U.S. Economy Grows More Than Expected in Fourth Quarter at 3.3%; 2.5% for 2023

Treasury Secretary Janet Yellen in Chicago to give ‘major’ address on economy

|

Today’s Digital Newspaper |

MARKET FOCUS

- GDP grows more than expected in fourth quarter

- Treasury Secretary Yellen to give ‘major’ economic address in Chicago

- Fed raised rate on loans to banks issued under an emergency program

- FAA orders Boeing to halt production of its bestselling 737 MAX 9 planes

- Tesla warns sales growth of its electric vehicles could be “notably lower” in 2024

- Microsoft becomes second company to ever top a $3 trillion valuation

- Billionaire Joe Lewis enters guilty plea in insider trading case

- ECB holds interest rates steady at 4%

- Brent crude surges to near two-month high above $81 as U.S. oil stocks plummet

- Middle East crisis disrupts supply chains, posing economic challenges for Europe

- Ag markets today

- India’s parboiled rice export prices hit record high

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Senate GOP split on national security deal impacting immigration & Ukraine aid

- Initial big push for a tax cut package and childcare tax credits is slowing down

ISRAEL/HAMAS CONFLICT

- Red Cross warns that Gaza at risk of complete medical shutdown

RUSSIA & UKRAINE

- Zelenskyy accuses Kremlin of endangering Ukrainian prisoners after plane crash

POLICY

- Former Treasury Secretary Robert Rubin calls for tax increases to address deficits

- How a rice grower and Farm Bureau member sizes up AFBF convention

- Donald Trump could claim up to $323 million in federal income-tax deductions

PERSONNEL

- Biden's deputy trade representative pick, Nelson Cunningham, facing challenges

CHINA

- Soybeans, sorghum and cotton main export sales to China

- China's customs administration decides to permit import of pork from Russia

- China says U.S. causing ‘trouble and provocation’ in Taiwan Strait

TRADE POLICY

- Recent developments concerning trade issues between U.S., Mexico, and Canada

ENERGY & CLIMATE CHANGE

- Biden postpones approval of country's largest natural gas export terminal

- LanzaJet opens world's first ethanol-to-SAF facility

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- USDA sends animal ID plan to OMB

HEALTH UPDATE

- Gene therapy is showing promise for treating inherited deafness

POLITICS & ELECTIONS

- AP will not refer to Trump and Biden as ‘presumptive’ nominees until at least March.

- Nikki Haley faces increased pressure from Republican Party leaders to drop out

- UAW workers formally endorse President Joe Biden for president in 2024 election

OTHER ITEMS OF NOTE

- Charter Communications receives largest portion of federal broadband subsidies

- Orbán delays Sweden's NATO entry amid growing frustration

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed overnight, with Asian shares mostly up and European shares mostly down. In Asia, Japan flat. Hong Kong +2%. China +3%. India -0.5%. In Europe, at midday, London -0.2%. Paris -0.5%. Frankfurt -0.4%. U.S. Dow is now up around 100 points. Netflix soared after its Tuesday earnings report and finished the day with gains of more than 10%.

U.S. equities yesterday: The Dow finished lower, falling into negative territory late in the session. The Blue Chip index was down 99.06 points, 0.26%, at 37,806.39. The Nasdaq gained 55.97 points, 0.36%, at 15,481.92. The S&P 500 rose 3.95 points, 0.08%, at 4,868.55.

— Federal Aviation Administration ordered Boeing to halt production of its bestselling 737 MAX 9 planes because of “unacceptable” quality issues. Yet the regulator did allow grounded models of the aircraft to return to the air, a relief to American carriers which had had to cancel hundreds of flights. The planes were prevented from flying earlier this month after a door blew out during an Alaska Airlines flight. Alaska Airlines said the grounding of Boeing 737 Max 9 planes will cost the company $150 million. Boeing is expected to give investors a year-ahead outlook on next week’s earnings call, but shares have already fallen more than 16 percent this month over Max concerns.

— Tesla warned that sales growth of its electric vehicles could be “notably lower” in 2024. In its latest earnings report the firm also revealed slower revenue growth and shrinking margins in the last quarter of 2023. Shares in the carmaker fell by 8% in premarket trading. Elon Musk, Tesla’s founder, said that in 2025 production would begin of a lower-cost EV built using “revolutionary manufacturing technology.” If the losses ahead of trading are realized after the opening bell, it would wipe out more than $50 billion in market value for the company. The announcement also hit stocks of other EV makers. Hours after the release of Tesla’s earnings report, Musk reiterated his demand for greater control over the company’s voting rights — to enable Tesla to pursue advanced AI and robotics technology — in a post on his social media platform X.

— Ag markets today: Corn, soybeans and wheat held in tight ranges in light overnight price action. As of 7:30 a.m. ET, corn futures were trading fractionally lower, soybeans were mostly 1 to 2 cents lower, SRW wheat futures were narrowly mixed, while HRW and HRS wheat were mostly 2 to 4 cents higher. Front-month crude oil futures were around 75 cents higher, and the U.S. dollar index was near unchanged.

Cash cattle start trading at higher prices. Cash sources reported initial cash cattle trade around $174.00 in Texas on Wednesday, which would be up $1.00 from last week’s activity in the state. While movement was limited in other areas, this sets the expectation cash prices will be at least $1.00 higher than last week’s average of $173.76.

Cash hog index climbing but still below year-ago. The CME lean hog index is up another 63 cents to $69.39 (as of Jan. 23). Since bottoming at the beginning of this month, the cash index is up $4.34. Last year at this time, the cash index was just putting in a seasonal low, though this year’s price is still $2.72 below year-ago.

— Agriculture markets yesterday:

- Corn: March corn rose 5 3/4 cents to $4.52 1/4, marking the highest close since Jan. 11.

- Soy complex: March soybeans rose 3/4 cent to $12.40 1/4 and near mid-range. March soybean meal gained $2.20 at $363.30 and near mid-range. March bean oil closed down 89 points at 47.32 cents and near the session low.

- Wheat: March SRW wheat rose 14 1/4 cents to $6.10 3/4, marking the highest close since Jan. 10, while March HRW closed 8 1/4 cents higher at $6.25 3/4. March HRS rose 5 1/2 cents to $7.04 1/2.

- Cotton: March cotton rose 80 points at 85.40 cents and near the session high. Prices hit a 2.5-month high.

- Cattle: Cattle futures turned higher Wednesday in apparent response to reports of stronger cash trading in the Southern Plains. Nearby February live cattle futures rose 70 cents to $175.35, while most-active April gained 52.5 cents to $178.35. January feeder futures, which expire at noon today, climbed 82.5 cents as well, closing at $231.825. Most-active March feeders inched up 12.5 cents to $233.75.

- Hogs: April lean hog futures surged $1.70 to $82.025, settling near session highs. Nearby February futures rose 60 cents to $73.90.

— Of note:

- Microsoft became the second company to ever top a $3 trillion valuation, capping a dramatic rise for the longtime tech titan that coincides with a broad technology rally and its backing of ChatGPT maker OpenAI. It’s only slightly less valuable than Apple, which became the first firm to ever score a $3 trillion valuation last summer.

- Billionaire Joe Lewis, former owner of the Tottenham Hotspur Premier League soccer team, entered a guilty plea in Manhattan on Wednesday in his insider trading case, six months after he was charged with securities fraud for allegedly passing inside information to his girlfriend and others in his circle. Lewis, who has an estimated net worth of $6.2 billion, pleaded guilty to three counts of securities fraud and said he “knew at the time what I was doing was wrong, and I’m so embarrassed,” Bloomberg reported.

— U.S. economy grows more than expected. In the last quarter of 2023, the U.S. economy expanded at an annualized rate of 3.3%, surpassing market expectations of a 2% increase. This growth followed a 4.9% rate in the previous quarter (Q3), as indicated by the advance estimate. The expansion was driven by various factors, including increased consumer spending, exports, state and local government spending, nonresidential fixed investment, federal government spending, private inventory investment, and residential fixed investment. Imports also saw an uptick during this period. When considering the entire year of 2023, the U.S. economy registered a growth rate of 2.5%, a notable improvement compared to the 1.9% growth observed in 2022. These figures closely align with the Federal Reserve's estimates of 2.6% for the year 2023.

Of note: Treasury Secretary Janet Yellen is in Chicago today, where she’s scheduled to deliver what the administration is calling a “major” address on the economy and President Joe Biden’s domestic agenda. “Though some forecasters thought a recession last year was inevitable, President Biden and I did not,” Yellen will say in prepared remarks. “Instead of contracting, the economy has continued to grow, driven by American workers and President Biden’s economic strategy. It now produces far more goods and services than it did before the pandemic.”

— ECB holds interest rates steady at 4%. European Central Bank (ECB) decided to maintain its key interest rates at their multi-year highs for the third consecutive meeting in January. This decision aligns with market forecasts. The ECB cited the ongoing decline in underlying inflation and the continued strong impact of previous interest rate hikes on financing conditions as reasons for this decision. Traders will closely monitor President Lagarde's press conference for any hints or insights regarding the potential timing of interest rate cuts later in the year.

Market perspectives:

— Outside markets: The U.S. dollar index was near unchanged. The yield on the 10-year U.S. Treasury note was weaker, trading around 4.16%, with a positive tone in global government bond yields. Crude oil futures were moving higher ahead of U.S. market action, with U.S. crude around $75.85 per barrel and Brent was around $80.30 per barrel. Gold and silver futures were narrowly mixed ahead of key economic updates, with gold weaker around $2,015 per troy ounce and silver firmer around $22.96 per troy ounce.

— Brent crude surges to near two-month high above $81 as U.S. oil stocks plummet. Brent crude futures soared to over $81 per barrel on Thursday, approaching a two-month high. This surge followed a significant decline in U.S. crude oil inventories, which dropped by 9.233 million barrels during the week ending January 19. This decline was the most substantial since August and exceeded market expectations, which had anticipated a decrease of 2.15 million barrels, as reported in the EIA Petroleum Status Report. Additionally, China's decision to reduce banks' reserve ratios next month, aimed at supporting its struggling economy, contributed to the positive market sentiment. Concerns regarding supply disruptions also persisted, with a U.S. and UK coalition launching strikes against Houthi fighters in Yemen, who had been targeting commercial shipping in the Red Sea.

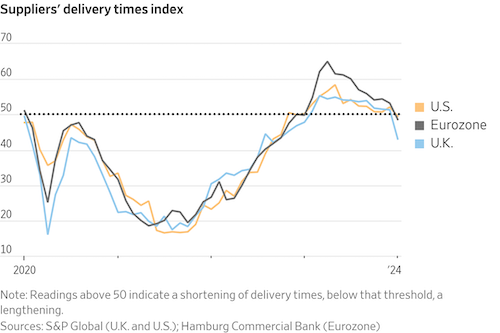

— Middle East crisis disrupts supply chains, posing economic challenges for Europe. The European economy is beginning to experience the consequences of supply-chain disruptions caused by the ongoing crisis in the Middle East, the Wall Street Journal reports (link). Recent data reveals that in January, businesses faced delays in receiving essential parts, primarily due to attacks by Yemen-based Houthi rebels on cargo ships in the Red Sea, disrupting crucial freight routes from Asia. These attacks prompted many freight carriers to opt for the longer and more expensive route around Africa via the Cape of Good Hope for safety reasons. If these additional costs continue to accumulate and persist, they could lead to fresh inflationary pressures in Europe. This, in turn, might delay the anticipated reduction in interest rates in the region.

— India’s parboiled rice export prices hit record high. Rates of parboiled rice exported from top hub India advanced to record highs this week on limited supplies and steady demand from Asian and African buyers. India’s 5% broken parboiled variety was quoted at record $533 to $542 per metric ton this week. Export prices for rice from Vietnam and Thailand declined. Vietnam’s 5% broken rice was offered at $630 per metric ton, down from $653 per ton a week ago. Thailand’s 5% broken rice prices were quoted at $663 to $665 per ton, down slightly from $665 last week.

— Ag trade update: Japan purchased 88,710 MT of milling wheat in its weekly tender, including 32,985 MT U.S. and 55,725 MT Canadian.

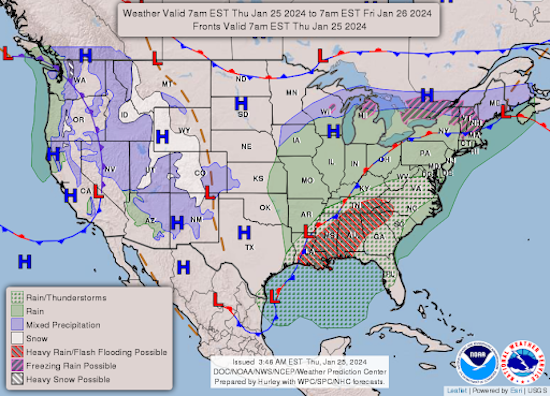

— NWS weather outlook: Flash Flooding and Severe Weather concerns continue for portions of the Southern Plains, Gulf Coast, Lower Mississippi Valley and Southeast... ...Freezing rain impacts possible over parts of southern Maine/central New England... ...Unseasonably warm air surges into the eastern third of the country leading to widespread record low temperatures Thursday night.

Items in Pro Farmer's First Thing Today include:

• Light grain trade overnight

• Red Sea attacks continue

• China eases rules for bank loans on commercial property

|

CONGRESS |

— Senate Republicans split on national security deal impacting immigration and Ukraine aid. Senate Republicans find themselves in a deep divide over a national security deal that has implications for immigration funding and aid to Ukraine. Former President Donald Trump's push to oppose a bipartisan border security compromise has created tension, with some Republicans insisting on addressing border issues before approving Ukraine aid. GOP leaders aim for a quick vote on the package next week, despite lacking a finalized deal or legislative text. However, resistance is growing, particularly among House Republicans, and Trump's opposition complicates the decision for on-the-fence Republicans torn between President Biden and Trump in a pivotal 2024 campaign issue.

— Initial big push for a tax cut package and childcare tax credits is slowing down. Several senators say they want a committee markup of the measure. The Senate is contemplating measures that could slow down the progress of the bipartisan tax bill unveiled earlier this month, worth nearly $80 billion. Senate Republicans and a key Democrat are expressing the desire to hold a committee markup on the bill, potentially delaying its passage. Sen. Mike Crapo (R-Idaho), the leading Republican on the Senate Finance Committee, has not rushed to endorse the compromise, citing concerns about the child tax credit expansion. Sen. John Thune (R-S.D.), according to reports, is pushing for a markup to potentially alter some child tax credit provisions related to earnings and work.

Meanwhile, several House GOP conservatives have taken aim at the tax package. House Speaker Mike Johnson (R-La.) has not yet indicated his position on the topic.

|

ISRAEL/HAMAS CONFLICT |

— Red Cross issued a warning that Gaza is at risk of a complete medical shutdown unless immediate action is taken to ensure the availability of essential services. William Schomburg, the head of the Red Cross office in Gaza, stated that every operational hospital in the Gaza Strip is facing overcrowding and shortages of medical supplies, fuel, food, and water. Israeli forces have alleged that Hamas is systematically operating within Gaza hospitals and nearby areas, using residents as human shields. Additionally, a United Nations building housing displaced Palestinians was struck by Israeli tank fire, resulting in the death of at least 12 people and injuries to 75 others. The White House has expressed serious concerns about the strike as Israel continues its military campaign in the region.

|

RUSSIA/UKRAINE |

— Zelenskyy accuses Kremlin of endangering Ukrainian prisoners after plane crash. Volodymyr Zelenskyy, the President of Ukraine, accused the Kremlin of "playing with the lives of Ukrainian prisoners." The accusation comes after a Russian military plane crashed in the Belgorod region, which is near Russia's border with Ukraine. The crash resulted in the deaths of at least 65 Ukrainian prisoners of war who were being transported for a prisoner exchange. Russia claimed that Ukraine had shot down the plane. Zelenskyy called for an international inquiry to establish all the clear facts surrounding this incident. The two countries will continue to exchange prisoners of war, as reported by Interfax, a Russian news agency.

The TASS news agency reported that missile fragments had been recovered from the crash site and that the black boxes from the plane had been recovered.

|

POLICY UPDATE |

— How a rice grower and Farm Bureau member sizes up AFBF convention. “As a member of both Farm Bureau and USA Rice, I am pleased with the overall outcome of this year’s American Farm Bureau policy development process,” said Louisiana rice farmer Richard Fontenot, who serves as 3rd Vice President of the Louisiana Farm Bureau and as a member of the USA Rice Farmers Board of Directors. Fontenot continued: “This is the first farm bill in a while where agriculture seems truly united. It was evident that regardless of region or crop, the farm safety net needs major improvement, and that means an increase in reference prices for commodity programs, among other items such as tweaks to crop insurance.”

— Former Treasury Secretary Robert Rubin warns of U.S. fiscal peril, calls for tax increases. Rubin, on Bloomberg Television’s Wall Street Week with David Westin, expressed deep concern about the state of the U.S. federal deficits, characterizing it as a "terrible place." He has called for tax increases to address the worsening fiscal situation.

Rubin cited the risks posed by the growing deficits, including the potential for higher interest rates, which have already seen a 3-percentage-point surge in longer-term Treasury yields due in part to the fiscal outlook's impact on inflation. He emphasized that the current risks are greater than those faced in the early 1990s when measures were taken to reduce the deficit.

Tax cuts are expensive. Rubin estimated that approximately 60% of the increase in debt from 2000 to 2022 can be attributed to tax cuts implemented by Republican administrations.

He urged a realistic approach to address the deficit, indicating that tax increases will likely be necessary.

Despite recent economic growth, the federal budget gap remains historically large, standing at about 6% of GDP, with rising interest costs on the debt contributing to the problem.

The issue of deficits is likely to be a central topic of debate in upcoming elections, especially as many provisions of former President Trump's 2017 tax-cut package are set to expire in 2025. Rubin cautioned against further tax cuts, stating that they would exacerbate the fiscal challenges without significantly boosting economic growth. He pointed to the successful deficit reduction efforts of the 1990s, which included tax hikes and a robust economic boom, as a model for addressing the current fiscal predicament.

— Donald Trump could claim up to $323 million in federal income-tax deductions for promising not to build on one of his golf courses in Florida, by far his largest known use of the conservation-easement tax break. Link to WSJ article for details.

|

PERSONNEL |

— President Joe Biden's deputy trade representative pick, Nelson Cunningham, is facing challenges in his nomination. Cunningham is facing opposition from liberals on the Senate Finance Committee, including Chair Ron Wyden (D-Ore.) and Sen. Sherrod Brown (D-Ohio). Brown announced he will oppose Cunningham's nomination due to the latter's support for the Trans-Pacific Partnership (TPP). Democrats have only a narrow majority on the Senate Finance Committee, so if Democrats like Brown oppose the nomination, it could lead to a deadlock unless Republicans support the nomination.

Of note: Even if the nomination reaches a vote, it is uncertain whether it will be successful, as other Democrats are also not enthused about giving Cunningham the job, and Sen. Wyden's concerns are considered critical on this matter.

|

CHINA UPDATE |

— Soybeans, sorghum and cotton main export sales to China. USDA Export Sales data for the week ending Jan. 18 included activity for 2023-24 of net reductions of 2,984 metric tons of wheat, net sales of 2,384 metric tons of corn, 60,346 metric tons of sorghum, 563,413 metric tons of soybeans, and 102,324 running bales of upland cotton. Net sales of 1,081 metric tons of sorghum for 2024-25 were also reported. For 2024, net sales of 3,068 metric tons of beef and 687 metric tons of pork were reported.

— China's customs administration decided to permit the import of pork from Russia, specifically from regions that have not been affected by African Swine Fever (ASF). This move allows qualified pork from ASF-free areas of Russia to enter China's market.

— China says U.S. causing ‘trouble and provocation’ in Taiwan Strait. China criticized the U.S. for causing “trouble and provocation” after an American Navy warship sailed through the sensitive Taiwan Strait since presidential and parliamentary elections on the island. “U.S. warships and planes have caused trouble and provocation on China’s doorstep, and carried out large-scale, high-frequency activities in waters and airspace around China,” Chinese Defense Ministry spokesperson Colonel Wu Qian said. The U.S. Navy said the destroyer USS John Finn transited through a corridor in the Taiwan Strait that was “beyond the territorial sea of any coastal state.” Wu said China’s response in driving away the ship was “justified, reasonable, professional and restrained.”

|

TRADE POLICY |

— Recent developments concerning trade issues between the US, Mexico, and Canada:

- Meetings have taken place in preparation for the Mid-Year Check-In meetings related to the US-Mexico-Canada Agreement (USMCA).

- Cara Morrow, Senior Advisor to the U.S. Trade Representative (USTR), met with Mexico's Under Secretary of Economy for Foreign Trade, Alejandro Encinas, in Toronto. Discussions in the meeting included topics such as steel and aluminum exports to the US and the Rapid Response Labor Mechanism. There was also a call for progress on Mexico's energy policies and environmental laws related to fisheries. Notably, the USTR's statement did not mention the dispute over GMO corn.

- Morrow met with Canada's Deputy Minister for International Trade, Rob Stewart. The USTR expressed dissatisfaction with Canada's dairy tariff rate quota allocation measures, among other issues.

- Canadian Agriculture Minister Lawrence - Recent developments concerning trade issues between the US, Mexico, and Canada:

- Meetings have taken place in preparation for the Mid-Year Check-In meetings related to the US-Mexico-Canada Agreement (USMCA).

- Cara Morrow, Senior Advisor to the U.S. Trade Representative (USTR), met with Mexico's Under Secretary of Economy for Foreign Trade, Alejandro Encinas, in Toronto. Discussions in the meeting included topics such as steel and aluminum exports to the US and the Rapid Response Labor Mechanism. There was also a call for progress on Mexico's energy policies and environmental laws related to fisheries. Notably, the USTR's statement did not mention the dispute over GMO corn.

- Morrow met with Canada's Deputy Minister for International Trade, Rob Stewart. The USTR expressed dissatisfaction with Canada's dairy tariff rate quota allocation measures, among other issues.

- Canadian Agriculture Minister Lawrence MacAulay had discussions with USDA Secretary Tom Vilsack regarding proposed changes in voluntary 'Product of USA' labeling regulations for meat and livestock, as well as California's Proposition 12. Canada raised concerns that these rules could potentially restrict trade and disrupt supply chains. USDA's final rule on voluntary Product of USA labeling is currently under review at the Office of Management and Budget.

- Recall that the U.S. recently lost a dispute with Canada on dairy issues and is currently pursuing a case under USMCA related to Mexico's ban on imports of GMO corn.

- MacAulay had discussions with USDA Secretary Tom Vilsack regarding proposed changes in voluntary 'Product of USA' labeling regulations for meat and livestock, as well as California's Proposition 12. Canada raised concerns that these rules could potentially restrict trade and disrupt supply chains. USDA's final rule on voluntary Product of USA labeling is currently under review at the Office of Management and Budget.

Recall that the U.S. recently lost a dispute with Canada on dairy issues and is currently pursuing a case under USMCA related to Mexico's ban on imports of GMO corn.

|

ENERGY & CLIMATE CHANGE |

— President Joe Biden postponed the approval of the country's largest natural gas export terminal due to increasing pressure from climate activists, as reported by the New York Times (link). The White House has now mandated the Department of Energy to carry out an environmental review of Calcasieu Pass 2, a $10 billion project developed by Venture Global, before granting approval. Calcasieu Pass 2 is among 17 proposed natural gas export terminals in the United States, and any delay in its approval could potentially affect other projects in the pipeline.

Venture Global criticized the Biden administration following the report, accusing the White House of attempting to shape policy through leaks to the media. Shaylyn Hynes, a spokeswoman for Venture Global, expressed concerns about the uncertainty this creates regarding whether US liquefied natural gas (LNG) can be relied upon by allies for their energy security. She also suggested that if the leaked report from anonymous White House sources is accurate, it could imply a moratorium on the entire U.S. LNG industry.

— LanzaJet opens world's first ethanol-to-SAF facility, but U.S. corn farmers need carbon capture for entry. LanzaJet (link) inaugurated the world's first ethanol-to-sustainable aviation fuel (SAF) production facility, Freedom Pines Fuels, in Soperton, Georgia. However, U.S. corn farmers face challenges entering the SAF market due to the carbon intensity of American ethanol. Link to YouTube video.

USDA Secretary Tom Vilsack gave remarks at the LanzaJet grand opening, stressing the opportunity ethanol-to-SAF production can create for American farmers. "This is a new industry that will use what you grow and convert it into something far more valuable," he said. Other government officials attending the event included U.S. Deputy Secretary of Energy David Turk, Georgia Public Service Commissioner Tim Echols, Treulin County Commissioner Phil Jennings, and Soperton Mayor John Koon.

The opening of Freedom Pines Fuels also featured the participation of LanzaJet shareholders and investors, including International Airlines Group (IAG), LanzaTech, Mitsui & Co, Shell, Suncor Energy, Microsoft Climate Innovation Fund, Breakthrough Energy, British Airways, and All Nippon Airways (ANA).

The company's ethanol-to-SAF technology was originally developed in collaboration with the Pacific Northwest National Lab in 2010, and its first commercial flights were completed in 2018 and 2019 with Virgin Atlantic and All Nippon Airways (ANA), respectively.

“This is a historic milestone in a long history of firsts for LanzaJet, the United States, and the [sustainable aviation fuel (SAF)] industry globally,” says LanzaJet CEO Jimmy Samartzis in a statement. “Our novel LanzaJet ethanol-to-SAF process technology is now deployed at our commercial plant in Georgia which will convert ethanol into drop-in SAF… As we start-up the plant, we will continue to refine our technology, while launching our efforts to advance new sustainable fuels projects globally. Between feedstock versatility, efficiency, and economics that enable scale in the U.S. and globally, we stand ready to meet aviation’s decarbonization goals established at the United Nations and country ambitions, such as the U.S. SAF Grand Challenge.”

Only one U.S. plant with carbon capture and sequestration (CCS) produces SAF-friendly ethanol, while Brazil leads in SAF-compatible ethanol production.

A recent study (link/pdf) suggests that Midwest corn farmers could benefit significantly from a 35 billion-gallon SAF market, but access remains a key issue. The IRFA released a study it commissioned from Decision Innovation Solutions (DIS), an economic research and development firm, to discover how a 35 billion-gallon SAF market would impact the Midwest economy. The study concluded Midwest corn farmers stand to gain $441 in additional income from such a market, if given the opportunity to access it. "For a 1,000-acre farm with 50/50 corn and soybeans and trendline national yields, this would mean $11,760 more income in 2050," according to the study.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— USDA sends animal ID plan to OMB. USDA has sent a final rule to the Office of Management and Budget (OMB) on updating animal disease traceability regulations to require the Animal and Plant Health Inspection Service (APHIS) to only recognize identification devices as official identification for cattle and bison if the devices have both visual and electronic readability (EID). USDA has targeted finalizing the rule in April.

|

HEALTH UPDATE |

— Gene therapy is showing promise for treating inherited deafness, researchers say. An experimental gene therapy restored at least some hearing for five of six participating children. Link for details.

|

POLITICS & ELECTIONS |

— AP says it will not refer to Trump and Biden as the ‘presumptive’ nominees for president until at least March.

— Former South Carolina Gov. Nikki Haley faces increased pressure from Republican Party leaders to drop out of the GOP presidential race after former President Donald Trump’s victory in New Hampshire on Tuesday. But Haley has vowed to continue her candidacy until at least her home state primary on February 24, even as Trump leads by 37 points in South Carolina, according to FiveThirtyEight’s polling average.

— The United Auto Workers (UAW), one of the country's major unions, formally endorsed President Joe Biden for the 2024 election on Wednesday. This endorsement holds significant importance for Biden, as it puts an end to months of anticipation and addresses criticism from some members who had concerns about his support for electric vehicles. Biden's aim is to secure support in crucial battleground states like Michigan, where the UAW is headquartered, in his competition against former President Trump.

|

OTHER ITEMS OF NOTE |

— A major cable company, Charter Communications, has received the largest portion of federal broadband subsidies, totaling over $12 billion in the last two years, aimed at assisting low-income households in paying for internet services, the Wall Street Journal reports (link). This represents nearly a quarter of the total funds distributed, surpassing its competitors. The allocation of such a significant share to Charter has raised concerns among regulators who are now scrutinizing the company's practices. Additionally, lawmakers are contemplating potential adjustments to the subsidy program's rules considering this development.

— Orbán delays Sweden's NATO entry amid growing frustration. Prime Minister Viktor Orbán of Hungary expressed Hungary's commitment to ratifying Sweden's bid to join NATO after Turkey approved Sweden's accession to the alliance. This move leaves Hungary as the only remaining holdout. Orbán reaffirmed Hungarian support for Sweden's NATO membership after a telephone conversation with NATO Secretary-General Jens Stoltenberg. He also stated his intention to urge the Hungarian parliament to ratify Sweden's entry into NATO as soon as possible.

There is frustration among NATO alliance members regarding Hungary's delay in ratifying Sweden's NATO membership. Orbán had invited his Swedish counterpart to Hungary for negotiations on this matter, causing some exasperation among NATO partners. Despite the delay, there is a general belief among diplomats that Sweden's NATO membership will eventually be ratified, and there is no indication of a real problem.

All NATO members, including Hungary, had agreed to bring in Sweden and Finland at the alliance's summit in 2022. Finland was formally admitted to NATO in April of the previous year.

Of note: Hungary's actions regarding Ukraine, blocking EU aid, and meeting with Russian President Vladimir Putin have also caused tensions with EU partners and the United States.

Stoltenberg welcomed Orbán's support for Sweden's NATO membership and expressed the hope for ratification when the Hungarian parliament reconvenes, which is expected to be in late February. The ratification process is within the hands of Orbán's Fidesz party, which holds a two-thirds majority in parliament.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |