Congress Returns Amid Two-Week Timeline to Clear Bills on Key Topics

USDA reports Friday | FAA orders temporary grounding of 171 Boeing aircraft | U.S. debt

Washington Focus

The Senate returns Jan. 8 and the House on Jan. 9. Their primary issues remain the same regarding (1) fiscal year 2024 funding, (2) aid to Ukraine, Israel and Taiwan, (3) border security and funding, and (4) continued work on a new farm bill, although not much on that is expected until at least the March timeframe.

Senators will hold full party meetings on Tuesday.

— House Speaker Mike Johnson (R-La.) has invited President Joe Biden to give his State of the Union (SOTU) address March 7. Link to letter. The SOTU is an annual message delivered by the president of the United States to a joint session of the United States Congress usually near the beginning of most calendar years on the current condition of the nation. This would be the latest SOTU address in a century.

Johnson said he was inviting Biden “in this moment of great challenge for our country.” Biden’s address is scheduled for after a pair of deadlines to avert a government shutdown. Funding for federal agencies that oversee programs for veterans, and on transportation, housing, agriculture and energy, is set to expire Jan. 19. Funding for the rest of the federal government, including the Pentagon, State Department and Homeland Security, will run out Feb. 2.

Of note: The SOTU address would come two days after Super Tuesday and three days after Donald Trump’s D.C. trial for conspiracy to subvert the 2020 election is set to begin.

— Biden administration concerned about potential gov’t shutdown amid border security and spending deadlock. Shalanda Young, the director of the Office of Management and Budget (OMB), expressed concerns about the possibility of a partial government shutdown in the United States due to a deadlock between Congress and the White House over border security and spending levels. Key points from her comments Friday at a breakfast in Washington hosted by the Christian Science Monitor:

- Shutdown concerns: Young is worried that the U.S. government may partially shut down later this month as Congress and the White House are unable to reach an agreement on border security and spending bills before the January 20 deadline.

- Daunting task: She describes the task of writing spending bills within the given timeframe as "daunting." Additionally, she mentions that some conservative Republicans are advocating for a government shutdown, which is concerning.

- Border security and immigration impasse: The deadlock between the White House and Republicans is primarily related to border security and immigration policy. GOP lawmakers are seeking changes in exchange for approving additional aid for Ukraine in its conflict against Russia's invasion. This impasse has also affected additional funds for Israel, Taiwan, and Indo-Pacific security.

- High probability of shutdown: The chances of a Jan. 20 shutdown are considered high because the new Speaker, Mike Johnson (R-la.), has vowed not to pass any more stopgap funding bills. If a shutdown occurs, several government departments would be affected, including USDA.

- Border crisis: The situation at the U.S.-Mexico border has become a significant challenge for President Joe Biden's reelection campaign, with historic numbers of encounters with migrants causing strain on the immigration system and local resources.

- Ukraine funding and border talks: Republicans have used Ukraine funding as leverage to push for concessions on immigration and border policy. Biden's attempts to secure additional funds for Ukraine before the holiday break were unsuccessful.

- Young's perspective: She indicates that the White House prefers to keep border talks separate from the government shutdown discussions. She also suggests that Speaker Johnson should get involved in discussions on the Senate side to find a solution.

- Funding levels and debt ceiling agreement: Talks about funding the government are stalled due to disagreements over the top-line funding level for fiscal year 2024. A debt ceiling agreement had set caps for the year, including a side deal for accounting moves, which some House Republicans reject.

- Leadership talks: Young says discussions between leaders are ongoing, but she did not provide specific details.

- Speaker Johnson's challenges: Young acknowledges the challenges Speaker Johnson faces within his caucus, including a narrow House majority and previous disputes over spending that led to changes in House leadership.

Of note: “Let me tell you what our top two priorities are right now,” Johnson told reporters last Wednesday. “In summary, we want to get the border closed and secured first, and we want to make sure that we reduce nondefense discretionary spending.”

— U.S. debt: $34 trillion… and rising. U.S. debt is rising along with interest costs to service it. Key things to know:

- Public debt above $34 trillion.

- Debt increasing no matter which political party is in control.

- Federal gov’t spending was $164 bil. higher during first two months of this fiscal year vs prior one, which means deficit this year could top last year’s $2 trillion.

- Debt as percentage of GDP approaching level at the end of World War II.

- Unemployment close to a postwar low when should be running budget surpluses, but instead running a deficit close to 6% of GDP.

- Foreigners reluctant to add to large U.S. gov’t bond holdings.

- Rating agencies warn, absent a change in policy direction, they’ll be forced to downgrade the country’s credit rating.

- Large deficits manageable when gov’t can finance itself at very low interest rates, but interest rates have risen.

- Gov’t must finance deficit and roll over its maturing debt at high interest rates.

- Net interest costs soared to $659 billion in fiscal year 2023, up $184 billion, or 39%, from the previous year and is nearly double from fiscal year 2020.

- Perspective: Cost of servicing debt about 30 cents of every tax dollar and will soon cost more than annual defense spending.

- Interest payments fastest-growing gov’t-budget spending item and could amount to around 3 ¼% of GDP by 2030.

- Impact: Interest payments expected to hit $1.4 trillion by FY 2033.

- U.S. will not default… Unlike other govts, which finance themselves in foreign currency, the U.S. gov’t finances itself in dollars. Means Fed can print the dollars to meet borrowing needs if foreign creditors go on a lending strike.

- Impacts: A recipe for a dollar crisis and another inflationary burst. This and the next item add up to a likely fiscal crisis ahead.

— Two other key issues Congress must deal with ahead:

- 2017 tax cuts expire end of 2025. These are not paid for and not in the budget baseline. To extend them all: $3.5 trillion over 10 years.

- Social Security and Medicare trust funds.

— U.S. Supreme Court to hear Trump's appeal on 2024 ballot removal. The U.S. Supreme Court agreed to hear former President Trump's appeal against a decision by Colorado's highest court, which ruled to remove him from the state's 2024 presidential ballot. The Colorado Supreme Court was the first to apply the 14th Amendment's insurrection clause to Trump's actions related to the Jan. 6 Capitol riot. This case is one of several legal challenges across the United States seeking to prevent Trump from appearing on future ballots.

The U.S. Supreme Court is set to hold oral arguments in the case on Feb. 8, following the Colorado Supreme Court's ruling earlier this month that temporarily stayed the decision until Jan. 4, pending further appellate proceedings. Per the Associated Press, that means the court’s final ruling on the matter could drop before Super Tuesday — when Colorado primary voters take to the polls.

— Scalise's medical leave and Johnson's resignation narrow House Republican majority. House Majority Leader Steve Scalise (R-La.) announced that he will undergo a stem-cell transplant and will be recovering outside of Washington until sometime in February. will work remotely this month before returning to Washington in February, according to his office.

Additionally, Rep. Bill Johnson (R-Ohio) is resigning effective Jan. 21 to assume the role of president at Youngstown State University.

Rep. Doug Lamborn became the latest House member to say he's heading for the exits, opening a solidly Republican seat around Colorado Springs that he's held since 2007. The announcement means all three seats currently held by Republicans in Colorado — those represented by Reps. Ken Buck, Lauren Boebert and Lamborn — will be open in 2024. Boebert is running for the seat currently held by Buck.

House Republicans currently control 220 seats following the resignation of former Speaker Kevin McCarthy (R-Calif.) on Dec. 31, while Democrats hold 213 seats. However, after Johnson's departure on Jan. 21, House Republicans will effectively have 218 votes, giving them a two-seat margin.

There is a special election scheduled for Feb. 13 in New York's 3rd District to replace former Rep. George Santos (R-N.Y.), who was expelled from the House on Dec. 1. Democrats are making a significant effort to win that seat, with former Democratic Rep. Tom Suozzi as their candidate.

Rep. Brian Higgins (D-N.Y.) is expected to resign in early February to become director of Shea’s Performing Arts Center in Buffalo.

— Impacts are increasing of ongoing attacks by Iranian-backed Houthi rebels in the Red Sea on the global economy and supply chains. Of note:

- Rerouting and increased costs: Due to the attacks, some of the world's largest logistics companies have stopped using the Red Sea transit route. As a result, shipments are being rerouted, adding approximately two weeks to each leg of the journey and costing about $1 million in additional fuel expenses for round trips between Asia and Europe. This has disrupted the normal flow of global trade through the Suez Canal, which typically handles about 12% of global trade.

- Rising shipping prices: The attacks have led to a significant increase in shipping prices. The cost of shipping a container from Asia to Northern Europe has risen by 173% since the attacks began, and prices from Asia to the Mediterranean have more than doubled. Additionally, the cost of insuring ships passing through the Red Sea has increased from 0.1% to 0.2% last month to about 0.5% of a ship's hull value.

- Steady oil prices: Despite a 40% drop in shipments of oil and refined products through the Suez Canal in December compared to October, oil prices have remained relatively stable. This is attributed to factors such as decreased demand for oil and high inventories of oil and gas. The price of Brent crude is approximately $79 per barrel, slightly lower than before the attacks began.

- Other supply chain threats: The Red Sea attacks are not the only threat to global supply chains. The Panama Canal, which handles about 5% of global trade, has restricted the number of vessels due to severe drought conditions. Continuing disruptions in global trade could lead to higher shipping costs, potentially passed on to consumers, at a time when inflation has already started to ease.

— Ukraine strikes Russian command post in Crimea, amid ongoing attacks. Kyiv's troops have reportedly destroyed a Russian command post at the Saky air base in western Crimea, according to Mykola Oleshchuk, Ukraine's air forces commander. However, specific details about the timing and method of the attack are not provided. Ukraine has recently launched missile attacks on various locations in Crimea, including the port of Feodosia, where they destroyed a large landing ship named "Novocherkassk."

Ukraine's claims cannot be independently verified. Russia's defense ministry stated that it intercepted and destroyed four missiles over the Crimean Peninsula after downing 35 drones the day before. Crimea, which Russia annexed from Ukraine in 2014, has been the target of ongoing Ukrainian drone and missile attacks. Despite not having its own warships, Ukraine is challenging Russia's naval superiority in the region. These attacks have forced Russia to move its ships away from potential harm, allowing Kyiv to maintain a shipping corridor in the Black Sea, facilitating grain exports even after Russia withdrew from the United Nations-backed Black Sea grain deal.

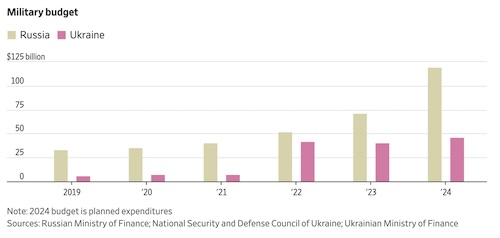

Russian President Vladimir Putin is wagering he can outlast Western support for Ukraine — if he can keep Russia’s war machine running, according to a Wall Street Journal article (link). Meanwhile, Russia’s military budget, at over $100 billion for 2024, is the highest it has been since Soviet times, growing by more than two-thirds from last year, according to the WSJ article. “Its manufacturing capacity has also overcome initial shortages to help Moscow’s war machine churn out weaponry for a lengthy campaign, often at the expense of civilian production.”

Economic Reports for the Week

Economic reports of note this week include updates on CPI (Thursday) and PPI (Friday). Other events include several Federal Reserve official speakers and on Wednesday, the World Economic Forum’s global risks report will be released in London.

Monday, Jan. 8

- Consumer credit likely rose to $9 billion in November, from $5.13 billion in the month before.

- Federal Reserve: Atlanta Federal Reserve Bank President Raphael Bostic to participate in moderated conversation on the economic outlook before the Rotary Club of Atlanta.

Tuesday, Jan. 9

- International trade likely expanded to a deficit of $65 billion in November from a deficit of $64.3 billion in October.

- Federal Reserve Vice Chair for Supervision Michael Barr will likely participate in a "Bank Regulation" moderated discussion with Women in Housing and Finance.

Wednesday, Jan 10

- MBA Mortgage Applications

- Federal Reserve: New York Federal Reserve Bank President John Williams will make keynote remarks at an event.

Thursday, Jan. 11

- Jobless Claims is expected to show initial claims for state unemployment benefits likely rose by 8,000 to a seasonally adjusted 210,000 for the week ending Jan. 6. Meanwhile, continued jobless claims for the week ended Dec. 30 is also due to be released.

- Consumer Price Index is likely to show that the CPI rose 0.2% in December after rising 0.1% in the month before. In the 12 months through December, the CPI is expected to climb 3.2%, following a 3.1% climb in November. Excluding the volatile food and energy components, the CPI is expected to rise 0.2% in December, slightly lower than the 0.3% rise in the prior month. The core CPI will likely gain 3.8% on a year-on-year basis in December.

- Fed Balance Sheet

- Money Supply

Friday, Jan. 12

- Producer Price Index likely rose 0.1% in December after remaining flat in November. In the 12 months through December, the PPI is expected to increase 1.3%. Excluding the volatile food and energy components, PPI likely edged up 0.2% in December after remaining flat the month before.

- Federal Reserve Bank of Minneapolis President Neel Kashkari is expected to participate in a fireside chat before the virtual 2024 Regional Economic Conditions Conference hosted by the Federal Reserve Bank of Minneapolis.

- China CPI, PPI for December

- JPMorgan Chase, the largest U.S. bank by assets, is expected to report results, with investors focusing on the bank's outlook for interest income growth and recovery in investment banking. Analysts expect the lender will hike its provisions to cover bad loans against an uncertain economy and focus on CEO Jamie Dimon's comments on the outlook for consumer spending in 2024.

- Citigroup is expected post a rise in the fourth quarter, as it continues with a broad reorganization plan. The bank is expected to detail out costs tied to overhaul and lay out plans to get its profitability in line with Wall Street rivals.

- Bank of America is expected to report a higher fourth-quarter profit, with investors closely looking at the second-large U.S. bank's outlook for interest income growth and consumer spending. Analysts are expected to focus on unrealized losses and economic and dealmaking recovery forecasts.

- Wells Fargo is expected to report a surge in fourth-quarter profit. Analyst and investor focus is expected on the fourth largest U.S. bank by assets provisioning more to cover potential losses in its commercial real estate portfolio and outlook for interest income as well as loan growth.

Key USDA & international Ag & Energy Reports and Events

In the ag sector: USDA’s World Agricultural Supply & Demand Estimates (WASDE) will be released on Friday. The International Grains Council’s monthly report and the Malaysian Palm Oil Board’s data on stockpiles, exports and production will also be published during the week.

Energy sector: The U.S. Energy Information Administration releases its monthly Short-Term Energy Outlook on Tuesday. China’s first batch of December trade data, including oil and gas statistics, is due at the end of the week

Monday, Jan. 8

Ag reports and events:

- Export Inspections

- Sugar production and cane crush data from Brazil’s Unica (tentative)

- Holiday: Japan, Russia

Energy reports and events:

- China Power and Energy Innovation Conference in Jiangsu

- Shell 4Q trading update

Tuesday, Jan 9

Ag reports and events:

- Field Crops, Statistical Bulletin

- Potatoes and Sweet Potatoes, Statistical Bulletin

- Rice Stocks, Statistical Bulletin

- Stocks of Grain, Oilseeds, & Hay, Statistical Bulletin

- EU weekly grain, oilseed import and export data

Energy reports and events:

- API weekly U.S. oil inventory report

- EIA releases monthly Short-Term Energy Outlook, or STEO

- Holiday: Panama

Wednesday, Jan. 10

Ag reports and events:

- Broiler Hatchery

- Livestock and Meat International Trade Data

- Malaysian Palm Oil Board monthly data on stockpiles, exports and production

- Malaysia Jan. 1-10 palm oil exports

- Brazil’s Conab issues production, area and yield data for corn and soybeans

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

Thursday, Jan. 11

Ag reports and events:

- Weekly Export Sales

- Meat Price Spreads

- U.S. Agricultural Trade Data Update

- Hogs and Pigs, Statistical Bulletin

- IGC monthly grains market report

- Malaysian Palm Oil Board economic review and outlook seminar, Kuala Lumpur

- Port of Rouen data on French grain exports

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

- ICE gasoil January futures expire

Friday, Jan. 12

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- WASDE

- Cotton Ginnings

- Crop Production

- Crop Production, Annual

- Grain Stocks

- Rice Stocks

- Winter Wheat and Canola Seedings

- Cotton: World Markets and Trade

- Grains: World Markets and Trade

- Oilseeds: World Markets and Trade

- World Agricultural Production

- Livestock and Poultry: World Markets and Trade

- Turkey Hatchery

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- China to issue first batch of December trade data, including oil and gas imports; oil products imports and exports

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |