Trump Beats Haley by Around 11 Points, but Loses Votes of Independents

China to cut banks' reserve requirement ratio 50 basis points from Feb. 5, inject 1 trillion yuan into market

|

Today’s Digital Newspaper |

Modified report today as I am traveling very early to Fargo, North Dakota, to attend two crop insurance meetings sponsored by Matt Allen of Farmers Agency, Inc.

Equities, Tuesday: The Dow finished lower while the Nasdaq and S&P 500 finished higher, with the S&P 500 notching a third record finish. The Dow fell 96.36 points, 0.25%, at 37,905.45. The Nasdaq rose 65.66 points, 0.43%, at 15,425.94. The S&P 500 gained 14.17 points, 0.29%, at 4,964.60.

Ag commodities, Tuesday:

- Corn: March corn futures closed up 3/4 cent at $4.46 1/2 though nearer the session low.

- Soy complex: March soybeans rose 15 1/4 cents $12.39 1/2 and marked the highest close since Jan. 9. March soymeal rose $5.30 to $361.10, ending high- range, while March soyoil gained a marginal 5 points, ending the session at 48.21 cents.

- Wheat: March SRW futures closed unchanged on the day at $5.96 1/2, though settled nearer session lows. March HRW futures rallied 10 1/2 cents to $6.17 1/2, settling near the session’s mid-point. March spring wheat fell 1 1/2 cents to $6.99.

- Cotton: March cotton fell 23 cents to 84.60 cents but still ended high-range.

- Cattle: February live cattle futures surged 87.5 cents to $174.65. March feeder cattle futures rallied $2.375 to $233.65, a two-month high close, while expiring January futures rose $1.175 to $231.00.

- Hogs: April lean hog futures rose $2.70 at $80.325, near the session high and hit a two-month high.

— China to cut banks' reserve requirement ratio, inject 1 trillion yuan into market. China’s central bank announced on Wednesday it would cut the reserve requirement ratio for commercial banks by 50 basis points from Feb. 5, according to governor Pan Gongsheng. The move is expected to inject 1 trillion yuan ($140 billion) of liquidity into the market, Pan told a press conference in Beijing. China and Hong Kong equities rallied.

— In December 2023, Japan's exports reached a new record high, increasing by 9.8% year-on-year to JPY 9,648.21 billion. This exceeded market expectations, which had predicted a 9.1% gain, and represented a rebound from a slight decline in November. This growth in exports was the strongest since December 2022 and was driven by strong demand from the United States and China. Over the entire year, exports from Japan grew by 2.8%.

— Argentina led the world ranking of food inflation in 2023. Argentina led global food inflation in 2023 above Lebanon and Venezuela. Additionally, the Middle Eastern nation reported its overall price index, which was 192%, compared to 211% for Argentina and 193% for Venezuela.

— Donald Trump won the New Hampshire primary with more than 54%, while Nikki Haley held just under 44%, with nearly 90% of votes counted. Trump’s New Hampshire win follows his landslide victory last week in Iowa, where the former president won more than 50% of the vote. He is the first non-incumbent in the modern era to win both Republican presidential contests in Iowa and New Hampshire. Trump’s win increases the chances of a rematch with Joe Biden. Haley vowed to fight on, but her loss raises questions about how long she can stay in the race.

Haley won 62% of voters who decided in the last few days as the field consolidated, according to the exit poll. Trump won 3 of 4 Republicans, but Haley won 60% of independents.

If Trump is convicted of a felony, 42% of voters in New Hampshire and nearly a third of Iowa’s Republicans caucus-goers said Trump would be unfit for the Presidency. A Wall Street Journal commentary said “that would mean he can’t win. Ms. Haley could stay in the race, rack up delegates, and see what happens if he is found guilty.”

On the Democratic side, President Joe Biden also beat his challengers via a write-in campaign, defeating Rep. Dean Phillips (D-Minn.) and author Marianne Williamson.

Next up: Nevada and the Virgin Islands hold their caucuses on Feb. 8, and South Carolina holds its Republican primary on Feb. 24.

— Today marks 700 days since Russia’s full-scale invasion of Ukraine. The war has turned into “a battle of ammunition,” NATO secretary-general Jens Stoltenberg warned.

— The U.S. has been urging China to press Tehran to control Iran-backed Houthi rebels who have been attacking commercial ships in the Red Sea. However, there has been limited cooperation from Beijing on this matter. U.S. national security adviser Jake Sullivan and his deputy have held discussions on this issue with the head of the Chinese Communist party's international department during meetings this month, according to U.S. officials.

— Six House Republicans oppose increase in reference prices. Six House Republicans, namely Reps. Alex Mooney (R-W.Va.), Andy Ogles (R-Tenn.), Brian Mast (R-Fla.), Andy Biggs (R-Ariz.), Carol Miller (R-W.Va.), and Nancy Mace (R-S.C.), have expressed their opposition to increasing the reference prices that trigger farm subsidy payments. They argue that during a time when Congress should be focused on reducing federal spending, it is important to resist costly efforts that expand government intervention in the free market. This stance was conveyed through a letter (link) and received endorsements from organizations including Taxpayers for Common Sense, the Heritage Foundation, the R Street Institute, National Taxpayers Union, Freedom Works, The Club for Growth, Competitive Markets Action, and the Council for Citizens Against Government Waste.

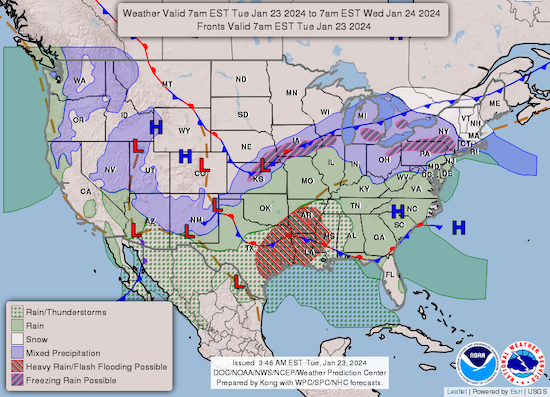

— NWS weather outlook: Heavy rainfall and concerns for flash flooding for portions of the Lower Mississippi Valley, Tennessee Valley and Gulf states through Friday morning... ...A swath of freezing rain and some accumulating snowfall will impact portions of the Midwest, Lower Great Lakes, and the Northeast... ...Much milder air with temperatures surging well above normal can be expected through the middle of the week for much of the eastern half of the country.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |