Lawmaker, Other Attacks on U.S. Ag Sector Part of Ideology, Not Budget Savings

China buys 440,00 MT U.S. SRW wheat | USDA announces other daily export sales

|

Today’s Digital Newspaper |

MARKET FOCUS

- Alaska Airlines announces acquisition of rival Hawaiian Airlines for $1.9 billion

- Fed more confident they may not need to continue raising rates to combat inflation

- Mortgage market's significance grows amid housing demand, FOMC's dilemma

- Bank of Mexico survey raises median GDP growth estimate this year to 3.4%

- ‘There’s a lack of tomatoes in the world’ — Kraft Heinz CEO Miguel Patricio

- California faces $58 billion budget shortfall due to delayed tax payments

- Bitcoin reaches highest price in nearly 20 months, with price exceeding $42,000

- Price of gold reached record high overnight, then tempers advance

- Key indicator of copper-market supply sinks to lowest level since August 2022

- Ag markets today

- USDA daily export sales:

— 440,000 MT soft red winter wheat to China during 2023-2024 marketing year

— 267,044 MT corn to Mexico during 2023-2024 marketing year

— 183,000 MT soybean cake and meal to the Philippines during 2023/2024 MY - Steady growth in farm debt amid robust loan performance

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Senate Dems reportedly abandon negotiations with GOP over border policy changes

- House to vote on bill blocking EPA emissions standards for cars

ISRAEL/HAMAS CONFLICT

- Israel says it killed key Hamas commander responsible for Oct. 7 attacks

- Israel expands offensive against Hamas into southern Gaza

RUSSIA & UKRAINE

- Ukrainian grain exports reached 13.4 million metric tons (MMT) as of Dec. 4

- More than 7 million metric tons (MMT) of cargo transported via alternative corridor

POLICY

- Politico: GAO recommends crop insurance subsidy reforms for cost savings

CHINA

- China Evergrande gets a lifeline

ENERGY & CLIMATE CHANGE

- Sen. Manchin criticizes loopholes in EV tax credit restrictions

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Tyson Foods inaugurates advanced $300 mil. manufacturing plant in Danville, Va.

HEALTH UPDATE

- Biden working on healthcare package he plans to introduce in potential second term

- Chinese addresses child pneumonia outbreak amid 'white lung syndrome' reports

OTHER ITEMS OF NOTE

- Axios: Farmers are increasingly turning to drones for tasks like applying pesticides

- Interior Dept. and California's Imperial Irrigation District agree on water conservation

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed to firmer in overnight trading. U.S. Dow opened lowered and is down around 100 points at this writing. In Asia, Japan -0.6%. Hong Kong -1.1%. China -0.3%. India +2.1%. In Europe, at midday, London -0.4%. Paris -0.3%. Frankfurt flat.

U.S. equities Friday and the week: All three major indices finished with gains despite a warning from Fed Chairman Jerome Powell that the U.S. central bank may not be done raising interest rates. The rise helped the Dow put up a gain of 2.4% for the week as the Blue Chip index booked its fifth winning week in a row. The Nasdaq rose 0.4% and the S&P 500 was up 0.8% over the week. On Friday, the Dow gained 294.61 points, 0.82%, at 36,245.50. The Nasdaq rose 78.81 points, 0.55%, at 14,305.03. The S&P 500 was up 26.83 points, 0.59%, at 4,594.63.

The benchmark 10-year Treasury yield, which hit 5% in October, fell 24 basis points the past week to end at 4.225%, its lowest yield since early September.

— Alaska Airlines announced its acquisition of rival Hawaiian Airlines for $1.9 billion. Both airlines will retain their individual brands, a unique decision made to honor the legacy of these nearly 100-year-old airlines and the communities they serve. The move is seen as consumer-friendly and aims to strengthen competition for Alaska Airlines, making it a more robust competitor against major carriers like United, Delta, Southwest, and American Airlines, which currently hold 80% of the domestic market share. Ben Minicucci, the CEO of Alaska Airlines, will assume the role of CEO for both airlines because of this acquisition.

The move comes as JetBlue Airways and Spirit Airlines face antitrust concerns over their $3.8 billion merger from the Justice Department, which has taken the case to a Boston federal court. Spirit CEO Ted Christie defended the deal to create a stronger alternative to the big four airlines.

— Agriculture markets Friday:

- Corn: March corn futures rallied 2 cents before ending the day at $4.84 3/4, marking a 2 1/4 cent gain on the week.

- Soy complex: January beans fell 16 3/4 cents to $13.45 1/2 but gained 14 3/4 cents on the week. January meal plunged $11.30 to $412.70 and gave up $21.40 from a week ago. January soyoil fell 81 points to 51.45 cents but gained 116 points week-over-week.

- Wheat: March SRW wheat futures rose 4 3/4 cents to $6.02 3/4 and near mid-range. For the week, March SRW rose 23 1/2 cents. March HRW wheat futures gained 3 3/4 cents to $6.46 3/4, nearer the session high, and for the week up 35 1/4 cents. March spring wheat rose 3/4 cents to $7.30 1/4 and gained 15 3/4 cents on the week.

- Cotton: March cotton fell 64 points to 79.42 cents and gave up 157 points on the week.

- Cattle: February live cattle futures fell $2.70 to $169.125, near the session low and on the week lost $1.85. January feeder cattle futures dropped $5.525 to $214.425, near the daily low and for the week down $4.90.

- Hogs: Expiring December hog futures edged 17.5 cents lower to $68.60 Friday, while most-active February futures led the deferred contracts lower. February hogs ended the week at $70.10, marking a daily drop of $1.375 and a weekly rise of $1.325.

— Ag markets today: Corn and soybeans traded lower through the overnight session, while wheat firmed this morning after earlier losses. As of 7:30 a.m. ET, corn futures were trading mostly 1 to 2 cents lower, soybeans were 6 to 9 cents lower, SRW wheat was 2 to 3 cents higher, HRW wheat was fractionally higher and HRS wheat was steady to fractionally higher. Front-month crude oil futures were modestly weaker, while the U.S. dollar index is mildly firmer.

Big beef movement. Packers are struggling to push wholesale beef prices higher, with Choice holding in the upper-$290.00 area and Select around $265.000. But spot movement was strong last week, with load counts totaling 749, including 159 loads on Friday. The increased movement suggests retailers are gearing up for year-end beef features.

Cash hog decline continues. The CME lean hog index is down 77 cents to $70.58 (as of Nov. 30), extending the seasonal price decline. December lean hog futures, which expire on Dec. 14 and are cash settled against the index on Dec. 18, finished Friday at a $1.98 discount to today’s cash quote. February lean hog futures hold a 48-cent discount to the cash index.

— Quotes of note:

- Fedspeak. Federal Reserve officials are becoming more confident that they may not need to continue raising interest rates to combat inflation. However, they are not yet considering ending rate hikes or initiating discussions about lowering rates. Consequently, it is expected that they will maintain the current interest rates at their December meeting and publicly communicate that the next rate change is more likely to be an increase rather than a cut.

- Mortgage market's significance grows amid housing demand, FOMC's dilemma. Dr. Vince Malanga, president of LaSalle Economics, notes the labor market has always been a crucial indicator for the Federal Open Market Committee (FOMC), but recently, the mortgage market's significance has been growing due to its role as a leading indicator for the housing market. With the decline in mortgage rates, there was an expectation of pent-up demand being released. Over the past four weeks, mortgage purchase applications have risen by nearly 15%, indicating an increase in housing demand. However, despite lower mortgage rates, housing remains unaffordable by various measures, and labor demand is showing signs of easing. As a result, Malanga says it is anticipated that the mortgage market will cool down soon. This cooling would likely be welcomed by the FOMC, he says, and could provide them with the flexibility to support market expectations of approximately fifty basis points of rate cuts in the coming months, albeit not immediately. Nevertheless, if housing demand continues to remain strong, there is a risk that fixed income markets may be misjudging the situation, similar to what happened last year. In such a scenario, the FOMC may resist efforts to further ease financial conditions. The upcoming year is marked by a presidential election and the government's potential allocation of infrastructure and "IRA" funds to stimulate the economy, regardless of deficits. Malanga concludes the FOMC typically prefers a passive approach, and it remains to be seen if they can afford to maintain this stance in the current economic environment.

- Economists surveyed by the Bank of Mexico have raised their median GDP growth estimate for this year to 3.4%, up from 3.3%, marking the 11th consecutive month of increasing forecasts. For 2024, the estimate among 37 analysts also increased to 2.1% from 2% in October. Year-end inflation forecasts for this year were adjusted down to 4.54% from 4.6%, while they remained unchanged at 4% for 2024. Core inflation forecasts saw minimal changes at 5.16% for 2023 and 4.1% for 2024. The majority of analysts anticipate that the Bank of Mexico will begin reducing its reference interest rate in the first quarter of 2024, with all analysts expecting a rate cut by the end of the second quarter. The central bank recently raised its GDP growth forecasts to 3.3% for 2023 and 3% for 2024, up from previous estimates of 3% and 2.1%, respectively.

- “It is very hard right now. There’s a lack of tomatoes in the world.” — Kraft Heinz CEO Miguel Patricio, on efforts to breed tomatoes resistant to the impact of climate change.

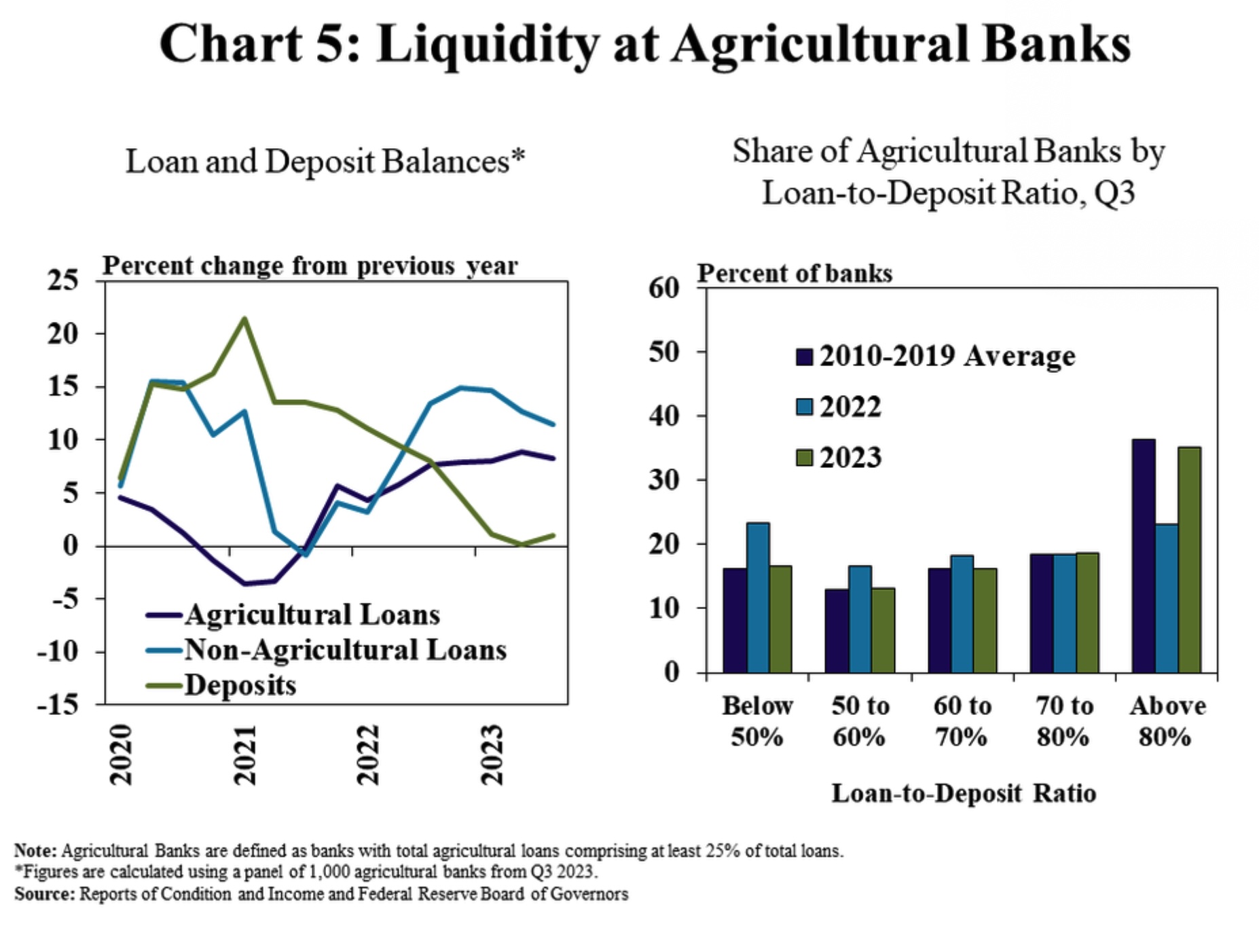

— Steady growth in farm debt amid robust loan performance. In the third quarter, farm debt balances at commercial banks showed steady growth, while loan performance remained robust, according to the Federal Reserve Bank of Kansas City (link). Despite some signs of reduced lending activity and varying loan demand, the total debt at commercial banks increased at a rate like the previous year. This growth in farm debt coexisted with low delinquency rates on agricultural loans, marking the third consecutive year of decline.

The steady loan growth coincided with a slowdown in deposit growth, resulting in stronger liquidity positions for agricultural banks. Rising interest rates led to heightened competition for deposits, increased funding costs, and a slight compression of net interest margins in recent months. However, agricultural banks continued to perform well, benefiting from higher interest income.

Farm debt increased by approximately 5% compared to the same period last year, driven by growing demand for production loans. While non-real estate debt maintained a steady growth rate, the growth in farm real estate debt was softer.

Loan performance remained strong, with delinquency rates on both real estate and non-real estate farm loans declining for the third consecutive year at agricultural and non-agricultural banks. Agricultural banks also maintained sound financial performance, despite some margin compression and persistently elevated unrealized losses on investment portfolios.

However, the tightening liquidity situation became evident, with steady loan growth and stagnant deposit levels. The share of agricultural banks with loan-to-deposit ratios above 80% increased, indicating a shift from the previous abundance of liquidity.

— California faces $58 billion budget shortfall due to delayed tax payments. The state is expected to face a significant budget shortfall of $58 billion over the course of three fiscal years, spanning from 2022-23 to 2024-25. This projection comes from a report released by the nonpartisan Legislative Analyst's Office (LAO) and is primarily attributed to lower-than-expected revenue collection due to postponed tax payments. The LAO report highlights the adverse effects of recent economic challenges and financial market instability on the state's revenues. It points out that postponed tax payments fell considerably short of initial projections. Several factors contributed to this economic downturn in California, including increased borrowing costs and reduced investments influenced by actions taken by the Federal Reserve. As a result, economic activity has slowed down, leading to a notable decline in home sales and reduced funding for California-based startups and tech companies.

One major consequence of these economic challenges is the drop in the number of companies going public in 2022 and 2023, which plummeted by 80% compared to the previous year. Consequently, California businesses have had limited resources available for expansion and hiring new employees.

The report also notes that California entered an economic downturn in the previous year, leading to a significant increase in the number of unemployed workers, which raised the unemployment rate from 3.8% to 4.8%. Additionally, inflation-adjusted incomes experienced five consecutive quarters of year-over-year declines from the first quarter of 2022 to the first quarter of 2023.

When crafting the 2023-24 budget, state lawmakers lacked a clear understanding of the impact of economic weakness on state revenues due to the postponed tax payment deadlines. The IRS extended these deadlines to accommodate those affected by severe winter storms. However, with the passing of these deadlines, the full extent of revenue weakness became apparent, with total income tax collections declining by 25% in 2022-23, resembling declines seen during the Great Recession and the dot-com bust.

The report suggests that the state's financial outlook remains uncertain, and past downturns like the recent episode have often been followed by further economic weakness. The LAO projects that revenue collection will be nearly flat in 2023-24, following a 20% decrease in the previous fiscal year, with the expectation of revenue growth returning in 2024-25 and beyond.

Of note: California has substantial reserves of $37.8 billion as an insurance policy against the risks of downturns.

Market perspectives:

— Outside markets: The U.S. dollar index was higher, with weakness in the euro, yen and British pound. The yield on the 10-year U.S. Treasury note was slightly higher, around 4.25%, while there was a mostly lower tone in global government bond yields. Crude oil futures remained lower ahead of U.S. market action but off lows from earlier in Asia. U.S. crude was trading around $73.40 per barrel and Brent around $78.20 per barrel. Gold and silver futures were weaker, with gold around $2,087 per troy ounce and silver around $25.57 per troy ounce.

— Bitcoin reached its highest price in nearly 20 months, with a price exceeding $42,000. This surge, an 8.2% increase in one day, is attributed to optimism regarding reduced regulatory pressure on the cryptocurrency industry and expectations of approval for cryptocurrency funds on the U.S. stock market. Investors are turning to riskier assets in anticipation of potential interest rate cuts by the Federal Reserve, despite the central bank's warnings against premature speculation. Additionally, larger institutions are showing increased interest in digital tokens following the resolution of high-profile criminal cases that had previously cast a shadow over the market.

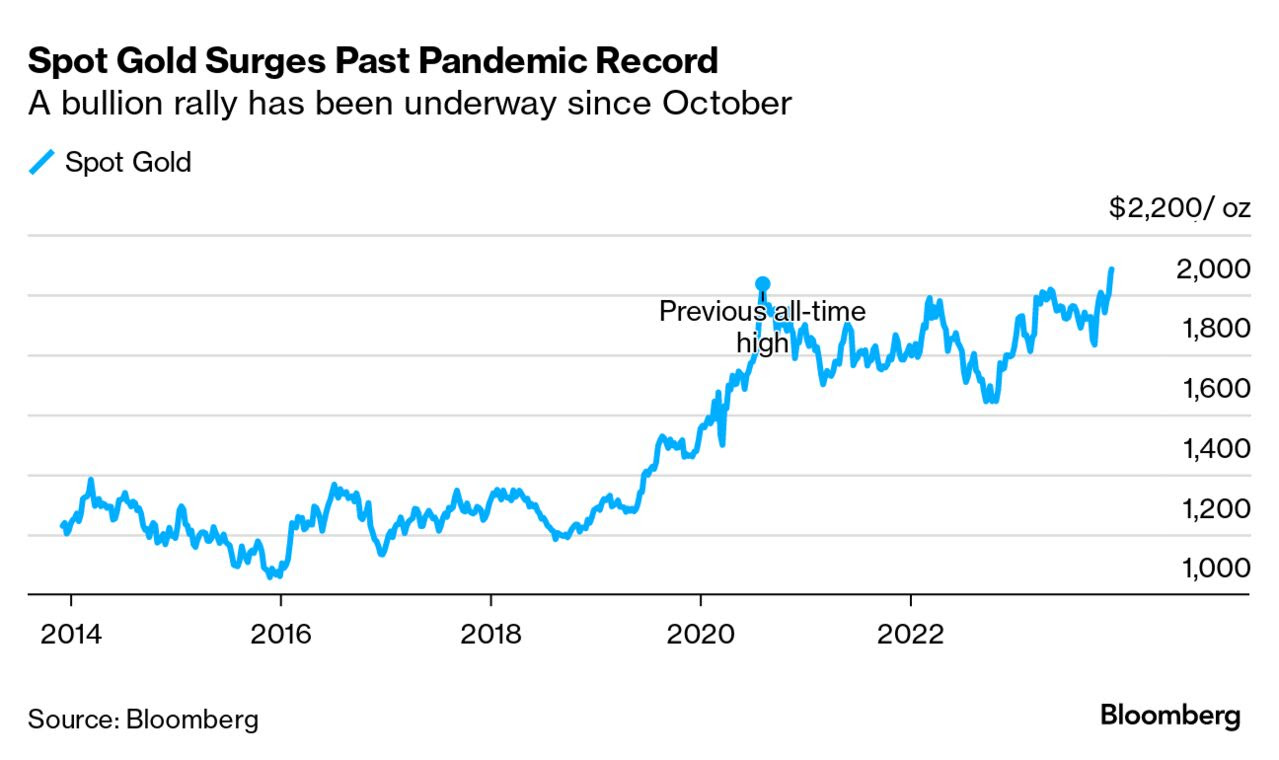

— Price of gold, considered a safe-haven asset, reached a record high overnight, with February Comex futures hitting an intraday peak of $2,152.30 per ounce. The precious metal has climbed about 15% from a low in early October. However, prices have slightly retreated from these highs just before the start of the New York trading session. Looking ahead to next year, potential Fed interest rate cuts — and a lower U.S. dollar that may come with them — could boost gold even more, some note.

— Key indicator of copper-market supply just sank to the lowest level since August 2022 as the shutdown of a large mine in Panama cut the availability of ore for next year. So-called treatment fees paid by Chinese smelters fell below $70 a ton, Fastmarkets data show. Link to details via Bloomberg.

— USDA daily export sales:

• 440,000 MT soft red winter wheat to China during 2023-2024 marketing year

• 267,044 MT corn to Mexico during 2023-2024 marketing year

• 183,000 MT soybean cake and meal to the Philippines during 2023/2024 marketing year

— Ag trade update: Algeria tendered to buy 50,000 MT of optional origin durum wheat.

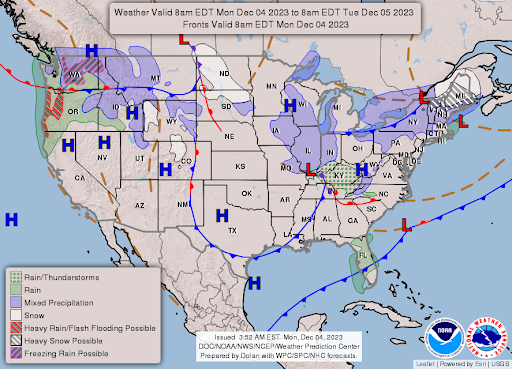

— NWS weather outlook: Excessive rainfall and instances of flooding are likely across parts of western Washington and Oregon over the next few days... ...Moderate snowfall to diminish throughout northern New England today... ...Heavy upslope snow potential forecast across the central Appalachians Tuesday night into Wednesday.

Items in Pro Farmer's First Thing Today include:

• Corn and beans weaker, wheat mostly firmer this morning

• AgRural cuts Brazilian soybean crop estimate

• South American weather update

• Bigger Canadian wheat, canola crop estimates expected

|

CONGRESS |

— Senate Democrats have reportedly abandoned negotiations with Senate Republicans over border policy changes due to what they see as unyielding GOP demands on asylum and parole reform. This development raises concerns about the Senate's ability to pass a $106 billion foreign aid package for Ukraine, Israel, and Taiwan. The breakdown in the talks is attributed to Republicans' insistence on incorporating elements of the House GOP's border-security bill, HR 2, which is unacceptable to Democrats. Senate Republicans have pledged to block any foreign aid bill that doesn't include substantial measures to address the migrant crisis at the U.S./Mexico border, a concern shared by many Democrats. House Speaker Mike Johnson (R-La.) has indicated that he will only pair Ukraine aid with HR 2, further complicating the situation.

White House Budget director warns of Pentagon resource shortage for Ukraine aid. In a letter (link) to congressional leaders this morning, White House budget director Shalanda Young writes that without congressional action before year’s end, the Pentagon “will run out of resources to procure more weapons and equipment for Ukraine and to provide equipment from U.S. military stocks.” Congress already has allocated $111 billion to assist Ukraine, including $67 billion in military procurement funding, $27 billion for economic and civil assistance and $10 billion for humanitarian aid. Young wrote that all of it, other than about 3% of the military funding, had been depleted by mid-November.

Of note: Senators will receive a classified briefing Tuesday afternoon on Ukraine and Israel.

— House to vote on bill blocking EPA emissions standards for cars. The House is scheduled to vote on a bill (HR 4468) aimed at preventing the EPA from finalizing its emissions standards for light- and medium-duty cars. A simple majority vote is required for the bill to pass. Today, the House Rules Committee is meeting to discuss this measure.

|

ISRAEL/HAMAS CONFLICT |

— Israel on Sunday said it killed a key Hamas commander responsible for the Oct. 7 attacks that left around 1,200 Israelis dead and scores of others abducted. This comes as Israel has vowed to free the 137 hostages still being held by Hamas and eliminate the militant group around the world, even if it takes years. Meanwhile, Israel has expanded its offensive against Hamas into southern Gaza as the war enters what may be its crucial phase. The Israeli government knows that its “window of legitimacy” may soon close.

|

RUSSIA/UKRAINE |

— Ukrainian grain exports reached 13.4 million metric tons (MMT) as of Dec. 4, according to data from the Agriculture Ministry, including 6.5 MMT of corn, 5.9 MMT of wheat, and 876,000 metric tons of barley. Those figures compare with year-ago when exports totaled 9.8 MMT of corn, 6.9 MMT of wheat and 1.48 MMT of barley.

— More than 7 million metric tons (MMT) of cargo has been transported via the alternative corridor established by Ukraine, according to Ukrainian President Volodymyr Zelenskyy. “Our ‘grain corridor’ also works,” he said on the Telegram social media site. “Exceeded the mark of 7 million tons of cargo.”

|

POLICY UPDATE |

— Politico: GAO recommends crop insurance subsidy reforms for cost savings. The Government Accountability Office (GAO) is recommending that lawmakers consider reducing or recalibrating crop insurance subsidies for both private insurers and the largest farms as a cost-saving measure for taxpayers, according to Politico, who says the new report was shared exclusively with them. This recommendation comes amid a long-standing policy debate that is expected to become a contentious issue during the next farm bill discussions.

Crop insurance is a widely popular program designed to provide financial protection to farmers in the event of natural disasters or market disruptions. However, critics argue that the subsidy system disproportionately benefits large farms and a handful of private insurance companies. They charge the current subsidy system encourages insurers to focus on larger and more expensive policies, making it challenging for smaller farmers to access the program's safety net.

Key findings from the GAO report, according to Politico:

- The GAO found that reducing premium subsidy rates for high-income policyholders by 15 percentage points in 2022 could have saved the federal government approximately $15 million.

- In 2022, only 1% of policyholders accounted for 22% of the federal crop insurance program's premium subsidy dollars, with an average subsidy of $464,900 per policyholder.

- The federal crop insurance program cost taxpayers $17.3 billion in 2022, with $3.7 billion going to private insurance companies. A significant portion of these subsidies went to insurers writing policies for larger farms with bigger policies.

- Larger policies made up about 2% of total policies but accounted for 36% of the total $2.1 billion in administrative and operating cost subsidies for private insurers.

- Setting the rate of return for insurance companies closer to the current market rate could potentially save billions over the next decade, according to the GAO.

The report was requested by Sens. Cory Booker (D-N.J.) and Kirsten Gillibrand (D-N.Y.).

Comments: One farm policy expert, asked to comment, emailed: “GAO has a long record of issuing reports that are hostile toward agriculture policy. This is just one more. Cory Booker is the senator who believes the U.S. food and agriculture system should be totally destroyed and rebuilt. He was featured in The NY Times series hit piece on U.S. agriculture that was widely repudiated even by USDA which has been sympathetic to many of these goals. The findings are a bit bizarre. Charging farm families who produce the bulk of the nation’s food, feed, fiber, and fuel 15 percentage points more for their insurance would save $15 million (with an m)? To most Americans $15 million is still a bit of money. But the injury to these farmers would be enormous while the money saved isn’t even a rounding error in federal budgeting.

“The 1% of farmers receiving 22% of total premium support is the same old EWG talking point rebranded for crop insurance. I wonder if GAO thought to ask the question, What percentage of total premium of premiums paid by farmers did these 1 percent pay? Dollars to donuts it is disproportionately higher.

“On rate of return for companies, companies are operating under terms set in 2010 when underwriting gains and A&O were cut deeply. Those cuts remain in effect. Congress actually passed what GAO proposes in 2015 and immediately repealed the provision because it would end Federal Crop Insurance.”

|

CHINA UPDATE |

— China’s Evergrande liquidation hearing pushed to January. China Evergrande Group said it has been granted an adjournment of a court hearing into a liquidation petition to Jan. 29, giving the embattled property developer time to finalize a revamped offshore debt-restructuring plan. The decision came as the world's most indebted developer with more than $300 billion in liabilities sought adjournment unexpectedly unopposed by the petitioner’s lawyer. The petitioner surprised the court on Monday when its lawyer started proceedings saying he was “instructed not to present any argument in opposition to” adjournment.

|

ENERGY & CLIMATE CHANGE |

— Sen. Joe Manchin (D-W.Va.) is strongly criticizing new restrictions on tax credits for electric vehicles (EVs), arguing that they contain significant loopholes. The issue revolves around recent regulations that limit the use of battery materials from China and other foreign adversaries to disqualify certain EVs from receiving the $7,500 tax credit. Manchin, whose pivotal vote helped pass the Inflation Reduction Act (Climate Bill) extending these credits, added language to the climate law that disqualifies vehicles with battery components from China and other foreign entities of concern. He has expressed his determination to oppose this proposed rule through various means, including urging the Treasury Department to make revisions, supporting a Congressional Review Act resolution, and backing any legal challenges against the rule.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Tyson Foods inaugurated an advanced $300 million manufacturing plant in Danville, Virginia, focused on automating the production of chicken nuggets and value-added products. This facility, spanning 325,000 square feet, will produce Tyson brands like Any’tizers snacks and chicken nuggets. The plant utilizes automated case packing lines and high-speed robotic case palletizing units. Once operating at full capacity, it's expected to produce 4 million pounds of protein weekly, sourcing poultry from Virginia.

Tyson aims to simplify its operations and boost value-added product production, following the closure of several other facilities this year. The Danville plant incorporates robotics, wearable armband devices for worker safety and productivity, and advanced product inspection technologies. Tyson is expanding its prepared foods facilities to cater to the profitable food service sector, but it's also curbing future capital expenditures due to slowing sales.

Link for details on this via FoodDive.

— Bipartisan lawmakers oppose USDA's beef imports from Paraguay over disease risk. A bipartisan group of lawmakers oppose USDA's final rule permitting beef imports from Paraguay due to concerns about the risk of foot-and-mouth disease. They argue in a letter (link)/pdf) that USDA has not met the necessary criteria to lift the ban on beef imports from Paraguay and that the department relied on outdated site visits, irrelevant inspections, and insufficient data in making this decision. Twenty-one lawmakers, led by House Agriculture members Tracey Mann (R-Kan.) and Jim Costa (D-Calif.), signed the letter to USDA Secretary Tom Vilsack.

Background: In November, USDA finalized a rule allowing beef imports from Paraguay under specific conditions, including the absence of foot-and-mouth disease in the exporting region for the past 12 months, meat sourced from premises without a history of FMD, and animal inspections before and after slaughter. This decision has sparked controversy and opposition from these lawmakers.

— Belgium reports bird flu outbreak on farm near French border. Belgium has reported an outbreak of highly pathogenic H5N1 avian influenza on a poultry farm in the northwestern part of the country, the World Organization for Animal Health (WOAH) said. The outbreak, the first this season, was detected in Diksmuide, not far from France.

— WSJ opinion: First they came for the cars, then the cows. The climate lobby is now aiming to use taxes and regulation to restrict your meat consumption, according to a commentary item (link) in today’s Wall Street Journal by Allysia Finley. She writes the global climate movement is increasingly advocating for the reduction of meat consumption through taxes and regulations. This push to limit meat consumption was highlighted at the United Nations' COP28 climate conference in Dubai, where calls were made to address meat consumption alongside fossil fuels and gasoline-powered cars to achieve net-zero emissions goals.

A UN report from the previous year argued that approximately 7 gigatons of CO2 emissions, equivalent to global natural-gas combustion emissions, should come from reduced meat consumption. Livestock production contributes to 11% to 17% of global greenhouse gas emissions and 32% of global methane emissions, which is 28 times more potent than carbon dioxide on a per-pound-of-protein basis.

Methane, a natural byproduct of cow digestion, poses a significant challenge as cows cannot be made more "fuel-efficient" like cars, Finley details. While efforts to reduce cow flatulence through dietary changes are being explored, such changes may affect the nutritional quality and taste of meat and milk. Some proposals, like taxing foods based on their carbon emissions, aim to make meat prohibitively expensive, pushing people toward a vegan diet.

Several countries, including New Zealand and the Netherlands, have considered measures such as taxing farmers based on land size, livestock ownership, production, and fertilizer use or paying farmers to shut down livestock operations to comply with emissions regulations, leading to reduced meat supply and higher prices.

In the United States, California has imposed regulations to reduce methane emissions from dairy and livestock operations, with consequences for farmers. These regulations include mandates to provide more space for farm animals, increasing livestock production costs. Congressional members from farming states have introduced legislation to block California from regulating farmers outside its borders.

Additionally, both California and the federal government offer regulatory credits for capturing methane from manure on dairy farms. These subsidies have prompted discussions about whether farmers will prioritize methane over milk production.

Bottom line: The commentary concludes that overall, the climate lobby is advocating for the use of regulations, taxes, and subsidies to reduce meat supply and increase its cost, like efforts against fossil fuels. This approach aims to curtail meat consumption without necessarily imposing direct restrictions, recognizing the potential unpopularity and legal challenges of such measures. The ultimate goal appears to be a broader reduction in material consumption, aligning with the broader ethos of asceticism in the climate movement. “But make no mistake: The climate religion’s ultimate goal isn’t to reduce carbon emissions or stop global warming. It is to force people to give up material joys and live as ascetics. Today’s climate clergy are like the wanton, well-dressed friar in Geoffrey Chaucer’s The Canterbury Tales, ostensibly begging for the poor while living sumptuously. They want to have their meat and eat it too.

Comments: Let’s connect some dots. The above commentary ties into efforts to destroy crop insurance (see related item under Policy section), deny crop protection products, end meaningful trade agreements that broaden market access, deny renewable fuels any meaningful role in addressing climate, etc. It is all part of a piece. The attacks are not motivated by budget savings. This is an ideology.

|

HEALTH UPDATE |

— President Joe Biden is working on a healthcare package that he plans to introduce in a potential second term. The initial announcements this week will focus on reducing prescription drug prices. The proposed agenda includes expanding provisions aimed at reducing prices for drugs like insulin, which were implemented for Medicare enrollees as part of the Inflation Reduction Act last year. Additionally, the plan seeks to reinforce the Affordable Care Act (ACA) by making the enhanced federal premium subsidies, which have assisted approximately 10 million people in affording coverage through the Obamacare exchanges, a permanent feature. This approach stands in sharp contrast to former President Donald Trump's promise to entirely repeal and replace the ACA.

— China's UN diplomat claims control over child pneumonia outbreak amid ‘white lung syndrome’ reports. China's top diplomat at the United Nations stated that the pneumonia outbreak affecting children in the country is under control, even as reports suggest a worsening spread. There are concerns about a condition referred to as "white lung syndrome" in China, which has raised international alarm. The World Health Organization (WHO) has expressed its intention to request additional health data from China, and leaders in various other countries are demanding greater transparency regarding the situation.

|

OTHER ITEMS OF NOTE |

— Farmers are increasingly turning to drones for tasks like applying pesticides and dropping seeds, replacing traditional crop-dusting planes, Axios reports (link). Crop-dusting has become a lost art due to the shift of professional pilots to safer and better-paying jobs elsewhere. Electric drones are seen as cleaner and quieter alternatives to the traditional planes or helicopters that typically run on leaded gasoline.

Guardian Agriculture, a company that manufactures large autonomous electric vertical takeoff and landing (eVTOL) drones for agricultural use, has started commercial operations. These drones are about the size of a small tractor, capable of carrying up to 200 lbs., and can cover up to 60 acres per hour. They offer greater efficiency by allowing the necessary chemicals or payloads to be left beside a field, enabling the drone to refill as needed for a specific task without having to return to a runway. Guardian Agriculture has received Federal Aviation Administration (FAA) approval for commercial eVTOL service in the U.S. and has secured $100 million in customer orders. The company's focus on agricultural operations allowed it to obtain FAA approval ahead of other eVTOL startups that are primarily pursuing passenger service.

The company believes that agriculture is an excellent sector to mature drone technology and demonstrate safety records before expanding into other areas. Their mission is to support American farmers and enhance food security in the country.

— Interior Dept. and California's Imperial Irrigation District agree on water conservation. The Interior Department and the Imperial Irrigation District in California announced an agreement (link) to conserve 100,000 acre-feet of water in Lake Mead for the current year. They will also engage in discussions regarding the conservation of up to 800,000 acre-feet of water through 2026.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |