USDA May Face Court Challenge in Its Implementation of ERP for 2022 Losses

Biden administration regulatory agenda has some surprising omissions re: RFS

|

Today’s Digital Newspaper |

A different format for the report today as I am in Palm Springs, Calif., speaking at the USA Rice Federation meeting.

— Markets:

- Equities:

On Wednesday, all three major indices finished in the red, falling into negative territory after midday and failing to be able lift higher for the session. The Dow ended down 70.13 points, 0.19%, at 36,054.43. The Nasdaq lost 83.20 points, 0.58%, at 14,146.71. The S&P 500 fell 17.84 points, 0.39%, at 4,549.34.

Today, Asian and European stock markets were mixed in overnight trading. U.S. stock indexes are pointed toward narrowly mixed openings. In Asia, Japan -1.8%. Hong Kong -0.7%. China -0.1%. India -0.2%. In Europe, at midday, London -0.1%. Paris -0.1%. Frankfurt -0.2%. - Energy: On Wednesday, the price of West Texas Intermediate (WTI) crude oil dropped by 4%, falling to below $70 per barrel. This marks the lowest price level since late June. Despite the decline, the oil-producing countries within OPEC+ have indicated their intention to maintain or potentially increase production cuts. Consequently, gasoline prices have also continued to decrease, reaching their lowest point since January.

- Bank of Japan commentary overnight was hawkish, and markets now expect a rate hike at the December meeting and that expectation is pushing global yields slightly higher.

- Argentina investors are preparing for a 44% devaluation of the country’s official exchange rate after Javier Milei’s inauguration on Dec. 10.

- Outside markets: The U.S. dollar index was lower, with the euro stronger against the greenback. The yield on the 10-year US Treasury note rose, Crude oil futures were higher, with U.S. crude around $70.25 per barrel and Brent around $75.25 per barrel. Gold futures and silver futures were up, with gold around $2,051 per troy ounce and silver around $24.25 per troy ounce.

- Grains firmer overnight. Early seller interest faded overnight, with corn, soybeans and wheat all trading solidly higher early this morning. As of 7:30 a.m. ET, corn futures were trading 2 to 3 cents higher, soybeans were 6 to 9 cents higher, SRW wheat futures were 2 to 4 cents higher, HRW was near unchanged and HRS wheat was mostly 3 to 4 cents higher. Front-month crude oil futures were modestly firmer, and the U.S. dollar index was around 200 points lower this morning.

- Choice beef drops again but movement surges. Wholesale Choice beef prices dropped $3.19 on Wednesday and are down $6.47 over the past week, while Select firmed 77 cents. Packers moved a huge 235 loads of product in the spot market, building on the recent surge in retailer buying.

- Cash hog index continues to drop but pace slows. The CME lean hog index is down another 17 cents to $69.43 (as of Dec. 5). That’s the smallest daily loss since Nov. 28, though the cash market is giving no signs the seasonal decline is imminent. December lean hog futures ended Wednesday $1.88 below today’s cash quote, while February hogs held a 13-cent discount.

- Brazil cuts soybean, corn crop forecasts. Conab now forecasts Brazil’s soybean crop at 160.18 MMT, down 2.24 MMT from last month. Corn production is estimated at 118.53 MMT, down 538,000 MT from November, including a safrinha crop of 91.24 MMT. Conab typically uses trendline projections for safrinha corn until February. The government’s crop forecasting agency noted “adverse conditions,” including hot and dry weather in center-west states and excessive rainfall in southern areas, for the cuts. Conab forecasts soybean production will fall 3.8% from year-ago in the center-west region, led by an expected 4.6% decline in top producer Mato Grosso. The southern region is expected to see soybean production increase 21.4% from last year, with a 68.1% surge forecast for Rio Grande do Sul, which was hurt by drought in 2022-23. Conab noted delays in soybean planting “open up uncertainties for second crop (safrinha) corn.”

- India permits exports of non-basmati white rice for Nepal earthquake victims. India’s government granted a one-time exemption from “prohibition” to the Indian Rice Exporters Federation for the export of 20 MT of non-basmati white rice as a donation to earthquake victims in Nepal.

- Ag trade: South Korea purchased 138,000 MT of corn to be sourced from the U.S., South America or South Africa and 65,000 MT of optional origin feed wheat. Japan purchased 132,504 MT of milling wheat from its weekly tender, including 59,446 MT U.S., 33,788 MT Canadian and 39,270 MT Australian. Algeria tendered to buy up to 120,000 MT of Argentine corn. Egypt tendered to buy an unspecified amount of wheat from multiple origins. Indonesia tendered to buy 534,000 MT of optional origin long grain white rice.

- Sales of U.S. rice to China, with initial pork sales for 2024. USDA’s weekly Export Sales report included more activity for China in the week ended Nov. 30 for 2023-24, including net sales of 65,000 metric tons of wheat, 274,495 metric tons of corn, 107,113 metric tons of sorghum, 555,248 metric tons of soybeans, 256 metric tons of rice, and 59,145 running bales of upland cotton. For 2023, there were net sales of 901 metric tons of beef and net reductions of 154 metric tons of pork. For 2024, there were net sales of 1,101 metric tons of beef and the first sales of pork at 221 metric tons.

- USDA daily export sale: 121,000 metric tons soybeans for delivery to unknown destinations during the 2023-2024 marketing year.

— Congress:

- Republicans in the Senate successfully blocked a spending package that included military aid for Ukraine. Senate Minority Leader Mitch McConnell (R-Ky.) said his party would withhold support for the bill unless Democrats agreed to implement migration restrictions at the U.S. southern border. President Joe Biden criticized Republicans, accusing them of endangering national security by using these tactics. The $111 billion spending package also encompassed aid for Israel, making it a contentious issue in Congress. The push for compromise on this topic will not pick up momentum. Both the House and Senate are scheduled to leave for the holiday recess at the end of next week. Sen. John Thune (R-S.D.) told Punchbowl News that the Senate would likely need to remain in session up until Christmas to pass a border-Ukraine-Israel-Taiwan bill.

- Lawmakers release compromise version of NDAA. Lawmakers unveiled the conference report of the fiscal year 2024 National Defense Authorization Act, which would authorize $886.3 billion in discretionary defense spending. The annual defense policy bill has been enacted into law 62 years in a row.

- Key lawmakers are working towards reaching an agreement on top-line funding levels between the House and Senate this week, although there is still uncertainty surrounding budget negotiations ahead of the Jan. 19 and Feb. 2 deadlines. Senate Appropriations Vice Chair Susan Collins (R-Maine) expressed her expectation for a bipartisan agreement on top-line funding levels this week. This agreement would mark a milestone in the funding talks and would be followed by discussions on how to allocate the total funding among the 12 annual appropriations bills. Meanwhile, House Speaker Mike Johnson (R-La.) recently presented a top-line funding offer to the Senate, as reported by Reps. Chuck Fleischmann (R-Tenn.) and Ken Buck (R-Colo.) after Johnson's meeting with House Republicans on Tuesday.

- Senate Ag panel forwards USDA, CFTC nominees. The Senate Ag Committee approved the nominations of Basil Gooden to be USDA undersecretary for rural development and Summer Mersinger for a full five-year term as a commissioner on the Commodity Futures Trading Commission (CFTC). The votes were 23-0 for both nominees. Mersinger was confirmed in 2022 to replace CFTC member Dawn Stump. Senate Ag Committee Chair Debbie Stabenow (D-Mich.) has been working to get the nominations before the full Senate ahead of their departure for the year. The strong votes and relatively easy confirmation hearings for both would suggest they could face little opposition in the full chamber.

- Farm bill update. During a House Ag Committee hearing, deep partisan divisions emerged regarding the reauthorization of the farm bill. Lawmakers split along party lines, particularly on issues related to conservation and nutrition funding. Committee Chair G.T. Thompson (R-Pa.) outlined his intentions to reallocate climate and conservation funds from the Inflation Reduction Act into other areas and to tighten regulations surrounding the Thrifty Food Plan. These actions are aimed at increasing the funding baseline, which can then be used for various bipartisan priorities, including strengthening the Title I farm safety net programs. Thompson emphasized his commitment to supporting rural communities that have faced significant challenges beyond their control. These proposals have received both support and criticism, reflecting the divisive nature of discussions around the farm bill reauthorization.

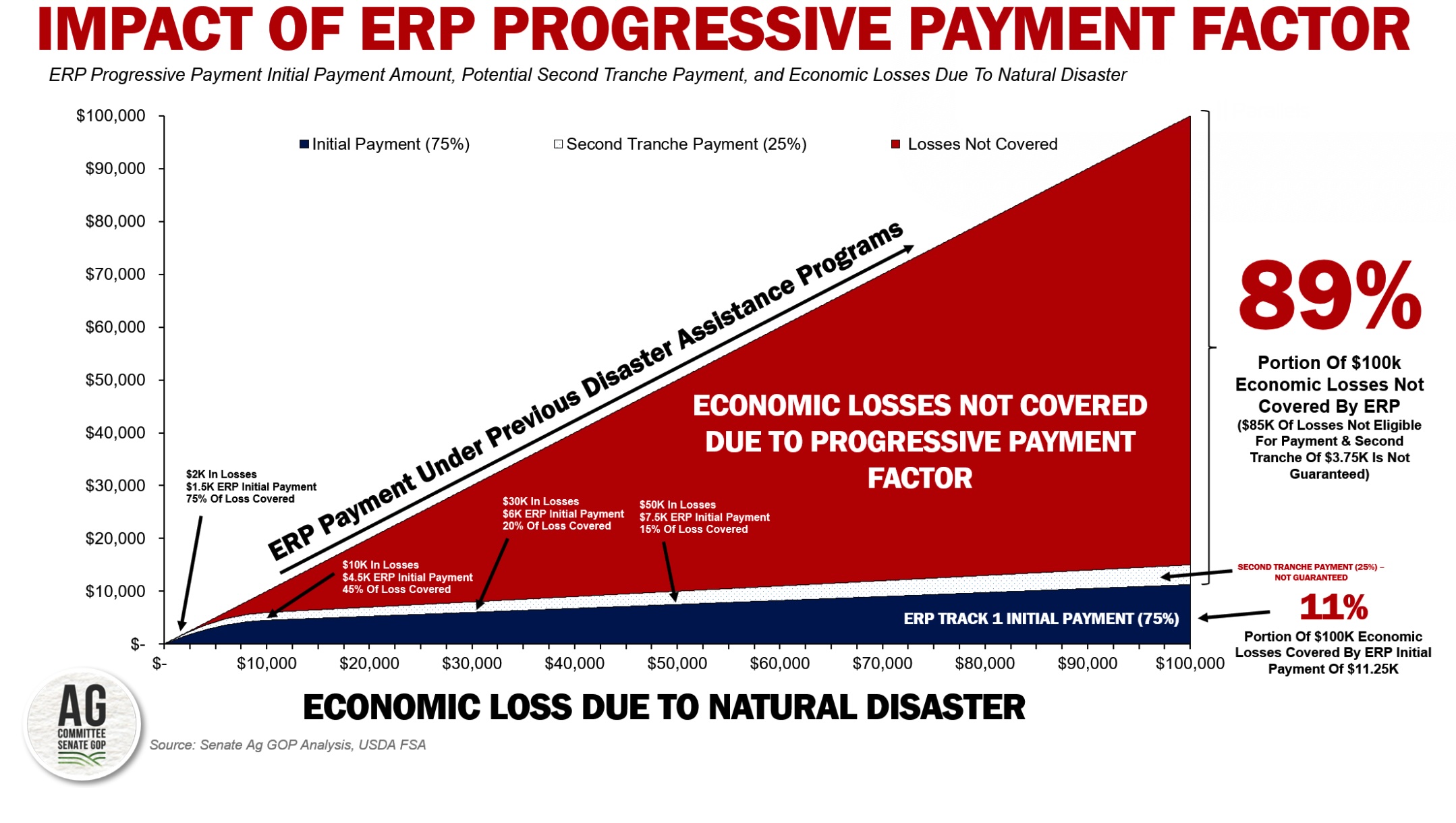

— USDA is responding to criticism from Republican lawmakers regarding their management of the Emergency Relief Program (ERP) for 2022 losses. A USDA spokesperson explained that the main issue is a lack of funding from Congress. They stated that Congress allocated only $3.2 billion to cover losses totaling over $10 billion. This funding gap forced USDA to make difficult choices to prioritize assistance for those in greatest need. The spokesperson added that if members of Congress are dissatisfied with these choices, they should advocate for more resources to enable the USDA to fully compensate farmers for their losses.

Some Republican House and Senate members have expressed their concerns to USDA Secretary Tom Vilsack, particularly regarding the new payment formula used for ERP in 2022. They believe this formula, different from the one used in 2020 and 2021, may result in significant producers receiving minimal or no assistance. Link to a blog report from the GOP staff at the Senate Ag Committee. Meanwhile, Senator John Hoeven (R-N.D.), Ranking Member of the Senate Agriculture Appropriations Committee, this week led a group of senators in requesting a Government Accountability Office (GAO) review of USDA’s implementation of disaster assistance for producer losses occurring in 2022.

Comments: USDA is not being totally informative on this topic. It initially provided an estimate of the disaster funding needed and that was woefully underestimated. USDA now says agency says it notified lawmakers of the $10 billion in estimated damages, but Congress chose to authorize only $3.2 billion instead. Congress is also at fault here because while lawmaker criticism has accelerated recently, this report and others talking with farmers clearly noted the major problems with USDA’s implementation of the program months ago. Farm-state lawmakers had time to act and like so many other things in Congress, they did not act. Meanwhile, USDA’s suggestion that Congress simply provide more funding is not the whole answer: Congress should no longer assume USDA is going to implement disaster aid programs in a favorable manner relative to production agriculture and instead for a select group of underserved farmers and other nuances. USDA claims the agency’s new methodology will result in around 170,000 farmers receiving more aid.

Bottom line, according to a lawyer contact: “USDA is talking nonsense. USDA has dealt with this in the past and has always calculated total benefits to each producer and then applied one factor to pare payments back, so they fit within budget. But this administration politicized the payments by applying six different factors to fully indemnify some farmers and punitively harm others who suffered the greatest loss. In other words, it applied a back door pay limit. It also arbitrarily limited refund of premiums and fees paid to ‘underserved’ farmers. In doing so, USDA plainly broke the law. If USDA does not comply with the law and Congress does not step in and defend the law it passed. then it will be up to a court. Courts look at deliberate violations of the law with a jaundiced eye in establishing remedies.”

— Challenges in forecasting CCC discretionary spending faced by CBO. A Southern Ag Today article (link) discusses the challenges faced by the Congressional Budget Office (CBO) in forecasting discretionary spending by the Commodity Credit Corporation (CCC). The CCC plays a crucial role in various government programs related to agriculture and commodity prices. Here are the key points:

- CBO's role: The CBO is responsible for forecasting federal government spending, which includes predicting the expenditures of agencies like the CCC.

- Forecasting challenges: Forecasting CCC spending is a complex task that involves predicting not only macroeconomic variables but also discretionary spending by executive branch agencies. This discretionary spending is authorized by Congress and includes various programs and initiatives.

- Changes in restrictions: From 2012 to 2017, Congress imposed restrictions on the Secretary's discretionary use of the CCC Charter Act. However, these restrictions were lifted in fiscal year 2018.

- Creative use of authority: Both the Trump and Biden administrations have used the CCC Charter Act's Section 5 in innovative ways to fund various programs. For example, during the U.S./China trade war, the Trump administration authorized substantial financial assistance to producers through the Market Facilitation Program (MFP).

- Baseline updates: CBO updates its baseline projections regularly, but historically, it did not include a separate line item for forecasting additional discretionary spending.

- Recent changes: In the January 2020 baseline, CBO began including a long-term forecast of $100 million per year in "Other CCC Spending" under CCC Charter Act Authority. This reflected the likelihood of continued discretionary spending.

- Spending discrepancy: Actual spending under Section 5 has averaged $10.7 billion over the last six years, significantly higher than CBO's current forecast of $1 billion per year.

- Future projections: Given recent spending trends and ongoing priorities, the article questions whether CBO will increase its forecasted spending under CCC Charter Act Authority in its upcoming Spring baseline update. It suggests that recent spending levels could become the norm, especially if the current administration is re-elected.

— Biden administration's EPA agenda omits Renewable Fuel Standard (RFS) actions. EPA's regulatory agenda, as released by the Biden administration, does not include any actions related to the RFS. Despite having finalized RFS levels for 2023, 2024, and 2025, which put the agency on track for the 2025 standards, there is no mention of any activities regarding proposed or final rules for the 2026 RFS standards. According to the rules, EPA should have finalized the 2026 RFS levels by October 2024.

There is also no of any actions by the administration concerning EPA's plans for addressing Renewable Identification Numbers (RINs) for electricity generated from renewable sources used to power electric vehicles. Although EPA had included provisions for eRINs in its proposed rule on RFS levels, they were not included in the final rule, and there is no timeline for finalizing these provisions.

Furthermore, the regulatory agenda does not specify when action will be taken to address issues related to fuel dispensing equipment for E15 (gasoline containing 15% ethanol).

— New cases of HPAI confirmed. USDA's Animal and Plant Health Inspection Service (APHIS) confirmed new cases of highly pathogenic avian influenza (HPAI) in commercial poultry operations. These cases include two commercial broiler production operations in Stanislaus County, California, with a combined total of 494,300 birds affected. Additionally, a commercial turkey meat bird operation in Barron County, Wisconsin, with 113,800 birds, has also been impacted by HPAI.

— The Biden administration has unveiled its regulatory plans for the USDA, with a focus on addressing various issues in animal agriculture. These plans include:

- Highly Pathogenic Avian Influenza (HPAI): USDA intends to propose a rule to align U.S. import regulations with global provisions concerning bird flu. This would involve revising regulations related to avian commodities to reduce the timeframe from 90 days to meet World Organization for Animal Health (WOAH) standards for regions that have been evaluated and found to warrant a reduction. The proposed rule is expected in July.

- Animal Identification (ID): The Animal and Plant Health Inspection Service (APHIS) is planning to issue a final rule that would recognize specific identification devices (such as ear tags) as official identification for cattle and bison, but only if these devices have both visual and electronic readability (EID). The final rule is targeted for April.

- Packers and Stockyards Act: USDA plans to propose a rule to amend regulations under the Packers and Stockyards Act to incorporate provisions for administering and enforcing the livestock dealer trust. This trust was established following amendments to the Packers and Stockyards Act in December 2020.

- Poultry Contracting: USDA is also working on a proposed rule regarding poultry contracting, with plans to release it in January.

— In October, the U.S. experienced a significant increase in both agricultural exports and imports. However, despite the rise in exports by more than 30% compared to September and a more than 10% increase in imports, there was still a trade deficit for the agricultural sector. Here are the key points:

- Export and import figures: U.S. ag exports in October amounted to $16.64 billion, while imports reached $16.90 billion.

- Trade deficit: The trade deficit for the agricultural sector in October was $261.7 million. This means that the U.S. imported slightly more agricultural products than it exported during that month.

- Persistent trade deficit: This marked the eighth consecutive month with a trade deficit for the agricultural sector. Out of the last 10 months, nine have shown a trade deficit.

- Seasonal trends: Typically, the agricultural sector experiences its strongest exports during the first three months of the fiscal year. However, in this case, it took until January for the sector to register a trade surplus for the month.

Bottom line: While U.S. ag exports and imports saw significant increases in October, the sector still faced a trade deficit, continuing a trend of monthly trade imbalances. Seasonal factors play a role, with stronger exports expected in the early months of the fiscal year.

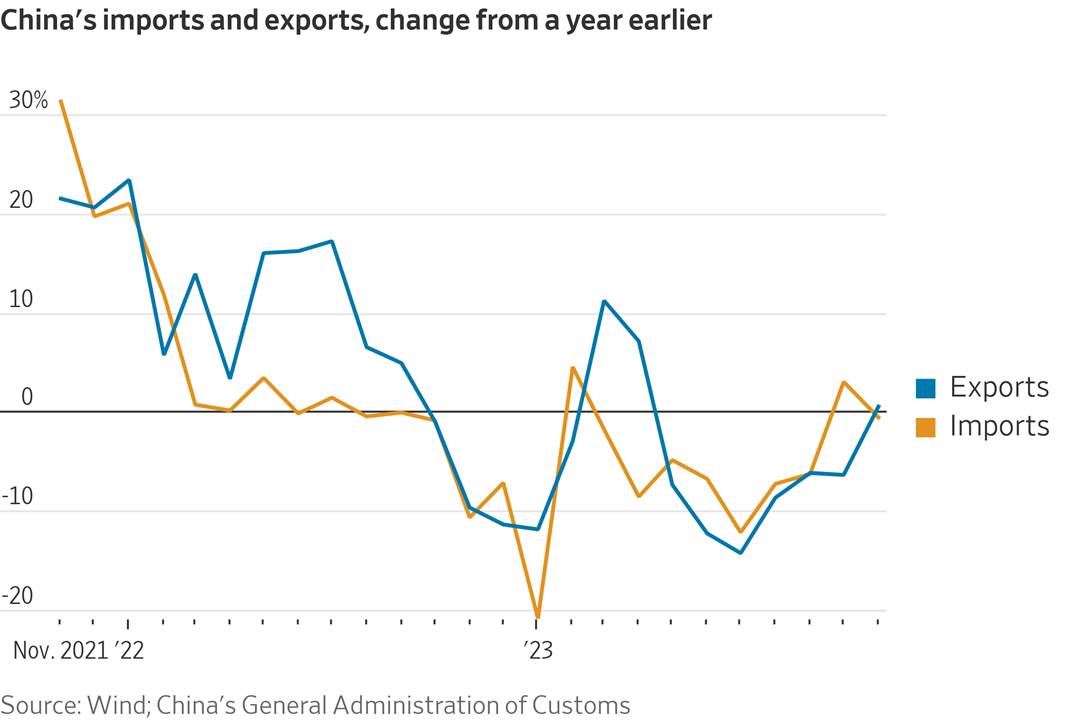

— In November 2023, China's exports unexpectedly saw a year-on-year growth of 0.5%, reaching $291.93 billion. This growth followed a 6.4% decline in the previous month and exceeded market expectations of a 1.1% drop. Notable points regarding these export figures include:

- First increase since April: This marks the first increase in Chinese exports since April, indicating a positive shift in the country's trade performance.

- Price cuts by manufacturers: Manufacturers in China have been cutting prices to attract buyers, which may have contributed to this increase in exports.

- Export categories: Sales increased for several categories, including unwrought aluminum and products (7.5%), steel products (43.3%), and rare earths (42.6%). However, exports declined for refined products (-17.3%) and grains (-20%).

- Trading partners: Exports to major trading partners showed mixed trends. Exports increased to the United States (7.3%) and Taiwan (6.4%), but decreased to Japan (-8.3%), South Korea (-3.6%), Australia (-9.1%), ASEAN countries (-7.1%), and the European Union (-14.5%).

- Year-to-date performance: When considering the first eleven months of the year, China's exports have dropped by 5.2% year-on-year to $3.08 trillion, reflecting the challenges and fluctuations in global trade during this period.

— China’s soybean imports surge in November but less than expected. China imported 7.92 MMT of soybeans in November, up 53.5% from October and 7.8% above year-ago but lower than traders’ expectations due to slower clearing of cargoes at customs. Traders expect soybean imports to jump sharply in December, unless unloading delays at ports worsen. During the first 11 months of this year, China imported 89.63 MMT of soybeans, up 13.3% from the same period last year.

— China’s meat imports inch up from October but down sharply from year-ago. China imported 557,000 MT of meat during November, up 0.9% from October but down 16.4% from last year. Through November, China imported 6.82 MMT of meat, up 1.8% from the same period last year.

— China’s FX, gold reserves increase in November. China’s foreign exchange reserves rose to $3.172 trillion in November, up from the previous month’s 12-month low of $3.101 trillion and above market expectations of $3.12 trillion, as the dollar weakened against other major currencies. Throughout November, the yuan saw a 2.6% rise against the dollar, while the dollar depreciated by 3.1% against a basket of other major currencies. China’s gold reserves rose to $145.7 billion by the month’s end, up from $142.17 billion at the close of October.

— China says U.S. plan to limit access to EV credits violates WTO rules. China said Biden administration plans to limit Chinese content in batteries eligible for electric vehicle (EV) tax credits from next year violate international trade rules and will disrupt global supply chains. The plans will make investors in the U.S. EV supply chain ineligible for tax credits should they use more than a trace amount of critical materials from China, or other countries deemed a “Foreign Entity of Concern” (FEOC). “Targeting Chinese enterprises by excluding their products from a subsidy’s scope is typical non-market orientated policy,” said a commerce ministry spokesperson. “Many World Trade Organization members, including China, have expressed concern about the discriminatory policy of the U.S., which violates the WTO’s basic principles,” he said.

— Moody’s reportedly tells some China-based workers to stay home. The ratings agency advised some employees to avoid the office before it cut its outlook on China’s sovereign credit rating this week, according to the Financial Times (link/paywall). The decision comes as Western companies in the country have taken greater precautions after a series of raids on their offices and growing sensitivity among Chinese officials over reporting on the economy.

— Xi urges EU/China trade partnership and supply chain trust in Beijing meeting. During a meeting in Beijing, Chinese President Xi Jinping expressed his desire for the European Union (EU) and China to become key trade partners and build trust in supply chains. Key points from the meeting include:

- High-quality development: President Xi stated that China is focused on high-quality development and high-level opening up, emphasizing its willingness to consider the EU as a crucial economic and trade partner.

- Mutual cooperation: Xi indicated that China wants to see the EU as a trusted partner in industrial and supply chain cooperation to achieve mutual benefits and win-win results.

- In-person summit: This meeting marked the first in-person summit between Chinese and EU officials in four years. Discussions were expected to cover various economic concerns and issues, including data flows and market access.

- Tensions and criticism: There have been tensions between the EU and China, particularly concerning the EU's efforts to secure its supply chains and an anti-subsidies investigation into Chinese-made electric vehicles. China criticized this investigation, urging the EU to avoid "trade protectionism."

- Eliminating interference: Xi called for both China and the EU to "eliminate all kinds of interference," potentially aimed at the United States and its efforts to restrict China's semiconductor development.

- Balanced trade relations: European Commission President Ursula von der Leyen described her conversation with Xi as "good and candid" and expressed a shared interest in "balanced trade relations."

- Italy's exit from Belt and Road: Italy formally informed China of its decision to exit the Belt and Road Initiative, reflecting ongoing strains in China-EU relations.

- Belt and Road discussion: Xi and EU leaders discussed the Belt and Road Initiative during the meeting, with Xi expressing a willingness to connect it with the EU's Global Gateway infrastructure plan.

- Challenges and concerns: Deep-seated issues, including Russia's actions in Ukraine, trade imbalances, and Chinese overcapacity affecting European markets, pose challenges to EU/China relations.

- Economic concerns: The EU is concerned about China's economic recovery and its potential impact on European industries and workers, given China's growing exports and the EU's trade deficit with China.

— McDonald's is launching a new small store format named CosMc's, starting this week and ahead of its original schedule. The fast-food giant plans to open 10 CosMc's locations by the end of 2024. These CosMc's stores will focus on customizable specialty beverages, competing with popular chains like Starbucks. The name "CosMc's" is a nod to a space alien character featured in McDonald's ads in the 1980s. This move follows McDonald's recent success with the Grimace Birthday Meal, which went viral in June and tapped into nostalgia. McDonald's has also set ambitious growth targets, aiming to expand rapidly to 50,000 restaurants by the end of 2027.

— USDA is taking steps to finalize labeling regulations for cell-based meat and introduce voluntary origin labeling. In May, USDA plans to propose a rule addressing the labeling of cell-based meat products. The goal is to establish unique terminology for these products, recognizing that their biological, chemical, nutritional, or organoleptic properties may differ significantly from conventionally produced meat and poultry, which is relevant to consumers. Additionally, in March, USDA intends to issue a final rule regarding voluntary labeling of meat and poultry products to indicate their U.S. origin. This rule aims to reduce consumer confusion about current voluntary U.S.-origin labeling policies.

The voluntary nature of the U.S. origin labeling program is expected to address concerns about the possibility of mandatory labeling efforts by Canada and Mexico. As these regulations move through the proposed and final rule stages, they will be subject to scrutiny and discussion before implementation.

— A new WSJ poll shows Nikki Haley has edged into second place behind Donald Trump in the Republican nomination race, fueled by her debate performances. Haley has faced criticism for her connections to Wall Street donors as her campaign gains momentum. During last night’s debate, Florida Governor Ron DeSantis and Ohio entrepreneur Vivek Ramaswamy criticized Haley for accepting contributions from corporate donors. Notably, former New Jersey Governor Chris Christie was the only candidate to strongly critique the absent frontrunner, Donald Trump. Despite Trump's continued popularity, the debate underscored how the race has shifted in favor of Nikki Haley, as indicated by rising poll numbers and donor support.

— Former House Speaker Kevin McCarthy announced his decision to leave Congress at the end of the year. McCarthy will very likely be succeeded by a fellow Republican in the central California district the ousted ex-speaker will soon vacate. The big questions are who and when. McCarthy’s departure may trigger a special election next spring in California’s 20th District, which includes parts of Fresno, Kern, Kings, and Tulare Counties.

McCarthy’s departure will result in a reduction of House Republicans' already narrow majority. With several retirements now pending, a majority that last week stood at a razor-thin 222-213 could shrink to as little as 219-213 by March, if Democrats can flip the House seat previously held by George Santos (R-N.Y.). That means Johnson could only lose two GOP votes to advance any party-line bill out of the House, as three defections would stall legislation at 216-216.

— A contentious debate over the origin labeling of beef is emerging as a significant factor in Montana's closely watched Senate race next year. Montana, which ranks among the top 10 states for cattle production with approximately 1.4 million head of cattle, is divided on the issue of reviving federal labeling requirements to indicate the origin of beef. While all the candidates support some form of beef origin identification, there are differences in their approaches and whether the government should be involved in meat labeling. A Bloomberg article (link) says this issue may become a focal point in the GOP primary scheduled for June and the general election next fall. Montana's statewide races often revolve around local land and agriculture matters. Additionally, Sen. Jon Tester, a Democrat, is seeking a fourth term, and Democrats likely need to secure his seat to maintain control of the Senate majority. Therefore, beef origin labeling could play a pivotal role in the upcoming Montana Senate race.

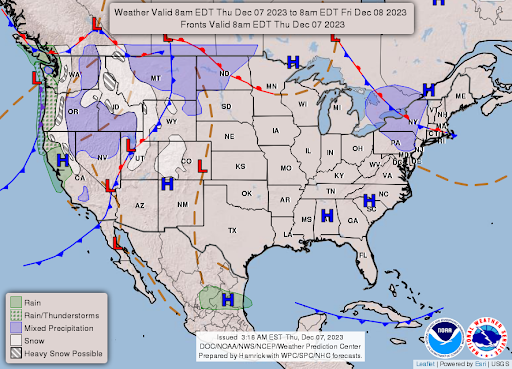

— NWS weather: Excessive Rainfall threat winding down across the Pacific Northwest for now... ...Cold, unsettled weather to shift into the Intermountain West and Plains through this weekend... ...Well above average and potentially record-breaking warmth forecast across the central United States over the next few days.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |