Thompson Clarifies Farm Bill Comments, Murky on House Timeline

Biden admits U.S. strikes have not stopped Houthi attacks on ships on Red Sea

|

Today’s Digital Newspaper |

MARKET FOCUS

- Macy's to reduce workforce by cutting 2,350 jobs

- CEOs increase planning for geopolitical scenarios

- Mortgage rates this week fell to lowest level in nearly eight months

- Despite cold weather and snowfall, natural gas prices continue to decline

- Panama Canal faces up to $700 million loss in 2024 due to low water levels

- Red Sea conflict disrupts shipping; Europe faces economic impact

- Ag markets today

- USDA daily sale: 297,000 MT soybeans to China during 2023-2024 marketing year

- They abducted a river in California. And it wasn’t even a crime

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- House, to avoid DC snowstorm, votes to approve CR, sending it to President Biden

- House and Senate not in session, with the House out all next week.

- House Ways and Means Committee mark up bipartisan tax deal today

- House Ag Chairman issues clarification on farm bill timing

RUSSIA & UKRAINE

- Russia: No prospect of reviving Black Sea grain deal

POLICY

- GAO criticizes USDA for inadequate reporting on foreign farmland ownership

CHINA

- Annual foreign investment flows into China shrinks first time since

- More corn, sorghum, soybean and cotton sales to China

TRADE POLICY

- USITC upholds duties on phosphate fertilizers from Morocco & Russia, tariffs reduced

POLITICS & ELECTIONS

- Charlie Cook on Donald Trump

OTHER ITEMS OF NOTE

- Biden administration to forgive $5 billion in student debt for 74,000 borrowers

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed to firmer overnight. U.S. stock Down opened up around 125 points. In Asia, Japan +1.4%. Hong Kong -0.5%. China -0.5%. India +0.7%. In Europe, at midday, London +0.4%. Paris +0.1%. Frankfurt +0.2%.

U.S. equities yesterday: The Dow rose 201.94 points, 0.54%, at 37,468.61. The Nasdaq gained 200.03 points, 1.35%, at 15,055.65. The S&P 500 was up 41.83 points, 0.88%, at 4,780.94.

— Macy's, the largest department store operator in the United States, is set to reduce its workforce by cutting 2,350 jobs, which accounts for roughly 3.5% of its employees. The affected stores — in Arlington, Virginia; San Leandro, California; Lihue, Hawaii; Simi Valley, California; and Tallahassee, Florida — will be closed sometime early this year. This move comes as Tony Spring, an experienced retail executive, is preparing to assume the role of CEO next month. Macy's has faced challenges due to a decline in sales, which began during the pandemic as the shift towards online shopping disrupted the retail industry.

— Ag markets today: Corn, soybeans and wheat modestly extended Thursday’s corrective gains during the overnight session. As of 7:30 a.m. ET, corn futures were trading a penny higher, soybeans were 5 to 7 cents higher, winter wheat markets were 3 to 4 cents higher and spring wheat was 4 to 7 cents higher. Front-month crude oil futures are anchored near unchanged, and the U.S. dollar index was around 175 points lower.

Still waiting on active cash cattle trade. Cash cattle negotiations remained at a standstill on Thursday, with asking prices in the $174.00 to $175.00 range and limited packer bids. Active cash trade may not come until after the Cattle on Feed Report unless packers get more aggressive with bids as feedlots appear unwilling to move cattle at lower prices.

Cash hog prices continue to grind higher. The CME lean hog index is up another 53 cents to $67.87 (as of Jan. 17), marking the seventh gain in eight days. February lean hog futures finished Thursday at a $3.23 premium to today’s cash quote.

— Agriculture markets yesterday:

- Corn: March corn rose 1 3/4 cents to $4.44, near the session high after notching a fresh three-year low early on.

- Soy complex: March soybeans saw corrective buying, rallying 7 3/4 cents before settling at $12.13 3/4, nearer session highs. March soymeal rallied $2.60 to $361.30, settling nearer session highs. March bean oil dropped 8 points to 47.62 cents, settling near the mid-point of today’s session.

- Wheat: March SRW wheat rose 3 cents to $5.85 1/2, near the session high and hit a seven-week low early on. March HRW wheat gained 11 1/4 cents at $6.05 1/4, near the session high today and hit a contract low early on. Spring wheat futures rallied 7 3/4 cents to $6.88.

- Cotton: March cotton futures rallied 81 points to 82.51 cents, the highest close since Dec. 7.

- Cattle: April live cattle rose $2.025 to $177.65. March feeder cattle gained $2.775 at $232.55. Both markets closed nearer their session highs and hit two-month highs.

- Hogs: Hog futures traded mixed Thursday, with nearby February dipping 35 cents to $71.10.

— Quotes of note:

- CEOs increase planning for geopolitical scenarios. Business leaders in Davos told Reuters they are increasingly turning to scenario planning to safeguard supply chains and lessen the potential hit from unexpected geopolitical crises. Many CEOs and executives foresee an upbeat U.S. economy in 2024, but are concerned about China and Europe, and the impact of unexpected global shocks on inflation. With supply chain disruptions caused by the pandemic worked through, CEOs are now grappling with impacts of Houthi attacks in the Red Sea.

- Retail pressure. “Despite our strong and tangible progress over the last few years, we remain under pressure.” —Macy’s CEO Jeff Gennette and President Tony Spring, who is set to succeed Gennette as chief executive officer next month, in a memo sent to employees Thursday.

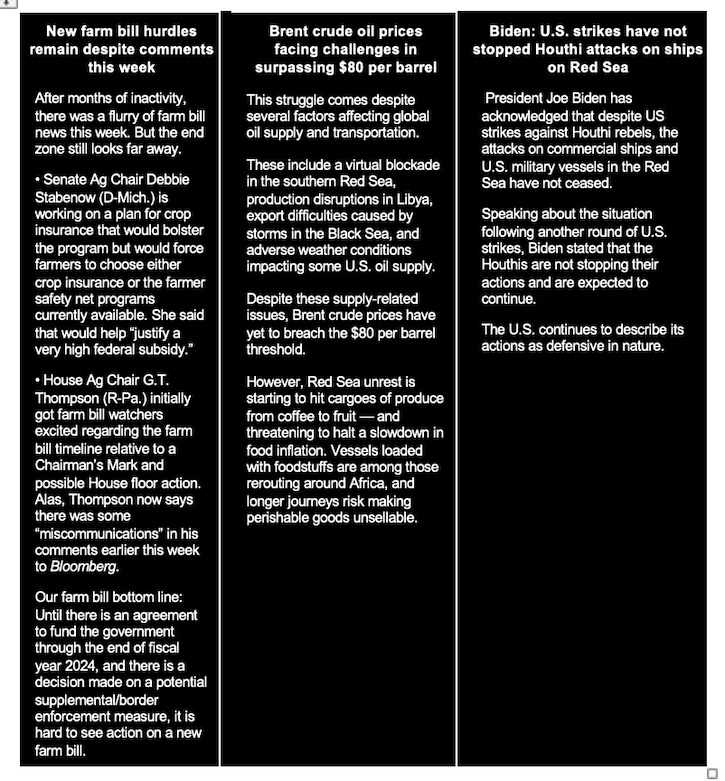

— Mortgage rates this week fell to their lowest level in nearly eight months, offering some relief to the battered housing market. The average rate on the standard 30-year fixed mortgage slid to 6.6%, according to mortgage-finance giant Freddie Mac.

Market perspectives:

— Outside markets: The U.S. dollar index was lower, with the euro and Swiss franc stronger against the greenback. The yield on the 10-year U.S. Treasury note eased slightly, trading around 4.13%, with a mixed tone in global government bond yields. Crude oil futures swung lower ahead of U.S. trading, with U.S. crude around $73.80 per barrel and Brent around $78.80 per barrel. Gold and silver were registering solid gains ahead of U.S. trading and economic updates, with gold around $2,035 per troy ounce and silver around $22.89 per troy ounce.

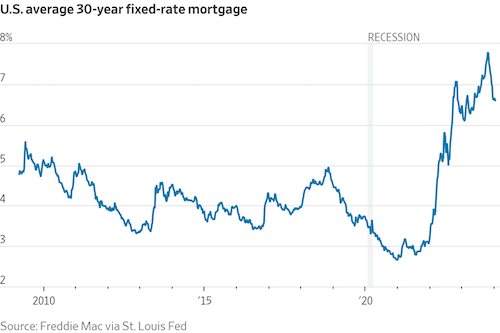

— Despite the current cold weather and snowfall across much of the country, natural gas prices continue to decline. These prices are currently approximately 15% lower than they were a year ago. One of the contributing factors to this decline is the robust production of natural gas, which has resulted in an excess supply of the fuel.

— Panama Canal faces up to $700 million loss in 2024 due to low water levels. In 2024, the Panama Canal is facing significant impacts due to low water levels, and these impacts are expected to result in financial losses. The Panama Canal Administrator, Ricaurte Vásquez, has stated that the new cuts to service caused by the low water levels are projected to cost between $500 million and $700 million. To address the low water levels, the Panama Canal will reduce the daily number of ship crossings. Under normal conditions in the previous year, there were 38 ship crossings per day. However, in 2024, this number is expected to be reduced to 24 ship crossings per day. The first quarter of the waterway's fiscal year has already seen a 20% decrease in cargo and 791 fewer ships passing through the canal compared to the same period in the previous year. These declining numbers and associated costs have led to a 36% reduction in ship crossings within the Panama Canal.

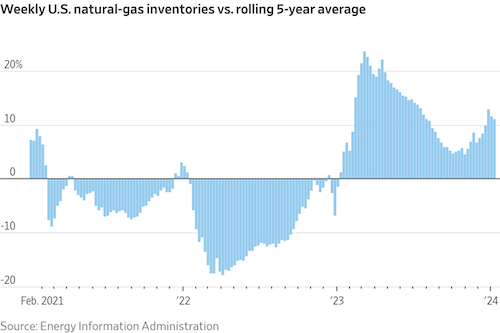

— Red Sea conflict disrupts shipping; Europe faces economic impact. The conflict in Europe's neighboring region is causing disruption for the second time in three years. Recent attacks by Houthi rebels on cargo ships in the Red Sea have prompted many carriers to choose the longer and more expensive route around Africa via the Cape of Good Hope for safety. These detours are driving up freight costs and causing concerns for retailers about stock shortages. Some factories have even halted production due to a lack of essential parts, according to the Wall Street Journal (link).

Of note: ““The Red Sea is not as dangerous to global trade as the events were a few years ago.” — Patrick Lepperhoff, a consultant with Inverto, a unit of BCG.

— USDA daily sale: 297,000 MT soybeans to China during 2023-2024 marketing year.

— Ag trade update: South Korea purchased 66,000 MT of optional origin corn.

— They abducted a river in California. And it wasn’t even a crime. During California’s recent drought, officials went to great lengths to safeguard water. That wasn’t enough to prevent farmers in the state’s agricultural heartland from draining dry miles of a major river for almost four months, the New York Times reports (link).

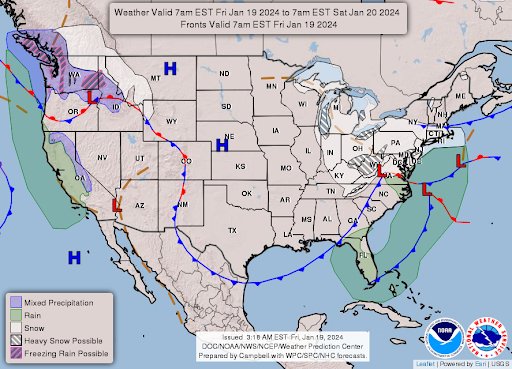

— NWS weather outlook: Another arctic air intrusion spreading into much of the central to eastern U.S.... ...Heavy precipitation moving into much of California for the weekend with heavy snow along the Sierra Nevada... ...Significant icing possible today and early Sunday through the Columbia River Gorge in the Pacific Northwest... ...Accumulating snows spreading from the Midwest into the Mid-Atlantic... ...Lake-effect snows remain active into Saturday.

Items in Pro Farmer's First Thing Today include:

• Mild followthrough buying in grains overnight

• Cattle on Feed Report out this afternoon

|

CONGRESS |

— House, to avoid DC snowstorm today, votes Thursday to approve CR, sending it to President Biden. We now know what can finally get House GOP leaders to schedule a vote: a weather forecast predicting several inches of snow. The House again cleared a stopgap spending measure (March 1 for some departments including USDA and March 8 for others). More Democrats voted for the measure than Republicans. The House voted 314 to 108 to approve the stopgap funding just hours after the Senate provided overwhelming bipartisan backing for the measure in a 77-to-18 vote, allowing lawmakers to narrowly beat a Friday deadline.

With the additional time, members of the House and Senate Appropriations Committees hope to push through the dozen bills funding the government according to the $1.66 trillion spending level agreed to. But lawmakers from both parties are having trouble dividing up the funding among the departments and work cannot continue until that task is completed.

— The House and Senate are not in session, with the House out all next week. But the House Ways and Means Committee may still mark up the bipartisan tax deal today, weather permitting.

— House Ag Chairman issues clarification on farm bill timing. In comments to Agri-Talk that will air this morning, Rep. G.T. Thompson (R-Pa.) tried to clear up some of his own confusing comments in remarks to Bloomberg earlier this week regarding action on a new farm bill. Here is how Thompson’s update went on Agri-Talk:

Agri-Talk’s Chip Flory asked Thompson: “Are we going to see a Chairman’s Mark of the bill by early February?”

Thompson: “No, there was some miscommunications. What I talked about (to Bloomberg) was that we would need a three week … three consecutive weeks at whatever point we can accomplish that. February does not… the congressional schedule would not allow that to occur. So that was a miscommunication. We’re working hard on this as you know. We’ve spent more than two years listening to producers and stakeholders so that we can write policies informed by the very people impacted by it. And we’re still waiting… Some of the things that are key, we really need to have the Congressional Budget Office complete its financial analysis. They’ve been really good with a lot of the titles, but they’re just not completely finished yet. What it really comes down to as I am looking at the congressional schedule is that we need three consecutive weeks to be able to get this done.”

Comments: The House is mostly in three straight weeks from Jan. 29-Feb. 12. They are out four days during that period. Then it is the first three weeks of March, so while Thompson did not specifically say March for the Chairman’s Mark, the three-week timeline he mentions occurs in early March.

Bottom line: Until there is an agreement to fund the government through the end of fiscal year 2024, and there is a decision made on a potential supplemental/border enforcement measure, it is hard to see action on a new farm bill.

Chip: How has it been working with Speaker Johnson. Is he encouraging you to push the timeline on the farm bill?

Thompson: “It has been outstanding. Speaker Johnson is so supportive. He’s voted for past farm bills. He’s been supportive on agriculture issues and personally he’s been very encouraging of me and my leadership so I’ve got a great partner when it comes to … .actually all our leadership. Leader Scalise, Whip Emmer, Conference Chair Stefanik. I’m blessed with a leadership team that are all in on this farm bill that recognize how important it is to this country, to food security, to national security, to economic security. I think in general the farm bill is seen as one of the most significant bipartisan accomplishments that we can achieve in the 118th Congress.”

Chip: So, when do you think you might be able to move the bill out of committee then?

Thompson: “Well, that depends on the Congressional Budget Office. We are absolutely dependent on them giving us the final estimates and projections. We are expecting here within a couple… well uh… I don’t know if it will be next week but sometime soon the most recent baseline projection for the farm bill and that will be significant, that will be a very useful piece of information. I have certainly enlisted the Speaker and his staff support of joining me and just really encouraging the Congressional Budget Office to provide their full attention to the farm bill.”

Chip: Regarding Title I funding… making some updates to the reference prices. Sen. Stabenow *D-Mich.) made mention of the need to update the ARC and PLC. Is that still the biggest hurdle for the overall bill?”

Thompson: “Well, it’s a significant amount of money and I certainly believe we need to do that. How much we can do and what improvements we’ll be able to accomplish is part of the remaining task of where we can find the financial resources. There’s no new money available really to invest in the current needs beyond those identified within our jurisdiction. That said, current and future needs cost money. This farm bill, Chip, has really come together in a real strong bipartisan way in terms of priorities. I would say tripartisan. I like to say that because of the voice of the American producer and processor as well. So how much we’re able to accomplish will really be driven by where we can find those additional financial resources. And yes, an update to Title I is an appropriate update. A minimal update is a significant amount of money and I think we want to do more than just a minimal update under Title I.”

Chip: Chairwoman Stabenow sent out a letter to her colleagues. Is it right that she is considering a proposal that would beef up crop insurance but would require row crop farmers to choose between the subsidized crop insurance and the ARC or PLC programs?

Thompson: “Well, I’m not sure about her proposal. Senator Stabenow is a good friend, the chairwoman on the Senate side, and she’s doing what she feels she needs to do. Obviously, we’re kind of focusing on what we believe is the best way to approach this. Overall, I do think it’s important to … one of the things that we could do when it comes to crop insurance is make it more affordable and more affordable for everyone. I think it has one of the biggest returns on investment. It is probably the number one need certainly that I heard traveling the country [at] over 80 different congressional listening sessions over the past two years and that is to protect and strengthen crop insurance.”

|

RUSSIA/UKRAINE |

— Russia: No prospect of reviving Black Sea grain deal. The Kremlin said there was no prospect of reviving the Black Sea grain deal and that alternative routes for shipping Ukrainian grain carried huge risks. These comments came after Ukraine’s ambassador to Turkey said on Thursday “certain negotiations” were underway regarding the UN-brokered Black Sea grain export initiative.

|

POLICY UPDATE |

— GAO criticizes USDA for inadequate reporting on foreign farmland ownership. A report (link) from the Government Accountability Office (GAO) criticized USDA's efforts to collect, track, and share data regarding foreign purchases of U.S. farmland under the Agricultural Foreign Investment Disclosure Act (AFIDA) of 1978. The GAO called for USDA to enhance its procedures, including providing data to the Committee on Foreign Investment in the U.S. (CFIUS) and improve data verification and monitoring.

While the USDA agreed with most GAO recommendations, it disagreed with certain steps, such as incorporating country information from additional foreign persons beyond the primary investor. This report is expected to influence further exploration of the topic by lawmakers through hearings and more.

|

CHINA UPDATE |

— Annual foreign investment flows into China shrinks first time since 2012. Foreign direct investment (FDI) into China fell 8% 1.13 trillion yuan ($157.1 billion) in 2023, the first annual decline since 2012. That underscores the challenge Beijing faces in trying to win back foreign firms as Western governments talk up “de-risking” with China.

— More corn, sorghum, soybean and cotton sales to China. USDA weekly Export Sales data for the week ended Jan. 11 reported 2023-24 activity including net sales of 60,000 metric tons of corn, 199,214 metric tons of sorghum, 465,113 metric tons of soybeans, and 227,7008 running bales of upland cotton. For 2024, net sales of 5,209 metric tons of beef and 88 metric tons of pork were reported.

|

TRADE POLICY |

— USITC upholds duties on phosphate fertilizers from Morocco and Russia, tariffs reduced. The UN International Trade Commission (USITC) has maintained its 2020 decision to impose duties on imports of phosphate fertilizers from Morocco and Russia. However, the Department of Commerce (DOC) reduced the tariffs from 19.97% to 7.41%. The U.S. Court of International Trade will review this remand decision, and the DOC will make another decision later this year through an administrative review process. The petition to the USITC was brought by the U.S. fertilizer company Mosaic, alleging unfair trading practices by Morocco and Russia had harmed their business.

|

POLITICS & ELECTIONS |

— Charlie Cook on Donald Trump: “Some Never Trumpers would lie down on the tracks, if need be, to try to derail Donald Trump’s third consecutive GOP nomination. Certain journalists will use every bit of their creativity to conjure up “but-if” scenarios that result in another nominee. But there was little in the results of the Iowa caucuses on Monday to support any conclusion other than Trump’s inevitability.”

|

OTHER ITEMS OF NOTE |

— Biden administration to forgive $5 billion in student debt for 74,000 borrowers. Among them, approximately 44,000 are teachers, nurses, firefighters, and public service workers who have earned forgiveness after 10 years of service. The remaining 30,000 have been in repayment for at least 20 years but have not received relief through income-driven repayment plans. The exact timeline for when eligible borrowers will receive this relief has not been disclosed. President Biden's administration has now forgiven more than $136 billion in student debt, despite a previous Supreme Court ruling against his plan to cancel up to $20,000 of student loans per borrower.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |