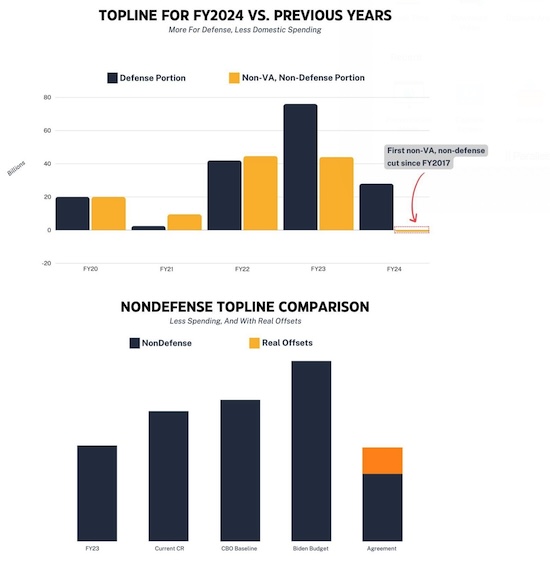

U.S. Inflation Data This Week Could Dampen Rate Cut Expectations

Study: Soda taxes slash sugar-sweetened beverage consumption by one-third in five cities

|

Today’s Digital Newspaper |

MARKET FOCUS

- Economists grapple with short-term relief & long-term concerns amid annual gathering

- Trucking banking on order volumes rebounding this year

- 19.6% of office space in major U.S. cities wasn’t leased as of the fourth quarter

- WTI crude futures falls more than 3% to below $71.50 per barrel

- Report: Carriers entering agreements with the Houthis to avoid attacks

- Boeing stock falls nearly 9%; Spirit Aerosystems, maker of Max 9’s door panel, sinks

- Ag markets today

- India’s ag exports to rise despite curbs on wheat, rice and sugar

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Congress reaches $1.6 trillion spending deal amid criticism and shutdown uncertainty

ISRAEL/HAMAS CONFLICT

- U.S. rewards for disintegration of Hamas

- U.S. officials fret about expanded conflict between Israel and Hezbollah in Lebanon

- Hezbollah says one of its commanders was killed in a strike in Lebanon

RUSSIA & UKRAINE

- Ukrainian grain exports so far in 2023-24 marketing year at 19.4 MMT

POLICY

- German farmers protest against government's plan to phase out subsidies

PERSONNEL

- Sec. of Defense Austin resumes full duties after spending time in military hospital ICU

CHINA

- China sanctions five U.S. defense industry companies

- China tells LGFVs to stop issuing offshore 364-day bonds

- China to sell pork from state

- China detains foreign consultant for alleged spying for Britain

- Xi’s solution for China’s economy risks triggering new trade war

- U.S. intelligence shows flawed China missiles led Xi to purge army

TRADE POLICY

- Philippines extends reduced pork tariffs, boosting U.S. exports

ENERGY & CLIMATE CHANGE

- Guidebook by American Farmland Trust aims to understand ag carbon markets

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Michigan football coach Jim Harbaugh raises chickens with dedication

- What’s the best time to eat dinner?

- Study: Soda taxes cut sugar-sweetened beverage consumption one-third in five cities

HEALTH UPDATE

- FDA approved mass drug imports from Canada for first

- FDA reports discovering "high level" of chromium in recalled cinnamon applesauce

- J.P. Morgan Healthcare Conference important annual event in healthcare industry

POLITICS & ELECTIONS

- Taiwan's crucial election on Saturday comes amid China's pressure

- Link to our Special Report on elections being held in 2024

- President Biden preparing ambitious second-term agenda

- Democratic lawmakers worry about Biden debating former President Trump

OTHER ITEMS OF NOTE

- Missing part of Alaska Airlines aircraft discovered in Portland backyard

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed overnight. U.S. Dow opened around 140 points lower. In Asia, Japan closed. Hong Kong -1.9%. China -1.4%. India -0.9%. In Europe, at midday, London -0.3%. Paris flat. Frankfurt +0.2%.

U.S. equities Friday: All three major indices managed modest advances Friday in the wake of the Employment report, snapping multiple day losing streaks for the Nasdaq and S&P 500. But Friday's gains were not enough to keep the indices from ending with losses in the first week of trading in 2024. The Down lost 0.6%, the Nasdaq dropped 3.2% while the S&P 500 declined 1.5%. On Friday, the Dow rose 25.77 points, 0.07%, at 37,446.11. The Nasdaq was up 13.77 points, 0.09%, at 14,524.07. The S&P 500 added 8.56 points, 0.18%, at 4,697.24.

— Earnings season kicks off with Wall Street banks and some other U.S. financial heavyweights the focus this week. BlackRock, Citigroup, JPMorgan Chase, Wells Fargo, BNY Mellon and Bank of America will all report fourth-quarter figures on Friday. Analysts will be watching the banks for non-performing loans (actual and provisions) and whether investment banking at last picked up at the end of a dismal year. They will also want to know whether net interest income is starting to be squeezed again.

— Agriculture markets Friday:

- Corn: March corn futures dropped 5 3/4 cents to $4.60 3/4, marking a 10 1/2 cent loss on the week.

- Soy complex: March soybeans fell 12 1/4 cents to $12.49 3/4, a 48 1/4-cent loss on the week. March soymeal fell $6.80 to $369.40, down $16.60 from a week ago, while March soyoil fell 53 points to 47.63 cents, marking a 55-point drop week-over-week.

- Wheat: March SRW wheat futures rose 2 1/2 cents to $6.16 and near mid-range. For the week, March SRW fell 12 cents. March HRW wheat futures gained 2 1/4 cents at $6.28, near mid-range and for the week down 14 cents. March spring wheat rose 3/4 cent to $7.12 but lost 11 1/2 cents on the week.

- Cotton: March cotton rose 7 points to 80.19 cents but lost 81 points on the week.

- Cattle: February live cattle futures fell 55 cents to $170.575 and nearer the session low. On the week, prices rose $2.075. March feeder cattle futures dropped $1.50 at $224.15, nearer the session low and for the week up $1.05.

- Hogs: Hog futures advanced again Friday, although the spring and summer contracts led the way higher. Nearby February hogs rose 95 cents to $70.00. That represented a weekly gain of $2.025.

— Ag markets today: Grain futures posted two-sided trade overnight, though markets are mostly weaker this morning. As of 7:30 a.m. ET, corn futures were steady to a penny lower, soybeans were mostly 2 to 4 cents lower, SRW wheat was 9 to 10 cents lower, HRW wheat was 5 to 6 cents lower and HRS wheat was mostly 2 to 3 cents lower. Front-month crude oil futures were around $2.00 lower, and the U.S. dollar index was modestly firmer.

Wholesale beef prices halt price drop. Choice boxed beef prices firmed $1.26 on Friday, while Select was 71 cents higher, halting the recent price drop in wholesale prices. With cutting margins deep in the red, packers will try to manage near-term slaughter needs as best they can without having to aggressively bids for supplies.

Cash hog index ticks down. After consecutive days of gains, the CME lean hog index ticked down a penny to $65.85 (as of Jan. 4). February lean hog futures finished last Friday $4.15 above today’s cash quote, which may limit buying until there are clearer signs of a seasonal low in the cash market.

— Of note:

- The trucking industry, which saw many layoffs and several big bankruptcies in 2023 after a pandemic period when the market ballooned, is banking on order volumes rebounding this year. Many companies also expect more truckers to leave the road, which would help drive up freight rates. “We still have too much carrier capacity,” said Dave Bozeman, CEO of freight broker C.H. Robinson Worldwide, which matches available loads with truckers.

- 19.6%: The share of office space in major U.S. cities that wasn’t leased as of the fourth quarter, according to Moody’s Analytics, up from 18.8% a year earlier and the highest number since at least 1979, which is as far back as Moody’s data goes. The record amount of vacancies reflects years of overbuilding and shifting work habits that were accelerated by the pandemic.

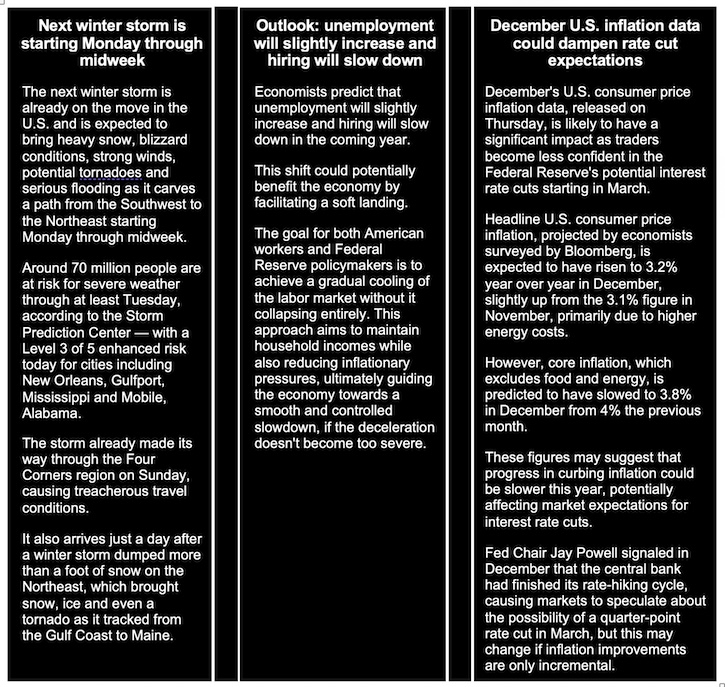

— Economists grapple with short-term relief and long-term concerns amidst annual gathering. The annual gathering of the nation's top economists brought mixed sentiments. On one hand, they are relieved that the U.S. is seemingly on track for economic growth in the short term instead of facing a recession. However, their concerns shift towards the long-term outlook and whether growth will surpass pre-pandemic levels. They find themselves perplexed by their earlier failure to anticipate what appears to be a "soft landing" — an economy with controlled inflation and no recession. Link to more via the WSJ.

Several factors have contributed to this unexpected outcome. Many of the economic wounds inflicted by the pandemic have healed, including immigration and labor force participation, leading to sustained job growth and moderated wage increases. Additionally, supply chain disruptions have largely been resolved, contributing to a more stable economic environment.

But concerns linger about inflation not fully returning to the Federal Reserve's 2% target, which could necessitate further interest rate adjustments. Investors are anticipating rate cuts by the Fed, starting in March, which is twice the projection made by Fed officials in December.

When looking at the long-term horizon, economists are less optimistic. They believe that merely returning to pre-pandemic trends will not substantially boost long-term growth. Sustainable growth must stem from productivity improvements to counteract challenges like an aging population, global conflicts, and fragmented international trade.

Hurdles ahead. Policymakers must be mindful of the potential negative repercussions of reversing productivity gains resulting from globalization and free-trade agreements, as protectionist measures can hinder economic growth.

Market perspectives:

— Outside markets: The U.S. dollar index was little changed with the yen and British pound both slightly weaker against the greenback. The yield on the 10-year U.S. Treasury note was rising, trading above 4% at around 4.05%, with a firmer tone in global government bond yields. Crude oil futures were under significant pressure, with U.S. crude around $71.25 per barrel and Brent around $76.30 per barrel (see next item). Gold and silver were registering sharp losses ahead of US trading, with gold around $2,027 per troy ounce and silver around $23.08 per troy ounce.

— WTI crude futures fell more than 3% to below $71.50 per barrel on Monday, paring gains from last week as Saudi Arabia announced that it will cut key crude prices for buyers in all regions for February amid a softening demand outlook. Rising oil supply from OPEC and non-OPEC producers also raised the likelihood of a market surplus this year. A Reuters survey showed that output from OPEC rose 70,000 barrels per day in December to 27.88 million bpd.

— Carriers are entering agreements with the Houthis to avoid attacks. Several sources in the Middle East confirm to ShippingWatch that the first shipping lines have made agreements with the Houthis to prevent their ships from being attacked in the Red Sea. Link for details.

— India’s ag exports to rise despite curbs on wheat, rice and sugar. India’s agricultural exports will rise in 2023-24 despite limits on wheat, rice and sugar, the country’s trade minister said. “We had agri exports in the aggregate of about $53 billion in 2022-23, and we expect the number to increase in the current year despite the restrictions placed on export of rice, wheat or sugar,” trade minister Piyush Goyal said. Data from state-run trade body APEDA showed exports of meat and dairy, cereal preparations and fruits and vegetables rose between April and November.

— Ag trade update: Jordan tendered to buy up to 120,000 MT of optional origin milling wheat.

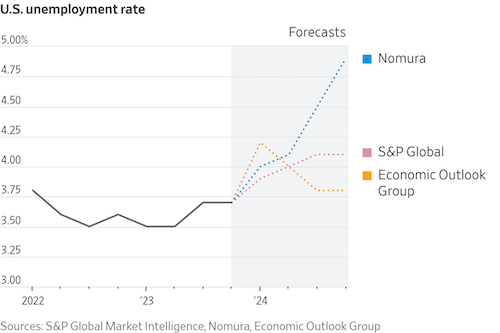

— NWS weather outlook: A Major Storm will produce widespread, significant impacts over much of the U.S. this week... ...A Major Winter Storm will bring several feet of snow to the Washington and Oregon Cascades through Tuesday.

Items in Pro Farmer's First Thing Today include:

• Grains mostly weaker this morning

• Generally favorable South American weather outlook

• China resumes state wheat reserve sales

• Eurozone economic sentiment reaches seven-month high

|

CONGRESS |

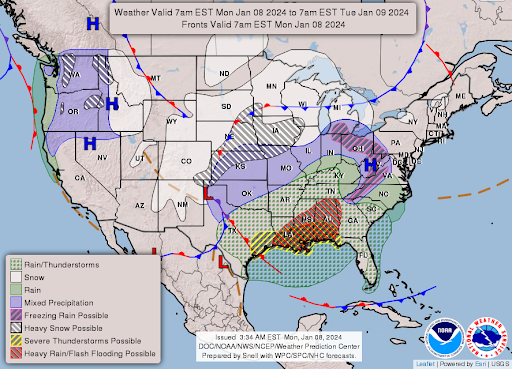

— Congress reaches $1.6 trillion spending deal amid criticism and shutdown uncertainty. The agreement, however, faced criticism from conservatives, and it's unclear if lawmakers can swiftly pass legislation to prevent a government shutdown. Both the House and Senate have limited time to craft bills to fund the government. The deal leaves several key issues unresolved, which could lead to tensions between House Speaker Mike Johnson (R-La.) and his conservative faction. The House Freedom Caucus said (link) the deal was “even worse than we thought.”

The agreement aims to prevent a government shutdown ahead of the January 19 deadline. Still, lawmakers need to finalize all 12 spending bills for federal agencies within a tight schedule. Money runs out for some agencies in January and for the rest in February, which could disrupt federal functions and payments.

Even if House lawmakers resolve internal issues, they have little time to align differences between the House and Senate versions.

Regarding border security and funding issues, Senate negotiators are addressing important changes related to asylum standards and the cap on humanitarian parole admissions — a group of bipartisan senators hopes to release its proposal to tighten U.S. border laws later this week, with any deal likely to face an uphill battle in the sharply divided Congress.

Biden administration measures have enabled the admission of hundreds of thousands of migrants into the United States. Another key issue under negotiation is whether migrants should be required to remain in a safe third country they passed through on their way to the U.S. border. These policy changes have the potential to significantly impact border-related matters.

Spending cuts take effect after April 30 if lawmakers can’t formalize the budget by then but instead pass another short-term funding resolution. The Congressional Budget Office said that could lead to broad reductions of 5% to 9% for nondefense funding.

Link/pdf to Speaker Johnson statement.

Link/pdf to Democratic leaders’ statement.

Link to our special report issued Sunday about the FY 2024 spending agreement.

|

ISRAEL/HAMAS CONFLICT |

— U.S. rewards for the disintegration of Hamas. The State Department launched a reward of up to $10 million for information leading to the disruption of the Hamas terrorist group's financial mechanisms and the arrest of key figures involved. The Department, a statement notes, is seeking information on several Hamas “financial facilitators” such as Abdelbasit Hamza Elhassan Mohamed Khair, known as “Hamza,” who from Sudan has managed numerous companies in the terrorists' investment portfolio and was previously involved in the transfer of almost $20 million to the group.

— U.S. officials are concerned that an expanded conflict between Israel and Hezbollah in Lebanon could be difficult to succeed and could have serious consequences due to Hezbollah's capabilities and the potential involvement of other actors in the region, such as Iran. Additionally, there are concerns about the impact on civilians in both Lebanon and Israel if such a conflict were to occur. The U.S. is actively working to prevent a full-blown war and seeking diplomatic solutions to reduce tensions.

Of note: Hezbollah said one of its commanders was killed in a strike in Lebanon, adding to concerns over a wider war as Israel battles Hamas in Gaza. In a statement, Hezbollah identified the commander as Wissam Hassan Al-Tawil and said he was killed in a strike in Khirbet Selm, a village in southern Lebanon that is about nine miles from the Israeli border.

Meanwhile, On Sunday, Israel's president said the resettlement of Palestinians out of Gaza is "absolutely not" Israel's position. It comes after some Israeli Cabinet members called for the forced displacement of Palestinians in parts of the Strip. The UN says that nearly 90% of the 2 million people living in Gaza have been forcibly displaced from the enclave since the Oct. 7 Hamas attack.

Israeli Defense Minister Yoav Gallant, in an interview with the WSJ (link), offered a stark assessment of the dangers he says his country is facing, signaling a potentially lengthy conflict in Gaza and an enduring shift in Israel’s defense posture.

|

RUSSIA/UKRAINE |

— Ukrainian grain exports so far in the 2023-24 marketing year are at 19.4 million metric tons (MMT), down from nearly 23.6 MMT at this point in the 2022-23 season, according to the Ukrainian Agriculture Ministry. Of the total, ministry data indicated that included 10.3 MMT of corn, 7.8 MMT, of wheat, and 1.2 MMT of barley. As of Jan. 9, 2023, total exports included 13.3 MMT of corn, 8.6 MMT of wheat, and 1.7 MMT of barley. Exports so far in January are at 1.03 MMT with no year-ago comparison given.

|

POLICY UPDATE |

— German farmers have launched protests against the government's plan to phase out subsidies, leading to road blockages with tractors across the country. The main point of contention is the government's intention to eliminate two tax breaks that farmers currently benefit from, providing them with approximately 900 million euros ($980 million) in annual savings. Farmers argue that these proposed cuts could threaten their livelihoods. The government had initially planned to end these subsidies abruptly, but it has since adjusted its approach due to budget constraints following a court ruling that invalidated the national budget. The modified plan involves a gradual reduction of the tax break for agricultural diesel: a 40% reduction in 2024, followed by a 30% reduction in 2025, and complete elimination in 2026.

|

PERSONNEL |

— Secretary of Defense Lloyd Austin has resumed his full duties after spending time in a military hospital ICU, but President Biden wasn’t informed of his hospital stay for days, administration officials say. Austin was hospitalized on Jan. 1 for complications resulting from an elective medical procedure, the Pentagon said Friday, but the White House was unaware of his hospitalization until Thursday, according to multiple reports. Austin, who was still hospitalized as of Saturday night, spent four days in intensive care, according to NBC, while Deputy Defense Secretary Kathleen Hicks partially took over some of his responsibilities, Politico reported, citing a senior Defense Department Official. The Pentagon also reportedly withheld the information from top Defense Department officials, telling some that he was working from home for the week, and did not notify Congress until 15 minutes before his hospitalization was made public in a Pentagon statement Friday evening, Politico reported.

Sen. Tom Cotton (R-Ark.) warned there would be “consequences” for Austin, while the Pentagon Press Association asserted in a statement “Secretary Austin has no claim to privacy in this situation.”

The Pentagon attributed the information lapse to an “evolving situation” and “medical and personal privacy issues,” while Austin admitted an err in judgment and said he “commit[s] to doing better” in a statement.

|

CHINA UPDATE |

— China sanctioned five U.S. defense industry companies, in an apparent response to the latest approvals of roughly $300 million in possible military sales to Taiwan.

— China tells LGFVs to stop issuing offshore 364-day bonds. Chinese regulators have told heavily indebted local government financing vehicles (LGFVs) to stop issuing offshore bonds with a 364-day duration, closing a regulatory loophole that had allowed them to increase borrowing further last year, four sources familiar with the matter told Reuters. LGFVs were set up by Chinese local governments to fund infrastructure investment, and their combined debt has ballooned to roughly $9 trillion, posing a major risk to a slowing economy. The latest guidance comes after a rush by many LGFVs to raise 364-day offshore bonds, seemingly in a bid to circumvent regulation that requires them to seek approval for offshore borrowings with maturities longer than a year.

— China to sell pork from state reserves. China will release 30,000 MT of frozen pork from state reserves on Jan. 10. Late last year, China made a series of pork purchases to support declining hog prices.

— China detains a foreign consultant for alleged spying for Britain. The Ministry of State Security says the consultant collected intelligence and found people on behalf of MI6, Britain’s spy agency. Link for details via the New York Times.

— Xi’s solution for China’s economy risks triggering new trade war. China’s shift toward high value added manufacturing threatens to further raise trade tensions with the U.S., Europe and others. Link to more via Bloomberg.

— U.S. intelligence shows flawed China missiles led Xi to purge army. The corruption throughout the nation’s defense industrial base is so extensive that US officials now believe Xi is less likely to contemplate major military action in the coming years than would otherwise have been the case. Link to details via Bloomberg.

|

TRADE POLICY |

— Philippines extends reduced pork tariffs, boosting U.S. exports. The President of the Philippines, Ferdinand Marcos Jr., signed an executive order extending the reduced tariff rates on imported pork for the third consecutive year. The in-quota duty will remain at 15%, and the out-of-quota rate will be 25%. These measures were initially implemented in May 2021 in response to an African swine fever (ASF) outbreak, which led to a pork shortage in the country. The Philippines had lowered import duties from 30% and 40% and increased the minimum access volume (MAV) to 254,210 metric tons (MT) from 54,210 MT.

This policy has significantly boosted U.S. pork exports to the Philippines, reaching a record of $205 million in 2021, representing a nearly 79% increase. However, after the increased MAV expired in January 2022, exports decreased to just under $135 million that year, with an estimated value of about $120 million in 2023. Despite the drop, these figures remain higher than historical levels.

Of note: The Philippines is a significant market in Asia with a population of over 109 million people who have a cultural preference for pork. The lowered tariffs have played a key role in driving increased U.S. pork exports to the country, making it one of the top 10 markets for American pork products.

|

ENERGY & CLIMATE CHANGE |

— Key points from a guidebook created by American Farmland Trust aims to understand agricultural carbon markets. These markets have been evolving rapidly and are used by corporations to meet their sustainability goals through the purchase of carbon credits generated by farmers adopting "climate-smart practices." The guidebook (link) provides a list of 10 important questions that farmers may want to consider when thinking about participating in agricultural carbon markets. These questions are divided into two sections:

Section 1: Background on How Ag Carbon Markets Work

- What is an ag carbon market and why are farmers being asked to join? This question seeks to provide an understanding of the purpose and significance of agricultural carbon markets.

- Just how many ag carbon markets are there and how do they differ? This question helps clarify the various agricultural carbon market programs and their distinctions, allowing farmers to make informed choices.

- What the heck is additionality, why is it so important, and how does it affect me? Additionality is a key concept in carbon markets, and this question explores its significance and implications for farmers.

- How is the government involved in agricultural carbon markets? This question addresses the role of government in regulating and facilitating agricultural carbon markets.

Section 2: Questions That Are Top of Mind for Farmers

- Am I eligible to participate? This question explores the eligibility criteria that farmers need to meet to engage in agricultural carbon markets.

- What are the current ag carbon markets paying for (practices or outcomes)? It delves into what exactly these markets are compensating farmers for, whether it's specific practices or the overall carbon reduction outcomes.

- They want to look at my what?! What information and access do I have to provide? This question addresses the data and information farmers may need to share with market participants and the access they must provide.

- How long are the contracts & who's liable if something goes wrong? Farmers need to understand the duration of their commitments and the liability implications in case of unforeseen issues.

- Money matters: How can I make a market work for me? This question focuses on financial aspects, helping farmers figure out how to maximize their benefits from participating in carbon markets.

- How do I know which carbon market is right for me and where can I get more information? Farmers are encouraged to assess their options and seek additional resources and information to make informed decisions about the right carbon market for their needs.

The guidebook also offers supplementary materials, such as infographics, and a glossary of terms to provide more insights and assist with understanding agricultural carbon markets. For a concise overview, a "Highlights" document is available (link), summarizing the key points from the guidebook.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Michigan football coach Jim Harbaugh raises chickens with dedication. Michigan football coach Jim Harbaugh has a surprising hobby — he's a dedicated backyard chicken farmer. Harbaugh, who is leading the Wolverines to the national championship game, is as passionate about his fowl as he is about football. His chickens provide a welcome distraction during a season marked by scandal. Quarterback J.J. McCarthy, who has relatives with chickens, described Harbaugh's hen house as a "five-star hotel for chickens." Link to more via the Wall Street Journal.

— What’s the best time to eat dinner? Your grandparents were onto something with those early-bird dinners: The best time to eat the evening meal is four hours before bedtime. Link to details.

— Soda taxes slash sugar-sweetened beverage consumption by one-third in five cities, study shows. A study (link) of five U.S. cities has found that the imposition of soda taxes led to a significant reduction in the consumption of sugar-sweetened beverages (SSBs), with an average decrease of 33%. The research, which analyzed years of sales data, supports the arguments of advocates for soda taxes, who claim that higher prices discourage the consumption of sugary drinks associated with obesity and chronic diseases like diabetes. The World Health Organization recommends limiting sugar intake to less than 10% of daily calories, ideally less than 5%.

Details: The study looked at the impact of soda taxes in Boulder, Colorado; Philadelphia, Pennsylvania; Oakland, California; Seattle, Washington; and San Francisco, California. It found that SSB prices increased by an average of 33.1% in the two years following tax implementation, resulting in an average price increase of 1.3 cents per ounce. SSB purchases also declined by an average of 33.0%, both in terms of volume and total purchases. Importantly, these changes occurred immediately after the implementation of the tax and were sustained over time. There was no evidence of increased cross-border purchases following the tax implementation. The study examined a total of 5,500 Universal Product Codes categorized as SSBs and included 26,338 stores, with 496 of them located in cities with SSB taxes, 1,340 in neighboring cities, and 24,502 in a "donor pool."

The American Beverage Association have voiced opposition to SSB taxes, arguing that they are unproductive and harm consumers. They claim that calorie intake from beverages has already decreased significantly in recent decades.

|

HEALTH UPDATE |

— FDA approved mass drug imports from Canada for the first time. The regulator allowed Florida to buy millions of dollars of medicines at far lower prices than the state would have to pay in the United States. The decision upends a policy that critics say kept drug prices high and overrides long-held objections from the pharmaceutical industry.

— FDA reported discovering a "high level" of chromium in recalled cinnamon applesauce pouches, which were previously found to be contaminated with lead and had caused illnesses in many children. The presence of chromium was detected in both the pouches and the cinnamon obtained from a facility in Ecuador associated with Austrofoods. FDA's Deputy Commissioner for Human Foods, Jim Jones, previously suggested to Politico that the contamination of these pouches might have been intentional, possibly for economic adulteration purposes. The FDA's investigation into this matter is still ongoing.

— J.P. Morgan Healthcare Conference (Jan. 8-11) is an important annual event in the healthcare industry, known for significant announcements and discussions. It typically features M&A (mergers and acquisitions) announcements, drug data results, and financial guidance updates that coincide with company presentations. JPMorgan anticipates that the key themes of this year's conference will revolve around the macroeconomic environment and the role of artificial intelligence (AI) in healthcare. These topics are expected to be prominent in the discussions.

|

POLITICS & ELECTIONS |

— Taiwan's crucial election on Saturday comes amid China's pressure; Vice President Lai Ching-te leads. In a pivotal presidential and legislative election, Taiwan voters are heading to the polls on Saturday, Jan. 13. China is increasing pressure on the island, particularly under the leadership of Taiwan's President Tsai Ing-wen, who is known for fostering an unofficial relationship with the United States. In the current race, Vice President Lai Ching-te, the successor candidate for the Democratic Progressive Party, is leading in polls. Lai's stance is openly disliked by Chinese officials, while two other candidates in the race are perceived as more inclined towards closer ties with Beijing. Despite never having governed Taiwan, China's Communist Party asserts territorial claims over the island. Chinese authorities express a desire for peaceful "reunification" but have not ruled out the use of force to assert control over Taiwan. Still, most China watchers believe a conventional Chinese invasion of Taiwan is highly unlikely in 2024, but tensions will remain high and will accelerate fears of shipping disruptions and boost military spending across Asia.

Link to our Special Report on elections being held in 2024.

— President Biden is preparing an ambitious second-term agenda, but the success of many of his plans depends on the outcome of congressional elections and the balance of power on Capitol Hill, the Wall Street Journal reports (link). While he achieved some significant legislative victories in his first term, certain proposals faced opposition from Republicans and moderate Democrats. If re-elected, Biden aims to revive these plans, including initiatives for tuition-free community college, prekindergarten, subsidized child care, and expanded assistance for the elderly and disabled. He also intends to push for an assault weapons ban, legislation to lower prescription-drug prices, and a bill to codify Roe v. Wade.

However, many of these proposals are expected to encounter substantial challenges in Congress unless Democrats can regain control of the House and maintain or expand their Senate majority. Therefore, Biden and his supporters are emphasizing the importance of voter support in upcoming elections. Nonetheless, Biden also seeks opportunities for bipartisan collaboration and has put forward policies like enhanced privacy protections for children and improved services for veterans, which he believes can garner bipartisan backing.

— Democratic lawmakers are expressing concerns about the possibility of President Biden debating former President Trump in the upcoming election, according to The Hill (link). Democrats fear that a debate between the two would only boost Trump's prominence as the likely GOP nominee. While Trump has skipped previous Republican primary debates, he has expressed eagerness to face Biden, even suggesting up to 10 debates. While some Democratic senators believe the decision to debate Trump rests with Biden and his campaign team, others argue that Biden need not feel obligated to debate him. They point to Trump's past behavior during debates and his refusal to engage with his Republican primary opponents. Not all Democrats share the view that Biden should avoid debating Trump. Some believe it would be damaging for Biden to avoid the debate and that such an event is expected of presidential candidates. They acknowledge that if Trump secures the GOP nomination, he will have gained legitimacy as a candidate. The Commission on Presidential Debates has already scheduled three general election debates for later in the year, but neither Biden nor Trump has committed to them yet.

|

OTHER ITEMS OF NOTE |

— The missing part of the Alaska Airlines aircraft that detached mid-flight has been discovered in a backyard in Portland. A schoolteacher reported finding the Boeing 737 MAX 9 fuselage door plug to the National Transportation Safety Board (NTSB). This part had gone missing when the aircraft took off from Portland on Friday, leading to a search operation by federal investigators. In response to this incident, the FAA (Federal Aviation Administration) ordered the grounding of all Boeing 737 Max 9 aircraft for thorough inspections. This decision came on Saturday, reflecting the seriousness of the situation. Additionally, the FAA, which serves as Boeing's primary regulator, is under intense scrutiny due to a recent series of airline delays and near-miss incidents between planes. The agency has faced criticism for granting aircraft manufacturers too much autonomy in the certification process. This incident adds to concerns about aviation safety and oversight in the industry.

Shares in Boeing fell nearly 9%, and Spirit Aerosystems, which makes the Max 9’s door panel, or “plug,” sank in premarket trading. Stock in Boeing, a major defense contractor, had risen sharply since war broke out in October between Israel and Hamas. But its shares remain well below the levels they hit in early 2019 on talk about the fuel-efficient Max.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |