U.S. Trade Gap Below Forecasts

USDA pays out over $1 bil. in bird flu payments | Ga. dairy plant signals transformative shift in industry

|

Today’s Digital Newspaper |

MARKET FOCUS

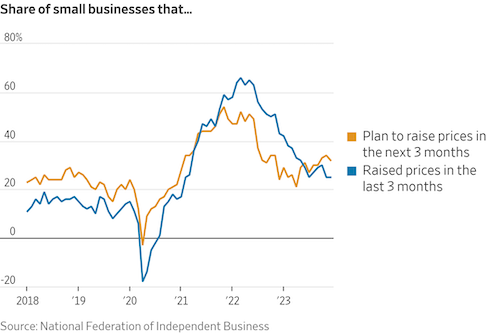

- U.S. trade deficit continues narrowing trend

- Red Sea freight traffic falls by 46%

- Bitcoin rose above $47,000 for the first time since April 2022

- Fed Governor Bowman believes inflation has not slowed enough to consider rate cuts

- Bostic: Fed ‘in a strong position’ on inflation battle

- SGH Macro Advisors: Fed could potentially cut rates as aggressively as it raised them

- IRS will start accepting federal income tax returns for the year 2023 on Jan. 29

- Eurozone unemployment rate fell to historic low in November

- Moderate salary raises for American workers in 2024

- Inflation expectations in U.S. have improved significantly

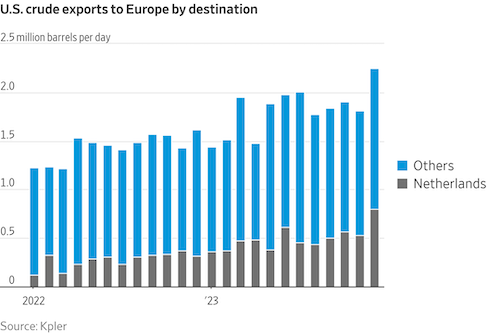

- Europe increasingly reliant on American oil

- Ag markets today

- India may see around $30 bil/ shaved off total exports in current fiscal year

- Ag trade update

- Natural disasters caused more than $250 billion worth of damage last year

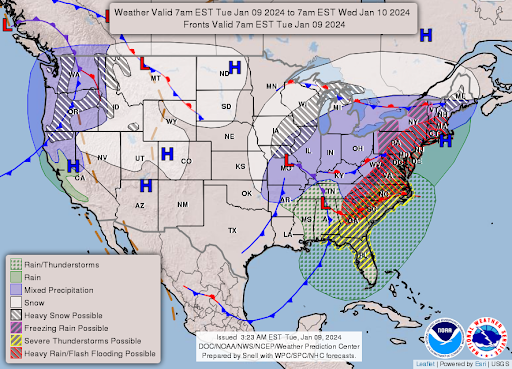

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- House GOP conservatives note opposition new fiscal year (FY) 2024 funding deal

- Senate border talks facing difficulties

ISRAEL/HAMAS CONFLICT

- About one in every 100 people in Gaza killed since war began

RUSSIA & UKRAINE

- White House meets with tech firms on Ukraine aid

POLICY

- Payments for Phase 2 of ERP steadily increasing

- USDA still has not released payment data for 2022

- Biden admin set to issue final rule regarding the classification of "gig" workers

PERSONNEL

- Biden won’t accept an Austin resignation if offered .

- Mitch Landrieu, infrastructure coordinator, to help lead Biden’s re-election campaign

- Biden on Monday renominated Julie Su to be secretary of Labor

CHINA

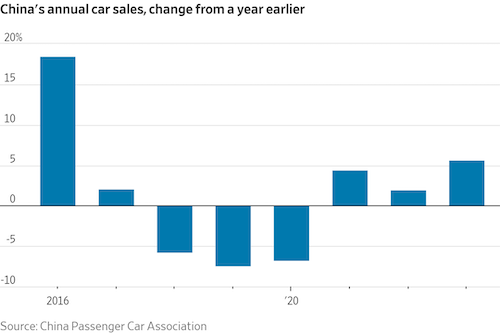

- China surges to the top of global auto exports

- Xi vows ‘no mercy’ as he deepens graft fight in key sectors, including ag

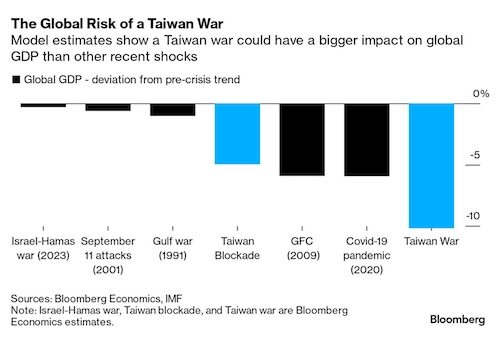

- Xi, Biden and the $10 trillion cost of war over Taiwan

- PBOC may use RRR cuts, other tools to boost economy

- Chinese online gaming tycoon ranks as major U.S. landowner

TRADE POLICY

- USDA allocates over $203 million to boost U.S. ag exports in 2024

ENERGY & CLIMATE CHANGE

- EPA grants nearly $1 billion for low-emission school buses

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- South Korea passes law which will end farming and sale of dog meat by 2027

- SCOTUS upholds poultry firms' judgment sharing agreement in price-fixing litigation

- USDA spent over $1 billion on bird flu outbreaks in two years.

POLITICS & ELECTIONS - Rep. Larry Bucshon (R-Ind.) announces his retirement

- 84-year-old Rep. Steny Hoyer (D-Md.), to seek re-

- Calif. Gov. Newsom (D) sets May 21 for special election re: McCarthy’s prior seat

OTHER ITEMS OF NOTE

- Buenos Aires inflation was 21% in December and 198% in 2023

- More than 31,000 Chinese citizens picked up crossing illegally into U.S. from Mexico

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed overnight. U.S. Dow opened around 210 points lower, then plunged around 300 points lower before recovering some of the losses. In Asia, Japan +1.2%. Hong Kong -0.2%. China +0.2%. India flat. In Europe, at midday, London -0.1%. Paris -0.4%. Frankfurt -0.5%.

U.S. equities yesterday: All three major indices ended in positive territory Monday after the Dow started the day with losses. The Dow ended up 216.90 points, 0.58%, at 37,683.01. The Nasdaq rose 319.70 points, 2.20%, at 14,843.77. The S&P 500 gained 66.30 points, 1.41%, at 4,763.54. The Dow was tempered by Boeing, which fell 8% on the day after the FAA grounded the company's 737 Max 9 planes after one of the jets flown by Alaska Airlines was forced to make an emergency landing on Friday. Meanwhile, United Airlines confirmed that it found loose bolts on an undisclosed number of its 737 Max 9 aircraft.

— Brent oil prices tanked Monday as Saudi Arabia cut its sale price. On Sunday, rising supply and competition from rival producers prompted Saudi Arabia to cut the February official selling price (OSP) of its flagship Arab Light crude to Asia to the lowest level in 27 months. "That's raising concerns about demand in China and global demand as well," Price Futures Group analyst Phil Flynn said. Brent traded down $2.64 or -3.4% to close at $76.12. WTI traded up $3.04 or 4.1% to close at $70.77.

— Bitcoin rose above $47,000 for the first time since April 2022 with U.S. regulators seen close to approving the introduction of ETFs that invest directly in the digital asset.

— Agriculture markets yesterday:

- Corn: March corn fell 5 3/4 cents to $4.55 and marked a fresh contract low early on.

- Soy complex: March soybeans fell 10 3/4 cents to $12.45 1/2 but closed well off session lows. March soymeal dropped 90 cents to $368.5 after making a three-month low early in the session. March soyoil rallied 18 points to 47.81 cents, despite making a seven-month low earlier in the session.

- Wheat: March SRW wheat closed down 19 3/4 cents at $5. 96 1/4 and near the session low. Prices closed at a five-week low close. March HRW wheat closed down 12 3/4 cents at $6.15 1/4, nearer the session low and hit a six-week low. March spring wheat futures fell 9 1/2 cents to $7.02 1/2, marking a six-week low.

- Cotton: March cotton rose 23 points to 80.24 cents, a mid-range close.

- Cattle: February live cattle fell 62 1/2 cents to $169.95 and near the session low. Prices hit a five-week high early on. March feeder cattle closed up 92 1/2 cents at $225.075 and near mid-range.

- Hogs: February lean hog futures rallied 60 cents to $70.60, while deferred contracts saw greater gains.

— Ag markets today: Corn, soybeans and wheat recouped a portion of Monday’s losses during overnight trade. As of 7:30 a.m. ET, corn futures were trading around a penny higher, soybeans were mostly 3 to 5 cents higher, SRW wheat was 3 to 4 cents higher, HRW wheat was 5 to 7 cents higher and HRS wheat was mostly 5 to 6 cents higher. Front-month crude oil futures were more than $1.50 higher, and the U.S. dollar index was around 180 points higher.

Weather adds uncertainty to cash cattle trade. Cash cattle prices averaged $174.01 last week, up $1.77 from the previous week and the third consecutive increase. Expectations are cash cattle will trade higher again this week, though the first major winter storm of the season across the central U.S. adds uncertainty as some plants could reduce slaughter runs, especially with margins deep in the red.

February hogs extend premium to cash index. The CME lean hog index is down 11 cents to $65.74 (as of Jan. 5), marking back-to-back mild declines after two days of gains last week. February lean hog futures finished Monday at a $4.86 premium to today’s cash quote.

— Quotes of note:

- Fed Governor Michelle Bowman reiterated that she believes inflation has not slowed enough to consider rate cuts. "Should inflation continue to fall closer to our 2% goal over time, it will eventually become appropriate to begin the process of lowering our policy rate to prevent policy from becoming overly restrictive. In my view, we are not yet at that point," Bowman said. "Important upside inflation risks remain."

- Bostic: Fed ‘in a strong position’ on inflation battle. Atlanta Federal Reserve Bank President Raphael Bostic said inflation has come down more than he expected and is on a path to reaching the Fed’s 2% goal, though it’s too early to declare victory. “We are on a path to 2% today,” Bostic said Monday in a speech to the Rotary Club of Atlanta. “The goal is to make sure we stay on the path.” Bostic noted the Fed “is in a strong position,” adding policymakers can continue to let monetary policy remain restrictive. Bostic repeated his expectation for two rate cuts this year.

- The Federal Reserve could potentially cut interest rates as aggressively as it raised them, according to Tim Duy, the chief U.S. economist at SGH Macro Advisors. Duy suggests that Federal Reserve Chair Jerome Powell acted swiftly to raise interest rates to combat rising inflation. However, with signs of inflation easing, the Fed may consider reversing those rate hikes at a similar pace. Duy highlights that the urgency to reduce rates could intensify if the Fed believes it is facing low inflation, similar to how it reacted to high inflation concerns two years ago. Additionally, concerns about the employment mandate could also drive the Fed to take swift action.

— The IRS announced it will start accepting federal income tax returns for the year 2023 on Jan. 29. If you're not someone who likes to file early, the regular deadline for submitting your tax return and paying any taxes owed is April 15. However, some tax filers may have later deadlines due to state holidays or extensions granted following natural disasters. When it comes to receiving tax refunds, the IRS typically issues them within 21 days after they accept your tax return. The good news is that most tax filers usually receive money back. Last year, out of the more than 160 million tax returns filed, the IRS issued nearly 105 million refunds. On average, these refunds amounted to $3,050, as per IRS filing statistics.

— Eurozone unemployment rate fell to historic low in November. The seasonally adjusted jobless rate in the Eurozone reached 6.4%, which matched June's historic low and slightly exceeded the market's anticipated rate of 6.5%. This decrease was accompanied by a drop of 99,000 unemployed individuals from the previous month, bringing the total to 10.970 million. Additionally, the youth unemployment rate, representing those under 25 years old actively seeking employment, decreased to 14.5% from the previous month's 14.8%.

Among the major Eurozone economies, Spain reported the highest jobless rate at 11.9%, followed by Italy at 7.5% and France at 7.3%. In contrast, Germany and the Netherlands had the lowest unemployment rates at 3.1% and 3.5%, respectively.

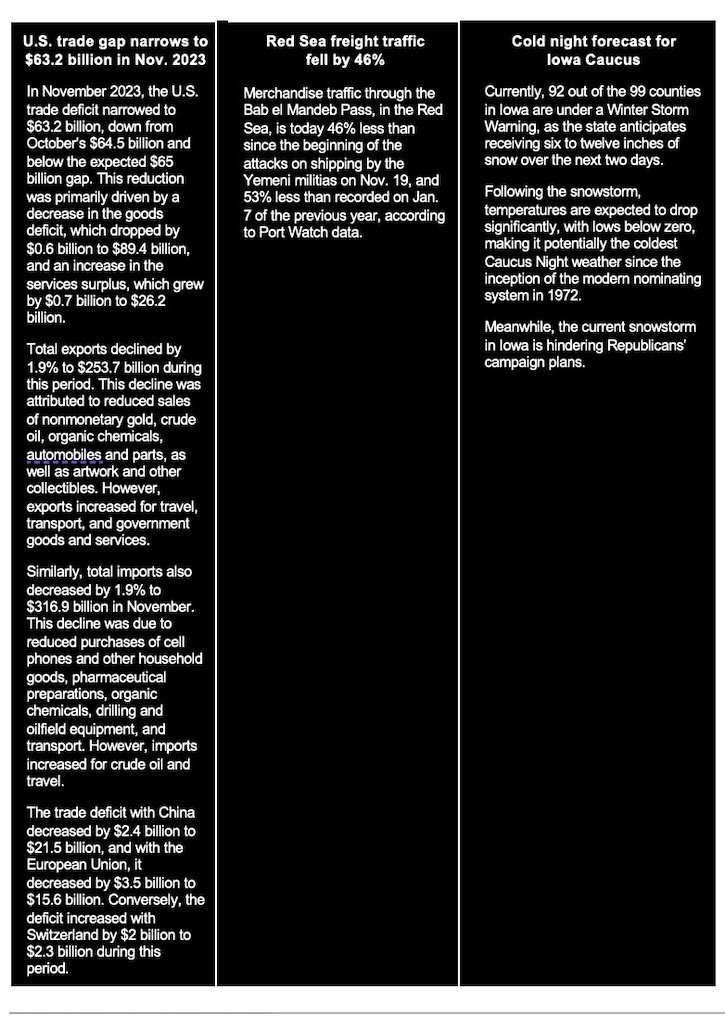

— Moderate salary raises for American workers in 2024. In 2024, American workers are likely to receive smaller pay raises compared to previous years. On average, companies are planning for salary increases of 4% for the year, as reported in a December survey of over 1,800 employers conducted by advisory firm Willis Towers Watson. This represents a decrease from the 4.4% raises given out in 2023 but is still notably higher than the average 3% increases observed in the years before the Covid-19 pandemic. Several factors contribute to these moderate pay increases. A cooling job market and reduced inflation have provided companies with the opportunity to offer less substantial raises while still aiming to attract and retain employees. Link to more via the Wall Street Journal.

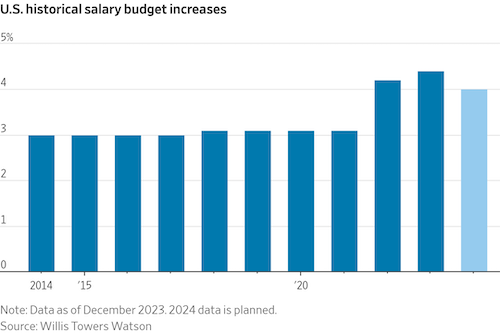

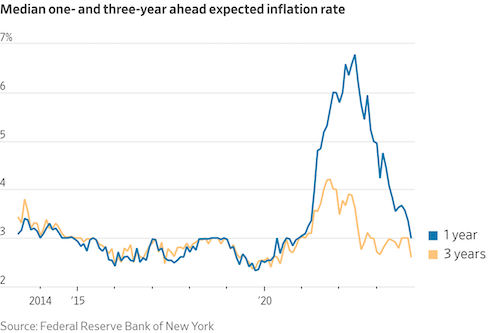

— Inflation expectations in the U.S. have improved significantly. According to a survey by the Federal Reserve Bank of New York (link), American consumers now anticipate a 3% increase in prices for the current year. This marks the lowest level of year-ahead inflation expectations since January 2021. Additionally, consumers foresee an annual inflation rate of 2.6% over the next three years, the lowest prediction since mid-2020. This development is likely welcomed by Federal Reserve officials who believe that public expectations play a crucial role in influencing inflation. When households and businesses expect persistent high inflation, it is more likely to become a reality.

But high and rising prices are still a challenge for many across the economic landscape. A National Federation of Independent Business survey (link) of small-business owners found that almost one-quarter said inflation was their single-biggest problem and nearly one-third planned to raise prices in the coming three months.

Market perspectives:

— Outside markets: The U.S. dollar index was higher, with the euro, yen, and British pound weaker against the greenback. The yield on the 10-year U.S. Treasury note rose, trading around 4.05%, with a mixed tone in global government bond yields. Crude oil futures continued to gain, with U.S. crude at around $72.60 per barrel and Brent at around $77.95 per barrel. Gold and silver futures were up, with gold around $2,042 per troy ounce and silver around $23.34 per troy ounce.

— Europe is increasingly reliant on American oil, as tankers delivered a record quantity of U.S. oil to the continent last month. This highlights the United States' role as Europe's energy supplier during times of uncertainty. In December, the European Union and the United Kingdom collectively imported nearly 2.3 million barrels of crude oil per day, as reported by ship-tracking company Kpler. This amount is nearly double what they imported in the months preceding Russia's invasion of Ukraine, which had a significant impact on global energy markets. Link to more via the Wall Street Journal.

— India may see around $30 billion shaved off its total exports in the current fiscal year, as threats to cargo vessels in the Red Sea lead to a surge in container shipping rates and prompt exporters to hold back on shipments. Link to more via Bloomberg.

— Ag trade update: South Korea purchased 135,0000 MT of corn — 67,000 MT expected to be sourced from South America and 68,000 MT expected to be sourced from the U.S., South America or South Africa. Algeria tendered to buy up to 120,000 MT of Argentine corn. Japan is seeking 89,260 MT of milling wheat in its weekly tender. Egypt tendered to buy an unspecified amount of wheat from multiple origins. Tunisia tendered to buy 50,000 MT each of optional origin durum wheat and feed barley.

— Natural disasters caused more than $250 billion worth of damage last year, the hottest on record, with less than half of it being covered by insurance. Link for details via Bloomberg.

— NWS weather outlook: Major storm system will hammer the Eastern U.S. with widespread heavy rain, strong winds, and severe thunderstorms on Tuesday into early Wednesday... ...Unsettled weather conditions continue for the Western U.S. with much colder temperatures arriving for the Northern Plains.

Items in Pro Farmer's First Thing Today include:

• Mild corrective buying in grains overnight

• Cordonnier keeps South American crop estimate unchanged

|

CONGRESS |

— House GOP conservatives are expressing opposition to the new fiscal year (FY) 2024 funding deal, but their ability to block it appears limited. Senate leaders from both parties support the deal, with Senate Minority Leader Mitch McConnell (R-Ky.) telling Bloomberg that Congress is on track to avoid a shutdown by the Jan. 19 deadline. House Democrats are also expected to support the package, as Minority Leader Hakeem Jeffries (D-N.Y.) praised it, and his caucus had previously approved these spending levels.

There is significant support for the deal in both chambers, including from many House Republicans who want to avoid a government shutdown. There would be obstacles if the House attempts to attach conservative policy riders.

Democrats suggested they had gotten the better of the deal and were able to achieve their original goal of holding the line on their push for $772 billion in nonmilitary spending. “And that $772 billion was precisely the number we reached,” Senate Majority Leader Chuck Schumer (D-N.Y.) said on the Senate floor on Monday. “Not a nickel — not a nickel — was cut.”

Schumer and Treasury Secretary Janet Yellen also sought to downplay the impact of $10 billion in accelerated cuts to IRS enforcement funding won by House Speaker Mike Johnson (R-La.) Instead of being spread across two years as initially agreed, $20 billion in cuts would be imposed this fiscal year. Since it was awarded $80 billion through the Inflation Reduction Act, the IRS has been racing to modernize its antiquated technology and beef up its teams of tax collectors to crack down on tax evasion. Yellen expressed optimism that even if some of the funds were taken away, those efforts would be able to proceed. “In the short run, certainly the medium run, the IRS would be able to continue its important work in modernizing our tax system,” she told reporters after an event in Virginia.

Bottom line: Speaker Johnson faces a daunting task in getting a deal to fund the government over the finish line amid strenuous opposition from conservatives and rebels in his conference. The Speaker, elected just a few months ago after his predecessor was tossed for working with Democrats to fund the government, is now himself likely to rely on the minority party in the House to get his deal approved over outrage from his right flank.

— Senate border talks aimed at crafting an immigration-policy-for-foreign-aid deal are facing difficulties. Sen. James Lankford (R-Okla.), one of the key negotiators, announced that there would be no framework agreement reached this week due to numerous unresolved issues. The main point of contention is the presidential asylum authority known as parole, which Republicans are seeking to limit significantly. Restricting parole, which allows presidents to temporarily admit migrants for humanitarian or other reasons, is a sticking point for many progressives. So far, the Biden administration has not shown any willingness to compromise on this issue.

|

ISRAEL/HAMAS CONFLICT |

— About one in every 100 people in Gaza has been killed since the war between Israel and Hamas began in October. The death toll in Gaza surpassed 22,800 this week, according to Palestinian statistics, as Israel faces pressure to minimize civilian casualties. Meanwhile, Israeli forces are maintaining their strikes in the wake of the Oct. 7 Hamas attack when militants killed more than 1,200 people, mostly civilians, and kidnapped some 200 others. As of last week, the Israeli government believed 132 hostages from the attack were still being held in Gaza, of whom dozens are thought dead.

|

RUSSIA/UKRAINE |

— White House meets with tech firms on Ukraine aid. White House officials held a meeting with representatives from Palantir Technologies, Anduril Industries, Fortem, Skydio, and other defense companies to discuss advanced battlefield technologies that could support Ukraine in its efforts to resist Russia's invasion. Reports note the discussions were not intended to replace the urgently needed funding currently stalled by congressional Republicans but aimed to gather insights from these companies about the capabilities they are developing.

|

POLICY UPDATE |

— Payments for Phase 2 of the Emergency Relief Program (ERP) have been steadily increasing, reaching $874.54 million by Jan. 8, distributed among 10,218 recipients. This reflects a rise from the previous week when payments amounted to $854.57 million for 10,182 recipients. The total ERP payments have now reached $8.33 billion, while Phase 1 payouts have remained relatively stable at $7.45 billion. Of note: USDA has not released any payment data for the 2022 ERP initiative at this time.

— Biden administration is set to issue a final rule regarding the classification of "gig" workers, determining when they should be considered employees rather than independent contractors. This rule will be published on Jan/ 10, with it taking effect on March 11. It mandates that employers provide specific benefits and protections to workers currently categorized as contractors, including minimum wages, overtime pay, unemployment insurance, and Social Security benefits.

Acting Labor Secretary Julie Su stated that the rule aims to create a fair playing field for businesses, safeguard workers' right to fair compensation, and recognize the crucial role played by true independent contractors in the economy.

This new rule will overturn a 2021 rule from the Trump administration that made it easier for companies to classify workers as independent contractors. It requires businesses to consider various factors, such as a worker's potential for profit or loss, the level of control exerted by the company over the worker, and whether the worker is an integral part of the company's operations.

The U.S. Chamber of Commerce has indicated its intention to likely challenge the rule in court. Companies like Uber and Lyft had expressed concerns about the rule, which could have forced them to classify drivers as employees rather than contractors. However, CR Wooters, head of Uber federal affairs, stated that the rule does not significantly change the legal framework under which the ride-share company operates.

|

PERSONNEL |

— Biden won’t accept an Austin resignation if offered. President Joe Biden is not considering firing Defense Secretary Lloyd Austin after he did not tell the White House about his emergency hospitalization, four senior administration officials told Politico. “Austin’s going nowhere,” one of the senior administration officials said.

— Mitch Landrieu, the White House infrastructure coordinator, is stepping down to help lead the president’s re-election campaign.

— President Biden on Monday renominated Julie Su to be secretary of Labor. She has served as acting secretary of the department since last year amid continued opposition to her nomination by all Republican senators and two Democrats.

|

CHINA UPDATE |

— PBOC may use RRR cuts, other tools to boost economy. Chinese officials indicated they may lower the amount of money banks must set aside as reserves to boost lending, even after the central bank provided a massive amount of liquidity via other tools in recent weeks. The People’s Bank of China (PBOC) may use open market operations, medium-term lending facilities and reserve requirements among other monetary policy tools to provide “strong” support for reasonable growth in credit, Zou Lan, head of PBOC’s monetary policy department told the Xinhua news agency. PBOC will strengthen its counter-cyclical and cross-cycle policy adjustments to create favorable financial conditions for the country’s economic growth, according to Zou.

Of note: Zou made similar public comments in July before the central bank cut the so-called reserve requirement ratio, or RRR, in September.

— China food security: agricultural corruption crackdown ‘far-reaching,’ state broadcaster says. The South China Morning Post reports (link) that a “corruption crackdown in the agricultural sector of a key northernmost province has ‘far-reaching’ significance when it comes to ensuring China’s food security, according to a four-part documentary series by state broadcaster CCTV.” A total of 1,011 cases of corruption have been filed and 1,367 officials in Heilongjiang province disciplined as of November, according to the second episode of the series produced by CCTV and China’s anti-corruption agency, the Central Commission for Discipline Inspection (CCDI), which aired on Sunday.

— Chinese online gaming tycoon ranks as major U.S. landowner. Chinese national Chen Tianqiao, who amassed his wealth through online gaming, is now one of the most prominent non-American landowners in the United States. Chen owns a substantial 198,000 acres of timberland in Oregon, ranking him as the country's 82nd-largest property owner, according to the Land Report (link). Foreign ownership of U.S. land, especially land utilized for farming, has become a politically sensitive topic in recent years, with approximately 40 million acres of American agricultural land owned by non-U.S. entities as of 2021. Link to more via Bloomberg.

Of note: The country’s biggest landowner is the Emmerson family, owners of timberland empire Sierra Pacific Industries, followed by billionaires John Malone, Ted Turner and Stan Kroenke.

— China becomes top global auto exporter with record overseas sales in 2023. China has seen a remarkable increase in its overseas auto sales, reaching a record high last year. This growth puts China on track to surpass Japan and become the world's largest auto exporter, signifying a significant shift in the global auto industry. Although China is already recognized as a leader in electric vehicles, the surge in overseas sales was primarily driven by traditional gasoline-powered cars, with particularly strong demand in Russia. Chinese car manufacturers capitalized on the departure of Western automakers from the Russian market after the conflict in Ukraine, selling at least five times as many vehicles in Russia in 2023 compared to the 160,000 sold in 2022. Link to details via the WSJ.

— A China invasion of Taiwan would cost the world economy $10 trillion — about 10% of global GDP, Bloomberg Economics estimated (link). That would dwarf the blow of the Ukraine war, Covid pandemic and the global financial crisis.

|

TRADE POLICY |

— USDA allocates over $203 million to boost U.S. ag exports in 2024. USDA’s Foreign Agricultural Service (FAS) announced investments totaling over $203 million in nearly 70 agricultural organizations for the expansion of export markets for U.S. food and agricultural products in the fiscal year (FY) 2024. This support is provided through the Market Access Program (MAP) and the Foreign Market Development (FMD) program.

The funding breakdown is as follows:

- Market Access Program (MAP): FAS will allocate $174.3 million to 68 nonprofit organizations and cooperatives for fiscal year 2024. These funds are directed towards consumer promotion, including brand promotion for small businesses and cooperatives. The organizations supported by MAP use the funding extensively for promoting various agricultural products such as fruits, vegetables, nuts, processed goods, and bulk commodities. On average, each MAP participant contributes more than $2.50 for every $1 in federal funding.

- Foreign Market Development (FMD) Program: FAS will provide $27 million for fiscal year 2024 to 20 trade organizations representing U.S. agricultural producers. The focus of the FMD program is on generic promotion of U.S. commodities, rather than promoting specific branded products. Priority is given to organizations that represent entire industries or have a nationwide membership and scope. These organizations typically contribute more than $2.50 for every $1 in federal funding they receive through the program.

USDA has published the list of organizations that will receive MAP (link) and FMD (link) awards for fiscal year 2024. These programs play a crucial role in expanding the export potential of U.S. agricultural products, contributing significantly to the agricultural industry and the broader U.S. economy.

Additionally, USDA has introduced a new program called the Regional Agricultural Promotion Program (RAPP), which complements the funds announced for FY 2024. RAPP will provide $1.2 billion to assist exporters in reaching non-traditional markets and maintaining relationships in existing markets. This initiative encourages exporters to establish and grow their presence in markets with rising demand for U.S. products. Applications for the first tranche (link) of RAPP funding, totaling $300 million, are open until Feb. 2, 2024, with projects allowed to extend up to five years.

|

ENERGY & CLIMATE CHANGE |

— EPA grants nearly $1 billion for low-emission school buses. EPA granted approximately $1 billion to 67 recipients to replace their school bus fleets with low-emission buses. This funding contributes to a total investment of nearly $2 billion, benefiting 280 school districts in 37 states, to support the transition to cleaner energy buses. EPA Administrator Michael Regan emphasized the positive impact of this policy, citing the enthusiasm of students experiencing their first rides on clean school buses.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— South Korea passed a law which will end the farming and sale of dog meat by 2027. The consumption of dog meat has grown unpopular in recent years and faced increasing resistance from animal-rights campaigners. According to a Gallup poll from 2023, less than a fifth of South Koreans now say that they support the practice. Dog meat stew, called "boshintang,” is considered a delicacy among some older South Koreans, but the meat has fallen out of favor with diners and is no longer popular with young people. Under the new law the consumption of dog meat itself will not be illegal.

— Supreme Court upholds poultry companies' judgment sharing agreement in price-fixing litigation. The U.S. Supreme Court decided not to review a lower court ruling regarding an agreement among major poultry companies to share the cost of any judgments in price-fixing litigation cases. This case involves Armory Investments LLC v. Tyson Foods Inc. and pits large poultry companies against poultry purchasers, including retailers and food companies. The Supreme Court's decision leaves in place a May 2022 ruling by Judge Thomas Durkin of the U.S. District Court for Northern Illinois that upheld a judgment sharing agreement (JSA) among 14 poultry companies. These companies, including Tyson Foods and Perdue Farms, agreed to collectively share any costs arising from ongoing broiler chicken price-fixing lawsuits brought by purchasers.

— USDA spent over $1 billion on bird flu outbreaks in two years. Since the onset of bird flu outbreaks nearly two years ago, USDA has allocated over $1 billion for compensating farmers for lost flocks and containing the spread of the viral disease, according to the Food and Environmental Reporting Network, citing a spokesperson for the Animal and Plant Health Inspection Service

The primary expenditure, totaling $715 million, was directed towards indemnities for depopulated birds and eggs, benefiting producers, growers, and integrators.

An additional $183 million was used for culling and disposing of flocks and virus elimination efforts.

The remaining expenses, estimated at approximately $130 million, covered associated personnel, contractors, state agreements, and field costs.

Among the major recipients of indemnities, Jennie-O Turkey Store, a subsidiary of Hormel Foods, received the largest sum, totaling $74.8 million. Other prominent recipients included Rembrandt Enterprises of Iowa with $27.9 million, Sunrise Farms of Iowa with $25.8 million, MG Waldbaum of Minnesota with $25.2 million, and Tyson Foods of Arkansas with $24.3 million.

Facts and figures. USDA indicates that overall, since 2022 over 79 million birds have been impacted, with a notable increase to 11.4 million last month, up from 1.3 million in October.

UC Davis Professor Dr. Maurice Pitesky tells CBS News (link) that these figures are worrying, and there's a potential for another rise in poultry and egg prices. "This is, at some level, an existential issue for the commercial poultry industry," said Dr. Pitesky. "It's going to take some time for the industry to adapt to this new reality. But unfortunately, I think, we're in kind of a new world in the United States with respect to the risk."

Of note: These ongoing outbreaks of highly pathogenic avian influenza represent the largest animal disease event in the history of the United States.

— Walmart's $350 million dairy plant in Georgia signals transformative shift in industry. Walmart's intention to construct a $350 million dairy processing facility in Georgia has the potential to bring about a significant change in the dairy industry, particularly in the Southeastern United States. Instead of relying solely on suppliers, the largest food retailer in the U.S. plans to buy milk directly from farmers. This shift in approach could have transformative implications for the dairy sector, analysts note. Link for details via Tank Transport.

|

POLITICS & ELECTIONS |

— Rep. Larry Bucshon (R-Ind.) announced his retirement, bringing the total number of House members not seeking re-election Nov. 5 to 37. This group comprises 15 Republicans and 22 Democrats. Among the retiring Democrats, 13 are running for higher office, primarily Senate seats, while only four of the 15 departing House Republicans are pursuing other roles in public service.

— 84-year-old Rep. Steny Hoyer (D-Md.), a former House majority leader, will file paperwork for re-election today. It would be his 23rd term. Hoyer, who is on the Appropriations Committee, cited securing funding for the FBI headquarters as unfinished business he wants to conclude.

— California Gov. Gavin Newsom (D) set May 21 for a special election to fill the House seat formerly held by Republican Rep. Kevin McCarthy (R-Calif.), who retired from Congress Dec. 31 after his colleagues ousted him as Speaker.

|

OTHER ITEMS OF NOTE |

— Buenos Aires inflation was 21% in December and 198% in 2023. There were increases of 760% in some products. On Thursday, the national data for last year will be known, through Indec. Argentina has already surpassed all the rest of the Latin American countries, since Venezuela registered a price increase of 193% last year; the lowest inflation in the region was observed in Ecuador, with 1.3%.

— In the first 11 months of 2023, more than 31,000 Chinese citizens were picked up by law enforcement crossing illegally into the U.S. from Mexico, government data show — compared with an average of roughly 1,500 per year over the preceding decade.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |