Labor Market Added 199,000 Jobs in November as Unemployment Rate Hits 3.7%

Markets scaling back rate cut expectations, move to near even in March vs being over 50% for cut in March

|

Today’s Digital Newspaper |

I am en route back to Washington, D.C. after speaking at the USA Rice Federation meeting in Palm Springs, California.

— Jobs report: In November, total employment in the U.S. increased by 199,000 jobs, a significant improvement compared to the previous month's 33-month low of 150,000, as reported by the Labor Department in its monthly employment report. Economists had predicted an addition of 172,500 jobs for November, according to consensus estimates compiled by FactSet. The increase in employment includes approximately 41,000 autoworkers and actors who returned to their jobs after strikes, and others in related businesses that had been stalled by the walkouts. However, it marked the second consecutive month with job additions below the average monthly gain of 240,000 observed over the past year, signaling a slowdown in the labor market.

The unemployment rate reached 3.7% in November, and annual hourly wages saw an increase of 12 cents, equivalent to a 0.4% rise.

Impacts: While the unemployment rate and wage increases remain within historical norms, they reveal certain weaknesses in the labor market. For instance, in November 2022, the unemployment rate was 3.5%, and wage growth was at a higher 5%. This suggests a shift in labor market conditions over the past year. Stocks slipped in early trading after the numbers were released, likely a nod to the higher growth and strong economy exhibited by today’s jobs data, meaning rates could remain elevated for longer. The 10-year Treasury yield has risen sharply to 4.25%.

— The Federal Reserve is expected to keep the federal funds target range unchanged at 5.25-5.5% at the Dec. 12-13 FOMC meeting. The Fed will be hesitant to endorse market expectations of significant rate cuts until they are confident that inflationary pressures have been subdued. Key Federal Reserve officials are supporting the narrative that current monetary policy is restrictive enough to bring inflation down to the target of 2%. The focus at the upcoming meeting is on individual forecasts from Fed members and whether they will support the market's perception of upcoming rate cuts. Markets have shifted their expectations significantly, now pricing in the possibility of aggressive interest rate cuts in the coming year, with 125 basis points (bp) of rate cuts expected. This shift in sentiment is reflected in the decline of the U.S. 10-year Treasury yield from nearly 5% in late October to 4.1% in early December.

Of note: After today’s Jobs report, markets are scaling back interest rate cut expectations, moving to near even in March vs being over 50% for a cut in March.

— Markets:

- Equities:

On Thursday: All three major indices ended higher Thursday with an eye ahead to Friday's key jobs report. The Dow was up 62.95 points, 0.17%, at 36,117.38. The Nasdaq rose 193.28 points, 1.37%, at 14,339.99. The S&P 500 gained 36.25 points, 0.80%, at 4,585.59.

Today: The Dow opened weaker but has already lifted off lows. In Asia, Japan -1.7%. Hong Kong -0.1%. China +0.1%. India +0.4%. In Europe, at midday, London +0.2%. Paris +0.7%. Frankfurt +0.1%.

- Currencies: The key focus in currency markets this week has been the Japanese yen, as traders speculate about a potential shift away from negative interest rates by the Bank of Japan. The yen experienced significant volatility on Friday, with an initial surge gradually subsiding during the Asian trading session. Investors are prepared for more unpredictable movements, but as of now, the yen stands as the best-performing major currency for the week and ranks third among more than 150 currencies tracked by Bloomberg.

- Energy: Gasoline in the U.S. is set to get even cheaper as the underlying futures benchmark sank to a two-year low, a sign that inflation could continue to ease.

- India working to prevent disruption of ethanol supplies for gasoline blending. India is working to ensure supplies of ethanol for blending with gasoline are not disrupted, government officials said on Friday, a day after curbs were placed on ethanol production from cane juice to boost sugar supplies. The government will now rely on corn for ethanol production to meet gasoline blending goals.

- Outside markets: The U.S. dollar was slightly, with the euro and British pound both weaker against the greenback. The yield on the 10-year U.S. Treasury note was higher, trading around 4.18%, ahead of the jobs update, with a mostly higher tone in global government bond yields. Crude oil futures continued to advance, with U.S. crude around $71 per barrel and Brent around $75.80 per barrel. Gold and silver futures were narrowly mixed, with gold weaker around $2,044 per troy ounce and silver firmer around $24.09 per troy ounce. ·

- Ag markets:

USDA daily export sales:

— 136,000 MT soybeans to China during the 2023-2024 marketing year

— 110,000 MT soft red winter wheat to China, 2023-2024 marketing year

— 165,000 MT corn to unknown destinations, 2023-2024 marketing year

Grains: Corn, soybeans and wheat held in relatively tight trading ranges overnight ahead of USDA’s December crop reports later this morning. As of 7:30 a.m. ET, corn futures were trading steady to fractionally higher, soybeans were 3 to 4 cents higher, SRW wheat was 6 to 7 cents lower, HRW and HRS wheat futures were2 to 3 cents lower. Front-month crude oil futures were around $1.25 higher, and the U.S. dollar index was nearly 200 points higher this morning.

Beef movement stays strong as prices slide. Choice wholesale beef prices fell another 72 cents on Thursday, while Select dropped $1.07. Packers continued to move a lot of beef at the lower prices, with 218 loads changing hands – the second straight day with spot movement of more than 200 loads.

Cash hog market continues seasonal slide. The CME lean hog index is down another 31 cents to $69.12 (as of Dec. 6). Hog supplies are likely peaking seasonally, with this week’s kill total usually marking the annual peak. But market-ready supplies are likely to remain above year-ago levels, which seems likely to keep a lid on cash prices through the balance of this year and may continue weighing on the market in early 2024.

- December crop reports out at noon ET. USDA won’t update its corn and soybean crop estimates in the Crop Production Report at noon ET, though there will be a revised cotton production forecast. Any changes to domestic use in the Supply & Demand Report will likely be limited, with traders expecting ending stocks to come in at 2.152 billion bu. for corn (2.156 billion bu. in November), 243 million bu. for soybeans (245 million bu. in November) and 684 million bu. for wheat (same as November). The bigger focus will be global production forecasts, especially for South America.

- The Brazil corn basis is high enough for U.S. corn to compete through early June, says grain trader and analyst Richard Crow. He adds: “The West Coast capacity may get tested. The rumor of a million tons of Chinese corn switched from Brazil to the U.S. It is interesting to note that a million tons of futures cleared “clearport” the day before yesterday. The primary variable to corn still rests with the Brazil’s second corn crop, what it may be.”

- Government-held wheat stocks in India have reached a seven-year low, with inventories standing at 19 million metric tons (MMT), according to government sources cited by Reuters. To stabilize domestic prices, the Indian government has released additional supplies from its reserves into the private market, and it has also imposed a ban on wheat exports to bolster domestic stocks. Despite a significant decline in global wheat prices, which have fallen by approximately 35% this year, wheat prices in India have surged by more than 20% in recent months. This increase is attributed to concerns that the country's wheat crop may be smaller than official estimates. Interestingly, India has resisted calls to boost wheat imports to increase supplies, despite favorable global prices. Traders mentioned in the report suggest that the current low global wheat prices would be an opportune time for India to consider increasing its wheat imports.

— Congress:

- Aid to Ukraine: Foreign Affairs Chair Michael McCaul (R-Texas) said the chamber is out of time to approve Ukraine aid in 2023.

- FY 2024 funding: House Speaker Mike Johnson (R-La.) suggested the possibility of a continuing resolution (CR) that would last for the remainder of the fiscal year. He emphasized this point in a recent letter to his colleagues, stating he has no intention of considering any more short-term extensions. While firm on not wanting short-term extensions, Johnson appears open to negotiations on broader government funding issues. He specifically mentioned the debt-limit measure, which contains statutory spending caps and is supported by a significant majority of his party's Conference. This measure serves as the foundation for ongoing negotiations. However, he did not address other important factors in these negotiations, such as redirected rescissions (reducing previously allocated funds) and cap-exempt emergency funds. These are additional elements that will likely play a role in determining final funding outcomes.

- Personnel: Senate Republicans are calling for FDIC Chair Martin Gruenberg to resign over allegations of a toxic workplace culture including allegations of sexual harassment. They also asked Gruenberg in a letter for information regarding the allegations, which the agency is also investigating internally.

— Sen. Stabenow rejects GOP plan to restrain Thrifty Food Plan budget increases. X Senate Ag Chair Debbie Stabenow (D-Mich.) expressed her strong opposition to a House Republican proposal during a gathering of anti-hunger advocates. The Republican plan aimed to ensure that any future updates to the Thrifty Food Plan (TFP) would not increase the budget. The context for this opposition is that the TFP had recently been updated by President Joe Biden's administration for the first time in many years. This update resulted in a significant increase in the cost of the Supplemental Nutrition Assistance Program (SNAP), which helps low-income individuals and families purchase food. Stabenow spoke at the Food Research & Action Center conference in Washington, D.C., This coalition is urging lawmakers to resist any attempts to reduce SNAP benefits and even suggested that, if necessary, they should consider not reauthorizing a new farm bill in this Congress if SNAP remains at risk.

The Food Research & Action Center has made it clear that they are prepared to oppose any efforts to weaken SNAP in the upcoming farm bill, stating that having no bill at all is preferable to having a bad one. Despite the opposition, House Ag Chair G.T. Thompson (R-Pa.) has stated that he is committed to his efforts to implement new restrictions on the TFP and other related measures. Thompson acknowledged that these ideas have received both praise and criticism but affirmed that he would not back down from his position.

— Japan’s economy shrank at the sharpest pace since the height of the pandemic, an outcome that complicates the policy path for the Bank of Japan. In Q3 of 2023, the Japanese economy contracted by 0.7% quarter-on-quarter, which was worse than the initially reported 0.5% contraction and followed a downwardly revised 0.9% growth in Q2. This marks the first GDP contraction since Q3 of 2022 and is attributed to increased cost pressures and mounting global challenges. Several key factors contributed to this contraction:

- Private consumption declined by 0.2%, a contrast to the earlier flat estimate and the Q2 figure, which showed a 0.6% drop.

- Capital expenditures also saw a decrease of 0.4%, compared to the initial estimate of a 0.6% fall and the Q2 figure of a 1.3% decline.

- Public investment decreased more than initially thought, by 0.8%, in contrast to the preliminary estimate of a 0.5% fall and the 1.5% growth seen in Q2.

- Net trade had a negative impact on GDP, with exports rising by 0.4% (compared to 3.8% in Q2) and imports increasing by 0.8% (compared to -3.3% in Q2).

- Government spending, however, rose by 0.3%, consistent with preliminary figures and following a 0.1% decrease in Q2.

— China:

- China's Politburo signals commitment to economic support. On Friday, China's top 24 Communist Party leaders, known as the Politburo, indicated their commitment to providing support for the country's economy. During the meeting, chaired by President Xi Jinping, no new policies were introduced, but there was a clear emphasis on strengthening fiscal measures and improving the effectiveness of monetary policy. Specifically, the statement highlighted that fiscal policy would be enhanced "appropriately," indicating a willingness to increase government spending as needed. Additionally, the statement noted that monetary policy should be flexible, appropriate, targeted, and effective. Notably, the previous description of monetary policy as "forceful" was omitted from the statement, suggesting a potential shift in approach toward a more measured and targeted approach to monetary measures. Separately, China’s foreign exchange regulator said the country will relax restrictions on outbound direct investment and capital rules for foreign direct investment.

— Israel/Hamas:

- Today, the United Nations Security Council convenes to address the deteriorating humanitarian situation in Gaza. One of the primary concerns is the healthcare system's decline, forcing numerous families to seek ways to help their sick and injured loved. Israel's security cabinet approved a limited increase in fuel supplies to Gaza, but global leaders and aid organizations are calling for more assistance to reach the region. In northern Gaza, 97% of households face inadequate food consumption, and approximately 83% in southern Gaza are resorting to extreme consumption strategies for survival, as reported by the UN World Food Program. The conflict has resulted in a significant loss of life, with at least 17,177 Palestinians killed in Israeli attacks in Gaza since Oct. 7, according to the Hamas-controlled health ministry, and approximately 46,000 people have been injured.

- UN Secretary-General Antonio Guterres has invoked Article 99 of the UN Charter to alert the UN Security Council about an impending "humanitarian catastrophe" in Gaza and has called for an immediate ceasefire. Article 99, a rarely used provision, grants the UN Secretary-General the authority to inform the council of situations that he believes pose a threat to international peace and security. The last time Article 99 was invoked was over 50 years ago in 1971 during the conflict that led to the creation of Bangladesh. The United Arab Emirates (UAE) has proposed a resolution for an immediate humanitarian ceasefire. However, it remains uncertain whether the United States will support this resolution. Earlier in the week, US officials suggested that the UN Security Council should not interfere with diplomatic efforts between Israel and Palestine. U.S. Deputy Ambassador Robert Wood expressed that a ceasefire "would not be useful" at this time.

— Russia & Ukraine:

- Ukraine has harvested nearly 78 million metric tons (MMT) of grains and oilseeds so far in 2023, the Agriculture Ministry said Friday, including 57.6 MMT of grains and 20.7 MMT of oilseeds. The grain harvest includes 22.5 MMT of wheat, 26.9 MMT of corn, 5.9 MMT of barley and smaller amounts of other cereal grains. For oilseeds, the total includes 11.9 MMT of sunflower seed and over 4 MMT of rapeseed.

- Russian President Vladimir Putin announced his intention to run for president in the upcoming elections scheduled for 2024. If successful, this move would extend his time in power until at least 2030. If he completes his term, Putin would become the longest-serving leader in Russia since Josef Stalin, surpassing Leonid Brezhnev's 18-year leadership. Putin, who is currently 71 years old, had been reported a month ago to have made the decision to seek re-election.

— Senior U.S. agricultural trade officials emphasized the need for market diversification to boost farm exports. Currently, the majority of U.S. food and agricultural exports are concentrated in four major markets, accounting for nearly $6 out of every $10 in sales. To expand export volumes and reduce dependence on these markets, the officials stressed the importance of developing new customers in countries that were not traditionally part of the export landscape.

Projections indicate that agricultural exports are set to decline for the second consecutive year in fiscal year (FY) 2024, falling by 12% from the record-high of $193.1 billion achieved in fiscal 2022. Simultaneously, agricultural imports are expected to reach $200 billion for the first time, resulting in a trade deficit in agricultural products for the United States in four out of the past five years.

In response to these challenges, Doug McKalip, the U.S. chief agricultural negotiator, and Alexis Taylor, USDA undersecretary for trade, suggested that diversifying markets could be a solution. The two officials spoke at the American Peanut Council conference.

USDA is launching a new cost-sharing initiative called the Regional Agricultural Promotion Program to support exporters in breaking into new markets and expanding their presence in growing markets. An initial $300 million in grants has been made available for the program's first year. McKalip highlighted the potential in countries that "have a lot of potential" and mentioned ongoing negotiations with Taiwan, Kenya, and 12 countries in the Indo-Pacific Economic Framework. He also emphasized efforts to accelerate the pace of trade talks, which typically take years to conclude.

Taylor emphasized the importance of diversification as a tool for industry growth and risk mitigation in a volatile global marketplace. While the U.S. remains committed to its established consumer base worldwide, Taylor urged exploring growth opportunities in regions such as Africa, Latin America, the Middle East, and Southeast Asia. These vast regions, with substantial populations, are projected to account for one-fifth of U.S. food and agricultural exports in the current fiscal year. In contrast, China, Mexico, Canada, and the EU, the four largest customers, are expected to generate three-fifths of sales.

China, despite being viewed as an adversary nation by some, remains the top destination for U.S. food and agricultural exports, with purchases forecasted at $29.5 billion this year. Annual sales to China dipped to $17 billion during the Trump-era trade war but rebounded to reach $39.2 billion in fiscal 2022.

The composition of U.S. agricultural exports is diverse, with major bulk products like soybeans, cotton, rice, wheat, and corn accounting for one-third of sales. Horticultural products (fruits, vegetables, nuts) make up nearly a quarter, while livestock, dairy, and poultry constitute one-fifth, and sugar and related products like coffee account for 4%.

Additionally, U.S. imports of sugar, fruits, vegetables, nuts, beef, wine, and distilled spirits are nearly twice the size of exports of those products.

— EU considers reopening WTO case against U.S. over steel and aluminum tariffs. The European Union (EU) is considering reopening a World Trade Organization (WTO) case against the U.S. over a previous dispute involving steel and aluminum tariffs, according to Bloomberg. During the Trump era, both the EU and the U.S. imposed tariffs on each other's goods, totaling over $10 billion. However, the EU is not currently planning to immediately reimpose retaliatory tariffs on American products in this dispute, a significant concession in ongoing negotiations with Washington.

By reopening the WTO case, the EU aims to keep the option of imposing tariffs open for the future while extending a settlement that avoids the return of tariffs on billions of dollars' worth of exports next month. A final decision on this matter has not been made by Brussels.

The EU's decision to refrain from imposing tariffs is partly due to concerns that such actions could benefit former President Donald Trump's political campaign ahead of the American elections in November. The EU and the U.S. have been engaged in intense negotiations for months to find a resolution to the dispute.

The trade conflict began when Trump imposed tariffs on European steel and aluminum, citing national security concerns. In response, the EU imposed its own retaliatory measures. A temporary truce was reached between the EU and the Biden administration in 2021, with both sides giving themselves a two-year window to negotiate a permanent resolution to the steel and aluminum dispute. Failure to reach an agreement could lead to the return of some tariffs next year.

As part of the 2021 truce, the U.S. partially removed its tariffs and introduced tariff-rate quotas on metals. Meanwhile, the EU froze its restrictive measures. This situation has been deemed imbalanced by the EU, costing EU exporters over $350 million annually in duties.

Negotiations between the EU and the U.S. have stalled over the terms of the truce extension. The U.S. wants to maintain the status quo until the end of 2025, while the EU has requested replacing the current tariff-rate quota system with annual quotas to better reflect historical trade patterns. The Biden administration has not yet agreed to the EU's request, and EU member states are reluctant to reimpose tariffs on U.S. goods, fearing potential political implications in the U.S.

— U.S. ag groups urge lower duties on Moroccan fertilizer imports. Almost 60 U.S. agricultural and commodity groups are urging the U.S. Department of Commerce (DOC) to either eliminate or further reduce import duties on phosphate fertilizer imports from Morocco. The DOC had previously lowered countervailing duties (CVD) on Moroccan phosphate fertilizer to 2.12% after an administrative review, down from the previous rate of 19.97%. However, the reduction had limited impact since Morocco had largely halted shipments of the product to the U.S. The groups argue that the ongoing imposition of duties is due to the International Trade Commission's (ITC) affirmative finding of injury. The U.S. Court of International Trade (CIT) identified errors in the ITC's injury determination and sent the decisions back for review. DOC is expected to address CIT concerns regarding duty calculations, while the ITC is set to respond in January. These duties were imposed following a trade case initiated by U.S. producer Mosaic, and Mosaic retains the option to appeal the pending decisions by DOC and ITC.

— The FDA is warning against consuming cantaloupe products involved in an ongoing recall due to a salmonella outbreak. Since late November, there have been 230 reported cases of illness in 38 U.S. states, resulting in three deaths. In Canada, 129 salmonella cases and five deaths have been confirmed across six provinces. The outbreak has been linked to whole and pre-cut cantaloupes grown in Mexico and sold under the Rudy and Malichita brands. These products have been distributed through various retailers, including Sprouts, Trader Joe's, KwikTrip, RaceTrac, Aldi, Walmart, and Vinyard. The CDC is advising businesses not to sell the contaminated fruit and to thoroughly sanitize any items that may have come into contact with it.

— The UN Food and Agriculture Organization (FAO) Food Price Index (FFPI) remained unchanged in November at 120.4 points. This stability resulted from a combination of declining prices for cereals and meat, which offset higher prices for vegetable oils, dairy products, and sugar. Compared to the same period last year, the FFPI is down by 14.4 points (10.7%).

Cereal grain prices dropped by 3.7 points from October and significantly, over 29 points from November 2022. This decline was driven by lower prices for coarse grains like corn and barley, although sorghum prices saw a slight increase. Wheat prices decreased by 2.4% in November.

Vegetable oil prices increased by 4.1 points (3.4%), primarily due to higher world palm and sunflower oil prices, which offset the lower quotations for soy and rapeseed oil.

Dairy product prices experienced a second consecutive monthly increase, rising by 2.5 points (2.2%) from October. However, they remain considerably lower, down by 23.2 points (16.9%) compared to November 2022.

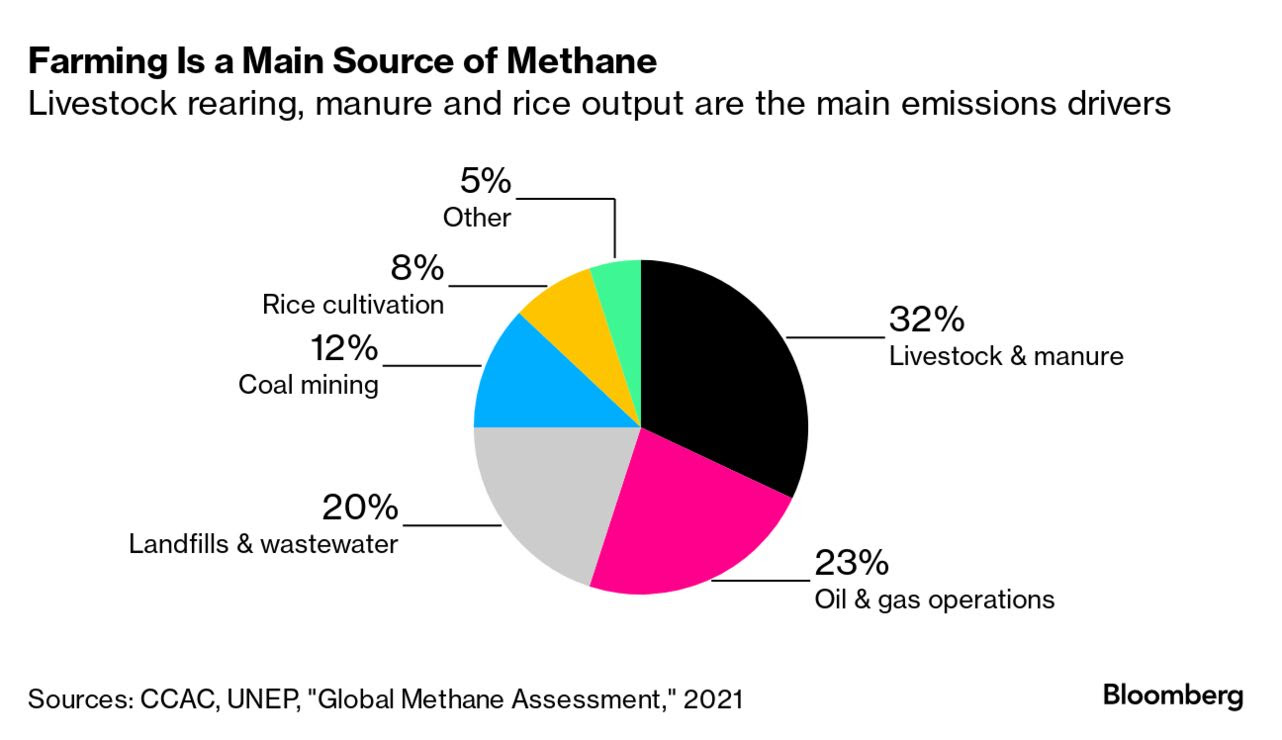

— Major dairy producers commit to disclose methane emissions to address livestock's environmental impact. Six major dairy producers, including the Bel Group, Danone, General Mills, Kraft Heinz, Nestlé, and a segment of Lactalis, have committed to disclosing their methane emissions as part of their efforts to address the significant environmental impact of livestock. This announcement was made during the COP28 climate summit, and the companies have joined together to promote transparency in their dairy supply chains. Each of them has pledged to develop and implement comprehensive methane action plans in collaboration with the Environmental Defense Fund (EDF).

Agriculture is responsible for around 40% of global methane emissions, a potent greenhouse gas with 80 times the warming potential of carbon dioxide. Most of these emissions stem from livestock, whether released through belching or in the form of manure. While efforts to address methane emissions have primarily focused on the energy sector, such as reducing leaks from oil wells, tackling this issue in agriculture has proven challenging due to limited data reporting and the ongoing development of solutions.

— Sales of antibiotics for use in cattle, hogs, and poultry increased by 4% in 2022, reaching 11.17 million kilograms (24.6 million pounds), according to the Food and Drug Administration (FDA). This marks the second consecutive annual increase in antibiotic sales for food animals. However, these sales are significantly lower than levels observed before the FDA banned the use of antibiotics to promote weight gain in food-producing animals. Link to the FDA’s 2022 “Summary Report on Antimicrobials Sold or Distributed for Use in Food-Producing Animals.”

The restrictions on antibiotic use were implemented as part of a broader government effort to safeguard the effectiveness of antibiotics for human disease treatment. Since 2017, the FDA has mandated veterinary oversight for antibiotic use in preventing or treating diseases in food animals. Six months ago, the FDA further restricted over-the-counter sales of medically important antibiotics for livestock.

In 2022, approximately 56% of antibiotic sales were categorized as medically important, totaling 6.24 million kilograms, the highest figure in six years. Conversely, sales of antibiotics classified as not medically important decreased by 190,000 kilograms. Among medically important antibiotics, tetracyclines accounted for 36% of all sales, while ionophores, considered not medically important, represented 37% of sales.

The peak year for antibiotic sales for food animals was 2015, with 15.58 million kilograms sold. It's important to note that the FDA monitors the sales of antibiotics for livestock but does not track the actual usage of these drugs.

— Federal judge blocks Iowa counties' restrictions on CO2 pipeline routing. In a lawsuit brought by Summit Carbon Solutions, a federal judge has issued a ruling that prevents Story and Shelby counties in Iowa from enforcing ordinances that would place limitations on the routing of carbon dioxide pipelines. Link for details.

— Weather:

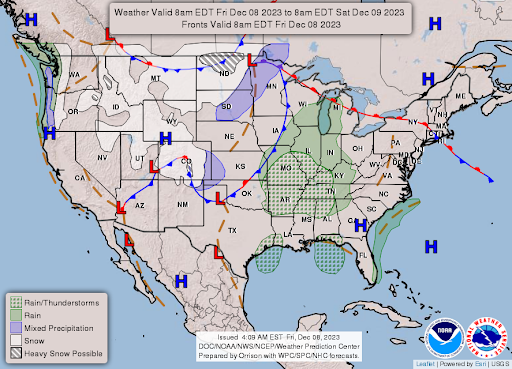

- A multi-threat storm will traverse through the eastern half of the U.S. this weekend, unloading heavy rain and snow across several states. Powerful wind gusts could also knock out power and disrupt travel in busy cities as the adverse weather stretches more than 1,200 miles from the Gulf Coast to the Canadian border.

- NWS: Unsettled weather with Excessive Rainfall and Heavy Snowfall implications return to the Pacific Northwest this weekend... ...Severe Thunderstorms and Heavy rainfall spread from Gulf Coast to East Coast this weekend... ...Warm temperatures shift from Mississippi Valley to East Coast.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |