What Xi Told Biden About Taiwan at San Francisco Confab

Trump barred from Colorado’s 2024 ballot | Ag, rail groups push to reopen U.S./Mexico bridges | EPA allows chlorpyrifos use

|

Today’s Digital Newspaper |

MARKET FOCUS

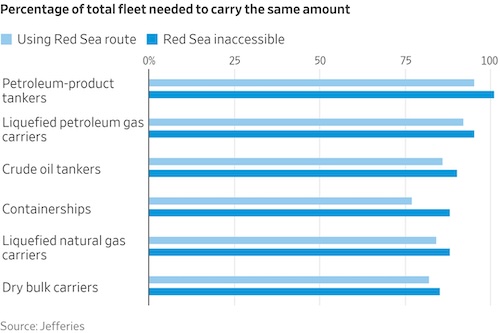

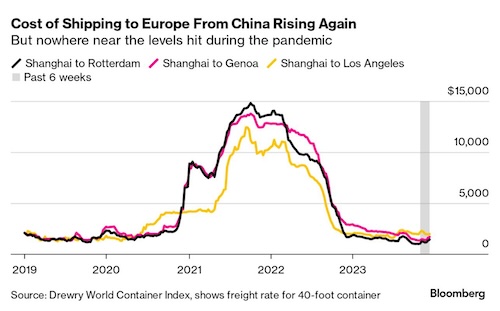

- Red Sea attacks complicate shipping, raises prices and forcing alternatives

- Red Sea, red ink?

- Shipping outlook

- Atlanta Fed’s Raphael Bostic doesn’t expect urgency to lower rates next year

- Watch core inflation: chief investment officer at Morgan Stanley Wealth Management

- FedEx, a bellwether for the economy, reported profit below analyst expectations

- ‘Everybody and their grandmother are inside Costco during the holidays’

- BoA: European equities and earnings to decelerate in early 2024

- U.S. population experiencing gradual recovery from the pandemic's impact

- Wealthiest Californians fleeing the state

- U.K. inflation rate slows more than expected

- Ag markets today

- Brazil planning to enhance biodiesel blend in diesel fuel and stop importing biodiesel

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Senate completes voting for the year, heads home

- Timelines and deadlines: A look at key issues in early 2024

ISRAEL/HAMAS CONFLICT

- Israel draws new deal for release of dozens of hostages from Gaza

RUSSIA & UKRAINE

- APK-Inform raises Ukraine’s grain crop, export forecasts

- Ukraine facing concerning situation where its front-line troops are aging

POLICY

- Vilsack criticizes conservative lawmakers for attempting to limit SNAP

PERSONNEL

- FERC GOP Commissioner James Danly plans to step down by year-end

CHINA

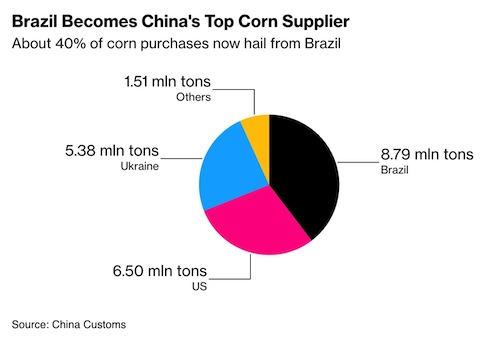

- Brazil overtakes U.S. in corn shipments to China, extends lead for soybeans

- China to promote increase in grain yields

- EU's China approach, potential impact of hard decoupling examined in new study

TRADE POLICY

- Progress has been made at WTO re: reforms to dispute settlement process

- Railroads & shipping partners urge reopening of bridges along U.S./Mexico border

- History professor at Wellesley College identifies new types of borders within nations

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- General Mills cut its annual sales forecast

POLITICS & ELECTIONS

- Donald Trump is barred from Colorado’s state primary ballot

OTHER ITEMS OF NOTE

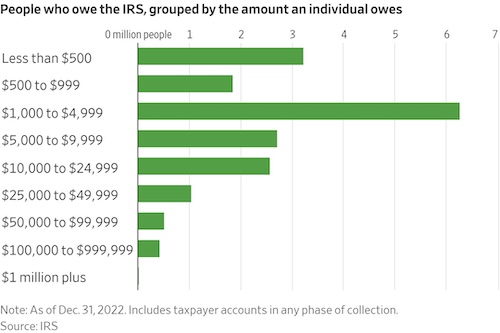

- IRS plans to waive about $1 billion worth of penalties for taxpayers

- EPA allows chlorpyrifos use

- Release of five wolves in the Colorado mountains is controversial

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed overnight. U.S. Dow opened around 70 points lower. Of note: The S&P 500 is within about a half-percentage point of a record this morning as investors bet that a wave of interest rate cuts is coming next year. In Asia, Japan +1.4%. Hong Kong +0.7%. China -1%. India -1.3%. In Europe, at midday, London +0.6%. Paris +0.1%. Frankfurt flat.

U.S. equities yesterday: The Dow registered its fifth record finish in a row, rising 251.90 points, 0.68%, at 37,557.92. The Nasdaq rose 98.01 points, 0.66%, at 15,003.22. The S&P 500 gained 27.81 points, 0.59%, at 4,768.37.

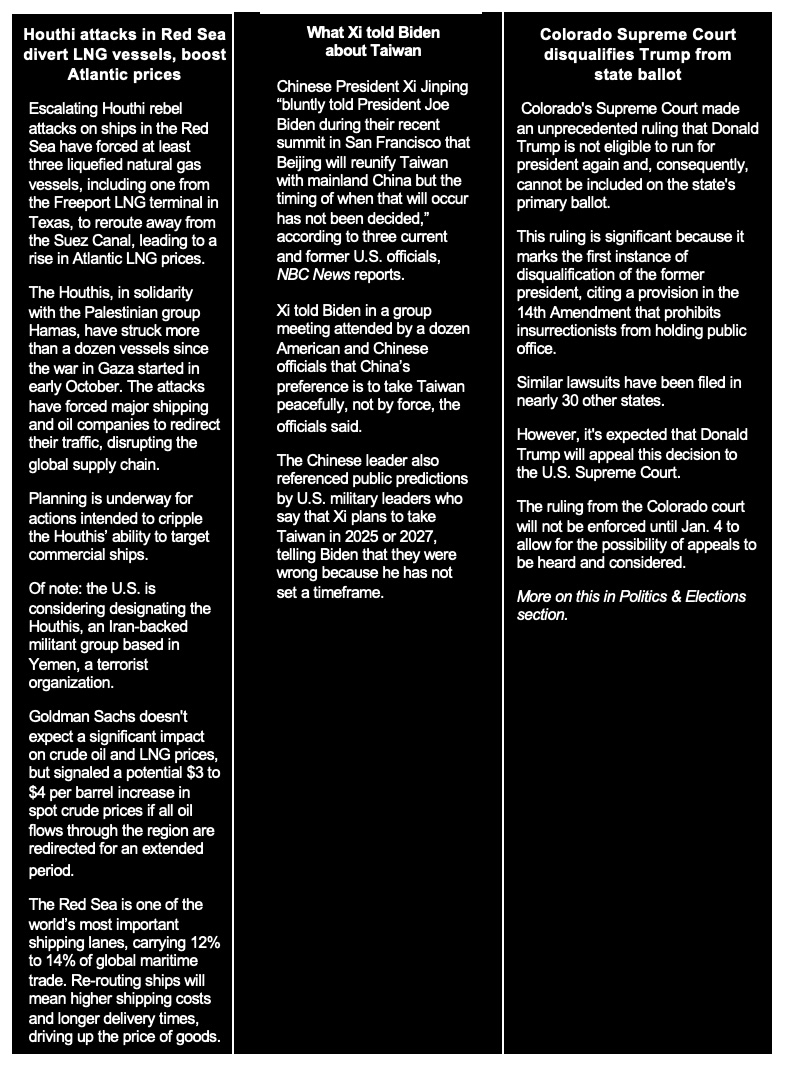

— FedEx, a bellwether for the health of the economy, reported profit below analyst expectations as cost cuts weren’t enough to make up for volume declines at the air-freight unit amid a lingering cargo recession. The company lowered its sales forecast for the fiscal year ending May 31. The decline in revenue was led by FedEx's largest unit Express, hurt by lower volumes and fuel surcharges. "With regard to Q3 expectations, we anticipate our typical seasonality, which implies a lighter quarter sequentially for earnings," CFO John Dietrich said on an earnings call. The disappointing outlook also weighed on FedEx's rivals, sending shares of UPS 3% lower. Still, shares of FedEx are up big on the year — nearly 62% as of Tuesday’s close — widely outperforming the S&P 500′s gains. Also of note: Like a lot of companies, FedEx has spent much of the year bracing for tougher times. Its cost-cutting drive allowed it to improve margins even as the top line fell. It maintained earnings guidance for the year.

— Agriculture markets yesterday:

- Corn: March corn futures fell 4 1/4 cents to $4.72 3/4 and near the session low.

- Soy complex: January soybean futures fell 14 1/2 cents to $13.12 1/2, nearer session lows. January soybean meal fell $8.30 to $404.5. January soyoil rallied 2 points to 50.66 cents.

- Wheat: March SRW wheat rose 5 3/4 cents to $6.22 3/4 and near the session high. March HRW wheat gained 13 3/4 cents at $6.41 1/2. Prices closed near the session high and hit a two-week low early on. Spring wheat futures rallied 6 3/4 cents before settling at $7.28 1/4.

- Cotton: Nearby March futures rose 36 points to 79.46 cents per pound.

- Cattle: February live cattle futures fell 85 cents to $168.775, settling near the session low. January feeder futures fell $1.275 to $221.90, also near session lows.

- Hogs: Hog futures posted varying losses Tuesday, with nearby February tending toward the weak end of the spectrum. It fell $1.025 cents to $70.55.

— Ag markets today: Corn, soybean and wheat futures traded narrowly on either side of unchanged during quiet overnight price action. As of 7:30 a.m. ET, corn futures were trading around a penny higher, soybeans were mostly 1 to 4 cents higher and wheat futures were mostly 1 to 2 cents lower. Front-month crude oil futures were around $1.00 higher, and the U.S. dollar index was more than 250 points higher this morning.

Lengthy cash cattle standoff likely. Packers and feedlots have yet to establish bids and asking prices in this week’s cash cattle market, signaling negotiations are likely to extend deep into the week. That’s typically the case during weeks when there’s a Cattle on Feed Report.

Seasonal weakness continues for hogs/pork. The CME lean hog index is down another 22 cents to $66.37 (as of Dec. 18), extending the seasonal price drop. The pork cutout value dropped 91 cents on Tuesday to $83.06. While wholesale pork prices have held up better than the cash hog market, that’s a new low on the seasonal decline.

— Quotes of note:

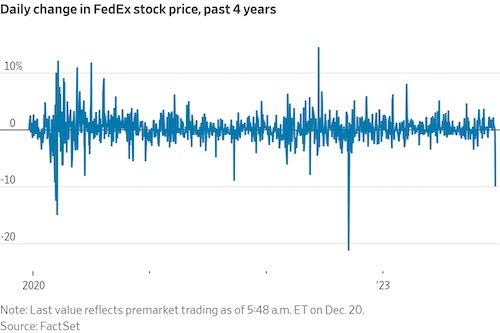

- Fedspeak. Recent statements from several senior officials at the Fed have attempted to clarify and backtrack on comments made by the Fed's chair, Jay Powell, last week. Powell had surprised Wall Street by announcing that the Fed anticipated making three interest-rate cuts in the coming year, ending a period of tight credit. Raphael Bostic, the president of the Atlanta Fed, has now added his voice to the chorus of officials pushing back against this stance. He emphasized that there was no immediate need to lower borrowing costs, citing the possibility of persistently high inflation over the next six months. Other Fed officials, such as Loretta Mester, John Williams, and Austan Goolsbee in Cleveland, New York, and Chicago, respectively, have also expressed cautious views. Bostic went further by predicting no more than two rate cuts in the upcoming year, with none expected in the first half. This contrasts with market expectations, as traders in the futures market were anticipating as many as five rate cuts.

- Watch core inflation. Lisa Shalett, the chief investment officer at Morgan Stanley Wealth Management, warned investors in a research note on Monday that there has been little progress lately in bringing core inflation, which strips out food and fuel prices, closer to the Fed’s 2 percent target. “Core inflation isn’t even close to ‘mission accomplished,’” she wrote.

- Shipping outlook. C.H. Robinson expects the freight slowdown will linger into next year, but sees a recovery taking hold in the second half of 2024. Chief Executive Officer Dave Bozeman said in an interview with Bloomberg (link) that the recovery will be driven as replacement demand for goods picks up. Meanwhile, trucking rates will increase as capacity comes out of the market, in part due to bankruptcies like Yellow Corp. One of the ships fired at by Houthi rebels had 28 containers that C.H. Robinson was moving for customers, and those had to be rescheduled, he said. “Disruption is what we do,” Bozeman said. “Customers look to us to bring calm to the storm.”

- “Everybody and their grandmother are inside Costco during the holidays. The lines are spilling out into the aisles. It’s insane.” — Shiana Warren, who delivers for Uber Eats, Instacart and DoorDash.

- Bank of America's latest European Fund Manager Survey indicates that European equities and earnings are expected to decelerate in early 2024 after a rally in late 2023. Although investors maintain a positive outlook for equities in the coming year, the survey reveals that 65% of them anticipate short-term losses, a significant increase from 47% in the previous month. This shift in sentiment follows gains in equity markets since late October. The survey highlights that 88% of investors expect European earnings-per-share to decrease due to slowing economic growth and waning inflation. Additionally, a net 6% of respondents view European equities as overvalued, marking a change from the previous month when a net 26% believed stocks were undervalued. The survey also provides insights into sector preferences among investors. European insurance and technology sectors continue to be popular choices for overweighting, with healthcare joining them. In contrast, sectors such as chemicals, automobiles, and construction are perceived as less favorable for investment in the coming year, according to Bank of America analysts.

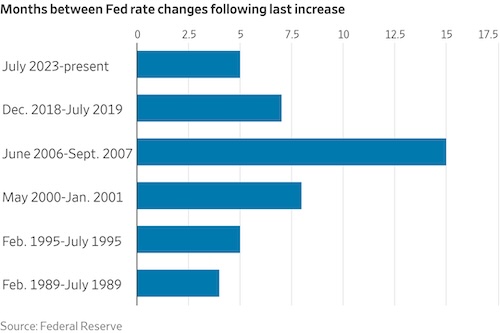

— U.S. population is experiencing a gradual recovery from the pandemic's impact, with a growth rate of 0.5% reported this year, according to Census Bureau estimates released on Tuesday. This growth brings the total population to 334.9 million, reflecting an increase of 1.6 million people over the past year. This slow growth is a result of several factors, including elevated death rates, which are gradually decreasing from the peak levels seen during the pandemic but still remain higher than pre-pandemic levels. Additionally, record low birthrates have contributed to the modest population growth observed in the United States.

— Wealthiest Californians are fleeing the state. In a reversal from past decades, more college graduates and professionals are moving out of California than coming into it to escape the higher taxes and cost of living and it is cutting into tax revenues that are hurting state and local governments. Moody’s Analytics economist Mark Zandi analyzed moves in and out of California for the LAT using Equifax credit data, to zero in on the age of the movers. He found that since the pandemic in early 2020, California has lost residents in every age group, but by a significant margin the biggest net out-migration came from those 35 to 44 years old. “This is probably motivated by the severe housing affordability crisis in California,” Zandi said. “It’s all but impossible for them to become homeowners in the state.” Link for details via the Los Angeles Times.

— U.K. inflation rate slows more than expected. In November 2023, the U.K.'s annual inflation rate dropped to 3.9%, marking its lowest level since September 2021, down from 4.6% in October and below the expected 4.4%. Transport had the most substantial impact, with a -1.5% contribution, primarily driven by lower prices for motor fuels and, to a lesser extent, secondhand cars, maintenance and repairs, and airfares. Food and non-alcoholic beverages experienced a slowdown in price growth (9.1% vs. 10.1%), primarily related to bread and cereals.

Additionally, annual core inflation also decreased to 5.1%, its lowest point since January 2022.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker, with the euro, yen, and British pound all weaker against the U.S. currency. The yield on the 10-year U.S. Treasury note was weaker, trading around 3.88%, with a lower tone in global government bond yields. Crude oil futures firmed ahead of U.S. gov’t inventory data due later this morning, with U.S. crude around $74.55 per barrel and Brent around $79.75 per barrel. Gold and silver futures were under mild pressure ahead of U.S. trading, with gold around $2,047 per troy ounce and silver around $24.29 per troy ounce.

— Red Sea, red ink? Shipping firms, oil companies and insurers remain jittery about a possible snarl to one of the world’s most crucial trade routes in the Red Sea. More than a hundred container ships are taking the long route around Africa to avoid violence in the Red Sea, creating extra costs and delays, as the US weighs up how to respond to the latest threat to the world economy. Widespread disruption to trade flows could reignite inflation by boosting prices for goods and energy.

Of note: Stephen Gordon of Clarksons says traveling from Asia to Northern Europe around the southern tip of Africa extends journey times to 40 days from 31 days. It also takes twice the fuel to go around Africa, adding tens of millions in costs. Maersk CEO Vincent Clerc says it could take weeks for a U.S.-led naval operation to make the Red Sea safe again for its ships.

— In early 2024, Brazil is planning to enhance its biodiesel blend in diesel fuel and stop importing biodiesel. The country's CNPE energy council decided to increase the mandated biodiesel blend level to 14% in March, which will further rise to 15% in 2025, up from the current 12%. Initially, the CNPE had announced plans to incrementally increase the biodiesel percentage, with targets set for 13% in April 2024, 14% in 2025, and 15% in 2026.

Additionally, the energy policy council has formed a working group to address biodiesel imports and will suspend these imports until the group completes its discussions. Another working group has been established to explore the possibility of increasing the mandatory ethanol blend in fuel from the current 27% to 30%.

— Academics call for greater USDA transparency in market reports. According to three academics, USDA reports play a crucial role in market price discovery and reducing information imbalances. They say that to maintain trust among producers and the public, USDA should enhance transparency regarding its survey and forecasting methods. Link for details.

— Ag trade update: South Korea purchased 65,000 MT of optional origin corn. Jordan tendered to buy up to 120,000 MT of optional origin milling wheat.

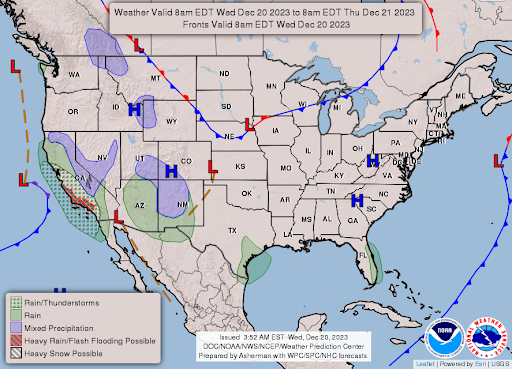

— NWS weather outlook: There is a Moderate Risk of excessive rainfall over parts of Southern California on Wednesday and Thursday... ...Rain for most of California... ...Temperatures will be 15 to 25 degrees above average over parts of the Northern/Central High Plains.

Items in Pro Farmer's First Thing Today include:

• Quiet overnight grain trade

• SovEcon raises Russian 2024 wheat crop forecast

• China leaves benchmark lending rate unchanged

|

CONGRESS |

— Senate has completed its voting for the year, wrapping up most of its year-end tasks. Sen. Tommy Tuberville (R-Ala.), released his military holds, indicating his willingness to support these initiatives. Additionally, a temporary FAA funding bill was passed by a voice vote, indicating broad support.

Sens. Chuck Schumer (D-N.Y.) and Mitch McConnell (R-Ky.), who lead their respective parties in the Senate, issued a joint statement in which they committed to acting on a supplemental bill addressing issues related to Ukraine, Israel, and immigration early in 2024. Their statement emphasized the importance of not ignoring these national security challenges and pledged to address them in the upcoming legislative session.

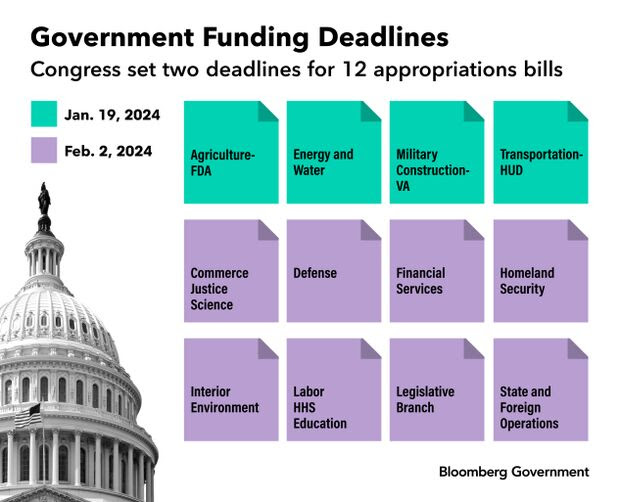

— Timelines and deadlines of note.

- Dec. 31: Former House Speaker Kevin McCarthy (R-Calif.) will resign from Congress. House. That means House Republicans will being 2024 with just 220 members.

- January: House Speaker Mike Johnson (R-La.) is planning a trip to the U.S./Mexico border.

- Jan. 8: Senate returns from holiday break.

- Jan. 9: House of Representatives return from holiday recess.

- Jan. 15: 2024 GOP presidential nomination race formally kicks off in Iowa (caucus).

- Jan. 19: First deadline for the stopgap spending measure for around 20% of gov’t, including USDA.

- Jan. 23: New Hampshire presidential primary.

- Feb. 2: Second deadline for around 80% of FY 2024 spending measure.

- Feb. 3: South Carolina Democratic presidential primary.

- Feb. 24: South Carolina Republican presidential primary.

- March 8: FAA reauthorization extension ends.

- March 13-15: House GOP retreat at the Greenbrier Resort in West Virginia

- FY 2024 spending: The House has passed seven of the 12 annual spending bills, while the Senate has approved only three.

- Supplemental spending: Additional aid for Ukraine, Israel and Taiwan is being linked in the Senate with border security and immigration, but negotiations as expected have proved complex.

- New farm bill: At best this is a March issue. But as previously noted, House Democrats sense New York redistricting may provide them the seats needed to regain control of the chamber in 2025. That may lead Democrats to drag their feet relative to inking a new farm bill in calendar 2024. As for the bill itself, answers to key topics are just as far from solution as ever, including additional funding ($4 billion to $5 billion in Senate but zero in House which wants adjust funding in some areas) and policy issues (nutrition, conservation and reference prices).

|

ISRAEL/HAMAS CONFLICT |

— The Israeli government has drawn up a new deal for the release of dozens of hostages from Gaza, reports note, a proposal that comes after a round of talks between U.S., Israeli and Qatari officials this week. The pact reportedly calls for a pause in fighting for up to a week and the release of 40 hostages, including many of the women and children Hamas had previously agreed to release, as well as hostages who require medical attention. It also would allow for the flow of additional humanitarian aid into Gaza.

|

RUSSIA/UKRAINE |

— APK-Inform raises Ukraine’s grain crop, export forecasts. Agriculture consultancy APK-Inform increased its 2023 Ukraine grain production forecast by 1.6 MMT to 56.3 MMT amid a larger corn crop. The firm raised its Ukraine corn production estimate 1.6 MMT to 27.6 MMT, while leaving the wheat crop at 21.5 MMT. APK-Inform now forecasts Ukraine’s 2023-24 grain exports at 38.1 MMT, including 22 MMT of corn and 13.5 MMT of wheat, up 3.4 MMT from its prior outlook.

— Ukraine is facing a concerning situation where its front-line troops are aging, and efforts to rebuild its military forces are being hampered by corruption and fear, the Wall Street Journal reports (link). The infantry in Kyiv, which bears the brunt of casualties, is experiencing a chronic shortage of personnel after nearly two years of resisting Russia's full-scale invasion. Many of the most motivated fighters volunteered early in the conflict, and those who remain have often been killed or wounded, leaving them exhausted. Ukraine is now relying on conscription and sometimes forcibly rounding up men to replenish its military ranks. In contrast, Russia can tap into a much larger population pool to replace its heavy losses in the conflict.

|

POLICY UPDATE |

— USDA Secretary Tom Vilsack criticized conservative lawmakers for attempting to limit SNAP (Supplemental Nutrition Assistance Program/food stamps) benefits while simultaneously seeking to expand crop subsidies in the new farm bill. He argued they should explore alternative solutions rather than constraining SNAP benefits.

Background: Republican members of Congress have been dissatisfied with the Biden administration's updates to the Thrifty Food Plan, used to calculate SNAP benefits. The 2018 Farm Bill called for this update, the first in many years, resulting in a 25% increase in benefits compared to pre-pandemic levels. House Ag Chair G.T. Thompson (R-Pa.) has suggested that the new farm bill should require future updates to be revenue-neutral. There have been other proposals that would cut SNAP funding.

Vilsack emphasized that SNAP benefits should reflect current conditions and food costs. He said 41 million Americans should not have to sacrifice to fund resources for a smaller group, and he urged Congress to explore creative solutions to address the issue.

|

PERSONNEL |

— FERC GOP Commissioner James Danly plans to step down by year-end. That will drop the panel down to three members.

|

CHINA UPDATE |

— Brazil overtakes U.S. in corn shipments to China, extends lead for soybeans. Brazil overtook the U.S. in November to become China’s biggest corn supplier this year. China imported 3.22 MMT of corn from Brazil last month, pushing the tally for the first 11 months of 2023 to 8.8 MMT — 39.7% of its total. China imported 6.5 MMT of U.S. corn through November — 29.3% of its total. China imported 5.29 MMT of soybeans from Brazil in November, increasing this year’s total to 64.97 MMT. China’s imports of U.S. beans totaled 2.3 MMT last month for a total of 20.36 MMT through November.

— China to promote increase in grain yields. China will promote increases in grain yields across large areas and consolidate the results of expanding the planting of soybeans, state broadcaster CCTV reported. The remarks by President Xi Jinping at the annual central rural work conference came as China reported a record corn crop this year. Under a push for food security, Beijing continued to offer subsidies to farmers planting staple grains. China’s soybean harvest also expanded this year.

— EU's China approach and potential impact of hard decoupling examined in new study. Ursula von der Leyen, the European Union chief, describes the EU's approach to China as "de-risking without decoupling," a term adopted by the U.S. This approach involves diversifying supply chains away from China while maintaining economic ties. However, a new study by the Kiel Institute for the World Economy (link) examines what would happen if a "hard decoupling" occurred between China and Germany, Europe's largest economy and the world's third-largest exporter, in the event of a Chinese invasion of Taiwan.

The study models a "Cold War 2.0 scenario" where the global economy splits into three blocs: the Group of Seven (the West), China and its allies (notably Russia), and neutral countries like Brazil and Turkey. In an extreme scenario where trade between the West and China drops to zero due to a Chinese attack on Taiwan, the German economy would contract by 5% in the first year, a comparable impact to the global financial crisis and the Covid-19 pandemic, with a longer-term loss of 1.5%.

While these short-term costs are significant, the study suggests they are manageable. It also highlights that Berlin previously cut trade and energy ties with Russia following Moscow's invasion of Ukraine in 2022, which still affects German industry and business.

The study's authors argue that it's better to start reducing dependence on China now, rather than waiting for a more costly "hard decoupling" forced by geopolitical events, likening it to paying an insurance premium.

|

TRADE POLICY |

— Progress has been made at the World Trade Organization (WTO) regarding reforms to the dispute settlement process, with a working group led by Marco Molina of Guatemala nearing the finalization of a reform package. WTO members aim to complete these reforms by 2024, with a focus on the February Ministerial Conference. However, significant challenges remain, particularly concerning the appellate body, which has been suspended since 2019 due to the U.S. blocking new members. The unresolved issues surrounding the appellate body could potentially hinder a comprehensive agreement on dispute settlement reforms.

— Railroads and their shipping partners are urgently requesting the swift reopening of several bridges along the U.S./Mexico border that were recently closed by American immigration authorities. These closures were implemented as a response to a significant increase in illegal migration, which has placed immense strain on border communities in Texas, Arizona, and California. Customs and Border Protection made the unusual decision to close two railway bridges in Texas, including a major one in Eagle Pass that plays a crucial role in cross-border commerce.

The closure is having a significant impact on the transportation of grains and oilseeds, which are essential commodities for one of the United States' most important export markets and trading partners. In a joint statement issued on Dec. 18, the National Grain and Feed Association (NGFA) and the North American Export Grain Association (NAEGA) called for the immediate reopening of the crossings to allow trains to pass between the U.S. and Mexico. “The North American market and grain trade supply chain are deeply intertwined,” the statement said. “The closure of these two crossings is impacting the flow of grain and oilseeds for both human and livestock feed to one of the United States’ most important export markets and trading partners.”

According to USDA info, rail represents 64% of grain and oilseed exports to Mexico, including 15,565,138 metric tons of grains and oilseeds exported via rail in 2021, and 3.45 metric tons of grains and oilseeds in the third quarter of 2023.

Mexico’s National Union of Poultry Producers (UNA) also warned of feed shortages due to the closures. About 25% of Mexico’s yellow corn inputs from the U.S., and 63% of its soybean paste imports are moved through the two crossings, the UNA said, adding the closure of the rail bridges could affect the import and timely supply of feed for poultry farmers. UNA also said the shutdown could affect production of chicken and eggs in Mexico.

Union Pacific, a major railroad company, has expressed concern, noting that the closed sites represent 45% of the railroad's cross-border business, and there is not enough capacity at their other gateways to redirect this traffic. Consequently, the railroads and their shipping customers are calling for the affected border crossings to be reopened promptly to mitigate the disruptions to trade and transportation.

— A history professor at Wellesley College has identified the emergence of new types of borders within nations, which mark areas that truly benefit from free trade. These borders take the form of special economic zones, where companies can operate with minimal regulation or government intervention. Link to details via Bloomberg.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— General Mills cut its annual sales forecast on Wednesday, hurt by slowing demand for its higher-priced breakfast cereals, snack bars and pet food products. Elevated interest rates and sticky inflation are prompting consumers to opt for pantry staples from cheaper private-label alternatives to pricier national brands such as General Mills and Conagra Brands.

|

POLITICS & ELECTIONS |

— Colorado Supreme Court, in a 4-3 ruling, removed Trump from the state's primary ballot, concluding that he "incited and encouraged the use of violence and lawless action to disrupt the peaceful transfer of power." It is the first time a court has found that Section 3 of the 14th Amendment — which bans insurrectionists who once swore to uphold the Constitution from holding office — applies to Trump. Trump lost Colorado by double digits in 2020 and no Republican has won the state since 2004. Courts have so far rejected similar lawsuits in other states. The Colorado decision will very likely be appealed to the Supreme Court. The Colorado court stayed the ruling until Jan. 4, with the option to keep the stay in place if the Supreme Court takes up the case before then. The state's primary is set for Super Tuesday, on March 5.

Of note: The Colorado court wrote: ““We are mindful of the magnitude and weight of the questions now before us. We are likewise mindful of our solemn duty to apply the law, without fear or favor, and without being swayed by public reaction to the decisions that the law mandates we reach.”

Background: The 14th Amendment states officials who take an oath to support the Constitution are banned from future office if they "engaged in insurrection." But the amendment's wording is vague, doesn't explicitly mention the presidency and has only been applied twice since 1919.

|

OTHER ITEMS OF NOTE |

— IRS plans to waive about $1 billion worth of penalties for taxpayers who missed deadlines during the pandemic. Roughly 4.6 million individual taxpayers who owe for tax years 2020 and 2021 will be eligible for the penalty relief.

— EPA announced its decision to allow the use of the pesticide chlorpyrifos on crops, including soybeans, following a ruling by the U.S. Court of Appeals for the Eighth Circuit last month. The court determined that the EPA unlawfully revoked its permission to use the insecticide in 2021. This decision comes after a ban on chlorpyrifos use on food crops was put in place in 2021, following a Ninth Circuit ruling that required the EPA to either ban the pesticide's use on food crops or reduce allowable residue levels within 60 days to protect children. The EPA will publish a notice in approximately a week to officially indicate that chlorpyrifos can be used again, pending the termination of the Eighth Circuit's jurisdiction over the case. While the EPA will allow all canceled uses of chlorpyrifos to resume, it plans to propose a new rule revoking pesticide residue tolerances for all uses except 11 specified by the court. These 11 uses, which include crops like alfalfa, soybeans, citrus, peaches, and tart cherries, rely on chlorpyrifos to control various insects.

The EPA is working with pesticide manufacturers to identify additional restrictions that would allow the 11 high-benefit uses of chlorpyrifos to continue while safeguarding farmworkers, vulnerable populations, and endangered species. The agency is also addressing concerns about the impact of chlorpyrifos and other pesticides on threatened or endangered species, such as orcas, salmon, and sturgeon, as identified in a 2022 Biological Opinion by the National Marine Fisheries Service.

States with the highest chlorpyrifos use in 2019 included Iowa, Nebraska, and Minnesota, with high-use crops including corn, soybeans, and various orchards, including grapes.

— Release of five wolves in the Colorado mountains begins first-of-its kind state reintroduction effort. Two ranchers’ groups sued state and federal wildlife officials days before efforts to capture the wolves in Oregon began, but a federal judge on Friday denied the groups’ request to delay the reintroduction. Link for details via the Denver Post.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |