China Clears Licenses for GMO Corn and Soybean Production

Xi says Taiwan reunification will ‘surely’ happen | Massachusetts seeks dismissal of Q3 animal welfare law challenge

|

Today’s Digital Newspaper |

MARKET FOCUS

- Many businesses will be operating with minimal staffing or closed

- Chicago Fed National Activity Index increased to +0.03 in Nov., notable improvement

- U.S. home prices surge 4.9% YOY in October 2023 amid supply shortage

- Ag markets today

- El Niño threatens rising prices for sweet raw materials

- H&P Report negative compared to expectations

- Cattle on Feed Report: Mildly negative but not likely market-moving

- Cold Storage Report: Pork stocks decline less than normal

- Ag trade update

- NWS weather outlook

ISRAEL/HAMAS CONFLICT

- Israel’s war cabinet discusses three-step plan put forward by Egypt

RUSSIA & UKRAINE

- Zelenskyy praises shooting down of two Russian fighter jets on Christmas Eve

- Russian grain crop second largest ever

POLICY

- White House: No need to prepare for automatic spending cuts yet

CHINA

- USTR extends exclusions on Section 301 tariffs on Chinese goods

- Soymeal for feed drops heavily in China

- China’s yuan is quietly gaining ground

- China economists expect slower 4.6% growth in 2024

TRADE POLICY

- USTR lets ITC decision to ban Apple Watches stand

- USTR adjusts sugar TRQ reallocations

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Massachusetts seeks dismissal of Q3 animal welfare law challenge

POLITICS & ELECTIONS

- Koch family, with donor network, supporting Nikki Haley in 2024 Republican primary

- Nikki Haley closes gap on Trump in New Hampshire primary race

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed overnight. U.S. Dow opened slightly lower then went slightly higher. The week between Christmas and New Year's typically sees a subdued financial environment, characterized by last-minute tax planning and closing of books. This pattern is expected to continue this year, as the economic calendar remains uneventful during this period. In Asia, Japan +0.1%. Hong Kong closed. China -0.7%. India +0.3%. In Europe, at midday, London closed. Paris closed. Frankfurt closed.

U.S. equities Friday: Wall Street extended its bull run to eight straight weeks. The Dow declined -0.05%, at 37,385.97. The S&P 500 rose 7.88 points, +0.17%, at 4,754.63. The Nasdaq rose 29.22 points, +0.19%, at 14,992.97.

For the week, the Dow rose 0.22%, the S&P gained 0.75%, and the Nasdaq climbed 1.21%.

— Benchmark 10-year Treasury yields ended slightly higher after data showed inflation moderating in November roughly in line with expectations, and as traders closed positions ahead of the long weekend.

— Many businesses will be operating with minimal staffing or closed, and many consumers will be on vacation in the days between Christmas on Monday and New Years on Monday, Jan 1.

— Agriculture markets Friday:

- Corn: March corn futures closed 1/2 cent higher to $4.73, though they lost 10 cents on the week.

- Soy complex: March soybean futures rallied 4 1/2 cents to $13.06 1/4, marking a 25 1/4-cent loss on the week. Nearby January futures rose 2 1/2 cents to $12.99 3/4. March meal futures rose $4.70 to $391.1, losing $5.50 on the week. March bean oil futures dropped 31 points to 49.02 cents, losing 113 points on the week.

- Wheat: March SRW wheat futures rose 3 3/4 cents to $6.16 1/4 and nearer the session high. For the week, March SRW fell 13 cents. March HRW wheat futures fell 3 3/4 cents to $6.23 and nearer the session low. On the week, March HRW lost 19 3/4 cents. Spring wheat futures closed steady on the session at $7.14 1/4, though lost 16 1/2 cents on the week.

- Cotton: Cotton bulls couldn’t sustain the mid-morning surge to a one-week high but did manage a significant daily advance. March futures rallied 63 points to close at 79.76 cents/pound. That marked a weekly decline of 17 points.

- Cattle: February live cattle futures fell 15 cents to $168.525 and near mid-range. On the week, Feb. cattle fell 82 1/2 cents. March feeder cattle futures closed up $1.025 at $224.40 and nearer the session high. For the week, March feeders rose $2.225.

- Hogs: Nearby February futures lead the hog market higher Friday. It climbed 70 cents to $71.35; the close marked a weekly decline of 55 cents.

— Ag markets today: There was no overnight trade in the grain markets due to Christmas. Grain and livestock markets resumed trading at 9:30 a.m. ET. Front-month crude oil futures were favoring the upside along with U.S. stock index futures, though volume is light after the holiday. The U.S. dollar index was trading near unchanged.

Cash cattle modestly firmer. Trade through Thursday last week averaged $170.13, which will likely be enough to end the six consecutive weeks of continued weakness in the cash cattle average. Holiday-shortened kill schedules are likely to weigh on prices, though packers appear to continue to be short bought on slaughter needs.

Hogs search for seasonal low. Despite a brief uptick in the CME lean hog index last week, the index fell 44 cents to $66.25 (as of Dec. 21), marking a fresh seasonal low. Price action today is likely to be dictated by Friday’s Hogs & Pigs Report, though traders will remain focused on cash fundamentals as the week goes on.

— Chicago Fed National Activity Index, which measures economic activity in the United States, increased to +0.03 in November. This is a notable improvement from the revised figure of -0.66 in the previous month. The positive value of +0.03 suggests that economic activity expanded during November. This expansion in economic activity is reflected in the fact that all four major categories of indicators used in the index increased compared to October. Additionally, two of these categories made positive contributions to the overall index in November.

— U.S. home prices surge 4.9% YOY in October 2023 amid supply shortage. In October 2023, the S&P CoreLogic Case-Shiller 20-city home price index in the United States saw a substantial year-on-year increase of 4.9%. This growth is the largest recorded since November 2022 and is in line with what market experts had anticipated. The primary driving force behind this surge in home prices has been a shortage of available homes for sale, which has placed upward pressure on housing costs. Furthermore, the situation might continue to support rising home values due to two additional factors. Firstly, mortgage rates have been on the decline, making it more affordable for prospective buyers to enter the housing market. Secondly, the Federal Reserve has indicated a slightly more accommodating monetary policy stance, which could potentially contribute to further home price appreciation in the months ahead.

When examining specific markets within the 20-city index, Detroit emerged as the fastest-growing market for the second consecutive month, boasting an impressive 8.1% annual gain. Following Detroit, San Diego and New York recorded annual gains of 7.2% and 7.1%, respectively.

On a month-to-month basis, the 20-city composite index showed a modest 0.1% increase in home prices.

Market perspectives:

— Outside markets: The U.S. dollar index was slightly higher amid mild weakness in the euro and British pound. The yield on the 10-year U.S. Treasury note was slightly weaker, around 3.88%, with few global government bond markets trading. Crude oil futures were moving higher, with U.S. futures around $75 per barrel and Brent around $80.35 per barrel. Gold and silver were rising, with gold around $2,073 per troy ounce and silver around $24.64 per troy ounce.

— El Niño threatens rising prices for sweet raw materials. The El Niño weather pattern, characterized by a rise in sea temperatures in the eastern Pacific, is causing concerns about the cost of certain raw materials, especially those with a sweet taste. This pattern has led to extreme weather conditions and supply issues, causing futures contracts for orange juice, cocoa, coffee, and sugar to surge in price. El Niño is a natural climate phenomenon associated with increased storms and droughts. Rabobank, an agribusiness bank, predicts that major sugar-exporting countries like Thailand, India, and Australia will be heavily affected by El Niño. However, the global impact of these disruptions may take some time to fully materialize.

— H&P Report negative compared to expectations. USDA’s Hogs & Pigs Report estimated the U.S. hog herd at 74.971 million head as of Dec. 1, up 15,000 head from year-ago, whereas traders expected a 481,000-head decline based on the average pre-report estimate. The market hog inventory increased 221,000 head (0.3%) from year-ago, while the breeding herd declined 205,000 head (3.3%). The data was negative compared to pre-report expectations, though it wasn’t overly bearish. However, the sharp revisions to past data will increase trader skepticism toward these numbers and may cause them to believe USDA’s sampling methodology is consistently undercounting hog numbers.

— Cattle on Feed Report: Mildly negative but not likely market-moving. USDA’s Cattle on Feed Report estimated the Dec. 1 large feedlot (1,000-plus) head inventory increased 313,000 head (2.7%) from year-ago. Traders expected feedlot supplies to rise 257,000 head (2.2%). November placements of cattle into feedlots declined 1.9%, though traders anticipated a 3.8% decline. November marketings fell 7.4% compared with the expected 6.7% drop. The data is mildly negative compared to pre-report expectations, though we doubt it will have much of lasting market impact.

— Cold Storage Report: Pork stocks decline less than normal. USDA’s Cold Storage Report showed pork inventories totaled 416.1 million lbs. at the end of November, down 21.8 million lbs. (5.0%) from October. The five-year average was a 45.2-million-lb. decline during the month. Pork stocks dropped 35.5 million lbs. (7.9%) from year-ago and were 55.1 million lbs. (11.7%) under the five-year average. Beef stocks totaled 454.7 million lbs., up 9.0 million lbs. (2.0%) from October. The five-year average was a 10.4-million-lb. increase during the month. Beef stocks fell 68.6 million lbs. (13.1%) from year-ago and were 49.0 million lbs. (9.7%) less than the five-year average.

— Ag trade update: South Korea purchased an estimated 60,000 MT of soymeal, expected to be sourced from South America. Bangladesh tendered to buy 50,000 MT of milling wheat. Pakistan issued an international tender to buy up to 110,000 MT of wheat.

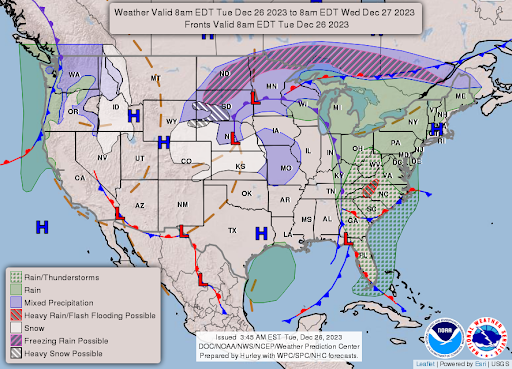

— NWS weather outlook: Significant winter storm with heavy snow, blizzard conditions, and potentially damaging icing continues across portions of the north-central U.S. through early Wednesday... ...Moderate to heavy rain for much of the East as the work week begins, with potential flooding across portions of the southern and central Appalachians... ...Precipitation chances pick back up across northern California and the Pacific Northwest Wednesday.

|

ISRAEL/HAMAS CONFLICT |

— Israel’s war cabinet met Monday night to discuss a three-step plan put forward by Egypt for ending the war in Gaza, Israeli officials said. The Egyptian proposal for peace in the Gaza war is the most comprehensive one presented to both parties involved in the conflict. However, it is expected that some terms of the proposal will face strong resistance from both sides. The key elements of the proposal include:

- An initial ceasefire to facilitate the release of Israeli hostages in exchange for the release of around 140 Palestinian prisoners.

- The formation of a transitional government for the Gaza Strip and the West Bank, consisting of various Palestinian factions, including Hamas.

While there are discussions and proposals in progress, it is unclear if they are being seriously considered by all parties. Israeli Prime Minister Benjamin Netanyahu has visited Israeli troops in Gaza and has expressed the intention to continue the military offensive despite international pressure for a ceasefire. Netanyahu has also outlined his prerequisites for a peace deal in an op-ed in the Wall Street Journal (link).

Additionally, Israeli forces have targeted Palestinian refugee camps in central Gaza, indicating preparations for a potential expansion of their ground offensive into a third area of the territory. This situation suggests that the conflict is far from over, with Israel determined to confront Hamas.

|

RUSSIA/UKRAINE |

— Ukrainian President Volodymyr Zelenskyy on Monday praised the shooting down of two Russian fighter jets on Christmas Eve and said, “this Christmas sets the right mood for the entire year ahead.” In a Christmas message, Zelensky also referred to Ukraine’s claim to have destroyed a further three Russian fighter planes on Friday (link to Associated Press). “The stronger our air defense, the fewer Russian devils will be in our skies and on our land,” Zelenskyy said, praising Ukraine’s “capabilities in negotiations with partners, capabilities in bolstering our sky shield, capabilities in defending our homeland from Russian terrorists.”

— Russian grain crop second largest ever. Russia’s grain harvest in 2023 will total 142.6 MMT, down 9.5% from last year’s record, according to Russian state statistics. Russian wheat production totaled 92.77 MMT, down from 104.23 MMT in 2022. Russia is the world largest exporter of wheat, expecting to total 65 MMT this year, though exports are limited by lack of vessels and problems with insurance and payments caused by Western sanctions, says Russian Agriculture Minister Patrushev.

|

POLICY UPDATE |

— White House: No need to prepare for automatic spending cuts yet. Federal agencies should not prepare for automatic spending cuts, despite a measure in the June debt-limit law that threatened sequestration if lawmakers relied too long on stopgaps, the White House said (link). The 1% automatic spending cuts wouldn’t go into effect until April 30, rather than the Dec. 31 deadline mentioned in the law, according to the document posted on the White House website.

|

CHINA UPDATE |

— Office of the U.S. Trade Representative (USTR) has extended the exclusions on Section 301 tariffs on Chinese goods. These exclusions, which were previously set to expire on Dec. 31, have now been extended through May 31, 2024. Additionally, USTR has announced the opening of a public comment docket on Jan. 22 for existing exclusions. The purpose of this extension is to facilitate a structured transition as the exclusions come to an end. It will also consider cases where there is evidence that additional time might lead to changes in sourcing to the United States or other countries, aligning with statutory factors and objectives. This extension will play a role in coordinating further decisions on these exclusions within the context of the ongoing four-year review process.

— Soymeal for feed drops heavily in China. While China’s animal feed production rose in the first 11 months of 2023, the use of soymeal as feedstock dropped 11% year-on-year, according to its agriculture ministry. The nation is trying to reduce its heavy reliance on soymeal exports as part of a push for food security, and is opting to use alternatives for feed, such as sunflower seed, rapeseed and distiller’s dried grains.

— Experts anticipate that China's economic growth will slow down in the upcoming year, with a projected rate of 4.6%, following this year's expected expansion of 5.2%. Several factors contribute to this slowdown, including a slump in the real estate market and stagnant consumption.

A survey of 25 China specialists revealed that most expect this year's growth to be in line with Beijing's official target of around 5%. Additionally, 12 out of 19 economists who provided growth forecasts in the previous poll have raised their outlook.

However, there are concerns about the property sector's impact on economic growth. S&P Global Ratings predicts a 4.6% growth rate for 2024 but suggests a downside scenario of 2.9%, particularly depending on developments in the property sector. The sluggish housing market and weak consumer confidence are among the top risks cited by economists. Concerns also revolve around Beijing's ability to implement effective stimulus measures. China's troubled real estate sector remains a significant challenge, with major indebted developers facing financial difficulties. Banks are hesitant to provide additional loans without clear regulations in place.

To address local governments' financial challenges due to a drop in land rights sales, Beijing issued new government bonds. However, there are doubts about the effectiveness of these measures, with concerns that the ability to support the economy through public investments may have limits.

On the currency front, economists expect the yuan (renminbi) to gradually rebound, influenced by expectations of U.S. Federal Reserve rate cuts in the coming year.

Geopolitical tensions, such as those between the U.S. and China, continue to pose risks to the Chinese economy. Demographic challenges, including a declining population and youth unemployment, also affect the economic outlook.

In the long term, experts predict notable slowing of Chinese economic growth due to demographic factors, deleveraging, and de-risking, with real GDP growth slowing to 3% by 2034.

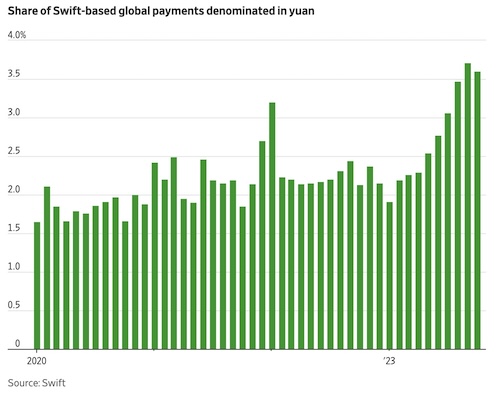

— China’s yuan is quietly gaining ground. A surge in the global use of the Chinese currency could complicate the impact of any future Western sanctions. Link for details via the WSJ.

|

TRADE POLICY |

— USTR lets ITC decision to ban Apple Watches stand. The U.S. Trade Representative (USTR) confirmed its decision not to overturn the U.S. International Trade Commission's (ITC) ruling, which banned the import of some Apple Watches. This ban was prompted by a complaint from Masimo, a medical monitoring technology company, alleging that Apple's smartwatches, which include a pulse oximeter feature for monitoring blood oxygen levels, infringed upon Masimo's patents. The import ban, initiated by the ITC, came into effect on Dec. 26 after the USTR's review.

— USTR adjusts sugar TRQ reallocations. On Nov. 30 the Office of the U.S. Trade Representative (USTR) announced the reallocation of 223,740 metric tons raw value (MTRV) of the original tariff-rate quota (TRQ) quantity from those countries that had stated they did not plan to fill their Fiscal Year (FY) 2024 allocated raw cane sugar quantities. USTR said in a Federal Register notice (link) Fiji was not consulted and did not receive a reallocated amount. Based on further consultation with certain quota holders, USTR has determined that 3,217 MTRV is reallocated to Fiji, the amount that Fiji would have received if included in the reallocation of November 30, 2023.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Massachusetts seeks dismissal of Q3 animal welfare law challenge. The state of Massachusetts has requested the dismissal of a lawsuit challenging its Question 3 (Q3) animal welfare law. They argue that Triumph Foods' complaint lacks merit as the company cannot demonstrate harm resulting from the related regulations. The Q3 standards, which regulate pork sold in Massachusetts, came into effect on Aug. 24. Triumph Foods claims that Q3 violates the Commerce Clause and other provisions of the U.S. Constitution.

U.S. District Judge William Young previously rejected most of the complaint in October but maintained a claim that the law discriminates against out-of-state producers. Massachusetts, in its motion to dismiss on Dec. 18, pointed out that all Triumph products are sold through Seaboard Foods under a 2004 agreement. State officials argued that Triumph has not proven that Seaboard cannot continue to meet its obligations under the agreement despite Massachusetts' policies. Therefore, they contend that the entire amended complaint should be dismissed for lack of jurisdiction.

|

POLITICS & ELECTIONS |

— Koch family, along with their donor network, is reemerging in presidential politics by supporting Nikki Haley in the 2024 Republican primary and opposing former President Donald Trump. They are actively contributing financially to these efforts.

— Nikki Haley closes gap on Trump in New Hampshire primary race. In New Hampshire, where the primary follows the Iowa contest by only eight days, former South Carolina Governor Nikki Haley is closing the gap with former President Donald Trump. While Trump still maintains a substantial 17-percentage-point lead over Haley in the aggregated polls by Decision Desk and The Hill, this lead has notably decreased since the start of December. As recently as Dec. 6, Trump had a 27-point lead over Haley. And in a surprise poll released at the end of last week by the American Research Group, Trump had just a four-point lead on Haley. In a Christmas Day post on Truth Social, he wrote “there is no Haley surge” and pointed to his wide lead in national surveys.

— A new tax on imports and a split from China: Trump’s 2025 trade agenda. Donald Trump plans to sharply expand his use of tariffs if he returns to power, risking disruption to the economy in an attempt to transform it. Link for details via the New York Times.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |