Volatility Returns to Shipping Costs on Red Sea Attacks, Other Issues

Farm Bureau president cites lack of labor as ag sector’s biggest problem

|

Today’s Digital Newspaper |

MARKET FOCUS

- ADM places CFO on leave and cut its earnings outlook amid a probe

- Macy's turns down $5.8 billion acquisition proposal

- Three Fed officials stress incoming data will guide decision on interest rates

- Market awaits Fed's clarity on interest rates amid economic

- Two major Wall Street firms advising investors to consider buying five-year U.S. notes

- Davos focuses on Trump and European conflicts, overlooking Asia

- Red Sea attacks raise shipping costs

- Global ocean shipping rates experiencing significant surge

- Carloads of grain carried by U.S. railroads down 29.9% from last year

- European natural gas futures see continued declines

- Ag markets today

- NWS weather outlook

- Pro Farmer First Thing Today items

ISRAEL/HAMAS CONFLICT

- Mexico and Chile ask court to investigate whether crimes were committed

- IDF completes demolishing Hamas’ main rocket, weapons mfg industrial zone

- Netanyahu rejected calls for Palestinian sovereignty

- Israel and Hamas in early stages of negotiations: WSJ

RUSSIA & UKRAINE

- Ukrainian drone strikes oil depot in Russia

- EU officials begin tackling plan to unlock billions in military assistance for Ukraine

POLICY

- Urgent need for guestworker program reform in U.S. agriculture: Farm Bureau

CHINA

- China leaves benchmark lending rates unchanged

- Brazil’s share of China’s soybean imports rises, U.S. declines

- Enforcement of China forced-labor import ban needs to be tougher: U.S. lawmakers

- Steel and GDP figures fuel skepticism over China’s data

- Can China pull its economy out of a deflationary nosedive?

ENERGY & CLIMATE CHANGE

- OMB concludes meeting on E15 waiver request by eight states

- Energy Dept. awards contracts for 3.2 million barrels of oil at $75.96/barrel for SPR

- Cold weather hits electric car sales in Europe for first time since 2020

- Biden official urges enhanced EV charging network, $46.5 mil. funding for 30 projects

- Bipartisan group of senators introduce Farm to Fly Act for SAF

- direct support to rural America, farmers, the agriculture industry, and the aviation sector.

- Major U.S. truck builders invest $2 bil. in battery factory for commercial vehicles

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Raising Cane's (chicken fingers) founder buys luxury Dallas condo floors

POLITICS & ELECTIONS

- Nikki Haley now only potential roadblock to a Trump nomination as DeSantis drops out

- Louisiana’s legislature passes map giving state second majority-Black district

- Sen. Tim Scott (R-S.C.) drops out of race, endorses Donald Trump

- Disbelief over likely presidential candidates among Democrats and Republicans

- Dems worried about outlook in Michigan election contests for president and Senate

- Biden reportedly considering freshening up his policy platform

OTHER ITEMS OF NOTE

- Japan lands spacecraft on moon, becoming fifth country to do so

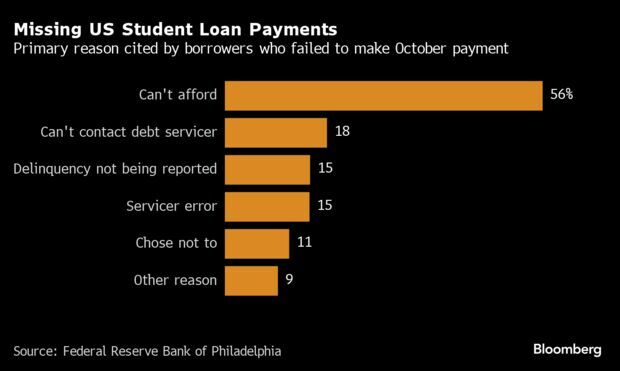

- Americans failing to pay student-loan bills say payments were unaffordable

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed overnight. U.S. Dow opened around 70 points higher and is currently just over 200 points higher. A rout in Chinese stocks listed in Hong Kong is intensifying. The Hang Seng dropped closer to a level last seen almost two decades ago. In Asia, Japan +1.6%. Hong Kong -2.3%. China -2.7%. India closed. In Europe, at midday, London +0.2%. Paris +0.4%. Frankfurt +0.5%.

U.S. equities Friday: The Dow gained 359.19 points, 1.05%, at 37,863.80. The Nasdaq rose 255.32 points, 1.70%, at 15,310.97. The S&P 500 was up 58.87 points, 1.23%, at 4,839.81.

For the week, the Dow gained 0.7%, the S&P added 1.2% (ending at a record level) and the tech-heavy Nasdaq Composite climbed 2.3%, lifting all three major stock market averages into positive territory for the year.

— Earnings reports this week include: United Airlines (Monday), Netflix and Procter & Gamble (Tuesday), Tesla and CSX (Wednesday), Intel and American Airlines (Thursday) and American Express and Norfolk Southern (Friday).

— ADM placed its CFO on leave and cut its earnings outlook amid a probe into certain accounting practices. CFO Vikram Luthar has been put on administrative leave, effective immediately, and Ismael Roig will serve as interim CFO, the company said in a statement on Sunday. The probe, which is in response to a voluntary document request by the Securities and Exchange Commission, surrounds certain practices and procedures with respect to the company’s nutrition reporting segment, ADM said. It is cooperating with the SEC.

— Macy's turned down a $5.8 billion acquisition proposal from Arkhouse Management and Brigade Capital Management. The offer aimed to purchase the remaining shares of Macy's stock that the firms do not already own for $21 per share. Macy's CEO Jeff Gennette stated that the proposal "fails to provide compelling value" to the company's shareholders. However, he noted that Macy's remains open to opportunities that align with the best interests of the company and its shareholders. This rejection comes as Macy's endeavors to address declining sales and compete with online retailers and discounters. In a recent announcement, Macy's revealed plans to reduce its workforce by 3.5%, affecting approximately 2,350 jobs, and to close five stores.

— Ag markets today: Corn, soybeans and wheat traded on both sides of unchanged during the overnight session but are mostly weaker this morning. As of 7:30 a.m. WT, corn futures were trading fractionally to a penny lower, soybeans were 1 to 2 cents lower, winter wheat markets were 4 to 6 cents lower and spring wheat was narrowly mixed. Front-month crude oil futures were modestly firmer, and the U.S. dollar index was more than 125 points lower this morning.

Neutral Cattle on Feed report. Friday’s Cattle on Feed Report showed there were 11.930 million head of cattle in large feedlots (1,000-plus head) as of Jan. 1, up 248,000 head (2.1%) from year-ago. December placements dropped 4.5%, while marketings slipped 0.9% from year-ago levels. All three categories virtually matched the average pre-report estimates. As a result, the market should have little to no price response.

Cash hog index continues to firm, pork cutout pauses. The CME lean hog index is up another 19 cents to $68.06 (as of Jan. 18). While gains haven’t been strong, that’s the eighth gain in the last nine days, as the cash index continues the rebound from the seasonal low. After a recent string of steady gains, the pork cutout value slipped 17 cents on Friday and movement slowed to 245.2 loads.

— Agriculture markets Friday:

- Corn: March corn futures rallied 1 1/2 cents to $4.45 1/2, though traded as high as $4.49 1/2. Prices lost 1 1/2 cents on the week.

- Soy complex: March soybeans fell 1/4 cent to $12.13 1/4 and gave up 11 cents on the week. March soymeal closed $1.30 lower on the day and $5.90 on the week at $356.20. March soyoil fell 61 points to 47.40 cents, representing an 85-point loss on the week.

- Wheat: March SRW wheat futures rose 7 3/4 cents to $5.93 1/4 and near mid-range. For the week, March SRW fell 2 3/4 cents. March HRW wheat rose 2 3/4 cents to $6.08 and nearer the session low. On the week, March HRW lost 7 1/4 cents. March spring wheat rose 8 cents to $6.96 and gained 3 cents on the week.

- Cotton: March cotton rallied 144 points to 83.95 cents, a 264-point week-over-week gain. Cotton surged to a two-and-a-half-month high in early trade and notched gains for the fourth straight session amid U.S. dollar weakness, a rally in equities and robust export demand.

- Cattle: April live cattle futures fell 27 1/2 cents to $177.375 and near mid-range. For the week, April cattle rose $3.20. March feeder cattle futures dropped 60 cents to $231.95 and nearer the session low. On the week, March feeders gained $4.25.

- Hogs: Hog futures ended the week rather poorly, with the nearby February contract sliding 35 cents to close at $70.75. That represented a weekly decline of $1.15.

— Quotes of note:

- Three Fed officials on Friday emphasized incoming data will guide their decision on when to cut interest rates, and made clear they haven’t seen enough evidence yet to begin easing.

— Chicago Fed President Austan Goolsbee said officials should consider cutting rates as inflation falls to avoid keeping policy too tight.

— Atlanta Fed President Raphael Bostic said he’s open to changing his views on the timing of cuts depending on the data.

— San Francisco Fed President Mary Daly said it’s “premature” to think cuts are around the corner.

Of note: The Fed communications blackout period around the Jan. 30-31 FOMC meeting went into effect at midnight on Saturday, Jan. 20, and lasts through midnight on Thursday, Feb. 1.

- Two major Wall Street firms are advising investors to consider buying five-year U.S. notes, following a recent significant decline in their value. Key points from their recommendations:

— Morgan Stanley's perspective: Morgan Stanley believes there is potential for a rebound in Treasury bonds, particularly the five-year U.S. notes. They base this on the expectation that upcoming economic data in the coming weeks might surprise on the downside, which could have a favorable impact on the bond market.

— JPMorgan's recommendation: JPMorgan is also suggesting that investors consider buying five-year U.S. notes. One reason for this recommendation is that yields on these notes have already increased to levels last observed in December. This could present an opportunity for investors.

Caution regarding rate cuts: Both firms are cautious about the market's anticipation of early central bank interest-rate cuts. They note that despite recent fluctuations, central bank officials have pushed back against rate cuts, and there have been positive data points, such as healthy retail sales figures. As a result, traders have reduced their bets on the Federal Reserve implementing interest-rate cuts this year.

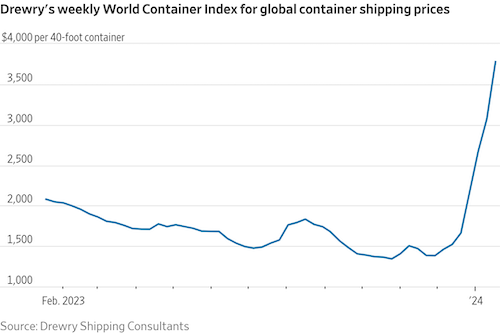

- "Volatility is back, big time in international container shipping." — Philip Damas, managing director of the Drewry Shipping Consultants group.

- “Our economy and our key industries depend on a steady flow of immigrants,” said Jim Rooney, chief executive of the Greater Boston Chamber of Commerce. “Whether you’re from a red state or a blue state,” lack of congressional action on immigration “is affecting your workforce needs,” he said. The number of unfilled jobs in the U.S. — at 8.8 million in November — exceeded the number of job seekers by about 2.5 million. But some 4 in 10 Iowa Republican voters in the caucuses ranked immigration as the most important issue facing the U.S., according to AP VoteCast.

— Market awaits Fed's clarity on interest rates amidst economic conditions and political uncertainty. The upcoming Federal Open Market Committee (FOMC) meeting (Jan. 30-31) faces the challenge of bridging the significant gap between market expectations for interest-rate cuts and the committee's own projections for policy in 2024. While no rate moves are expected at the end of the two-day meeting on Jan/ 31, the market will be eager to hear Federal Reserve Chair Powell's explanation of potential future rate cuts.

The current economic conditions indicate steady growth with low unemployment, inflation above the central bank's targets, and favorable financial conditions.

Federal-funds futures continue to price in up to six rate reductions of 25 basis points each by December, although this exceeds the FOMC's most recent Summary of Economic Projections, which calls for the equivalent of three 25-basis-point reductions by the end of the year.

Fed Gov. Christopher Waller suggested that rates could start to come down once the FOMC is confident that inflation is sustainably near the 2% target. However, the marked easing in financial conditions, including rising stock prices and improvements in credit markets, points to stronger economic growth ahead.

While politics aren't supposed to influence Fed policy, the upcoming elections could affect business and consumer expectations, potentially influencing the economy and policy in a counterintuitive way. Fed policy has largely avoided political influence, but there is a historical precedent where economic policy uncertainty ahead of an election influenced business decisions.

Of note: Consumer sentiment is currently at a two-year high, with declining inflation expectations. This doesn't align with the aggressive rate cuts priced in by the futures market. The wide gap between market expectations and central bank projections leaves room for Fed Chair Powell to provide clarity during the upcoming meeting.

— Davos focuses on Trump and European conflicts, overlooking Asia. The annual meeting of the World Economic Forum in Davos this year shifted its focus away from Asia, with the Eurocentric crowd primarily discussing Donald Trump's potential return to the U.S. presidency and the ongoing conflicts in Gaza and Ukraine.

The gathering coincided with Trump's landslide victory in the Republican Party Iowa caucuses, sparking discussions about his chances of regaining the presidency. Some referred to this as the "Davos Consensus," even though the U.S. election outcome remains uncertain.

The panel titled "4.2 billion people at the ballot box" briefly touched on other elections, including India's, where 900 million people vote. However, the primary concern for many was the U.S. election and its potential impact on Europe, with some expressing concerns about Trump's lack of support for NATO and the European Union.

The Eurasia Group's Ian Bremmer mentioned a significant chance of Trump returning to power, which he viewed as a potential "unmitigated disaster" for Europe. He also highlighted the potential consequences for U.S. support to Ukraine in its conflict with Russia.

Taiwanese President-elect Lai Ching-te was named among the "dangerous friends" for the U.S. in a risk report due to his potential actions in pursuit of greater autonomy.

Market perspectives:

— Outside markets: The U.S. dollar index was lower, with the British pound stronger against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 4.08%, with a lower tone in global government bond yields. Crude oil futures moved higher ahead of U.S. trading, with U.S. crude around $73.65 per barrel and Brent around $78.70 per barrel. Gold and silver were weaker ahead of US market action, with gold around $2,027 per troy ounce and silver around $22.28 per troy ounce.

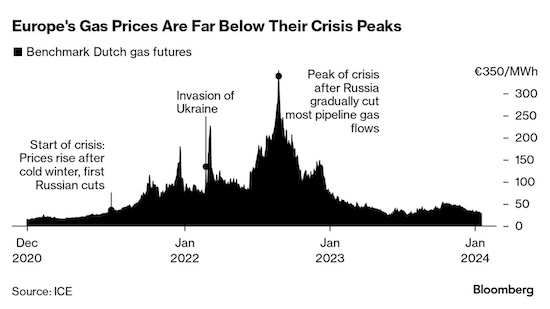

— European natural gas futures have seen a continued decline in the fourth week of January, with prices dropping to €27 ($29.40) per megawatt-hour. This marks an 11% decrease from the previous week and represents fresh 6-month lows. Europe is experiencing milder temperatures, which reduces the demand for natural gas for heating purposes. This is partly due to the impact of storm Isha, which brought strong winds and contributed to the overall increase in wind-power generation. Meanwhile, gas reserves in Europe are currently at elevated levels. As of January 20, gas storage levels in the European Union are at 75%. Specific countries like Germany are at 78.2%, Italy at 71.5%, and France at 65.7%. These high storage levels indicate an abundance of natural gas supply. Also of note: The overall demand for natural gas in Europe remains weak and is below the levels seen before the conflicts in 2023. This reduced demand is likely influenced by the mild weather and possibly other economic factors. Europe is expected to enter the spring season with over half of its underground gas storage capacity still available. This exceeds the 10-year average of 35%, indicating that there is a significant surplus of stored natural gas.

— Global ocean shipping rates are experiencing a significant surge due to ongoing attacks by Houthi rebels on cargo vessels in the Red Sea region, the Wall Street Journal reports (link). These disruptions are particularly concerning for ships transiting through the Suez Canal and are causing disruptions throughout supply chains in Europe and the United States. Of note:

- Houthi attacks: The Houthi rebels' attacks on cargo vessels in and around the Red Sea have been persistent, leading to increased risks and uncertainties for shipping in the region.

- Impact on supply chains: The disruptions caused by these attacks are affecting supply chains, causing delays and increased costs for shipping goods. This is having a ripple effect on industries and businesses in Europe and the U.S.

- Rising shipping costs: The average worldwide shipping costs for a 40-foot container have surged to $3,777 per container in the past week, as reported by London-based Drewry Shipping Consultants. This represents a more than doubling of shipping costs in just one month.

— 18,776: Carloads of grain carried by U.S. railroads in the week ending Jan. 13, down 29.9% from the same week last year, according to the Association of American Railroads.

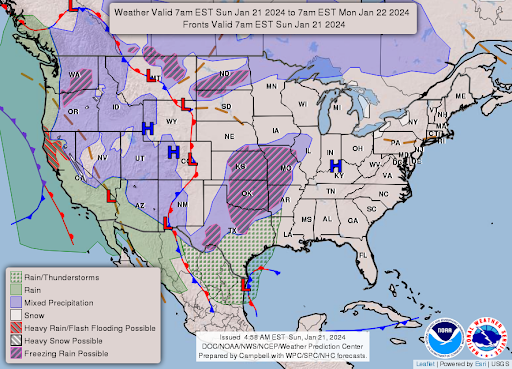

— NWS weather outlook: More unsettled weather expected to impact the West Coast with heavy rain impacting California today... ...Freezing rain across the central Plains this morning is expected to rapidly spread northeastward into the Midwest today followed by another round of freezing rain tonight from the Midwest to the lower Great Lakes... ...Accumulating snowfall across the lower Great Lakes on Tuesday... ...A couple rounds of heavy rain will raise flooding potential across eastern Texas today, expanding east into the lower Mississippi Valley Tuesday into early Wednesday.

Items in Pro Farmer's First Thing Today include:

• Grains favor the downside overnight

• Brazil trends wetter, Argentina drier this week

• Brazil soybean harvest reaches 6% done

• Limited demand for Chinese wheat auction

|

ISRAEL/HAMAS CONFLICT |

— Mexico and Chile asked the International Criminal Court to investigate whether crimes were committed by Hamas in its Oct. 7 attack or by Israel in its response.

— The Israel Defense Forces (IDF) said it had completed demolishing the Hamas terrorist group's main rocket and weapons manufacturing industrial zone in the central Gaza Strip, along with a vast network of tunnels that housed some of the facilities. The Army stated that its troops reached the southernmost point of their ground offensive in Gaza.

— Israel's Prime Minister Benjamin Netanyahu rejected calls for Palestinian sovereignty, saying on Saturday that Israel must retain security control over "all the territory west of Jordan — and this is contrary to a Palestinian state." His comments come after talks with President Joe Biden on post-war Gaza. Biden said that he believed Netanyahu could ultimately be convinced of a two-state solution. The two remain at odds over what Gaza will look like after the conflict.

— Israel and Hamas are currently in the early stages of negotiations with the involvement of the U.S., Egypt, and Qatar, the Wall Street Journal reports (link). These countries are urging both sides to commit to a plan for a gradual release of hostages, with the ultimate goal of ending the ongoing conflict. Neither side has agreed to this plan yet, and there is still a considerable distance to cover in these negotiations. However, these U.S.-backed talks offer a glimmer of hope for potential progress in resolving the situation.

|

RUSSIA/UKRAINE |

— A Ukrainian drone struck an oil depot in Russia, the latest attack aimed at stopping Moscow from fueling its tanks and fighter jets.

— European Union officials will start tackling a new plan to unlock tens of billions of dollars in military assistance for Ukraine. The country is expected to run out of money within months and be forced to take painful economic measures if Western aid doesn’t come through. Link to more via the Wall Street Journal.

|

POLICY UPDATE |

— Urgent need for guestworker program reform in U.S. agriculture: Farm Bureau president. The president of the largest U.S. farm group, Zippy Duvall, emphasized the urgent need for Congress to reform the guestworker program to address labor shortages in American agriculture. Speaking at the American Farm Bureau Federation convention, Duvall highlighted the importance of addressing this issue, which he described as the most significant limiting factor for American agriculture. Key points from Duvall's speech (link):

- Labor shortages: Duvall stressed that labor shortages are a critical concern for the agricultural industry. He called for reforms to the H-2A visa program, which currently provides seasonal workers, to also allow for year-round workers. Additionally, he suggested setting wages at a more affordable level for employers instead of relying on federally set rates that are becoming increasingly unaffordable.

- Farm bill: Duvall urged the passage of a new farm bill that includes an updated safety net. This safety net should take into account rising production costs and the impact of inflation on the prices of agricultural supplies.

- Reference prices: The American Farm Bureau Federation and other farm groups are advocating for higher reference prices in the farm bill, a factor that influences crop subsidies. However, the cost of increasing reference prices has led to disagreements and discussions about potential funding sources.

- Animal welfare law override: The American Farm Bureau Federation is seeking a congressional override of California's Proposition 12 animal welfare law, which has implications for livestock farming.

- Challenges in Congress: Duvall acknowledged the challenges in achieving these reforms given the current political environment in Washington, D.C. He noted the difficulty in reaching a consensus on comprehensive immigration reform and emphasized the need for action despite the political hurdles.

- Undocumented farmworkers: Approximately half of U.S. farmworkers are believed to be undocumented, and many are nearing retirement age. The agricultural industry has struggled to attract workers for physically demanding tasks in the fields and livestock management.

|

CHINA UPDATE |

— The People's Bank of China (PBoC) decided to maintain its lending rates at the January fixing to support the economic revival of China. Of note:

- Loan prime rates unchanged: The one-year loan prime rate (LPR), which is used for corporate and household loans, remains at a record low of 3.45%. This rate has been unchanged for the fifth consecutive month. Additionally, the five-year rate, which is a reference for mortgages, is also held steady at 4.2% for the seventh consecutive month.

- Recent liquidity injection: Prior to this decision, the central bank had increased liquidity injection through medium-term policy measures in the previous week. However, despite these measures, they have chosen to keep the interest rates unchanged.

- Economic growth: The Chinese economy experienced a year-on-year growth rate of 5.2% in the fourth quarter of 2023. This represents an acceleration from the 4.9% gain in the third quarter. However, it fell slightly short of forecasts, which had predicted a growth rate of 5.3%. For the full year 2023, China's GDP expanded by 5.2%, surpassing the government's target of around 5.0%. This growth also marks a significant acceleration from the 3.0% rise in 2022, attributed to various support measures and a favorable base effect from the previous year.

— Brazil’s share of China’s soybean imports rises, U.S. declines. China’s soybean imports from Brazil in 2023 jumped 29% from the prior year to 69.95 MMT. Imports from the U.S. fell 13% to 24.17 MMT. Brazil’s market share grew to 70%, while the U.S. share shrank to 24%. China’s soybean imports in the first quarter are forecast to slow by about 20% from a year earlier to 18.5 MMT, according to a Reuters survey, after a record slaughter shrank pig herds. Exports from Argentina are expected to jump in 2024 amid forecasts for a rebound in its soybean crop from drought, which could bring further competition to U.S. soybeans.

— Enforcement of China forced-labor import ban needs to be much tougher, say U.S. lawmakers. The leaders of a bipartisan committee said the Biden administration should consider using criminal prosecutions and closing a trade loophole. Link to details via the WSJ.

— Steel and GDP figures fuel skepticism over China’s data. Surprising statistics deepen doubts about official measures of activity in the world’s second-largest economy. Link/paywall to Financial Times article on the topic.

— Can China pull its economy out of a deflationary nosedive? While no one wants to talk about the ‘r’ word just yet, China may already be on course for big trouble — depending on whose economic definitions you believe, and the effectiveness of policy measures implemented so far. Link for more.

|

ENERGY & CLIMATE CHANGE |

— OMB concludes meeting on E15 waiver request by eight states; final rule publication date TBD. The Office of Management and Budget (OMB) hconcluded its solitary meeting regarding the request for a 1-PSI volatility waiver for ethanol-blended fuels like E15, submitted by eight states, including Illinois, Iowa, Minnesota, Missouri, Nebraska, Ohio, South Dakota, and Wisconsin. This meeting involved representatives from the Renewable Fuels Association (RFA) and other stakeholders. Currently, there are no additional meetings scheduled on this matter by OMB. The Environmental Protection Agency (EPA) has not yet determined the publication date for the final rule regarding this issue, as it was listed as "to be determined" in the agency's regulatory plans for the upcoming year.

— Energy Dept. awards contracts for 3.2 million barrels of oil at $75.96/barrel for SPR. The Strategic Petroleum Reserve (SPR) contracts were granted to several companies, including BP Products North America Inc., ExxonMobil Oil Corporation, Phillips 66 Company, Macquarie Commodities Trading US LLC, and Sunoco Partners Marketing & Terminals LP. The purchase price for the oil averaged $75.96 per barrel. This procurement is part of the government's strategic efforts to maintain and manage oil reserves for various purposes, including energy security and economic stability.

— Cold weather hits electric car sales in Europe for first time since 2020. Cold temperatures are causing a major drop in driving range, and European electric car sales have fallen for the first time since 2020. EV sales in Europe suffered their first fall since April 2020 last month, as a drop-off in government subsidies drove down demand.

— Biden official calls for enhanced EV charging network, $46.5 million funding for 30 projects. An official from the Biden administration, Gabe Klein, emphasized the need to enhance the performance and resilience of the electric vehicle (EV) charging network to accelerate the adoption of EVs and promote the decarbonization of the transportation sector. This statement comes as the Energy Department prepares to unveil a $46.5 million initiative to support 30 projects in 16 states and Washington, D.C., aimed at expanding and improving EV charging infrastructure. These projects are intended to enhance and expand EV charging ports, making it easier for individuals to charge their electric vehicles.

— Bipartisan group of senators introduce Farm to Fly Act for Sustainable Aviation Fuel (SAF). A bipartisan group of senators, including Jerry Moran (R-Kan.), Amy Klobuchar (D-Minn.), and Joni Ernst (R-Iowa), is set to introduce the Farm to Fly Act, a companion bill to a House measure aimed at expediting the production and advancement of sustainable aviation fuel (SAF). Key points about the measure:

- Bill purpose: The Farm to Fly Act is designed to clarify the eligibility of SAF within the USDA's agricultural bioenergy programs. It also establishes a standardized definition of SAF for USDA purposes and promotes collaboration for aviation biofuels through USDA programs and public-private partnerships.

- Significance: Sustainable aviation fuel has gained widespread support from lawmakers, industry groups, and commercial airlines to reduce the carbon footprint of air travel. It also represents a new market for biofuels, which are crucial for farmers' income, especially as electric vehicles are increasingly replacing traditional biofuels like ethanol.

- Vilsack’s perspective: USDA Secretary Tom Vilsack has been an advocate for SAF, viewing it as a potentially lucrative revenue source for farmers. He has been actively promoting the Biden administration's investments in this area. Additionally, the Inflation Reduction Act (Climate Bill) has a tax credit for SAF producers.

- Benefits: Sen. Moran highlights that the Farm to Fly Act aims to enhance the accessibility of biofuels for commercial aviation, offering direct support to rural America, farmers, the agriculture industry, and the aviation sector.

— Major U.S. truck builders invest $2 billion in battery factory for electric commercial vehicles. The largest commercial truck and engine manufacturers in the U.S., including Cummins, Daimler Truck, and Paccar, are making a significant investment in electric truck technology. They plan to construct a $2 billion factory in Mississippi, which will become the nation's largest facility dedicated to manufacturing batteries for commercial vehicles, the Wall Street Journal reports (link). Of note:

- Shift to electric power: Cummins, Daimler Truck, and Paccar are placing their bets on the trucking industry's willingness to transition from diesel-powered trucks to electric ones. This reflects the growing pressure from federal and state regulators for truckers to adopt cleaner and more sustainable transportation options.

- Challenges for electric trucks: While electric trucks have been available for some time, the trucking industry has been slow to embrace them due to concerns about their cost, durability, and the lack of charging infrastructure for long-haul journeys.

- Cost reduction: The construction of the new battery factory is expected to lower the overall cost of electric trucks, making them more attractive to trucking operators. This, in turn, is expected to accelerate the adoption of electric big rigs.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Raising Cane's (chicken fingers) founder buys luxury Dallas condo floors. Todd Graves, the founder of Raising Cane's Restaurants, has acquired the top two floors of a luxury condo building under construction in Dallas' Knox Street project. While the exact purchase price remains undisclosed, a one-story penthouse in the same location was recently listed for $25 million, suggesting Graves's purchase could be substantially higher. This acquisition highlights the growing trend of Dallas attracting ultra-wealthy individuals.

|

POLITICS & ELECTIONS |

— Louisiana’s legislature passed a congressional map that gives the state a second majority-Black district, obeying a court order. The new map increases the Black makeup of Louisiana’s 6th Congressional District from 23% to 54% (59% of voters in the new district backed Biden in 2020. This very likely means a Democratic House seat gain. The map heads to the desk of Gov. Jeff Landry (R), who was sworn into office last week, for approval. Landry has said he supports the map. The seat is held by Rep. Garret Graves, a Republican who was a once top lieutenant of former California congressman and former House Speaker Kevin McCarthy (R). Graves had also endorsed one of Landry’s rivals in the gubernatorial race. The new map protects the seats of the two most powerful Louisiana Republicans in the House: Speaker Mike Johnson and Majority Leader Steve Scalise.

Of note: While redistricting occurs every ten years after the Census, some say it seems like every 10 minutes following so many court cases throughout some states.

— Sen. Tim Scott (R-S.C.), who dropped out of the 2024 Republican presidential primary last year, endorsed Donald Trump. The 56-year-old bachelor proposed Saturday to girlfriend Mindy Noce on Kiawah Island, the Washington Post reports.

— With DeSantis stepping aside and endorsing Trump, former South Carolina Governor Nikki Haley becomes the sole alternative to Trump in the GOP presidential race. The announcement comes just one day before the New Hampshire primary. A recent CNN poll indicates that Donald Trump holds substantial support among likely Republican primary voters in the state, with 50% of support. In contrast, Nikki Haley stands at 39%. Ron DeSantis suspended his campaign after a disappointing second-place finish in the Iowa Republican caucuses. Additionally, he was polling at only 6% in New Hampshire, which is below the 10% minimum support required to win delegates according to Republican Party rules.

— A lot of disbelief over likely presidential candidates among Democrats and Republicans. Link to a recap of some of the theories and conspiracy theories behind what some are thinking, via the New York Times.

— Democrats are worried about outlook in Michigan election contests for president and Senate. The Wall Street Journal notes that top Democrats in this state that will help decide the presidential race are “sounding alarms about recent polls showing Biden trailing Donald Trump, the Republican presidential front-runner, by nearly double digits. Michigan Rep. Elissa Slotkin, who is seeking to succeed retiring Democratic Sen. Debbie Stabenow in the state’s Senate race, has expressed concerns that Biden’s bad poll numbers could hurt her race and other down-ballot contests, according to people who have spoken with her.” A survey conducted by Glengariff Group for the Detroit News and WDIV-TV in early January found Trump leading Biden, 47% to 39%. The poll shows Biden with weak support from nearly all of the Democrats’ key constituencies.

— President Joe Biden is reportedly considering freshening up his policy platform as he prepares for a potential repeat battle with former President Donald Trump. The Washington Post reports (link) some of the ideas being discussed by his inner circle include implementing a new tax on the wealthy to support Social Security. This proposal is intended to contrast with Trump's stance, as Trump opposes cuts to the Social Security program but has not provided a detailed plan to ensure its financial stability. These discussions are part of an ongoing conversation leading up to the State of the Union address and the White House budget proposal for fiscal year 2025, both scheduled for March. The article says the Biden campaign and White House officials are currently navigating the challenge of highlighting Biden's first-term achievements while also setting new goals for his second term. This comes at a time when many voters remain dissatisfied with the state of the U.S. economy, despite its surprising resilience and strength.

|

OTHER ITEMS OF NOTE |

— Japan landed a spacecraft on the moon on Friday, becoming only the fifth country to do so, but a solar panel issue could limit the data the country can collect. The Smart Lander for Investigating Moon was operated by the Japan Aerospace Exploration Agency. This achievement provides a much-needed boost to Japan's space program, which has experienced a series of setbacks in recent years. But this time, a solar panel was not functioning, indicating that the spacecraft wasn't facing in the intended direction, and the battery power was expected to last only a few hours. The Japan Aerospace Exploration Agency team said it believes the solar power issue is the result of the spacecraft facing the wrong direction.

— More than half of Americans who’ve failed to pay student-loan bills since the October restart said the main reason was that payments were unaffordable, according to new research by the Philadelphia Fed.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |