tariffs is it’s the only tool in the toolbox to address a lot of the fundamental macro-economic problems,” he said. “Part of the verbiage, and you know, it’s used to create leverage. But at the end of the day, you have to have somebody who wants to go to bat for this country and make changes. And President Trump did that.”

Focus shifts to domestic issues. Craig Thorn, a partner with ag consultancy DTB Associates, said another lingering impact from the trade war and the U.S. stepping back from a focus on inking new free trade agreements (FTAs) is a greater focus on domestic issues by U.S. farm and ag trade groups lobbying in Washington. “If there are no trade negotiations going on, you're not going to pay a lot of attention to the possibility of making more money from the world market,” said Thorn.

A Glauber warning. “What scares me most about another trade war is I'm just not sure that Congress is going to be willing to shell out $25 billion on top of all the other government programs, payments that go into agriculture year in and year out,” Glauber said.

Former Chief Agricultural Negotiator Darci Vetter, who served during the Obama administration, warned that levying new tariffs could have blowback for existing FTAs and relations with more friendly partners like Canada and Mexico. “What signal are we sending about where we see our North American partners?” she said regarding new tariffs, noting the U.S.-Mexico-Canada Agreement (USMCA) has a mandatory, joint review by all three signatories in 2026.

Trump administration chief ag negotiator Gregg Doud was an outspoken critic of EU policies on crop protection products. During his Trump administration tenure and since, he has targeted EU policies, including their more restrictive approach on issues like pesticide authorizations and minimum residue levels (MRLs) permitted for imports. H repeated those criticisms Monday. “Very simply, the Europeans like to use mandates and heavy-handed government to tell European farmers they will do X,Y and Z, and the United States prefers a more voluntary approach and setting targets and incentivizing farmers to reach goals,” Doud said. “It basically comes down to a fundamental difference in the role of government and how it sees these types of issues, and agriculture is just one area where this occurs.”

If Biden wins another term, will his trade policy shift? “They'll keep the same trade policy because he has strong support from the labor unions and certain constituencies,” said Sharon Bomer-Lauritsen, founder of the ag trade consultancy AgTrade Strategies. “It's those constituencies that undergird the current Biden administration trade policy.” But Thorn sees a potential shift and said he thinks there are “people in the administration, especially in the White House, who understand the value of free trade and trade agreements. And I think that there are people in the foreign policy establishment who understand that the trade policy that they've implemented, is not supporting their foreign policy.” Those tensions, he said, “could potentially be helpful in the second term” in terms of elevating the need for a more aggressive trade strategy.

Doud was not optimistic about returning to the prior days of trade policy under both Democratic and Republican administrations. He said the issue, in part, is that “other parts of the U.S. economy are like, ‘We're done giving. We’re not interested in giving as much anymore.’ And I think that makes it more difficult for U.S. agriculture to get what it wants in the international trade arena.”

The shift in mood and approach to trade is evident in the lack of discussion about trade rules during farm bill negotiations on Capitol Hill, according to Vetter. In the past, farm-state lawmakers were well-versed in world trade rules and regularly consulted with administration officials to ensure compliance with agricultural trade agreements. However, recent developments, such as the United States' withdrawal from the Trans-Pacific Partnership and the preference for bilateral negotiations under the Trump administration, have altered the approach to trade, with a focus on bilateral agreements and a diminished role for the World Trade Organization (WTO) in resolving trade disputes. One of Trump's significant trade achievements was the passage of the USMCA.

— The Biden administration is reinstating sanctions on Venezuela, reversing the lifting of some sanctions that occurred in October. This decision comes after Venezuela barred a key opposition presidential candidate, Maria Corina Machado, from running in the upcoming elections. Initially, the US had eased sanctions in response to Venezuela's commitment to hold elections.

The rollback of restrictions on Venezuela's oil industry is now at risk of expiring due to the recent Venezuelan court ruling and the arrest of several opposition members. The State Department has given U.S. entities conducting transactions with the state-owned gold miner Minerven until Feb. 13 to wind down those transactions.

The Biden administration has warned that if Machado and other opposition figures are not allowed to run in the elections, restrictions on the oil industry will be reimposed on April 18. Additionally, the administration is considering additional measures in response to the situation in Venezuela.

— Macron urges EU's Von der Leyen to halt Mercosur trade deal amid farmer protests. French President Emmanuel Macron intensified his opposition to a trade deal between the European Union and the South American Mercosur bloc. He reached out to European Commission President Ursula von der Leyen, urging her to halt the ongoing negotiations. This move comes as Macron faces domestic farmer protests, partly triggered by concerns about foreign competition.

Stipulations. France said the trade deal should not proceed unless farmers in the four Mercosur countries (Argentina, Brazil, Uruguay, and Paraguay) adhere to the same environmental regulations as those in Europe. The French government is responding to protests by farmers who have been blocking highways around Paris with their tractors, demanding concessions to ease the challenges of rising costs and bureaucratic hurdles. These protests also highlight concerns about unfair competition from foreign countries, exacerbated by free trade agreements like the one with Mercosur. Farmers have also criticized the recent free trade agreement with New Zealand and opposed the previously frozen free trade deal with the U.S. during Donald Trump's presidency.

Around 100 lawmakers from Macron's party sent a letter to von der Leyen expressing their concerns about the impact of Mercosur on French farmers and describing it as "anachronistic."

Macron's stance on Mercosur contrasts with German Chancellor Olaf Scholz, who has publicly supported the swift conclusion of the negotiations. Macron is scheduled to visit Brazil in March, and sources close to him believe that his position on Mercosur will not significantly affect the relationship with Brasilia.

These ongoing farmer protests have placed Macron in a challenging position, with Marine Le Pen's National Rally seeking to capitalize on the movement. Macron recently reshuffled his government and passed a divisive immigration law with support from the far-right, causing tension within his party's left-leaning members.

Of note: The European Commission is indicating the talks between EU and Mercosur are still on.

|

ENERGY & CLIMATE CHANGE |

— Gas stoves pass energy efficiency standards, avoiding U.S. ban. The Department of Energy announced that the majority of gas stoves currently available on the market meet President Biden's new energy efficiency standards. This means that gas stoves will not be banned in the U.S. in the near future. The announcement comes after a controversial statement by a Biden administration official a year ago, suggesting that the Consumer Product Safety Commission could consider banning gas stoves due to their association with childhood asthma. The agency revealed that 97% of gas stoves already conform to the new standards, which are designed to reduce harmful carbon dioxide emissions. Additionally, at least 77% of smooth-top electric ranges also meet these new energy efficiency standards.

— POET is teaming up with Summit Carbon Solutions to capture and store carbon dioxide emissions at 17 of the world's largest ethanol production facilities. This partnership comes after Navigator CO2 Ventures abandoned its carbon pipeline project, in which POET was involved. Summit will be responsible for capturing and storing 4.7 million metric tons of carbon dioxide from POET's 12 Iowa and five South Dakota plants. Additionally, Summit plans to capture 18 million metric tons of carbon dioxide from 33 biofuel plants across five states via a 2,000-mile pipeline. However, the pipeline project has faced opposition from farmers and landowners concerned about potential land damage and carbon dioxide leaks, with permit applications being denied in North Dakota and South Dakota.

— Sustainable Aviation Fuel (SAF) is expected to play a significant role in decarbonizing aviation, but global production remains limited, accounting for less than 0.1% of what is needed for 2050 net-zero targets in 2022. Co-processing, alternative feedstocks, and emerging pathways like eFuels are seen as potential solutions to boost SAF production. Co-processing allows refineries to convert renewable feedstocks into biojet fuel economically. Existing refineries are upgrading to produce SAF from various pathways, including Fischer-Tropsch (FT) and hydrocracking.

While eSAF holds promise, it is currently more expensive than traditional SAF due to the high cost of green hydrogen. Financial incentives, regulatory support, and investment in research and development are essential to facilitate the adoption and commercialization of eSAF, according to its proponents.

Facts and figures. By the end of 2022, eight refineries in the United States had completed conversions to produce Renewable Diesel (RD) or Sustainable Aviation Fuel (SAF), or a combination. A year later, an additional six sustainable fuels plants joined their ranks in the United States.

|

HEALTH UPDATE |

— Elon Musk tweeted last night that his brain implant startup Neuralink completed its first operation on a human. Musk — who didn't disclose details about the patient — wrote that they are "recovering well." He said the device — Telepathy — "enables control of your phone or computer, and through them almost any device, just by thinking." The technology is not new. Some of Neuralink’s competitors, such as Blackrock Neurotech, have already implanted many chips in human brains.

|

OTHER ITEMS OF NOTE |

— Tickets for the matchup between the Chiefs and 49ers at the Feb. 11 Super Bowl are the most expensive ever, going for an average $9,815 each, according to TickPick. That’s 70% more than last year.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |