U.S. PCE Index Shows No Change, Weakest Since July 2022

As EU/Mercosur near closing trade deal, U.S. ag sector anxiety increases re: trade policy

|

Today’s Digital Newspaper |

MARKET FOCUS

- Federal Reserve officials conveying minimal urgency to raising interest rates

- Ackman betting Fed will begin cutting interest rates sooner than markets predict

- PCE index showed no change, marking weakest performance since July 2022

- Eurozone inflation rate falls more than expected

- Mixed signals on Fed's stance ahead of December FOMC meeting

- WTI crude futures marketing third consecutive session of gains

- Ag markets today

- USDA daily export sale: 134,000 MT soybeans to China during 2023-2024 MY

- Argentina raising price of biodiesel for blending with gasoil

- Cost of shipping fuels across Atlantic hits highest point in almost 16 months

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Diminished shutdown odds as House conservatives soften demands

- Two House panels to conduct hearings on enhancing supply chain for critical materials

ISRAEL/HAMAS CONFLICT

- Israel and Hamas today agreed to extend their cease-fire by another day

- Saudi Arabia approaches Iran with offer to boost cooperation and investments

RUSSIA & UKRAINE

- IKAR expects smaller 2024 Russian wheat crop

POLICY

- G.T. Thompson aims to lower crop insurance costs in upcoming farm bill

- California program reimburses landowners for replenishing groundwater

CHINA

- USDA reports sales of several commodities to China in most recent week

- China manufacturing shrinks more than expected

- Vilsack anticipates China will resume buying corn from U.S.

- Vilsack announces formal launch of Regional Agricultural Promotion Program (RAPP)

- Summit highlights prevailing theme of uncertainty surrounding U.S./China relations

- China says working with U.S. to restore military communication channels

TRADE POLICY

- EU aims for key Mercosur trade deal amid election year

ENERGY & CLIMATE CHANGE

- EPA offers March 28 target deadline to finalize rule allowing year-round E15 fuel sales

- Biden to introduce tax-credit rules for U.S. EV market

- Report: Global greenhouse gas emissions from ag increased by 14% past 20 years

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Major outbreak of HPAI confirmed on an egg farm in northwestern Iowa

HEALTH UPDATE

- Fauci to testify on Covid origins to House GOP: WSJ

- Last week, approximately 18,000 Americans hospitalized with Covid-19, 10% increase

POLITICS & ELECTIONS

- Newsom and DeSantis to appear on Fox News event

- McCarthy talks about speculation he won't seek re-election to House seat

- New Mexico Supreme Court upholds Democratic-drawn congressional map

OTHER ITEMS OF NOTE

- Wolverines will be listed as threatened under Endangered Species Act

- EPA proposes 10-year deadline to replace lead water pipes across the U.S.

|

MARKET FOCUS |

— Equities today: Asian and European markets were mixed to firmer in overnight trading. U.S. Dow opened up around 185 points. In Asia, Japan +0.4%. Hong Kong +0.2%. China +0.3%. India +0.2%. In Europe, at midday, London +0.5%. Paris +0.2%. Frankfurt +0.2%.

U.S. equities yesterday: U.S. stock indices finished narrowly mixed, with the Dow slightly higher and the Nasdaq and S&P 500 weaker. The Dow was up 13.44 points, 0.04%, at 35,430.42. The Nasdaq declined 23.27 points, 0.16%, at 14,258.49. The S&P 500 lost 4.31 points, 0.09%, at 4,550.58.

— Agriculture markets yesterday:

- Corn: March corn rose 2 1/4 cents to $4.75 3/4, closing nearer the session high after marking a fresh contract low early on.

- Soy complex: January soybeans rose 1/2 cent to $13.47 and nearer the session high. March soybean meal fell $2.10 to $416.90 and nearer the session low. March bean oil closed down 15 points at 52.48 cents and near mid-range.

- Wheat: March SRW rose 13 3/4 cents to $5.85 3/4, the highest close since Nov. 15. March HRW rallied 16 1/2 cents to $6.34 1/4, near the session high, while March spring wheat rose 12 cents to $7.25 1/4.

- Cotton: March cotton fell 1 point to 79.59 cents and nearer the session low.

- Cattle: December live cattle futures rose 25 cents to $171.90, while most-active February gained 65 cents to $173.475. January feeder futures rallied $1.15 to $222.20.

- Hogs: February lean hog futures rallied $1.075 before ending the day at $70.10, while nearby December futures edged up 5 cents to $68.975.

— Ag markets today: Corn, soybeans and wheat again traded in relatively tight ranges during a quiet overnight session. As of 7:30 a.m. ET, corn futures were trading narrowly mixed, soybeans were fractionally to 2 cents lower, winter wheat markets were mostly 1 to 3 cents lower and spring wheat was fractionally to 2 cents higher. Front-month crude oil futures were around 65 cents higher, and the U.S. dollar index was more than 500 points higher.

Cash cattle expectations improving. Light cash cattle trade this week started at $1.00 to $2.00 lower prices after Monday’s sharp futures selloff. But most feedlots passed and are now hoping to get steady/firmer prices given the corrective rebound in futures. Packers are also thought to be short bought on near-term slaughter needs after small purchases the three previous weeks.

Big hogs pressuring cash market. Hog slaughter weights are rising seasonally, running well above both year-ago and the five-year average. While a seasonal top in weights should come soon, there are no indications it will happen this week. The extra pork is likely to keep pressure on the cash hog market. The CME lean hog index is down another 13 cents to $71.53 as of Nov. 28.

— Quotes of note:

- Federal Reserve officials are conveying a sense of minimal urgency when it comes to raising interest rates. These comments have led traders to anticipate the possibility of the first rate cut by the U.S. central bank occurring as early as May next year. Cleveland Fed President Loretta Mester, known for her more hawkish stance, mentioned that the current policy is well-prepared to allow the central bank to remain flexible and respond to evolving economic conditions. Atlanta Fed President Raphael Bostic expressed growing confidence regarding the trajectory of inflation. Meanwhile, Richmond Fed chief Thomas Barkin suggested that policymakers should keep the option of a rate hike open but refrained from explicitly endorsing one at the next meeting. In the backdrop of these statements, the latest reading of the Personal Consumption Expenditures (PCE) inflation, which is the Fed's preferred measure, will be released today, potentially providing further insights into the central bank's policy decisions.

- Billionaire investor Bill Ackman is betting the Federal Reserve will begin cutting interest rates sooner than markets are predicting. The Pershing Square Capital Management founder said such a move could happen as soon as the first quarter. Traders had been fully pricing in a rate cut in June, according to swaps market data. “We’re betting that the Federal Reserve is going to have to cut rates more quickly than people expect,” Ackman said in an upcoming episode of The David Rubenstein Show: Peer-to-Peer Conversations. “That’s the current macro bet that we have on.”

- “We haven’t learned to control capacity.” — Nils Haupt, a spokesman for German container line Hapag-Lloyd.

— In October, the U.S. Personal Consumption Expenditures (PCE) price index showed no change, marking its weakest performance since July 2022. This figure followed consecutive monthly increases of 0.4% in both September and August, surprising the market which had anticipated a 0.1% rise. Additionally, the annual inflation rate declined to 3%, its lowest level since March 2021. Meanwhile, the core PCE gauge, which excludes volatile food and energy prices, saw a modest 0.2% increase from the previous month, falling slightly short of the 0.3% increase seen in September and aligning with market expectations.

— Eurozone inflation rate falls more than expected. In November, the annual inflation rate in the Euro Area decreased to 2.4%, marking its lowest point since July 2021. This decline followed a reading of 2.9% in September and fell below the anticipated rate of 2.7%. Additionally, the core inflation rate, which excludes the influence of volatile food and energy prices, also moderated to 3.6%, reaching its lowest level since April 2022 and falling short of expectations set at 3.9%.

— Mixed signals on Fed's stance ahead of December FOMC meeting. As the Federal Reserve officials prepare for the upcoming Federal Open Market Committee (FOMC) meeting on Dec. 12-13, there are mixed signals regarding the central bank's stance on interest rates and inflation:

- Some Fed officials have recently expressed comfort with the current state of monetary policy, suggesting that the Fed may have completed its cycle of interest rate hikes.

- However, other policymakers continue to indicate that further rate increases may be necessary if progress toward the Fed's 2% inflation target is not deemed fast enough.

- The Beige Book report, released two weeks prior to the FOMC meeting, suggested that inflation had moderated in most Fed districts since the previous report. Nonetheless, consumers were still facing high prices for goods.

- Fed Chairman Jerome Powell and others have conveyed uncertainty about whether current interest rates are restrictive or not.

- The report also highlighted that higher interest rates were impacting various sectors, including autos, real estate, and commercial real estate, with rising vacancy rates noted.

- The upcoming release of the Personal Consumption and Expenditures report is expected to play a significant role in shaping the Fed's next steps.

- While a steady rate decision is anticipated at the upcoming meeting, the focus is shifting towards when the Fed might begin reducing rates and how long they will maintain current rate levels. Fed officials emphasize that these decisions will be data-driven and based on upcoming economic indicators.

Bottom line: Overall, there are differing views among Fed officials, but the current expectation is for a stable interest rate decision at the upcoming meeting, with a focus on future rate adjustments driven by economic data in the coming months.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer, with both the euro and British pound weaker. The yield on the 10-year U.S. Treasury note was firmer, trading around 4.28%, with a mixed tone in global government bond yields. Crude oil futures were higher, maintaining earlier gains, as OPEC+ countries were meeting on output levels. U.S. crude was around $78.50 per barrel, and Brent around $83.60 per barrel. Gold and silver futures were mixed ahead of economic data, with gold weaker around $2,060 per troy ounce, and silver higher around $25.50 per troy ounce.

— On Thursday, WTI crude futures climbed to over $78.5 per barrel, marking their third consecutive session of gains. This increase comes ahead of the OPEC+ meeting scheduled for later in the day. The focus of expectations is whether Saudi Arabia will extend its voluntary supply cuts, possibly until at least the first quarter of 2024. There's also speculation that OPEC+ might consider extending or deepening supply cuts into the next year to bolster the oil market. OPEC and its allies are reportedly considering new oil production cuts of as much as 1M bbl/day, Despite Saudi Arabia's push for production quota reductions among OPEC+ members to stabilize the market, a definitive resolution has not been reached. The meeting, originally scheduled for Nov. 26, was delayed to Nov. 30 due to a disagreement involving African producers Nigeria and Angola concerning output quotas. Additionally, official data revealed an unexpected increase in U.S. crude inventories for the previous week, adding to the factors influencing the oil market's dynamics.

— Argentina has raised the price of biodiesel for blending with gasoil to 686,986 pesos ($1,908) per metric ton, effective in December. This price increase was announced through an official resolution, which also left room for potential changes in the price-setting process. The resolution specifies that payment for biodiesel cannot exceed seven calendar days from the invoice date. It remains uncertain whether the incoming administration might modify this regulation or address other policy changes in the future.

— Cost of shipping fuels like diesel across the Atlantic has reached its highest point in almost 16 months due to an El Niño-driven drought that has led to historically low water levels in the Panama Canal (link/Bloomberg). This reduction in water levels has caused congestion in the Panama Canal, potentially causing delays in the Suez Canal in Egypt (link) and impacting shipments of liquefied natural gas (LNG).

— USDA daily export sale: 134,000 MT soybeans to China during 2023-2024 marketing year.

— Ag trade update: Taiwan purchased 109,325 MT of U.S. milling wheat.

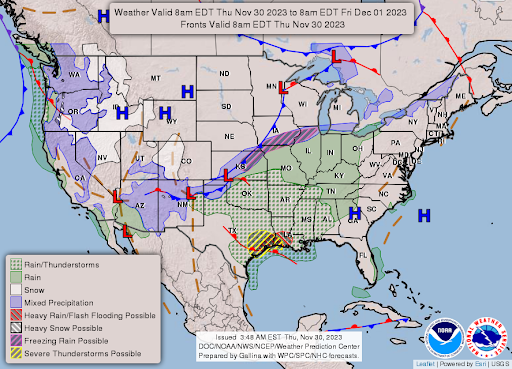

— NWS weather outlook: Storm system to bring threat of severe thunderstorms and heavy rain from the Southern Plains to the Lower Mississippi Valley on Thursday, spreading further into the Southeast Friday... ...Areas of light to moderate precipitation expected from the Central Plains to the interior Northeast, with a wintry mix possible for some locations... ...Atmospheric river activity arriving across the Pacific Northwest by the end of the week will bring heavy rain to the coastal ranges, and heavy snowfall to the Cascades... ...Locally heavy snowfall possible for higher mountain elevations in the Four Corners region.

Items in Pro Farmer's First Thing Today include:

• Another quiet overnight grain session

• Limited deliveries against December grain contracts

• China’s factory sector faces deeper contraction

|

CONGRESS |

— Diminished shutdown odds as House conservatives soften demands. The likelihood of a partial government shutdown in January has diminished as House GOP rebels have eased their demands for significant spending cuts to domestic programs. This shift increases the prospects of a bipartisan spending agreement being reached before the Jan. 19 deadline.

The change in stance occurred after the House struggled to pass bills that adhered to the lower spending levels demanded by the House Freedom Caucus, which holds substantial influence in the narrow Republican majority.

Currently, the government is funded through a temporary spending bill that covers part of the federal government (including Agriculture) until Jan. 19 and the rest until Feb. 2. Differences between the Republican-controlled House and the Democratic Senate had raised concerns about shutdowns after those dates, as Speaker Mike Johnson (R-La.) pledged not to pass any more temporary spending extensions.

The House Freedom Caucus had initially pushed for $120 billion in cuts below the $1.59 trillion budget cap agreed upon in a June debt ceiling deal between President Joe Biden and Congress, which they opposed. Their softened stance now provides Speaker Johnson with room to negotiate a bipartisan spending deal and address other issues, including the Senate's attempt to spend more than the debt ceiling limit allows.

A caveat. Freedom Caucus Chair Scott Perry (R-Pa.) has stated that the group is willing to accept the higher budget caps, but they will insist that no budgetary maneuvers be employed to exceed that limit. This means that a side agreement reached between Biden and former Speaker Kevin McCarthy (R-Calif.), which counted $20 billion in future cuts to the IRS, may need to be reconsidered.

— Two House panels will conduct hearings today, each focused on enhancing the supply chain for critical materials.

- An Oversight subcommittee will host officials from the Interior, Energy, and Defense Departments. These officials are expected to testify about the vulnerabilities in critical mineral supply chains, which include issues like excessive dependence on foreign imports. The discussion will also address how these vulnerabilities may pose threats to national security and industries reliant on these materials.

- A separate Science committee hearing will feature an Energy Department official who will discuss the role of federal research in establishing a resilient supply chain for critical minerals and materials. This hearing will explore strategies for strengthening the supply chain in this crucial area.

|

ISRAEL/HAMAS CONFLICT |

— Israel and Hamas today agreed to extend their cease-fire by another day, allowing for the release of more hostages held by the militant group in Gaza. The two sides announced the extension minutes before their cease-fire was due to end.

Some Israeli and U.S. officials are discussing the idea of expelling thousands of lower-level militants from the Gaza Strip as a way to shorten the war, the Wall Street Journal reports (link). The idea is reminiscent of the U.S.-brokered deal that allowed Palestinian leader Yasser Arafat and fighters to flee Beirut during Israel’s 1982 siege of the Lebanese capital.

— Saudi Arabia has approached Iran with an offer to boost cooperation and invest in its sanctions-stricken economy if the Islamic republic stops regional proxies from turning the Israel-Hamas war into a wider conflict. Link to details via Bloomberg.

|

RUSSIA/UKRAINE |

— IKAR expects smaller 2024 Russian wheat crop. Russia’s IKAR agricultural consultancy said it expects Russia’s 2024-25 grain crop to total 145 MMT, including 92 MMT of wheat. IKAR projects Russia will export 63 MMT of grain in 2024-25, including 48 MMT of wheat.

|

POLICY UPDATE |

— G.T. Thompson aims to lower crop insurance costs in upcoming farm bill. In preparation for the upcoming farm bill, House Ag Chairman G. T. Thompson (R-Pa.) told Politico his intent to make crop insurance more affordable. Thompson said the committee is exploring various options to achieve this goal. “We need to look and see how do we make crop insurance more affordable and get more individuals to sign up for it,” Thompson said. When asked about where the money would come, presumably for higher premium subsidies, Thompson said: “I got lots of ideas for money.”

The primary focus is on increasing enrollment in crop insurance by reducing its cost for farmers. Currently, the government subsidizes about 60% of crop insurance premiums to encourage participation. While Thompson did not explicitly state that he aims to raise premium subsidies, he mentioned that he has ideas for securing the necessary funds.

— California farmers test novel groundwater replenishment program. In California's Pajaro Valley, a novel program is being tested to replenish groundwater by reimbursing landowners for the water they help filter back into the earth, according to Inside Climate News (link). This initiative aims to address the challenges of groundwater depletion and its mismanagement in the state, where groundwater supplies a significant portion of water for agriculture and public use. To address these issues, the Pajaro Valley started a program called "recharge net metering," inspired by the concept of homeowners receiving rebates for generating solar energy. Under this program, landowners are paid rebates for the amount of water they help return to the groundwater, encouraging practices like flooding land and planting cover crops to increase moisture absorption.

This initiative has been successful in the Pajaro Valley, with significant interest from landowners. It has shown potential cost-effectiveness, with recharge net metering being cheaper per acre-foot compared to other water-saving measures like desalination. The program forecasts substantial infiltration of groundwater, benefiting the region's water supply.

However, challenges remain, including maintenance costs and the potential loss of agricultural land. Organizers are considering adjustments, such as tying payments to inflation, to make the program more appealing to farmers. Additionally, nationwide groundwater regulations are inconsistent, and the success of programs like recharge net metering may depend on local economic incentives.

|

CHINA UPDATE |

— USDA reports sales of several commodities to China in most recent week. USDA export sales figures for the week ended Nov. 23 included sales of several commodities to China for the current marketing year. For 2023-24, net sales of 197,310 metric tons of wheat, 131,000 metric tons of corn, 241,219 metric tons of sorghum, 892,263 metric tons of soybeans and 64,598 running bales of upland cotton were reported. For 2023, activity included net sales of 591 metric tons of beef and net reductions of 61 metric tons of pork. There were also net sales of 956 metric tons of beef reported for 2024.

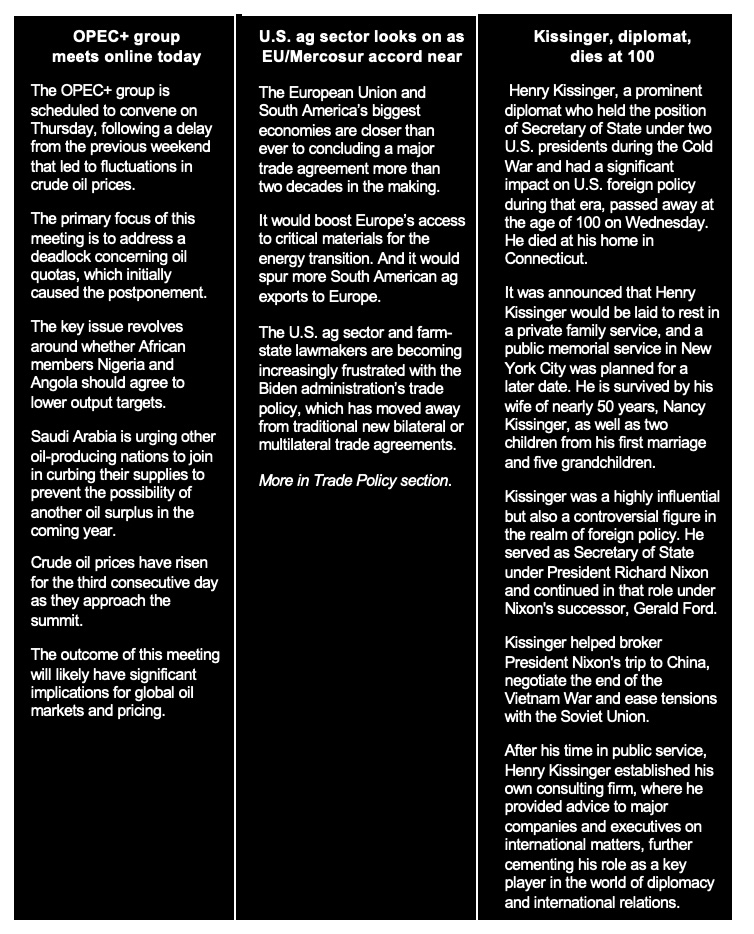

— China manufacturing shrinks more than expected. In November 2023, China's official NBS Manufacturing Purchasing Managers' Index (PMI) decreased slightly to 49.4, down from 49.5 in October. This figure fell below market expectations of 49.7 and represented the lowest reading since June. This decline underscores the need for additional government support in the face of weak demand and a downturn in the property market within the Chinese economy.

Only construction registered any expansion compared with the previous month.

On the cost side, input price inflation eased to a five-month low, registering at 50.7 compared to 52.6. In contrast, output prices dropped for the second consecutive month, though at a slower rate, with a reading of 48.2 versus 47.7.

Business sentiment improved to its highest level since February, reaching 55.8 compared to 55.6, suggesting an increase in optimism among manufacturers despite the challenging economic conditions.

— USDA Secretary Tom Vilsack anticipates that China will resume buying corn from the United States. China had turned to Brazil and other South American suppliers for corn due to lower prices compared to U.S. supplies. While Vilsack didn't make specific predictions about the extent of China's interest in U.S. corn, he acknowledged that the U.S. market has experienced some tightness, with prices somewhat higher than those in Brazil and South America. He noted that China often takes advantage of cost-effective opportunities and expects a gradual rebalancing of this trend over time.

However, Vilsack emphasized that the Biden administration is actively working to reduce dependence on China and other major markets for U.S. agricultural products.

He announced the formal launch of the Regional Agricultural Promotion Program (RAPP), backed by Commodity Credit Corporation (CCC) funding, with an initial allocation of $300 million (link). The program aims to promote U.S. agricultural products in South Asia, Southeast Asia, Latin America, the Middle East, and Africa, with $25 million earmarked for initiatives in Africa. Notably, the program excludes the promotion of U.S. agricultural products to China, Canada, Mexico, and the European Union (EU) in its initial round of activities.

— The New York Times DealBook Summit highlighted a prevailing theme of uncertainty surrounding U.S./China relations and the potential for a conflict with Taiwan. Key points from the summit include:

- Jensen Huang, CEO of Nvidia, emphasized the challenge of achieving supply chain independence, estimating it would take a decade or two due to the complexity of systems with numerous components. He emphasized the importance of embarking on this journey despite its challenges.

- JPMorgan CEO Jamie Dimon expressed confidence and stated that he is "not afraid of China." He also pointed out the complexities of China's relationships with its Asian neighbors and concerns about its aging and shrinking population.

- Taiwan President Tsai Ing-wen provided insight into the internal challenges facing Chinese leadership. She suggested that, given these challenges and the global community's preference for peace and stability, it may not be an opportune time for China to consider a major invasion of Taiwan.

— China confirms it is working with U.S. to restore military communication channels based on Xi/Biden agreement. Chinese defense ministry says it is in talks to resume suspended dialogues “on the basis of equality and respect,” but warns against American military aid to Taiwan. Link to more via South China Morning Post.

|

TRADE POLICY |

— EU aims for key Mercosur trade deal amid election year. EU trade negotiators are eager to secure at least one significant deal before heading into an EU parliamentary election year in 2024. After over two decades of negotiations, there is renewed optimism that a trade agreement with Mercosur is within reach. Mercosur is a customs union comprising Argentina, Brazil, Uruguay, and Paraguay.

If the deal is reached, it would establish a vast integrated market of 780 million consumers, making it the largest agreement in the European Union's history and one of the world's most substantial free trade pacts. European exporters would save approximately €4 billion ($4.4 billion) in import tariffs, and it would provide access to critical materials needed for the development of green and digital technologies.

For South America, this agreement holds the promise of expanded access to European markets, particularly benefiting industries seeking greater market reach and the region's already robust agricultural sector, known for exporting products like beef, soybeans, and coffee.

Additionally, the agreement would strengthen ties between the two regions at a time when global competition for influence, particularly from China and Russia, has been growing in resource-rich nations across the Americas.

Securing this deal would be a significant achievement for the EU, especially following setbacks with Australia's trade negotiations, where agricultural issues caused complications and delayed progress on an FTA that had been in the works for over five years.

Of note: The possible new EU/Mercosur trade deal comes as the U.S. ag sector and farm-state lawmakers are increasingly pessimistic regarding U.S. trade policy’s lack of garnering new bilateral or multilateral trade agreements.

|

ENERGY & CLIMATE CHANGE |

— EPA offers March 28 target deadline to finalize a rule allowing year-round E15 fuel sales in eight states. This move comes in response to a lawsuit brought by the attorneys general of Iowa and Nebraska. EPA initially proposed allowing year-round E15 sales in these states following their petition on the matter. Although there were reports suggesting a delay in finalizing the rule, court filings now establish March 28, 2024, as the target date for the EPA to issue the final rule.

EPA stated that it had received numerous administrative petitions requesting a delay related to its proposal to permit E15 sales. According to the law, the EPA must consider these petitions, along with input from the Department of Energy, to assess whether the rule might lead to an insufficient gasoline supply.

Bottom line: The significance of this rulemaking lies in it being the first instance of the EPA finalizing a rule under this Clean Air Act provision. While it will apply to only eight states, its impact will extend to a considerable portion of the United States' fuel system.

— Biden to introduce tax-credit rules for U.S. EV market. The Biden administration on Friday is expected to introduce new tax-credit rules aimed at influencing the American electric vehicle (EV) market. These rules are designed to promote the growth of domestic auto-supply chains and reduce reliance on China, which is a significant provider of clean-energy technology and a geopolitical competitor to the United States. The move is part of the White House's efforts to reshape the EV market and enhance its strategic position in the industry.

— Global greenhouse gas emissions from agriculture have increased by 14% over the past 20 years, according to a report (link) by the Food and Agriculture Organization (FAO). Livestock, particularly cattle and sheep, were responsible for slightly more than half of this increase. The carbon footprint of these animals was significantly higher when calculated per kilogram of product compared to pigs, chickens, and dairy.

Agricultural emissions worldwide totaled 7.8 billion metric tons in 2021, with around 53% coming from livestock-related activities. Emissions from enteric fermentation in ruminant livestock's digestive systems alone accounted for 37% of agricultural emissions.

The report also highlighted the impact of natural disasters on agricultural production and the increasing cost of a healthy diet, with many people unable to afford nutritious food.

Additionally, FAO noted a decline in the agricultural workforce and a reduction in agricultural land over the same period. Pesticide use increased by 6%, with half of it used in the Americas. Despite these challenges, the global value added by agriculture, forestry, and fishing grew by 84% in real terms between 2000 and 2021, reaching $3.7 trillion in 2021.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— A significant outbreak of highly pathogenic avian influenza has been confirmed on an egg farm in northwestern Iowa, involving 1.613 million hens. This outbreak is the largest in the U.S. since a similar incident occurred on a Nebraska egg farm in November of the previous year.

|

HEALTH UPDATE |

— Fauci to testify on Covid origins to House GOP: WSJ. Anthony Fauci, the former chief White House medical adviser, has agreed to testify in front of a Republican-led House committee regarding the origins of the Covid-19 pandemic and the United States' response, the Wall Street Journal reports (link). This testimony will commence with two days of closed-door, transcribed interviews in January, followed by a public hearing later. It's worth noting that U.S. intelligence agencies have differing views on the origins of the virus.

— Last week, approximately 18,000 Americans were hospitalized with Covid-19, marking a 10% increase compared to the previous week, according to data from the CDC. This uptick in hospitalizations comes as health officials pay closer attention to the BA.2.86 coronavirus variant. This week, the World Health Organization classified BA.2.86 as a "variant of interest," although the current risk level is considered low. BA.2.86 was first identified in the U.S. in August and has become the third most common variant, responsible for around 1 in 11 new cases. Only 16% of American adults and 6% of children have received the latest Covid-19 vaccine, which studies have shown to enhance antibody levels against prevalent strains.

|

POLITICS & ELECTIONS |

— Newsom and DeSantis to appear on Fox News event. California Democratic Governor Gavin Newsom and Florida Republican Governor Ron DeSantis are set to participate in a nationally televised event tonight on Fox News. Both are considered rising stars in American politics and have presidential ambitions, although they may need to bide their time for future election cycles to pursue those aspirations. Nearly a fifth of Americans live in California and Florida, and other states often copy their policies.

— Former Speaker Kevin McCarthy (R-Calif.) said about mounting speculation he won't seek re-election to his House seat: "I have another week or so to decide ... If I decide to run again, I have to know in my heart I'm giving 110%."

— New Mexico Supreme Court upholds Democratic-drawn congressional map. The Associated Press reports (link) New Mexico’s Supreme Court has “upheld a Democratic-drawn congressional map that divvied up a conservative, oil-producing region and reshaped a swing district along the U.S. border with Mexico.” On Monday, “all five justices signed a shortly worded order to affirm a lower court decision that the redistricting plan enacted by Democratic state lawmakers in 2021 succeeded in substantially diluting votes of their political opponents — but that the changes fell short of ‘egregious’ gerrymandering.”

|

OTHER ITEMS OF NOTE |

— Wolverines will be listed as threatened under the Endangered Species Act, a rebuke of a Trump administration decision to avoid protecting the small bear-like mammal, the Interior Department announced yesterday.

— EPA proposes 10-year deadline to replace lead water pipes across the U.S. EPA is putting forth a new rule that mandates water systems throughout the United States to replace millions of lead service lines within a span of 10 years. This rule aligns with the Biden administration's objective of eliminating lead pipes from the nation's water infrastructure. The urgency behind this move is driven by the well-established connection between lead exposure and significant health and developmental issues, especially in children.

EPA's proposal is straightforward: it requires the replacement of lead service lines within a 10-year timeframe, regardless of the specific lead levels found in tap water or other drinking water samples. The proposal also mentions the possibility of allowing extra time in "limited circumstances" for systems that necessitate comprehensive system-wide line replacements.

— Jimmy Kimmel: “Everything is a mess in Washington, including our national Christmas tree, which fell over last night due to 40-mile-an-hour winds. It fell over at around 5:00, and no one got video of it. Three hundred million iPhones in this country, and not one of them was pointed at the White House at 5:00 p.m. This is why no one believes in UFOs.”

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |