American Warship and Two Commercial Vessels Attacked in Red Sea Sunday

Friday: Employment & USDA reports | COP28 summit | Supplemental spending/border talks

Washington Focus

An American warship and two commercial vessels were attacked in the Red Sea Sunday, the Pentagon said, a possible major increase in aggression in Middle Eastern waters, where Iran-backed Yemeni rebels have escalated attacks on Western and Israeli-linked ships.

The Pentagon confirmed the attack Sunday, shortly after British officials said they received reports of drone attacks in the Red Sea’s Bab al-Mandab Strait, though neither government provided details, including who was responsible for the attack. An anonymous U.S. official told the Associated Press the attacks lasted for about five hours in Sanaa, Yemen. A second anonymous government source said the USS Carney intercepted at least one drone in the attack, the AP reported.

The attacks come as Yemen’s Iran-backed Houthi rebels have been targeting Israel amid its war with Hamas. The group said in a statement Sunday it attacked two “Israeli” ships, the first with a missile and the second with a drone, the Times of Israel reported, though it remains unclear if the U.S. Navy ship was among the two the group said it attacked.

A U.S. Defense official said a U.S. warship shot down Houthi drones, responding to the ballistic missile attack.

Talks between Israel and Hamas to hand over hostages held in Gaza in return for a pause in fighting there have stalled, the White House said Sunday, while Israeli forces step up attacks and direct Palestinians in the enclave to move into a narrower strip of land. “The negotiations have stopped. That said, what hasn’t stopped is our own involvement, trying to get those back on track… We would like that to happen today,” White House National Security Council spokesman John Kirby told NBC. He blamed Hamas for failing to provide a fresh list of civilian women and children to be released.

Israel recalled its negotiating team from Qatar on Saturday after it said talks had reached an impasse. Saleh al-Arouri, Hamas’s deputy political chief, said the militant group has only hostages who are soldiers and “civilians serving in the army,” and that it wouldn’t release more of them until Israel ends its war.

— Another week with the same unsettled congressional issues on (1) Fiscal year (FY) 2024 appropriations, (2) Supplemental aid to Ukraine, Israel and Taiwan, (3) Border security and funding (4) Federal Aviation Admin. reauthorization, (5) Section 702 (FISA) reauthorization and reform, and (6) National Defense Authorization Act.

— Supplemental spending measure. Senate Majority Leader Chuck Schumer (D-N.Y.) told Democrats to be ready for a vote on President Joe Biden's supplemental bill, likely to occur on Wednesday or Thursday. To pave the way for this vote, Schumer is expected to act on Monday or Tuesday to initiate a vote aimed at overcoming a filibuster, although it's anticipated that Republicans will block this move. Nevertheless, some senators are in favor of this course of action.

Progress on border talks has come to a standstill, with Democratic negotiators facing increased pressure from progressives and immigration activists. This situation is complicating the potential passage of aid for Israel and Ukraine in the coming weeks. Republicans have framed the talks as primarily focused on border security rather than broader immigration issues, claiming to be addressing national security concerns by reducing the number of migrants at the southern border. Reports of potential changes to the asylum system have raised alarm among Democrats. One contentious point is the proposal to increase the "credible fear" standard for claiming asylum from any chance above 10%, which Republicans seek to implement.

— The House voted Friday to expel Rep. George Santos over allegations the New York Republican stole money from his own campaign and committed other misdeeds. The 311-114 vote is just the sixth time House members have booted one of their own. The top four GOP leaders all voted to save Santos. Republicans split almost evenly, with 105 voting for expulsion and 112 against. Just two Democrats voted against expulsion and another two voted "present."

"To hell with this place," Santos said after the vote, which followed the release of a scathing report from the House Ethics Committee.

Impact: Santos' removal narrows the House GOP majority to a three-vote margin. President Biden carried New York’s 3rd Congressional District by roughly 8 percentage points in 2020, and the Cook Political Report rates the area a “Republican toss up” for 2024 (link). New York Gov. Kathy Hochul (D) will call a special election within 10 days of Santos’s expulsion, and the election is required to take place between 70 and 80 days later, according to state law, setting up a February or March election day.

— House Speaker Mike Johnson (R-La.) believes the GOP has impeachment votes for Biden inquiry. In a Fox News interview on Saturday Johnson said the GOP has enough votes to initiate an impeachment inquiry into President Joe Biden. He stated that he expects no Democrats to support this effort but believes they should. He emphasized that he views this impeachment inquiry as a necessary step and different from previous impeachment proceedings against Donald Trump. He and Elise Stefanik (R-N.Y.), both of whom served on Trump's impeachment defense team, criticized previous impeachments as politically motivated. Johnson emphasized the importance of following a methodical process, highlighting the GOP's commitment to the rule of law.

The Biden administration has been under investigation by House Republicans regarding his family's overseas business dealings and allegations of weaponizing the federal government. Johnson mentioned that those leading the investigations have encountered resistance from the White House. He mentioned that several committees, including Judiciary, Oversight, and Ways and Means, have been diligently pursuing evidence. However, they claim that the White House is obstructing their efforts by preventing Department of Justice (DOJ) witnesses, a former White House counsel, and the national archives from cooperating, as well as withholding thousands of pages of evidence.

— The House will consider HR 1713, a bill that would require USDA and Energy (DOE) to collaborate on research and development activities that focus on a variety of topics, including environmental science, biofuels, energy storage, invasive species management, electric grid modernization, and rural technology development. The bill also would require USDA and DOE to report to the Congress on those efforts.

Of note: Using information from the departments, the Congressional Budget Office (CBO) expects that the bill’s requirements are largely being met under current law. As a result, CBO estimates that implementing HR 1713 would have an insignificant cost, mostly for the report. Any spending would be subject to the availability of appropriated funds.

— The Supreme Court on Tuesday will hear arguments in Moore v. U.S., a case that could redefine what Congress can and cannot tax under the Constitution. The case challenges a provision of the 2017 tax law that imposed a one-time tax on profits held by companies outside the United States. This case could have far-reaching implications for the federal tax code. The case centers around the question of whether income must be "realized" or received before it can be subject to taxation. Charles and Kathleen Moore, a couple from Washington state, argue that they should not be taxed because they had not realized any income from their investment in an India-based company when the law was passed.

The case raises fundamental questions about what constitutes "income" under the Constitution and whether realization is necessary for taxation. The 16th Amendment allows Congress to tax "income, from whatever source derived," without specifying whether income must be realized.

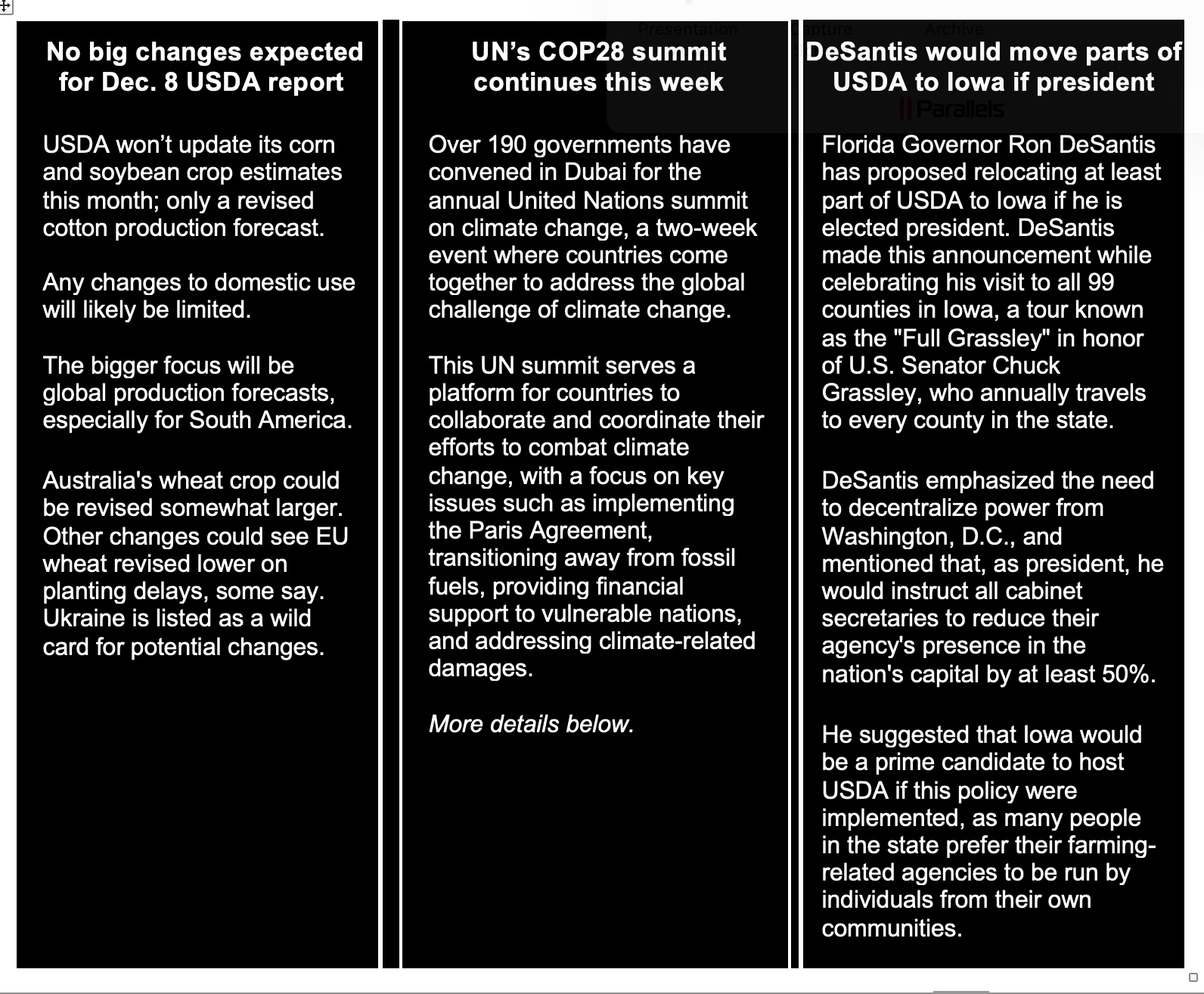

— Over 190 governments have convened in Dubai for the annual United Nations summit on climate change, a two-week event where countries come together to address the global challenge of climate change. The summit will focus on four key topics:

- Paris Climate Accord: One major agenda item is a report on the worldwide progress in implementing the Paris Climate Accord. This landmark agreement aims to limit global warming by reducing greenhouse gas emissions. Countries will assess and discuss their efforts to meet the accord's targets.

- Future of Fossil Fuels: Another significant topic is the future of fossil fuels. As the world seeks to transition to cleaner energy sources, discussions will likely revolve around reducing dependence on fossil fuels and transitioning to renewable and sustainable alternatives.

- Climate Finance for Poorer Countries: Providing climate finance to poorer countries is a critical aspect of climate action. The summit will likely address the need for financial support to help developing nations adapt to the impacts of climate change and reduce their own emissions.

- Climate Damage Fund: The establishment of a fund to address and pay for climate damage will also be on the agenda. Climate change is already causing severe impacts in various regions, and this fund aims to assist those affected and help them recover from climate-related disasters.

— Global leaders at the COP28 climate summit are making efforts to reduce methane emissions, a potent greenhouse gas produced by various sources, including oil and gas drilling, livestock, and decaying vegetation. These efforts involve a combination of financial incentives and strict new regulations to encourage countries and energy companies to tackle methane emissions.

The Biden administration announced a final methane rule for U.S. oil and gas producers, requiring them to address methane leaks, reduce excess gas flaring, and conduct regular inspections of facilities to prevent methane from escaping into the atmosphere. This rule will be phased in over the next two years.

To encourage action on methane emissions, U.S. Special Presidential Envoy for Climate John Kerry announced a $1 billion grant fund to help lower-income nations reduce methane emissions from their oil and gas operations. This fund will support countries like Kazakhstan, identified as a methane "super-emitter," in joining the Global Methane Pledge, an initiative to reduce both methane leaks and venting by 2030.

China, the largest emitter of methane globally, has not yet joined the U.S.-led Global Methane Pledge, but it has recently added methane to its 2035 climate action plan.

— In the fourth debate of the 2024 Republican presidential primary season, which is scheduled to take place Wednesday in Tuscaloosa, Alabama, Donald Trump has chosen not to participate once more. Despite facing a total of 91 criminal counts spread across four indictments, Trump maintains a strong lead in both national and early state polling. This debate is taking place about six weeks before the Iowa caucuses, a crucial event in the primary election process.

Of note: Trump's absence from all GOP debates has been a consistent trend, and back in October, his campaign even called for the cancellation of all future debates organized by the Republican National Committee. This decision has generated significant attention and speculation about the dynamics of the Republican primary race and Trump's strategy leading up to the 2024 election.

— On the trade policy front, the EU's trade commissioner, Valdis Dombrovskis, has canceled a trip to Brazil aimed at finalizing the EU's trade deal with the South American Mercosur countries. The deal's completion this year has become increasingly uncertain due to various setbacks, including a change of government in Argentina and opposition from French President Emmanuel Macron.

Dombrovskis was scheduled to travel to Rio de Janeiro for a Mercosur gathering on Dec/ 7, but the agreement has faced challenges. Macron expressed concerns about the deal during a meeting with Brazilian President Luiz Inácio Lula da Silva at the COP28 climate summit. He cited issues related to environmental targets and the contradiction between the deal and efforts to decarbonize industries in Europe.

Macron's opposition has added further uncertainty to the prospects of finalizing the long-awaited trade agreement between the EU and Mercosur nations, which include Brazil, Argentina, Uruguay, and Paraguay. “I can’t ask our farmers, our industrialists in France but also everywhere in Europe to make efforts to apply new rules to decarbonize … and then say all of a sudden, ‘I’m removing all the tariffs to allow products to enter which do not apply these rules,’” Macron said.

Hearings and Other Events

Monday, Dec. 4:

- Energy carbon programs. United States Energy Association virtual event on Community Benefit Plans developed for Department of Energy Carbon Management projects.

- National Grain and Feed Association's Country Elevator Conference, Dec. 3-5, Louisville.

Tuesday, Dec. 5:

- Climate-smart agriculture and small farmers. Society for International Development, Washington, D.C. Chapter virtual discussion on "Regenerative Sustainable Climate Smart Agriculture & Smallholder Farmers."

- WRDA. House Transportation and Infrastructure Water Resources and Environment Subcommittee hearing on "Water Resources Development Acts: Status of Past Provisions and Future Needs."

- FBI oversight. Senate Judiciary Committee hearing on "Oversight of the Federal Bureau of Investigation." FBI Director Christopher Wray testifies.

- U.S. energy dominance. House Energy and Commerce Energy, Climate, and Grid Security Subcommittee hearing on "America's Future: Leading a New Era of Energy Dominance, Security, and Environmental Stewardship."

- Global energy issues. Atlantic Council eighth annual "Global Energy Forum.”

- American Seed Trade Association’s Field Crop Seed Convention, Orlando.

Wednesday, Dec. 6:

- China food security. Center for Strategic and International Studies Freeman Chair in China Studies virtual discussion on "China's Food Security Challenges."

- Budget process reform. House Budget Committee hearing on "Budget Process Reform Member Day Hearing."

- 2024 elections. PunchBowl News discussion on "news of the day, tech policy and the latest on the 2024 presidential and congressional campaigns."

- Oversight of Wall Street firms. Senate Banking, Housing and Urban Affairs Committee hearing on "Annual Oversight of Wall Street Firms."

- Federal debt cost to taxpayers. House Ways and Means Oversight Subcommittee hearing on "Hidden Cost: The True Price of Federal Debt to American Taxpayers."

- Tax policy. House Ways and Means Tax Subcommittee hearing on "Tax Policies to Expand Economic Growth and Increase Prosperity for American Families."

- Sustainable Agriculture Summit, Charlotte, N.C.

- USA Rice Outlook Conference, Dec. 6-8. Indian Wells, California.

Thursday, Dec. 7:

- Clean Air Act panel. Environmental Protection Agency meeting of the Clean Air Act Advisory Committee to provide independent advice and counsel to EPA on economic, environmental, technical, scientific and enforcement policy issues associated with implementation of the Clean Air Act of 1990.

- State Department nominee. Senate Foreign Relations Committee hearing on the nomination of Kurt Campbell to be deputy secretary of State.

Friday, Dec. 8:

- Economic statistics. Bureau of Economic Analysis (holds a meeting of the Federal Economic Statistics Advisory Committee for a meeting on statistical methodology and other technical matters related to the collection, tabulation, and analysis of federal economic statistics.

Key Economic Reports and Events for the Week

November jobs data on Friday and the latest Job Openings and Labor Turnover Survey on Tuesday are the highlights. It is a relatively calm week on the earnings calendar.

Monday, Dec. 4

- Factory Orders: The Commerce Dept. is expected to report that factory orders for October likely dipped 2.6% after rising 2.8% in September.

- Motor Vehicle Sales

- General Motors CEO Mary Barra to meet with media in Detroit to update on the automaker's progress in 2024 in terms of its business plans.

Tuesday, Dec. 5

- S&P Global US Services PMI - Final

- ISM Non-Manufacturing PMI will likely show a reading of 52 in November after a print of 51.8 in October.

- JOLTS - Job Openings

- Senior executives from Goldman Sachs, JPMorgan and other global banks to speak at the Goldman financial services conference in New York.

- Senate Banking Committee expected to publish testimony from the chief executives of JPMorgan, Goldman Sachs, Bank of America, Citigroup and four other lenders ahead of their appearance before the Senate on Wednesday.

- Federal Reserve: Federal Reserve Division of Supervision and Regulation Director Michael Gibson is scheduled to testify on "Fostering Financial Innovation" before the House Financial Services Subcommittee on Digital Assets, Financial Technology and Inclusion.

- CVS Health to hold its annual Investor Day in Boston. Investors will look for updates to the company's long-term growth and earnings targets.

Wednesday, Dec. 6

- MBA Mortgage Applications

- ADP National Employment is expected to show that private payrolls rose by 128,000 in November, compared with a 113,000 increase in October.

- Productivity and Costs

- Trade Balance: The Commerce Department is set to report the U.S. trade deficit likely expanded to $64.1 billion in October from $61.5 billion in September.

- McDonald's Investor Update will likely reveal details on the company's plans for growth and expansion over the next few years. Its expansion in China and other international markets, outlook on the U.S. consumer and expectations for profitability will be on top of investors' minds, according to Reuters.

- Campbell Soup is expected to post a dip in its first-quarter sales as benefits stemming from higher prices of its soups and sauces start to fade while demand also slows. Investors will be watching for the company's annual forecast, its comments on pricing, demand trends and its expectations for a return to volume growth.

- Chief executives for the nation's eight largest banks will testify before the Senate Banking Committee, where they will face questions about their business and hiring practices, support for the U.S. economy, and other matters.

- The Bank of Canada's rate decision. The Canadian central bank will likely hold its key overnight interest rate at 5%.

Thursday, Dec. 7

- Jobless Claims possibly rose 5,000 to a seasonally adjusted 223,000 for the week ending Dec. 2.

- Wholesale Inventories

- Consumer Credit

- Fed Balance Sheet

- Money Supply

- Dollar General is expected to post a rise in third-quarter revenue, helped by steady demand for affordable groceries and household staples from cost-conscious shoppers. Investors will eye for updates from the retailer on demand trends going into the holiday season, margin recovery, annual forecast and how CEO Vasos plans to turnaround the business.

- China: November trade balance figures

- Brazil: 63rd summit of heads of state of Mercosur and associated nations in Rio

- China: EU/China Summit begins in Beijing, attended by European Commission president Ursula von der Leyen, European Council president Charles Michel and Chinese President Xi Jinping.

Friday, Dec. 8

- Employment: Economists forecast payrolls growth will rise to 200,000 in November from 150,000 job additions in October, and the unemployment rate to stay steady at 3.9%. Average hourly earnings likely rose 0.3% in November after climbing 0.2% in October. In the 12 months through November, wages increased 4.0%.

- University of Michigan's preliminary reading of its Consumer Sentiment Index for December likely marginally advanced to 62.0, from November's final reading of 61.3.

- China: November consumer price index (CPI) and producer price index (PPI) inflation rate data (PM local time)

Key USDA & international Ag & Energy Reports and Events

On the ag front, USDA’s monthly reports come Friday, the same day of the FAO food price index and monthly grains report.

For the energy sector, the United Nations’ COP28 climate change conference in Dubai will run through the week and beyond.

Monday, Dec. 4

Ag reports and events:

- Export Inspections

- Dairy Products

- StatsCanada production data for soybeans, wheat, barley and canola

Energy reports and events:

- COP28, Dubai (through Dec. 12)

- Holiday: UAE

Tuesday, Dec. 5

Ag reports and events:

- Purdue agriculture sentiment

- EU weekly grain, oilseed import and export data

- Australia’s Abares to release quarterly report

- Malaysia’s Dec. 1-5 palm oil exports

- Holiday: Thailand

Energy reports and events:

- API weekly U.S. oil inventory report

Wednesday, Dec. 6

Ag reports and events:

- Broiler Hatchery

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- World Nuclear Industry Status Report published

- ExxonMobil provides 2023 Corporate Plan Update

Thursday, Dec. 7

Ag reports and events:

- Weekly Export Sales

- Livestock and Meat International Trade Data

- Brazil’s Conab production, area and yield data for corn and soybeans

- Port of Rouen data on French grain exports

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

- China’s first batch of November trade data, including oil, gas and coal imports; oil products imports and exports

- Holiday: Myanmar

Friday, Dec. 8

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- WASDE

- Crop Production

- World Agricultural Production

- Cotton Ginnings

- Cotton: World Markets and Trade

- Grains: World Markets and Trade

- Oilseeds: World Markets and Trade

- U.S. Agricultural Trade Data Update

- FAO food price index and monthly grains report

- China’s agriculture ministry (CASDE) monthly report on supply and demand for corn and soybeans

- FranceAgriMer’s weekly crop condition report

- Holiday: Argentina, Chile, Colombia, Philippines;, Panama

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |